Let’s be honest—nobody gets excited about needles, doctor's visits, and long waits just to get life insurance. What if you could skip all that and still get the financial protection your family deserves? That's exactly what no-medical-exam term life insurance is all about.

Instead of the old-school physical, insurers now use data to approve your policy in days—sometimes even minutes. It's a faster, simpler, and far more convenient way to get things done.

Your Guide to No-Exam Life Insurance

Think of it like the express lane at the grocery store. The traditional route means scheduling appointments, giving fluid samples, and then waiting weeks for lab results to come back. The no-exam path lets you bypass all those lines. It's built for people who value their time just as much as their family’s security.

This speed and convenience have made it a go-to choice for so many people, especially those with packed schedules. Busy parents, freelancers, and small business owners can apply for and lock in their coverage on a lunch break instead of having to take a day off work. The whole process is designed for modern life.

How Does It Work Without an Exam?

So, how can insurers feel confident offering coverage without a physical check-up? It all comes down to data. "No exam" doesn't mean "no information needed." It just means they perform a digital check-up instead of a physical one.

Insurers use a few key sources to get a clear picture of your health and risk profile almost instantly. This modern approach to underwriting pulls from:

- Your Application Answers: You’ll fill out a detailed health questionnaire online. Honesty here is key.

- Public Records: Information from your driving record (MVR) helps assess risk.

- Digital Health Data: Insurers can access prescription histories and check the MIB (Medical Information Bureau), which is a secure database of past insurance applications.

By pulling these digital puzzle pieces together, an insurer can assess your eligibility and make an offer, often within 24 to 48 hours. This approach removes the biggest headaches of traditional life insurance.

The popularity of this method has skyrocketed thanks to these digital underwriting leaps. In fact, no-exam policies now make up over 20% of new term life sales, a massive jump from less than 5% just a decade ago.

This is a game-changer for people like 1099 contractors who can’t afford the downtime for a medical exam. It’s an evolution that ensures protecting your loved ones fits into your life, not the other way around. You can discover more insights about the rise of no-exam life insurance policies at Insuranceopedia.

It might seem strange that an insurance company would hand out a huge policy without ever asking you to see a doctor. How can they be sure you're a safe bet? It’s not magic—it's a smart, data-driven process that builds a clear picture of your health in minutes, not weeks.

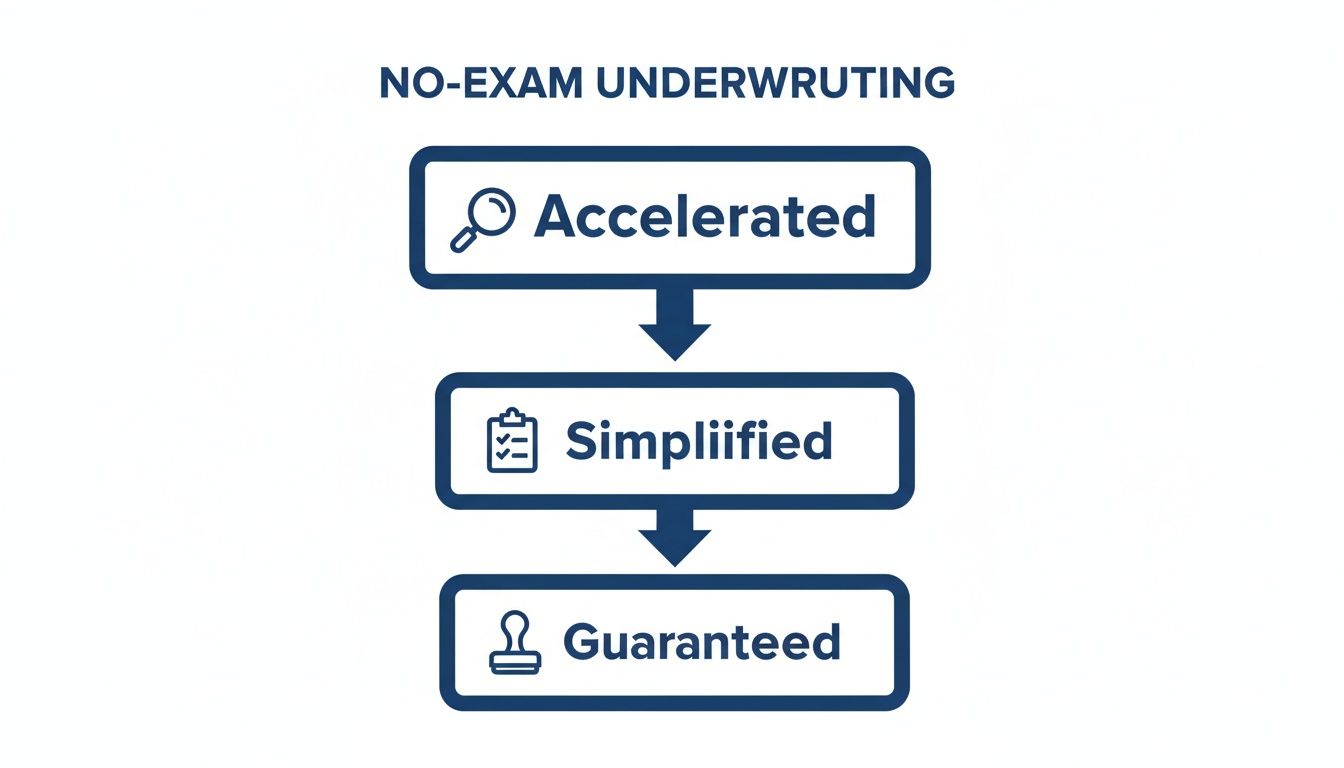

Instead of a stethoscope and a blood pressure cuff, insurers now use powerful algorithms and secure digital records. This lets them offer term life insurance with no medical exam by quickly sorting applicants into different categories using three main underwriting paths. Each one is built for a different type of person, balancing speed, convenience, and cost.

Comparing No-Exam Life Insurance Underwriting Types

To figure out which no-exam policy is right for you, it helps to see how they stack up against each other. This table breaks down the key differences between the three main underwriting processes, from the questions they ask to the coverage you can get.

| Underwriting Type | Medical Questions? | Typical Coverage Amount | Best For | Approval Speed |

|---|---|---|---|---|

| Accelerated Underwriting | Yes, detailed health & lifestyle questions | Up to $2 million+ | Healthy individuals seeking high coverage and low rates | 24-48 hours |

| Simplified Issue | Yes, a short list of "yes/no" questions | Up to $500,000 | People in decent health who want a balance of convenience and cost | A few days |

| Guaranteed Issue | None | $5,000 – $25,000 | Individuals with serious health issues who can't get other coverage | Almost instant |

As you can see, the less an insurer knows about your health, the more the policy features change to manage their risk. Let’s dive into what that really means for you.

Accelerated Underwriting: The Fast Track for Healthy People

Think of Accelerated Underwriting like getting pre-approved for a home loan. If you have a great credit score and a solid job, the bank can approve you for a big loan at a fantastic rate, fast. Life insurance companies do the same thing, using data to confirm you're a low-risk applicant and rushing your approval through.

This is the most in-depth of the no-exam options. While you get to skip the needles and nurses, you give the insurer permission to pull data from different sources to verify what you put on your application. This digital background check typically includes:

- Your Prescription History: Insurers can see what medications you’ve been prescribed, which paints a very clear picture of your health.

- The MIB (Medical Information Bureau) Report: This is an industry-wide database that logs information from past insurance applications.

- Your Driving Record (MVR): A clean driving history suggests you’re not a big risk-taker.

- Public and Credit-Based Data: Financial stability often correlates with better long-term health.

If all the puzzle pieces fit together and point to excellent health, you can lock in coverage up to $2 million or more, sometimes in just 24-48 hours. The rates are often nearly identical to what you’d get with a full medical exam. But be aware, if the algorithm spots any red flags, the insurer might still ask for a medical exam to move forward. You can learn more about how this works by exploring the modern life insurance underwriting process.

Simplified Issue: The Balanced Middle Ground

Simplified Issue is a bit like applying for a store credit card. You don’t have to show them years of tax returns; you just answer a few direct questions about your finances. Approval is quick, but the credit limit is usually lower than a traditional Visa or Mastercard.

This kind of no-exam policy works the same way. You’ll answer a handful of simple health questions on the application—usually about 10-20 "yes" or "no" questions. Your answers are what determine if you get approved.

Key Takeaway: Simplified Issue skips the deep data dive and relies on your direct answers. Because the insurer has less to go on, they take on more risk, which you’ll see reflected in the policy’s features.

This path is perfect for people who might not qualify for the absolute best rates but are still in reasonably good health. Coverage amounts are generally lower than accelerated policies, often capping out around $500,000. Premiums are a bit higher than a fully underwritten policy but more affordable than the next option, making it a great compromise between convenience and cost. Approval is still very fast, usually taking just a few days.

Guaranteed Issue: The Safety Net Option

Finally, there’s Guaranteed Issue, which is the insurance world’s version of a secured credit card. Approval isn't based on your history; it’s practically a sure thing as long as you meet the basic age rules. But that accessibility comes with some serious limits and higher costs.

Guaranteed Issue policies ask zero health questions. None. Approval is almost certain for anyone in the eligible age bracket (usually 50-85). This makes it a lifeline for people with serious health conditions who’ve been turned down for every other type of coverage.

However, this comes with some major trade-offs:

- Lower Coverage Amounts: The death benefits are small, typically ranging from $5,000 to $25,000. They’re designed to cover final expenses, like a funeral or remaining medical bills.

- Higher Premiums: Because the insurer is flying blind on your health, the cost per dollar of coverage is the highest you’ll find.

- Graded Death Benefit: This is the most important part to understand. If the insured person dies from natural causes within the first two or three years of the policy, the beneficiaries don't get the full death benefit. Instead, they usually get back all the premiums paid, plus a little interest.

This "waiting period" protects the insurance company from immediate claims on high-risk individuals, while still offering a valuable financial safety net for those who would otherwise have no options at all.

Understanding the True Cost of Convenience

Let’s get straight to the point. One of the biggest questions about term life insurance with no medical exam is simple: does skipping the doctor’s visit cost you more?

The short answer is yes, it often does. But before you write it off, it’s important to understand why. It’s not some hidden fee or penalty—it's a calculated trade-off you make for speed and simplicity.

Think of it like buying a used car. You could take it to a mechanic for a full inspection, giving you total confidence in what you’re buying. Or, you could buy it "as-is" without one. The seller has to price that second car to account for the unknown—a potential engine issue they can’t see. They’re taking on more risk.

Insurers work the same way. This is called risk pricing. Without the hard data from a medical exam (blood work, urine samples, blood pressure readings), they have less information to go on. To balance that uncertainty, they build a small buffer into your premium. You’re paying for the convenience of skipping the exam.

The Price of Speed and Simplicity

So, what does this trade-off actually look like in your bank account? The price difference really depends on the type of no-exam policy you get, your age, and your general health.

If you’re healthy and qualify for Accelerated Underwriting, the price difference might be tiny—maybe just a few dollars a month. But for Simplified or Guaranteed Issue policies, the premium will be noticeably higher than a traditional plan.

This flowchart breaks down how it works.

As you move down from accelerated to guaranteed, the insurer has less and less health data. To manage their risk, they usually raise the premiums and offer lower coverage amounts.

Real-World Cost Examples

Let’s talk real numbers. Take Lincoln Financial, which offers some of the most competitive no-exam rates out there. A 20-year, $100,000 policy for a 70-year-old non-smoker can start around $7 per month for women and $9 for men.

Sure, those rates might be 20-50% higher than a fully underwritten plan. But for people who need coverage fast, the value is incredible. Think about families without work-based health options or blue-collar workers, where traditional exams sometimes disqualify 15-25% of applicants for minor, manageable issues like high blood pressure.

Thanks to digital tools that reduce fraud and cut costs, no-exam policies now make up 25% of all term life sales in the U.S.—a massive leap from just 10% back in 2020.

The real question is about value. Is paying a slightly higher premium worth getting your family critical financial protection in a few days instead of waiting weeks? For a growing number of people, the answer is a clear yes.

It’s also smart to understand the world of professional insurance advice, as this can also factor into the overall picture of your investment. To dive deeper, you can also learn more about the costs of term life insurance in our article. We want to be transparent so you can decide if the convenience is truly worth it for your family.

Who Really Needs a No-Exam Policy?

The idea of skipping a medical exam for life insurance sounds great to just about everyone. Who wouldn’t want to avoid needles and paperwork? But term life insurance with no medical exam is more than just a shortcut; it's a lifeline for people in very specific situations.

When you look at a few real-world scenarios, it becomes clear who these policies are designed for. They solve genuine problems, making financial protection possible when the traditional route feels like a roadblock.

The Gig Worker and the Super-Parent

Let’s talk about two people who understand the value of time better than anyone: Maria, a freelance graphic designer, and David, a working dad with two little ones.

Maria, the Gig Worker: As a contractor, Maria’s schedule is a chaotic mix of client deadlines. Taking time off for a medical exam isn’t just an inconvenience—it's a direct hit to her income. A no-exam policy lets her lock in coverage between projects, sometimes in under an hour, so her family is protected without costing her a day's pay.

David, the Super-Parent: Between his job, his partner’s job, school runs, and soccer practice, David’s calendar is bursting at the seams. Finding a free moment for a doctor’s visit feels like a fantasy. A no-exam policy means he can get this critical task checked off his list from the couch on a Saturday morning. Instant peace of mind.

For Maria and David, time is everything. The sheer speed and simplicity make no-exam insurance the obvious choice.

The Needle-Avoider and the Savvy Senior

It’s not always about a busy schedule. For some, it’s about health concerns or simply hating medical procedures.

Think about Susan, who has a serious fear of needles. It's not a small thing; it's a genuine phobia that’s kept her from getting life insurance for years. A no-exam policy completely removes that barrier. For her, paying a slightly higher premium is a tiny price for a stress-free experience that finally lets her protect her family.

This approach is also a game-changer for older adults. For instance, AARP offers a no-exam term life plan for people aged 50-74, providing up to $150,000 in coverage until age 80. This is huge for early retirees or those planning their legacy, especially when you consider that 40% of applicants over 50 give up on traditional applications because of the exam hassle. You can learn more about the top no-exam policies for various age groups on NerdWallet.

Key Insight: No-exam life insurance isn’t a one-size-fits-all solution, but it’s the perfect fit for anyone who values speed, simplicity, and a less invasive process. It breaks down the common walls that stop people from getting the protection they need.

People with Minor, Managed Health Issues

There’s one more group that wins big with these policies: people with well-managed health conditions. While a full medical exam can put every little thing under a microscope, a Simplified Issue policy takes a broader view.

If you have controlled high blood pressure or your cholesterol is a bit elevated, you might find it much easier to get approved for a no-exam policy. The health questionnaire focuses on major red flags, not minor details, making the path to approval smoother for people who are generally healthy.

This can be a smart move if you need coverage now and don’t want to risk delays—or even a denial—over a single lab result. Of course, if you have more serious health issues and have been turned down before, your next step might be looking into guaranteed issue life insurance. It’s all about finding the right fit for your health and your family’s future.

Getting Your No-Exam Policy in Four Simple Steps

Applying for no-exam term life insurance is refreshingly simple. Gone are the days of endless paperwork and appointments. The whole thing feels more like a quick digital checklist, designed to get you covered and back to your life.

Here’s a look at how you can lock in that peace of mind for your family in four straightforward steps.

Step 1: Get Your Basic Info Ready

Before you even think about quotes, take a few minutes to gather some key details. This isn’t about hunting for old medical records; it’s just having the essentials on hand so the application process is smooth and fast.

You’ll want to have these ready:

- Personal Details: Your full name, address, date of birth, and Social Security number.

- Beneficiary Information: The name, birthday, and relationship of the person (or people) who will receive the policy's payout.

- Basic Medical History: Be ready to answer questions about major diagnoses, surgeries, or any medications you’re currently taking.

Having this ready beforehand turns what could be a stop-and-start chore into a simple, ten-minute task.

Step 2: Compare Quotes Online to Find Your Best Fit

Here's the deal: not all no-exam policies are the same. The rates and coverage amounts can swing wildly from one insurer to the next, so shopping around is a must. The easiest way to do this is by using an online comparison tool to see what different companies offer for your age and health profile.

As you explore options, connecting with expert insurance agents can give you invaluable guidance through the noise. This step is all about making sure you don't overpay and that you find a policy that truly fits what your family needs. Ready to see what's out there? You can get a personalized term life insurance quote right now.

Step 3: Fill Out the Digital Application—Honestly

Once you've zeroed in on an insurer, it's time to fill out the digital application. This is mostly a series of questions about your health and lifestyle. It can be tempting to fudge the details a bit to get a lower rate, but trust me on this: honesty is absolutely critical.

Crucial Reminder: Every insurance policy has a "contestability period," which is usually the first two years. If you pass away during this time and the insurer finds out you weren't truthful on your application, they can legally deny the claim. That would leave your family with nothing.

Being upfront ensures your policy does exactly what you bought it for—protecting your loved ones without any hitches.

Step 4: Finalize Your Coverage and Make It Official

After you hit "submit," the insurer's digital underwriting kicks in. While some decisions are almost instant, "fast approval" can mean anywhere from a few minutes to a couple of business days. Behind the scenes, the company is verifying your information against various digital records.

Once you’re approved, you'll get your policy documents electronically. The last thing to do is review the details, sign the policy, and make that first premium payment. The moment that payment goes through, your coverage is officially active. Your family is protected.

When a Medical Exam Is Actually the Better Choice

The promise of skipping a medical exam for life insurance is tempting. It’s fast, simple, and avoids any needles. But what if that convenience comes with a hidden cost?

Sometimes, the smartest financial move is to take a deep breath and schedule that exam. While it might feel like a hassle, it could unlock significant savings, especially if you’re in good health.

Why Healthy People Should Consider the Exam

Think of it this way: a medical exam is your chance to prove you’re a low-risk applicant. If you don’t smoke, manage your health well, and have no serious conditions, a fully underwritten policy will almost always be cheaper.

The savings aren't just a few dollars here and there. We're talking about thousands of dollars over the life of your policy. That short-term inconvenience becomes a brilliant long-term investment in your family's financial security.

Plus, some situations pretty much require a full medical review. You’ll almost certainly need one if:

- You need a lot of coverage. If you're looking for a death benefit over $2 million for things like estate planning or securing a business loan, insurers want the full picture.

- You have a well-managed health condition. Let's say you have high cholesterol but keep it under control with medication. A no-exam application might just see the diagnosis and charge you more. An exam, however, shows the full story—that you're actively managing your health, which can earn you a much better rate.

A medical exam gives the insurance company a clear and complete picture of your health. When they have all the facts, their risk goes down—and they pass those savings on to you with lower premiums.

Deciding what's right for you comes down to a simple trade-off between convenience and cost. If you’re young, healthy, and need a substantial policy, scheduling an exam is often the most responsible financial choice you can make. It’s about making sure you’re not overpaying and getting the absolute most protection for every dollar you spend.

Got Questions About No-Exam Insurance? We've Got Answers.

Even with all the details laid out, a few questions might still be lingering. That's completely normal. This last section is all about tackling those common "what ifs" and "how does that work" moments, so you can move forward feeling totally confident.

Let's clear up any final doubts and make sure you have everything you need to choose the right protection for your family.

Can I Still Get Approved If I Have a Pre-Existing Condition?

Yes, absolutely. Having a health condition doesn’t automatically shut the door. It just helps determine which door is the right one for you.

If you have something minor and well-managed, like controlled high blood pressure, you could easily sail through with an Accelerated Underwriting or Simplified Issue policy.

For more significant health issues, a Guaranteed Issue policy is often the best route. It skips the health questions entirely, so approval is practically a sure thing as long as you fall within the age requirements.

What's the Most Coverage I Can Realistically Get?

This is where expectations are key. No-exam policies are built for speed and convenience, not for massive, multi-million-dollar payouts. The coverage limits really depend on the type of underwriting.

- Accelerated Underwriting: This is where you'll find the highest limits, often reaching $1 million to $2 million or even more for applicants in great health.

- Simplified Issue: These policies typically top out around $500,000.

- Guaranteed Issue: Since there are no health questions, the coverage is much smaller—usually between $5,000 and $25,000—and is really designed for final expenses.

If you're looking for a huge policy to cover something like estate taxes, a traditional policy with a medical exam is almost always going to be the way to go.

Are the Application Questions Tricky?

Not at all. Think of them as straightforward and to the point. Insurers aren't trying to catch you in a lie; they're just trying to get a clear, quick picture of your overall risk. They’ll ask about major health events, lifestyle choices (like smoking), and any high-risk hobbies. No curveballs, no "gotcha" questions.

The single most important thing is to be 100% truthful. If an insurer discovers you misrepresented something on your application, they can deny a claim made within the first two years. That would defeat the whole purpose of getting the policy in the first place.

Honesty is what makes sure your policy will actually be there for your family when it matters most.

What Happens if My No-Exam Application Is Denied?

A denial isn't a dead end—it's just a detour. If your application for an accelerated or simplified issue policy gets turned down, you still have some really solid options.

First, you can always apply for a fully underwritten policy that includes a medical exam. Sometimes, the detailed information from an exam gives the insurer the clarity they need to give you a green light.

If that’s not the right move, a Guaranteed Issue policy is a great safety net. It offers a smaller amount of coverage without asking a single health question. A denial just means it's time to pivot and find a different path to get your family protected.

Ready to see just how simple getting covered can be? At My Policy Quote, we take the guesswork out of finding the right no-exam term life policy. Get your free, no-obligation quote today and you could secure your family's future in minutes!