As you approach Medicare eligibility, the landscape of supplemental insurance, often called Medigap, can feel overwhelming. With numerous standardized plans labeled by letters, how do you determine which one is the right fit for your health needs and budget? Original Medicare (Part A and Part B) covers a significant portion of healthcare costs, but it leaves behind gaps like deductibles, coinsurance, and copayments that can lead to substantial out-of-pocket expenses. This is precisely where a Medicare Supplement policy becomes essential for financial peace of mind.

This comprehensive guide is designed to demystify your options and empower you to identify the best medicare supplement plan for your unique circumstances. We will provide a detailed, side-by-side comparison of the top seven most popular and effective plans, including Plan G, Plan N, and the now-restricted Plan F. For each plan, we will break down its specific benefits, typical cost structures, and the ideal user profile it serves, from frequent travelers to budget-conscious retirees.

Forget the confusion of complex insurance charts. This article presents a clear, actionable roadmap. You'll understand exactly what each plan covers, such as the Medicare Part A deductible or Part B excess charges, and how those benefits translate to real-world scenarios. By the end of this roundup, you will have the clarity and confidence needed to make an informed decision, securing both your health coverage and financial stability for 2025 and the years to come. We will explore the following key plans:

- Medicare Supplement Plan F

- Medicare Supplement Plan G

- Medicare Supplement Plan N

- Medicare Supplement Plan K

- Medicare Supplement Plan L

- Medicare Supplement Plan A

- Medicare SELECT Plans

1. Medicare Supplement Plan F

Medicare Supplement Plan F, often called Medigap Plan F, represents the most comprehensive coverage available. For decades, it was considered the gold standard because it covers virtually all of the "gaps" in Original Medicare (Part A and Part B). This includes deductibles, copayments, and coinsurance, leaving beneficiaries with minimal to no out-of-pocket costs for Medicare-approved services.

However, a key eligibility restriction is now in place. Due to the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Plan F is only available to individuals who were eligible for Medicare before January 1, 2020. If you became eligible for Medicare on or after this date, you cannot purchase Plan F. For those who still qualify, it offers unparalleled peace of mind and predictable healthcare spending.

How Plan F Provides Comprehensive Coverage

Plan F simplifies medical billing by covering costs that Original Medicare leaves to the beneficiary. This "first-dollar coverage" means that after Medicare pays its share, Plan F pays the rest for approved services.

Key Covered Costs Include:

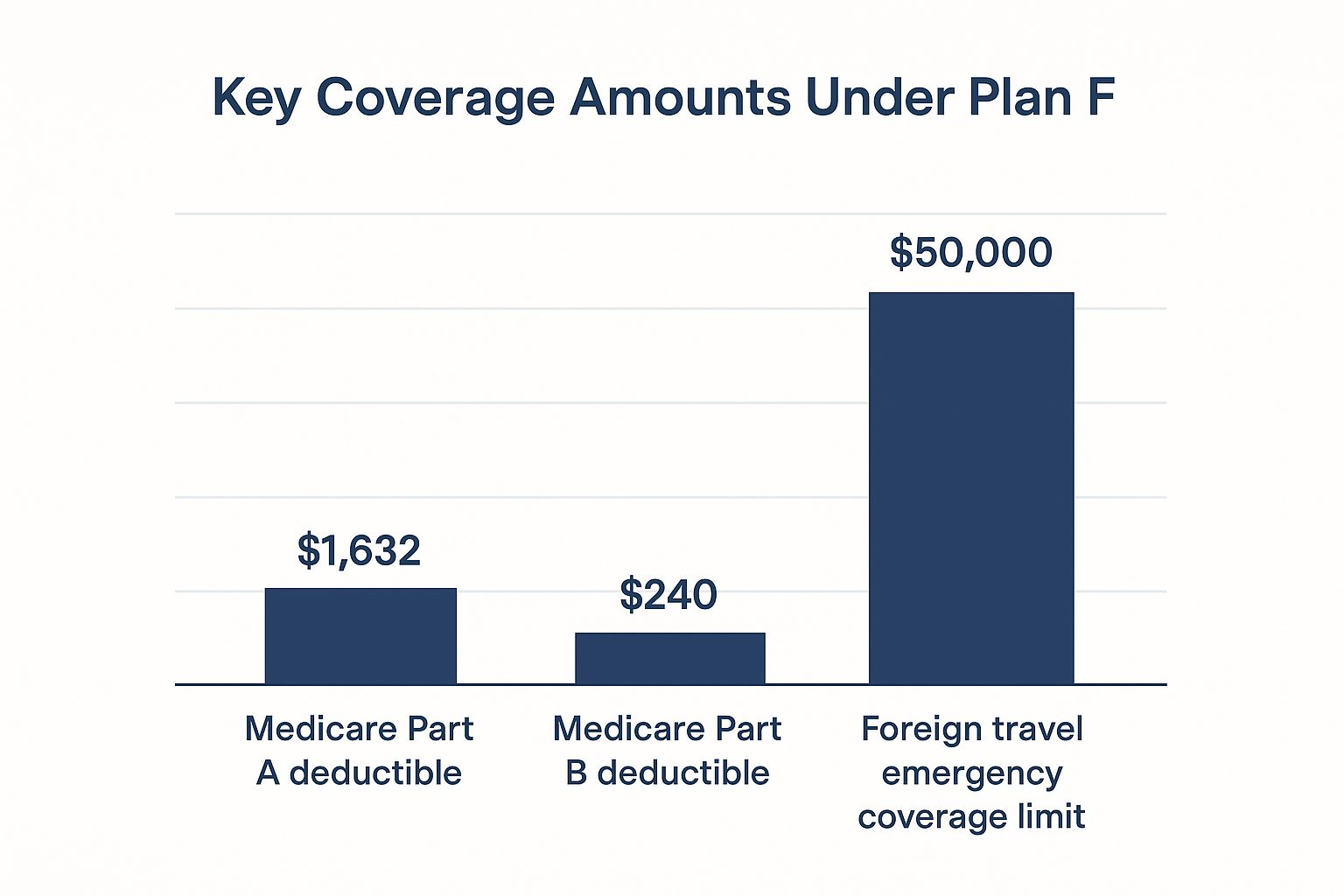

- Part A Deductible: Covers the significant hospital deductible ($1,632 in 2024) for each benefit period.

- Part B Deductible: Pays the annual deductible for doctor visits and outpatient services ($240 in 2024). This is a primary feature that newer plans are barred from covering.

- Part B Excess Charges: Protects you from doctors who charge more than the Medicare-approved amount.

- Foreign Travel Emergency: Covers 80% of emergency care costs incurred outside the U.S., up to a $50,000 lifetime limit.

The following bar chart visualizes the scale of three major costs that Plan F covers, illustrating why it provides such robust financial protection.

This chart highlights the significant financial liabilities, like the Part A deductible and the potential for international emergency costs, that Plan F eliminates for its members.

Is Plan F the Right Choice for You?

Plan F is often the best medicare supplement plan for those who prioritize budget predictability and want to avoid unexpected medical bills. It is particularly beneficial for:

- High Healthcare Utilizers: Individuals with chronic conditions who have frequent doctor visits or hospital stays can save thousands annually on copayments and deductibles.

- Those Seeking Simplicity: With Plan F, you show your Medicare and Medigap cards, and you typically have no further bills to pay for covered services.

- Frequent Travelers: Retirees who travel internationally gain valuable protection against overseas medical emergencies.

Actionable Tips for Plan F

Key Insight: While Plan F offers the most coverage, it also commands the highest premiums. Because the pool of eligible beneficiaries is shrinking, premiums are expected to rise more steeply over time compared to other plans like Plan G.

If you are eligible and considering Plan F, follow these steps:

- Enroll During Open Enrollment: The best time to buy Plan F is during your 6-month Medigap Open Enrollment Period, which starts the month you're 65 and enrolled in Part B. During this window, you have a guaranteed issue right, meaning insurers cannot deny you coverage or charge you more due to health conditions.

- Compare Insurer Premiums: Even though Plan F benefits are standardized by the government, the premiums charged by private insurance companies can vary significantly for the exact same coverage. Get quotes from multiple top-rated carriers.

- Conduct an Annual Review: If you have Plan F, review your premium costs annually. If they become too high, you might consider switching to Plan G, which offers nearly identical coverage but does not pay the Part B deductible.

2. Medicare Supplement Plan G

Medicare Supplement Plan G has quickly become the new gold standard for beneficiaries eligible for Medicare on or after January 1, 2020. It offers coverage nearly identical to the comprehensive Plan F, with one key difference: it does not cover the annual Medicare Part B deductible. This structure makes Plan G the most extensive option available to new enrollees, providing robust protection against most of the major out-of-pocket costs associated with Original Medicare.

For many, Plan G strikes the perfect balance between comprehensive benefits and manageable premiums. Once you meet the annual Part B deductible ($240 in 2024), the plan covers 100% of the remaining Medicare-approved costs for the rest of the year. This predictability and security make it a top contender for the best medicare supplement plan for today's retirees.

How Plan G Provides Extensive Coverage

Plan G simplifies healthcare budgeting by covering nearly all gaps left by Original Medicare. After you pay the small annual Part B deductible yourself, Plan G steps in to handle the rest, protecting you from large, unexpected medical bills.

Key Covered Costs Include:

- Part A Deductible: Fully covers the hospital inpatient deductible ($1,632 in 2024) for each benefit period.

- Part B Coinsurance/Copayment: Pays the 20% that Original Medicare doesn't cover for doctor visits and outpatient care.

- Part B Excess Charges: A crucial benefit that protects you if a doctor charges more than the Medicare-approved amount. This is a feature not included in some other popular plans like Plan N.

- Foreign Travel Emergency: Covers 80% of costs for emergency medical care received outside the U.S., up to a $50,000 lifetime maximum.

This extensive coverage means that after satisfying one small, predictable deductible each year, your healthcare costs are covered for all Medicare-approved services.

Is Plan G the Right Choice for You?

Plan G is an excellent choice for individuals who want first-rate coverage and are comfortable paying the annual Part B deductible out-of-pocket. It is particularly well-suited for:

- New Medicare Beneficiaries: Since Plan F is unavailable, Plan G is the most comprehensive option for anyone who became eligible for Medicare in 2020 or later.

- Those Seeking Financial Security: It offers peace of mind against catastrophic hospital bills and high costs from chronic conditions.

- Savvy Consumers: Many beneficiaries find that the annual savings in premiums for Plan G (compared to Plan F) are greater than the Part B deductible, making it a financially smart choice.

Actionable Tips for Plan G

Key Insight: The only difference between Plan F and Plan G is the Part B deductible. Often, the lower premium for Plan G saves you more money annually than the deductible itself, making it a better value even for those eligible for Plan F.

If you are considering Plan G, follow these steps:

- Enroll at the Right Time: Secure your Plan G policy during your 6-month Medigap Open Enrollment Period. This window starts the month you turn 65 and are enrolled in Part B, and it guarantees your right to buy any plan without medical underwriting.

- Compare Premium Costs: Plan G benefits are standardized by law, but prices are set by private insurance companies. You can find essential tips for finding budget-friendly health coverage on mypolicyquote.com to help you compare quotes from different carriers to ensure you get the best rate.

- Factor in the Deductible: When budgeting, remember to account for paying the annual Part B deductible out of your own pocket before your full coverage kicks in.

3. Medicare Supplement Plan N

Medicare Supplement Plan N strikes a popular balance between comprehensive coverage and lower monthly premiums. It is designed for beneficiaries who are comfortable with some predictable, minor cost-sharing in exchange for significant premium savings compared to more robust plans like G or F. Plan N covers most of the major gaps in Original Medicare but requires small, fixed copayments for certain routine medical services.

This plan is an excellent option for healthy, active seniors who want strong protection against major, unexpected medical events but don't anticipate frequent doctor or emergency room visits. By taking on minimal out-of-pocket costs, members can achieve a more affordable monthly budget while still having a solid safety net.

How Plan N Balances Coverage and Cost

Plan N covers the big-ticket items like the Medicare Part A hospital deductible but introduces a cost-sharing model for everyday care. After you meet your annual Part B deductible ($240 in 2024), Plan N's unique structure comes into play.

Key Covered Costs & Cost-Sharing Structure:

- Part A Deductible: Fully covers the hospital deductible ($1,632 in 2024).

- Part A Coinsurance: Covers hospital and skilled nursing facility coinsurance.

- Part B Coinsurance: Covers most of the 20% coinsurance, but with exceptions. You will be responsible for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in a hospital admission.

- Foreign Travel Emergency: Includes coverage for 80% of emergency care costs during foreign travel, up to a $50,000 lifetime maximum.

- Part B Excess Charges: It's important to note that Plan N does not cover Part B excess charges. These are additional fees some doctors can charge above the Medicare-approved amount.

Is Plan N the Right Choice for You?

Plan N is often the best medicare supplement plan for budget-conscious individuals who still want robust catastrophic coverage. It is particularly beneficial for:

- Healthy Retirees: If you only visit the doctor a few times a year, the premium savings can easily outweigh the small copayments you might incur.

- Cost-Aware Consumers: Individuals who are willing to check if their doctors accept Medicare assignment (meaning they don't bill for excess charges) can maximize their savings.

- Those Seeking a Middle Ground: Plan N offers a great compromise between the lower coverage of high-deductible plans and the high premiums of Plans F or G.

Actionable Tips for Plan N

Key Insight: The primary appeal of Plan N is its lower premium. However, you must confirm that your preferred doctors and specialists accept Medicare assignment to avoid being billed for Part B excess charges, which Plan N does not cover.

If you are considering Plan N, follow these steps:

- Verify Doctor Participation: Before enrolling, ask your regular physicians' billing offices if they "accept Medicare assignment." This simple question can save you from unexpected bills later on.

- Calculate Potential Out-of-Pocket Costs: Estimate your typical number of doctor visits per year and multiply by $20. If this total, combined with the lower premium, results in significant savings over Plan G, Plan N is likely a smart financial choice.

- Use Your Medigap Open Enrollment Period: To get Plan N without medical underwriting, enroll during your 6-month Medigap Open Enrollment Period. This guarantees your acceptance regardless of your health history.

4. Medicare Supplement Plan K

Medicare Supplement Plan K offers a unique cost-sharing structure designed for beneficiaries who want lower monthly premiums in exchange for taking on a portion of their out-of-pocket costs. Unlike plans that cover 100% of specific gaps, Plan K covers 50% of most major costs until you reach an annual out-of-pocket limit. For 2024, this limit is set at $7,060.

This design makes it a compelling option for healthy, budget-conscious individuals who want a safety net against catastrophic expenses without paying for comprehensive daily coverage. It strikes a balance between the full exposure of Original Medicare and the high premiums of first-dollar coverage plans.

How Plan K's Cost-Sharing Works

Plan K’s defining feature is its 50% coverage for most services after Original Medicare pays its share. It fully covers the Medicare Part A coinsurance. Once your total out-of-pocket spending on covered services reaches the annual maximum ($7,060 in 2024), the plan pays 100% of all covered costs for the rest of the year.

Key Covered Costs Include:

- Part A Coinsurance & Hospital Costs: Covers 100% of Part A coinsurance, plus an additional 365 days of hospital care after Medicare benefits are used up.

- Part B Coinsurance/Copayment: Covers 50% of these costs.

- First 3 Pints of Blood: Covers 50%.

- Part A Hospice Care Coinsurance/Copayment: Covers 50%.

- Skilled Nursing Facility Coinsurance: Covers 50%.

- Part A Deductible: Covers 50% of the hospital deductible ($1,632 in 2024).

This structure provides a predictable ceiling on your annual healthcare spending, which is a crucial protection that Original Medicare lacks.

Is Plan K the Right Choice for You?

Plan K can be the best medicare supplement plan for those who are relatively healthy and prioritize low monthly premiums over comprehensive, day-to-day coverage. It is particularly well-suited for:

- Budget-Conscious Beneficiaries: Individuals on a fixed income can benefit from the significantly lower premiums compared to Plans G or N.

- Healthy & Active Adults: If you rarely visit the doctor, you can save money on premiums while still having a robust safety net for an unexpected major health event.

- Strategic Savers: Those who can comfortably set aside funds to cover the potential out-of-pocket maximum may find the premium savings make financial sense.

Actionable Tips for Plan K

Key Insight: The primary appeal of Plan K is its out-of-pocket maximum. This feature transforms it from a simple cost-sharing plan into powerful protection against catastrophic illness or injury, making it more than just a low-premium option.

If you are considering Plan K, use these strategies:

- Assess Your Financial Risk: Before enrolling, confirm that you have savings or the financial capacity to cover the annual out-of-pocket maximum ($7,060 in 2024) if a serious health issue arises.

- Calculate Your Break-Even Point: Compare the annual premium savings of Plan K against a more comprehensive plan like Plan G. Determine how many doctor visits or medical services you would need before the higher out-of-pocket costs of Plan K outweigh the premium savings.

- Use It as a Protective Measure: Think of Plan K less as day-to-day insurance and more as a shield against worst-case scenarios. Understanding how to choose health insurance is key. Learn more about making smart coverage choices on mypolicyquote.com.

5. Medicare Supplement Plan L

Medicare Supplement Plan L offers a unique cost-sharing structure that provides a middle ground between basic and comprehensive coverage. It’s designed for beneficiaries who want more protection than high-deductible plans but are comfortable sharing some costs to keep their monthly premiums lower than those for plans like G or N. Plan L operates on a 75/25 cost-sharing model for most services, meaning it pays 75% of most covered expenses after Original Medicare pays its share.

A crucial feature of Plan L is its annual out-of-pocket maximum, which is set at $3,530 for 2024. Once you have paid this amount in out-of-pocket costs for the year, Plan L covers 100% of all Medicare-approved services for the remainder of the year. This provides a vital financial safety net against catastrophic healthcare expenses.

How Plan L Provides Balanced Coverage

Plan L helps manage medical costs by covering a significant portion of the gaps in Original Medicare, but not all of them. This shared responsibility helps keep premiums affordable while still offering substantial protection.

Key Covered Costs Include:

- Part A Deductible and Coinsurance: Plan L covers 100% of the Part A hospital coinsurance and hospital costs for an extra 365 days after Medicare benefits are exhausted. It also covers 75% of the Part A deductible.

- Part B Coinsurance/Copayment: The plan covers 75% of the Part B coinsurance or copayments for doctor visits and outpatient care.

- Skilled Nursing Facility Care: It covers 75% of the coinsurance for skilled nursing facility stays.

- First Three Pints of Blood: Plan L covers 75% of the cost for the first three pints of blood needed for a transfusion.

Is Plan L the Right Choice for You?

Plan L is often the best medicare supplement plan for those who are relatively healthy but want a safeguard against high or unexpected medical costs. It is particularly beneficial for:

- Budget-Conscious Individuals: Those who can handle some out-of-pocket costs in exchange for a lower monthly premium. A retiree with a moderate, predictable income may find Plan L offers the right balance.

- Beneficiaries Seeking a Safety Net: The annual out-of-pocket limit is the main attraction. It protects you from the unlimited financial risk associated with Original Medicare alone.

- Those Wanting More Than Plan K: If you want a higher percentage of cost-sharing coverage (75% vs. Plan K's 50%) and a lower out-of-pocket maximum, Plan L is a logical step up.

Actionable Tips for Plan L

Key Insight: Plan L's value is directly tied to its out-of-pocket maximum. If your annual healthcare spending is consistently low, a plan with lower premiums might be better. If your spending is high, a more comprehensive plan like G or N could be more cost-effective despite higher premiums.

If you are considering Plan L, follow these steps:

- Assess Your Health and Budget: Realistically evaluate your typical annual healthcare needs. Calculate whether paying 25% of most costs, up to the annual limit, is financially manageable for you.

- Shop During Open Enrollment: To guarantee your ability to purchase Plan L without medical underwriting, enroll during your 6-month Medigap Open Enrollment Period. This window ensures you get the best rates and cannot be denied coverage.

- Compare Premium vs. Out-of-Pocket Limit: When comparing quotes, don't just look at the premium. Factor in the total potential annual cost, which is the premium plus the out-of-pocket maximum ($3,530 in 2024), to understand your worst-case financial scenario.

6. Medicare Supplement Plan A

Medicare Supplement Plan A offers the most basic, foundational coverage among the standardized Medigap plans. It is designed to cover the most significant inpatient hospital cost-sharing left by Original Medicare. Because it offers minimal benefits compared to other plans, Plan A typically comes with the lowest monthly premium, making it a potential option for those with extremely limited budgets.

While every insurance company offering Medigap must offer Plan A, it is often chosen by a small segment of beneficiaries. Its primary purpose is to provide a safety net against major hospital costs rather than comprehensive, day-to-day medical expense coverage. Beneficiaries must be prepared to pay for most out-of-pocket costs, including all Medicare Part B deductibles and coinsurance.

How Plan A Provides Foundational Coverage

Plan A focuses on covering four specific cost-sharing gaps in Original Medicare, primarily related to inpatient care. It is the core benefit package upon which all other Medigap plans are built.

Key Covered Costs Include:

- Part A Coinsurance and Hospital Costs: Covers the daily coinsurance for extended hospital stays and provides coverage for an additional 365 days after Original Medicare benefits are used up.

- Part B Coinsurance or Copayment: Pays the 20% coinsurance for most doctor services and other outpatient care after you've met your Part B deductible.

- First 3 Pints of Blood: Covers the cost of the first three pints of blood needed for a medical procedure.

- Part A Hospice Care Coinsurance or Copayment: Helps with the out-of-pocket costs for hospice care.

This plan notably does not cover the Part A deductible, Part B deductible, skilled nursing facility care coinsurance, or any foreign travel emergencies. The lack of these benefits means a beneficiary could face thousands of dollars in out-of-pocket expenses for a single hospital stay.

Is Plan A the Right Choice for You?

Plan A is rarely considered the best medicare supplement plan for the average person due to its significant coverage gaps. However, it can be a viable choice in very specific circumstances for those who prioritize the lowest possible premium above all else. It may be suitable for:

- Those on a Strict Budget: Individuals who cannot afford the higher premiums of plans like G or N might choose Plan A for catastrophic hospital coverage.

- Healthy Individuals with Savings: A healthy person who understands the financial risks and has sufficient savings to cover potential deductibles and other costs might opt for Plan A.

- Beneficiaries with Other Coverage: Someone who has other limited health coverage, such as from the VA or a retirement plan, might use Plan A just to fill the specific gap of Part B coinsurance.

Actionable Tips for Plan A

Key Insight: Choosing Plan A is a significant financial trade-off. You accept much lower monthly premiums in exchange for taking on the risk of substantial out-of-pocket costs for common medical services, including the large Part A hospital deductible.

If your budget limits you to considering Plan A, use these tips:

- Confirm You Can Cover the Gaps: Before enrolling, calculate if you can afford to pay the Medicare Part A deductible ($1,632 in 2024) and the Part B deductible ($240 in 2024) out-of-pocket, plus any skilled nursing facility costs.

- Understand the Coinsurance Benefit: The main value of Plan A is covering the 20% Part B coinsurance. A full understanding of how rising healthcare costs impact this is critical; you can learn more about how healthcare pricing transparency affects your potential expenses.

- Plan for Future Upgrades: View Plan A as a temporary solution if possible. Plan to review your finances annually and look for opportunities to switch to a more comprehensive plan, like Plan G or N, if your budget allows. You may have to go through medical underwriting to switch plans after your initial open enrollment period.

7. Medicare SELECT Plans

Medicare SELECT plans are a unique type of Medigap policy that offers the same standardized benefits as traditional plans like G or N, but at a lower monthly premium. The trade-off for this cost saving is a network restriction. To receive full benefits, beneficiaries must use doctors and hospitals within the plan’s specific network for non-emergency care.

This model allows insurance companies to manage costs more effectively, passing the savings on to members through reduced premiums. If you seek routine care outside the approved network, you may be responsible for some or all of the costs that Medigap would typically cover. However, emergency care is always covered, regardless of whether the hospital is in-network or not.

How SELECT Plans Balance Cost and Access

A SELECT plan is essentially a standard Medigap plan (like Plan G) with an added network requirement. The core benefits remain identical to its non-SELECT counterpart. The primary difference lies in how you access care to get those benefits paid.

Key Features Include:

- Lower Premiums: The main appeal of a SELECT plan is the significant premium savings compared to a standard Medigap plan.

- Identical Benefits (In-Network): When using network providers, a SELECT Plan G offers the exact same coverage as a standard Plan G.

- Network of Providers: You must use specific hospitals and, in some cases, doctors to get full coverage for scheduled procedures and visits.

- Emergency Coverage: All Medigap SELECT plans must cover you for emergency services at any hospital, even if it is out-of-network.

This structure makes a SELECT plan a potentially smart choice for those whose preferred healthcare providers are already part of the plan’s network.

Is a Medicare SELECT Plan the Right Choice for You?

A SELECT plan is often the best medicare supplement plan for budget-conscious individuals who do not mind a network limitation and can confirm their trusted doctors are included. It is particularly beneficial for:

- Cost-Conscious Beneficiaries: Individuals looking for the lowest possible premium for a given level of coverage (e.g., Plan G benefits).

- Those with Established Local Doctors: If your current primary care physician and local hospital are in the SELECT network, you can save money without disrupting your care.

- Urban/Suburban Dwellers: People living in areas with robust SELECT network options, including a wide range of specialists, are great candidates.

Key Insight: The main risk of a SELECT plan is inflexibility. If you want the freedom to see any doctor or specialist who accepts Medicare nationwide without penalty, a standard Medigap plan is a safer choice. Always verify the network before enrolling.

If you're exploring different insurance options for your family, you can learn more about family health insurance on mypolicyquote.com.

Actionable Tips for SELECT Plans

- Verify Your Providers: Before committing, get a current provider directory from the insurance company. Call your most important doctors' and hospitals' billing offices to confirm they are "in-network" with that specific SELECT plan.

- Analyze the Network's Breadth: Check for a good selection of specialists in your area, such as cardiologists, oncologists, or orthopedists. A limited specialist network could be a major drawback later on.

- Evaluate Travel Habits: If you are a "snowbird" or travel frequently within the U.S., a SELECT plan may be inconvenient. Check if the network has coverage in the areas you visit often.

- Understand Your "Right to Switch": In certain situations, such as moving out of the plan's service area, you have a guaranteed issue right to switch to a standard Medigap plan. Know your rights.

Top 7 Medicare Supplement Plans Comparison

| Plan | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Medicare Supplement Plan F | Low – comprehensive coverage, no cost-sharing | High premiums | Minimal out-of-pocket expenses, full coverage | Individuals eligible before 2020 seeking predictability | Most comprehensive coverage; no referrals; worldwide coverage |

| Medicare Supplement Plan G | Low – similar to Plan F but pay Part B deductible | Moderate premiums | Nearly full coverage after deductible | New beneficiaries wanting extensive coverage with some cost-sharing | Comprehensive; available to all new enrollees; covers Part B excess charges |

| Medicare Supplement Plan N | Moderate – cost-sharing with copayments | Lower premiums than F and G | Good coverage with some out-of-pocket copays | Beneficiaries accepting copays to reduce premiums | Lower premiums; includes foreign travel coverage |

| Medicare Supplement Plan K | Moderate – 50% cost-sharing, annual limit | Low premiums | Basic coverage; potential high out-of-pocket costs before limit | Budget-conscious with minimal healthcare needs | Low premium; catastrophic cap on out-of-pocket expenses |

| Medicare Supplement Plan L | Moderate – 75% cost-sharing, annual limit | Moderate premiums | Balanced cost-sharing with lower out-of-pocket max | Those needing moderate coverage and cost-sharing | Lower out-of-pocket max than Plan K; moderate premiums |

| Medicare Supplement Plan A | Low – very basic hospital coverage | Lowest premiums | Minimal coverage; large gaps remain | Extremely limited budgets needing hospital protection | Lowest cost; basic hospital coverage |

| Medicare SELECT Plans | Higher – network restrictions apply | Lower premiums | Same benefits within network; less flexibility | Comfortable with provider network restrictions | Lower premiums; emergency coverage anywhere |

Making Your Final Choice and Taking the Next Step

Navigating the landscape of Medicare Supplement plans can feel overwhelming, but by now, you have a comprehensive roadmap. We’ve dissected the most popular options, from the robust, near-complete coverage of Plan G to the budget-conscious, cost-sharing structure of Plan N. You’ve seen how high-deductible versions can lower monthly premiums and how unique options like Plan K and Plan L provide a crucial safety net against catastrophic costs. The single most important takeaway is this: the best medicare supplement plan is not a universal answer but a personalized solution.

Your ideal plan is the one that aligns perfectly with your individual health profile, your financial comfort zone, and your tolerance for risk. The journey to finding it begins with a clear-eyed self-assessment.

A Framework for Your Final Decision

To transition from learning to deciding, use this strategic framework. It breaks the choice down into manageable, actionable steps, ensuring you don't miss a critical detail.

1. Re-evaluate Your Personal Health & Financial Profile:

- Current Health: How often do you visit doctors or specialists? Do you have chronic conditions requiring regular care? A high-use individual might find Plan G’s predictable costs more valuable than Plan N’s lower premiums.

- Future Projections: Consider your family health history. If there's a high probability of needing more intensive care in the future, securing a more comprehensive plan now during your Open Enrollment Period is a strategic move.

- Financial Situation: How much can you comfortably allocate to a monthly premium? A self-employed professional with fluctuating income might prefer the low premium of Plan N, feeling confident they can cover the occasional copay. Conversely, a retiree on a fixed income may prioritize the budget certainty of Plan G, even with its higher premium.

Key Insight: Don’t just shop for the person you are today. Choose a plan that provides security for the person you might be in five or ten years. Your Medigap Open Enrollment Period is your golden ticket to guaranteed acceptance, regardless of health.

2. The Critical Role of Premium vs. Out-of-Pocket Costs:

This is the central balancing act. A lower premium often means higher potential out-of-pocket costs, while a higher premium typically minimizes or eliminates them.

- Scenario A (Risk Averse): If the thought of unpredictable medical bills for doctor visits or a Part B excess charge causes stress, paying a higher, fixed premium for Plan G offers unparalleled peace of mind. You know exactly what your healthcare costs will be, outside of the Part B deductible.

- Scenario B (Cost-Conscious & Healthy): If you are in good health and comfortable with small, predictable copays for doctor visits ($20) and ER trips ($50), Plan N is an exceptional choice. The premium savings can be substantial over the course of a year, freeing up funds for other needs.

3. The Final Step: Compare Quotes from Multiple Carriers:

Remember, while Medigap plans are standardized by the government (a Plan G from Company A has the same benefits as a Plan G from Company B), the prices are not. Insurance carriers set their own premiums based on location, age, and other factors. Skipping this comparison step is like leaving money on the table.

Comparing quotes is the single most effective action you can take to ensure you are not overpaying for your chosen coverage. This is where you transform your research into tangible savings and secure the best medicare supplement plan at the best possible price.

By thoughtfully working through these steps, you empower yourself to make a confident, informed decision. You move beyond simply picking a plan to strategically selecting a long-term healthcare partner that safeguards both your health and your financial well-being for years to come.

Ready to see how much you could save? The experts at My Policy Quote make it simple to compare rates from top-rated insurance carriers in your area. Use our free, no-obligation tool at My Policy Quote to find the most affordable coverage that fits your needs and budget.

Article created using Outrank