Losing your employer-sponsored health insurance can be a major setback, and the high cost of COBRA continuation coverage often adds financial stress to an already challenging situation. While COBRA offers a way to keep your exact same health plan, its steep price, often the full premium plus a 2% administrative fee, makes it unaffordable for many individuals and families.

Fortunately, numerous COBRA insurance alternatives exist that can provide quality coverage, often at a fraction of the cost. This guide is designed to be your comprehensive resource for navigating these options. We will break down several distinct pathways to securing health insurance, from government-sponsored marketplaces and short-term policies to health-sharing ministries and private insurance brokers.

This resource list moves beyond simple descriptions to give you practical, actionable information. For each of the 12 platforms and services covered, you'll find a detailed analysis of who it's best for, the pros and cons, potential costs, and crucial implementation steps. With direct links and screenshots for each resource, you can confidently evaluate your choices and find a plan that protects your health without breaking the bank. This guide will help you make an informed decision and transition smoothly to your next health coverage solution.

1. My Policy Quote

My Policy Quote stands out as a premier resource for individuals seeking robust, personalized cobra insurance alternatives. Instead of offering a one-size-fits-all solution, this platform functions as a dedicated insurance brokerage, connecting users with licensed, state-certified agents who provide tailored guidance across all 50 states. This direct, expert-led approach is particularly valuable for those navigating the complexities of post-employment health coverage for the first time, including early retirees, self-employed professionals, and families.

The platform excels in simplifying the insurance shopping experience. Users can get fast, customized quotes, often within minutes, by working directly with an agent who assesses their specific needs, budget, and health status. This streamlined process eliminates the guesswork and overwhelming research typically associated with finding a new plan.

Why It’s a Top COBRA Alternative

My Policy Quote distinguishes itself by providing access to a broad spectrum of high-quality plans that many people might overlook. They specialize in Gold and Platinum level health insurance, major medical, short-term policies, and a comprehensive suite of supplemental options like dental, vision, and critical illness coverage.

This ensures you can build a benefits package that truly rivals or even surpasses your former employer-sponsored plan, often at a more competitive price point. The emphasis on lifetime client support means you have a dedicated advocate not just during enrollment, but for the entire duration of your policy. For those proactively planning for a potential job loss, exploring options ahead of time is crucial. You can learn more about how to prepare for losing your job on MyPolicyQuote.com.

Key Features & Considerations

| Feature | Details |

|---|---|

| Expert Guidance | Access to licensed agents in all 50 states for personalized consultations. |

| Plan Variety | Extensive selection of major medical, short-term, and supplemental plans. |

| Speed & Efficiency | Fast quotes and potential for same-day policy documents. |

| Cost Structure | Pricing is provided during a free, no-obligation consultation. |

Pros:

- Nationwide network of licensed, state-certified agents.

- Fast, transparent quotes and rapid policy issuance.

- Wide range of health and supplemental insurance products.

- Free consultations and lifetime support post-enrollment.

Cons:

- Pricing requires direct consultation rather than being listed upfront.

- Plan availability is dependent on third-party insurers and market conditions.

Website: https://mypolicyquote.com

2. HealthCare.gov

Losing job-based coverage is a Qualifying Life Event, which means you can immediately enroll in an Affordable Care Act (ACA) plan through HealthCare.gov, the official federal marketplace. This platform is a cornerstone for anyone seeking comprehensive cobra insurance alternatives, as it's designed to provide coverage that often costs significantly less than COBRA premiums, especially with financial assistance.

The website’s primary function is to help you compare plans side-by-side and determine your eligibility for subsidies. The application process assesses your income and household size to see if you qualify for a Premium Tax Credit, which directly lowers your monthly payment. Many users find the interface straightforward, guiding them through enrollment step-by-step.

Key Considerations

- Coverage & Cost: All marketplace plans must cover essential health benefits, including preventive care, emergency services, and prescription drugs. While some plans have high deductibles, the potential for subsidies makes them a top low-cost health insurance option. You can find more details about budget-friendly ACA plans at mypolicyquote.com.

- Enrollment: You typically have a 60-day Special Enrollment Period after losing your job to sign up. Missing this window means you must wait for the annual Open Enrollment Period.

Website: https://www.healthcare.gov

3. WeShare by Unite Health Share Ministries

For those seeking a non-traditional route, WeShare by Unite Health Share Ministries offers a faith-based health cost-sharing program. This model functions as a community-driven alternative to standard insurance, where members contribute a monthly amount to help pay for each other's eligible medical expenses. It stands out as one of the unique cobra insurance alternatives by integrating community support with financial protection.

The platform emphasizes a holistic approach to well-being. Beyond just sharing medical costs, it provides members with access to wellness programs, including fitness and mental health resources. Users can typically access a broad network of providers, offering flexibility similar to some PPO plans. The monthly contribution amounts are often significantly lower than typical COBRA premiums, making it an attractive option for budget-conscious individuals and families.

Key Considerations

- Coverage & Cost: WeShare is not insurance and isn't regulated by the same laws. While monthly contributions are low, members should carefully review the guidelines for what is considered an eligible expense. Pre-existing conditions may have limitations or waiting periods before they are shareable.

- Enrollment: Unlike ACA plans, health sharing ministries often allow enrollment year-round. However, you must agree to a statement of faith or shared beliefs to become a member, which is a key requirement for participation.

Website: https://www.unitehealthshare.org/weshare

4. Stride Health

For freelancers, gig workers, and self-employed professionals seeking a streamlined way to find coverage, Stride Health offers a powerful, personalized platform. It functions as an enhanced private enrollment partner for ACA plans, making it a highly effective cobra insurance alternative by simplifying what can often be a confusing process. The platform specializes in helping you find the most affordable plan based on your unique needs, location, and income.

Stride’s main advantage is its recommendation engine, which assesses your health needs and financial situation to suggest the optimal plan. The interface is clean and user-friendly, guiding you through subsidy calculations and enrollment without the complexities of the federal marketplace. Its year-round customer support is a significant benefit for those who need help managing their plan after enrollment.

Key Considerations

- Coverage & Cost: Stride focuses exclusively on official ACA marketplace plans, ensuring all options cover essential health benefits. Its algorithm excels at identifying plans where you can maximize premium tax credits. The emphasis on personalization in health insurance is a key trend, and you can explore more about the future of tailored healthcare solutions at mypolicyquote.com.

- Enrollment: Similar to HealthCare.gov, you must enroll during a Special Enrollment Period (like after losing a job) or the annual Open Enrollment Period. Stride simplifies this process by pre-filling applications and providing clear deadlines.

Website: https://www.stridehealth.com

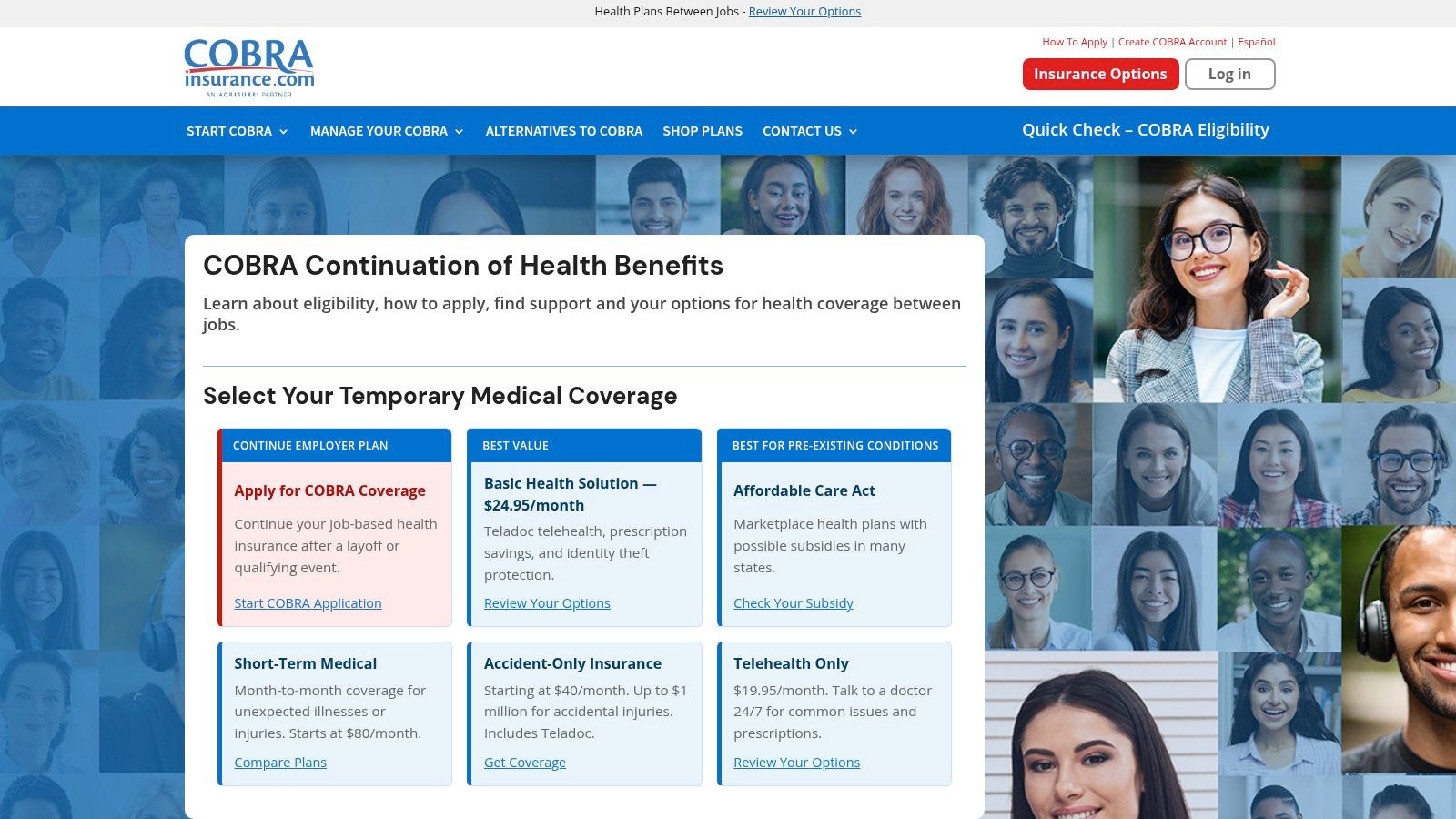

5. COBRAInsurance.com

While its name suggests a focus on COBRA, COBRAInsurance.com is actually a valuable hub for exploring a wide range of cobra insurance alternatives. This platform functions as an educational resource and comparison tool, designed to help you understand your options beyond simply continuing your old employer's plan. It provides detailed guides and side-by-side comparisons of ACA plans, short-term health insurance, and even Medicaid.

The website’s primary strength is its ability to consolidate information, allowing users to evaluate different types of coverage in one place. Its tools are user-friendly, guiding you through the pros and cons of each alternative, making it easier to determine which path is most suitable for your financial and healthcare needs. It's particularly useful for those who feel overwhelmed by the complexity of health insurance after a job loss.

Key Considerations

- Coverage & Cost: The platform provides access to quotes for short-term plans, which can be very affordable but often lack comprehensive benefits and may not cover pre-existing conditions. It also clarifies ACA and Medicaid options, which offer more robust coverage. This makes it a great starting point for those bridging a coverage gap, such as early retirees who can find guidance on health insurance before Medicare at mypolicyquote.com.

- Enrollment: COBRAInsurance.com helps you understand the different enrollment windows for each type of plan. It clarifies the strict 60-day Special Enrollment Period for ACA plans while highlighting the year-round availability of short-term insurance.

Website: https://www.cobrainsurance.com

6. KeenanDirect

For those who find the health insurance landscape overwhelming, KeenanDirect offers a more hands-on approach. Instead of a purely do-it-yourself platform, it connects you with certified insurance agents who provide personalized guidance. This service is a valuable cobra insurance alternative for individuals who want expert help navigating their options, including ACA plans and other private insurance products, to find the most suitable and affordable coverage.

The core function of KeenanDirect is to simplify the complex process of choosing a health plan. An agent will work with you to evaluate your eligibility for tax credits, transparently review plan premiums and coverage details, and help you enroll. This human touch can be a significant advantage, ensuring you understand the fine print before committing to a plan.

Key Considerations

- Guidance & Cost: The service is free to use, as agents are compensated by insurance carriers. They focus on finding affordable, comprehensive coverage by comparing options from a variety of providers. Their expertise helps demystify deductibles, copays, and network limitations.

- Enrollment & Access: Because it relies on licensed agents, support is personalized but dependent on agent availability. This model is particularly beneficial for those in states with a complex marketplace or anyone unsure about how to properly apply for subsidies.

Website: https://www.keenandirect.com

7. NerdWallet

NerdWallet serves as an educational hub rather than a direct insurance marketplace. It provides extensive guides, articles, and financial advice to help you understand the complex landscape of cobra insurance alternatives. Instead of selling plans, its primary role is to empower you with the knowledge needed to compare options like ACA plans, short-term insurance, and health sharing ministries from a financial perspective.

The platform excels at breaking down intricate topics into easy-to-understand language. You can find detailed articles explaining the pros and cons of COBRA versus other coverage, how to calculate potential costs, and what to look for in a policy. This makes it an invaluable first stop for anyone feeling overwhelmed by their choices after losing employer-sponsored health insurance.

Key Considerations

- Coverage & Cost: NerdWallet does not offer insurance directly. Instead, it provides tools and information to help you estimate costs and understand coverage differences. Its articles often link to official marketplaces or trusted third-party brokers where you can get a quote and enroll.

- Enrollment: Since it is an informational resource, there are no enrollment periods or deadlines. However, the site consistently emphasizes the 60-day Special Enrollment Period for marketplace plans and provides checklists to ensure you don’t miss crucial dates.

Website: https://www.nerdwallet.com

8. Patient Advocate Foundation

Unlike platforms that sell policies, the Patient Advocate Foundation (PAF) serves as a crucial educational and support resource. It is an excellent starting point for those who feel overwhelmed by the complexity of finding cobra insurance alternatives, especially when dealing with a serious medical condition. PAF empowers you with knowledge about your rights, how to navigate insurance appeals, and where to find financial assistance programs that can make healthcare more affordable.

The website offers a wealth of free materials, case management services, and financial aid directories. It’s designed not to sell you a plan but to ensure you understand all your options and can advocate for yourself effectively. This focus on patient rights and support makes it a unique and invaluable tool for anyone facing a coverage gap combined with health challenges.

Key Considerations

- Coverage & Cost: All resources and support services provided by PAF are completely free. While they don't offer insurance directly, they guide you toward financial aid programs, co-pay relief, and other cost-saving measures that can significantly reduce your out-of-pocket medical expenses.

- Enrollment: PAF does not handle insurance enrollment. Instead, its professional case managers can help you understand enrollment periods, eligibility for programs like Medicaid or ACA subsidies, and how to appeal a coverage denial. Their role is to support your journey, not process your application.

Website: https://www.patientadvocate.org

9. Healthcare Concierge

For those who find navigating the health insurance landscape overwhelming, a service like Healthcare Concierge offers personalized guidance. Instead of presenting a broad marketplace, this platform connects you with specialists who assess your specific health and budget needs to find suitable private plans. This hands-on approach makes it a standout among cobra insurance alternatives for individuals wanting expert advice without doing all the research themselves.

The core function is a one-on-one consultation where an advisor helps you compare off-marketplace plans that often go overlooked. They assist with everything from understanding plan terminology to completing the enrollment paperwork, aiming to find cost-effective coverage that aligns with your medical requirements. This tailored support can be particularly valuable for those with complex health situations or who are new to buying individual insurance.

Key Considerations

- Coverage & Cost: While the service focuses on affordable private insurance, the plans themselves vary in cost and coverage. The primary benefit is the expert assistance in finding a plan that balances premiums, deductibles, and network access. Be sure to ask if there are any fees associated with the consultation service itself.

- Enrollment: The concierge service can help you enroll anytime, as private plans often have more flexible enrollment periods than ACA marketplace plans. However, service availability may be limited by region or specialist capacity.

Website: https://www.healthcareconcierge.com

10. Emmie Mae Health Insurance Advisors

For those who find navigating the health insurance landscape overwhelming, a dedicated advisor can be an invaluable resource. Emmie Mae Health Insurance Advisors provides personalized, expert guidance to help individuals find private health plans that serve as excellent cobra insurance alternatives. Instead of just presenting a list of options, they focus on understanding your specific health needs and budget to recommend the most suitable coverage.

This service is ideal for people who prefer a human touch over automated platforms. The advisors assist with comparing complex plan details, deciphering insurance jargon, and managing the enrollment process from start to finish. This hands-on approach ensures you don't just find a plan, but you understand what you're buying.

Key Considerations

- Coverage & Cost: The primary goal is to find cost-effective private plans that offer robust coverage. While some services may involve a consultation fee, the potential savings from avoiding high COBRA premiums often justify the cost. The personalized service aims to match you with a plan that fits your financial situation.

- Enrollment: An advisor can help you determine if you qualify for a Special Enrollment Period outside of the standard open enrollment window. Their expertise can be particularly helpful if your situation is complex or you're unsure which life events make you eligible for immediate coverage.

Website: https://www.emmiemaehealthinsurance.com

11. NPA Benefits

NPA Benefits serves as an educational hub rather than a direct insurance marketplace, making it a valuable starting point for those researching cobra insurance alternatives. The platform focuses on providing clear, comparative information about your options, including ACA plans, short-term policies, and Medicaid. It is designed to demystify the complex world of health insurance after a job loss.

The website's primary strength is its informational content. It offers resources that break down complex terms and eligibility requirements for different programs. By arming users with knowledge, NPA Benefits helps you understand which type of coverage might be the most cost-effective and suitable for your situation before you begin the application process elsewhere.

Key Considerations

- Guidance & Resources: The site excels at offering a comprehensive overview of the post-employment insurance landscape. Its articles and guides compare the pros and cons of various plans, helping you identify key cost-saving strategies. It’s a great resource for understanding the fundamental differences between major coverage types.

- Actionability: A key limitation is that NPA Benefits does not offer direct enrollment. After using its resources to inform your decision, you must navigate to external websites like HealthCare.gov or a private broker to actually purchase a plan.

Website: https://www.npabenefits.com

12. Noozhawk

While not a direct provider, Noozhawk serves as a valuable informational resource for those researching cobra insurance alternatives. This community-focused news platform publishes articles that break down complex health insurance topics into accessible, practical advice. It's a great starting point for understanding your options before you begin shopping for a plan.

The website's strength lies in its easy-to-understand content that often explores various coverage types beyond traditional insurance. By providing regularly updated health information and guidance, it empowers readers to make more informed decisions when faced with losing employer-sponsored coverage. Think of it as an educational first step in your research process.

Key Considerations

- Coverage & Cost: Noozhawk does not sell insurance. It provides free-to-access articles and guides discussing concepts like health sharing ministries, short-term plans, and other strategies to find affordable coverage. The content is designed to give you a foundational understanding of the landscape.

- Enrollment: As an informational site, there is no enrollment process. Its purpose is to equip you with the knowledge needed to confidently navigate platforms like HealthCare.gov or engage with insurance brokers.

Website: https://www.noozhawk.com

COBRA Insurance Alternatives Comparison

| Provider | Core Features/Offerings | User Experience/Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 My Policy Quote | Personalized quotes,licensed agents, wide plan access | ★★★★★ Fast quotes & lifetime support | 💰 Competitive pricing, no-obligation consult | 👥 Self-employed, families, Medicare clients | ✨ Same-day policies, Gold/Platinum plans |

| HealthCare.gov | ACA plan comparison, subsidy eligibility | ★★★★ User-friendly, educational | 💰 Subsidy potential | 👥 General public, ACA eligible | ✨ Official ACA marketplace, essential benefits |

| WeShare by Unite Health Share | Faith-based cost sharing, wellness programs | ★★★ Flexible provider choice | 💰 Lower contributions than COBRA | 👥 Faith-based communities | ✨ Holistic wellness, community-driven sharing |

| Stride Health | Personalized ACA plans, subsidy checks | ★★★★ Simplified enrollment | 💰 High subsidy qualification | 👥 ACA plan seekers | ✨ Year-round support |

| COBRAInsurance.com | COBRA info, short-term plans, Medicaid guidance | ★★★ User-friendly tools | 💰 Variety of alternatives | 👥 COBRA users, ACA seekers | ✨ Detailed COBRA comparisons |

| KeenanDirect | Certified agent guidance, tax credit evaluation | ★★★ Expert personalized help | 💰 Affordable coverage focus | 👥 Region-specific clients | ✨ Transparent premium reviews |

| NerdWallet | In-depth guides, financial advice | ★★★★ Trusted, user-friendly | 💰 Free advice, no direct enroll | 👥 Financially savvy consumers | ✨ Regular regulation updates |

| Patient Advocate Foundation | Insurance appeals, financial aid info | ★★★ Supportive patient advocacy | 💰 Free resources | 👥 Patients needing advocacy | ✨ Focus on rights & appeals |

| Healthcare Concierge | Personalized consultations, private plan assistance | ★★★ Tailored, enrollment support | 💰 Cost-effective focus | 👥 Private insurance shoppers | ✨ Enrollment assistance |

| Emmie Mae Health Insurance Advisors | Expert private insurance advice, plan comparisons | ★★★ Personalized, expert support | 💰 Cost-effective alternatives | 👥 Private plan buyers | ✨ Help with complex terms |

| NPA Benefits | COBRA alternatives info, cost-saving strategies | ★★★ Educational content | 💰 Free educational resources | 👥 Info seekers on insurance options | ✨ Comprehensive COBRA alternative analysis |

| Noozhawk | Articles on insurance alternatives, community info | ★★★ Accessible, practical advice | 💰 Free info | 👥 General readers | ✨ Regular topic updates |

Making Your Choice: A Strategic Path to Your Next Health Plan

Navigating the landscape of health coverage after leaving a job can feel overwhelming, but as this guide has shown, you are far from powerless. The decision to forgo expensive COBRA coverage opens up a world of powerful cobra insurance alternatives. From the comprehensive plans on the ACA Marketplace to the flexible, budget-friendly options offered by short-term policies and health shares, you have a wealth of resources at your fingertips.

The key is shifting your mindset from a passive recipient of employer-sponsored benefits to an active, informed consumer of healthcare. This journey requires a clear-eyed assessment of your personal circumstances. Tools like HealthCare.gov provide a centralized hub for ACA plans, while platforms like Stride Health and NPA Benefits cater specifically to the needs of freelancers and independent contractors. For those seeking temporary coverage, exploring options via brokers like KeenanDirect or informational sites like NerdWallet can illuminate the best path forward.

A Framework for Your Decision

There is no one-size-fits-all solution. The "best" alternative to COBRA is the one that aligns perfectly with your life right now. To find it, you must evaluate your situation through four critical pillars. Use this framework as a final checklist before you commit to a plan:

- Budget: What is the maximum monthly premium you can comfortably afford? Remember to factor in potential out-of-pocket costs like deductibles, copayments, and coinsurance. A high-deductible plan might have a low premium but could be costly if you need significant medical care.

- Health Needs: Do you or your family members have pre-existing or chronic conditions? Are there specific prescription drugs you must take? Ensure any plan you consider, especially non-ACA compliant ones like short-term insurance or health shares, will cover your essential medical needs without exclusions.

- Risk Tolerance: How much financial risk are you willing to assume? If you are young, healthy, and have a solid emergency fund, a plan with a higher deductible or the non-traditional structure of a health share like WeShare might be an acceptable trade-off for lower monthly costs. If you have dependents or medical concerns, the security of a comprehensive ACA plan is likely a better fit.

- Timeframe: Are you looking for a long-term health insurance solution or simply a temporary bridge to cover a gap of a few months? Your answer will determine whether a renewable ACA plan or a limited-duration short-term policy makes the most sense.

Your Next Actionable Step

Losing employer-sponsored health coverage can feel like a moment of instability, but it is also a powerful opportunity. It is a chance to take direct control of your healthcare decisions and find a plan that truly serves your financial and personal well-being. By leveraging the tools and strategies outlined in this article, you can confidently navigate the available cobra insurance alternatives and secure quality, affordable coverage. You don't have to face this complex decision alone; expert guidance can provide invaluable clarity.

Ready to find the most affordable and effective COBRA alternative for your specific needs? The expert advisors at My Policy Quote specialize in comparing plans from top carriers to find you the best coverage at the lowest price. Get a free, no-obligation quote in minutes and let a professional guide you to the right choice.