The core difference really boils down to this: term life insurance is pure, straightforward protection for a set amount of time. It’s perfect for temporary responsibilities, like making sure your mortgage gets paid off if something happens to you. On the other hand, whole life insurance is built to last your entire life and comes with a cash value savings account, making it a permanent piece of your financial puzzle.

Choosing Your Financial Safety Net

When you’re weighing term vs. whole life insurance, you're really choosing between two very different financial strategies. The right choice for you depends entirely on your goals, your budget, and how long you need the coverage. One path gives you the most coverage for the least amount of money, while the other offers a lifelong guarantee and investment-like features for a much higher price tag.

Think of it like buying a car. Term life is like a reliable, fuel-efficient sedan that gets you from point A to point B during a specific journey—like from the day your kids are born until they graduate college. Whole life is more like a luxury RV; it’s designed for the entire road trip of life, costs a lot more upfront, and has built-in amenities (that’s the cash value).

The Core Trade-Off Explained

The central trade-off is simple but has huge implications. With term life, you accept that the coverage is temporary. If you outlive the policy, your family doesn’t get a payout. The upside? It’s so affordable that you can secure a massive death benefit during the years you need it most.

With whole life, the payout is guaranteed, no matter when you pass away, as long as you’ve paid your premiums. It also forces you to save money through its cash value component. While there are many different types of life insurance, understanding this fundamental difference is the most important first step.

The "better" policy doesn't exist. The right policy is the one that solves your specific financial problem. It's all about matching the policy's design to your personal timeline and what you want to achieve.

A 2022 study from Ohio State University drove this point home. It found that households with only term life insurance were 3.95 times more likely to be financially secure after the death of a primary earner compared to those with no coverage at all. That really highlights the power of getting affordable, high-value protection when your family is most vulnerable.

To make this initial choice a little clearer, here’s a straightforward, side-by-side comparison.

Quick Look: Term vs. Whole Life Insurance at a Glance

This table breaks down the essentials, giving you a clear view of how these two policies stack up.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | A fixed term (like 10, 20, or 30 years) | Lifelong, permanent coverage |

| Primary Purpose | Income replacement for a specific time | Lifelong protection, estate planning, legacy building |

| Premium Cost | Much lower and fixed for the term | Substantially higher, but usually fixed for life |

| Cash Value | None. It's pure insurance. | Builds tax-deferred cash value you can borrow against |

| Flexibility | High. You can let it expire when you no longer need it. | Low. It’s a lifelong financial commitment. |

As you can see, they serve very different needs. One is a targeted solution for a temporary problem, while the other is a long-term financial asset.

How Each Insurance Policy Actually Works

To really get to the bottom of the term vs. whole life debate, you have to look under the hood. It’s one thing to know the definitions, but it’s another to understand how they actually function day-to-day and over the long haul. Think of it this way: one operates like a simple rental agreement for protection, while the other is more like a complex financial tool with a lot of moving parts.

Term life insurance is loved for its simplicity. The core of it works on a principle called level premium, which is just a fancy way of saying your monthly payment is locked in. It will not change for the entire term you choose—whether that’s 10, 20, or 30 years.

This straightforward structure makes budgeting a breeze. It ensures your costs stay predictable during the years when your financial responsibilities—like a mortgage or raising kids—are at their highest. You're essentially renting a large amount of protection for a specific, defined period.

Understanding Term Policy Expiration and Options

So, what happens when your term is up? The policy simply expires. If you outlive the term, the coverage ends, you stop paying, and that's that. Your beneficiaries don’t get a payout because the risk period you were insured for has passed. That’s the fundamental trade-off for its affordability.

But you're not always left high and dry. Most modern term policies come with a couple of important lifelines for what comes next:

- Annual Renewability: Many policies let you renew your coverage year-by-year once the initial term ends, but there's a catch. The premium will be much, much higher because it’s recalculated based on your current age and health. It can be a decent stop-gap, but it's a costly long-term plan.

- Conversion: This is a game-changer. The convertibility option allows you to trade in all or part of your term policy for a permanent one, like whole life, without having to do another medical exam. This is an incredibly powerful feature if your health takes a turn and you suddenly need lifelong coverage.

The real value of a term policy is how perfectly it lines up with temporary needs. Its simplicity and predictability make it the right tool for protecting your biggest financial responsibilities for a set amount of time.

Dissecting The Dual Nature Of Whole Life

Whole life insurance is a completely different animal because of its dual structure. When you pay your premium, the money gets split between two different jobs: funding the death benefit and building a cash value account.

Part of your payment covers the actual cost of insurance and administrative fees. The rest gets funneled into that cash value account, which is designed to grow over your lifetime at a guaranteed, fixed interest rate.

A major selling point here is that the cash value grows on a tax-deferred basis. You don’t pay taxes on the gains as they pile up, which is why some people view permanent insurance as a conservative financial tool. For those wanting to dig deeper into permanent options, understanding products like Variable Universal Life insurance can show how the investment side of things can vary.

Accessing Your Policy's Cash Value

That growing cash value isn’t just a number on a statement—it's a liquid asset you can actually use while you're still alive. There are a few ways to get your hands on it, and each has its own financial implications.

You can take out a policy loan. This isn't taxable and doesn't require a credit check because you're borrowing against yourself, using your policy as collateral. Just remember, any loan balance you haven't paid back when you pass away will be subtracted from the death benefit your family receives.

Another option is a withdrawal, also known as a partial surrender. You can typically withdraw up to the amount you've paid in premiums completely tax-free. Anything you take out beyond that is considered a gain and will be taxed. It’s also crucial to know that withdrawals will permanently reduce your policy's death benefit. Getting a handle on these mechanics is a key part of understanding life insurance policies in detail.

A Realistic Look at Policy Costs and Value

When it comes to choosing between term and whole life insurance, the conversation almost always lands on one thing: money. The price tag. While both are designed to protect your family, the cost difference is massive, and it's not just a few dollars here and there.

Understanding why whole life costs so much more is the key to making a smart decision, not just an emotional one.

Term life insurance is built to be affordable. Period. It covers you for a specific window of time—like the 20 or 30 years you’re raising kids or paying down a mortgage—and that’s it. There’s no complex savings account attached, so you’re only paying for the death benefit protection. It’s simple, powerful, and incredibly cost-effective.

Whole life is a different animal entirely. It bundles that death benefit with a cash value savings component and guarantees coverage for your entire life. That combination—lifelong protection plus forced savings—is what drives the premium through the roof. You’re not just buying insurance; you’re funding a savings account, paying higher administrative fees, and covering the much higher risk you pose to the insurer in your later years.

Unpacking the Premium Price Gap

Let's be clear: the cost difference isn't small. It's often a game-changer. For many families who need a lot of coverage but are working with a real-world budget, that price gap is the deciding factor.

To give you a sense of the scale, let's look at some numbers. A healthy 20-year-old woman looking for a $500,000 policy might find a 20-year term plan for around $18.54 a month. That same $500,000 of coverage in a whole life policy could easily cost $287 a month.

That means the whole life policy is over 15 times more expensive for the exact same death benefit.

This is the core trade-off. With term, you get pure, no-frills protection when you need it most, for a very low cost. With whole life, you pay a steep price for permanence and the attached cash value feature.

Where Does Your Whole Life Premium Go?

It helps to know what you’re actually paying for with that high whole life premium. Each payment you make gets split into three main buckets, and only one of them is for the pure insurance.

- Cost of Insurance: This is the actual price to insure your life, just like a term premium. It covers the risk that the company will have to pay out the death benefit.

- Fees and Commissions: A slice of your premium goes to the insurance company's operating costs and the agent’s commission. These are almost always higher for permanent policies because they're more complex to manage.

- Cash Value: The biggest chunk of your premium, especially in the early years, gets funneled into the cash value account, where it starts to grow, tax-deferred, very slowly.

The high premium on a whole life policy is basically front-loading the cost of insurance for your entire life. You overpay in your younger, healthier years to keep the premium from skyrocketing when you're older and more expensive to insure.

Buy Term and Invest the Difference

This massive cost gap is what led to a popular financial strategy called “Buy Term and Invest the Difference.” The idea is straightforward: instead of locking yourself into a high whole life premium, you buy an affordable term policy that covers your needs and invest the money you save each month.

Let’s go back to our 20-year-old. She could buy the term policy for $18.54/month and invest the extra $268.46 she would have spent on whole life. Over decades, that money has the potential to grow into a much larger nest egg than the guaranteed cash value in the whole life policy, especially with the power of compound returns.

But there’s a catch: this strategy demands discipline. It only works if you actually invest the difference, consistently. For people who find it hard to save, the forced savings aspect of a whole life policy can be a good thing. It really comes down to what you know about yourself and your financial habits. A detailed breakdown of term life insurance costs can help you run the numbers for your own situation.

Matching Your Policy to Your Life Stage

The textbook definitions of term and whole life insurance don't mean much until you see how they work in the real world. A policy is just a tool, and the "best" one isn't about fancy features—it's about how well it solves your problem, right now. What works for a young family just starting out will be completely wrong for someone planning their retirement.

Let's move past the theory. Think of these policies as different tools for different jobs. Your job is to pick the right one for where you are in life. That’s the single most important part of this decision.

Scenario One: The Young Family and The Mortgage

Picture a couple in their early 30s. They have two small kids and just signed the papers for a 30-year mortgage. Their biggest fear is simple: if one of them passes away unexpectedly, how would the other person possibly cover the mortgage, bills, and save for college on just one income?

Their need for protection is huge, but it's not forever. It's tied directly to the years they'll be raising their children and paying off that house.

- The Right Tool: A 30-year term life insurance policy is the perfect fit. It’s designed to match the exact timeline of their biggest debts and responsibilities. They can get a massive death benefit—often $1,000,000 or more—for a surprisingly low monthly cost, giving them the peace of mind that their family is secure.

- Why Not Whole Life: The premiums for a whole life policy would be so high they’d probably have to settle for a much smaller death benefit. That would leave them underinsured during the most critical years, defeating the whole purpose of getting coverage in the first place.

The lesson here is all about timeline alignment. Term life shines when your biggest financial worries have a clear end date. It gives you the most protection for the least amount of money, exactly when you need it most.

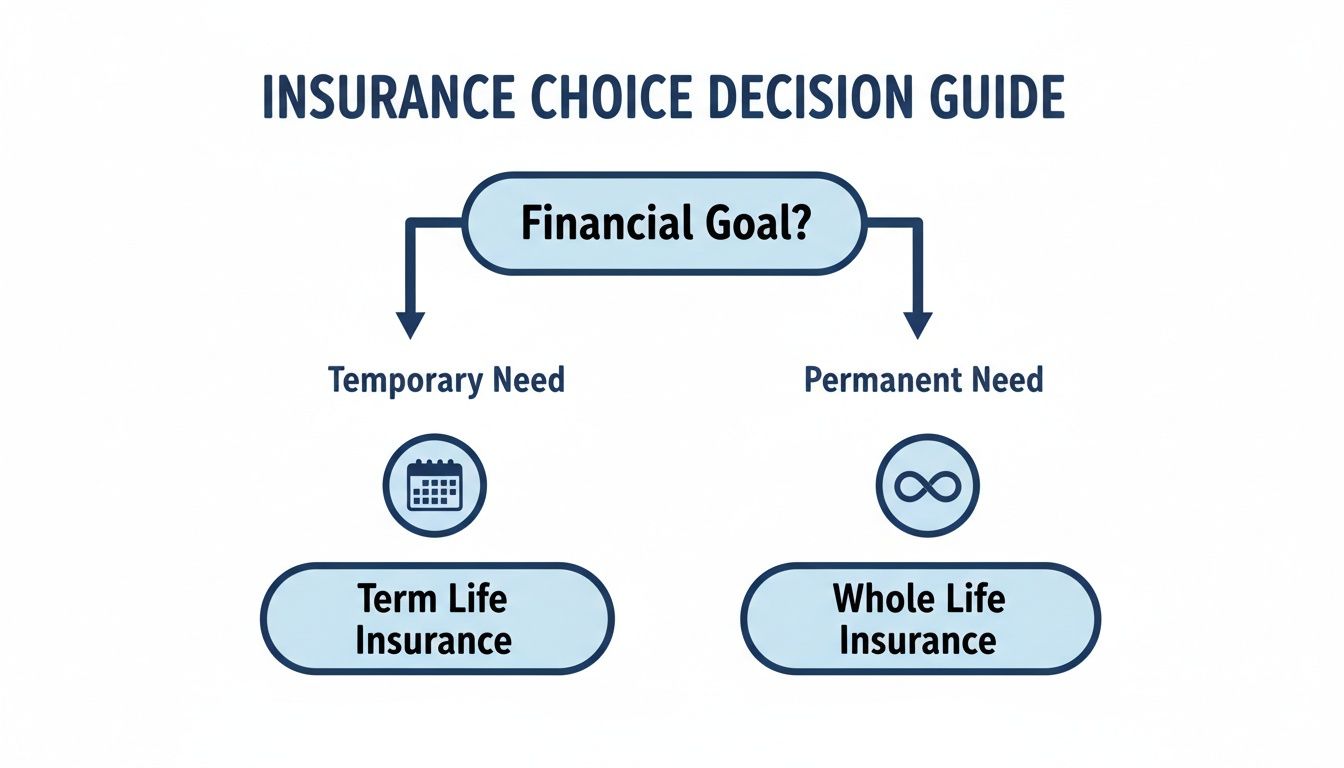

This decision tree helps visualize that core choice between temporary needs and lifelong goals.

As you can see, it all starts with one question: is your goal for a set period, or is it for your entire life?

Scenario Two: The Business Owner Securing a Loan

Now, imagine a 45-year-old entrepreneur who needs a big loan to expand her business. The bank agrees, but with one condition: she needs life insurance to cover the loan amount, ensuring they get their money back if she dies before it's repaid. The loan term is 10 years.

Once again, the need is specific, temporary, and has a clear dollar amount attached.

- The Right Tool: A 10-year term policy is a no-brainer. It's the most cost-effective way to meet the lender's requirement without draining cash flow with high premiums. In a decade, when the loan is paid off, she can let the policy expire. Job done.

- Why Whole Life is Inefficient: Using a whole life policy here would be like using a sledgehammer to hang a picture. It's overkill—far too expensive and permanent for what is purely a temporary business need.

Scenario Three: The High-Net-Worth Individual and Estate Planning

Finally, let's look at a well-off couple in their late 50s. Their kids are independent, the house is paid off, and their retirement savings are solid. Their main concern now is what happens after they're gone. They want to leave their estate to their heirs, but they know a hefty estate tax bill will come due.

This is a permanent problem. It’s not a matter of if it will happen, but when. They need a guaranteed source of cash so their kids won't be forced to sell assets like the family business or real estate just to pay the taxes.

- The Right Tool: Whole life insurance was built for this. It provides a guaranteed, tax-free death benefit that will be there no matter how long they live. It’s the perfect way to provide instant liquidity to settle estate costs. Plus, the policy's cash value grows over time, becoming another conservative asset in their portfolio.

- Why Term Life Fails: A term policy is a huge gamble for them. If they outlive the term, the coverage vanishes, and they’re right back where they started—with a massive tax problem and no solution. They need the certainty that only a permanent policy can offer.

As these situations show, the "term vs. whole" debate isn't about which one is "better" in a vacuum. The right choice is always the tool that solves your specific problem most efficiently. Sometimes, unique circumstances come into play, like choosing the right expat life insurance plan if you live and work abroad. It all comes down to what you need to protect, and for how long.

Customizing Your Coverage with Riders and Features

Choosing between term and whole life isn't just about the death benefit. Both types of policies can be shaped and molded with special add-ons called riders. Think of them as optional upgrades that let you build a safety net that’s far more personal and robust.

These riders transform a basic policy from a simple payout at death into a dynamic financial tool. They add layers of protection that can make a huge difference while you're still living, addressing specific worries and filling potential gaps in your financial plan.

Enhancing Your Policy with Common Riders

While you can find a long list of available riders, a few really stand out for their practical, real-world value. They often kick in while you're alive, adding a "living benefits" component to your coverage.

Three of the most valuable riders you'll come across include:

- Accelerated Death Benefit (ADB): This is often included at no extra cost. It’s a powerful feature that lets you access a portion of your death benefit early if you’re diagnosed with a terminal illness. Those funds can be a lifeline for medical bills or other final expenses.

- Waiver of Premium: If you become totally disabled and can't work, this rider has your back. It covers your insurance premiums for you, making sure your policy doesn’t lapse when you can least afford for it to.

- Child Rider: For a small cost, this rider provides a modest amount of term life insurance for all of your children under a single add-on. It's a simple way to get them some coverage, which can often be converted into their own permanent policy later on.

These are just a few of the tools you can use to build a truly comprehensive defense. To see a full list, check out our guide on what a rider is on life insurance and get the details on how each one works.

The most powerful features in a life insurance policy are the ones that offer flexibility. Life is unpredictable, and having options to adapt your coverage as your circumstances change is priceless.

The Convertibility Feature: A Game-Changing Option for Term Life

If there's one feature of a term policy you absolutely need to know about, it's the convertibility option. This powerful clause gives you the right to convert some or all of your term coverage into a permanent policy—like whole life—without having to go through another medical exam.

This is an incredible safety net. Let’s say you buy a term policy while you're young and healthy, but later develop a medical condition that would make you uninsurable. The conversion privilege guarantees you can still secure lifelong coverage, no questions asked about your health.

It effectively bridges the gap in the term vs. whole life debate. You can start with the affordable protection of term insurance during your high-need years, all while keeping the door open to permanent coverage down the road.

Comparing Flexibility: Term vs. Whole Life

When it comes to built-in flexibility, term insurance generally gives you more freedom. Its core feature is its temporary nature. You can pick a term that perfectly matches a specific need—like a 30-year mortgage—and just let the policy expire once that debt is paid off.

Whole life, on the other hand, is a lifelong commitment. While it offers its own kind of flexibility by letting you access the cash value through loans or withdrawals, the policy itself is designed to be permanent. If you decide to cancel it, especially in the early years, you could face significant surrender charges and lose a good chunk of the premiums you've paid.

Ultimately, understanding these features and riders is the key to building a policy that does more than just pay out when you're gone. It allows you to create a plan that adapts with you, providing security not just for your family's future, but for your own financial well-being today.

Got Questions? We've Got Answers

Even after weighing the pros and cons, a few common questions always pop up. Let's tackle them head-on, so you can feel 100% confident in your choice.

Can I Really Have Both Term and Whole Life Insurance?

Yes, you absolutely can—and for many people, it's the smartest strategy out there. Think of it as "layering" your protection. You can use a larger, more affordable term policy to cover the big, temporary expenses, like your 30-year mortgage or the kids' college fund.

At the same time, a smaller whole life policy acts as a permanent safety net. It’s there to cover final expenses, handle estate taxes, or leave a guaranteed legacy, no matter when you pass away. This mix-and-match approach often gives you the best of both worlds: high coverage when you need it most and a permanent foundation for life.

What Happens If I Outlive My Term Policy?

This is a great question. When your term policy ends, the coverage simply expires. You stop making payments, and the insurance company is no longer on the hook for a death benefit. It's important to remember you don't get any money back; you paid for peace of mind during a specific period, and that's exactly what you got.

This is why picking the right term length from the start is so critical. Before it expires, you usually have a couple of options: you can renew it year by year (at a much higher price) or, if your policy has a conversion feature, you can switch it to a permanent plan without needing a new medical exam.

An expiring term policy isn't a failure—it's the goal. The idea is to become "self-insured" by the time it ends. Your mortgage is paid off, your kids are independent, and your retirement savings have grown enough to take care of your loved ones.

Is the Cash Value in Whole Life a Good Investment?

It’s better to think of it as a very conservative, tax-advantaged savings account, not a high-growth investment. The real power of whole life is in its guarantees—the death benefit, the level premiums, and the slow, steady cash value growth. It also creates a kind of forced savings habit, which can be incredibly valuable.

But will it beat the stock market? Probably not. That's the whole idea behind the "buy term and invest the difference" philosophy. If your main objective is to grow your wealth as fast as possible, you’ll almost always get better returns by pairing an affordable term policy with your own diversified investment portfolio.

Feeling your way through the details of term vs. whole life insurance can be a lot to handle, but you’re not in this alone. The experts at My Policy Quote are here to help you compare personalized options and find the perfect fit for your life, your family, and your budget. Get your tailored quote today and secure your family’s future.