Losing your job is stressful enough without having to worry about your health coverage. The good news is you don’t have to. The key is finding a temporary health insurance plan that acts as a bridge, protecting you and your family from surprise medical bills while you figure out what's next.

Your main choices are usually continuing your old plan with COBRA, finding a new one through the ACA Marketplace, or getting a fast, flexible short-term plan for emergencies.

Staying Covered During Your Job Transition

Losing your employer's health insurance can feel like the safety net just vanished. But you have more options than you might realize for temporary coverage. Think of this time between jobs as a canyon—you're on one side with your old job, and your new opportunity is on the other. You just need a bridge to get there safely.

The thing is, there isn't just one bridge. There are several, and each one is built for different needs and budgets.

This guide is your map to those bridges. We'll walk through every solid path forward, so you can make a decision that feels right, without getting bogged down in confusing insurance jargon. Our goal is to replace that feeling of uncertainty with a clear, simple action plan.

Of course, a job transition brings up more than just insurance questions. For tips on handling this period professionally, check out this great resource on managing employment gaps to make sure you're covered on all fronts.

Comparing Your Temporary Health Insurance Options

To get started, let's put your main choices side-by-side. Each one offers a different mix of cost, coverage, and flexibility. Getting a handle on these key differences is the first step to finding your perfect fit.

For a deeper look, you can also explore our detailed guide on navigating a health insurance gap between jobs.

Comparing Your Temporary Health Insurance Options

Here's a quick look at how the most common temporary health insurance options stack up. This table helps you see the major trade-offs at a glance.

| Coverage Option | Best For | Typical Cost | Coverage Level |

|---|---|---|---|

| COBRA | Keeping your exact same doctors and plan benefits, especially if you're in the middle of ongoing treatment. | High (102% of the full premium) | Comprehensive |

| ACA Marketplace Plan | Those who need comprehensive benefits and may qualify for income-based subsidies, making it a potentially affordable choice. | Varies (often low with subsidies) | Comprehensive |

| Short-Term Plan | Healthy individuals who need a fast, low-cost safety net for major emergencies and don't have pre-existing conditions. | Low | Limited |

| Spouse's/Partner's Plan | People whose spouse or partner has an employer-sponsored plan they can join during a special enrollment period. | Moderate | Comprehensive |

While this gives you a snapshot, the right choice really comes down to your personal health needs, your budget, and how long you think you'll be between jobs. Now, let's dive deeper into what each of these solutions really means for you.

Understanding COBRA vs ACA Marketplace Plans

When you’re in between jobs, figuring out health insurance can feel like a huge puzzle. Two of the biggest pieces you’ll encounter are COBRA and ACA Marketplace plans. They both get you from Point A to Point B, but they take very different routes.

Think of it this way: COBRA is like keeping your familiar, fully-loaded family car. You know exactly how it drives and all its features are right where you left them. The catch? You’re now paying for the entire car payment, insurance, and gas yourself.

The ACA Marketplace, on the other hand, is a bustling transit hub. Losing your job is like getting a special ticket to enter. Once inside, you can choose from all sorts of routes (plans) that fit your new destination and budget. Some routes even come with steep discounts (subsidies) to make the trip much more affordable.

This choice is becoming more common. In 2023, around 155 million people had health plans through their jobs, a drop from 157 million the year before. This isn't just about job changes; it shows more people are learning about their Marketplace options, especially with better financial help available.

What Is COBRA Coverage?

COBRA—short for the Consolidated Omnibus Budget Reconciliation Act—is a federal law that lets you hold onto the exact same health plan you had with your old job. It’s built for a seamless transition, so you don’t have to switch doctors or interrupt any ongoing treatments.

So, who gets it? COBRA typically applies to people working at companies with 20 or more employees who lose their coverage after leaving a job (unless they were fired for gross misconduct).

The biggest plus here is continuity. Your progress toward your deductible, your network of doctors, and your prescription coverage all stay the same. If you're in the middle of a major treatment or managing a chronic illness, that stability is priceless.

But—and it’s a big but—this continuity comes with a hefty price tag. You’re now on the hook for 100% of the premium your employer used to help pay, plus an administrative fee of up to 2%. It often turns into a shockingly high monthly bill.

Key Takeaway: COBRA is perfect for keeping your doctors and plan benefits without interruption, but it's usually the most expensive way to stay insured temporarily.

You have a 60-day window from the day you get your COBRA notice to sign up. It’s a hard deadline, so you need to act fast.

How ACA Marketplace Plans Work

The Affordable Care Act (ACA) Marketplace offers a totally different path. When you lose your job-based insurance, it’s considered a Qualifying Life Event. This unlocks a 60-day Special Enrollment Period for you to shop for a new plan on HealthCare.gov or your state’s official exchange.

You’re not just continuing your old plan; you’re picking a brand new one. These plans are sorted into metal tiers—Bronze, Silver, Gold, and Platinum—which help you balance what you pay each month with how much you’ll pay when you actually need care.

The number one advantage of the ACA Marketplace is affordability. Depending on what you expect your income to be for the rest of the year, you could qualify for powerful financial assistance:

- Premium Tax Credits: These are discounts that directly lower your monthly premium.

- Cost-Sharing Reductions: If you choose a Silver plan, these can also lower your deductible, copayments, and coinsurance.

This financial help can make great coverage surprisingly cheap—sometimes even cheaper than what you were paying as an employee. Plus, all ACA plans have to cover essential health benefits and can’t turn you away for pre-existing conditions.

Head-to-Head Comparison: COBRA vs. ACA

Choosing between these two really comes down to what you value most right now. Let’s put them side-by-side to make the decision clearer.

| Feature | COBRA | ACA Marketplace Plan |

|---|---|---|

| Cost | High (you pay 102% of the total premium) | Varies (often low with income-based subsidies) |

| Provider Network | Unchanged (you keep your current doctors) | Varies (you might need to find new in-network doctors) |

| Plan Benefits | Identical to your old employer's plan | Varies by plan tier (Bronze, Silver, Gold, etc.) |

| Deductibles | Your progress toward your deductible continues | Resets to $0 with a new plan |

| Enrollment | A 60-day window to elect coverage | A 60-day Special Enrollment Period after job loss |

Here’s the bottom line: If keeping your exact doctors and plan is your top priority and you can handle the high cost, COBRA is a solid, reliable choice. To get a better handle on the numbers, our guide on how much COBRA insurance really costs breaks it all down.

But if your budget is the deciding factor, the ACA Marketplace is almost always going to be the more financially sustainable option.

What Are My Other Coverage Options?

While COBRA and ACA plans are heavy hitters, they aren’t the only players in the game. When you’re between jobs, other paths can offer a crucial safety net, especially if speed and cost are your top concerns. Think of these alternatives as specialized tools—each one is perfect for a specific job, but not necessarily for every situation.

This flexibility is more important than ever. Today’s workforce is constantly in motion, with people shifting between full-time, part-time, and contract gigs. While the coverage gap between part-time and full-time workers has gotten smaller, a big difference remains. In fact, only 19 percent of part-time workers get coverage through their own job, compared to 62 percent of full-time employees. This highlights why having solid temporary insurance options is so essential during any career change.

Short-Term Health Plans: The Quick Fix

Short-term health insurance plans are exactly what they sound like: a temporary patch for your coverage needs. They’re designed to be a fast, affordable safety net against the big, unexpected stuff—a serious accident or a sudden illness.

You can often apply and get approved in a single day, with coverage kicking in almost immediately. This speed is their biggest plus, especially if you need proof of insurance in a hurry or are worried about going even a day without coverage. The monthly premiums are usually much lower than COBRA or an unsubsidized ACA plan, making them a go-to for anyone on a tight budget.

But that affordability comes with some serious trade-offs.

Important Caveat: Short-term plans are not ACA-compliant. This means they don’t have to cover essential health benefits, can turn you down for pre-existing conditions, and often have limits on what they’ll pay out.

Because of these limitations, they're really best for people who are generally healthy and don't expect to need much more than emergency care. For a deeper dive, be sure to check out our complete guide on what short-term health insurance covers.

Joining a Spouse or Partner's Plan

If your spouse or domestic partner has health insurance through their job, this is often one of the best and most stable solutions out there. Losing your own job-based coverage counts as a Qualifying Life Event, which opens up a Special Enrollment Period on their plan.

This gives your partner 30 days (sometimes it's 60, but it's vital to check with their employer) to add you and any dependents to their health insurance. This route typically gets you comprehensive, ACA-compliant benefits without the sticker shock that can come with COBRA.

Here’s a quick rundown:

- Eligibility: You need to be legally married or a recognized domestic partner.

- Action Required: Your partner has to contact their HR department to get the ball rolling within that 30-day window.

- Coverage: You get access to a full-featured group plan that covers pre-existing conditions and all the essential benefits.

This path offers a fantastic blend of high-quality coverage and manageable costs, making it a top choice if it's available to you.

Medicaid and CHIP: Government-Sponsored Coverage

For individuals and families with limited income, Medicaid and the Children's Health Insurance Program (CHIP) offer comprehensive health coverage for very little or no cost. Eligibility isn't based on your old salary—it's based on your current monthly household income.

If your income has dropped significantly after losing your job, you might qualify now even if you didn't before.

You can apply for Medicaid or CHIP any time of year; there’s no need to wait for a special enrollment period. These programs provide strong benefits that cover a wide range of medical services, making them a true lifeline for many families navigating a job transition. Checking your eligibility through your state's official marketplace or Medicaid agency is a simple step that could connect you with excellent, affordable coverage.

How to Budget for Temporary Coverage

Let's get right to the question that’s probably keeping you up at night: how much is this going to cost? When you’re between jobs and that regular paycheck isn’t coming in, every single dollar matters. It’s time to get real about the costs so you can make a plan that doesn’t leave you with any nasty financial surprises.

Think of it like this: your main car is in the shop, and you need a temporary rental. You could get the exact same model (that's COBRA), but you'll be paying the full, undiscounted daily rate. Or, you could find a more budget-friendly option that still gets you from A to B (like an ACA Marketplace plan), and you might even qualify for a special discount because of your current situation.

Calculating the Cost of COBRA

The math for COBRA is painfully simple, and it almost always leads to sticker shock. With COBRA, you’re on the hook for 100% of the premium—both your share and what your old employer used to pay. On top of that, there's a small administrative fee of up to 2%.

So, the formula looks like this:

(Your Old Contribution + Your Former Employer's Contribution) x 1.02 = Your New Monthly COBRA Bill

If your employer was kicking in $450 a month and you were paying $150, your new COBRA payment will jump to around $612. It’s the same fantastic coverage you’re used to, but the cost feels completely different when you’re shouldering the whole thing yourself.

Unlocking Affordability with ACA Subsidies

The ACA Marketplace works on a totally different model. The price you pay isn't a fixed number; it’s all based on your estimated household income for the entire year. This is where things get interesting and where a lot of people find huge savings.

When you lose your job, your projected income for the year takes a nosedive. This often makes you eligible for something called a Premium Tax Credit, which is just a fancy name for a subsidy that directly lowers your monthly insurance bill.

For instance, say you earned $30,000 in the first six months of the year but now expect to earn very little while you job hunt. The Marketplace might estimate your total annual income at just $35,000. They use that lower number to calculate your subsidy, which can slash the cost of a great plan from hundreds of dollars down to $50 or even $0 a month. You can explore our guide on how to find affordable health insurance to learn more about making this work for you.

The Low Premium, High-Risk Structure of Short-Term Plans

Short-term plans are built to be the cheapest upfront option, period. Their monthly premiums are often just a fraction of COBRA or an unsubsidized ACA plan—sometimes you’ll see them for under $200. They keep costs low by offering limited benefits and, crucially, by not covering pre-existing conditions.

But that low premium comes with a major catch: you could face huge out-of-pocket costs if you actually get sick or hurt. These plans are known for having sky-high deductibles and often don't cover essentials like maternity care or mental health services.

Budgeting Insight: A short-term plan drops your fixed monthly expense but cranks up your financial risk. You're basically betting that you'll stay perfectly healthy until you land your next job.

Estimated Monthly Cost Scenarios

To help you see how this all plays out, let's look at a few real-world examples. This table gives you a snapshot of what different people might pay each month, showing just how much the costs can swing depending on the path you choose for temporary health insurance between jobs.

| Profile Scenario | Estimated COBRA Cost | Estimated ACA Silver Plan Cost (with subsidy) | Estimated Short-Term Plan Cost |

|---|---|---|---|

| Single, 30-Year-Old | $550 / month | $40 / month | $110 / month |

| Married Couple, 45-Years-Old | $1,200 / month | $95 / month | $250 / month |

| Family of Four | $1,800 / month | $150 / month | $380 / month |

Note: ACA costs are based on a projected annual household income of $35,000 for the individual and $70,000 for the couple/family.

As you can see, while COBRA provides that seamless continuation of coverage, the ACA Marketplace is often the most affordable way to get comprehensive protection when you need it most.

Choosing the Right Plan for Your Situation

Okay, we’ve covered the theory. But let’s be real—the best way to understand your options is to see how they play out for actual people. Finding the right temporary health insurance isn't about a one-size-fits-all answer. It's a personal puzzle, and your life, your budget, and your health are the pieces.

So, let's walk through a couple of common scenarios. By seeing how different people think through their choices, you can start to map out your own path with more confidence.

Meet Alex: The Newly Self-Employed Freelancer

Alex, a 32-year-old graphic designer, just took a leap of faith, leaving a steady agency job to launch a freelance business. For the first few months, income is going to be a rollercoaster, so a huge monthly bill is a non-starter. Health-wise, Alex is in great shape and usually only sees a doctor for an annual checkup.

- Top Priority: Low monthly cost and flexibility.

- COBRA: This was an easy no. A premium of over $600 a month? That’s just not realistic when you're building a business from scratch.

- ACA Marketplace: Now this looks promising. Because Alex’s income is projected to be lower this year, they qualify for some serious subsidies. A solid Silver plan comes down to just $55 a month.

- Short-Term Plan: Also a contender. A plan with a $5,000 deductible would only cost $90 a month. It’s basically a safety net for a true worst-case scenario.

Alex's Decision: Alex goes with the ACA Marketplace plan. Even though the short-term plan had a slightly lower premium, the peace of mind from having comprehensive coverage for a subsidized price won out. It provides a stable foundation while the new business gets off the ground.

This is a common choice for people entering the gig economy. Think about it: temporary help agency workers have an employer-sponsored coverage rate of only 16.6 percent. Most independent contractors are in the same boat. Affordable, quality options like the ACA are a game-changer. You can find more data on this from the Bureau of Labor Statistics on health coverage for alternative workers.

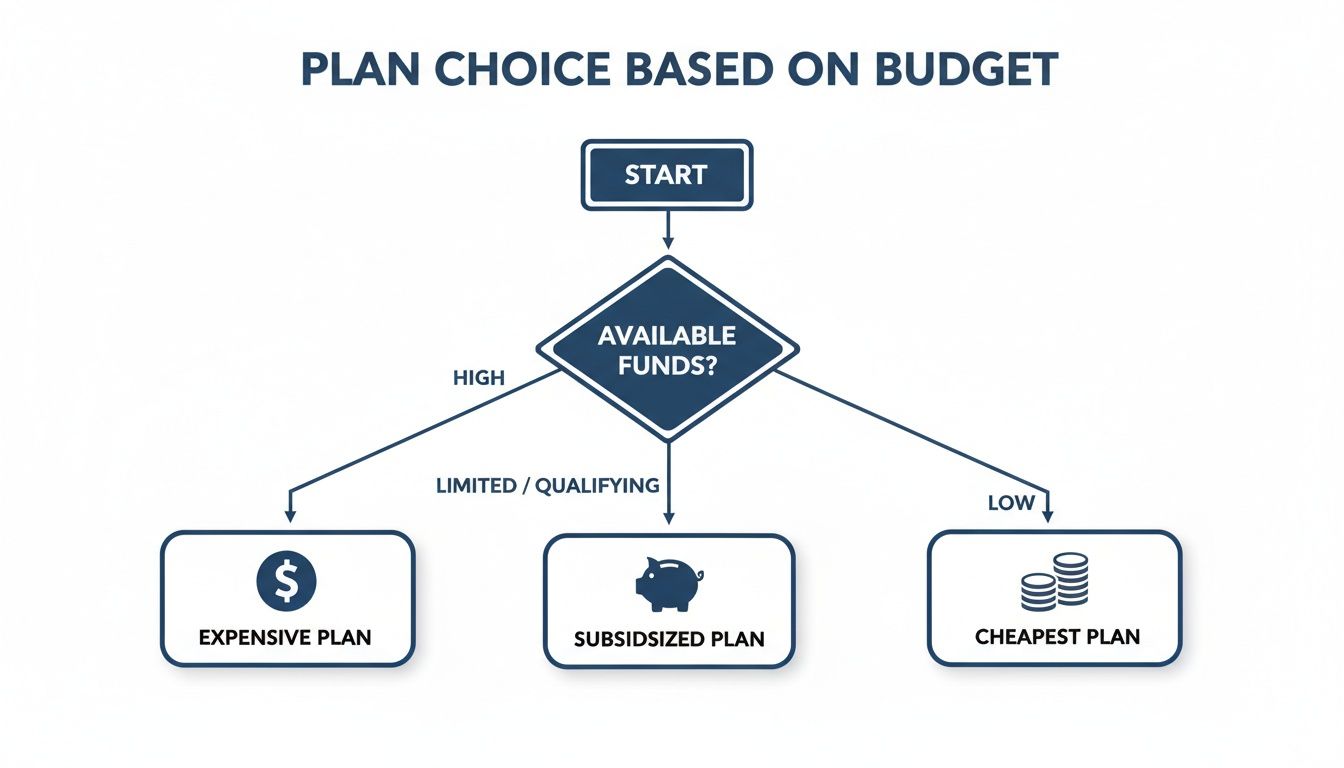

This simple flowchart shows how your budget really steers the ship when choosing a plan.

As you can see, your wallet is usually the best place to start.

Meet Sarah: The 62-Year-Old Bridging to Medicare

Sarah was recently laid off from her corporate job and is just three years away from Medicare eligibility. She’s actively managing a pre-existing condition that requires regular visits to a specialist and specific, ongoing prescriptions.

Key Consideration: Keeping her doctors and making sure her medications are covered is everything. Cost matters, but not if it means risking her health.

For Sarah, the choice is tough but clear.

- COBRA: This is the only option that guarantees she can keep her entire medical team without a single interruption. The benefits are identical to what she had. The downside? It’s pricey—around $850 per month.

- ACA Marketplace: A new plan would almost certainly mean finding new doctors within a new network, a headache she desperately wants to avoid. She’d also have to cross-check her exact medications against the new plan's approved list.

- Short-Term Plan: This isn't even on the table. It would refuse to cover her pre-existing condition, leaving her completely exposed to massive medical bills.

Sarah's Decision: With a heavy sigh, Sarah chooses COBRA. That high monthly payment is a tough pill to swallow, but the absolute certainty of keeping her trusted specialists during this critical pre-Medicare window makes it worth it. It’s the price she’s willing to pay for stability when she needs it most.

Your Step-by-Step Action Plan for Getting Covered

Losing your job is stressful enough. Figuring out health insurance on top of it can feel like trying to solve a puzzle against a ticking clock. But you don't have to panic. The key is to break it down into simple, manageable steps.

Think of this as your roadmap from job loss to peace of mind. Let's walk through it together.

First things first: get organized. Pull together all your essential documents. This means finding your termination letter (proof of job loss) and getting the Social Security numbers and birth dates for everyone in your house who needs coverage. Having this on hand now will save you a massive headache later.

Next, grab a calendar. You have a 60-day window from the day your old plan ends to sign up for a COBRA or ACA Marketplace plan. This deadline is critical. Missing it could lock you out of real coverage until the next Open Enrollment period, so treat it like it's set in stone.

Figure Out Your Needs and Budget

Now it’s time to think like your family's healthcare manager. What do you actually need? Do you have prescriptions you take every month? Ongoing treatments for a chronic condition? A doctor you absolutely can't imagine leaving?

Make a list of these non-negotiables. Be honest.

This list is your foundation for setting a budget. Calculate what you can realistically afford to pay each month for a premium. Just remember, a super-low premium often means you'll pay a lot more out-of-pocket when you actually need care. The goal is to find that sweet spot that protects both your health and your wallet.

Your honest assessment of your family's health needs and financial reality is the single most important step you can take. It’s the bedrock of your decision, ensuring you don’t end up overpaying for benefits you won't use or, even worse, being underinsured when an emergency strikes.

Compare Your Options and Take Action

With your needs and budget clearly defined, you’re ready to compare your top contenders side-by-side. How do COBRA, ACA plans, and short-term options stack up for your specific situation?

This is where the rubber meets the road. Here's a quick cheat sheet:

- COBRA: Choose this if keeping your exact same plan and doctors is your #1 priority and you can handle the higher premium.

- ACA Marketplace: Your best bet if affordability is the main goal, since you might qualify for subsidies to lower your monthly cost.

- Short-term insurance: A good option for a low-cost, temporary safety net if you’re generally healthy and just need protection against a major accident.

Once you’ve made a decision, don’t put it off. Submit your application and get it done, well before the deadline hits. Taking that final, decisive step is what secures your coverage and protects your family's well-being while you figure out what's next in your career.

Your Questions Answered: Navigating Temp Health Insurance

Jumping between jobs often brings up a ton of questions about health insurance. It can feel like a maze, but getting straight answers makes all the difference. Here are the most common questions we hear from people just like you.

What if I Quit My Job? Can I Still Get Covered?

Yes, you absolutely can. It’s a common myth that quitting leaves you with no options.

While quitting your job usually means you can't get COBRA, it does count as a qualifying life event. This is huge. It unlocks a 60-day Special Enrollment Period on the ACA Marketplace, letting you shop for a real, comprehensive health plan.

You can also buy a short-term health plan anytime. These don't require a special reason, making them a quick and easy fallback no matter why you left your job.

What Happens if I Miss the 60-Day Enrollment Deadline?

This one is serious. That 60-day window is a hard deadline, not a suggestion.

If you miss it, your options for getting a comprehensive ACA or COBRA plan evaporate. You'll most likely have to wait until the next annual Open Enrollment Period to sign up for major medical coverage, which could be months away.

Your only real option in that gap would be a short-term plan. But remember, these are temporary fixes—they aren't ACA-compliant and usually won't cover pre-existing conditions. Missing that deadline leaves you dangerously exposed to high medical bills.

Here's the bottom line: That 60-day deadline is not flexible. Circle it on your calendar, set a reminder, and act fast. Protecting yourself means respecting that timeline.

How Soon Will My New Coverage Actually Start?

This is a great question, because the timing can be a deal-breaker depending on what you need right now. The start date really changes based on the plan you choose.

Here's a quick look at how it breaks down:

- COBRA: This is the only option that offers retroactive coverage. Once you sign up and pay, your plan is effective all the way back to the day you lost your old insurance. That means zero gap in coverage.

- ACA Marketplace Plans: Your coverage almost always starts on the first day of the month after you enroll. For example, if you pick your plan on May 20th, it will kick in on June 1st.

- Short-Term Plans: These are the fastest. In many cases, you can get coverage as soon as the day after you apply. It’s a nearly instant safety net.

That speed is exactly why short-term plans are so popular as a bridge while you're waiting for an ACA plan or your next job's benefits to start.

Figuring all this out can be a headache, but you don't have to do it alone. The experts at My Policy Quote are here to help you compare your options and find a plan that fits your life and your budget.

👉 Visit https://mypolicyquote.com to get personalized guidance today.