When you're sorting through the alphabet soup of health insurance—HMO, PPO, EPO—it's easy to get lost. Then comes POS. So, what exactly does that mean?

In health insurance, POS stands for Point of Service. It’s a type of plan designed to give you a bit of the best of both worlds, mixing the structure of an HMO with the freedom of a PPO. It’s a middle-ground option for people who want both savings and flexibility.

Unpacking the Meaning of a POS Plan

Think of a POS plan as a hybrid car. It gives you the structured, cost-saving engine of an HMO but also has the flexibility to go a little further, like a PPO.

The core idea is right in the name: your costs and rules are determined at the "point of service"—that is, where you decide to get care. You'll have a main doctor, your Primary Care Physician (PCP), who acts as your home base for healthcare, just like in an HMO. They coordinate your care and refer you to specialists when needed.

But here's the twist. While you get the lowest costs by staying inside your plan's network, a POS plan gives you the option to see doctors outside that network. You’ll pay more for it, but the choice is yours. This dual nature is what makes it unique.

POS Plan at a Glance

So, how does this all come together in practice? The table below breaks down the must-know features of a POS plan. It’s a quick cheat sheet to see how the plan operates day-to-day.

| Feature | How It Works in a POS Plan |

|---|---|

| Primary Care Physician (PCP) | Required. Your PCP is your main doctor and your first point of contact for most medical needs. |

| Referrals | Required for in-network specialists. You must get a referral from your PCP to see other doctors within the network. |

| In-Network Care | Covered. You pay lower out-of-pocket costs like copayments and coinsurance for network providers. |

| Out-of-Network Care | Covered, but costs more. You have the freedom to see specialists outside the network, but you'll face higher deductibles and may need to file your own claims. |

Ultimately, a POS plan tries to balance cost management with personal choice. It gives you a clear path for affordable care through your PCP and network, but leaves a door open if you need or want to go elsewhere.

If terms like "copayment" or "deductible" still feel a bit fuzzy, don't worry. You can find simple, clear explanations in our complete health insurance glossary.

How You Actually Use a POS Plan

Knowing what a POS plan is and knowing how to use it day-to-day are two different things. With a Point of Service plan, everything usually starts with one key person: your Primary Care Physician (PCP).

Think of your PCP as your healthcare quarterback. They’re your go-to for routine checkups, when you get sick, and for just about any general health question. More importantly, they’re the one who coordinates all your care, making sure you see the right specialists when you need to.

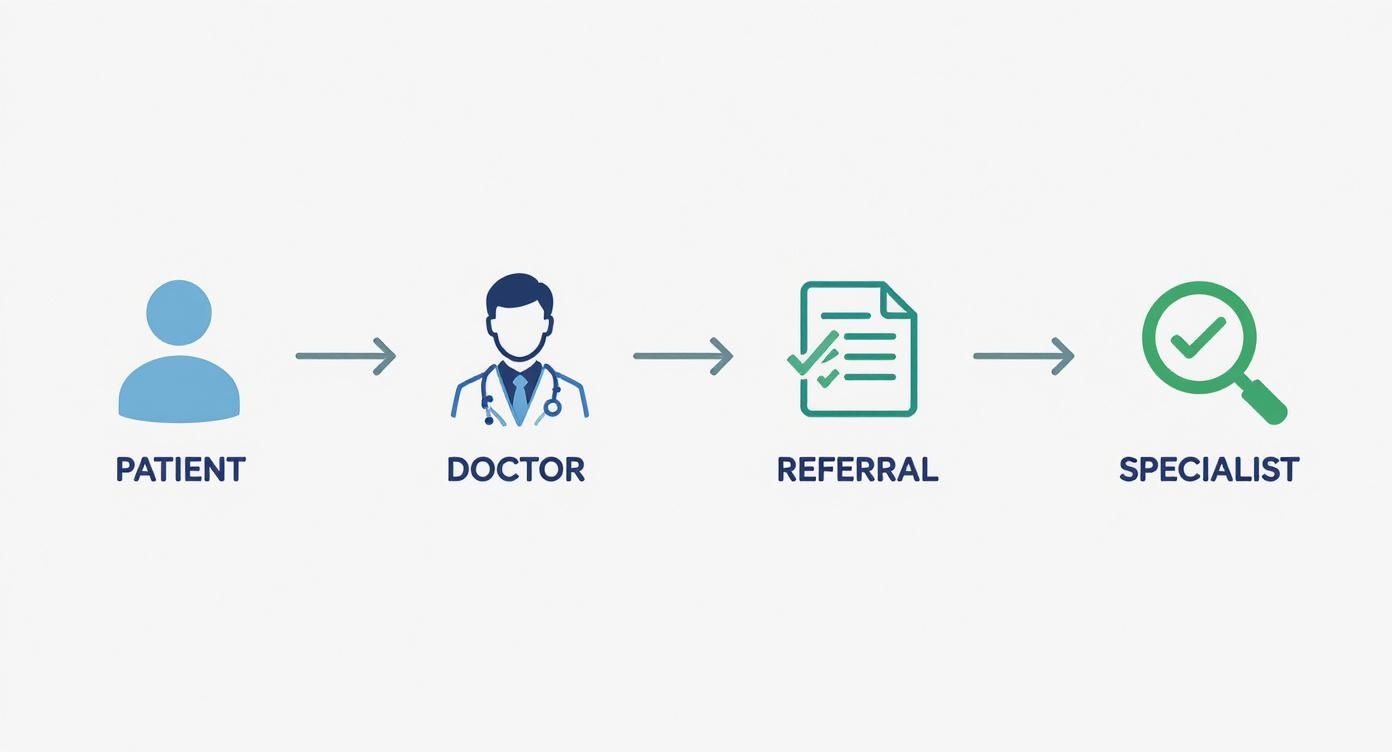

Your PCP and the Referral Game

When you need to see a specialist—like a dermatologist for a rash or a cardiologist for your heart—this is where your plan’s rules really kick in. It all comes down to getting a referral.

-

For In-Network Specialists: To get the best price, you need to visit your PCP first. They’ll check out what’s going on and give you a referral, which is just a formal green light to see a specialist inside your plan’s network. This keeps everything coordinated and ensures the visit is medically necessary.

-

Why It Matters: If you skip the referral and go straight to an in-network specialist, your plan might not cover it at all. It’s a gatekeeper system, and it’s one of the main ways these plans keep costs down.

A referral from your PCP is like having a key. It unlocks the lowest costs for seeing specialists in your network. Forgetting this step can mean paying a lot more, because the visit could be treated as out-of-network.

This system is designed to streamline your care and control costs. But what if you want or need to go outside the lines?

In-Network vs. Out-of-Network: You Choose Your Path

This is where the "Point of Service" flexibility really shows up. You get to decide where you receive care, but each choice has a different price tag.

Scenario 1: Staying In-Network

Let's say you need to see an allergist. You go to your PCP, talk about your symptoms, and get a referral to an allergist who is in your network. Because you followed the rules and stayed in-network, you'll pay a small, predictable copay or coinsurance. Your costs are low, and your PCP is kept in the loop on your treatment. Simple.

Scenario 2: Going Out-of-Network

Now, imagine a top-rated allergist you’ve heard great things about isn't in your plan's network. With a POS plan, you can still make an appointment with them directly—no referral needed. But that freedom comes at a cost.

You'll have a completely separate (and much higher) deductible and coinsurance for out-of-network care. You might also have to pay the doctor's full fee upfront and then submit a claim to your insurance company yourself to get some of it back. It’s a common headache, so it pays to know what to do if your doctor doesn’t accept your health insurance before you make that call.

Using a POS plan is all about balancing cost with choice. Stick with your PCP and get referrals for in-network care, and you’ll save the most money. But having the option to go out-of-network is a great safety net for those times when you need more options.

Comparing POS, HMO, and PPO Plans Side by Side

Trying to pick a health plan can feel a lot like car shopping. They all promise to get you where you need to go, but the ride, the features, and the price tag can be worlds apart. To find the right fit for your health and your wallet, you need to understand the real differences between POS, HMO, and PPO plans.

Let's make this practical. Imagine you've got a nagging shoulder pain that just won't go away, and you're pretty sure you need to see an orthopedic specialist. How would that play out with each type of plan?

-

With an HMO Plan: Your first stop is always your Primary Care Physician (PCP). You can only see that specialist if your PCP gives you a referral, and it must be someone inside the HMO's network. Going outside the network isn't an option, except for a true, life-threatening emergency.

-

With a PPO Plan: Here, you've got freedom. You can find an orthopedic specialist on your own and book an appointment directly—no referral needed. You’ll save money by choosing an in-network doctor, but the plan will still cover a portion of the bill if you decide to see an out-of-network specialist. You'll just pay more out-of-pocket.

-

With a POS Plan: This is your hybrid option. For the lowest costs, you'll act like you're on an HMO: visit your PCP, get a referral, and see an in-network specialist. But what if the best shoulder doctor in the city isn't in your network? With a POS plan, you have the option to see them anyway. You’ll just pay more, similar to how a PPO works.

A Head-to-Head Feature Comparison

To really see the trade-offs, let's put these plans next to each other. Each one is built around a different priority. HMOs are all about keeping costs down. PPOs are built for flexibility. And POS plans? They try to give you a little bit of both.

Here’s a simple table to break it down.

Feature Comparison POS vs HMO vs PPO

| Feature | POS Plan | HMO Plan | PPO Plan |

|---|---|---|---|

| PCP Required | Yes, you must have a PCP. | Yes, a PCP is required. | No, a PCP is not required. |

| Referrals Needed | Yes, for in-network specialists. | Yes, referrals are required. | No, referrals are not needed. |

| Out-of-Network Care | Yes, covered at a higher cost. | No, except for emergencies. | Yes, covered at a higher cost. |

| Paperwork | You may need to file your own claims for out-of-network care. | The plan handles claims for in-network care. | You may need to file claims for out-of-network care. |

As you can see, the biggest differences come down to how much freedom you want versus how much you want to save.

The referral process is central to how a POS plan works for in-network care. It all starts with your family doctor.

This just shows that to keep things simple and affordable with a POS plan, your PCP is your trusted starting point for getting the care you need.

Making the Right Choice for You

At the end of the day, the "best" plan is the one that fits your life. A POS plan can be a fantastic choice if you like the cost savings and coordinated care of an HMO but hate the idea of being completely locked into a network.

It gives you a clear, structured path for everyday healthcare while leaving a door open for those times you might need to see a specific provider outside the network. It’s a safety net for your health choices.

If you're still weighing your options, taking a closer look at what is the difference between HMO and PPO can give you even more clarity. Knowing the details helps you see exactly where the POS plan fits and whether its balanced approach is the right one for you.

Breaking Down the Costs of a POS Health Plan

Knowing the rules of a POS plan is one thing. Understanding what it’s actually going to cost you is something else entirely. Let's be honest, health insurance costs can feel like a maze, but they really boil down to just a few key pieces that determine what you'll pay.

Think of it like a cell phone plan. You have a fixed monthly bill to keep your line active, but then you have other charges based on how much data you use or if you make international calls. Health insurance works in a similar way, with a few predictable parts.

The Core Components of Your Costs

To really get a grip on your budget, you need to know the four main players in the cost game for any POS plan. Each one has a specific job in shaping your total healthcare spending for the year.

- Premium: This is your non-negotiable monthly payment to the insurance company. It keeps your coverage active, whether you see a doctor a dozen times or not at all.

- Deductible: This is the magic number you have to pay out-of-pocket for your care before your insurance starts chipping in. With a POS plan, you’ll have one deductible for in-network care and a much, much higher one for going out-of-network.

- Copayment (Copay): Think of this as a flat fee for a specific service. It might be $30 for a check-up with your primary care doctor. You'll usually see these for in-network visits, and they typically don't count toward your deductible.

- Coinsurance: Once you've paid your full deductible, the cost-sharing begins. Coinsurance is your percentage of the bill. For example, your plan might cover 80%, leaving you to pay the remaining 20%.

Getting the hang of copays and coinsurance is a big deal. To dive deeper, check out our guide on coinsurance vs copay.

How Your Choices Affect Your Wallet

With a POS plan, the decisions you make have a direct impact on your bank account. Staying inside your network is always, without a doubt, the most affordable option.

Let’s see it in action: In-Network vs. Out-of-Network

Say you need a minor procedure that costs $2,000.

- In-Network Path: Your PCP refers you to a specialist in your network. Your plan has a $500 deductible and 20% coinsurance. You pay the first $500 to meet your deductible. Then, you pay 20% of the leftover $1,500, which is $300. Your total out-of-pocket cost is $800.

- Out-of-Network Path: You decide to see a specialist without a referral. Your out-of-network deductible is a hefty $3,000. Because the $2,000 bill doesn't meet that higher deductible, you're on the hook for the entire amount. Your total out-of-pocket cost is $2,000.

This is why sticking to the plan's structure—using your PCP and getting those referrals—is so critical for keeping your costs down. When you're weighing your options, it's also smart to look into the tax deductibility of medical premiums, as it can be another factor in your overall financial picture.

Finally, there's one more term you need to know: the out-of-pocket maximum. This is your ultimate financial safety net. It’s the absolute most you will have to pay for covered, in-network care in a single year. Once you hit that number, your plan pays 100% for the rest of the year. It's what protects you from truly catastrophic medical bills.

The Good and The Bad: Is a POS Plan Right for You?

No health plan is perfect for everyone. It's all about trade-offs. A Point of Service (POS) plan is a classic example of this—it gives you a taste of freedom but asks for a little more effort in return.

Let's be real: its biggest selling point is flexibility. If you love your doctor but they aren't in-network, a POS plan keeps that relationship on the table. But before you jump in, you need to understand both sides of the story.

The Upside: What You’ll Love About a POS Plan

The hybrid model of a POS plan creates a sweet spot for people who want the best of both worlds—structure and freedom.

- You're Not Trapped: This is the big one. Unlike a strict HMO, you can see out-of-network doctors. You're never completely locked into a single list of providers.

- Save Money by Staying In-Network: When you play by the rules—using your primary care physician (PCP) for referrals—your costs are lower and more predictable, just like an HMO. It’s a clear, affordable path for your everyday care.

- A Safety Net When You Need It: Life happens. If you or a family member gets a rare diagnosis and the top specialist in the field is out-of-network, you can still see them. This coverage is an incredible safety net.

This mix of managed costs and provider choice is what makes a POS plan so appealing. It’s a middle-ground option that works for a lot of people.

The Downside: What You Need to Watch Out For

That freedom comes at a price—both in dollars and in administrative legwork. The drawbacks pop up when you decide to step outside the plan's preferred path.

- Out-of-Network Care Hits Your Wallet Hard: Sure, you can go out-of-network, but it's going to cost you. A lot more. You’ll face a completely separate—and much higher—deductible and coinsurance.

- The Hassle of Referrals: Having to get a referral from your PCP for every specialist visit can feel like an extra hoop to jump through. If you forget, your claim could be denied, leaving you with the full bill.

- Get Ready for Paperwork: If you see an out-of-network provider, be prepared to pay the entire cost upfront. Then, it's on you to file the claim and wait for your insurance company to reimburse you. It’s an extra layer of admin you have to manage yourself.

Why do people go out-of-network anyway? One health insurance study found that 38% of POS members did it just to get direct access to a specialist without a referral. Others just couldn't part with a doctor they already knew and trusted.

Ultimately, a POS plan is built for someone who likes having a dedicated PCP to coordinate their healthcare but still wants the option to venture out if they absolutely need to.

Is a POS Health Insurance Plan the Right Choice for You?

Figuring out if a Point of Service (POS) plan is right for you is all about weighing what you value most: flexibility versus structure. It’s a true hybrid, blending features from other plans, and while it isn't a perfect fit for everyone, it hits a sweet spot for a lot of people.

A POS plan really works wonders for someone who likes having a trusted Primary Care Physician (PCP) coordinating their care but still wants the option to see a specialist outside the network. It gives you a clear, affordable path for your day-to-day healthcare needs, plus a critical escape hatch for those "just in case" moments.

Who Is a POS Plan Actually Good For?

Certain lifestyles and health needs just click with what a POS plan brings to the table. You might be the ideal person for one if any of these sound familiar.

- You're a Planner Who Likes a Backup Plan: You’re totally fine with getting referrals from your PCP to keep costs low, but you sleep better at night knowing you can go out-of-network for a highly recommended specialist if you really need to.

- Your Family Has a Mix of Needs: Maybe your kids have a pediatrician you absolutely adore, but they're out-of-network. A POS plan lets you keep seeing them (at a higher cost) while using in-network doctors for everyone else to keep your budget in check.

- You're Cautious and Cost-Conscious: Low in-network costs are your priority, but you're okay with paying more for that one-off situation where you need specialized care from someone outside the approved list.

In the world of employer-sponsored insurance—which covers almost half of all Americans—POS plans have long been that middle-ground option between a restrictive HMO and a pricier PPO. For businesses, offering this kind of balance is a huge plus. One study even found a company slashed employee turnover by 44% just by rolling out better benefits, including flexible plans like a POS. You can learn more about how POS plans benefit both employees and employers.

When Another Plan Might Make More Sense

On the flip side, a POS plan could be more of a headache than it's worth for some folks.

If you travel constantly, a PPO is probably your best friend, giving you nationwide access to doctors without the referral runaround. And if your main goal is the absolute lowest monthly premium and you don't mind sticking to a strict list of doctors, an HMO will likely make you happier.

To get to the bottom of it, just ask yourself a few honest questions:

- How big of a deal is it for me to keep my current doctors, especially if they aren't in-network?

- Am I really okay with getting a referral from my PCP every time I need to see a specialist?

- Do I think I'll need specialized care that might not be available in a smaller network?

Your answers will give you a clear-eyed view of what truly matters, helping you decide with confidence if a POS plan is the right partner for your health journey.

Common Questions About POS Plans

Alright, let's clear up some of the questions that pop up when you're actually using a POS plan. Think of this as the practical, real-world side of things.

Do I Always Need a Referral for In-Network Specialists?

For the most part, yes. That referral from your Primary Care Physician (PCP) is really the cornerstone of how a POS plan keeps things organized and costs down for in-network care.

If you skip that step, you'll likely find that your plan either won't cover the visit at all, or it will treat the specialist as an out-of-network provider. That means you'll be paying a whole lot more out of your own pocket. Keep in mind, some newer POS plans are becoming a bit more flexible on this, so it's always smart to double-check the fine print of your specific policy.

What Happens During a Medical Emergency?

In a true emergency, forget about networks. Just get to the nearest emergency room. Period.

Emergency care is almost always covered as if you were in-network, no matter where you are. This is a crucial protection designed to prevent you from facing insane costs during a crisis.

Your health and safety come first. Insurers cannot penalize you for seeking emergency care at an out-of-network facility when time is critical.

How Does the Claims Process Work for Out-of-Network Care?

This is where you need to be a little more hands-on. When you see an out-of-network doctor, you’ll probably have to pay the full cost of the service right then and there.

Afterward, it's up to you to submit a claim form along with an itemized bill to your insurance company. They'll review it and then send you a check to reimburse you for their share. Just remember, that share is often a smaller percentage than what they'd cover for an in-network visit.

Figuring out health insurance doesn't have to be a headache. The experts at My Policy Quote are here to help you weigh your options and find a plan that actually fits your life and your budget. You can explore your personalized quotes today at https://mypolicyquote.com.