Ever tried to make sense of your health insurance paperwork? All that talk about premiums, deductibles, and HMOs can feel like learning a new language. You’re definitely not alone.

Simply put, employer-sponsored health insurance is a health plan you get through your job. Your employer picks up a big chunk of the bill, making healthcare more affordable and easier to access for you. Think of it as a team effort to keep you covered.

Your Simple Guide To Workplace Health Insurance

For most of us, the road to health coverage runs straight through our workplace. It's the most common way people get insured in the United States, so getting a handle on the basics is your first step toward making smart healthcare choices for you and your family.

At its heart, this is a group health plan. Your company buys a plan and offers it to you and your colleagues as a benefit. The biggest win here is cost-sharing.

Because the company is buying for a large group, insurance carriers offer much better rates than you could ever find on your own. Your employer pays a large portion of the monthly insurance bill (the premium), and your share is just taken out of your paycheck. Easy.

The Foundation of American Healthcare

This model is deeply woven into the American system. Employer-sponsored plans cover a massive 154 million people, making it the primary source of health coverage for most working-age Americans.

This system really took off after World War II. Back then, wage controls meant companies couldn't just offer more money to attract great workers, so they started offering beefed-up health benefits instead. It was a competitive edge, and it stuck.

That tradition is still alive and well today, with health insurance being a make-or-break factor for many people when they're looking at a job offer. While we're focused on health coverage, it's often just one piece of larger comprehensive employee benefits packages designed to bring in and keep top talent.

Think of it this way: Your employer is essentially buying health insurance in bulk. This group buying power doesn't just make your plan more affordable—it also simplifies the entire process for you.

To help you navigate all this, it’s useful to know the lingo. The terms can be confusing, so let’s quickly break down the most common ones you'll see.

Key Health Insurance Terms Explained

Here's a quick reference for the essential terms you'll encounter in your employer's health plan options.

| Term | What It Really Means |

|---|---|

| Premium | The fixed amount you pay every month to keep your insurance active. This is usually deducted from your paycheck. |

| Deductible | The amount you have to pay out-of-pocket for medical services before your insurance starts paying its share. |

| Copay | A flat fee you pay for certain services, like a doctor's visit or a prescription. For example, $25 per visit. |

| Coinsurance | The percentage of costs you pay for a covered health service after you've met your deductible. For example, you pay 20%, your plan pays 80%. |

| Out-of-Pocket Maximum | The absolute most you'll have to pay for covered services in a plan year. Once you hit this limit, your plan pays 100% of covered costs. |

Getting comfortable with these terms is the first step. Throughout this guide, we’ll dive deeper into the different types of plans (like HMOs and PPOs), explain how enrollment works, and give you the tools to pick a plan that actually fits your life. Our goal is to turn that confusion into confidence.

How You and Your Employer Share Healthcare Costs

Think of your health insurance bill as a team effort. You and your employer are in a financial partnership, working together to make healthcare affordable. Both of you chip in, just in different ways and at different times.

Let's break down how this cost-sharing really works.

The most obvious part of this partnership is the premium. To get the full picture, you need a solid understanding of health insurance premiums first. It’s basically a monthly subscription fee that keeps your plan active. Your employer pays a big chunk of this fee directly to the insurance company, while your smaller share is automatically taken out of your paycheck.

Premiums have been skyrocketing for years, with family coverage now averaging over $26,000 annually. The good news? Employers typically cover about 70-80% of that bill. Still, the portion workers have to pay has climbed steadily. This employer contribution is the main reason getting insurance through your job is usually much cheaper than buying a plan on your own. You can find more on these healthcare cost trends on deloitte.com.

The Costs You Pay When You Use Your Insurance

Once your plan is active, you’ll start to see your out-of-pocket costs. These are the expenses that pop up when you actually go to the doctor or get a prescription. They’re designed to be predictable, and they’re a core part of how insurance works.

First up is the deductible. This is a specific amount of money you have to pay for covered medical services before your insurance starts kicking in. For example, if you have a $1,500 deductible, you're on the hook for the first $1,500 of your healthcare bills for the year. Simple, routine visits often skip the deductible, but bigger procedures almost always count toward it.

After you hit your deductible, you’ll usually share costs in two other ways:

- Copayments (Copays): A flat, fixed fee you pay for a specific service. Think of it as your entry ticket—maybe $30 for a primary care visit or $50 to see a specialist.

- Coinsurance: This is a percentage of the bill you pay after your deductible is met. If your plan has 20% coinsurance, you pay 20% of the cost, and the insurance company handles the other 80%.

Getting a handle on these terms is key to budgeting for your health. To dive deeper, check out our guide on deductibles and copays for a clearer explanation.

Your Financial Safety Net

All these out-of-pocket costs might sound a little scary, but every plan has a built-in safety feature: the out-of-pocket maximum. This is the absolute most you will ever have to pay for covered medical care in a single year.

This annual cap is your ultimate financial backstop. Once you hit your out-of-pocket maximum—by paying your deductible, copays, and coinsurance—your insurance plan pays 100% of the costs for all covered services for the rest of that year.

This limit is what prevents a major accident or illness from turning into a financial catastrophe. It gives you incredible peace of mind, because you know there’s a firm ceiling on what you might have to spend. Knowing this number helps you see your worst-case financial scenario and appreciate the true value of your benefits.

Choosing The Right Type Of Health Plan

Once you've got a handle on how the costs are split, the next puzzle is figuring out the alphabet soup of health plans: HMO, PPO, HDHP. Most employers will offer a few choices, and the "best" one isn't about a universal winner—it's about finding the best fit for you.

It all comes down to your personal needs, your budget, and how you like to get your medical care. Each plan strikes a different balance between what you pay, how much freedom you have, and which doctors you can see. Let's break down the big three you’ll likely run into.

HMO Health Maintenance Organization

Think of a Health Maintenance Organization (HMO) as having a dedicated team captain for your health—your Primary Care Physician (PCP). Your PCP is your go-to for everything and acts as the gatekeeper for any specialized care you might need.

With an HMO, you stick to a specific network of doctors, hospitals, and specialists. Need to see a cardiologist or a dermatologist? You’ll need a referral from your PCP first. The trade-off for this more structured system is usually cost. HMOs often come with lower monthly premiums and more predictable expenses when you need care.

- Best for: People and families who want to keep costs down and are comfortable having a PCP coordinate their care.

- Keep in mind: If you go outside the network for care, it's generally not covered, except in a true emergency.

PPO Preferred Provider Organization

A Preferred Provider Organization (PPO) is all about flexibility. You don’t have to pick a PCP, and you can see specialists whenever you want without asking for a referral. For anyone who wants more direct control over their healthcare, this freedom is a huge plus.

PPOs have a network of "preferred" providers, and you’ll always pay less when you stay inside that network. But the key is, you have the option to see an out-of-network doctor. You’ll just pay a higher share of the bill. That flexibility, of course, comes at a price—PPOs typically have higher monthly premiums than HMOs.

To really see how these two stack up, check out our deep dive on the difference between HMO and PPO plans.

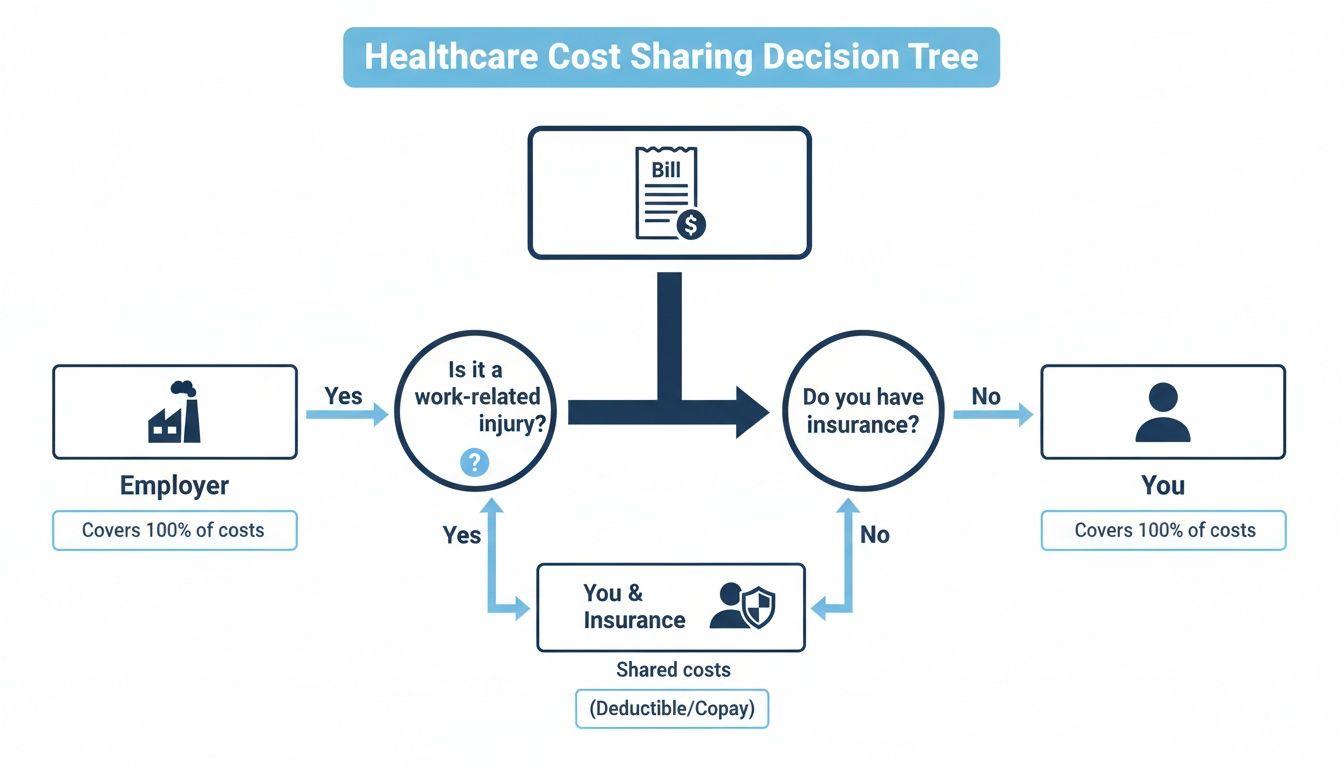

This chart gives you a quick visual on how those medical costs are typically shared.

As you can see, while your job covers most of the premium, you're responsible for things like deductibles and copays when you actually go to the doctor.

HDHP and HSA The Savings Duo

A High-Deductible Health Plan (HDHP) is just what it says on the tin: a plan with a higher deductible than you'd find in a traditional plan. In exchange for you taking on more of the initial financial risk, your monthly premium is much, much lower. This can be a brilliant financial move for people who are generally healthy and don’t see the doctor often.

But the real magic of an HDHP is its partnership with a Health Savings Account (HSA).

An HSA is a special savings account you can use for medical expenses, and it comes with a triple tax advantage you won't find anywhere else. The money you put in is pre-tax, it grows tax-free, and any withdrawals for qualified medical costs are also completely tax-free.

Many employers will even kick in some seed money to get your HSA started. Better yet, the funds in an HSA are yours to keep. Forever. They roll over every year and even come with you if you change jobs, becoming your own personal fund for healthcare.

This one-two punch makes an HDHP a powerful tool for managing today's costs and saving for tomorrow's. It's an active way to handle your healthcare finances that rewards smart planning.

HMO vs PPO vs HDHP A Practical Comparison

Feeling a little lost in the acronyms? This side-by-side look at the most common health plans can help you find your best fit.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | HDHP (High-Deductible Health Plan) |

|---|---|---|---|

| Monthly Premiums | Lowest | Highest | Lower |

| Network Rules | Must stay in-network (except emergencies) | In-network is cheaper, but out-of-network is an option | Flexible, similar to a PPO but with a high deductible |

| PCP Required? | Yes, you must choose a Primary Care Physician | No, not required | No, not required |

| Specialist Referrals | Yes, required from your PCP | No, you can self-refer | No, you can self-refer |

| Best For | Cost-conscious individuals who like coordinated care | People who want maximum flexibility and choice | Healthy individuals who want low premiums and tax savings |

| Key Feature | Low out-of-pocket costs and premiums | Freedom to see any provider | Pairs with a powerful, tax-free Health Savings Account (HSA) |

Ultimately, the right plan is the one that aligns with your life. Do you value low monthly payments over flexibility? Or is having the freedom to choose any doctor worth a higher premium? Answering those questions is the first step to making a confident choice.

When And How You Can Enroll In A Health Plan

Unlike a gym membership you can pick up on a whim, you can’t just sign up for your company’s health insurance whenever you feel like it. Enrollment is locked into very specific windows of time.

Getting the timing right is everything. Miss your chance, and you could be left without coverage when you need it most.

The Annual Open Enrollment Window

The main event for choosing your benefits is your company's annual Open Enrollment period. Think of it as your yearly opportunity to hit the refresh button on your healthcare.

For a few weeks every fall, all eligible employees get to choose a new health plan, adjust their current coverage, or add family members. This is your moment to review all the options and make a smart choice for the year ahead. Keep an eye out for emails from HR—missing this window means you'll likely have to wait a full year for another shot.

During open enrollment, you’re in the driver's seat. It's the perfect time to ask yourself some important questions. Did you get married? Is your family growing? Did your health needs shift? This is when you can switch from a PPO to an HMO, or maybe move to a high-deductible plan to get the benefits of a Health Savings Account (HSA).

Once you’ve made your choice, it’s locked in for the entire plan year, which usually runs from January 1st through December 31st. That’s why it’s so critical to choose with care. If you want to dive deeper, our complete guide on what open enrollment means has you covered.

When Life Changes Your Plans

But what happens if a major life event throws a wrench in your plans mid-year? You don’t have to wait. This is where a Qualifying Life Event (QLE) comes in.

A QLE opens up what’s called a Special Enrollment Period. It’s a brief window—typically 30 to 60 days—that allows you to make essential changes to your health plan outside of the usual schedule.

A Qualifying Life Event is a specific, defined change in your personal circumstances that allows you to enroll in or alter your health insurance outside of the standard open enrollment period. It's the system's way of ensuring you can adapt your coverage when life throws you a curveball.

These events are your ticket to making mid-year adjustments. Some of the most common QLEs include:

- Changes in Your Household: Getting married, having a baby, adopting a child, or getting divorced.

- Losing Other Health Coverage: Losing insurance from another job, turning 26 and aging off a parent's plan, or losing eligibility for Medicare or Medicaid.

- A Change in Where You Live: Moving to a new ZIP code or county where your current plan’s network isn’t available.

If you experience one of these events, you have to act fast. You’ll need to let your employer know and provide proof—like a marriage license or birth certificate—within the deadline. Understanding these rules is a huge part of knowing what employer-sponsored health insurance is and how to make it work for you.

Tax Advantages And Post-Employment Coverage

Your health plan’s value goes way beyond just doctor visits—it has a huge impact on your wallet. An employer-sponsored plan often comes with some serious tax benefits that can lower your costs, while federal law provides a safety net if you ever find yourself between jobs.

Getting a handle on these two things—the tax perks and your options after leaving a job—gives you the full financial picture. It’s about making your money work harder for you while you're employed and making sure you have a bridge to stay covered when you move on.

Maximizing Your Savings With Pre-Tax Dollars

One of the best financial perks of a workplace plan is paying for your premiums with pre-tax dollars. When your share of the cost is taken out of your paycheck before taxes are calculated, it actually lowers your total taxable income.

This means you’re not just buying insurance; you're also shrinking your tax bill, which puts more money back in your pocket. It’s like getting an automatic discount on your healthcare, something you just can't get when you buy a plan on your own.

Beyond the premiums, many employers also offer special savings accounts to help you cover out-of-pocket medical costs completely tax-free.

- Health Savings Account (HSA): If you have a High-Deductible Health Plan (HDHP), an HSA is a game-changer. It offers a triple tax advantage: your contributions are pre-tax, the money grows tax-free, and any withdrawals for qualified medical expenses are also tax-free.

- Flexible Spending Account (FSA): An FSA lets you set aside pre-tax money for predictable health expenses like copays, prescriptions, and dental work. It's a fantastic tool for budgeting what you’ll spend on healthcare for the year.

Think about it like this: these accounts let you use untaxed money for everything from a routine check-up to new glasses. Depending on your tax bracket, that’s like getting a 20-30% discount on healthcare.

Staying Covered After Leaving A Job With COBRA

So, what happens to your health insurance if you leave your job? Fortunately, a federal law called the Consolidated Omnibus Budget Reconciliation Act, or COBRA, provides a critical safety net.

COBRA gives you the right to continue the exact same health plan you had with your employer for a limited time, usually up to 18 months, after your job ends. It doesn't matter if you quit, were laid off, or had your hours cut. It’s designed to prevent a dangerous gap in your coverage while you figure out what’s next.

But there’s a catch: the cost. While you get to keep your group plan, you lose your employer's contribution. That means you're now responsible for paying 100% of the premium, plus a small administrative fee.

This can be a real sticker shock, so it’s important to weigh all your options. Losing your job is a Qualifying Life Event, which means you can also shop for a new plan on the ACA Health Insurance Marketplace. A key number to know is the ACA's affordability standard, which for an upcoming year is set at 9.96% of household income. If your COBRA premium costs more than that, you might qualify for subsidies on a marketplace plan. You can read more about these ACA affordability benchmarks on healthaffairs.org.

Exploring Your Options Beyond An Employer Plan

While a job-based health plan is a fantastic benefit, it’s not the only path to getting quality medical coverage. It's smart to understand all your options, whether you're a freelancer, between jobs, or just curious about what else is out there.

Employer plans are great because of group buying power and the fact that the company chips in a significant amount for your premiums. The trade-off? You often get limited choices, since your employer has already pre-selected the plans and networks available. When you step outside that system, a whole world of possibilities opens up.

The Health Insurance Marketplace

The most common alternative is the Health Insurance Marketplace, which you might also hear called the ACA Exchange. Think of it as a centralized online shop where you can compare and buy individual health plans from different insurance companies. This is the go-to resource for the self-employed, gig workers, and anyone whose job doesn’t offer affordable coverage.

One of the biggest advantages of the Marketplace is the financial help available. Based on your income and household size, you might qualify for:

- Premium Tax Credits: These are subsidies that directly lower your monthly premium payments, making your coverage much more affordable.

- Cost-Sharing Reductions: If your income is within a certain range, you can also get a plan that reduces your out-of-pocket costs, like deductibles and copays.

This financial support is designed to put individual coverage within reach, leveling the playing field for those without a traditional employer plan. If you find yourself in this situation, our guide on how to get health insurance with no job gives you practical next steps.

Other Avenues for Coverage

Beyond the Marketplace, a few other pathways exist, each serving different needs. It’s important to know about them so you can find the right fit for your specific situation.

First, you can always purchase a private health plan directly from an insurance company. This route gives you the widest selection of plans, but you won't be eligible for the premium tax credits you can get through the Marketplace. It's a solid option for people who don't qualify for subsidies but still want to shop for their own coverage.

Important Takeaway: The main difference between buying on the Marketplace and buying directly is access to financial help. The plans themselves are often identical, but only Marketplace enrollment can unlock government subsidies to lower your costs.

Finally, government-sponsored programs provide a crucial safety net for those who are eligible.

- Medicare: This is the federal health insurance program mainly for people aged 65 or older, as well as some younger people with disabilities. It’s the cornerstone of healthcare for most retirees.

- Medicaid: This program provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, and people with disabilities. The rules for who qualifies can vary quite a bit from state to state.

Knowing these alternatives gives you a complete map of your options. Whether you're navigating a career change, starting your own business, or planning for retirement, you can make an informed decision that gets the best possible coverage for you and your family.

Your Job-Based Insurance Questions, Answered

When you’re dealing with job-based health insurance, life can throw you a curveball. Unexpected changes bring up all sorts of questions. Let's walk through some of the most common situations you might run into, with clear, simple answers.

What Happens To My Health Insurance If I Quit My Job?

Leaving a job is a big step, and it's natural to wonder what happens to your coverage. Typically, your health insurance will end either on your last day or at the end of the month. But don’t worry—this kicks off a special enrollment window, giving you a couple of solid options to stay insured.

One path is COBRA. This federal program lets you keep your exact same health plan for up to 18 months. The catch? You have to cover the full premium yourself, including the part your old boss used to pay. It can get pricey, fast.

The other, often more affordable, option comes from losing your job being a Qualifying Life Event. This gives you a 60-day window to sign up for a new plan on the ACA Health Insurance Marketplace. You might even qualify for subsidies that make your monthly payments much more manageable than COBRA.

Can I Add My Spouse Or Children To My Plan?

Absolutely. Most companies let you cover your dependents on your plan. This usually includes your legal spouse and your children up to age 26—it doesn’t matter if they’re married, living at home, or financially independent.

You can add your family to your plan at specific times:

- Right when you start a new job and first enroll.

- During your company’s annual open enrollment period.

- After a Qualifying Life Event, like getting married, having a baby, or adopting a child.

Just keep in mind, adding family members will increase the premium deducted from your paycheck, since you'll be moving to a family plan.

Your ability to cover dependents is a core feature of most employer-sponsored health insurance plans. It's designed to provide a single, streamlined source of coverage for your entire household, simplifying how you manage your family's healthcare needs.

Is My Employer Legally Required To Offer Health Insurance?

This all comes down to the size of the company. Thanks to the Affordable Care Act (ACA), there’s a rule called the "employer mandate."

This rule says businesses with 50 or more full-time equivalent employees have to offer affordable, quality health coverage to their full-time team. If they don't, they could face some hefty financial penalties.

But for small businesses—those with fewer than 50 employees—it's a different story. They are not legally required to offer health insurance. Many do it anyway as a great perk to attract and keep good people, but it’s their choice, not a legal requirement.

At My Policy Quote, we specialize in helping individuals and families find the right health insurance, whether you're navigating job changes, self-employment, or exploring alternatives to an employer plan. Discover your options and get a clear, personalized quote by visiting us at https://mypolicyquote.com.