Shopping for health insurance can feel like you're standing at a crossroads with two very different paths ahead.

One path leads to the government's official Health Insurance Marketplace. Think of it as a massive, centralized store where you can browse plans from different companies all in one place. This is also the only place you can get a helping hand from the government in the form of premium tax credits or cost-sharing reductions to make coverage more affordable.

The other path? That's the off-exchange health insurance market. It's less like a single store and more like visiting a brand's boutique directly. You go straight to the source—an insurance company's website like Cigna or Blue Cross Blue Shield—or work with an independent insurance agent to find your plan.

Unpacking the World of Off-Exchange Health Insurance

So, why would anyone choose to bypass the main Marketplace? It often comes down to one simple reason: you don't qualify for government subsidies.

If your household income is above the threshold for financial help, you'll be paying the full premium no matter where you buy. Going directly to the insurer can sometimes open up a wider variety of plans that aren't even listed on the Marketplace, giving you more tailored options.

This direct route often makes more sense for:

- Self-employed professionals who want a simpler application without complex income verification.

- Early retirees who need solid coverage before they're eligible for Medicare.

- Higher-income families looking for more plan choices when financial aid isn't a factor.

Keeping Up with a Changing Market

The off-exchange world has become a critical part of the health insurance landscape, especially as things shift. We're seeing a major decline in traditional, fully insured health plans offered by employers. In fact, over 2 million fully insured lives were lost from the commercial market between July 2024 and January 2025 alone.

This trend is pushing more people to find coverage on their own. While the ACA Marketplace hit a record 24 million enrollees in 2025, big changes are on the horizon. With key subsidies set to expire and less funding for enrollment support, buying directly from an insurer is becoming a more reliable and attractive option for many.

The real difference isn't about the quality of the insurance—it's about how you buy it. An off-exchange plan is simply a policy you purchase outside the government's system, which is perfect for anyone paying their own way.

Figuring out if public or private insurance is the right fit for you is the first, most important step. Taking the time to explore your options will help you see if the subsidy-free, direct-to-carrier model aligns with your finances and healthcare needs. To learn more about this, check out our guide on public vs private insurance.

Comparing On Exchange and Off Exchange Health Insurance

Shopping for health insurance can feel like you’re standing in front of two different doors to the same building. One door is the “on-exchange” marketplace, a government-run hub. The other is the “off-exchange” path, which takes you right to an insurance company’s front desk.

Both can get you great coverage, but the journey—and what you end up paying—can be worlds apart.

The single biggest difference comes down to financial help.

Think of the on-exchange marketplace, like Healthcare.gov, as the only place that accepts government “coupons” to lower your bill. These come in two forms: Premium Tax Credits (which lower your monthly payment) and Cost-Sharing Reductions (which lower your out-of-pocket costs like deductibles). If your income is within a certain range, these subsidies can make a huge difference.

On the other hand, buying off-exchange health insurance means you’re paying the full sticker price. No subsidies, no tax credits. This route makes the most sense for people whose income is too high to qualify for government assistance.

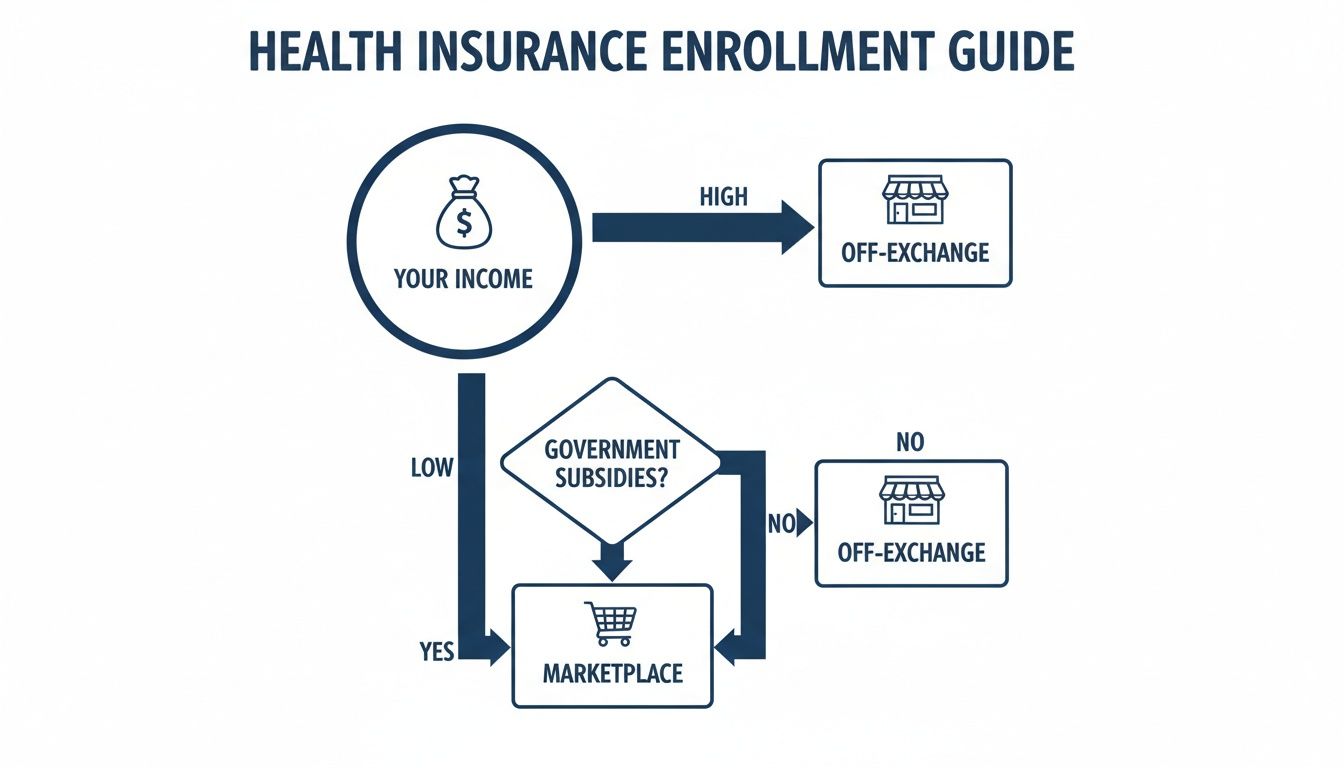

This simple guide shows how your income is the first thing to consider when deciding where to shop.

As you can see, if you think you’ll get a subsidy, the Marketplace is where you need to be. If not, going directly to insurers might be a faster, more direct route.

Plan Selection and Variety

Beyond subsidies, the variety of plans can also differ. The government marketplace has a ton of options, but it doesn't always show you every single plan an insurer offers in your area.

Some insurance companies sell extra plans exclusively off-exchange. These plans might have different doctor networks or unique benefit designs. For shoppers who don't qualify for subsidies anyway, this is a huge plus—you get to see the entire catalog and find the perfect fit.

The Shopping Experience

How you actually buy a plan is also totally different.

- On-Exchange: You use one government website to compare plans from multiple companies, all in one place. It’s centralized, but it also means dealing with the federal or state application process.

- Off-Exchange: You can shop on an insurer’s website or work with an independent insurance agent. A good broker gives you personalized advice and can show you plans from several carriers at once, which saves a lot of time.

To really see the difference, let's put them side-by-side. This table breaks down the key features of on-exchange versus off-exchange plans so you can quickly see which path aligns with your needs.

Key Differences On-Exchange vs Off-Exchange Health Insurance

| Feature | On-Exchange (ACA Marketplace) | Off-Exchange (Direct Purchase) |

|---|---|---|

| Subsidy Eligibility | Yes. This is the only place to get Premium Tax Credits and Cost-Sharing Reductions. | No. You must pay the full premium without any government financial assistance. |

| Plan Availability | Features a broad selection of ACA-compliant plans from various carriers. | May offer all on-exchange plans plus additional plans not listed on the Marketplace. |

| Shopping Process | Centralized shopping on a single government website (e.g., Healthcare.gov). | Purchase directly from an insurer's website or through an independent broker or agent. |

| ACA Compliance | All plans are fully compliant with the Affordable Care Act. | Most major medical plans are ACA-compliant, but non-compliant options (like short-term plans) are also sold here. |

This comparison highlights that your choice really hinges on your eligibility for financial aid and how you prefer to shop for coverage.

No matter where you buy, any plan that’s considered ACA-compliant has to cover the same ten core medical services. To get a handle on these requirements, it’s worth learning about what are essential health benefits and why they’re so critical.

Ultimately, choosing between on-exchange and off-exchange insurance is a strategic move based on your finances. If you qualify for subsidies, the marketplace is almost always the smarter financial choice. But if you don’t, the off-exchange market can open the door to more options and a more personal shopping experience.

Who Should Actually Consider Off-Exchange Health Insurance?

While the official ACA Marketplace is a lifeline for millions, it’s not a one-size-fits-all solution. In fact, for certain people, buying off-exchange health insurance—meaning directly from an insurer—isn't just an alternative. It’s a smarter financial move.

So, when does it make sense to step outside the Marketplace? Let's look at who benefits most. You might just see yourself in one of these scenarios.

Self-Employed Professionals and Contractors

If you're a freelancer, consultant, or 1099 contractor, you know that income can be a moving target. One month is great, the next is a little lean. This makes estimating your annual income for the Marketplace feel like a high-stakes guessing game.

Guess too low, and you could owe thousands back in tax credits. Guess too high, and you miss out on help you were entitled to all along. Shopping off-exchange cuts through all that noise.

- No Income Guesswork: The application is usually much simpler because it focuses on your health needs, not complex financial forecasts.

- No Subsidy Cliff: You can stop worrying about earning one dollar too much and losing your financial aid. You’re not applying for it anyway.

- Direct and Simple: It’s a straightforward way to get ACA-compliant coverage without jumping through bureaucratic hoops.

This direct path offers a dose of stability in a career built on flexibility. If this sounds like you, our guide on health insurance options for self-employed dives deeper into finding the right fit.

Early Retirees Who Need a Bridge to Medicare

Retiring before 65 throws you into a unique healthcare gap. You're too young for Medicare, but you no longer have an employer's plan. For early retirees with solid retirement savings or pension income, ACA subsidies are often completely out of reach.

This is where off-exchange plans become an essential bridge. They allow you to find high-quality, comprehensive coverage to secure your pre-Medicare years. Instead of being penalized for saving diligently, you can shop for a plan based purely on its benefits, network, and price—protecting your health without income-based roadblocks.

Off-exchange health insurance has become a vital lifeline for self-employed professionals and others who don't qualify for ACA subsidies, offering stability amid skyrocketing exchange premiums.

Higher-Income Families Looking for Better Options

Does your household income top 400% of the Federal Poverty Level? If so, you probably don’t qualify for premium tax credits. And when you’re paying full price for a plan, you owe it to yourself to explore every single option out there to get the best value.

Sometimes, insurers offer a wider variety of plans on their own websites than they list on the Marketplace. These exclusive off-exchange plans might come with:

- Different Doctor Networks: You might find a plan that includes a specific hospital system or a group of specialists that aren't available in on-exchange options.

- Unique Plan Designs: The benefits could be structured in a way that better suits your family’s specific health needs.

- Potentially Better Rates: By cutting out the administrative overhead of the exchange, some direct plans might just offer a more competitive premium for those paying full price.

This is more important than ever. A perfect storm of factors is brewing, and experts predict ACA Marketplace insurers will raise premiums by an average of 26% in 2026, driven by expiring tax credits and rising healthcare costs. For the millions who could lose their assistance, off-exchange plans will become an even more critical safety net. You can discover more insights about these premium hikes on kff.org. For anyone not getting a subsidy, comparing these direct plans is one of the smartest ways to keep costs under control.

When you start looking for health insurance outside the government Marketplace, it can feel like you've found a secret menu. This is the world of off-exchange health insurance. While you'll see a lot of the same plans available on the official exchanges, you'll also find some completely different options built for very specific situations.

Getting to know all the choices is the key to finding the right fit. It's not just about buying a plan without subsidies—it’s about having access to a wider variety of coverage solutions. Let's break down exactly what you'll find out there.

ACA-Compliant Major Medical Plans

These are the most common plans you'll find off-exchange, and they are the foundation of the private market. An ACA-compliant plan sold directly by an insurer offers the exact same protections and benefits as one sold on the Marketplace.

That means it covers the ten essential health benefits, can't turn you away for pre-existing conditions, and has no annual or lifetime caps on what it pays for your care. Think of it like buying a product directly from the brand’s store instead of from a big-box retailer. Same product, just a different storefront.

These plans are perfect for anyone who needs solid, year-round coverage but doesn't qualify for a government subsidy. They come in the familiar metal tiers—Bronze, Silver, Gold, and Platinum—so you can still choose the right balance between your monthly premium and out-of-pocket costs.

Short-Term Health Insurance

Picture this: you've just left a job and are waiting a couple of months for your new employer's benefits to kick in. You need a safety net, but just for a little while. That’s exactly what short-term health insurance is for.

These plans are meant to be temporary fixes, not permanent solutions. They are not ACA-compliant, which means they have some pretty big limitations you need to know about.

- Pre-existing Conditions: They almost never cover health issues you had before the plan started.

- Limited Benefits: They often leave out things like maternity care, mental health services, and prescription drugs.

- Coverage Duration: Federal rules limit the initial term to less than one year, though some states allow for extensions.

It's best to think of short-term plans as catastrophic coverage. They're a low-cost way to protect yourself from a major, unexpected medical disaster during a transition, but they are absolutely not a replacement for real health insurance.

Because they offer less coverage, the monthly premiums are much lower. They fill an important need for people in between jobs or life events, but you have to go in with your eyes wide open.

Fixed-Indemnity and Supplemental Plans

Think of these less like traditional health insurance and more like a financial cushion. A fixed-indemnity plan pays you a specific, fixed dollar amount for certain medical events, no matter what the doctor actually charges. For example, a plan might pay you $300 for each day you're in the hospital or $75 every time you visit a doctor.

These plans aren't designed to be your main coverage. Instead, they work alongside your major medical plan. That cash benefit can help you meet your deductible, pay household bills while you're out of work, or cover other surprise expenses that pop up.

Association Health Plans

If you're a freelancer, gig worker, or small business owner, an Association Health Plan (AHP) offers a way to join forces with others like you. The goal is to create a large group to get better rates and benefits, just like employees at a big company do.

These plans let people in the same industry—like a real estate association or a freelance writers' guild—buy into group coverage. Some AHPs offer ACA-compliant benefits, but others don't, so it's critical to read the fine print.

The different plan structures you'll encounter off-exchange, from restrictive HMOs to more flexible EPOs, can get confusing. To get a better handle on how these networks function, you can learn more by reading about the difference between HMO and EPO plans. This knowledge is key to making sure your favorite doctors and hospitals are in your network, no matter which off-exchange plan you pick.

A Step-by-Step Guide to Buying an Off Exchange Plan

Ready to look beyond the government Marketplace? Buying an off-exchange health insurance plan sounds complicated, but it’s actually pretty straightforward when you know the steps. Let’s walk through the whole process, from the first bit of research to getting your new ID card in the mail.

Think of it like planning a road trip. You wouldn’t just start driving without a destination, a full tank of gas, and a good map. Let's map out your health insurance journey the same way.

Step 1: Confirm Your Subsidy Status

This is the first, and most important, stop. You need to be sure you don’t qualify for subsidies. Since those premium tax credits are only available on the official Marketplace, it really only makes sense to buy off-exchange if you’re going to be paying the full premium anyway.

Jump on an online subsidy calculator for a quick estimate. If your household income is above 400% of the Federal Poverty Level, there’s a very good chance you won’t get any financial help. If that’s you, the off-exchange market is where you'll find the widest variety of plans.

Step 2: Research Carriers and Brokers

Okay, subsidy status confirmed. Now it's time to shop. You’ve basically got two main paths you can take to buy an off exchange health insurance plan:

- Go Directly to the Insurer: Head over to the websites of big-name carriers like Blue Cross Blue Shield, Cigna, or UnitedHealthcare. You’ll be able to browse their entire catalog of plans, including some options you won't find listed on the government exchange.

- Work with an Independent Broker: A licensed insurance broker is like having a personal shopper for your health coverage. They can pull up plans from multiple carriers at once, give you real advice, and help you understand the fine print—and it doesn’t cost you anything extra.

Partnering with a broker can save you a ton of time and often uncovers hidden gems you would’ve missed on your own.

Step 3: Get Your Essential Documents Together

Whether you decide to enroll by yourself or with a broker's help, you'll need some basic info ready to go. Having these details handy will make the application process much smoother.

- Social Security numbers for everyone who needs coverage.

- Dates of birth for all family members.

- Your home and mailing address.

- Basic income details (even though it's not for subsidies, some applications still ask).

As you start the process of buying an off-exchange plan, you’ll run into a few application documents. To make sure everything goes smoothly, it helps to know how to efficiently fill out necessary application forms.

Step 4: Understand the Critical Enrollment Dates

Here’s a crucial detail: you can’t just buy an ACA-compliant health plan whenever you feel like it. Enrollment is limited to specific timeframes to keep the system fair for everyone.

Open Enrollment Period (OEP): This is the main window every year when anyone can sign up for a health plan. In most states, it typically runs from November 1st to January 15th.

If you miss that window, your only other chance to enroll is if you have a Qualifying Life Event, which opens up a Special Enrollment Period (SEP). These are major life changes like losing your job-based health coverage, getting married, having a baby, or moving. Knowing these dates is absolutely key to avoiding a gap in your coverage.

Common Mistakes to Avoid When Shopping Off Exchange

Going off-exchange opens up a world of health insurance options, but it's a path with a few hidden traps. It’s easy to get sidetracked if you don't know what to look for. Knowing the common pitfalls ahead of time is the key to finding a plan that actually protects you when you need it most.

The biggest mistake? Accidentally buying a plan that isn't ACA-compliant when what you really need is solid, comprehensive coverage. Lots of plans sold directly by brokers or insurers—like short-term or fixed-indemnity plans—don't have to follow Affordable Care Act rules. This means they can flat-out deny you for pre-existing conditions and often skip coverage for essentials like prescriptions or mental health care.

If you need real, year-round insurance, always confirm the plan offers Minimum Essential Coverage (MEC). An ACA-compliant plan will say so clearly, saving you from discovering a massive coverage gap when it's too late.

Overlooking the Provider Network

This is another classic—and costly—blunder. You find an off-exchange plan with a great-looking premium, sign up, and then realize your trusted family doctor, your preferred hospital, or the specialist you rely on is out-of-network.

It's a gut-wrenching moment. Using out-of-network providers can trigger staggering medical bills that your insurance won't touch, completely defeating the purpose of having a plan in the first place.

Before you commit to any off-exchange plan, stop and visit the insurer’s website. Use their provider lookup tool. Search for your doctors and local hospitals by name. Don't just assume they're covered—verify it.

This one simple step is your best defense against future financial headaches and ensures you can actually get the care you need without breaking the bank.

Falling for Deceptively Low Premiums

Finally, if a premium seems too good to be true, it probably is. Everyone wants an affordable plan, but an unbelievably low monthly payment is often a red flag for major trade-offs that leave you exposed.

These "bargain" plans usually hide their downsides in the fine print, which only become obvious when you try to use your insurance. Keep an eye out for:

- Sky-High Deductibles: A cheap premium might be tied to a deductible so high—sometimes $10,000 or more—that you end up paying for almost all your medical care yourself anyway.

- Bare-Bones Benefits: The plan might completely exclude basics like prescription drugs or specialist visits, which are standard on any ACA-compliant plan.

- Per-Incident Caps: Some non-compliant plans will only pay a set amount for a specific illness or injury. Once you hit that cap, the rest of the bill is all yours.

By looking past the premium, confirming a plan is ACA-compliant, and checking the network, you can confidently choose an off-exchange policy that delivers real security.

A Few Lingering Questions About Off-Exchange Insurance

As you get closer to a decision, a few questions are bound to pop up. That’s completely normal. The world of off-exchange health insurance has its own quirks and rules, so let’s clear up the most common points of confusion with some straight answers.

This quick rundown will solidify what you’ve learned and help you move forward with total confidence.

Can I Switch Plans Anytime I Want?

This is a big one. Lots of people think that because you’re buying privately, you can just swap from an on-exchange to an off-exchange plan whenever you feel like it. But that’s not quite how it works.

For the most part, the same enrollment rules apply to all ACA-compliant plans, no matter where you get them.

You have to enroll during the annual Open Enrollment Period (usually November 1st to January 15th). The only exception is if you have a Qualifying Life Event—like losing your job, getting married, or moving. That opens up a special 60-day window to get a new plan.

Are All Off-Exchange Plans ACA-Compliant?

No, and this is probably the most critical thing to understand. While major insurance carriers sell fully ACA-compliant plans directly to consumers, the off-exchange market is also where you’ll find non-compliant options.

These include short-term health plans, fixed-indemnity plans, and other niche insurance products.

The key difference? These plans don't have to cover pre-existing conditions or the ten essential health benefits. Always, always verify a plan’s status before you buy to make sure it gives you the protection you actually need.

Is buying off-exchange always cheaper? It really comes down to one thing: your subsidy eligibility. If you don't qualify for financial help, off-exchange plans can sometimes be a better deal. They may have smaller rate increases and offer a wider variety of options not available on the Marketplace.

Will I Get Hit With a Penalty for a Non-ACA Plan?

Good news on the federal front: the individual mandate penalty for not having ACA-compliant health insurance was zeroed out back in 2019. That means you no longer face a federal tax penalty for choosing a non-compliant plan.

However, a handful of states decided to create their own individual mandates. These include:

- California

- Massachusetts

- New Jersey

- Rhode Island

- Vermont

- Washington, D.C.

If you live in one of these places, you could face a state tax penalty for not having qualifying coverage. It’s smart to check your local rules. For everyone else, the decision is all about your personal budget and comfort with risk, not about avoiding a penalty.

Getting answers to these questions is the first step toward finding coverage that truly fits your life. The team at My Policy Quote is here to give you the personalized support you need to compare plans and make a choice you feel good about. Explore your options today at https://mypolicyquote.com.