Navigating the health insurance landscape can feel overwhelming, especially when your top priority is affordability. The question of where to find cheap health insurance is more critical than ever, with rising costs and a dizzying array of options. Whether you're a self-employed professional, an early retiree, or part of a working family, knowing where to start is the first and most crucial step toward securing coverage that protects your health without breaking the bank.

This guide is designed to be your definitive roadmap. We've done the research to compile the 12 best websites, platforms, and resources available today. Our list cuts through the noise, directing you to the exact places that can connect you to low-cost or even no-cost health plans. Understanding the financial burden many face, including the prevalence of medical debt across the nation, underscores the vital importance of securing affordable healthcare coverage before you need it.

We will move beyond simple descriptions and dive into practical, actionable details for each resource. You will find:

- Who it’s best for: A quick breakdown of the ideal user for each platform.

- What you need: The specific documents required to apply.

- How to save: Tips on maximizing subsidies and finding the most affordable options.

- Direct links and screenshots: Visual guidance to simplify your search.

This resource is built to help everyone from 1099 contractors and parents buying for adult children to financial advisors guiding their clients. Let’s explore the most effective pathways to affordable, quality health insurance tailored to your unique situation.

1. My Policy Quote

Best For: Comprehensive plan comparison and expert guidance for individuals and families.

My Policy Quote is a standout choice for those looking for where to find cheap health insurance because it operates as a licensed, nationwide brokerage. This structure provides a significant advantage: instead of being limited to one carrier, you gain access to a broad market of plans from various top-rated insurance companies across all 50 states. This model is especially effective for self-employed workers, pre-Medicare adults (60-64), and families who need to compare diverse options to find the most cost-effective coverage.

The platform streamlines the often-overwhelming process of shopping for insurance. Its core strength lies in combining technology with human expertise, offering fast, no-obligation quotes-often in under 10 minutes-and personalized support from state-certified agents.

Key Features and Benefits

The platform excels at simplifying plan selection by offering a full spectrum of health-related products. This one-stop-shop approach saves time and ensures all your coverage needs are met cohesively.

- Extensive Plan Access: Compare major medical, top-rated Gold and Platinum plans, and short-term options side-by-side. Their agents help navigate complex terms, and you can learn more about key concepts like the differences between coinsurance and copay on MyPolicyQuote.com to make informed decisions.

- Comprehensive Supplemental Coverage: Beyond primary health plans, My Policy Quote offers a robust catalog of supplemental insurance, including dental, vision, critical illness, and hospital indemnity. This is ideal for building a customized safety net that fills gaps left by standard medical plans.

- Lifetime Agent Support: A key differentiator is the promise of ongoing support after enrollment. You are assigned an agent who can assist with policy questions, renewals, or coverage changes for the life of your plan, providing a consistent point of contact.

- Rapid Enrollment: The process is built for speed. Many applicants receive policy documents the same day they apply, a critical benefit for those needing immediate coverage due to a life change or loss of a previous plan.

Pricing and Access

My Policy Quote does not list flat-rate pricing on its website. Instead, costs are personalized based on your location, age, health needs, and chosen plan. To see rates, you must request a free quote by filling out a form or calling them directly at (855) 469-1883. While the site advertises potential savings of "47% Or More," your actual costs will vary.

Pros and Cons

| Pros | Cons |

|---|---|

| Full Market Access: Compare plans from multiple carriers in all 50 states in one place. | No Upfront Pricing: You must contact them for a quote to see personalized rates. |

| Expert Guidance: Licensed agents provide personalized advice and ongoing lifetime support. | Broker Model: Expect follow-up communication as part of their sales and advisory process. |

| Speed and Efficiency: Get quotes in minutes and potentially enroll on the same day. | Variable Plan Types: Offers ACA-compliant plans alongside short-term options that may lack comprehensive coverage. |

| Wide Product Range: Access major medical, short-term, and extensive supplemental insurance. |

Website: https://mypolicyquote.com

2. HealthCare.gov

For millions of Americans, HealthCare.gov is the single most important resource for finding affordable health insurance. It's the official federal marketplace established by the Affordable Care Act (ACA), serving residents of states that don't operate their own exchange. Its primary purpose is to provide a one-stop shop where you can compare and enroll in plans that meet ACA standards and, crucially, access income-based financial assistance.

This platform stands out because it is the only place to qualify for Advance Premium Tax Credits (APTC) and Cost-Sharing Reductions (CSR) in most states. These subsidies are the key to making coverage genuinely cheap for those with low-to-moderate incomes. A single application screens you for all available financial help, including an automatic referral to your state’s Medicaid or CHIP program if your income is low enough.

Practical Tips for Using HealthCare.gov

To get the most out of the platform, have your income documents (like pay stubs or tax returns) and social security numbers for all applicants ready. While the interface can seem complex initially, the "window shopping" feature lets you browse plans and estimate costs without creating an account. If you need help, the site offers a directory to find free, certified assisters in your local area.

Key Feature: HealthCare.gov is the exclusive portal for accessing federal subsidies like Premium Tax Credits, which can dramatically lower your monthly health insurance costs.

Pros & Cons

| Pros | Cons |

|---|---|

| Only place to get subsidies in most states | Does not list off-exchange or short-term plans |

| All plans are ACA-compliant | User interface can be complex for newcomers |

| Screens for Medicaid/CHIP automatically | Strict enrollment periods (Open Enrollment) |

| Free, impartial enrollment help available |

For those looking for where to find cheap health insurance with government assistance, this is the definitive starting point. Discover more about how to navigate the official HealthCare.gov platform to secure the best rates.

Website: https://www.healthcare.gov

3. HealthSherpa

For those seeking a more streamlined alternative to the official marketplace, HealthSherpa offers a simplified, user-friendly interface for enrolling in ACA-compliant health plans. As a government-approved Enhanced Direct Enrollment (EDE) partner, it provides access to the exact same plans, prices, and subsidies as HealthCare.gov but with a faster, more intuitive application process. This makes it an excellent choice for individuals who find the federal platform cumbersome.

HealthSherpa's key advantage is its end-to-end enrollment capability. You can shop, apply, upload documents, and manage your plan entirely on its site without being redirected. It’s designed to simplify the consumer experience with clear status tracking and helpful guides, making it easier to navigate Open Enrollment or Special Enrollment Periods. It also provides an optional connection to certified agents or brokers for personalized support at no extra cost.

Practical Tips for Using HealthSherpa

Before starting, gather the same income and personal information you would for HealthCare.gov. The platform's quoting tool allows you to quickly compare plans and see your estimated subsidy eligibility. Take advantage of their document workflow tools to easily upload proof of income or other required verification, which can speed up your application approval significantly.

Key Feature: HealthSherpa provides a faster, CMS-approved enrollment experience for the same ACA plans and subsidies, allowing you to complete the entire application on one platform.

Pros & Cons

| Pros | Cons |

|---|---|

| Faster, more user-friendly interface | Redirects to state sites for some state-based marketplaces |

| Same plans, prices, and subsidies as the federal marketplace | Account creation is required to complete an application |

| End-to-end enrollment without leaving the site | Does not show off-marketplace plan options |

| Optional access to free agent/broker assistance |

For consumers looking where to find cheap health insurance with a smoother, more supportive application experience, HealthSherpa is a top-tier alternative.

Website: https://www.healthsherpa.com

4. eHealth Insurance

eHealth Insurance operates as one of the largest and oldest private online marketplaces for health insurance. As a licensed broker, it provides a broad selection of plans, including ACA-compliant options available both on and off the federal/state exchanges, alongside other products like dental, vision, and some non-ACA plans. This makes it a useful platform for consumers who want to see a wider spectrum of coverage choices in a single interface.

The platform distinguishes itself by combining the convenience of online shopping with personalized support from licensed agents via phone or chat. This hybrid approach is ideal for individuals who want to do their own research but may also need expert guidance to navigate complex plan details. While it can connect you to subsidized Marketplace plans, it also prominently features private and short-term options, offering more choice but requiring careful consumer review.

Practical Tips for Using eHealth Insurance

Before you begin, gather the same income and household information you would for HealthCare.gov to get accurate subsidy estimates. Use their comparison tools to line up plans side-by-side, but pay close attention to the plan type (e.g., ACA-compliant vs. Short-Term). If you are looking for where to find cheap health insurance with comprehensive benefits, be sure to filter for "ACA" or "Marketplace" plans to ensure they meet federal coverage standards.

Key Feature: eHealth allows users to compare a wide variety of plans, including both ACA-compliant marketplace options and private/alternative plans, all in one place.

Pros & Cons

| Pros | Cons |

|---|---|

| Wide plan inventory from various carriers | May not show every available Marketplace plan |

| Convenient phone and chat support from agents | Also lists short-term plans with fewer protections |

| Compare on-exchange and off-exchange plans | The focus on choice can be overwhelming for some |

| No extra cost to consumers for using services |

For those wanting a broker-assisted experience with a broader view of the market, eHealth provides a robust tool for comparison shopping.

Website: https://www.ehealthinsurance.com

5. Stride Health

For freelancers, gig workers, and self-employed professionals, Stride Health offers a streamlined platform designed to simplify finding affordable health insurance. It functions as an enhanced direct enrollment partner with HealthCare.gov, focusing on the unique needs of the 1099 workforce. The platform translates complex insurance options and tax implications into easy-to-understand language, making it a go-to resource for those navigating coverage outside of traditional employment.

Stride specializes in identifying ACA-compliant plans and calculating potential tax credits based on the often-variable income of its target users. It integrates this process with helpful tools and educational content tailored to self-employment, covering everything from dental and vision add-ons to retirement planning. This focused approach removes much of the guesswork for independent contractors looking for cheap health insurance solutions.

Practical Tips for Using Stride Health

To get the most accurate plan recommendations, gather your estimated net annual income after business expenses. Stride's tools are built to accommodate fluctuating earnings, so providing a realistic projection is key. The platform guides you through screening for subsidies and then helps you compare plans based not just on premiums but on total estimated annual cost, which is crucial for budgeting.

Key Feature: Stride Health offers a user-friendly experience specifically tailored to the income and lifestyle needs of gig workers and freelancers, simplifying ACA enrollment and tax credit estimation.

Pros & Cons

| Pros | Cons |

|---|---|

| Streamlined experience for freelancers | May redirect to state sites to complete enrollment |

| Displays same ACA pricing and subsidies | An account is required to enroll in a plan |

| Free to use for plan comparison/enrollment | Fewer plan options than a direct marketplace search |

| Offers guidance on dental and vision |

For independent workers wondering where to find cheap health insurance, Stride provides a targeted and supportive environment. Its focus on the self-employed makes it an invaluable ally in securing coverage.

Website: https://www.stridehealth.com

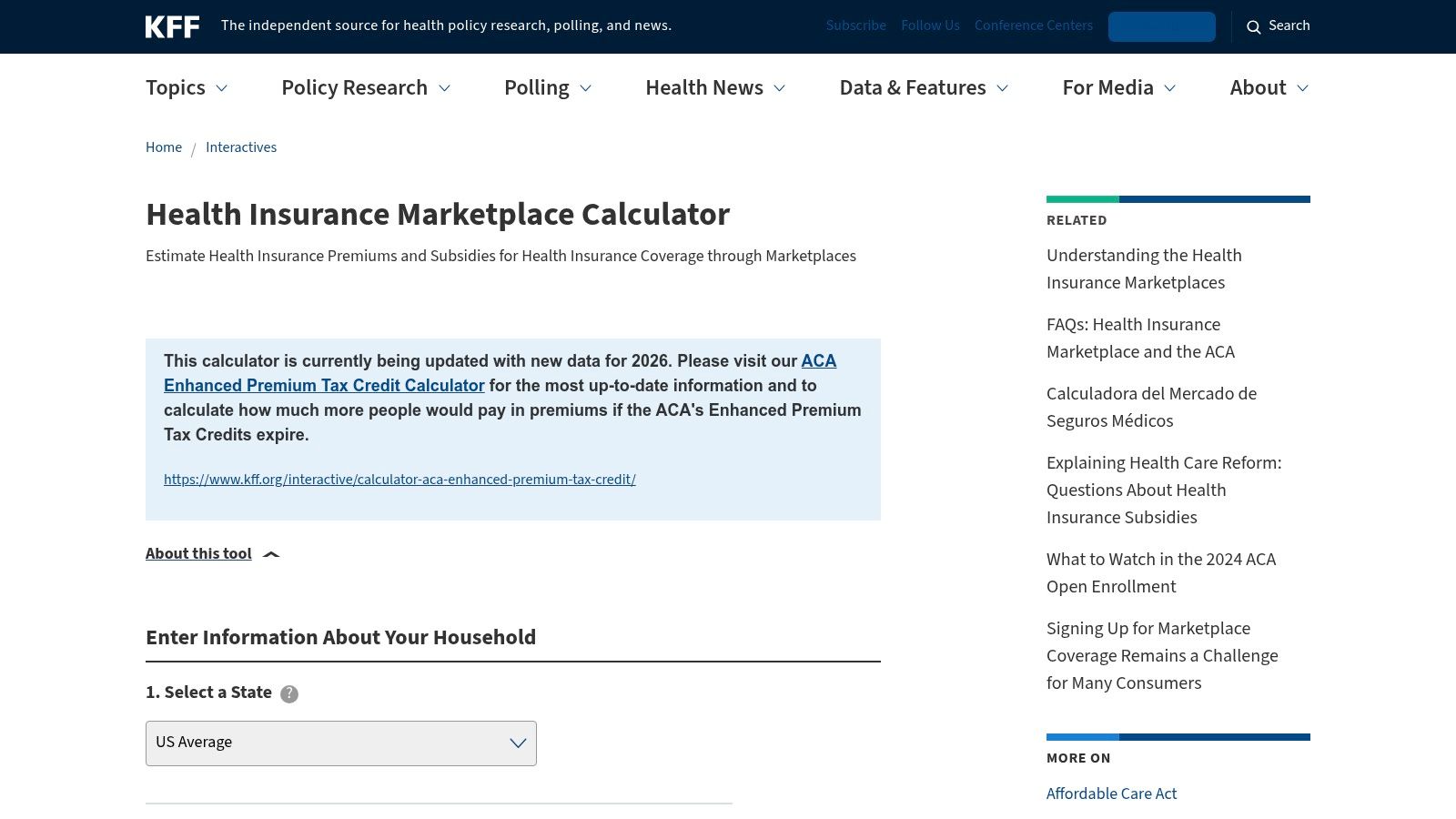

6. KFF Health Insurance Marketplace Calculator

Before you dive into an official application, knowing what you might pay is crucial for budgeting. The KFF Health Insurance Marketplace Calculator is an indispensable, nonprofit tool for estimating your costs. Developed by the highly respected Kaiser Family Foundation, this interactive calculator provides data-driven estimates of your premiums and potential subsidies without requiring you to create an account or submit personal information to an insurance marketplace.

This platform excels at helping you understand the financial impact of different choices. You can input your income, age, and family size to see estimated costs for bronze, silver, and gold plans in your county. It clearly explains how Advance Premium Tax Credits (APTC) and Cost-Sharing Reductions (CSRs) could affect your bottom line, making it a powerful planning resource for self-employed individuals, early retirees, and families trying to anticipate cash flow needs.

Practical Tips for Using the KFF Calculator

To get an accurate estimate, use your projected Modified Adjusted Gross Income (MAGI) for the upcoming year. Experiment with different income levels to see how a pay raise or a change in employment might impact your subsidy eligibility. While the tool is fantastic for research, remember that it provides estimates only; you must apply through an official marketplace like HealthCare.gov for final pricing and enrollment.

Key Feature: The KFF Calculator offers unbiased, data-backed estimates of health insurance costs and subsidies, allowing for realistic financial planning before you officially apply.

Pros & Cons

| Pros | Cons |

|---|---|

| Nonprofit, data-driven estimates | Estimates only, not an enrollment platform |

| Excellent for realistic budgeting and planning | Must apply on an official marketplace for final pricing |

| Helps understand subsidy and CSR eligibility rules | |

| No personal data collection required to use |

For anyone asking where to find cheap health insurance information to budget effectively, the KFF Calculator is an essential first step.

Website: https://www.kff.org/interactive/subsidy-calculator/

7. Medicaid.gov

For individuals and families with low incomes, Medicaid.gov serves as the essential gateway to what is often the most affordable health coverage available. This official federal website doesn't provide insurance directly but acts as a central hub, directing users to their specific state’s Medicaid and Children’s Health Insurance Program (CHIP) agencies. If you meet the income and household criteria, these programs offer comprehensive health benefits at little to no cost, making them a critical resource for millions.

The platform’s main function is to simplify the first step: finding your state’s specific program and application portal. Since eligibility rules and benefits are determined at the state level, this centralized resource is invaluable for navigating a complex system. Unlike private insurance or ACA Marketplace plans, Medicaid and CHIP allow for enrollment at any time of year, providing a crucial safety net for those who experience a sudden loss of income or employment.

Practical Tips for Using Medicaid.gov

The most effective way to use the site is through its state resource finder. Select your state from the map or dropdown menu to be taken directly to the local agency responsible for managing applications. Before applying, gather documentation proving your income, address, and citizenship or lawful presence. Remember that even if you apply through HealthCare.gov, your application will be forwarded to your state’s Medicaid agency if your income falls within the qualifying range.

Key Feature: Medicaid.gov is the authoritative source for connecting with state-specific Medicaid and CHIP programs, which provide free or very low-cost comprehensive health coverage year-round to eligible individuals.

Pros & Cons

| Pros | Cons |

|---|---|

| Cheapest path to coverage if eligible (often $0) | Strict income and asset rules vary by state |

| Enrollment is available any time of year | Covered benefits and processing times differ |

| Provides comprehensive benefits | Navigating state-specific rules can be confusing |

| Covers children through the CHIP program |

This site is the definitive starting point if you're looking for where to find cheap health insurance based on your income. Find out more about the specific requirements by exploring how to qualify for Medicaid.

Website: https://www.medicaid.gov

8. InsureKidsNow.gov

For families focused on securing coverage for their children, InsureKidsNow.gov is a vital federal resource. This official website provides a direct pathway to information and enrollment for two key programs: Medicaid and the Children's Health Insurance Program (CHIP). Its purpose is to help parents find low-cost or free health and dental coverage for children, teens, and sometimes pregnant people, simplifying a process that can vary significantly by state.

The platform's main function is to serve as a central hub, connecting you to your specific state's CHIP or children's Medicaid program. Unlike the ACA Marketplace, which has strict enrollment periods, you can apply for CHIP and Medicaid at any time of the year. This makes it an essential tool for families experiencing a change in income or job status who need immediate coverage for their kids.

Practical Tips for Using InsureKidsNow.gov

To get started, simply use the state lookup tool on the homepage, which will direct you to your local program's website and application process. The site also features a helpful dentist locator specifically for providers who accept Medicaid or CHIP, addressing a common challenge for families. Having information like your household income and family size handy will streamline the application once you are redirected to your state's portal.

Key Feature: InsureKidsNow.gov is a dedicated federal portal that offers year-round enrollment access to free or low-cost health coverage for children through state-specific CHIP and Medicaid programs.

Pros & Cons

| Pros | Cons |

|---|---|

| Best starting point for kids' low-cost coverage | Adult coverage depends on separate eligibility |

| Year-round application availability | Benefits and eligibility rules vary by state |

| Provides multilingual support and help lines | Adults often must use the Marketplace if ineligible |

| Includes a dedicated pediatric dentist locator |

For parents wondering where to find cheap health insurance specifically for their children, this government site is the most direct and reliable place to begin.

Website: https://www.insurekidsnow.gov

9. Covered California

For residents of the Golden State, Covered California is the designated and exclusive online marketplace for finding ACA-compliant health insurance. As California's state-run exchange, it replaces HealthCare.gov and provides a tailored experience with robust plan choices. Its core function is to be the single access point for both federal premium tax credits and additional state-specific subsidies, which can significantly reduce insurance costs for eligible individuals and families.

The platform stands out by integrating its application process with Medi-Cal, the state’s Medicaid program. This means a single application determines your eligibility for all available financial assistance, from subsidized private plans to free or low-cost public coverage. It simplifies the search for where to find cheap health insurance by ensuring you are routed to the most affordable option based on your income and household size. After exploring plans, it can be helpful to understand broader state-specific healthcare services in California to get a full picture of your options.

Practical Tips for Using Covered California

To streamline your application, have proof of income, identification, and residency for all household members handy. The "Shop and Compare" tool is invaluable for previewing plans and estimated costs without creating an account first. If you need personalized guidance, the platform features an extensive network of free, certified enrollers and insurance agents in your community who can walk you through the entire process.

Key Feature: Covered California is the only place for Californians to access both federal and state financial help, often resulting in very low or even zero-dollar monthly premiums.

Pros & Cons

| Pros | Cons |

|---|---|

| Both federal and state subsidies available | Only available to California residents |

| Seamless screening for Medi-Cal eligibility | Requires an account to complete enrollment |

| Strong consumer support and local assistance | Does not list plans sold outside the exchange |

| Wide selection of ACA-compliant plans |

This is the essential starting point for any Californian seeking affordable coverage. Find out more about qualifying life events that may allow you to enroll outside the standard Open Enrollment period.

Website: https://www.coveredca.com

10. NY State of Health (New York State of Health)

For New York residents, NY State of Health is the exclusive, state-run marketplace for finding affordable health insurance. It functions similarly to HealthCare.gov but is tailored specifically to the needs of New Yorkers, offering access to Qualified Health Plans, Medicaid, and Child Health Plus. Its primary role is to provide a centralized platform for comparing plans and accessing state and federal financial aid.

The platform's standout feature is the Essential Plan, a unique New York program providing comprehensive health benefits with a $0 monthly premium and no deductible for low-to-moderate-income adults who qualify. This makes it one of the best places where to find cheap health insurance for those who meet the specific income criteria, offering coverage far more affordable than standard marketplace plans.

Practical Tips for Using NY State of Health

Before starting your application, use the site's cost estimator tool to get a quick idea of your eligibility for various programs and subsidies. The platform offers robust support, including a directory of certified in-person assisters (Navigators) who can guide you through the enrollment process for free. Have proof of income, residency, and social security numbers ready for a smoother application experience.

Key Feature: The Essential Plan offers premium-free, comprehensive health coverage with no deductible to hundreds of thousands of eligible New Yorkers, a benefit not available in most other states.

Pros & Cons

| Pros | Cons |

|---|---|

| The Essential Plan offers $0 premium coverage | Only available to New York residents |

| Single application screens for all state programs | Program rules and offerings can differ from other states |

| Strong network of free, in-person assisters | Open enrollment timelines may vary each year |

| User-friendly interface and support tools |

Explore your options and see if you qualify for special New York programs to lower your health insurance costs.

Website: https://nystateofhealth.ny.gov

11. Get Covered New Jersey

For residents of the Garden State, Get Covered New Jersey is the official health insurance marketplace and a key resource for finding affordable coverage. As a state-based exchange, it replaces HealthCare.gov for New Jerseyans, offering plans that meet ACA standards while also providing access to exclusive state-level financial assistance that can make policies significantly cheaper.

This platform stands out because it offers additional state subsidies, known as New Jersey Health Plan Savings, on top of federal Advance Premium Tax Credits (APTC). This "subsidy stacking" means that many eligible residents can secure lower monthly premiums than they would in states that only use the federal marketplace. The site provides a single application to determine eligibility for all available federal and state financial help, as well as NJ FamilyCare (Medicaid/CHIP).

Practical Tips for Using Get Covered New Jersey

Before you start, use the “Shop and Compare” tool to get a quick estimate of your potential net premium without creating an account. This gives you a clear idea of your costs. When you are ready to apply, have your household income information and social security numbers handy. If the process seems overwhelming, the platform features a directory of certified, local assisters who can provide free, expert guidance throughout your enrollment.

Key Feature: Get Covered New Jersey offers exclusive state-based subsidies that stack with federal tax credits, often making it one of the best places where to find cheap health insurance for eligible residents.

Pros & Cons

| Pros | Cons |

|---|---|

| Extra state subsidies significantly reduce premiums | Only available to New Jersey residents |

| Clear, NJ-specific plan and cost guidance | Account creation is required to complete an application |

| Free, local enrollment assistance is available | Restricted to Open and Special Enrollment Periods |

| One application for all financial aid programs |

Website: https://www.nj.gov/getcoverednj/

12. Pennie

For residents of the Keystone State, Pennie is the official state-based marketplace for finding affordable health insurance. As Pennsylvania's alternative to HealthCare.gov, it provides a centralized platform to compare and enroll in ACA-compliant health plans. Its primary advantage is tailoring the insurance shopping experience specifically to Pennsylvanians, complete with state-funded support networks.

Pennie is the exclusive portal for Pennsylvania residents to access federal subsidies, including Advance Premium Tax Credits (APTC) and Cost-Sharing Reductions (CSR). The platform features a user-friendly savings calculator that shows you the net price of plans after financial assistance is applied. A standout feature is its dedicated outreach and tools designed to help people smoothly transition from Medicaid to a marketplace plan without a gap in coverage, a common challenge for those with fluctuating incomes.

Practical Tips for Using Pennie

Before you start, gather income information and social security numbers for everyone in your household applying for coverage. Use the "Shop and Compare" tool to anonymously browse plans and estimate your potential savings. If you need assistance, Pennie provides a directory of certified, in-state assisters and brokers who offer free, expert guidance to help you choose the best plan for your needs.

Key Feature: Pennie provides targeted support and resources for Pennsylvanians transitioning off Medicaid, simplifying the move to a marketplace plan.

Pros & Cons

| Pros | Cons |

|---|---|

| Exclusive source for subsidies in PA | Only available to Pennsylvania residents |

| Strong, state-specific enrollment support | Plan availability and costs vary by county |

| Consumer-friendly tools for Medicaid transitions | Limited to ACA-compliant plans |

| All plans meet ACA requirements |

For Pennsylvanians wondering where to find cheap health insurance, Pennie is the essential starting point for securing subsidized, comprehensive coverage.

Website: https://pennie.com

Affordable Health Insurance: 12-Resource Comparison

| Provider | Core offering | UX / Quality (★) | Value / Pricing (💰) | Target audience (👥) | Key differentiator (✨) |

|---|---|---|---|---|---|

| 🏆 My Policy Quote | Licensed nationwide broker — fast, tailored health & life quotes; many supplemental options | ★★★★☆ — quick agent response & same‑day docs for some | 💰 Free quotes; claims “Save 47%+”; personalized pricing only via quote | 👥 Self‑employed, 60–64, working families, advisors | ✨ Full 50‑state market access + lifetime support |

| HealthCare.gov | Official ACA federal Marketplace — enroll, compare, screen for Medicaid/CHIP | ★★★★☆ — authoritative but complex UI for some | 💰 Lowest net prices if eligible for subsidies | 👥 Subsidy‑eligible consumers, low/mod income | ✨ Official source for on‑exchange plans & APTC/CSR |

| HealthSherpa | CMS‑approved EDE: end‑to‑end Marketplace enrollment, docs & SEP handling | ★★★★ — smooth, faster quote flows | 💰 Free; same premiums as Marketplace | 👥 General consumers seeking fast Marketplace enrollment | ✨ EDE workflows, status tracking, optional agent help |

| eHealth Insurance | Large online broker: on‑exchange, off‑exchange & select non‑ACA plans | ★★★★ — wide inventory, phone/chat support | 💰 No broker fee; mix of subsidized & private pricing | 👥 Shoppers comparing on/off‑exchange options | ✨ Broad plan mix in one place |

| Stride Health | ACA comparisons focused on freelancers & gig workers; tax credit screening | ★★★★ — streamlined for gig economy | 💰 Free; shows Marketplace pricing where eligible | 👥 Freelancers, 1099 workers, gig drivers | ✨ Gig‑worker guidance and budgeting tools |

| KFF Marketplace Calculator | Interactive premium & subsidy estimator (county level) | ★★★★ — data‑driven, clear estimates | 💰 Free estimator — not enrollment pricing | 👥 Advisors, planners, budget‑conscious shoppers | ✨ County‑level subsidy & benchmark estimates |

| Medicaid.gov | Federal portal to state Medicaid & CHIP applications and info | ★★★★★ — program‑specific guidance; varies by state | 💰 Often $0 premiums if eligible | 👥 Low‑income individuals & families | ✨ Lowest‑cost comprehensive coverage when eligible |

| InsureKidsNow.gov | Federal CHIP/children’s Medicaid info, state lookups & pediatric resources | ★★★★★ — family/pediatric focus | 💰 Often $0 or very low cost for kids | 👥 Families with children, pregnant people | ✨ Pediatric dental/provider locators & multilingual help |

| Covered California | CA state ACA exchange — shop, compare, Medi‑Cal screening | ★★★★ — strong local support & tools | 💰 State + federal subsidies; low net premiums for many | 👥 California residents seeking ACA coverage | ✨ Integrated Medi‑Cal screening & state subsidies |

| NY State of Health | NY official Marketplace; QHPs + Essential Plan & Medicaid/CHPlus screening | ★★★★ — robust assister network | 💰 Essential Plan = $0 for eligible residents | 👥 New York residents, low/mod income adults | ✨ Essential Plan (zero‑premium option) |

| Get Covered New Jersey | NJ state exchange — shop/compare, NJ state subsidies info | ★★★★ — NJ‑specific guidance & assisters | 💰 State + federal subsidies reduce net premiums | 👥 New Jersey residents | ✨ Extra NJ subsidies and clear local guidance |

| Pennie | Pennsylvania ACA Marketplace with savings calculator & assister network | ★★★★ — consumer‑friendly onboarding | 💰 Shows net premium after APTC/CSR | 👥 Pennsylvania residents, those leaving Medicaid | ✨ Tools for Medicaid transitions and local outreach |

Your Next Step to Affordable Coverage

Navigating the landscape of health insurance can feel like an overwhelming journey, but as we've explored, you are far from alone and have a powerful toolkit at your disposal. The search for where to find cheap health insurance is not a hunt for a single, secret solution. Instead, it is a strategic process of matching your unique circumstances-your income, family size, employment status, and state of residence-with the right resource designed to serve you.

From the federal reach of HealthCare.gov and its user-friendly partners like HealthSherpa, to the vital safety nets of Medicaid and CHIP, the primary path to affordability for millions is through government-supported programs. The critical first step is always to check your eligibility for subsidies or free coverage, as this represents the single most significant cost-saving opportunity available. Tools like the KFF Calculator can give you a reliable preview of what to expect, demystifying the financial aspect before you even begin an application.

Matching the Tool to Your Situation

The sheer number of options highlights a crucial takeaway: there is no one-size-fits-all answer. Your ideal starting point depends entirely on who you are.

- For the Self-Employed or 1099 Contractor: Platforms like Stride Health are built specifically for your fluctuating income and business-focused needs, integrating health coverage into your broader financial picture.

- For Early Retirees or those in a "Coverage Gap": The ACA Marketplace is your most powerful ally. It prevents age from being a punitive pricing factor and offers premium tax credits that can make comprehensive plans surprisingly affordable.

- For Working Families or Individuals with Unstable Employer Coverage: State-based marketplaces like Covered California, Pennie, or NY State of Health often provide additional state-level subsidies, making them a more cost-effective choice than the federal platform. Never assume you earn too much; check your eligibility every year.

- For Parents and Advisors: The most important role you can play is one of guidance. Direct your adult child or client to these resources and empower them to run the numbers. Showing them how to use HealthCare.gov or an agent-assisted service like My Policy Quote is more valuable than just giving them advice.

Final Considerations Before You Act

Remember that "cheap" should never mean "inadequate." The lowest premium is not always the best value. Pay close attention to deductibles, out-of-pocket maximums, and provider networks. A plan is only affordable if you can actually use it without risking financial hardship when you need care. This is where the guidance of a licensed agent can be invaluable, as they can translate the complex jargon into a clear comparison of real-world costs.

Ultimately, the power is in your hands. You are now equipped with a map and a compass, showing you the various roads to affordable coverage. The journey from uninsured to insured is a series of small, manageable steps: calculate your estimated subsidy, gather your documents, and explore your options on the platform best suited for you. The peace of mind that comes with knowing you and your family are protected is well worth the effort.

Ready to see real quotes and get personalized, no-cost help from a licensed professional? The experts at My Policy Quote can guide you through the entire process, from checking for subsidies to comparing on- and off-marketplace plans to find the perfect fit. Visit My Policy Quote to get started and simplify your search for affordable health insurance today.