When you first look at a health insurance plan, one of the first—and most confusing—terms you’ll run into is the deductible. Getting this one concept right is the key to understanding how your plan really works and avoiding those dreaded surprise medical bills.

So, what is it? Simply put, the health insurance deductible is the amount of money you have to pay for your own medical care before your insurance company starts chipping in. It’s a set amount that resets every year.

Demystifying Your Health Insurance Deductible

Think of your deductible as the price of admission to your plan’s cost-sharing benefits. You have to pay that initial amount out of your own pocket first. Until you’ve met that magic number, you’re on the hook for 100% of your covered medical costs.

Let’s say your plan has a $3,000 deductible. This means you need to pay the first $3,000 of your eligible healthcare bills for the year. Once you’ve hit that $3,000 threshold, the insurance company finally opens its wallet. From that point on, you’ll start sharing costs through things like copays and coinsurance.

Here’s a common mix-up: your monthly premium does not count toward your deductible. Your premium is just the fee you pay to keep your plan active, like a monthly subscription. The deductible only comes into play when you actually go to the doctor or hospital.

Key Characteristics of a Deductible

To really get how deductibles work, you just need to remember a few simple rules that define when and how you pay.

- It Resets Annually: Your deductible starts over every single plan year, which is usually January 1st. Nothing you paid in the previous year rolls over—you get a clean slate.

- It Only Applies to Covered Services: The only expenses that count toward meeting your deductible are for treatments and services your specific plan actually covers. If you get care that isn't covered, that money won't help you reach your deductible.

- Preventive Care Is Usually Exempt: Thanks to the Affordable Care Act (ACA), most plans cover things like annual check-ups, flu shots, and important health screenings at 100%, even if you haven't paid a dime toward your deductible yet.

A lot of people think that once they meet their deductible, everything is free from then on. That's a huge misconception. Hitting your deductible just means you've unlocked your plan's cost-sharing feature. You'll still have out-of-pocket costs until you hit your plan's out-of-pocket maximum for the year.

How Deductibles Vary By Plan

Deductibles are not one-size-fits-all. They can be wildly different from one plan to the next, which directly impacts your monthly budget and how much you could end up paying if you get sick.

There's usually a trade-off. Plans with low monthly premiums often come with high deductibles. On the flip side, plans with higher monthly premiums tend to have lower deductibles. If you want to get into the nitty-gritty of policy language, this guide is great for understanding the fine print of excesses and deductibles.

Choosing the right balance is the heart of picking a good health plan. For families on a budget or self-employed folks, it's all about weighing the predictable cost of the premium against the potentially high—and unpredictable—cost of a large deductible.

The Trade-Off Between Premiums and Deductibles

Choosing a health insurance plan often feels like trying to balance a seesaw. On one end, you have your monthly premium; on the other, your annual deductible. Push one side down, and the other almost always goes up. This simple trade-off is the biggest financial puzzle you’ll need to solve when picking your coverage.

A low monthly premium looks great on paper, especially if you're an independent contractor or managing a tight family budget. It gives you predictable costs you can count on. But that immediate savings usually comes with a much higher deductible, meaning you could face a huge bill if you actually need serious medical care.

On the flip side, a plan with a higher premium will typically have a much lower deductible. Yes, your fixed monthly payment is bigger, but you get to your plan's cost-sharing benefits a lot faster. This is the most important decision you'll make—balancing your month-to-month budget against the risk of future health expenses. For a full breakdown of what goes into that monthly payment, you can learn more about insurance premiums in our article.

High Deductible vs. Low Deductible Plans

So, which side of the seesaw should you lean toward? The honest answer is: it depends entirely on you. There’s no single “best” choice—only the one that fits your health, your comfort with risk, and your bank account.

A high-deductible health plan (HDHP) is often a smart move for people who are generally healthy and don’t expect to need much more than preventive check-ups. The biggest perk is the significantly lower monthly premium, which keeps more cash in your pocket.

In contrast, a low-deductible plan makes more sense for anyone who anticipates needing regular medical care. This includes people with chronic conditions, families with young kids, or someone planning a surgery. That higher premium is a calculated cost to protect yourself from large, unexpected bills down the road.

The core question to ask yourself is: "Would I rather pay more every month for peace of mind, or pay less monthly and be prepared for a larger one-time expense if I get sick or injured?" Your answer will guide your entire health insurance strategy.

Visualizing the Financial Impact

Let's look at a simple example to see how this plays out over a year for a self-employed professional.

| Plan Feature | Plan A (High Deductible) | Plan B (Low Deductible) |

|---|---|---|

| Monthly Premium | $350 | $550 |

| Annual Deductible | $7,000 | $1,500 |

| Total Annual Premium Cost | $4,200 | $6,600 |

| Total Cost After a Major Event | $4,200 (Premiums) + $7,000 (Deductible) = $11,200 | $6,600 (Premiums) + $1,500 (Deductible) = $8,100 |

This comparison makes it crystal clear. If you stay healthy all year, Plan A saves you $2,400 in premium costs. But if you have one major medical event, Plan B could save you over $3,000 in total spending.

The Rising Cost of This Trade-Off

This balancing act has gotten tougher as deductibles in health insurance have skyrocketed over the past decade. This trend puts a heavy burden on anyone without employer-sponsored coverage, like 1099 contractors and working-class families.

The average deductible for single coverage in employer plans jumped from $1,300 in 2013 to over $1,800 by 2023—that's a 38% increase. The trend is even worse in individual marketplace plans, where a bronze plan might have a low premium but comes with a jaw-dropping deductible averaging $6,000 or more.

How Different Health Plans Approach Deductibles

Not all health plans are built the same, and that’s especially true when it comes to deductibles. The type of plan you pick—whether it's an HMO, PPO, or a high-deductible plan—doesn't just change which doctors you can see. It completely changes how and when your deductible comes into play.

Getting this right is the key to knowing what you'll actually pay for healthcare. Think of it like a cell phone plan. Some have a low monthly fee but sting you on data overages, while others cost more upfront for unlimited everything. Health plans work the same way, and the deductible is a huge piece of that puzzle.

HMOs and PPOs: The Traditional Models

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are probably the plan types you've heard of most. While they're different in how much freedom you have to choose your doctors, their approach to deductibles can be pretty similar.

With a lot of HMOs and PPOs, some services are shielded from your main deductible. For example, you might just pay a simple, flat copay for a regular doctor’s visit. You pay your $40 copay at the front desk, and that’s it. Your deductible doesn’t even get involved for that appointment.

But for the big stuff—a hospital stay, an MRI, or surgery—that deductible will absolutely kick in. You'll be responsible for paying the full cost of those services out of your own pocket until you’ve hit your deductible for the year.

High-Deductible Health Plans: A Different Strategy

Like the name says, High-Deductible Health Plans (HDHPs) are designed around a much bigger deductible. The trade-off? Your monthly premium is usually a lot lower. In exchange, you agree to handle more of your initial healthcare costs yourself.

With an HDHP, just about everything counts toward your deductible, from a check-up to a prescription refill. This is a major shift from the copay-first style of more traditional plans.

The big upside is that HDHPs can be paired with a Health Savings Account (HSA). An HSA is a powerful tool that lets you set aside pre-tax money for medical expenses, and those funds can even grow tax-free. For a deeper look, check out our guide on what is a High-Deductible Health Plan. This combo is a favorite for healthy people and entrepreneurs who want to keep their monthly bills low while saving smartly for the future.

The one thing to always remember about deductibles in health insurance is that some costs are exempt. The Affordable Care Act (ACA) requires all compliant plans to cover a list of preventive services at no cost to you. This is true even if you haven't paid a dime toward your deductible. Think annual physicals, flu shots, and important health screenings.

Individual vs. Family Deductibles: The Embedded vs. Aggregate Puzzle

This is where things can get a little tricky for families. Family plans have two numbers to watch: an individual deductible and a family deductible. How they work together depends on whether your plan has an "embedded" or "aggregate" structure. This tiny detail can make a massive difference to your wallet.

Here’s a quick breakdown:

- Embedded Deductible: Each person on the plan has their own individual deductible. As soon as one person meets their personal limit, the insurance company starts sharing their costs—even if the total family deductible is still unmet. This is the most common setup and offers great protection if one person has a major health issue.

- Aggregate Deductible: Here, all the family's medical costs get thrown into one big pot. Insurance won't pay for anyone until the entire family deductible has been met. This could happen from one person's huge medical bill or from a bunch of smaller costs from everyone combined.

Let's put it into a real-life scenario. Imagine a family of four with a $3,000 individual deductible and a $6,000 family deductible.

Scenario 1 (Embedded Deductible): One child needs a surgery that costs $4,000. The family pays the first $3,000, which meets that child's individual deductible. After that, the insurance plan starts paying its share on the remaining $1,000. That child is now covered for the rest of the year.

Scenario 2 (Aggregate Deductible): The same child has the same $4,000 surgery. The family pays the entire $4,000 out-of-pocket. They still have $2,000 to go before the plan will help pay for anyone's care.

This is one of the most important—and most overlooked—details when you're choosing a family plan. Always, always check the "Summary of Benefits and Coverage" document to see which kind of deductible your plan uses.

What Happens After You Meet Your Deductible?

Hitting your health insurance deductible is a huge milestone. Think of it as crossing a finish line in your plan year—you’ve paid your share upfront, and now your insurance company finally steps in to start sharing the load. This is where your health plan really starts to show its value, shifting you from covering 100% of your medical bills to a new phase of teamwork.

But don’t mistake this for "free" healthcare. Instead, you're entering a partnership with your insurer. This next stage is all about two new terms you need to know: coinsurance and the out-of-pocket maximum. Getting this sequence right is critical if you’re trying to manage the costs of a major health event.

Entering the Coinsurance Phase

Once your deductible is officially met, coinsurance kicks in. This is just a fancy term for a percentage split. Your insurance company pays a big chunk of the bill for covered services, and you pay the smaller remaining slice.

A common split is 80/20. This means your insurer pays 80% of the bill, and you’re on the hook for the last 20%.

Let's say your plan has a $3,000 deductible and 20% coinsurance. You’ve already paid that first $3,000 in medical bills. Then, you have a follow-up procedure that costs $1,000. Instead of paying that whole amount, you’ll only owe $200 (20% of $1,000). Your insurance covers the other $800.

This cost-sharing continues for every covered service you get for the rest of the year. Every coinsurance payment you make is still an out-of-pocket expense, but it’s a whole lot better than what you were paying before.

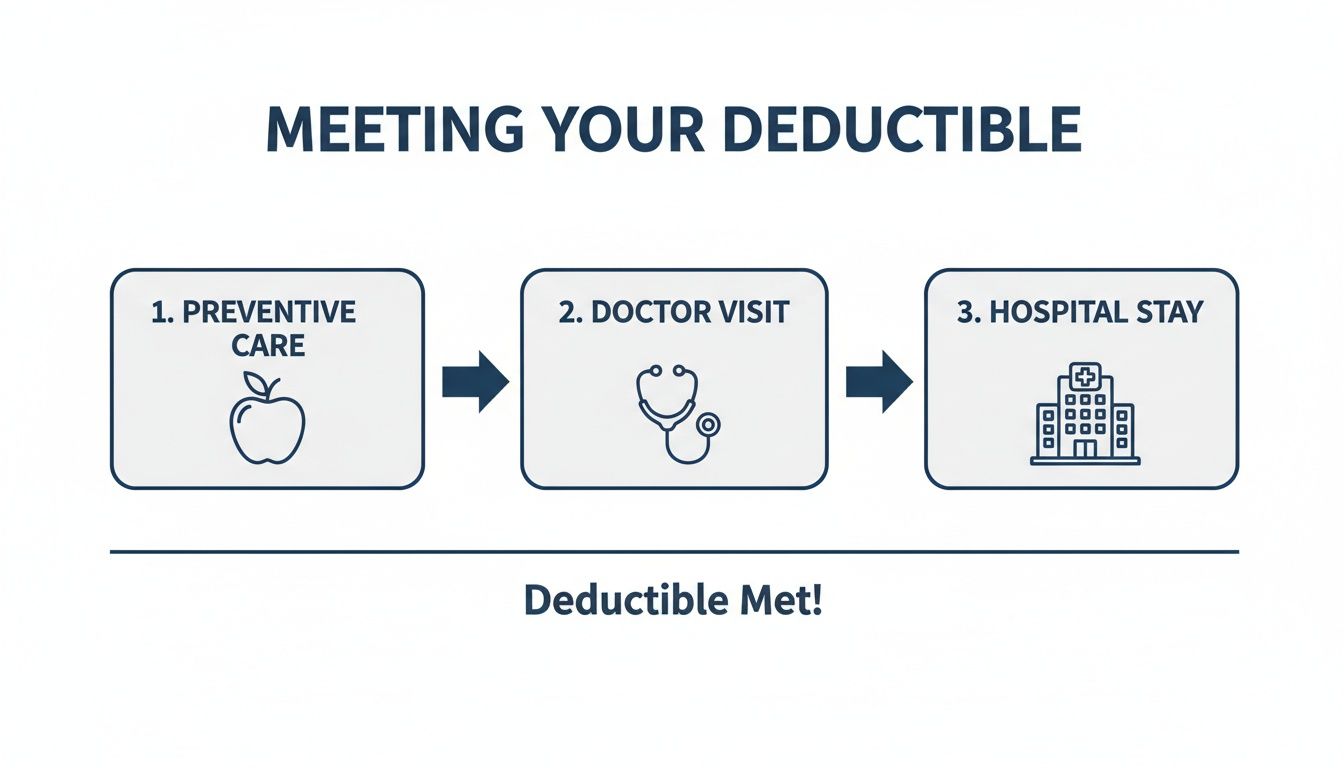

The infographic below gives you a nice visual of this journey, from your first visit to finally reaching that cost-sharing phase.

It’s a clear reminder of how different types of care all add up, getting you closer to the point where your insurer starts helping out.

The Ultimate Safety Net: The Out-of-Pocket Maximum

While you’re paying your coinsurance, there’s another important number to keep your eye on: your out-of-pocket maximum. This is the absolute most you will have to pay for covered healthcare in a single plan year. It’s your financial safety net, designed to protect you from truly catastrophic medical bills.

Everything you pay toward covered, in-network care—your deductible, your copayments, and all your coinsurance payments—counts toward this limit. Your monthly premiums, however, do not.

Once you hit your out-of-pocket maximum, your insurance company takes over and pays 100% of all covered in-network medical bills for the rest of the plan year. This is the point where you get true financial peace of mind.

Let's walk through a full scenario to see how all these pieces fit together.

A Step-by-Step Medical Scenario

Meet Sarah. She’s a freelance graphic designer, and here’s a look at her health plan:

- Deductible: $4,000

- Coinsurance: 20%

- Out-of-Pocket Maximum: $7,500

- Early Year Doctor Visits: Sarah has a few minor appointments that add up to $500. She pays this full amount herself. She has now paid $500 toward her $4,000 deductible.

- Unexpected Surgery: Later in the year, Sarah needs a surgery that costs $10,000. She first pays the remaining $3,500 of her deductible ($4,000 – $500). Her deductible is now met.

- Coinsurance Kicks In: For the remaining $6,500 of the surgery cost, Sarah is responsible for her 20% coinsurance. She pays $1,300 (20% of $6,500), and her insurer handles the other $5,200.

- Tracking Total Spending: So far, Sarah has paid a total of $5,300 out of her own pocket ($500 for visits + $3,500 for the deductible + $1,300 in coinsurance). This entire amount counts toward her $7,500 out-of-pocket max. She only has $2,200 left to pay before her insurance covers everything at 100%.

Some plans use the phrase "no charge after deductible," which can mean you skip the coinsurance step entirely. If you want to dive deeper into that specific plan feature, our guide explains in detail what 'no charge after deductible' means. This journey—from the first dollar to the final cap—is the heart of how deductibles in health insurance really work to manage your costs.

Choosing the Right Deductible for Your Life

Knowing how deductibles work is one thing, but picking the right one for you? That's where it gets personal. There’s no magic number here. The best choice is tied directly to your health, your finances, and how much risk you’re comfortable taking on.

Think of it as a calculated bet on your own future. Are you betting on a healthy year with just a few check-ups? Or do you know you'll have regular doctor visits and prescriptions? Answering that question honestly is the first step to finding a plan that protects you without breaking the bank.

Matching Your Deductible to Your Life Stage

Your personal situation is the most important piece of the puzzle. A young, healthy freelancer has completely different needs than a family with small kids or someone nearing retirement.

-

For the Healthy Self-Employed Professional: If you rarely see a doctor, a high-deductible health plan (HDHP) is often a brilliant move. The low monthly premium frees up cash, which is a big deal for any entrepreneur. Even better, you can pair it with a tax-advantaged Health Savings Account (HSA) to save for future medical costs. You can learn more by exploring our guide on the basics of HSA and HRA plans.

-

For the Family on a Tight Budget: Here, predictability is everything. A lower-deductible plan might have a higher premium, but it can stop one unexpected illness from turning into a financial disaster. Knowing your insurance will kick in sooner offers priceless peace of mind.

-

For the Early Retiree: If you're in your early 60s and not on Medicare yet, you’re in a unique spot. You might feel great now but want a safety net for any age-related issues that could pop up. A mid-range deductible can be a great compromise between affordable premiums and a reasonable out-of-pocket risk.

A Practical Checklist for Your Decision

Making the right call means taking a clear-eyed look at your life. Grab a notebook and work through these questions to get a real picture of your healthcare needs.

- Look at Your Past Health: How many times did you visit a doctor last year (not counting preventive care)? Did you have any surprise trips to the ER or a specialist?

- Check Your Prescription Needs: Do you take any medications regularly? Find out what they cost and how different plans cover them—some costs might apply to your deductible.

- Assess Your Financial Cushion: If a medical emergency happened tomorrow, do you have enough saved up to comfortably pay a high deductible?

- Think About the Future: Are you planning any big life changes in the next year, like having a baby or scheduling a surgery?

Answering these questions gives you a solid, data-driven foundation. It moves you from just guessing to making a smart, informed decision about deductibles in health insurance.

Your deductible is more than a number on a page—it's your financial exposure. The right one is a number you can actually afford to pay if you have a tough health year, without it derailing your entire financial life.

For many people on the ACA Marketplace, especially the self-employed and families, this decision is getting harder. A KFF analysis points out that with enhanced tax credits set to expire, many face a tough choice: soaring premiums or sky-high deductibles. Switching to a bronze plan might lower your monthly bill, but it pushes individual deductibles past $7,000, with out-of-pocket limits over $9,200. For the 23% of Marketplace users who already had deductibles over $5,000 in 2023, this creates a massive financial barrier that can make people think twice about getting routine care. You can read the full analysis on these challenging tradeoffs at KFF.org.

This new reality makes choosing wisely more critical than ever. The framework below can help you see which path might be a better fit.

Deductible Decision Framework

This table breaks down the key factors to help you weigh your options between a low and high deductible plan.

| Consideration | Best for Low Deductible Plan | Best for High Deductible Plan |

|---|---|---|

| Health Status | You have a chronic condition or expect to need frequent medical care. | You are generally healthy and rarely visit a doctor outside of preventive care. |

| Financial Situation | You prefer a higher, fixed monthly cost to avoid big, unexpected bills. | You have a solid emergency fund that could cover the full deductible if needed. |

| Risk Tolerance | You are risk-averse and value the peace of mind from lower out-of-pocket costs. | You are comfortable with some financial risk in exchange for big monthly premium savings. |

| Prescription Drugs | You take expensive or multiple maintenance medications on a regular basis. | You have few or no recurring prescription needs. |

Ultimately, picking a deductible is about creating a financial safety net that fits your life. When you evaluate your personal needs and financial readiness, you can move from confusion to confidence—and choose a health plan that truly has your back.

Common Questions About Health Insurance Deductibles

Even after you get the hang of how deductibles work, a few practical questions almost always pop up. Let's tackle them head-on.

Think of this as your quick-reference guide to clear up any lingering confusion and help you feel totally confident in your health insurance choices.

Do My Monthly Premiums Count Toward My Deductible?

This is probably the most common question out there, and the answer is a simple, firm no. Your monthly premium payments do not count toward meeting your deductible.

Here’s an easy way to think about it: Your premium is like a gym membership fee. You pay it every month just to keep your access. Your deductible, on the other hand, is what you have to spend on actual services before the insurance company’s bigger benefits kick in.

What Happens If I Don’t Meet My Deductible by Year-End?

If you don't hit your full deductible by the end of your plan year (usually December 31st), it resets to zero. Tough, but true.

None of the money you spent toward your deductible carries over. This is a huge detail for financial planning. If you've paid $4,000 toward a $5,000 deductible by December, that progress vanishes on January 1st. You start over from $0, which can be a real sting if you have a medical procedure scheduled for early in the new year.

Are Any Services Covered Before I Meet My Deductible?

Yes, absolutely! This is a key feature that provides value from day one. Many plans, especially those compliant with the Affordable Care Act (ACA), cover certain services before you've paid a single dollar toward your deductible.

The most common pre-deductible perks are preventive care services. These usually include:

- Annual physicals to get a baseline on your health.

- Immunizations like your yearly flu shot.

- Screenings for things like high blood pressure, cholesterol, and certain cancers.

Some plans also use a flat copay for things like a primary care visit or a generic prescription. You might pay a $30 fee for the visit, and that service won't be subject to your main deductible. Always check your plan’s "Summary of Benefits and Coverage" to see exactly what’s covered upfront.

Not meeting your deductible doesn't mean your insurance is useless. You’re still getting the benefit of the insurer's negotiated rates with in-network doctors, which are often way lower than what you'd pay without any coverage at all.

How Does a Family Deductible Work?

Family plans add a little twist with two important numbers: an individual deductible and a total family deductible.

Most plans today use an "embedded deductible." This is generally more family-friendly. Each person has their own deductible, and once one person meets their personal limit, the insurance starts paying for their costs—even if the bigger family deductible hasn't been met.

The other type is an "aggregate deductible." Here, everyone's costs are pooled together. The insurance won't start paying for anyone until the total family deductible is met, either by one person's major medical event or the combined costs of a few family members. Knowing which one you have is crucial for budgeting.

Beyond understanding your plan, it’s important to know your rights. If a claim is unfairly denied, you might need to consider consulting a lawyer for insurance claims to get the benefits you're entitled to.

Navigating health insurance can feel like a puzzle, but you don’t have to solve it alone. At My Policy Quote, we specialize in helping individuals, families, and self-employed pros find plans that truly fit their lives and budgets. Get a personalized quote today and take the first step toward confident coverage.