When you get that sudden, nagging illness or a minor injury, the last thing you want to worry about is a massive, unexpected medical bill. That’s where the urgent care copay comes in.

Think of it as a predictable, flat fee you pay right at the front desk. It’s a simple, upfront cost that makes urgent care a smart and affordable choice for those non-life-threatening moments—like a sprained ankle, a nasty flu, or a cut that needs stitches.

What Is An Urgent Care Copay, Really?

Your urgent care copay is a pre-negotiated rate between your health insurance plan and an in-network clinic. Instead of facing a confusing, itemized bill that could run into thousands of dollars, you know exactly what your initial cost will be before you even see the doctor.

This fixed amount is a huge relief, especially for self-employed professionals, families with active kids, and anyone managing their finances closely. It takes the guesswork out of getting care. For a deeper dive, understanding what a copay is in health insurance in general provides a great foundation.

Why It’s Such a Smart Financial Move

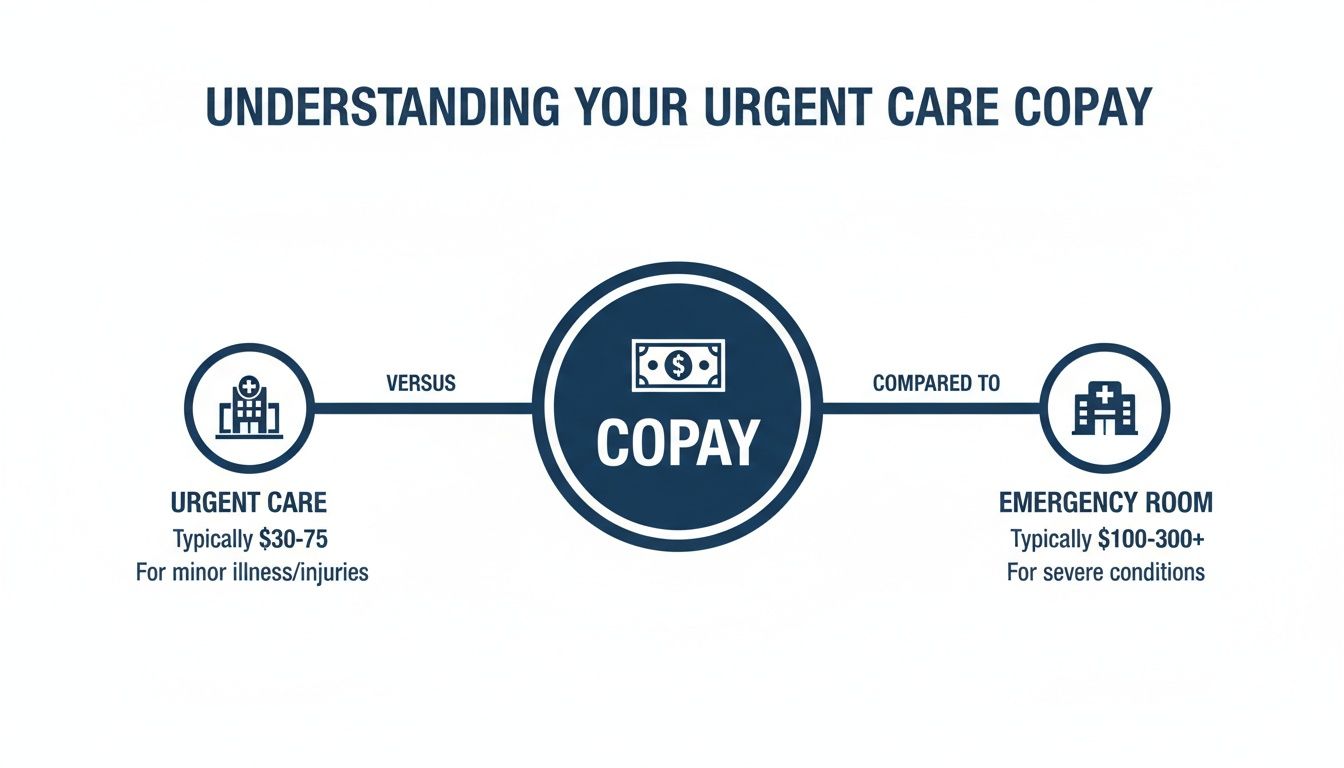

Urgent care sits in that perfect sweet spot—it’s more immediate than waiting for a primary care appointment but far less expensive than a trip to the emergency room. That predictability is its superpower.

Here’s why it works so well:

- No Sticker Shock: You pay a clear, set fee for the visit, which is often between $50 and $150. Compare that to the average ER visit, which can easily top $1,500, and the benefit is obvious.

- Care When You Need It: Can’t get in to see your regular doctor for a few days? Urgent care gives you a quick, affordable path to treatment for things that can’t wait.

- Helps the Whole System: By choosing urgent care for the right reasons, you help keep emergency rooms free for true, life-threatening crises like heart attacks or severe accidents.

To see just how much you can save, let's look at some common scenarios.

Urgent Care vs Emergency Room Cost at a Glance

The table below paints a pretty clear picture. The difference between a predictable copay and a potentially massive ER bill is staggering.

| Medical Issue | Typical Urgent Care Cost | Typical Emergency Room Cost |

|---|---|---|

| Sinus Infection | $120 | $700 |

| Minor Cut with Stitches | $200 | $2,200 |

| Sprained Ankle | $180 | $800 |

| Flu or Strep Throat | $150 | $750 |

Note: Costs are estimates and can vary by location and insurance plan.

As you can see, for the same problem, the cost difference is night and day.

Ultimately, your urgent care copay is more than just a fee—it’s a tool that empowers you. It lets you get the right care, right when you need it, without the fear of a devastating bill. To learn more about how these payments fit into your bigger insurance picture, you can explore how do copays work in different situations.

How Copay, Deductible, and Coinsurance Work Together

Trying to understand your health insurance can feel like you've been handed a puzzle with a few pieces missing. You’ve got three main parts to fit together: your copay, your deductible, and your coinsurance.

Think of them like a team. Each one has a specific job, and they all work together to handle your healthcare costs. Your urgent care copay is often the first and simplest player you'll meet. It's that fixed, upfront fee you pay for a visit—kind of like a cover charge.

But what about the other two? The deductible and coinsurance usually step in for any services that go beyond that initial consultation.

A Real-World Urgent Care Scenario

Let's walk through a situation. Imagine you twist your ankle chasing your dog in the backyard and decide to head to an urgent care clinic.

- The Copay: The first thing you'll do is check in and pay your urgent care copay. Let's say it's $75. This gets you in the door to see the doctor.

- The Deductible: After examining your ankle, the doctor thinks it might be a fracture and orders an X-ray. That X-ray is a separate service, and it costs $200. This is where your deductible comes into play.

Your deductible is the amount you have to pay out-of-pocket for medical services before your insurance plan starts chipping in.

If your plan has a $3,000 deductible, you're on the hook for that $200 X-ray bill. The good news? That $200 payment now gets credited toward your $3,000 deductible. It's important to know that your copay, however, usually doesn't count toward meeting it.

This is why choosing urgent care over the ER can save you a lot of money upfront.

The urgent care copay is a small, predictable fee for access. An ER copay is much higher because it's designed for true, life-threatening emergencies that require a whole different level of resources.

Where Coinsurance Fits In

So what happens once you’ve finally paid enough out-of-pocket to meet your deductible for the year? This is when your insurance company really steps up to the plate and coinsurance begins.

Coinsurance is the cost-sharing part of your plan. It’s the percentage of the bill you pay after your deductible has been met. A common setup is 80/20, meaning your insurer pays 80% and you pay the remaining 20%.

Let’s go back to our ankle injury. Imagine that later in the year, you need a $1,000 MRI. You've already met your $3,000 deductible from earlier medical costs. With an 80/20 coinsurance plan, you wouldn't be paying that full $1,000.

Instead, the cost is split:

- Your insurance company pays its 80% share ($800).

- You pay your 20% share ($200).

This sharing continues until you hit your plan's out-of-pocket maximum—the absolute most you’ll have to pay for covered care in a single year. For a deeper dive, our guide on coinsurance vs copay breaks it down even further.

Once you see how these three pieces—copay, deductible, and coinsurance—connect, you can start to predict your healthcare spending and avoid those dreaded surprise bills.

What Can You Realistically Expect to Pay for an Urgent Care Copay?

So, let's cut to the chase. When you walk into an urgent care clinic, what's the actual number you'll see on the bill? While every plan is a little different, there’s a general ballpark you can count on.

Typically, an urgent care copay will fall somewhere between $50 and $150.

This range is one of the sweet spots in healthcare. It's worlds away from the several hundred dollars you might fork over for an emergency room visit, which is why so many people turn to urgent care for issues that are immediate but not life-threatening. Of course, the exact number printed on your insurance card isn’t pulled out of a hat; a few key things determine what you’ll pay.

Key Factors That Determine Your Copay Amount

Think of your copay as a price tag that shifts depending on your specific insurance "membership." It's not a random number; it's a calculated cost based on the DNA of your health plan.

Here’s what really moves the needle:

- Your Insurance Plan Type: An HMO plan might land you a lower copay—say, $50—but you'll have to stick to their approved list of doctors. A PPO, on the other hand, gives you more freedom to choose, but that flexibility might come with a higher copay, maybe $75 or more.

- Your Geographic Location: Healthcare just costs more in some places. A visit to a clinic in a bustling downtown area will likely have a higher copay than one in a quiet suburban town, simply because their operating costs are different.

- The Clinic’s Network Status: This one is a game-changer. Your low copay only works if you visit an in-network clinic. Stepping outside that network can make your costs explode.

Getting a handle on how these costs connect is crucial, as it directly shapes what you pay out-of-pocket. Our guide on deductibles and copays breaks this relationship down even further.

The In-Network Advantage: A Membership Analogy

Imagine your health insurance is like a membership to an exclusive club—one that gets you special discounts at certain places. The urgent care centers in your plan’s network are the "preferred partners" of that club.

When you visit an in-network clinic, you get to flash your membership card and unlock that discount—your low, predictable copay. Why? Because your insurance company has already shaken hands with these clinics and negotiated fair rates. It’s a win-win.

But if you go to an out-of-network clinic, it’s like trying to use your membership card at a store that’s never heard of your club. You lose all your special pricing. Suddenly, you’re on the hook for a much bigger piece of the bill, often paying the full, undiscounted rate for everything.

The recent explosion in urgent care use shows just how much these savings matter. Between 2018 and 2022, spending on urgent care for people with employer-sponsored insurance shot up by a staggering 51.1%, climbing from $18 to $27 per person. This wasn't because prices went up; it was because more and more people—especially families and the self-employed—realized how valuable these clinics are for fast, affordable care. You can dig into the numbers behind this trend in urgent care spending to learn more.

The Financial Risk of Out-of-Network Urgent Care

Stepping into an out-of-network urgent care clinic is one of the easiest—and most financially punishing—mistakes you can make with your health insurance.

Think of your insurance plan’s network as a special club of “preferred partners.” Your insurer has already sat down with these clinics and negotiated discounted rates. That handshake deal is precisely why you get to pay a simple, predictable urgent care copay.

But the moment you walk into a clinic outside that network, all those protections vanish. The clinic has zero agreements with your insurer, which means you’re on the hook for their full, non-discounted prices. This one decision can turn a manageable $75 copay into a bill that spirals into the thousands.

The Dangers of Going Out-of-Network

The fallout from an out-of-network visit isn’t just about a higher price tag. It opens the door to some serious financial traps you would otherwise completely avoid.

- Total Claim Denial: Your insurance company might just flat-out refuse to pay anything, leaving you responsible for 100% of the bill.

- No Price Controls: You’ll be charged the clinic's full retail rates—often called “chargemaster” prices—which can be wildly inflated compared to what they charge insurers.

- Balance Billing: This is the scariest one. Even if your insurance agrees to pay a small portion of the bill, the out-of-network clinic can legally come after you for the rest. This is called balance billing.

Here’s a real-world example: The out-of-network clinic charges $800 for your visit. Your insurer decides the "reasonable" cost is only $150 and pays that. The clinic then sends you a bill for the remaining $650. An in-network clinic is contractually forbidden from ever doing this.

Making the right choice here is more important than ever. With medical costs for group plans still climbing at around 8.5%, knowing how to use your network is key. For a lot of people, that predictable $50-$200 urgent care copay is a lifeline compared to an ER visit with a $1,000+ deductible. You can read more about these ongoing cost trends and see how they’re hitting different markets.

How to Verify a Clinic Is In-Network

Thankfully, avoiding this financial landmine is pretty straightforward. Before you head out the door, take just a few minutes to confirm the clinic's network status. Never, ever assume a clinic is in-network just because it’s close to your house.

- Use Your Insurer’s App or Website: This is your source of truth. Log into your insurance portal and use their "Find a Doctor" or "Find Care" tool.

- Filter for Urgent Care: Don’t just search for any doctor. Make sure you specifically filter for "Urgent Care" providers near you.

- Call the Clinic to Confirm: Once you have a name and address, pick up the phone and call them directly. Ask this exact question: “Are you in-network with the [Your Plan Name] plan?” Don't just ask if they “take” your insurance—that can be misleading and cost you a fortune.

This quick check is the single best thing you can do to protect yourself from a nasty surprise bill. It ensures you only pay your expected urgent care copay and nothing more. Getting familiar with your network rules is a huge part of managing your healthcare costs, especially if you're trying to understand the difference between a PPO and an HMO.

Using Urgent Care to Lower Your Healthcare Spending

Knowing your urgent care copay is the first step. The next is turning that knowledge into a real-world, money-saving strategy.

Choosing urgent care over the emergency room for issues that aren't life-threatening isn't just a small change in habit—it's a massive financial decision. It’s one that can save you hundreds, if not thousands, of dollars from a single visit.

This is especially true if you have a high-deductible health plan (HDHP), where you're on the hook for more costs before your insurance starts paying. A predictable $75 copay at an urgent care for a sprained ankle feels a lot better than a $1,500+ ER bill that goes straight toward that big deductible.

The Ripple Effect of a Smart Choice

Your decision to pop into an urgent care clinic has a bigger impact than you might realize. When thousands of us make that same choice, it creates huge savings across the entire healthcare system, which helps keep costs down for everyone. It’s a simple, practical way to be a smarter healthcare consumer.

This is a game-changer for people with less stable job-based insurance or for pre-Medicare adults who are often more exposed to high out-of-pocket bills. In fact, one study that tracked poison center callers across three states found that sending patients to more appropriate care settings instead of the ER generated net savings between $36.5 million and $58.0 million for the region every single year.

Those are some serious numbers, and they show the financial power of picking a lower-cost option like urgent care. You can dig into the details of the economic benefits of this care shift on PubMed.

Urgent Care as a Cost-Containment Tool

Think of urgent care as your go-to for immediate but non-emergency needs. It's a cornerstone of smart personal healthcare budgeting. At its core, it’s about getting the right level of care at the right price, so a minor medical issue doesn’t snowball into a major financial headache.

This strategy is just one piece of a much larger puzzle. While urgent care is a fantastic cost-effective option, it helps to understand the broader healthcare cost containment strategies that shape how costs are managed across the entire system.

Ultimately, your urgent care copay isn't just another fee. It's your ticket to affordable, efficient medical help when you need it. By consciously choosing urgent care instead of the ER for the right situations, you take direct control over your healthcare spending and help build a more sustainable system for all of us.

Your Urgent Care Copay Questions, Answered

Alright, you've got the basics down. But we all know that when it comes to health insurance, the real confusion happens in the details. Let's walk through some of the most common questions that pop up when you're standing at the urgent care check-in desk.

Think of this as your practical, no-nonsense guide to handling those tricky real-world situations with confidence.

Does My Urgent Care Copay Count Toward My Deductible?

This is easily one of the biggest points of confusion, and the answer is almost always no.

In most plans, your urgent care copay does not count toward your annual deductible. It’s best to see the copay for what it is: a flat fee you pay for the visit itself, kind of like a cover charge. Your deductible is that bigger pile of money you have to pay out-of-pocket for other medical services before your insurance really starts to kick in and share the costs.

Here’s the important part, though: any extra services you get during that visit—like an X-ray, lab work, or a few stitches—are billed separately. The money you pay for those services almost always chips away at your deductible.

The Bottom Line: Your copay is just for the visit. Payments for anything extra are what help you meet your deductible. It's always a smart move to glance at your plan's "Summary of Benefits and Coverage" document, just in case your plan is one of the rare exceptions.

What if I Go to Urgent Care Without My Insurance Card?

Forgetting your insurance card is stressful, but it's not the end of the world. Don't panic. The front desk staff can often look up your policy using your name, date of birth, and other personal details.

If they can’t find you in their system, you’ll probably have to pay the full "self-pay" rate for the visit right then and there.

It’s not ideal, but it’s fixable. Here’s what you do next:

- Get an Itemized Receipt. Before you walk out the door, make sure they give you a detailed receipt listing every single service and what it cost. This is crucial.

- Submit the Claim Yourself. Head to your insurer's website, find their claim form, and submit it along with a copy of that itemized receipt.

- Get Reimbursed. Your insurance company will process the claim just like they would have at the clinic. They’ll then mail you a check for the amount they would have covered, minus your usual copay and anything else that applies to your deductible.

Can I Get a Surprise Bill After Paying My Copay?

Unfortunately, yes. This is one of the most frustrating and important things to understand about our healthcare system. Your copay covers the basic consultation, but it doesn’t cover all the other things that might happen during your visit.

The biggest trap is the out-of-network surprise. Here’s how it works: The urgent care clinic itself is in your network, so your copay is accepted. But—and this is a big but—the independent lab they use for your blood test or the radiology group that reads your X-ray is not in your network.

Weeks later, a completely separate and unexpected bill shows up in your mailbox from that out-of-network provider.

To protect yourself from this, ask one very specific question when you check in: “Are all services performed here today, including any labs or imaging, considered fully in-network with my plan?” Getting a clear "yes" can save you a massive headache later.

Navigating the fine print of health insurance can feel like a full-time job, but you don't have to do it alone. The experts at My Policy Quote can help you find a plan that actually fits your life and budget, protecting you from those frustrating and unexpected costs. https://mypolicyquote.com