Short-term health insurance is all about having a financial safety net when you’re between major health plans. Think of it as a cost-effective bridge—it’s there to protect you from catastrophic hospital bills, not for routine checkups. It’s a popular choice for people navigating life’s transitions.

What Is Short Term Health Insurance and Who Is It For

Imagine short-term health insurance as the spare tire in your car. It’s not meant for a cross-country road trip, but it’s an absolute lifesaver if you get a flat tire between destinations. This type of coverage is built specifically to fill those gaps in your life, offering a shield against sudden, high-cost medical emergencies—like a broken bone or an unexpected trip to the ER.

These plans are a world away from the comprehensive policies you find on the ACA (Affordable Care Act) marketplace. They aren’t required to cover the ten essential health benefits, which is a big reason why their price tag is so much lower. The trade-off? They usually don’t cover pre-existing conditions, maternity care, mental health services, or preventive care.

Who Benefits Most From Temporary Coverage

The perfect candidate for cheap short term health insurance is usually a healthy person who’s going through a temporary life change. These plans offer peace of mind without the hefty monthly premiums of a major medical plan.

This might be you if you are:

- Between Jobs: You’ve left one company and are just waiting for the benefits at your new job to start.

- A Recent Graduate: You just turned 26 and can’t stay on your parents' plan, but you haven't landed your own coverage yet. Our guide on health insurance for temp workers has some great insights for this exact situation.

- Self-Employed or a Contractor: You need a stopgap plan between projects or while you wait for the next ACA open enrollment period to begin.

- An Early Retiree: You’ve retired before 65 and need something to hold you over until you’re eligible for Medicare.

For early retirees aged 60-64, pre-Medicare, short-term policies fill the gap before age 65 eligibility, avoiding COBRA's hefty $600+ monthly fees that burden working-class families.

To give you a clearer picture, here’s a quick overview of what these plans are all about.

Short Term Health Insurance At a Glance

| Feature | Description | Ideal For |

|---|---|---|

| Duration | Coverage lasts from 30 days up to 36 months in some states. | Gaps between jobs, waiting for ACA enrollment, or other temporary situations. |

| Cost | Premiums are significantly lower than ACA plans. | Healthy individuals on a tight budget needing catastrophic coverage. |

| Coverage Focus | Primarily covers unexpected injuries and sudden illnesses. | Emergencies like broken bones, hospitalizations, or urgent surgeries. |

| Exclusions | Does not cover pre-existing conditions, maternity, or preventive care. | People without chronic conditions who don't need routine checkups. |

| Enrollment | You can enroll any time of year, with coverage often starting the next day. | Anyone needing immediate coverage outside of the standard open enrollment window. |

This table shows why short-term plans are such a practical tool for specific, temporary needs, but it's important to know their limits.

Setting Realistic Expectations

The word "cheap" is always attractive, but you have to understand what you're actually buying. The low cost is possible because of medical underwriting. Insurers will look at your health history and can deny you coverage for pre-existing conditions. It’s how they keep the premiums down for the healthy people they approve.

Ultimately, short-term health insurance is a strategic tool. It’s there to make sure one major medical event doesn’t become a devastating financial crisis while you’re in a period of transition.

What Short-Term Health Insurance Actually Covers

Let's get one thing straight: short-term health insurance isn't a replacement for a comprehensive, long-term plan. Think of it less like a full-service hospital and more like a well-stocked first-aid kit. It’s there for the big, unexpected stuff—a sudden injury or a serious illness that could otherwise leave you with a mountain of debt.

It's not designed for your annual check-up or ongoing treatments. That's exactly why it's often called cheap short-term health insurance. These plans are built to give you a financial safety net during a temporary gap in coverage, protecting you from catastrophic events without the high price tag of an ACA plan.

Knowing this difference is everything. It helps you use the plan for what it’s for and avoid nasty surprises later. You’re buying protection against the kind of medical bills that can derail your life, not a plan for your day-to-day wellness.

What’s Usually Included?

While no two plans are identical, most are built around one core idea: covering new, unexpected medical problems that crop up after your policy starts. It’s your backstop for life's "what ifs."

Here’s what you can generally expect to be covered:

- Emergency Room Visits: For a sudden accident or a life-threatening condition, these plans are designed to help with the sky-high costs of emergency care.

- Hospital Stays: This typically includes your semi-private room, nursing services, and other inpatient care needed for a covered illness or injury.

- Urgent Care Services: Got a high fever or a nasty sprain that needs attention now? Urgent care visits are often covered for issues that aren't life-threatening but still need prompt care.

- Surgeries: Medically necessary surgeries that result from a new, covered condition are a core part of what these plans do.

- Certain Diagnostic Tests: Things like X-rays, bloodwork, and other lab tests needed to figure out what's wrong with a new medical issue are usually included.

But remember, even for these covered services, you'll have out-of-pocket costs. To get a better handle on how that works, check out our guide on deductibles and copays. It breaks down what you'll pay before your insurance starts paying its share.

The whole point of a short-term plan is risk management. It’s built to shield you from the five- or six-figure bills that a major accident can create, making sure a temporary gap in coverage doesn't become a long-term financial nightmare.

What's Almost Always Left Out?

That low monthly premium comes at a cost, and it's all about what the plan doesn't cover. By trimming the benefits down to the essentials, insurers keep these plans affordable. You absolutely have to know these limitations before you sign up.

Here are the most common things you won't find covered:

- Pre-existing Conditions: This is the big one. Short-term plans will not cover any medical issue you had before the policy began. Insurers can look back months or even years to determine what counts.

- Preventive Care: Forget about annual physicals, routine checkups, immunizations, or wellness screenings. These plans are reactive, not proactive.

- Maternity and Newborn Care: Anything related to pregnancy, from prenatal visits to delivery and newborn care, is specifically excluded.

- Most Prescription Drugs: While drugs given to you in a hospital might be covered, the prescriptions you pick up at the pharmacy almost never are.

- Mental Health Services: Therapy, counseling, and treatment for substance abuse are generally not included in these plans.

- Dental and Vision Care: These are totally separate types of insurance and are not part of a short-term medical plan.

Going through this list is critical. If you know you'll need care for any of these things, a short-term plan is not for you. Its value is laser-focused on one thing: protecting your finances from the shock of a sudden medical crisis.

Comparing Short Term Plans to ACA, COBRA, and Medicaid

Choosing a health plan can feel like you’re staring at a map with four different roads leading to unknown places. When you suddenly need coverage, figuring out the difference between cheap short term health insurance, ACA plans, COBRA, and Medicaid is the first step. Each one is built for a different person and a different situation.

Here's a simple way to think about it. A short-term plan is like a temporary rental car—it’s affordable and gets you where you need to go when your main car is in the shop. An ACA plan is like leasing a reliable daily driver with all the modern safety features. COBRA is like keeping your old, familiar car but having to pay the full, expensive loan and insurance yourself. And Medicaid is like a public transit system, providing essential transportation for those who qualify based on income.

The right choice comes down to your health, your budget, and how long you’ll need coverage. A healthy 28-year-old freelancer who just needs a safety net for major accidents might find a short-term plan is a perfect fit. But for someone with a chronic condition like diabetes, an ACA plan's comprehensive coverage is non-negotiable.

ACA Marketplace Plans: The Comprehensive Option

Affordable Care Act (ACA) plans, which you find on the government's Health Insurance Marketplace, are the gold standard for comprehensive coverage. They are legally required to cover ten essential health benefits—including things short-term plans almost never touch, like preventive care, maternity services, and mental health treatment.

Most importantly, ACA plans cannot deny you coverage or charge you more for pre-existing conditions. This is their single biggest advantage over short-term insurance. If you have any ongoing health issue, an ACA plan is almost always the safer bet. Plus, many people qualify for income-based subsidies that can dramatically lower the monthly premium.

The catch? Enrollment is limited to the annual Open Enrollment Period (usually in the fall) unless you have a Qualifying Life Event, like losing your job or getting married.

COBRA: Continuing Your Employer Coverage

COBRA (the Consolidated Omnibus Budget Reconciliation Act) lets you keep the exact same health insurance you had from a former employer, usually for up to 18 months. Its main benefit is continuity. You keep your doctors, your network, and all your coverage without any interruption.

The downside is the sticker shock. With COBRA, you’re on the hook for 100% of the premium, plus an administrative fee of up to 2%. Since most employers pay a huge chunk of that cost for active employees, your monthly payment can suddenly skyrocket. COBRA is often a last-resort option for those who absolutely need to maintain specific, continuous care and can handle the high price tag. If you're weighing your options, you might find value in our detailed guide on COBRA insurance alternatives.

Medicaid: Government-Sponsored Coverage

Medicaid is a joint federal and state program providing free or very low-cost health coverage to millions of Americans. This includes eligible low-income adults, children, pregnant women, and people with disabilities. Eligibility is based strictly on your income.

Just like ACA plans, Medicaid offers comprehensive coverage for a wide range of services and fully covers pre-existing conditions. If your income falls below a certain level (which varies by state), Medicaid is an incredible option that provides robust benefits at little to no cost to you.

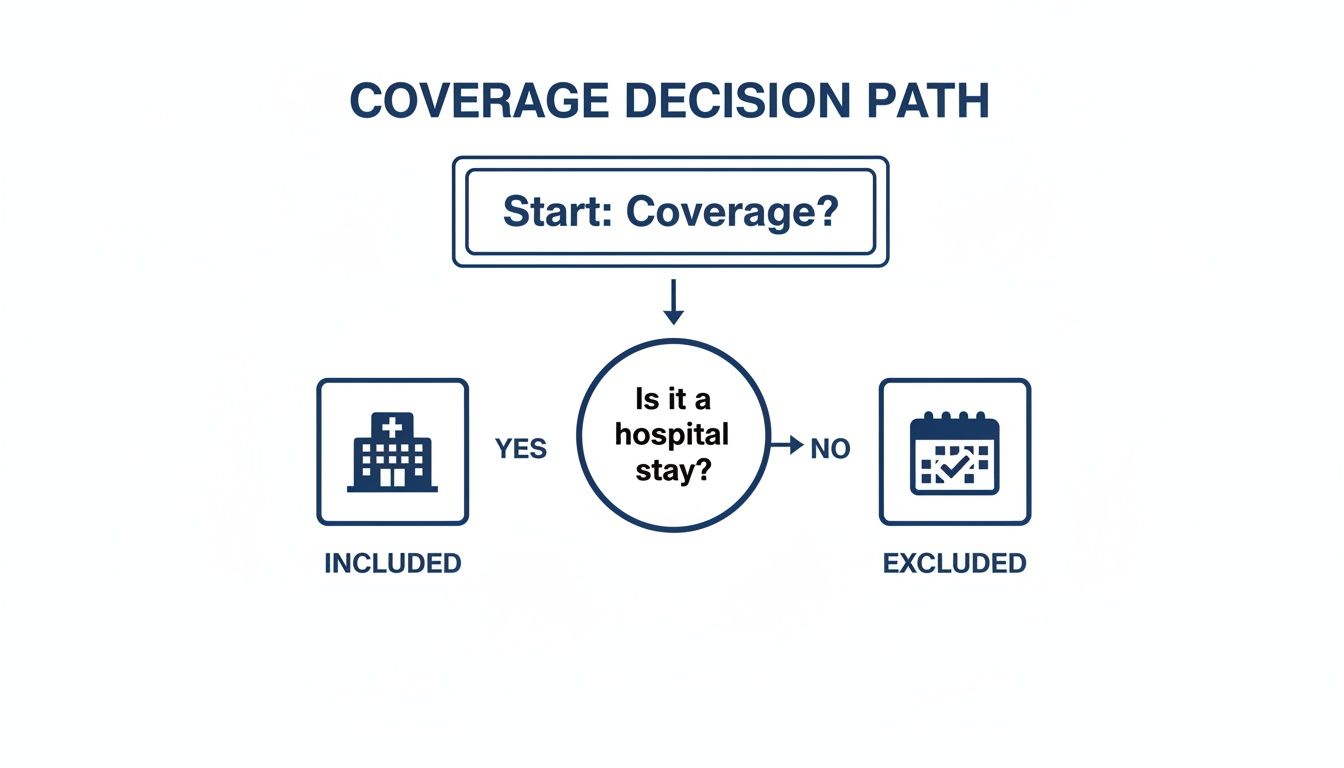

This flowchart gives you a simple way to visualize whether a plan is designed for major medical events or just to fill a temporary gap.

As you can see, plans designed for long-term protection (like ACA or COBRA) are built around hospital-level care, while temporary plans are meant to bridge coverage gaps.

With global medical costs projected to climb 10.3% in 2026, finding an affordable option is more critical than ever. For working-class families and those without employer benefits, short-term health insurance stands out as a budget-friendly shield, often costing just $100-$200 monthly compared to $500+ for comprehensive plans.

Key Takeaway: Your health status and financial situation are the two most important factors. Short-term plans offer affordability in exchange for limited coverage, while ACA, COBRA, and Medicaid offer more comprehensive protection under different eligibility and cost structures.

Insurance Options Head-to-Head Comparison

To make your decision a little easier, let's put these plans side-by-side. This table breaks down the key differences so you can see where each option shines and which one aligns with your needs.

| Feature | Short-Term Insurance | ACA Marketplace | COBRA | Medicaid |

|---|---|---|---|---|

| Monthly Cost | Low | Varies (subsidies available) | Very High | Free or Very Low |

| Pre-Existing Conditions | Not Covered | Covered | Covered | Covered |

| Enrollment Period | Any time | Open Enrollment or SEP | Within 60 days of losing job | Any time (if eligible) |

| Coverage Level | Limited (catastrophic) | Comprehensive (10 essentials) | Comprehensive (same as job) | Comprehensive |

| Best For | Healthy people in transition | Anyone, especially with health needs | Those needing continuous, specific care | Low-income individuals & families |

Ultimately, choosing the right plan is a deeply personal decision. A cheap short term health insurance plan is an excellent tool for the right person at the right time—a healthy individual needing a temporary safety net. But if you have ongoing health needs or want the peace of mind that comes with robust benefits, exploring the ACA Marketplace or Medicaid is the smarter path forward.

Key Factors That Influence Your Premium Cost

Figuring out the price of cheap short term health insurance can feel like a mystery, but it’s actually a pretty straightforward calculation. Insurers look at a handful of factors to guess how likely you are to need medical care, then set your monthly premium based on that risk.

Think of it like getting a quote for car insurance. The type of car you drive matters, but so does your driving record. It's the same here—your personal profile and the amount of coverage you choose both play a huge role in your final cost. Once you understand these moving parts, you can see exactly where your money is going and find ways to get a more affordable rate.

Personal Factors That Shape Your Quote

Your personal details create the starting point for any insurance quote. Insurers use this info to build your individual risk profile. You can’t change your age, of course, but knowing how these factors work helps explain why your quote might look different from someone else’s.

Here’s what insurers look at first:

- Your Age and Gender: Younger people usually pay less because, statistically, they're less likely to need a lot of medical care. Premiums go up as you get older. Gender can also play a role, as health risks and care patterns often differ.

- Your Location: Healthcare doesn't cost the same everywhere. A procedure in a big city is almost always more expensive than the same one in a small town. Your zip code directly impacts your premium to reflect these local price differences.

- Tobacco Use: Smoking is linked to a long list of health problems, so tobacco users are seen as a higher risk. If you use tobacco, you can expect to pay a much higher premium than a non-user.

Your premium is essentially a reflection of your calculated risk. While you can't control factors like your age or location, you have significant control over the plan's structure, which is where the real savings can be found.

Plan Choices You Control

This is where you get in the driver's seat. By adjusting the details of your coverage, you decide how much financial risk you’re willing to take on in exchange for a lower monthly payment. It's a trade-off between your premium and what you might have to pay out-of-pocket.

It’s like adjusting the settings on a remote control. You can turn the volume up or down to find the right balance for you.

Here are the plan features you can tweak to find a cheaper premium:

- The Deductible: This is the amount you have to pay for covered services before your insurance plan starts chipping in. Choosing a higher deductible is the single most powerful way to lower your monthly premium.

- Coverage Limits (Maximum Benefits): Short-term plans cap how much they will pay out. A plan with a $1 million maximum benefit will naturally cost more than one with a $250,000 limit. Picking a lower limit can reduce your premium, but it also increases your financial risk if something major happens.

- Coinsurance and Copayments: After your deductible is met, you’ll still share costs with the insurer. This is done through coinsurance (a percentage split, like 80/20) or copayments (a flat fee for a visit). Plans where you pay a higher percentage (like a 70/30 split) will usually have lower premiums.

State Regulations and Duration

Finally, where you live matters. It impacts not just the cost but also the availability and rules of your plan. Federal guidelines allow short-term plans to last up to 364 days and be renewed for up to 36 months. But here’s the catch: many states have their own, stricter regulations.

For example, some states cap plan durations at just three or six months and might not allow you to renew them at all. These shorter terms can affect pricing, as insurers have to account for the limited time frame. Always check your state's specific rules—they can make a big difference in your options for finding cheap short term health insurance.

Actionable Strategies to Find the Most Affordable Plan

Finding a genuinely cheap short-term health insurance plan isn’t about stumbling upon a hidden deal. It’s about being strategic. With the right approach, you can lower your monthly premium without gutting the protection you actually need.

Think of it like customizing a new car. You wouldn't pay extra for heated seats if you live in Miami. In the same way, you shouldn't overpay for insurance features you're unlikely to use. The secret is aligning your coverage with your real-life health and financial situation.

It takes a little bit of homework, but the savings are absolutely worth it. Let's walk through the practical steps you can take to lock in the most affordable temporary coverage.

Adjust Your Deductible and Out-of-Pocket Maximum

Want the fastest way to slash your monthly premium? Choose a higher deductible.

Your deductible is simply the amount you agree to pay for medical care before your insurance plan starts chipping in. When you take on more of that initial risk, the insurance company rewards you with a much lower bill each month.

This strategy is a perfect fit if you have a healthy emergency fund. If you can comfortably cover a $5,000 or $10,000 deductible, you could save hundreds of dollars over the life of your policy.

It's a straightforward trade-off:

- Lower Deductible: You'll pay more each month, but your costs will be lower if you actually need to use your insurance.

- Higher Deductible: You get a smaller monthly premium, but you need to be ready to pay more upfront if a medical issue pops up.

Choosing a higher deductible is a calculated risk. It’s a fantastic way to secure cheap short-term health insurance if you’re generally healthy and have the savings to back it up. But it’s not the right move if a large, unexpected bill would create a financial crisis.

Compare Quotes from Multiple Carriers

Never, ever accept the first quote you see. The market for short-term health insurance is competitive, and prices can vary wildly between companies for the exact same coverage.

Using an online quote comparison tool is the smartest and fastest way to see all your options in one place. You can instantly spot which carrier offers the best value and play around with different deductibles to see how the numbers change across providers.

For more on this, our guide on where to find cheap health insurance breaks it down even further.

Real-World Savings Scenarios

Let's see what this looks like for a few different people.

Scenario 1: The 28-Year-Old Freelancer

- Profile: Healthy, non-smoker, just needs a six-month plan to bridge a gap between contracts. He has a $5,000 emergency fund ready to go.

- Strategy: He opts for a plan with a high $7,500 deductible and a $1 million maximum benefit.

- Result: He locks in a premium around $95 per month, giving him solid protection against a catastrophe while keeping his monthly costs super low.

Scenario 2: The 62-Year-Old Early Retiree

- Profile: In good health but needs coverage for two years until she's eligible for Medicare. She'd rather have a smaller out-of-pocket risk.

- Strategy: She chooses a more balanced $2,500 deductible, understanding that her age will make the premium higher.

- Result: She finds a great plan for about $220 per month. It costs more, but it provides the stronger safety net she wants at this stage in life.

This approach is especially vital for early retirees. A recent insurance industry outlook report from Deloitte noted that 4.3 million early retirees delayed Medicare in 2023 due to cost. Many turned to short-term policies averaging $150/month for one person—a huge difference from a $1,200 COBRA family plan.

By thoughtfully tweaking your plan and comparing every option on the table, you can find coverage that protects both your health and your bank account.

Got Questions About Short Term Health Insurance? We've Got Answers.

Jumping into the world of temporary health coverage can feel a little confusing. Because cheap short term health insurance plays by a different set of rules than traditional plans, it’s smart to get clear on the details before you sign up.

Let's walk through the most common questions to help you make a decision you feel good about and sidestep any surprises. Getting these details right is the key to using a short-term plan for what it is: a temporary financial safety net.

Can They Deny Me Coverage?

Yes, they absolutely can. This is a huge difference from ACA Marketplace plans, which have to cover everyone regardless of their health history. Short-term insurance uses a process called medical underwriting.

When you apply, you’ll fill out a detailed health questionnaire. Insurers look over your medical background to figure out their risk. If you have certain pre-existing conditions—like cancer, diabetes, or heart disease—they will likely turn down your application. Be honest. Lying on your application can get your policy canceled or claims denied right when you need help the most.

Do These Plans Cover Pre-Existing Conditions?

No, and this is the biggest reason they cost less. Short-term policies are designed to cover new and unexpected illnesses or injuries that pop up after your coverage starts.

They will not cover any medical issue you were diagnosed with or treated for before your policy began. Insurers often use a "look-back period," sometimes scanning your medical records from the past few years to define what they consider pre-existing. This makes these plans a much better fit for people who are generally healthy and just need to bridge a gap between more permanent insurance options.

How Long Can I Keep My Short-Term Plan?

This completely depends on where you live. Federal rules allow for an initial plan term of up to 364 days. It's also possible to renew it for a total of up to 36 months.

Heads Up: Many states have their own, much stricter rules. Some limit plans to just three or six months and don't allow renewals at all. A few states have even banned them completely. Always, always check your state's specific regulations so you know exactly how long you can stay covered.

This patchwork of rules means a little local homework is essential to avoid finding yourself in an unexpected coverage gap.

Is Short-Term Insurance Considered “Minimum Essential Coverage”?

Nope. Short-term health plans do not meet the standards for "minimum essential coverage" (MEC), as defined by the Affordable Care Act (ACA). While the federal tax penalty for not having MEC was zeroed out to $0 in 2019, this is still a critical detail for one big reason.

Losing your short-term health plan when it ends does not count as a "Qualifying Life Event." That means it won’t trigger a Special Enrollment Period, which is what lets you buy an ACA plan outside of the normal Open Enrollment window. You'll have to wait for the next Open Enrollment period unless something else happens, like getting married or losing your job.

Ready to see just how affordable temporary coverage can be? At My Policy Quote, we make it simple to compare plans and find the right fit for your needs and budget.