When you’re trying to figure out health insurance, two terms pop up constantly: copay and coinsurance. They might sound similar, but they work in completely different ways, and knowing the difference is key to managing your healthcare costs.

The simplest way to think about it is this: a copay is a fixed dollar amount you pay for a service, like $30 for a routine doctor's visit. On the other hand, coinsurance is a percentage of the final bill you're responsible for, but only after you’ve met your annual deductible.

Your choice between a plan emphasizing one over the other really comes down to what you value more: predictable, fixed costs for every visit or paying lower monthly premiums in exchange for more variable expenses when you do need care.

Understanding the Core Difference in Your Costs

Think of your health insurance plan as a rulebook for how you and your insurer split medical bills. Copayments (copays) and coinsurance are the two main rules that define your share of the cost. Though they both represent your out-of-pocket expenses, they kick in at different times and are calculated in fundamentally different ways.

A copay is like a flat-rate entry fee for a specific service. It’s a predictable, upfront cost you pay each time you see a doctor or fill a prescription. This amount is always the same, regardless of what the service actually costs the insurance company, which gives you a strong sense of financial predictability for routine care.

Coinsurance, however, is all about sharing the cost after you've paid your full annual deductible. It's calculated as a percentage. For instance, on an 80/20 plan, your insurer covers 80% of the approved medical bill, leaving you to pay the remaining 20%. This applies to bigger-ticket items like surgeries or hospital stays.

The Key Takeaway: Copays offer predictability for everyday services. Coinsurance is about sharing a percentage of major costs once your deductible is paid off. Getting this straight is the first and most important step to avoiding those dreaded surprise medical bills.

Copay vs Coinsurance At a Glance

To make it even clearer, let’s break down the essential differences side-by-side. This table gives you a quick snapshot of how each one works.

| Attribute | Copay (Copayment) | Coinsurance |

|---|---|---|

| Payment Structure | A fixed, predetermined dollar amount (e.g., $30). | A percentage of the total medical bill (e.g., 20%). |

| When It Applies | Typically paid at the time of service for specific care. | Applies after you have fully met your annual deductible. |

| Cost Predictability | Highly predictable; you always know the cost upfront. | Variable; the amount you owe depends on the service's total cost. |

| Common Uses | Routine doctor visits, specialist appointments, prescriptions. | Hospital stays, surgeries, expensive diagnostic tests. |

Ultimately, understanding this distinction helps you see how a plan is built. A plan heavy on copays is designed for predictable, routine use, while a plan with lower premiums and higher coinsurance is often better for those who don't expect frequent medical needs but want protection against major events.

How Copayments Create Predictable Healthcare Costs

When you're trying to manage your money, predictability is everything. In the often-confusing world of healthcare expenses, copayments (or copays) are designed to give you exactly that. They're simple, fixed fees you pay for specific medical services, so you know the cost upfront—before you even walk into the doctor's office.

Think of a copay as a straightforward entry fee for a service. It doesn't matter if the total bill for your visit ends up being $150 or $350; your copay stays the same. This takes the guesswork out of routine medical care, making it much easier to budget for your health throughout the year.

The Role of Copays in Your Healthcare Plan

You'll usually find copays attached to common and routine services. This design is intentional—it helps keep costs stable for the kind of care most people need on a regular basis.

Here are the typical services where you'll see a copay:

- Primary Care Visits: A standard check-up with your family doctor.

- Specialist Appointments: Seeing a cardiologist, dermatologist, or another specialized physician.

- Urgent Care Visits: For those minor emergencies that don't quite require a trip to the hospital.

- Prescription Drugs: These are often tiered, meaning you’ll have different copay amounts for generic versus brand-name medications.

A 2020 analysis of employer plans revealed that for outpatient office visits, 56% of people had copayments. The average cost was $26 for primary care and $41 for specialists. These numbers show just how common this fixed-fee model is for everyday healthcare.

The real beauty of a copay-focused plan is its financial clarity. You know exactly what you’re on the hook for with a visit or a prescription, which helps you sidestep those dreaded surprise bills for common healthcare needs.

This stability is a huge deal when you're trying to find the right coverage. If you expect regular doctor's appointments or prescriptions, understanding these fixed costs is critical. Our guide on how to choose health insurance can walk you through how to evaluate plans based on this key feature.

Ultimately, a plan with a clear copay structure is built for easy financial planning. For individuals and families who value predictable expenses more than a lower monthly premium, this model offers some much-needed peace of mind. Knowing your cost for a specialist visit is always $50, for example, makes healthcare budgeting a whole lot less stressful than dealing with a percentage of some unknown total.

How Coinsurance Impacts Your Financial Risk

Copays give you a sense of control with their predictable, fixed costs. Coinsurance, on the other hand, plays by a completely different set of rules. It’s the percentage of your medical bills you owe after you’ve met your annual deductible.

Because it’s a percentage, the actual dollar amount you pay isn't set in stone. It’s tied directly to how much your medical care costs, which can feel like a huge financial gamble.

Think about it this way: a $50 copay for a specialist visit is always $50. But with a 20% coinsurance, your bill is a moving target. For a small $500 procedure, you'd owe $100. But for a major surgery that costs $50,000, that same 20% suddenly means you’re on the hook for a massive $10,000 bill.

This is the central trade-off you make with plans that rely on coinsurance. They often tempt you with lower monthly premiums, but they expose you to much higher and less predictable costs if a serious health issue pops up.

The Role of Your Deductible and Out-of-Pocket Max

Coinsurance doesn’t exist on its own. It’s part of a team, working alongside two other critical numbers in your plan: your deductible and your out-of-pocket maximum.

You don't start paying coinsurance until after your deductible is fully paid for the year. This cost-sharing continues until you finally hit your out-of-pocket maximum—the absolute most you are required to pay for covered care in a policy year. This number is your ultimate financial safety net.

Crucial Insight: In a plan with coinsurance, your out-of-pocket maximum is the single most important number to know. It’s the ceiling on your financial risk, preventing a medical crisis from turning into a personal financial catastrophe.

Research has shown that when patients have to pay a direct percentage of the cost, it changes how they use healthcare. One analysis found that introducing a 25% coinsurance rate led to an average drop of 1.37 healthcare visits per person. It’s a powerful reminder that when you share the cost, you think twice, especially about more expensive services.

When Coinsurance Makes Sense

A plan with a higher coinsurance could be a smart move if you're generally healthy and don't expect to need frequent or major medical care. The lower monthly premium saves you money all year, as long as you have enough in savings to cover your deductible and potential coinsurance if something unexpected happens.

It's always a good idea to assess if you might be overpaying on insurance for coverage you rarely use.

However, if you have a chronic condition or know you’ll need expensive treatments, the unpredictable nature of coinsurance could leave you with overwhelming bills. In that case, a plan with fixed, predictable copays might offer more peace of mind, even if the monthly premium is higher.

Comparing Costs in Real-World Medical Scenarios

Definitions are one thing, but seeing how coinsurance vs copay actually affects your wallet is another. Let's walk through a few real-world examples to see how your out-of-pocket costs might look under two very different types of plans.

To keep it simple, we'll imagine two common health plans:

- Plan A (Copay-Focused): This plan comes with a higher monthly premium but gives you the predictability of fixed copays for most services.

- Plan B (Coinsurance-Focused): You'll enjoy lower monthly premiums here, but you're on the hook for a percentage of your medical bills after hitting your deductible.

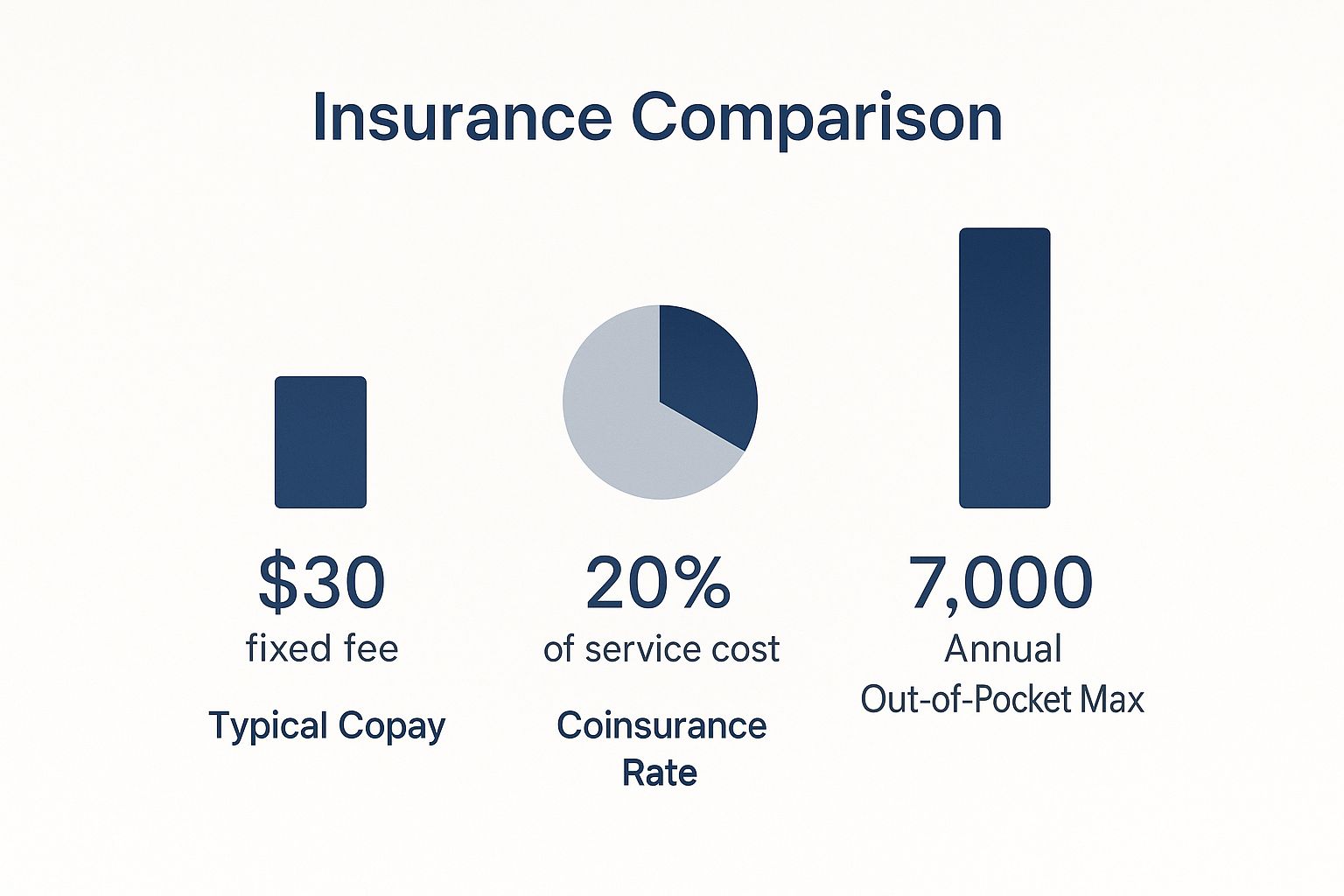

This infographic breaks down the core pieces we’ll be talking about—the copay, the coinsurance, and that all-important out-of-pocket maximum that acts as your financial safety net.

To make sense of how these plans work in practice, we've created a table comparing patient costs for a few common medical events. It highlights just how differently your finances can be impacted depending on your coverage.

Patient Cost Breakdown by Medical Service

| Medical Scenario | Plan A (Copay-Based) | Plan B (Coinsurance-Based) | Key Financial Takeaway |

|---|---|---|---|

| Routine Specialist Visit ($300 Bill) | $50 copay. You pay a small, fixed fee. The plan covers the rest. | $300. You pay the full amount until your deductible is met. | Copay plans make routine and predictable care much more affordable. |

| Brand-Name Rx ($600 Bill) | $75 copay. Your cost is set by the drug tier, not the retail price. | $600. You owe the full cost until the deductible is met. Afterward, you'd pay coinsurance (e.g., 20% or $120). | For expensive but necessary medications, a copay plan offers a significant financial buffer. |

| Hospital Stay ($25,000 Bill) | $1,000 copay. You pay a one-time fee for the admission, regardless of the total bill. | $9,000. You first pay your $5,000 deductible, then 20% of the remaining $20,000 ($4,000). | Coinsurance plans can leave you with a much higher bill for major, unexpected medical events. |

As you can see, the "better" plan completely depends on the situation. For everyday care, the copay plan's predictability is a clear winner. But for a major hospitalization, the math gets far more complex, and the lower premiums of a coinsurance plan can quickly be offset by a huge bill.

The Financial Shift: For low-cost, frequent care, copay plans are often superior. For high-cost, infrequent events, the math becomes far more dependent on your deductible and coinsurance.

Let's break down that hospital stay scenario again, because it's where the real trade-offs become crystal clear.

Imagine you're hospitalized for three days, and the final bill is $25,000. We'll assume Plan B has a $5,000 deductible and 20% coinsurance.

- With Plan A (Copay-Focused), you might have a per-admission copay. In this case, you’d pay a $1,000 copay for the entire hospital stay. That’s it.

- With Plan B (Coinsurance-Focused), your bill is calculated in stages. First, you have to pay your $5,000 deductible out of pocket. After that, you're responsible for 20% of the remaining $20,000, which adds another $4,000. Your total cost? A staggering $9,000.

This is the moment of truth for most people. The copay plan, despite its higher monthly cost, puts a hard limit on your financial exposure during a crisis. The coinsurance plan, while cheaper day-to-day, can leave you with a much, much larger bill when you need your insurance the most.

Why Do Insurance Plans Even Have Different Cost-Sharing Models?

Have you ever stared at your health plan summary and wondered what was going through the designers' minds? The choice between a copay and coinsurance isn't just a flip of a coin—it’s a carefully crafted strategy to manage costs and guide how you use your healthcare.

Each model has a specific job, and understanding it can change how you see your plan.

Copays for the Predictable Stuff

Insurers use copays for routine, predictable services. Think of your annual check-up or a generic prescription you refill every month.

This fixed fee makes your out-of-pocket costs crystal clear. You know what you'll owe before you even walk in the door, which encourages you to get the preventive care you need without worrying about a surprise bill. It keeps things simple for everyone.

Coinsurance for the Big, Unexpected Events

On the other hand, coinsurance comes into play for the less frequent but much more expensive events—like major surgery or a long hospital stay.

Since the total bill for these things can swing wildly, a percentage-based model lets the insurer share that massive financial risk with you. It’s a way to keep the plan from going under while still providing coverage for catastrophic situations.

Aligning Costs with Different Plan Types

The kind of plan you have often signals which cost-sharing method it prefers. Employer-sponsored PPO plans, known for their richer benefits, lean heavily on copays to make everyday care accessible and affordable.

Conversely, High-Deductible Health Plans (HDHPs), especially those you find on the marketplace, rely more on coinsurance to keep your monthly premiums as low as possible.

The data backs this up. A 2014 analysis showed that employer-based plans used copayments for 72% of services, while coinsurance only accounted for 21.6%, particularly for generic drugs. Marketplace plans, especially the lower-cost Bronze ones, used coinsurance far more often. You can see the full cost-sharing breakdown on Commonwealthfund.org.

The core strategy is really quite simple: Copays are for managing predictable, low-cost care, while coinsurance is for protecting both you and the insurer from the financial shock of a major medical event after your deductible is met. Seeing it this way reveals the financial logic behind your plan's design.

Every health plan is a balancing act. Lower monthly premiums often mean you take on more of the cost-sharing responsibility, like a higher deductible and coinsurance. This is at the heart of the trade-off between health insurance vs personal savings when it comes to paying for medical care.

When you read your plan's summary with this in mind, you're not just seeing numbers—you're understanding why you pay for care the way you do.

How to Choose the Right Health Plan for Your Needs

Picking the right health plan isn't about finding a secret "best" option—it's about finding the one that fits you. The whole coinsurance vs. copay debate really comes down to your personal health, your budget, and how much financial uncertainty you can handle.

There’s no magic formula here. Let's walk through a few common scenarios to see how your life situation points you toward one model or the other.

The Healthy Young Professional

If you're young, healthy, and don't have any chronic conditions, a plan with lower premiums and higher coinsurance often makes the most sense. You probably aren't planning on frequent trips to the doctor or specialist. The goal is simple: keep your fixed monthly costs as low as possible while still having a safety net for a true emergency, like a sudden accident.

You’re essentially betting on your good health to save cash on premiums all year. The most important thing is making sure you have enough in savings to cover that deductible if a surprise medical issue does pop up.

The Growing Family

For a family with young kids, a copay-focused plan is usually a lifesaver. Children mean more visits to the pediatrician, trips to urgent care, and the occasional specialist. The predictability of a fixed copay makes budgeting a whole lot easier than staring down a percentage of an unknown bill every time someone gets sick.

For families, predictable costs are often king. A plan with clear copays for doctor visits and prescriptions can prevent the financial stress of numerous small but frequent medical needs, even if the monthly premium is higher.

Sure, the monthly premium might be more expensive. But the peace of mind that comes from knowing a doctor's visit will always be a set fee, like $30, is invaluable when you're trying to manage a family budget.

The Individual Managing a Chronic Illness

If you're managing a condition like diabetes or heart disease, you already know you’ll need regular specialist visits, ongoing tests, and consistent prescription refills. In this situation, a copay-heavy plan is almost always the smarter financial move. Predictable costs for frequent services stop your routine care from turning into a major financial strain.

A plan that leans on coinsurance could be financially devastating, since you'd constantly be paying a percentage of very expensive services. Your goal should be to minimize out-of-pocket spending for the care you absolutely know you'll need.

Questions to Ask When Reviewing a Plan

Before you lock in your decision, especially during a limited sign-up window, you have to ask the right questions. You can learn more about this period in our article on what open enrollment is and why it matters.

Grab the plan's Summary of Benefits and Coverage (SBC) and find the answers to these critical questions:

- Do my most common services (primary care, specialists, prescriptions) come with a fixed copay?

- What's the deductible, and can I realistically afford to pay it out of pocket if I have to?

- What is the out-of-pocket maximum? This number is your absolute financial risk for the entire year.

- Are my preferred doctors and hospitals included in the plan's network?

Answering these questions takes you beyond the basic coinsurance vs copay debate and helps you land on a choice that genuinely fits your life.

Frequently Asked Questions

Even after you get the hang of coinsurance versus copays, a few tricky questions always seem to pop up. When you’re dealing with real-life medical bills, the details are what matter most. Getting clear on these finer points will help you use your plan with confidence.

Let’s tackle some of the most common head-scratchers.

Can a Single Service Have Both a Copay and Coinsurance?

It’s rare, but yes. For a simple doctor’s visit, you’ll typically pay one or the other. But for more complex medical events, you can absolutely run into both.

Think about a hospital stay. You might pay a fixed copay just for the admission itself. Then, for the surgery you have during that stay, you could be responsible for coinsurance on the final bill. It all depends on how your plan structures different types of care.

Do My Copayments Count Toward My Deductible?

In almost every health insurance plan, no. Copays are considered a separate, upfront fee you pay to access a service. They exist outside of your deductible.

Here’s the crucial part, though: While copays don't chip away at your deductible, they almost always count toward your out-of-pocket maximum. This is a huge deal. It means every single copay you make brings you one step closer to that all-important financial safety net.

Is 10% Coinsurance Always Cheaper Than 20%?

Not necessarily, and this is where a lot of people get tripped up. A plan with 10% coinsurance looks better at first glance, but you have to look at the whole picture.

What if that plan has a sky-high deductible? You could end up paying thousands out of your own pocket before that lower coinsurance rate even kicks in. A plan's true cost is always a combination of its premium, deductible, and coinsurance. You can't just focus on one number.