When you're trying to figure out the difference between a PPO and an HMO, it really boils down to a classic trade-off: flexibility versus cost.

Think of it this way: PPOs give you more freedom to choose your doctors, but that freedom comes with a higher price tag. On the other hand, HMOs offer lower monthly payments, but you have to play by their rules, which means staying within a specific network of doctors. The right choice for you depends entirely on what you value more—the ability to see any specialist you want or the comfort of a predictable, lower monthly bill.

Understanding PPO vs HMO Health Plans

Choosing between a PPO (Preferred Provider Organization) and an HMO (Health Maintenance Organization) is one of the biggest decisions you'll make with your health coverage. These two plan types are built on completely different philosophies, and that affects everything from your budget to how you get an appointment with a specialist. Getting a handle on these differences is the first real step to finding a plan that actually fits your life.

The numbers show a clear trend. A recent KFF Employer Health Benefits Survey found that 46% of workers with health coverage choose PPOs. In contrast, only 12% are in HMOs. This tells us that many people are willing to pay more for flexibility. You can dig into the complete 2025 KFF survey on employer health benefits to see the full breakdown.

Quick Comparison PPO vs HMO

To make this simple, let's just lay it all out. This quick table highlights the core differences so you can see, at a glance, which plan style might be a better match for your needs and your wallet. If you want to go even deeper, you can also explore the main differences between a PPO and an HMO.

| Feature | PPO (Preferred Provider Organization) | HMO (Health Maintenance Organization) |

|---|---|---|

| Primary Care Physician (PCP) | Optional. You can go straight to any doctor or specialist you want. | Required. Your PCP is your main point of contact and manages all your care. |

| Specialist Referrals | Not needed. You can book an appointment with a specialist directly. | Required. You need a referral from your PCP before you can see a specialist. |

| Out-of-Network Coverage | Yes. You can see providers outside the network, but you'll pay more for it. | No. Except for true emergencies, there's no coverage for out-of-network care. |

| Cost Structure | Higher monthly premiums and often higher deductibles. | Lower monthly premiums and usually lower out-of-pocket costs for care. |

So, what does this all mean? With a PPO, you're buying freedom. With an HMO, you're buying simplicity and cost savings. Neither is automatically "better"—it's all about what works for you and your family.

How PPO and HMO Networks Actually Work

Okay, so we've covered the definitions. But the real story of PPO vs. HMO isn't in the acronyms—it's in how you actually use the plan when you need care. The network structure is what dictates your entire healthcare experience, from a simple checkup to seeing a specialist for a serious concern.

With an HMO, everything revolves around your Primary Care Physician (PCP). Think of this doctor as your trusted quarterback. They’re not just for annual physicals; they coordinate every aspect of your care, acting as a gatekeeper to ensure you get the right treatment.

Navigating the HMO System

Let's say you develop a skin condition that just won't go away. If you have an HMO, your first call is always to your designated PCP. They'll take a look, and if they agree you need more specialized care, they will write you a referral to see a dermatologist who is in their network.

Without that official referral, your visit to the specialist won't be covered by the HMO. It's a structured system, but it's designed that way to manage care and keep costs down by making sure everything is coordinated. This PCP-first model is also a key feature of Point of Service (POS) plans, which you can learn more about in our guide on what POS means in health insurance.

The Freedom of a PPO Network

A PPO, on the other hand, puts you firmly in control. In that same scenario, you could research dermatologists in your plan's network and book an appointment yourself. No need to see your PCP first, no referral required. You just go.

This direct-access approach is a game-changer for people who value flexibility. And it gets better. If you discover the absolute best dermatologist for your condition is out-of-network, a PPO will still help cover the cost, though you'll pay a bigger share. With an HMO, you're generally on your own for out-of-network care unless it's a true life-or-death emergency.

With an HMO, your PCP guides your care journey. With a PPO, you are in the driver's seat.

This fundamental difference also shows up in the size of the networks themselves. PPO networks are almost always larger and spread out over a wider geographic area than HMO networks. This makes them a great fit if you travel a lot or have family members, like a kid away at college, who need reliable access to in-network doctors in another state.

Breaking Down the True Cost of Your Health Plan

When you’re staring at a PPO and an HMO side-by-side, it’s tempting to let the monthly premium be the deciding factor. It’s a fixed, predictable number you can plug into your budget. But that number is just the tip of the iceberg.

The real cost of your health plan is a mix of four different financial pieces that all come into play throughout the year. Getting a handle on these is the secret to avoiding those gut-wrenching surprise bills later on.

The Four Pillars of Health Insurance Costs

Your total annual healthcare spending really boils down to how these four factors work together:

- Premium: This is your non-negotiable monthly payment to keep your coverage active. HMOs usually win on this front with lower premiums, which is a big draw if you’re focused on predictable monthly expenses.

- Deductible: This is the amount you have to pay out-of-pocket for covered services before your insurance company starts chipping in. Many HMOs are known for having low or even $0 deductibles for in-network care.

- Copayments & Coinsurance: Think of these as your share of the cost for each doctor’s visit or medical service after you’ve met your deductible. A copay is a set fee (like $30 for a check-up), while coinsurance is a percentage of the final bill (you might pay 20%, for example).

- Out-of-Pocket Maximum: This one is a lifesaver. It’s the absolute most you’ll have to pay for covered services in a single year. Once you hit that number, your insurance takes over and pays 100% of covered costs.

The whole PPO vs. HMO cost debate really lives in the interplay between these elements. An HMO might look cheaper month-to-month, but a PPO could save you a fortune if you end up needing an out-of-network specialist. For a closer look at these terms, check out our guide on understanding deductibles and copays.

The cheapest plan isn't always the one with the lowest premium. It's the one that best matches your expected medical needs to its overall cost structure.

PPO vs. HMO: A Real-World Cost Scenario

The numbers don't lie—people are willing to pay for choice. In the massive $1.41 trillion U.S. group health insurance market, PPOs are the clear favorite, holding 49.46% of the revenue share. HMOs have a respectable 25.8% share, but it shows that while cost is a major concern, the flexibility of a PPO often wins out. You can dig into these market trends on GlobeNewswire for more details.

So, how does this actually play out for a family? Let's run the numbers with a hypothetical scenario.

Hypothetical Annual Healthcare Cost Scenarios

Here’s a look at the potential annual costs for a family with moderate healthcare needs, comparing a typical PPO with a typical HMO.

| Cost Component | Example PPO Plan | Example HMO Plan |

|---|---|---|

| Annual Premium | $12,000 ($1,000/mo) | $8,400 ($700/mo) |

| Deductible | $3,000 (Family) | $1,000 (Family) |

| Specialist Visits (6) | $300 (6 x $50 copay) | $240 (6 x $40 copay) |

| Out-of-Network Visit (1) | $400 (after deductible) | Not Covered ($1,000) |

| Total Annual Cost | $15,700 | $10,640 |

As you can see, if this family sticks to their network like glue, the HMO is the hands-down winner, saving them thousands. But all it takes is one critical visit to an out-of-network doctor to flip the script, making the "more expensive" PPO the better financial choice.

This is the classic trade-off in action: guaranteed savings versus the freedom to choose.

Matching a Health Plan to Your Life Stage

The HMO versus PPO debate isn't just a list of features—it’s about how your plan fits into your real life, right now. The best choice almost always comes down to your current situation. Think about your career, your family, and what you need to stay healthy.

Looking at a few common scenarios makes it much clearer how these plans actually work for different people.

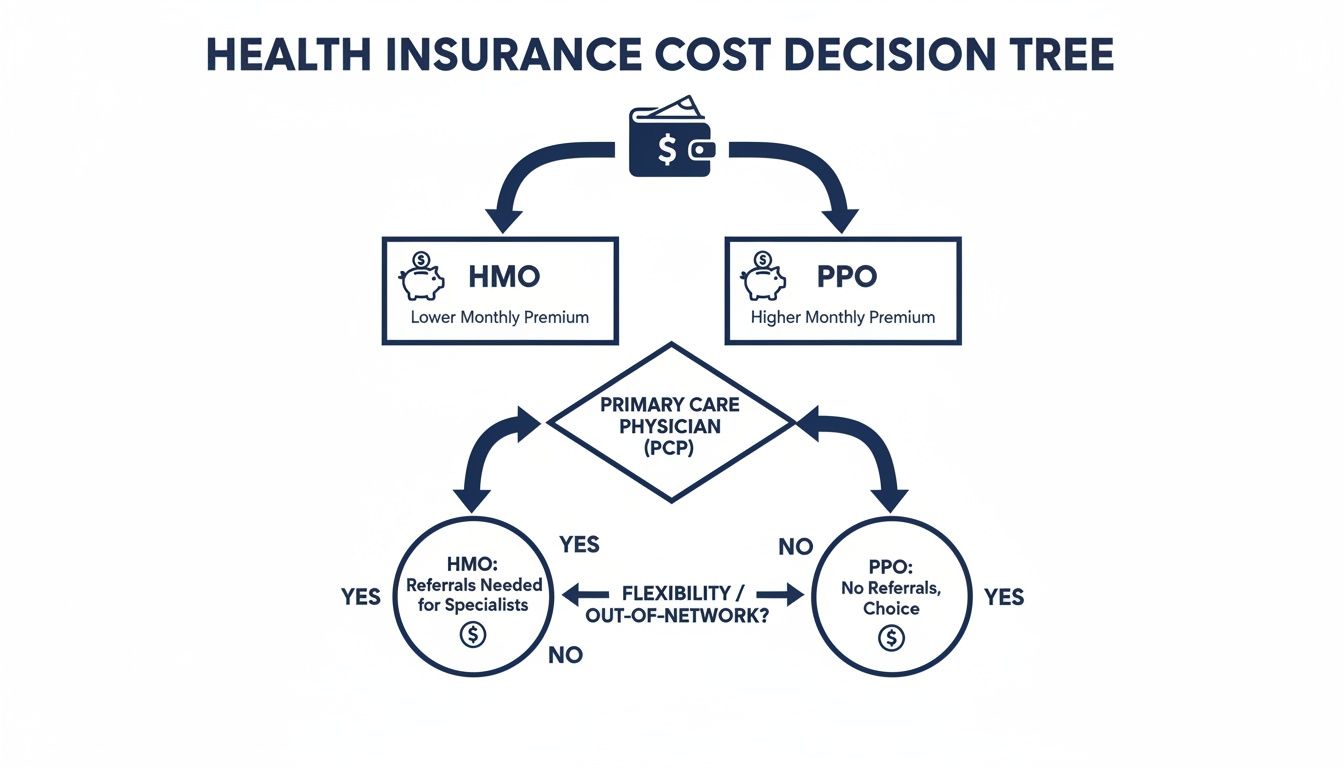

This simple decision tree breaks down the core choice: do you prioritize lower monthly costs or greater flexibility?

It really boils down to that financial trade-off. HMOs start with lower premiums, which is great for your budget. PPOs ask for more upfront but give you that freedom to choose.

For the Self-Employed Professional

When you're self-employed, your budget is everything. An HMO can be a lifesaver with its predictable, lower monthly premiums. It makes financial planning so much simpler when your income isn't always the same month to month.

But what if your work has you traveling all the time? Or you need to see a specialist without waiting? That’s where a PPO becomes invaluable. The freedom to see providers out-of-state without a referral is a game-changer for anyone who lives on the road.

- Best Fit: For professionals who travel, a PPO is usually the smarter choice. The higher premium is a small price to pay for the freedom to get care wherever you are, without stressing over network rules.

For the Young Family with Kids

For a growing family, healthcare costs can pile up fast. An HMO looks incredibly attractive with its lower premiums and predictable copays for all those pediatrician check-ups and surprise fevers. Having one primary care physician (PCP) coordinating everything can also make life a lot simpler.

The other side of the coin is specialist access. If your child needs to see a pediatric allergist or cardiologist, a PPO lets you skip the referral line and go straight to the doctor you choose—even one who isn’t in a smaller HMO network.

For families, it’s a delicate balance. You have the HMO's budget-friendly approach for everyday care versus the PPO's direct line to specialized pediatric care the moment you need it.

Even with the PPO’s flexibility, don’t count HMOs out. They still hold a massive 61.9% of the market share with 3,518 different plans available. Insurers just added 453 new HMOs—a 12% jump in one year—showing this cost-effective model is here to stay. Our guide on health insurance for young adults has more on this.

For Early Retirees and Parents of College Students

As you get closer to retirement, your health needs often become more complex. You might be managing chronic conditions or just planning for the future. Looking into dedicated health plans for those over 50 is a great way to find coverage that’s built for this stage of life.

An HMO can work beautifully for managing long-term conditions, especially if all your trusted doctors are already in the network. The coordinated care keeps everything organized under one roof.

However, a PPO is practically a necessity for two groups:

- Parents with a kid in college out-of-state: A PPO’s national network means your student can get in-network care near campus instead of flying home sick.

- Early retirees who travel or "snowbird": If you spend winters down south, a PPO gives you consistent, in-network coverage in both places. No gaps, no worries.

- Best Fit: A PPO is the undeniable winner for anyone whose life spans multiple states. Whether it's for college, retirement travel, or seeing specialists in different cities, that out-of-network benefit is the ultimate safety net.

Untangling the Biggest Myths About PPO and HMO Plans

Bad advice about health insurance can cost you. Big time. When you’re staring at PPO and HMO options, it’s easy to fall for old myths or just plain wrong information.

Let’s cut through the noise and get to the truth, so your choice is based on facts, not fear.

A huge one? The idea that HMOs offer second-rate medical care compared to PPOs. That's just not how it works. The quality of your care comes from your doctors and hospitals, not the logo on your insurance card. Both HMO and PPO networks are filled with top-tier, board-certified professionals.

The real difference is the roadmap you follow to get that care. An HMO coordinates everything through your primary care doctor, which can actually be a huge plus if you’re managing a long-term condition and need that steady guidance.

Myth 1: “PPOs Let You Go Anywhere and Cover Everything.”

This is a dangerous one. While PPOs are known for their out-of-network flexibility, it’s not a free-for-all. Think of it less as a VIP pass and more as an emergency exit.

Going out-of-network means you’ll face a completely separate—and much higher—deductible. On top of that, your coinsurance (the percentage you pay) will be significantly larger.

But here’s the kicker: PPOs only pay a portion of what they consider a “usual and customary” rate for a service. If your out-of-network doctor charges more than that rate, you are on the hook for 100% of the difference. This is called balance billing, and it’s how people end up with shockingly large medical bills they never saw coming.

The out-of-network benefit on a PPO is a safety net, not a blank check. It’s there for when you absolutely need it, but it’s designed to be expensive to encourage you to stay in-network.

Myth 2: “HMOs Give You Zero Choice.”

This myth makes HMOs sound like a prison sentence for your health. The reality is much different. You still have plenty of control—it's just more structured.

You get to pick your own Primary Care Physician (PCP) from a list of approved in-network doctors. This person isn’t a gatekeeper; they’re your partner and your first point of contact for all your health needs.

Need a specialist? Your PCP will refer you to one within the network, whether it’s a cardiologist, an allergist, or an orthopedist. You have access to a full team of experts—you just navigate it with your PCP’s help. This teamwork approach is what allows HMOs to keep their premiums more affordable.

And let’s clear up a critical misconception about emergencies. Federal law requires all plans, HMOs included, to cover emergency care at any hospital in the country, period. It doesn’t matter if it’s in-network or not. If it’s a true emergency, you’re covered. You should never, ever hesitate to get help because you're worried about networks.

Your Action Plan for Choosing the Right Coverage

Theory is one thing, but making a real-world decision is what counts. Think of this as your personal checklist for navigating the PPO vs. HMO choice, whether you’re in open enrollment or shopping on the marketplace. It’s designed to cut through the noise and get you to a confident decision.

Let's walk through it, step by step.

1. Define Your Healthcare Dealbreakers

Before you even glance at a plan, you need to know what you can't live without. This is the most critical step—it grounds your search in reality, not just marketing brochures.

- List Your People: Write down every single doctor you see, from your primary care physician to specialists.

- Map Your Places: Note the hospitals and urgent care centers you trust and want to be able to use.

- Check the Network: Once you have a plan in your sights, use its online provider directory to see if everyone on your list is in-network. Seriously, don’t skip this.

A plan is only as good as the doctors it gives you access to. If your go-to cardiologist is out-of-network on an HMO, that plan probably isn't the right fit, no matter how low the premium is.

2. Get Real About Your Annual Healthcare Needs

Now, look ahead at the coming year. A good-faith estimate of how much you'll use your insurance is key to figuring out what a plan will actually cost you.

Think about your family's typical year. How many specialist visits, therapy sessions, or physical therapy appointments do you usually have? Are you planning for a minor surgery or maybe even a new baby? This kind of foresight helps you see past the sticker price (the premium) to the total cost.

Your health history is the best crystal ball you have. Don’t pick a plan based on a perfect, "nothing goes wrong" year. Plan for a real one.

3. Tally Up the Total Potential Cost

That monthly premium? It’s just the cover charge to get in the door. To truly compare a PPO and an HMO financially, you have to look at the whole picture.

- Start with the annual premium (just multiply the monthly cost by 12).

- Add the plan’s family deductible.

- Factor in your best guess for copayments or coinsurance for the year.

This number gives you a much more honest comparison. It's not uncommon for a low-premium HMO to end up costing more than a PPO over the course of a year if you have a lot of specialist visits with high copays.

4. Investigate Your Prescription Drugs

Finally, don't let medications be an afterthought. A plan’s prescription drug formulary—its official list of covered drugs—can make or break your budget.

For every single plan you’re considering, pull up its formulary and make sure your essential medications are on the list. Just as important is the drug's "tier," which determines what you'll pay. A drug on a low tier might be a $10 copay, but the same drug on a high tier could run you hundreds.

Choosing between an HMO and a PPO is a big deal for your health and your wallet. At My Policy Quote, we give you the clarity and tools to compare plans and find coverage that actually fits your life. Get your personalized health insurance quote today.