When you hear "HSA" and "HRA," it’s easy to get them mixed up. They sound similar and both help with medical costs, but that's where the similarities end. The real difference comes down to one simple thing: who’s in charge of the money.

An HSA (Health Savings Account) is your money. It's a personal savings account you own and control, and it follows you wherever your career takes you. On the other hand, an HRA (Health Reimbursement Arrangement) is an employer-funded benefit, not an account. Think of it as a promise from your company to pay for certain health expenses—but they own it, not you.

Unpacking HSA and HRA Fundamentals

Getting a handle on the difference between a Health Savings Account (HSA) and a Health Reimbursement Arrangement (HRA) is a game-changer for your healthcare finances. While they both offer tax perks, they operate on completely different principles. These differences directly impact your financial freedom, your ability to save for the long haul, and what happens to your funds if you decide to switch jobs.

It all boils down to ownership. An HSA is like a 401(k) for healthcare—it's an account that belongs to you, giving you total say over how the money is used, saved, or invested. An HRA is a benefit your employer provides, promising to reimburse you for qualified medical costs up to a set limit each year.

Key Distinctions at a Glance

Let’s break down the most important differences in a simple format. This quick comparison shows you exactly how they’re structured and why it matters for your bottom line.

Here’s a snapshot of the fundamental differences between an HSA and an HRA. Pay close attention to who owns the account and what happens if you leave your job—these are the details that matter most.

HSA vs HRA Quick Comparison

| Feature | Health Savings Account (HSA) | Health Reimbursement Arrangement (HRA) |

|---|---|---|

| Account Ownership | You (the employee) own the account. | Your employer owns and controls the arrangement. |

| Funding Source | You, your employer, or anyone else can contribute. | Only your employer can contribute funds. |

| Portability | Fully portable. The account and its balance go with you if you leave your job. | Not portable. You typically forfeit the funds if you leave your job. |

| Investment Potential | Yes, funds can be invested for tax-free growth. | No, funds cannot be invested. |

As you can see, one is an asset you build for life, while the other is a temporary perk tied to your current role.

The crucial takeaway is this: An HSA is a long-term asset you build and control, while an HRA is a short-term benefit provided by your current employer.

This distinction is more important than ever as these plans become more common. The rise of HSAs, which must be paired with High-Deductible Health Plans (HDHPs), has been significant. Over the last decade, access to HSAs for private industry workers jumped from 24% to 39%, and the HDHPs needed to qualify for them grew from 38% to 50%. You can dig into the numbers yourself with this U.S. Bureau of Labor Statistics data.

Comparing Account Ownership and Portability

Getting to the heart of the HSA vs. HRA debate really comes down to one big question: who's in control? While both accounts are designed to help with medical bills, they operate on completely different playing fields when it comes to who owns the money, who puts it in, and what happens if you switch jobs.

These aren't just minor details in the fine print. They define the entire experience and will have a huge impact on your long-term financial health.

Who Controls the Funds?

The biggest split between an HSA and an HRA is ownership. It’s simple, really.

An HSA is yours. Think of it like a personal savings account, but just for healthcare. You own it, you control it, and you decide when and how to spend the money. That account stays with you no matter where you work. It’s your asset, period.

On the flip side, an HRA is owned and controlled by your employer. It's not really a bank account but more of a promise from your company to pay you back for certain medical expenses. Since they own it, they get to make all the rules—what's covered, how much you get, and whether they want to change the terms next year.

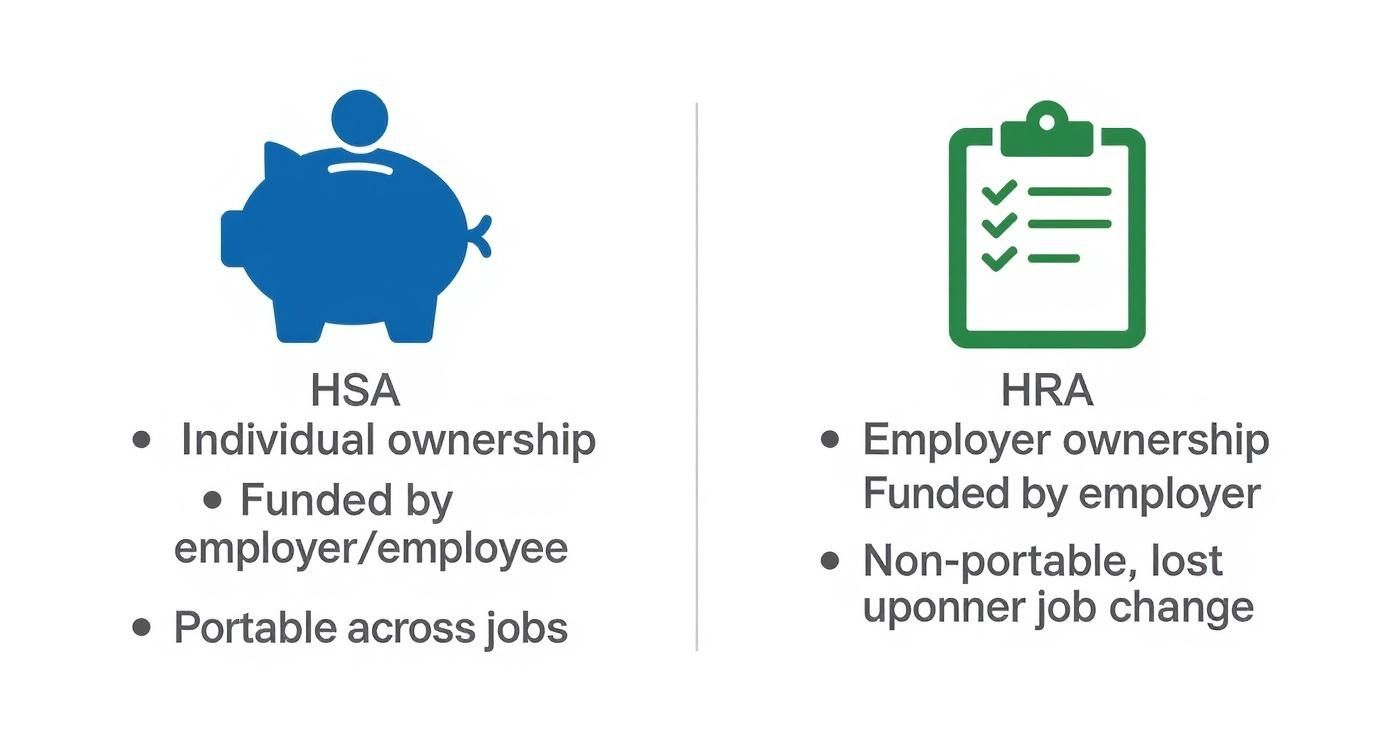

This side-by-side look makes the difference in ownership, funding, and portability crystal clear.

As you can see, an HSA is like your personal health piggy bank, while an HRA is more like a company-run reimbursement program with a clipboard of rules.

The Power of Portability

Ownership directly impacts what happens to your funds when you leave a job, which is a game-changer for anyone thinking about their career long-term.

- HSA Portability: Your HSA is 100% portable. If you change jobs, retire, or go freelance, that account—and every penny in it—comes with you. It’s yours to keep and grow throughout your entire career.

- HRA Portability: HRAs are not portable. The moment you leave your job, you almost always lose access to any leftover funds. The money stays with your old employer, and you’re back to square one.

That lack of portability is a massive downside for the HRA if you’re trying to build savings over time.

An HSA is a permanent financial asset that follows you through every stage of your career. An HRA is a temporary benefit that disappears when you walk out the door.

Understanding Contribution and Rollover Rules

The way money goes in and stays in also sets these two accounts worlds apart.

With an HSA, both you and your employer can contribute up to the annual IRS limit, which gives you the flexibility to max out your savings. Even better, every dollar rolls over, year after year, forever. There’s no "use-it-or-lose-it" catch, which is exactly why it’s such a powerful tool for long-term saving.

HRAs work differently. Only your employer puts money in. And whether those funds roll over at the end of the year is completely up to them. Many companies set up their HRAs with a use-it-or-lose-it rule, which pressures you to spend the money instead of save it. While some employers do allow rollovers, they control that benefit and can take it away, making the HRA a much less reliable way to build up a nest egg for future medical needs.

Contribution Limits And Financial Growth: Where The Real Differences Emerge

Okay, let's get into the money side of things. How cash gets into an HSA versus an HRA—and what it does once it's there—is where you’ll find the biggest gap between these two accounts. It’s not just about covering today’s copays; it’s about planning for your financial health down the road.

The funding rules are night and day. With an HSA, both you and your employer can put money in, up to an annual limit set by the federal government. These limits get adjusted for inflation, and if you're age 55 or older, you can even add a little extra through special "catch-up" contributions.

An HRA is a totally different story. Only your employer can fund it. You can't contribute a single dollar. Your company sets the annual amount, and that figure can be all over the map depending on where you work.

The Investment Engine Of An Hsa

Here’s the game-changer for HSAs: they can double as a long-term investment account. Once your balance hits a certain amount, you can start investing those funds in stocks, bonds, and mutual funds, just like you would with a 401(k).

This feature turns your HSA from a simple healthcare piggy bank into a serious retirement planning tool.

- Tax-Free Growth: Your investment earnings grow completely tax-free. No capital gains, no income tax.

- Tax-Free Withdrawals: As long as you use the money for qualified medical expenses, it comes out tax-free.

- Compounding Power: Over years—or even decades—this tax-free growth can build a massive health savings fund for your retirement years.

HRAs don't have this. The money just sits there. It can't be invested, and it doesn't earn a dime. It’s strictly a reimbursement tool, not a way to build wealth.

The ability to invest funds tax-free is the single most powerful financial advantage an HSA has over an HRA. It transforms the account from a simple spending tool into a strategic retirement asset.

To make these rules crystal clear, here’s a quick breakdown of how contributions work for each account.

Annual Contribution Limits and Rules

| Contribution Aspect | HSA Details | HRA Details |

|---|---|---|

| Who Can Contribute? | Both the employee and the employer can contribute. | Only the employer can contribute. |

| Annual Limit | The IRS sets annual limits. For 2024, it's $4,150 for individuals and $8,300 for families. | No federal limit. The employer decides the annual reimbursement amount. |

| Catch-Up Contributions | Individuals age 55 and older can contribute an additional $1,000 per year. | Not applicable, as there are no employee contributions. |

| Flexibility | Contribution amounts can be changed at any time during the year. | The employer sets the amount, and it is generally fixed for the plan year. |

As you can see, the HSA gives you far more control and a much higher ceiling for building up your savings.

Contribution Trends And Long-Term Impact

People are catching on. More and more employees are realizing just how valuable an HSA can be, and they're putting more money into them. Total HSA contributions have been climbing for years, with the average employee contribution now at $2,802. All that consistent saving is paying off, pushing average HSA balances up to $6,489. It shows people are using these accounts for more than just immediate bills.

This growth potential is a huge piece of your overall financial puzzle. If you're already putting the max into your other retirement accounts, an HSA is a fantastic next step. Many people are looking for smart, tax-advantaged strategies for saving for retirement after maxing out your 401(k), and the HSA fits perfectly. By understanding all your options, including a deeper look at Health Savings Accounts in CA, you can make sure you’re building the strongest financial future possible.

Navigating Eligibility and Health Plan Rules

Before you can pick between an HSA and an HRA, you have to know if you can even get one. The rules for qualifying are completely different, and this is where most people find their answer. One is tied directly to your health plan, while the other is all about what your employer decides to offer.

When it comes to a Health Savings Account (HSA), the IRS calls the shots. The biggest rule is non-negotiable: you must be enrolled in a qualifying High-Deductible Health Plan (HDHP). An HDHP is a specific kind of insurance that pairs a higher deductible with lower monthly premiums. If you don't have an HDHP, an HSA is off the table. Simple as that.

Defining a Qualifying Health Plan

Not just any plan with a high deductible will do. The IRS defines what an HDHP is with specific minimum deductibles and maximum out-of-pocket limits, which change almost every year to keep up with inflation.

There are other hurdles, too. Being enrolled in Medicare or being claimed as a dependent on someone else's tax return will also disqualify you. You can get into the nitty-gritty in our guide on what is a high-deductible health plan.

A Health Reimbursement Arrangement (HRA), on the other hand, is a different world. Eligibility is entirely up to your employer. They set the rules, they decide who qualifies, and they can offer it alongside almost any type of health plan—not just an HDHP. This gives companies a ton of freedom to design a benefit that works for their team.

Common Types of HRAs

Because employers have so much control, several popular HRA models have emerged. You might see:

- Qualified Small Employer HRA (QSEHRA): A great option for small businesses that don't offer a group health plan. It allows them to give employees tax-free money to buy their own insurance and cover medical costs.

- Individual Coverage HRA (ICHRA): For businesses of any size, an ICHRA offers tax-free reimbursements for medical expenses and premiums for employees who buy their own individual health coverage.

Here's the bottom line: HSA eligibility is strict—it’s all about your health plan and IRS rules. HRA eligibility is flexible—it’s a benefit designed and controlled by your employer.

The IRS also sets annual contribution limits for HSAs. For the upcoming year, projections point to $4,300 for individuals and $8,550 for families. Plus, anyone 55 or older gets to add an extra $1,000 as a "catch-up" contribution. You can track the official projections for HSA and HDHP figures to stay current. This is a key difference, as HRA funding amounts are set entirely by the employer.

Choosing Your Plan with Real-World Scenarios

Theory is one thing, but how does an HSA or HRA actually play out in real life? The right choice really comes down to your career, your family, and what you want your money to do for you. Let's walk through a few common situations to see which account makes sense for different people.

Seeing how these plans work for others can help you figure out what you truly need, turning technical features into real-world benefits.

The Young, Healthy Professional

Meet Alex, a 28-year-old software developer who almost never goes to the doctor. For someone like Alex, an HSA paired with a High-Deductible Health Plan (HDHP) isn't just health insurance—it’s a financial powerhouse.

Since Alex's medical costs are low, nearly all of their HSA contributions can be invested in mutual funds. The goal isn't just to cover a random copay; it’s to build a long-term, tax-free investment for retirement. That triple-tax advantage makes it an incredible partner to their 401(k).

The Family with Consistent Medical Needs

Now let’s look at the Miller family. They have two young kids with regular check-ups and a few specialist appointments each year. Their employer offers a generous HRA that covers the first $3,000 of their deductible.

For the Millers, the HRA provides immediate and predictable relief. Because it's funded by their employer, they don't have to stress about putting money aside for known expenses. The HRA acts as a safety net for their consistent out-of-pocket costs, making their healthcare budget way more manageable.

The right account isn't just about saving—it's about managing risk. An HRA is ideal for those who need predictable, upfront coverage, while an HSA excels for those who can prioritize long-term, tax-advantaged growth.

The Small Business Owner or Gig Worker

Next up is Maria, a freelance graphic designer who buys her own insurance on the marketplace. Her situation is a perfect example of where a special kind of HRA shines—the Individual Coverage HRA (ICHRA).

An ICHRA lets a small business reimburse Maria tax-free for her monthly premiums and other medical bills. This gives her the freedom to pick her own plan while still getting a benefit that feels like it came from a big employer. An HSA isn't an option without an HDHP, but the ICHRA offers flexibility that fits her unique work life. To see how these plans work, you can check out our guide comparing an HDHP vs a CDHP.

The Pre-Retiree Maximizing Savings

Finally, there’s David. He's 58 and laser-focused on beefing up his retirement funds. He qualifies for an HSA and can contribute the maximum for his family, plus an extra $1,000 "catch-up" contribution.

For David, the HSA is a critical retirement tool. He funds it aggressively, knowing that every single dollar can be used tax-free for medical expenses down the road—which are expected to be high. This lets him build a dedicated healthcare nest egg, protecting his other retirement accounts for day-to-day living expenses. An HRA wouldn’t work here; it isn’t portable and can’t be invested, so it offers zero long-term value for his goals.

Making the Right Choice and Optimizing Your Account

Choosing between an HSA and an HRA isn't just about picking a health plan. It’s a financial decision that should align with your life—your health, your budget, and where you see yourself in the future.

The right choice really boils down to your immediate needs versus your long-term goals. Do you need help with predictable medical bills right now, or are you looking for a flexible tool to build wealth for the future?

Think about your typical healthcare spending. If you have consistent medical costs and your employer offers a generously funded HRA, it can feel like an immediate win. It covers those bills without you ever contributing a dime. But if you’re generally healthy and can handle a higher deductible, an HSA opens up a powerful, tax-advantaged path to saving and investing.

A Framework for Your Decision

To make a smart choice, you have to get honest about your situation. Asking yourself these questions will point you in the right direction.

-

Evaluate Your Health Needs: Are you managing a chronic condition with regular, predictable expenses? Or are your doctor visits few and far between? An HRA is often a better fit for steady costs, while an HSA is perfect for those who want to save for the unexpected.

-

Analyze Employer Contributions: This one is huge. Compare what your employer is putting on the table. A company contributing $3,000 to an HRA might be far more valuable in the short term than a $500 seed contribution to your HSA.

-

Consider Your Long-Term Goals: Do you just want a simple way to get reimbursed, or are you looking for another retirement savings tool? Only an HSA grows with you as a long-term investment account, making it the clear winner for future planning.

Strategies to Maximize Your Account Value

Once you’ve made your choice, the work isn’t over. You have to actively manage the account to get the most out of it.

If you have an HSA, your goal should be to contribute the maximum allowed each year. Don’t forget the $1,000 catch-up contribution if you're 55 or older. Once your balance is big enough to invest, put those funds into low-cost index funds and let tax-free growth work its magic. And remember to save every single medical receipt. You can pay yourself back tax-free years from now, giving your investments more time to compound.

The most powerful way to use an HSA? Pay for your current medical expenses out-of-pocket if you can. This lets you treat your HSA as a pure investment vehicle, maximizing its tax-free growth for retirement.

If you have an HRA, optimization is all about strategic spending. Know exactly what your plan covers and submit every eligible expense for reimbursement right away. If your plan lets funds roll over, pay close attention to the rules so you don’t lose that money at the end of the year. Getting familiar with all the eligible purchases is key—our guide on what you can use your HSA for can be a great resource, as many expenses overlap with HRAs. By staying on top of it, you’ll get every dollar of benefit your employer offers.

Clearing Up the Confusion: HSA vs HRA FAQs

Digging into the details of an HSA and HRA can bring up some tricky questions. Let's clear the air and get you direct answers to the things people ask most, so you know exactly how these accounts work when it matters.

Can You Have an HSA and an HRA at the Same Time?

This is a classic question, and the answer is… it’s complicated. Generally, you can't contribute to an HSA if your company offers a standard, "general-purpose" HRA. The IRS sees that kind of HRA as disqualifying coverage, so it’s a no-go.

But there are a few important exceptions. You can have both if your employer’s HRA is one of these specific types:

- A limited-purpose HRA: This kind only pays for dental and vision costs. That leaves you totally free to use and contribute to an HSA for everything else.

- A post-deductible HRA: This one only kicks in after you’ve already met your high-deductible health plan's minimum deductible.

What Happens to My HSA Money When I Turn 65?

This is where the HSA really shines. At age 65, your account gets a major upgrade, almost like it transforms into a super-flexible retirement account. You can still pull money out 100% tax-free for any qualified medical expenses—a huge advantage when healthcare costs tend to rise.

But here’s the game-changer: you can also take money out for non-medical reasons without that steep 20% penalty. You’ll just pay regular income tax on those withdrawals, exactly like you would with a 401(k) or traditional IRA.

Think of it this way: at 65, your HSA keeps all its tax-free power for healthcare while also becoming a penalty-free backup fund for anything else life throws your way.

Does HRA Money Roll Over Every Year?

Whether your HRA funds roll over is completely in your employer's hands. Some companies are generous and let you carry over some or all of your unused balance. This can be great for building up a small safety net for future expenses.

On the other hand, many employers stick with a "use-it-or-lose-it" rule. If you don't spend the money by the end of the plan year, it goes straight back to the company. It’s absolutely critical to find out which policy your employer follows so you don't leave money on the table.

Navigating health insurance can feel like a maze, but it doesn’t have to be. At My Policy Quote, we’re here to give you clear, straightforward options to help you find the perfect fit. Explore your health plan options today.