So, what exactly is group health insurance? Think of it like a healthcare "bulk buying club" for your company. Instead of every employee fending for themselves in the individual market, your business brings everyone together into one large pool. This gives you the power to negotiate better rates and more comprehensive benefits for the whole team.

It’s a single policy, bought by you—the employer—and offered to all your eligible employees and even their families.

Understanding the Power of Group Coverage

At its heart, group health insurance runs on a simple but powerful idea: risk pooling.

For an insurer, guessing the healthcare needs of just one person is a huge gamble. But when they cover a whole group of people—some who are perfectly healthy, and others who might need more care—that risk gets spread out. It becomes much more predictable and a lot easier to manage.

This predictability is the secret sauce. It’s what allows insurance carriers to offer lower monthly premiums and richer benefits than what most people could ever find on their own. For you, the employer, this transforms into a game-changing tool for attracting and keeping the best people in a competitive world.

How It Works in Practice

Getting a group plan up and running is surprisingly straightforward. Here’s a quick look at the typical flow:

- You Choose the Plan: As the business owner or HR leader, you’ll work with a broker to pick a plan (or a few options) that fits your budget and meets your team's needs.

- Employees Enroll: During a set time called Open Enrollment, your team members can sign up, add their dependents, and choose their coverage for the year.

- Premiums Are Shared: The cost is typically split between you and your employee. Their portion is taken right out of their paycheck—often pre-tax, which saves them even more money.

This shared cost makes quality healthcare accessible and affordable. To really see the advantage, it’s worth comparing the key distinctions between individual vs group health insurance plans.

The real beauty of group coverage is stability. By spreading the risk, everyone is protected from the crushing costs of a major, unexpected medical event. It makes healthcare costs predictable for both your business and your employees.

Why Group Plans Are More Important Than Ever

Let’s be honest: a solid benefits package isn’t just a "nice-to-have" anymore. It's a core part of any smart business strategy.

The numbers don't lie. The global group health insurance market was valued at an incredible USD 3.11 trillion in 2025 and is on track to hit USD 5.87 trillion by 2032. This explosion is happening because companies everywhere are realizing that investing in employee wellness is the key to building loyal, productive teams.

The truth is simple: a healthy workforce is a productive workforce. When your employees know they have reliable access to care, they’re more focused, more engaged, and more likely to stick with you for the long haul.

To get a clearer picture of what this means for your team's day-to-day care, it's helpful to review a list of accepted insurance providers. This helps everyone understand which doctors and hospitals are in-network, making the whole process smoother.

Qualifying for a Group Health Plan

Not just anyone can offer a group health insurance plan. Insurers have some ground rules to make sure the "group" is a real business, not just a handful of people trying to get a better deal on coverage. Getting a handle on these rules is the first step to figuring out if this is the right move for your company.

At its core, a "group" needs to be a legitimate business entity—think LLC, S-Corp, C-Corp, or a partnership. Insurers want to see a genuine employer-employee relationship. This prevents random individuals from teaming up just for insurance, which could throw off the risk calculations for everyone.

What about sole proprietors? You can sometimes get in on the action, but you’ll almost always need at least one W-2 employee (who isn't your spouse) to officially form a group.

Small Groups vs. Large Groups

One of the biggest factors that will shape your insurance journey is your company's size. There’s a major dividing line between small and large employers, and it changes everything from your plan options and pricing to your legal responsibilities.

-

Small Groups: These are typically businesses with 2 to 50 full-time equivalent (FTE) employees. The plans are often "community-rated," which is a fancy way of saying your premiums are based on the general risk pool in your area (factoring in age and location), not on how healthy or sick your specific team is.

-

Large Groups: Once you hit 51 or more FTEs, you're in the big leagues. These plans are medically underwritten. This means the insurer will take a close look at your employees' past health claims to calculate your premium. For large groups, understanding what is underwriting in insurance is critical, as it has a direct impact on your bottom line.

This split is a big deal. Small businesses usually get simpler, more standardized plans, while larger companies have more room to negotiate but also deal with more complex pricing.

Meeting Participation Requirements

You can't just offer a plan; you need people to actually sign up for it. Insurers have what's called a minimum participation requirement, which means a certain percentage of your eligible employees have to enroll.

Why? It’s all about balance. This rule ensures you get a healthy mix of people—not just those who know they have big medical bills coming. This prevents a problem called "adverse selection." A common benchmark is that 70% of your eligible employees must enroll.

But there's a helpful exception: valid waivers. If an employee is already covered by a spouse's plan, their parent's plan, or something like Medicare, they can officially "waive" your coverage. The best part? These waivers usually don't count against you in that 70% calculation.

Let's say you have 10 eligible employees, but three of them are already covered elsewhere and sign a waiver. The insurer might only look at the remaining seven employees. You’d just need 70% of those seven to sign up. This little rule makes it much easier for small businesses to clear the hurdle and offer a fantastic group health insurance benefit.

Comparing The Most Common Plan Types

Trying to pick a group health insurance plan can feel like staring at a menu full of acronyms. HMO, PPO, EPO, POS… it’s enough to make your head spin. But here’s the secret: forget the jargon for a minute. The only things that really matter are cost, flexibility, and how your team gets to see a doctor.

Think of it like choosing a cell phone plan. Some plans are pricey but give you unlimited data and service anywhere. Others are a great deal, as long as you don’t leave their specific coverage area. Health plans work the same way, each one striking a different balance between network freedom and cost.

HMOs: Health Maintenance Organizations

A Health Maintenance Organization (HMO) is all about keeping things simple and affordable. It's built around a specific network of doctors and hospitals that have agreed to provide care at a lower cost. This structure is perfect for employers focused on keeping premiums down.

With an HMO, each employee picks a Primary Care Physician (PCP) from the network. That doctor becomes their go-to for everything, from annual checkups to managing ongoing health needs. If they need to see a specialist, like a dermatologist, they have to get a referral from their PCP first.

The whole idea behind an HMO is coordinated care. By having a PCP manage everything, the plan makes sure specialist visits are truly necessary, which helps control costs for the whole group.

The trade-off here is the network. HMOs generally don't cover any care outside their network, unless it's a true life-or-death emergency. It's a great fit for employees who want lower monthly costs and are happy to have a dedicated doctor guiding their healthcare journey.

PPOs: Preferred Provider Organizations

On the flip side, you have the Preferred Provider Organization (PPO). Just like the name implies, PPOs are all about flexibility, which is a huge plus for many employees. A PPO has a network of "preferred" doctors, but it also lets members see providers both inside and outside that network.

Here’s how that works:

- In-Network Care: Sticking with doctors inside the PPO network means lower out-of-pocket costs, like smaller copays.

- Out-of-Network Care: Employees can still see a doctor outside the network, but the plan covers less, leaving them with a bigger bill.

PPOs don't require a PCP, and you don't need referrals to see a specialist. That freedom usually comes with higher monthly premiums than an HMO. For a deeper dive, check out our guide on the differences between PPO and HMO plans.

The Hybrids: EPO and POS Plans

What if you want something in between? That's where two hybrid models come in: Exclusive Provider Organizations (EPOs) and Point of Service (POS) plans.

An Exclusive Provider Organization (EPO) is like a PPO because it doesn't require a PCP or referrals. But it’s like an HMO because it offers no coverage for out-of-network care (except for emergencies). It’s a solid middle-ground for people who want to go straight to a specialist but will stay in-network to keep costs down.

A Point of Service (POS) plan mixes features from both worlds. Like an HMO, members need a PCP and must get referrals. But like a PPO, it lets them go out-of-network for care, though they'll pay a lot more for it. This gives employees a safety net if they ever really need to see a specific out-of-network doctor.

Comparing Common Group Health Plan Types

To make it even clearer, here’s a quick side-by-side look at how these four main plan types stack up against each other. Each one is designed for a different set of priorities.

| Plan Type | Primary Care Physician (PCP) Required | Referrals Needed for Specialists | Out-of-Network Coverage | Best For |

|---|---|---|---|---|

| HMO | Yes | Yes | No (except emergencies) | Cost-conscious groups who prefer coordinated care. |

| PPO | No | No | Yes (at a higher cost) | Maximum flexibility and choice of doctors. |

| EPO | No | No | No (except emergencies) | Those who want direct specialist access but will stay in-network. |

| POS | Yes | Yes | Yes (at a higher cost) | A blend of HMO structure with PPO-like flexibility. |

Ultimately, the "best" plan depends entirely on what your team values most—whether that’s the lowest possible premium, the freedom to choose any doctor, or something in between.

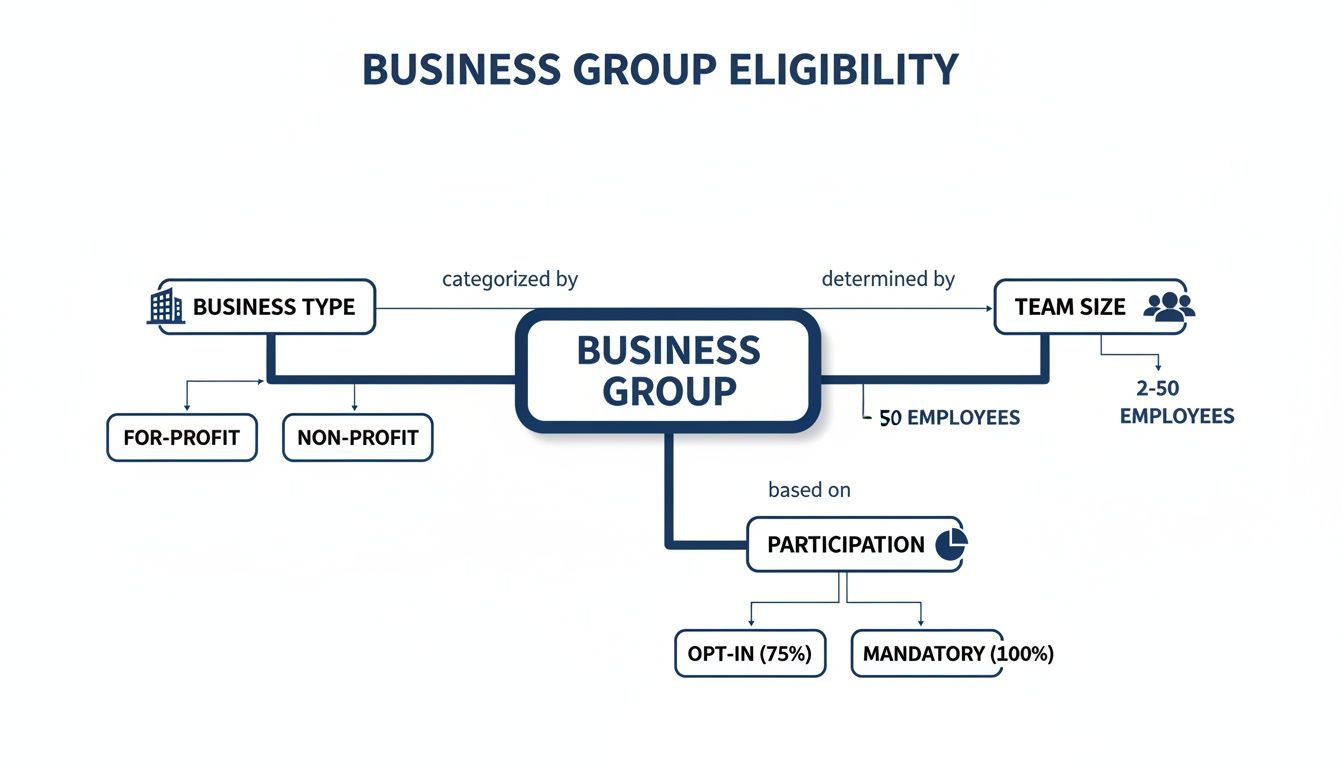

This flowchart walks through the key factors—like your business type, team size, and employee participation—that decide if your company can get group health insurance in the first place.

Making sure you’re eligible is the first step. Once that’s handled, you can confidently choose the plan type that truly fits your company’s needs and budget.

Breaking Down the True Costs for Your Business

Let’s get right to the big question on every employer’s mind: what is this actually going to cost? There’s no simple, one-size-fits-all price tag, but understanding what goes into your premium is the first step toward building a benefits plan that works for your budget and your team.

Think of it this way: insurers don't just pull a number out of thin air. They’re essentially calculating risk based on a handful of key factors unique to your business.

Key Factors That Drive Your Premiums

Your monthly premium is a blend of a few core elements. Each one gives the insurance carrier a clearer picture of your team’s potential healthcare needs.

- Average Age of Employees: This is a big one. A younger workforce generally has fewer health issues, which often translates to lower premiums. On the flip side, a more experienced team may have more healthcare needs, which can drive costs up.

- Location (Geographic Rating Area): Healthcare costs are not the same everywhere. A business in a major city will almost always pay more for the exact same plan than a company in a more rural area.

- Industry and Occupation: The kind of work you do matters. An office-based tech company has a very different risk profile—and likely lower premiums—than a construction firm where the potential for on-the-job injuries is higher.

- Plan Design: The richness of the benefits you choose has a direct impact on cost. A flexible PPO plan will cost more than a structured HMO. In the same way, plans with low deductibles and copays come with higher monthly premiums.

These pieces come together to create your company's unique financial picture. Knowing them helps you see where you have some control and where market forces are in charge.

The Dynamics of Cost-Sharing

Once the total premium is set, the next big decision is how to split the bill. This is cost-sharing—the agreement on how much the company pays versus how much the employee contributes from their paycheck.

This isn’t just a numbers game; it’s a strategic choice that impacts your budget and your ability to hire top talent. Most companies go with a fixed-percentage split, with the employer covering anywhere from 50% to 80% of the employee's premium. In fact, many states require a minimum employer contribution, usually 50%, just to qualify for a small group plan.

Your contribution strategy sends a powerful message. A generous split shows you’re invested in your team’s well-being and can easily be the deciding factor for a candidate choosing between two job offers.

To make benefits even more accessible, many employers also offer tax-advantaged accounts that help employees cover out-of-pocket costs. You can explore our guide to HSAs and HRAs to see how these powerful tools supplement a core health plan.

Smart financial planning is more critical than ever. Medical costs are on the rise, with insurers globally forecasting an average increase of 10.4% in 2025. Here in North America, the trend is moving from 8.1% in 2024 to a projected 8.7% in 2025. With 64% of insurers expecting this upward climb to continue, a thoughtful cost-sharing strategy is key to long-term success. You can learn more about the 2025 global medical trends and their impact on group health insurance.

Navigating the Rules of the Road: Legal & Compliance

The world of group health insurance has its own set of rules, and they’re there for a good reason—to protect both you and your team. It can feel like a lot of legal jargon at first, but think of these regulations less like roadblocks and more like guardrails. They keep the system running fairly and smoothly for everyone.

At the heart of it all is the Affordable Care Act (ACA). This piece of legislation changed the game for health coverage in the U.S., and one of its biggest impacts on businesses is the employer mandate.

The ACA Employer Mandate: What You Need to Know

This rule, officially called the Employer Shared Responsibility Provision, really only kicks in for Applicable Large Employers (ALEs). So, who’s an ALE? It’s any business that had an average of at least 50 full-time equivalent (FTE) employees during the last calendar year.

If that’s you, the ACA requires you to offer affordable health coverage that provides "minimum value" to your full-time staff and their kids. If you don't, you could face some pretty hefty penalties from the IRS. It's the government's way of making sure larger companies do their part in keeping the workforce healthy.

The ACA also created something incredibly helpful for smaller businesses: the Small Business Health Options Program (SHOP) Marketplace. It's a platform built specifically to help companies with 1-50 employees easily compare and buy group health plans.

What Happens When an Employee Leaves? Understanding COBRA

Life happens. Employees move on, change careers, or reduce their hours. That’s where COBRA steps in. The Consolidated Omnibus Budget Reconciliation Act is a federal law that gives employees the right to keep their group health coverage for a limited time after they leave.

It’s triggered by specific "qualifying events," such as:

- Losing a job, whether it was voluntary or not (as long as it wasn't for "gross misconduct").

- Having hours cut to the point where they no longer qualify for benefits.

- Life events like divorce or the death of the covered employee, which allows a spouse or dependent to stay on the plan.

Under COBRA, the former employee is on the hook for the full premium, plus a small administrative fee (up to 2%). It's definitely not cheap, but it’s a crucial safety net that prevents a dangerous gap in coverage during a major life change. This rule generally applies to employers with 20 or more employees.

The Foundation of It All: A Quick Look at ERISA

Finally, there’s the Employee Retirement Income Security Act (ERISA). Don't let the name fool you—it’s not just about retirement plans. This is a massive federal law that governs nearly all private-sector employee benefits, including your group health plan.

ERISA doesn't say you have to offer health insurance. But if you do, it sets the ground rules. It requires you to be transparent with employees about their plan, establishes who is responsible for managing it, and gives your team the right to sue if benefits are unfairly denied. It's the law that holds everything together with trust and accountability.

How to Implement Your First Group Health Plan

Making the call to offer group health insurance is a huge milestone. Now it's time to turn that decision into a real, working plan for your team. This is where your strategy meets reality. The whole thing breaks down into a few clear, manageable steps that will get you from idea to launch without the headaches.

It all starts with one key document: the employee census. Think of it as the blueprint for your entire plan. It’s a simple, confidential list of your eligible employees, with their date of birth, gender, zip code, and whether they plan to cover family members. Insurers use this info to figure out your group's risk profile and give you an accurate quote.

Once your census is ready, you'll want to find the right partner to help you shop the market. This is where an experienced insurance broker comes in. A great broker does more than just pull prices—they’ll dig into your census, understand your budget, and help you compare different carriers in a true apples-to-apples way.

Building Your Implementation Roadmap

After you and your broker have picked the perfect plan, the next step is planning a smooth rollout. A well-organized launch is everything. It prevents confusion and makes sure your team truly understands and values this new perk. A clear timeline is your best friend here.

Your roadmap should map out key dates for things like:

- Getting all the final paperwork signed with the insurance company.

- Creating easy-to-understand materials for your employees.

- Deciding on your open enrollment period—the specific window for sign-ups.

- The official plan start date when everyone’s coverage finally kicks in.

Don’t be shy with communication. Your goal is to answer questions before your employees even have to ask. Prepare simple guides that explain the plan options, costs, and key terms like "deductible" and "copay" in plain language.

Executing a Seamless Open Enrollment

Open enrollment is the main event. It's the one- or two-week period when your employees officially choose their plan and add their families. To pull it off, schedule a team meeting (or a webinar) where you and your broker can walk everyone through the options and answer questions live.

The goal is clarity and confidence. The more your employees understand their new benefits, the more valuable the plan becomes. A smooth enrollment process sets a positive tone for the entire year of coverage.

Remember, affordability is a huge deal for your team. In the U.S., average annual premiums for employer-sponsored plans hit $9,325 for single coverage in 2025. We're also seeing a big shift toward high-deductible plans—a full 34% of covered employees now have deductibles of $2,000 or more. This is especially true for small businesses, where 53% of workers are in these types of plans. This makes communicating costs clearly absolutely essential.

As you plan your implementation, you might also want to look into some employee wellness program ideas to get the most out of your new benefits package. Adding wellness initiatives can make your entire offering feel more complete.

From there, you just need to submit the final enrollment forms to the carrier and celebrate launching your company's new benefits

Frequently Asked Questions

Even after you've got the basics down, a few "what if" questions always pop up right when you're about to make a decision. Let's tackle some of the most common scenarios business owners face. Think of this as clearing up the final details so you can move forward with total confidence.

Can I Offer Coverage to Part-Time Employees?

Yes, you absolutely can, and it's a fantastic way to attract and keep great people. Legally, the Affordable Care Act (ACA) generally requires you to offer coverage only to full-time employees—those working 30 or more hours per week.

But you're free to go above and beyond that. If you decide to extend benefits to your part-time staff, the key is to be consistent. Offer it to all of them to avoid any hints of discrimination. Just remember to account for the extra cost in your budget, as adding more people will naturally increase your total premium.

What Happens if My Team Size Drops?

This is a huge concern for small businesses, where one or two people leaving can feel like a major shift. Insurers often have a minimum participation rule, which usually requires that around 70% of your eligible employees enroll in the plan. If you dip below that, you could risk losing your plan when it comes time for renewal.

But don't panic. Insurance carriers would much rather keep you as a customer than drop you. If you know your headcount is about to change, the best thing you can do is talk to your broker right away. They can help you explore your options, which might be as simple as finding a new plan better suited for your new team size.

Losing your group plan isn’t an automatic switch that gets flipped. Proactive communication is everything. Carriers want to work with you to find a solution.

How Does Offering Health Insurance Affect My Business Taxes?

This is where the good news really kicks in. Offering health insurance comes with some powerful tax advantages that make it far more affordable than the sticker price suggests.

For your business, every dollar you spend on premiums is generally 100% tax-deductible. It's a standard business expense that directly lowers your company's taxable income. Simple as that.

For smaller businesses, it gets even better. If you have fewer than 25 full-time employees, you might qualify for the Small Business Health Care Tax Credit. This credit, which you can access through the SHOP Marketplace, can cover up to 50% of the premiums you pay. That's a massive financial lift.

And for your employees? Their contribution is usually paid with pre-tax dollars, which lowers their personal taxable income and increases their take-home pay. It’s a true win-win that makes your compensation package incredibly valuable.

Figuring out all the little details of group health insurance can feel like a lot, but you don't have to sort through it by yourself. The experts at My Policy Quote are here to give you clear, straightforward advice and find the perfect fit for your business and your team.

Ready to see your options? Get a no-obligation quote today.