So, you have a Health Savings Account (HSA) and you're wondering what you can actually spend that money on. The short answer? A lot more than you probably think.

Your HSA is a dedicated, tax-free fund for a huge range of qualified medical expenses. This covers everything from routine doctor visits and prescriptions to dental work, new glasses, and even a surprising number of over-the-counter items. Think of it as your personal healthcare wallet, ready for both the expected and the unexpected.

Your Quick Guide to HSA Spending Power

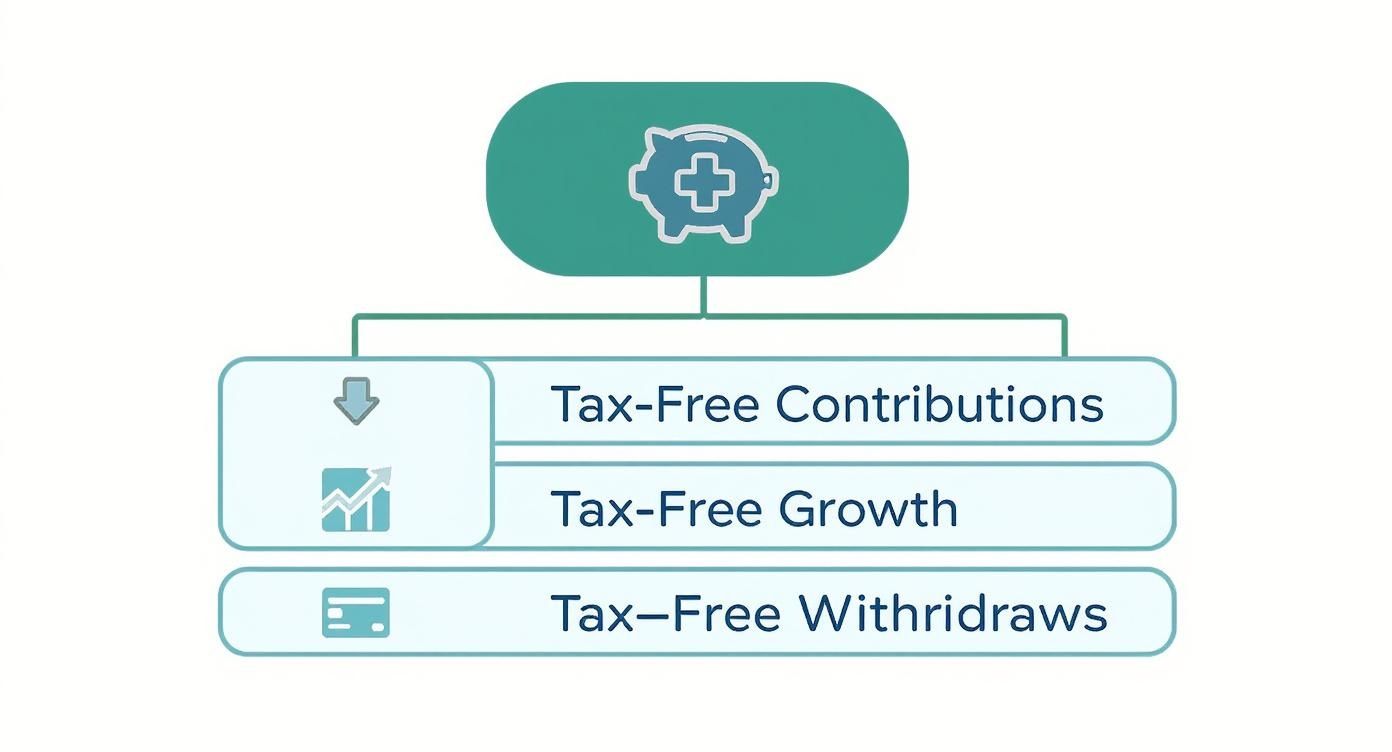

An HSA isn’t just another savings account; it's a financial powerhouse built to make healthcare costs more manageable. The concept is refreshingly simple: you put money in before taxes, it grows tax-free, and you take it out tax-free for qualified medical expenses. This "triple tax advantage" is what makes it one of the smartest ways to pay for your health.

But what really unlocks its potential is knowing what counts as a "qualified" expense. The list is surprisingly long and flexible, reaching far beyond the obvious copays and deductibles.

Expanding the Definition of Care

Thanks to recent updates like the CARES Act, the scope of what your HSA can cover has grown significantly. The list now includes not only traditional costs like coinsurance and emergency room visits but also everyday health items.

You can now use your funds for dental cleanings, vision exams, over-the-counter allergy and cold medications, and even personal protective equipment like masks. It's a game-changer. For a deeper dive, goodrx.com offers a fantastic breakdown of HSA-eligible expenses.

The power of an HSA lies in its flexibility. It empowers you to pay for both predictable costs, like annual eye exams, and unexpected ones, like a sudden dental procedure, all with tax-advantaged dollars.

HSA Eligibility at a Glance

To help you get a quick handle on what you can use your HSA for, the table below breaks down some common expenses. It shows what’s almost always covered, what might need a doctor’s note (called a Letter of Medical Necessity, or LMN), and what’s usually off-limits.

Keep in mind, the rules can have slight variations by state. If you're a California resident, you can learn more about how Health Savings Accounts work in CA in our dedicated guide.

| Expense Category | Typically Eligible | Sometimes Eligible (with LMN) | Generally Ineligible |

|---|---|---|---|

| Medical Services | Doctor visits, surgery, lab fees, physical therapy, hospital services, ambulance | Weight-loss programs, nutritional counseling, health club memberships | Cosmetic surgery, teeth whitening |

| Prescriptions & OTC | Prescription drugs, insulin, over-the-counter pain relievers, cold medicine, bandages | Vitamins and supplements for a specific medical condition | General health vitamins, toiletries (e.g., toothpaste, soap) |

| Dental & Vision | Exams, cleanings, fillings, braces, prescription glasses, contact lenses, LASIK | Orthodontics for cosmetic reasons | Non-prescription sunglasses |

| Wellness & Other | Smoking cessation programs, chiropractic care, acupuncture, menstrual care products | Massage therapy for a diagnosed condition, special dietary foods | General fitness programs, vacations |

Ultimately, knowing these rules helps you make the most of every tax-free dollar in your account.

How Your Health Savings Account Really Works

To get the most out of your HSA, you first need to understand how this powerhouse account actually operates. Think of it as a supercharged 401(k), but for healthcare. And that’s not just a catchy phrase—it’s the best way to describe its famous triple tax advantage.

This three-part benefit is the secret to its financial strength. First, every dollar you put in is tax-deductible, which lowers your taxable income for the year. Second, that money grows completely tax-free. And finally, when you take it out for qualified medical expenses, those withdrawals are also 100% tax-free. It's a win-win-win.

The Key to Unlocking Your HSA

There’s one main rule to open and contribute to an HSA: you have to be enrolled in a High-Deductible Health Plan (HDHP). An HDHP is a specific type of health insurance that usually comes with lower monthly premiums in exchange for a higher deductible than you’d see with traditional plans.

Let's quickly break down those key terms:

- Deductible: This is what you pay out-of-pocket for medical services before your insurance plan starts chipping in. If your deductible is $2,000, for example, you’re responsible for the first $2,000 of your healthcare bills.

- Out-of-Pocket Maximum: This is the absolute most you’ll have to pay for covered services in a single year. Once you hit this number, your insurance plan pays 100% of the costs for the rest of the year.

Getting how your HSA and your HDHP work together is everything. To dive deeper, check out our guide on what is a high-deductible health plan. It’s this partnership that lets you use tax-free money to cover your deductible and other medical costs.

Contribution Limits: The Rules of the Road

Just like any other tax-advantaged account, the IRS sets annual limits on how much you can contribute to your HSA. These numbers change with inflation, and there are different limits for individuals and families. It’s critical to stick to these rules to avoid any tax penalties.

For 2025, the contribution limits are $4,300 for individuals and $8,550 for families. To qualify for that HSA, your HDHP must have a minimum deductible of at least $1,650 for an individual or $3,300 for a family.

The Catch-Up Contribution: There’s a special rule for those aged 55 or older. You can contribute an extra $1,000 per year. This "catch-up" helps people nearing retirement give their healthcare savings a final boost.

These rules keep the system fair while still offering a powerful way to save. For those looking to really maximize their financial strategy, understanding the best tax strategies for high-income earners can show you how an HSA fits into a bigger wealth-building picture.

The real beauty of an HSA is that it’s not just for today's medical bills. Once you grasp these core ideas—the triple tax advantage, the HDHP requirement, and the contribution rules—you can turn it from a simple spending account into a cornerstone of your long-term financial health. You’re in the driver’s seat, building a tax-free nest egg for whatever health needs come your way, now and in the future.

A Detailed Breakdown of HSA Eligible Expenses

Now that you know the basic rules of an HSA, let’s get to the good part—exploring all the ways you can actually use it.

Think of your HSA debit card as your key to unlocking tax-free savings on a massive list of healthcare products and services. Most people are surprised to learn just how broad the list of eligible expenses really is. It covers everything from major surgeries to the stuff you grab at the drugstore every other week.

This power comes straight from the IRS, which defines "qualified medical expenses" as costs for diagnosing, treating, or preventing disease. That definition is a wide-open door, letting you use your pre-tax dollars for way more than you’d expect.

Core Medical Services and Treatments

This is the category most people think of first, and for good reason. It covers the essential medical care you and your family rely on to stay healthy. Using your HSA funds for these common costs helps you knock out your deductible and manage those out-of-pocket bills without feeling the full financial hit.

These services include:

- Doctor and Specialist Visits: Copays for your primary care physician, dermatologist, cardiologist—you name it.

- Hospital Services: Costs for inpatient care, surgeries, lab tests, and X-rays.

- Emergency Care: Ambulance rides and emergency room visits.

- Therapeutic Care: Physical therapy, chiropractic adjustments, and even acupuncture.

- Mental Health Services: Costs for therapy, counseling, and psychiatric care.

This diagram shows how an HSA gives you that powerful triple tax advantage, turning your necessary healthcare spending into a smart financial move.

It’s this structure that makes an HSA more than just a simple spending account. It’s a real long-term savings and investment tool for your health.

Comprehensive Dental and Vision Care

It’s a common mistake to think HSAs are only for traditional medical bills. The truth is, they’re just as powerful for keeping your teeth and eyes in great shape. These expenses add up fast, and using your HSA can mean saving a ton of money.

For dental care, almost all preventative and restorative procedures are covered. That means you can use your HSA for:

- Routine cleanings and exams

- Fillings, crowns, and root canals

- Braces and other orthodontia (for kids and adults)

- Dentures and bridges

Vision care works the same way. Go ahead and use your tax-free funds to pay for eye exams, prescription eyeglasses, contact lenses, cleaning solution, and even corrective surgeries like LASIK.

The Ever-Growing List of Over-the-Counter Products

Here’s where the everyday savings really kick in. Thanks to the CARES Act, you no longer need a prescription to buy hundreds of over-the-counter (OTC) items with your HSA. This simple change has turned the HSA into a tool you can use on your regular trips to the pharmacy or grocery store.

The ability to purchase common OTC items tax-free is a game-changer for family budgets. Every dollar spent from an HSA on these necessities is a dollar you save on taxes, which can add up to hundreds in savings annually.

The list of eligible products is huge and covers things you probably already buy.

Common HSA-Eligible OTC Categories:

- Pain Relief: Ibuprofen, acetaminophen, aspirin, and topical pain relief creams.

- Cold and Flu: Decongestants, cough drops, and sinus rinses.

- Allergy and Sinus: Antihistamines, nasal sprays, and eye drops.

- Digestive Health: Antacids, laxatives, and anti-diarrhea medications.

- First Aid: Bandages, antiseptic wipes, and medical tape.

- Feminine Hygiene: Tampons, pads, and menstrual cups.

- Skin Care: Acne treatments, sunscreen (SPF 15+), and hydrocortisone cream.

Understanding how to get the most out of these accounts is key. For a deep dive, our guide explaining the differences between an HRA and an HSA can help you figure out which account is the best fit for you.

Using your HSA for these smaller, frequent purchases is a simple but powerful strategy. By keeping track of these expenses, you're maximizing your tax savings every week, not just when a big medical bill arrives. This kind of strategic spending turns your HSA from a simple safety net into an active financial tool you can use all year long.

Surprising And Often Overlooked HSA Uses

Once you get the hang of using your HSA for the basics—like doctor visits and prescriptions—a whole new world of savings opens up. So many people leave money on the table simply because they don’t realize just how much their HSA can actually cover.

Think of your HSA less like a "sick day" fund and more like a personal wellness account. It’s designed to support your total health, from alternative therapies to long-term planning, and a surprising number of those expenses are eligible. Knowing about these hidden gems can completely change how you manage both your health and your budget.

Beyond the Doctor's Office

Most people are shocked to learn how many wellness and preventive care costs an HSA can cover. We're not just talking about traditional medical treatments.

Here are a few examples that catch people by surprise:

- Quitting Smoking: Any program designed to help you stop smoking is fair game. This includes things like nicotine gum and patches.

- Travel Costs: That’s right—the mileage you drive to a doctor's appointment, physical therapy session, or even the pharmacy is an eligible expense. So are bus fares and parking fees.

- Alternative Therapies: Treatments like acupuncture and chiropractic care are often eligible, giving you a tax-free way to manage pain and improve your well-being.

- Long-Term Care Insurance: You can use your HSA funds to pay the premiums on a qualified long-term care policy, helping you prepare for whatever lies ahead.

This kind of flexibility makes your HSA an even more powerful tool. For anyone who is self-employed, maximizing every tax advantage is a must. Understanding how to save for retirement when you're self-employed gives you the bigger picture of where a well-managed HSA fits into your financial life.

The Power of a Letter of Medical Necessity

Here's one of the best-kept secrets for getting the most out of your HSA: the Letter of Medical Necessity (LMN). It's a simple note from your doctor confirming that a specific product or service is needed to treat, diagnose, or prevent a medical condition.

An LMN is the key that can unlock eligibility for something that otherwise wouldn't qualify. It officially bridges the gap between a general wellness purchase and a medically necessary one.

A Letter of Medical Necessity transforms your HSA, letting it cover a personalized range of health needs. It's what allows you to use tax-free money for a gym membership to treat obesity or for special foods to manage celiac disease.

Think about what becomes possible with an LMN:

- Gym Memberships: If your doctor prescribes exercise to treat a condition like hypertension or diabetes, those membership fees can become an eligible expense.

- Specialized Mattresses: An orthopedic mattress that your doctor recommends to help with chronic back pain? That could be covered.

- Air Purifiers: For someone with severe asthma or allergies, a doctor-prescribed air purifier is a qualified expense.

Turning Everyday Items into Medical Expenses

The trick is to remember that the IRS cares more about the why behind your purchase than the what. A hot tub is usually a luxury item. But with an LMN from your doctor prescribing hydrotherapy for arthritis, it becomes a medical expense.

This same idea applies to all sorts of things. For example, kinesiology tape (like KT Tape) is a qualified medical expense right off the shelf because it’s used for pain relief. Many people buy it out-of-pocket, never realizing they could have used their pre-tax HSA dollars.

It also works for bigger-ticket items, like lead-based paint removal to protect a child from poisoning or home modifications like installing grab bars for someone with mobility issues. When you start thinking strategically and partner with your doctor, your HSA becomes a powerful financial ally on your health journey.

Mastering HSA Payments and Recordkeeping

Knowing which costs qualify is one thing. Actually paying for them—and keeping everything organized—is how you get real value from your HSA.

Think of your HSA like a toolbox. You have a couple of options to handle expenses:

- HSA Debit Card: Swipe at the pharmacy or doctor’s office and the money comes straight out of your account. It’s fast and you avoid the hassle of tracking reimbursements.

- Out-of-Pocket Reimbursement: Use your personal credit or debit card now, then withdraw from your HSA later. Handy if you’re chasing rewards or your HSA card isn’t at hand.

The Power Of Delayed Reimbursement

Here’s a trick many people miss: you don’t have to reimburse yourself immediately. Unlike an FSA, your HSA has no deadline for reimbursement. That means your funds can stay invested, growing quietly in the background.

Say you cover a $500 dental cleaning today with your credit card. Instead of dipping into your HSA right away, let that $500 sit and compound. Years from now—decades even—you can pull out the same amount tax-free. Meanwhile, your investment has had time to flourish.

Treat those past medical bills like an interest-free loan to yourself. You get the benefit of tax-free growth while preserving your spending power.

Why Meticulous Recordkeeping Is Non-Negotiable

Whether you pay with your HSA card or go the reimbursement route, a paper trail is your best friend. If the IRS ever knocks, you’ll need to prove every withdrawal was for a valid health expense.

Make sure each claim shows:

- What You Purchased: The exact product or service (e.g., prescription, exam, lab test).

- When You Purchased It: The date on the receipt.

- How Much It Cost: The precise dollar amount.

Without that trio of details, you risk disallowed withdrawals and unexpected taxes or penalties.

Simple Tips For Flawless Records

You don’t need a fancy system—just consistency. Think of your receipts as breadcrumbs that lead back to your tax return.

- Set Up a Dedicated Folder on a cloud service like Google Drive or Dropbox named “HSA Receipts [Year].”

- Snap a Photo Immediately after each visit using your smartphone.

- Use Descriptive File Names such as “2024-10-26-CVS-ColdMeds-$15.79.jpg” before saving it to your folder.

A few seconds now will save hours of stress later.

HSAs have never been more popular: there were roughly 37 million accounts active at the end of 2023. To dive deeper into this trend, check out the growth of Health Savings Accounts.

Your Top HSA Questions, Answered

Once you get the hang of your Health Savings Account, the real questions start popping up. The day-to-day, "what-if" scenarios are where you truly learn how to make this account work for you. Let's tackle the most common questions we hear so you can use your HSA with total confidence.

Can I Use My HSA for My Family?

Yes, absolutely. This is one of the most powerful, family-friendly perks of an HSA. You can use your funds to pay for qualified medical expenses for yourself, your spouse, and any dependents you claim on your tax return.

It's a huge advantage, letting you manage your entire family's healthcare costs from one single, tax-advantaged account.

Here's the key thing to remember: your dependents don't even have to be covered by your high-deductible health plan (HDHP). Let's say your child is on another plan but is still your tax dependent. You can still use your HSA to pay for their braces, glasses, or doctor visits.

Just be aware that the IRS has specific rules for who counts as a "dependent." It’s not just about who lives with you. A domestic partner, for instance, wouldn't be covered unless they meet the official IRS criteria to be claimed on your taxes.

What Happens if I Change Jobs or Health Plans?

One of the best features of an HSA is its portability. This isn't like a Flexible Spending Account (FSA), where you often have to "use it or lose it." The money in your HSA is yours. Forever. It’s not tied to your employer or your health plan.

If you switch jobs, your HSA and every dollar in it goes with you. You can keep spending that money on qualified medical expenses without a single hiccup. The only thing that changes is your ability to put new money in.

To contribute to an HSA, you have to be enrolled in a qualified HDHP. So, if your new job offers a traditional PPO, you can’t add more funds. But you can—and should—keep using your existing balance and let it grow tax-free as an investment. It’s a valuable asset for your future, no matter where you work.

Are There Penalties for Using HSA Money on the Wrong Things?

Using your HSA for anything other than a qualified medical expense comes with a steep penalty, so it’s something you really want to avoid. If you're under 65, any withdrawal for a non-qualified expense gets hit twice: you'll pay your regular income tax on the amount, plus a 20% penalty.

Let's see how that plays out. Say you take out $1,000 for a home repair and you're in the 22% federal tax bracket. You'd owe $220 in income tax and another $200 as a penalty (20% of $1,000). That’s $420 gone, just like that. A very costly mistake.

But everything changes when you turn 65. The 20% penalty disappears. At that point, you can take money out for any reason at all—a vacation, a new car, anything—and you'll just pay regular income tax on it, kind of like a traditional 401(k). And, of course, withdrawals for qualified medical expenses are still 100% tax-free, for life.

Can I Invest My HSA Funds?

You bet. This is the secret that turns your HSA from a simple health savings account into a powerful retirement tool. Most HSA providers let you invest your funds once you have a minimum cash balance, which is often around $1,000.

Any amount over that threshold can be put into mutual funds, stocks, and other investments, just like in a 401(k).

Here's where the magic happens: any growth your investments earn is completely tax-free. Then, when you withdraw that money for a qualified medical expense down the road, the withdrawal is also tax-free. It’s an incredible triple-tax advantage that allows for serious compound growth.

By investing your HSA, you’re creating a dedicated, tax-free nest egg for health costs. Over the years, this can grow into a critical financial cushion for your medical needs in retirement.

At My Policy Quote, we believe that understanding the details of your health plan is the first step toward financial well-being. Whether you're a freelancer, a small business owner, or planning for retirement, we have the expertise to help you find the right coverage. Explore your options with us at https://mypolicyquote.com.