When you're trying to find the right health insurance, the alphabet soup of acronyms—HMO, PPO, EPO—can feel overwhelming. Let’s clear up the confusion around one of the most popular options: the EPO, or Exclusive Provider Organization.

What Is an EPO Health Plan

Think of an EPO as having an all-access pass, but only for a specific festival. The "exclusive" network of doctors, specialists, and hospitals is your festival ground. As long as you get care from providers inside that network, your plan helps cover the costs.

But what happens if you wander off to a different festival? For any non-emergency care, if you go outside that network, you're on your own. You'll likely have to pay 100% of the bill. This is the core trade-off: in exchange for staying within the network, you typically get lower monthly premiums.

A Smart Blend of Flexibility and Savings

EPOs have carved out a special place in the health insurance world by taking the best features from other plans to create a hybrid that just works for many people.

- From HMOs, it takes the network. This is the secret to keeping costs down. By sticking to a pre-approved list of providers, the insurance company can control expenses, which translates to more affordable premiums for you.

- From PPOs, it takes the freedom. Unlike many HMOs, you don't need a referral from a primary care doctor to see a specialist. If you need a dermatologist or a cardiologist, you can just book an appointment—as long as they're in your network.

This unique combination is why EPOs have become so popular. Their market share shot up from just 13% to 27% between 2017 and 2020 alone. It’s a clear sign that people want that sweet spot between managing costs and having direct access to the care they need.

An EPO plan puts you in the driver's seat of your healthcare journey, giving you the freedom to choose your specialists directly, as long as you stay on the roads within your plan's network.

To really get how these plans work, it helps to know the basics of insurance itself. Our simple guide on what health insurance is and how it works is a great place to start.

For a quick breakdown, here’s a look at what defines an EPO plan.

EPO Plan At a Glance

| Feature | How It Works in an EPO Plan |

|---|---|

| Provider Network | You must use doctors, hospitals, and specialists within the plan’s exclusive network. |

| Out-of-Network Care | Not covered, except in true, life-threatening emergencies. |

| Primary Care Physician (PCP) | You generally don't have to choose one, though it's always a good idea. |

| Specialist Referrals | Not required. You can see any in-network specialist without a referral. |

| Cost | Premiums are typically lower than PPO plans but may be higher than HMOs. |

This table shows how an EPO offers a middle ground—more freedom than an HMO, but with stricter network rules than a PPO, all designed to keep things affordable.

How an EPO Plan Works in the Real World

So, you get the basic idea of what an EPO is. But what does that actually look like when you need to see a doctor or get a prescription? It’s one thing to understand the theory, but how it all plays out in your day-to-day life is what really matters.

Using an EPO plan comes down to a few simple, but firm, rules. Think of it as a trade-off: you get lower monthly premiums in exchange for agreeing to play by the plan’s rules. These rules are what define your experience and, more importantly, your final bill.

At its core, an EPO really just has three main pillars:

- You have to stay within their “exclusive” network.

- You don't need a Primary Care Physician (PCP) to act as a gatekeeper.

- You can go straight to a specialist—no referral needed.

Let’s unpack what that means for you when you actually need care.

Sticking to the Exclusive Network

The first, and most important, rule of an EPO is right there in the name: Exclusive. This is the big one. For any non-emergency care, you must use the doctors, hospitals, and clinics that are part of your plan’s approved network.

If you decide to see a provider outside that network for a routine visit or a planned surgery, the plan simply won’t pay. You'll be on the hook for 100% of the cost. This network rule is the fundamental reason why EPOs often have lower premiums than more flexible PPO plans.

The only time this rule doesn't apply is in a true, life-threatening emergency. If you're facing a genuine medical crisis, your plan is required to cover your care at the nearest hospital, whether it's in-network or not.

No Primary Care Physician Gatekeeper

A lot of people absolutely love the freedom an EPO offers. Unlike a more restrictive Health Maintenance Organization (HMO), you’re not usually required to choose a Primary Care Physician (PCP) to manage all your care.

Now, learning how to find a primary care doctor is always a smart idea for your overall health, but an EPO won’t force you into that relationship. This structure puts you in the driver’s seat. You get to decide which in-network provider makes sense for you at any given time.

Direct Access to Specialists

Here’s where EPOs really shine for many people: you can see a specialist without getting a referral first. This is a huge leg up over the old-school HMO model, where you’d have to get a permission slip from your PCP for just about everything.

With an EPO, if you have a nagging knee problem or a skin issue, you can just look up an in-network orthopedic doctor or dermatologist and book an appointment directly. No extra steps, no waiting for a referral to go through.

Let's imagine how this plays out:

- The Situation: A freelance graphic designer has been dealing with nagging wrist pain after long hours on her computer. She’s pretty sure it’s a repetitive strain injury.

- The Action: Instead of making an appointment with a PCP just to be told what she already knows, she pulls up her EPO’s provider directory and finds an in-network orthopedic specialist.

- The Result: She books a visit directly with the specialist for the following week. She saves time, avoids the copay for a PCP visit she didn't need, and gets in front of an expert much faster.

This direct-access approach cuts out the red tape, making it simpler and quicker to get the specialized care you need, right when you need it.

EPO vs. PPO vs. HMO: A Head-to-Head Comparison

Choosing a health plan can feel like you're trying to predict the future. Will you need flexibility? Is cost your top priority? The three big players—EPO, PPO, and HMO—each offer a different answer. Getting to know them is the first step to picking a plan that actually fits your life and your wallet.

An HMO (Health Maintenance Organization) is usually the most budget-friendly choice. It keeps costs down by using a strict network of doctors. To see almost any specialist, you first need a referral from your Primary Care Physician (PCP). Think of your PCP as the quarterback of your healthcare team, directing every play.

A PPO (Preferred Provider Organization) is on the complete opposite side of the field. It gives you the most freedom, letting you see pretty much any doctor you want—in or out of network—without asking for a referral. That kind of flexibility comes with a higher price tag, though. PPOs typically have the highest monthly premiums and deductibles.

And then you have the EPO (Exclusive Provider Organization), which carves out a really smart middle ground. It combines the lower costs you'd find in an HMO with the PPO-style freedom of seeing in-network specialists without a referral.

The Trade-Offs in Action

At the end of the day, it almost always comes down to cost versus flexibility. With an EPO, you get real savings compared to a PPO. The trade-off? You give up the option to get non-emergency care outside your network. It's a calculated risk: are you comfortable with the doctors and hospitals in the network in exchange for a lower monthly bill?

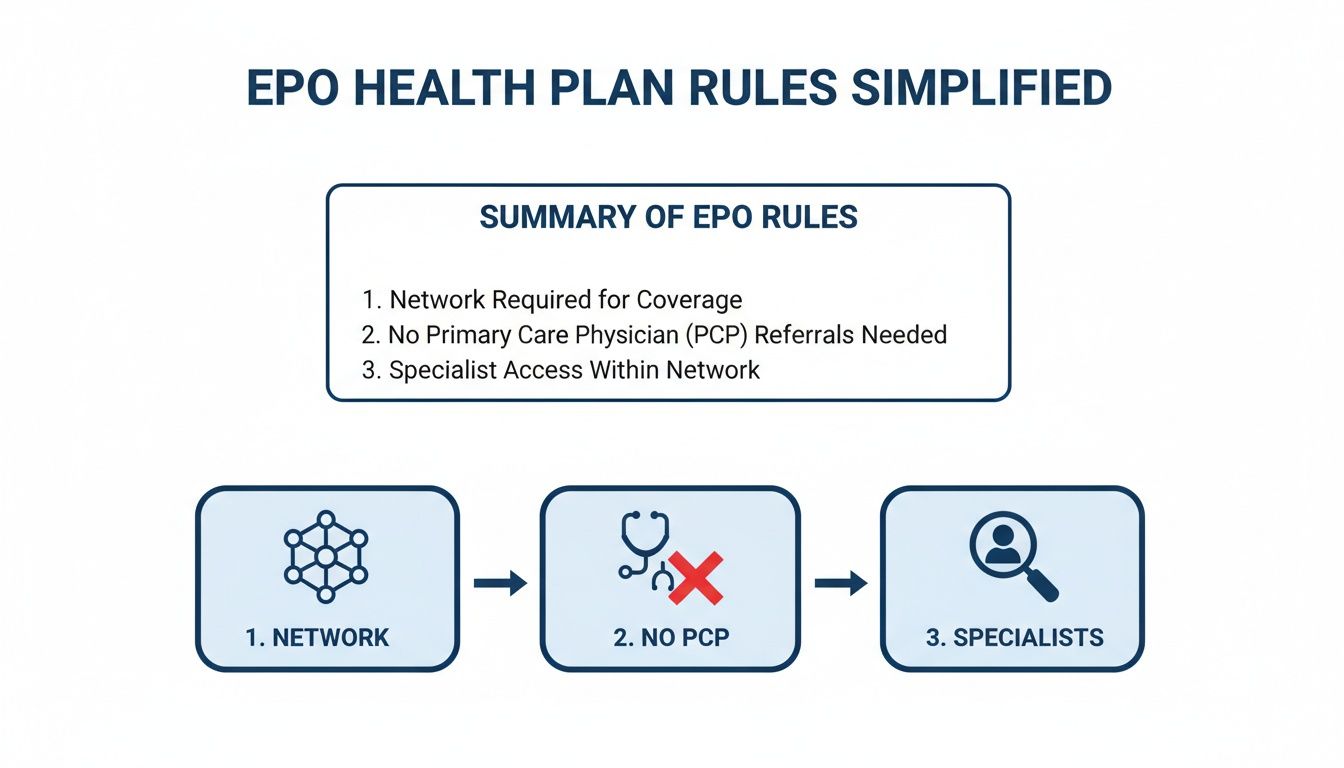

This simple graphic breaks down the core rules that make an EPO tick.

As you can see, the EPO model gives you direct access to specialists, cutting out the referral step that HMOs require, while still keeping you inside a specific network. If you're looking for a deeper dive into how to choose the right health plan for your situation, that's a great place to start.

Comparing EPO, PPO, and HMO Health Plans

To really see the differences, let's put these plans side-by-side and look at the features that matter most when you're making a decision.

| Feature | EPO (Exclusive Provider Organization) | PPO (Preferred Provider Organization) | HMO (Health Maintenance Organization) |

|---|---|---|---|

| Out-of-Network Care | Not covered, except in true emergencies. | Covered, but at a higher out-of-pocket cost. | Not covered, except in true emergencies. |

| Monthly Premiums | Moderate; typically lower than a PPO. | Highest; you pay a premium for flexibility. | Lowest; generally the most affordable option. |

| Referrals to Specialists | Not required for in-network specialists. | Not required. | Required for almost all specialist care. |

| PCP Requirement | Usually not required. | Not required. | Required; you must select a PCP. |

| Best For | Individuals who want lower costs and direct specialist access, and are confident in the plan's network. | People who want maximum choice in doctors and don't mind paying more for that freedom. | Budget-conscious individuals who are okay with having their care coordinated through a PCP. |

This table makes it clear: there's no single "best" plan, only the plan that's best for you.

While some industry projections show HMOs holding a 47.71% market share by 2026, the EPO is a growing and powerful alternative. Its hybrid approach is especially attractive for self-employed people and families who need that blend of affordability and direct access.

Ultimately, understanding the difference between HMO and EPO plans is a crucial step in finding coverage that feels right. The perfect plan is the one that aligns with your health, your budget, and the way you want to receive care.

The Pros and Cons of an EPO Plan

Every health insurance plan is a balancing act. You’re always weighing cost against choice and convenience, and an EPO plan is no different. It offers a really compelling mix of affordability and direct access to doctors, which makes it a fantastic option for a lot of people.

But its strict network rules mean it’s definitely not the right fit for everyone. To figure out if it’s for you, you have to be brutally honest about what you need. Let’s break down the good and the bad.

The Advantages of Choosing an EPO

The biggest draws of an EPO plan are the potential cost savings and how easy it is to see a specialist. If you’re budget-conscious and the doctors you like are already in the plan’s network, these benefits are hard to ignore.

- Lower Monthly Premiums: This is usually the headline feature. Because EPOs control costs by sticking to an exclusive network of doctors and hospitals, they can offer monthly premiums that are often significantly lower than what you’d pay for a more flexible PPO plan.

- No Referrals Needed for Specialists: This is a huge win for convenience and a major time-saver. You don’t need to get permission from a primary care physician (PCP) before you book an appointment with a specialist. That direct access cuts out an extra appointment and puts you in the driver’s seat.

- Potentially Larger Networks than HMOs: While it’s still a closed network, an EPO’s list of approved doctors is often larger and more comprehensive than what you'd find with many HMOs. This can give you more choices for providers while still keeping your costs predictable and low.

Think of an EPO as a streamlined path to healthcare. By getting rid of the referral "gatekeeper" and focusing on a curated network of providers, it's built for efficiency—and that efficiency can seriously lower your monthly bills.

The Disadvantages of an EPO Plan

The trade-off for all those benefits is a major lack of flexibility. If you're not careful, this can turn into a huge financial risk. The number one thing to remember about an EPO is that the network is everything.

- No Out-of-Network Coverage: This is the most critical point. Unless you are facing a true, life-threatening emergency, your EPO plan will not cover any care you get from a doctor or hospital outside its network. You’ll be on the hook for 100% of the cost. That’s how people end up with staggering, unexpected medical bills.

- Fewer Provider Choices than a PPO: Even if the network feels big, it will almost always offer fewer options than a PPO. This means that doctor your friend raved about or a specialist you’ve been seeing for years might not be on the list.

- The Risk of Network Changes: Doctors and hospitals can—and do—leave insurance networks. If your trusted specialist decides to stop taking your EPO plan halfway through the year, you’re stuck. You’ll have to find a new in-network doctor or pay the full, eye-watering price to keep seeing them.

Is an EPO Plan the Right Choice for You

Deciding whether an Exclusive Provider Organization (EPO) plan makes sense boils down to matching its perks with your everyday life. Reading about benefits and drawbacks is one thing—seeing how they play out in real life is another.

By exploring real-world examples, you’ll get a clearer picture of how an EPO aligns with your health needs, personal routine, and budget.

The Freelancer Or Gig Worker

Picture yourself balancing freelance gigs and fluctuating income. You value predictability in your monthly expenses and rarely need specialists outside a core group of providers.

An EPO can be a smart, budget-friendly fit:

- Lower Premiums: You’ll typically pay less each month compared to a PPO plan.

- Direct Specialist Access: No referrals needed to see an in-network orthopedic or other specialist if an issue—like carpal tunnel—arises.

- Solid Network: If your area has a robust roster of participating doctors and hospitals, being “exclusive” won’t feel restrictive.

Before you enroll, double-check that your go-to doctors and clinics are in the EPO network.

The Early Retiree

Imagine retiring early and waiting for Medicare eligibility at 65. You’ve already built trusting relationships with local physicians and a nearby hospital.

For an early retiree, an EPO plan can provide stable, affordable coverage during that critical gap. Just confirm your regular doctor and preferred hospital are included in the network.

If you’re comfortable without out-of-network freedom, you’ll save significantly versus a higher-cost PPO.

The Young Family On A Budget

Busy mornings, carpools, soccer practices—and the surprise of a feverish child in the middle of the night. Managing healthcare for growing kids on a tight budget is no small task.

An EPO could lighten the load:

- Streamlined Care: Skip referrals and head straight to an in-network pediatrician or specialist.

- Manageable Premiums: Lower monthly costs free up money for sports fees and school projects.

- Reliable Emergency Coverage: Ensure your local ER and hospitals are part of the network.

The most important step? Scan that provider list carefully. Make sure your favorite pediatrician and neighborhood hospital show up.

How to Find and Enroll in an EPO Plan

Alright, you understand what an EPO is. Now it’s time to turn that knowledge into action. The easiest time to shop for a new health plan is during the annual Open Enrollment Period, when the marketplace is open to everyone.

Start by comparing the EPO plans available where you live. It’s tempting to just look at the monthly premium, but be careful. A low premium can be a red flag for a sky-high deductible that you can’t afford. The real goal is to find a sweet spot—a plan with predictable monthly payments and out-of-pocket costs that won't break the bank when you actually need to use your insurance.

Your EPO Plan Checklist

As you start comparing your options, keep this simple checklist handy. It’ll help you stay focused on what really matters for your health and your wallet.

- Deductible: How much do you have to pay yourself before the plan starts chipping in?

- Out-of-Pocket Maximum: What's the absolute most you could possibly pay for covered services in one year?

- Copayments and Coinsurance: What’s your share for routine doctor visits or other medical services?

- Provider Directory: This is the big one. Are your must-have doctors, specialists, and local hospitals actually in the network?

The single most critical step is verifying your providers. An EPO’s value depends entirely on its network. Never assume your doctor is included; always check the plan’s official directory and then call the doctor’s office to confirm they accept that specific plan.

Doing this little bit of homework upfront is what separates a plan that works for you from one that just works on paper. For a full walkthrough of what comes next, check out our guide on how to apply for health insurance.

Navigating the world of health insurance can feel complex, and that's because it is. The professionals who guide you through it often complete rigorous health insurance certification programs to master all these details. By following these steps, you can confidently find an EPO plan that truly fits your life.

Got Questions About EPO Plans? We Have Answers.

Even after you've got the basics down, a few questions about how Exclusive Provider Organization (EPO) plans work in the real world probably come to mind. It’s completely normal. Getting clear on these details is the last step before you can choose your health coverage with total confidence.

Let’s tackle some of the most common ones.

What Really Counts as an Emergency for Out-of-Network Care?

This is a big one, since it’s the main exception to the “in-network only” rule. Insurers don't leave it up to guesswork. They use a standard called the "prudent layperson" rule.

So, what does that mean? It means a situation is considered an emergency if a regular person (not a doctor) with average health knowledge would reasonably believe their health is in serious danger without immediate medical help.

Think of things like severe chest pain, bleeding that won’t stop, or a sudden, scary difficulty breathing—not a nagging cough or a minor sprain that could wait for an in-network urgent care clinic.

Can I Change My EPO Plan in the Middle of the Year?

Generally, no. You can almost always only switch health plans during the annual Open Enrollment Period. But life happens, and there are exceptions for major events, known as Qualifying Life Events (QLEs). These grant you a Special Enrollment Period to make changes.

Common QLEs include things like:

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code where your current plan isn’t available

- Losing your other health coverage (like from a job change)

Without a QLE, you’ll have to wait for the next Open Enrollment window to make a switch.

How Do I Make Sure My Doctor Is in an EPO Network?

Never, ever assume. The best way to be 100% certain is a quick two-step process. First, use the insurance company’s official online provider search tool to see if your doctor is listed for the specific plan you're considering.

But don’t stop there. The most important follow-up is to call your doctor’s office directly. Ask the person who handles billing, "Do you accept the [Specific EPO Plan Name] plan?" This final confirmation is your safety net, because online directories can sometimes be out of date.

Ready to see if an EPO plan fits your budget and your life? At My Policy Quote, we take the confusion out of comparing plans and finding affordable coverage.

Get your free, no-obligation quotes today by visiting https://mypolicyquote.com.