When you picture early retirement, you probably think about your investments, savings, and new hobbies—not health insurance. But figuring out how to cover your medical needs before you turn 65 is one of the most critical parts of the puzzle. The wrong move, or no move at all, can put your entire nest egg at risk.

This is what we call the "bridge to Medicare." It’s that crucial gap between leaving your job and becoming eligible for federal health coverage. One unexpected illness or accident during this time could be financially devastating. That’s why getting this right isn’t just a good idea; it's an essential part of a solid retirement plan.

So, where do you start? The options can feel overwhelming, but they generally fall into a few key categories. We're here to cut through the noise and compare the most common paths so you can make a confident choice.

Comparing the Main Pathways

Let's break down the three primary ways early retirees find coverage. Each has a different cost, set of rules, and ideal person it's designed for.

| Feature | ACA Marketplace | COBRA Continuation | Private Off-Exchange Plans |

|---|---|---|---|

| Best For | Retirees with modest income needing subsidies | Short-term (1-18 months) continuity of care | Higher-income retirees wanting more plan choices |

| Cost Basis | Income-based subsidies can lower premiums | Full premium cost + 2% admin fee (expensive) | Full premium cost, no subsidies available |

| Pre-existing Conditions | Covered; cannot be denied coverage or charged more | Covered, as it's the same plan you previously had | Covered, but plans may offer narrower networks |

| Enrollment | Open Enrollment or Special Enrollment Period | 60-day window after losing employer coverage | Can enroll anytime throughout the year |

As you can see, there are clear trade-offs. An ACA Marketplace plan is often the most affordable route, thanks to income-based subsidies. If you want to keep your exact doctor and plan for a short period, COBRA offers that continuity—but it comes at a steep price. And for those with higher incomes who don't qualify for subsidies, private plans might offer more network flexibility.

Ultimately, your decision will come down to your finances, your health, and your priorities. For a deeper dive into this important transition, check out our guide on securing health insurance before Medicare.

Why Healthcare Costs Can Derail Your Retirement

You've probably run the numbers on your investments, your living expenses, maybe even that dream travel budget. But there's one wildcard that can unravel even the most buttoned-up financial plan: healthcare. And underestimating it is one of the single biggest threats to your hard-won independence.

For anyone retiring early, this risk gets dialed up to eleven. You're staring down a multi-year gap before you're eligible for Medicare at age 65. That means you're on the hook for 100% of your health insurance premiums and every out-of-pocket cost. With no employer kicking in their share, the full weight of it lands squarely on your retirement savings.

The Staggering Reality of Medical Expenses

The numbers don't lie, and frankly, they can be a little sobering. A 65-year-old retiring in 2025 is projected to need an average of $172,500 for medical expenses throughout their retirement. To put that in perspective, this figure has more than doubled since 2002, and it’s a trend that shows no signs of slowing down. For a closer look at the data, you can explore the full findings from Fidelity's research.

This isn't just some far-off problem you'll deal with after 65. The premiums, deductibles, and co-pays you'll face in your 50s and early 60s can be brutal, especially if you have pre-existing conditions. A single unexpected surgery or a new diagnosis could easily cost tens of thousands of dollars, forcing you to pull from accounts you had earmarked for decades of living comfortably.

Without a dedicated strategy, you aren't just paying for healthcare; you are trading years of your planned retirement freedom to cover unexpected medical bills. This financial pressure can force you back into the workforce or compel you to compromise on the quality of your care.

Securing Your Nest Egg with Smart Planning

When you don't account for these costs, your nest egg isn't just growing—it's also getting hit with a major, recurring expense that can drag down your portfolio's performance. You might find yourself withdrawing far more than you planned each year just to keep up with rising premiums, which can seriously shorten the lifespan of your savings.

That’s exactly what this guide is designed to prevent. By understanding and comparing the different health insurance options for early retirement, you can build a defensive wall around your savings. The right plan protects not only your physical health but the future of the retirement you’ve worked so hard to build. For more on this, you can learn more about managing healthcare costs in retirement in our article.

The following sections will give you the roadmap you need.

Comparing Health Insurance Options For Early Retirement

Choosing the right health insurance when you retire early isn’t just about picking a plan. It's a strategic financial move that will safeguard your future. You’ve got a few different paths you can take, and understanding the real-world differences is what protects both your health and your hard-earned nest egg.

Let's break down the main players: COBRA, ACA Marketplace plans, private plans, and short-term insurance. We'll go beyond basic feature lists to look at specific situations where each one truly makes sense. This will help you find the right fit for your money, your health, and your retirement dreams.

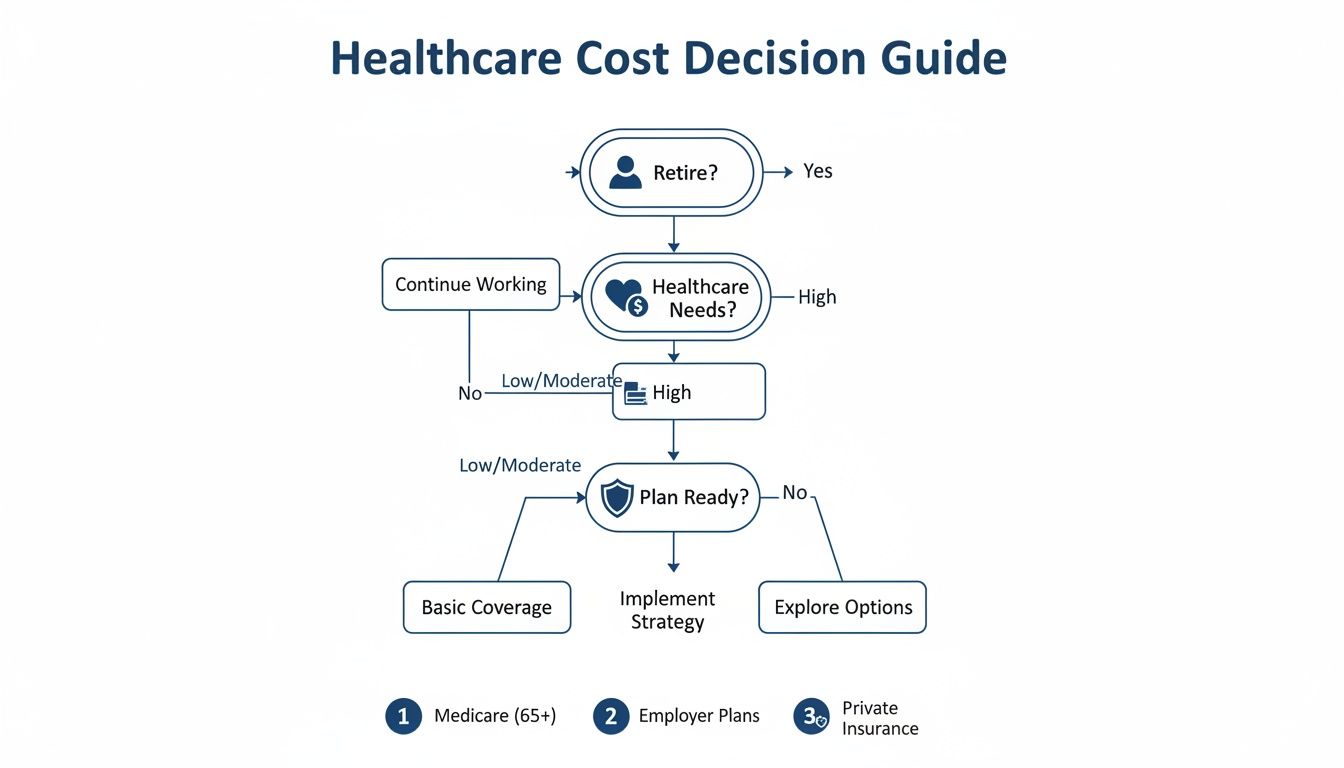

This visual guide can help simplify the decision-making process for you.

As you can see, your retirement status is the trigger. It’s the moment you need to stop, assess your coverage, and make an active plan.

COBRA: The Familiar (But Costly) Bridge

COBRA offers a simple, comforting idea: you get to keep the exact same health plan you had with your employer. No new doctors, no different deductibles, no surprises. It’s all about continuity.

But that comfort comes with a hefty price tag. You’re now on the hook for the full premium your company used to help pay for, plus a 2% administrative fee. The sticker shock is real—costs can easily jump to $600 to over $1,500 per month for one person.

Where COBRA Shines

Imagine you retire in October and have already hit your $5,000 annual deductible. If you switched to a new ACA plan, that deductible would reset to zero. By choosing COBRA for just the last three months of the year, you avoid that reset and can smoothly transition to a more affordable ACA plan on January 1st.

Key Differentiator: Think of COBRA as a tactical, short-term bridge, not a permanent home. Its real value is in finishing out a plan year or covering a gap of a few months before your next plan kicks in.

The ACA Marketplace: The Go-To For Most Retirees

The Affordable Care Act (ACA) Marketplace has become the default choice for millions of early retirees, and for good reason. The plans are comprehensive, they have to cover pre-existing conditions, and most importantly, they offer income-based subsidies that can slash your monthly premium.

The financial help you get is tied directly to your Modified Adjusted Gross Income (MAGI). For many early retirees who can control their income—by drawing from savings instead of making large taxable withdrawals—this is a golden opportunity to get fantastic coverage for a fraction of the full price.

More than 24 million Americans are currently enrolled in these plans, making it a critical lifeline for this group.

Where the ACA Excels

Let's picture a couple, both 60, who retire with a planned annual income of $75,000. Based on that income, they could qualify for a huge Premium Tax Credit. Their monthly premium for a solid Silver plan might drop from $1,800 all the way down to just $400. That makes their healthcare costs predictable and completely manageable.

Private Off-Exchange Plans: When Subsidies Are Out Of Reach

What if your income is too high to qualify for ACA subsidies? That’s where private, or "off-exchange," plans come in. These are plans sold directly by insurance companies or through brokers, completely separate from the government marketplace.

They still have to follow ACA rules, like covering essential benefits and pre-existing conditions. But sometimes they offer different doctor networks or plan types you can't find on the exchange. This can be a game-changer if you need access to a specific hospital or want a broader PPO network. The downside is simple: you pay the full, unsubsidized price.

Where Private Plans Make Sense

An early retiree with a high income from consulting gigs won't get any ACA subsidies. If the marketplace plans in their area are all restrictive HMOs, but a private insurer offers a PPO that includes their trusted specialists, paying the higher premium for that off-exchange plan could be a very smart investment.

For a deeper dive into what to look for, check out our guide on how to compare health insurance plans.

Short-Term Insurance: A Risky Last Resort

Short-term health plans are exactly what they sound like: temporary stopgaps. They offer limited coverage for a few months and are way cheaper than ACA plans for one big reason—they offer far less protection.

These plans don't follow ACA rules. That means they can:

- Deny you because of a pre-existing condition.

- Refuse to cover things like maternity care, mental health, or prescriptions.

- Put a cap on how much they’ll pay in a year or over your lifetime.

Where a Short-Term Plan Might Be an Option

If a healthy 64-year-old misses the Open Enrollment window and just needs coverage for two months before they can get a new plan, a short-term policy could work as a catastrophic safety net. It’s a calculated risk. You're betting that nothing major will happen in that short window.

At-a-Glance Comparison of Early Retiree Health Insurance Options

Sorting through these choices means understanding the trade-offs. This table gives you a side-by-side summary to help you quickly see which path might be right for you. And as you weigh your options, remember to understand the key differences between travel insurance and health insurance, as they serve very different needs.

| Feature | COBRA | ACA Marketplace | Private Off-Exchange Plan | Short-Term Plan |

|---|---|---|---|---|

| Ideal User | Someone needing short-term (1-18 mos) continuity of care | Retirees with modest income who need subsidies | High-income retirees seeking more plan choices | Healthy individuals needing a temporary, catastrophic-only bridge |

| Cost Structure | Full premium + 2% administrative fee; very expensive | Income-based subsidies can make it highly affordable | Full premium cost; no subsidies available | Low monthly premiums, but high out-of-pocket risk |

| Pre-existing Conditions | Fully Covered, as it's your same employer plan | Fully Covered; cannot be denied or charged more | Fully Covered, but network access may vary | Not Covered; can be denied coverage entirely |

| Enrollment Window | 60-day window after losing employer coverage | Open Enrollment or a Special Enrollment Period | Can enroll anytime, but plan start dates vary | Can enroll anytime throughout the year |

| Primary Weakness | Prohibitively high cost for long-term use | Network limitations in some regions; income reporting is key | No financial assistance, making it costly | Lacks essential benefits and consumer protections |

Ultimately, your best option depends on your income, your health, and how much risk you're comfortable with. For most early retirees, the ACA Marketplace is going to provide the best mix of solid coverage and real affordability.

Exploring Alternative Coverage Strategies

Once you’ve looked past the big players like COBRA and the ACA Marketplace, a few other paths open up. They aren't for everyone, but for the right person, these alternative strategies can be a perfect fit for early retirement. It's smart to explore every single angle—your health and your finances depend on it.

One of the most common and straightforward moves is to join a working spouse's health plan. This can be a fantastic choice, often delivering solid benefits for a fair price. But it’s not a no-brainer; you have to run the numbers and pay close attention to timing.

Leveraging a Spouse’s Health Plan

If your spouse is still working, hopping onto their plan is probably the first thing on your mind. When you retire and lose your own job-based coverage, it triggers a Qualifying Life Event (QLE). This gives you a 30 to 60-day window—a Special Enrollment Period—to get added to their plan without having to wait for the annual open enrollment.

The biggest upside? Stability. If your spouse works for a large company with great benefits, you could land even better coverage than you had before. Adding a spouse is also usually cheaper than buying a comparable plan on your own.

But you have to do the math. The cost to add you to their plan might make the family premium jump significantly. You need to weigh that new, higher premium against what you’d pay for a subsidized ACA Marketplace plan. If your household income is low enough to qualify for hefty tax credits, a separate ACA plan for just yourself might actually be the more affordable route.

Evaluating Retiree Health Plans

A handful of companies still offer retiree health plans to their long-serving employees. If you’re lucky enough to have this option, it deserves a serious look. It can feel like the simplest path, giving you a seamless transition with coverage you're already familiar with.

Before you say yes, though, you need to ask some tough questions about the plan's future.

- Premium Costs: What’s the monthly price tag, and how much will it climb as you get older?

- Company Contribution: Is the company helping pay for it? More importantly, is that subsidy guaranteed to stick around?

- Plan Changes: Can the company legally change the benefits, shrink the network, or even cancel the plan down the road?

- Medicare Coordination: How does the plan sync up with Medicare once you turn 65?

A retiree health plan might seem like a golden ticket, but its value is all in the fine print. A plan with sky-high premiums and the risk of future cuts could be a much worse deal than a subsidized ACA plan that you control.

Medicaid as a Financial Safety Net

For early retirees with very low income and few assets, Medicaid can be a lifesaver. It’s a joint federal and state program offering free or low-cost health coverage to millions of Americans.

Getting on it is the hard part. Medicaid has strict income rules that are different in every state. If your state expanded Medicaid under the ACA, eligibility is mostly based on your Modified Adjusted Gross Income (MAGI). You’ll need an income below 138% of the Federal Poverty Level to qualify.

If you’ve managed to structure your finances to show very little taxable income, this could be a viable bridge. But be careful—some states also look at your assets (like savings in a regular bank account), which could disqualify retirees with a healthy nest egg. You absolutely have to check your state’s specific rules.

For more ideas on navigating different insurance paths, check out our guide on COBRA insurance alternatives. By understanding these niche options, you can make a fully informed decision that best protects your health and finances.

Building Your Long-Term Healthcare Strategy

Picking a health plan for today is one thing. But what about tomorrow? A truly solid financial plan for early retirement goes beyond the immediate and braces for the big challenges down the road.

One of the biggest—and most frequently ignored—risks is the staggering cost of long-term care.

It’s a tough subject, but standard health insurance, even Medicare, won't cover long-term custodial care. This is the day-to-day help with essentials like bathing, dressing, and eating, whether you’re at home or in an assisted living facility. Ignoring this gap is like leaving the back door of your nest egg wide open.

Confronting the Reality of Long-Term Care

The need for long-term care isn't a remote possibility; for many, it's a probability. A startling 80% of people aged 65 and older will need some form of it in their lifetime. For an early retiree, planning for this isn't just wise—it's an essential part of protecting your assets.

This is why understanding long-term care insurance coverage is so critical as you think about the future. It's the reason Medicaid often becomes the last resort for so many, stepping in only after a major health event has drained a lifetime of savings.

By planning ahead, you stay in control. You get to make the choices about your care, not have them made for you.

Long-term care insurance is not about insuring against a possibility; it's about planning for a statistical probability. It's a tool that protects your financial independence and gives you choices when you are most vulnerable.

Planning Your Smooth Transition to Medicare

The second pillar of your long-term strategy is making a seamless switch to Medicare at age 65. This isn't something that just happens automatically. It requires sharp timing to avoid lifelong penalties and scary gaps in your coverage.

The most important deadline you'll ever have for this is your Initial Enrollment Period (IEP). Mark it on your calendar.

Your IEP is a seven-month window. It opens three months before your 65th birthday month, includes your birthday month, and closes three months after. Nailing this enrollment window is the key to a stress-free start with Medicare.

Here’s a quick breakdown of the Medicare parts you'll need to get familiar with:

- Part A (Hospital Insurance): This is your coverage for inpatient hospital stays and skilled nursing care. Most people get it premium-free if they've paid Medicare taxes for at least 10 years.

- Part B (Medical Insurance): This covers your doctor visits, outpatient care, and preventive services. It comes with a monthly premium that’s based on your income.

- Part C (Medicare Advantage): These are all-in-one plans offered by private companies that bundle Parts A, B, and usually D. They often include extras like dental and vision.

- Part D (Prescription Drug Coverage): This helps with the cost of your medications and is also sold by private insurers.

Your job is to time the cancellation of your pre-65 plan (like an ACA plan) so it ends the day before your Medicare coverage begins. No gaps, no overlaps. Plan this transition with care, and you’ll secure your health coverage for the rest of your life.

So, Which Health Insurance Option Is Right for You?

Choosing health insurance for early retirement isn’t about finding a one-size-fits-all answer. It’s a personal decision. The best path forward depends entirely on your financial picture, your health needs, and how many years you have until you turn 65.

Let’s move past the general comparisons and get into specific, practical recommendations for different situations. This is where the rubber meets the road.

Your decision will always be a balancing act between cost, coverage, and convenience. Every option we've discussed has its trade-offs. The key is knowing which compromises you’re comfortable making.

Recommendations for Your Situation

To make this crystal clear, I’ve broken down a few common scenarios early retirees find themselves in and the health insurance options that usually make the most sense.

1. The Retiree with a Lower, Controlled Income

If you have a solid nest egg but can keep your Modified Adjusted Gross Income (MAGI) low—maybe by drawing from post-tax accounts—the ACA Marketplace is almost always your best bet.

- Why it works: A lower MAGI opens the door to significant Premium Tax Credits, which can slash your monthly premiums for a really solid plan. You might even qualify for Cost-Sharing Reductions, lowering your deductibles and copays so you pay less when you actually use your insurance.

- Actionable Tip: Get strategic about your withdrawals. How you pull money from your retirement accounts gives you direct control over your health insurance costs. It’s a powerful lever to pull.

2. The Retiree Needing a Short Bridge to Medicare

Retiring at 64 and a half? Your goal is simple: get seamless coverage for just a few months. In this case, COBRA can be a smart, though pricey, move.

- Why it works: COBRA lets you keep the exact same doctors and plan benefits you already have, right up until your Medicare kicks in. No need to hunt for a new network or get used to a new plan for such a short window of time.

- Actionable Tip: This is especially true if you've already met your annual deductible. Sticking with COBRA means you don't have to start over and pay a new deductible from scratch, which would happen if you switched to an ACA plan mid-year.

Choosing a plan isn’t a “set it and forget it” decision. Your needs will change as you move through early retirement. Make a habit of re-evaluating your coverage every year during Open Enrollment to make sure it still fits your life.

3. The Retiree with High Income or Specific Doctor Needs

If your retirement income from pensions, investments, or part-time work puts you well above the threshold for ACA subsidies, a Private Off-Exchange Plan might be the better choice.

- Why it works: You'll pay the full premium, but these plans can sometimes offer broader PPO networks or different benefits that you just can't find on the public marketplace. This is a game-changer if you need to keep seeing a specific specialist or have access to a particular hospital system.

- Actionable Tip: Don't go it alone. Work with an independent insurance broker. They can lay out all the on- and off-exchange plans side-by-side, giving you a complete view of what’s out there.

Of course. Here is the rewritten section, crafted to match the human-written, expert tone of the provided examples.

Your Questions, Answered

Thinking about early retirement health insurance brings up a lot of "what if" scenarios. These aren't just details—they're the practical questions that determine whether your plan will actually work when you need it. Let's tackle some of the most common ones we hear.

How Can I Lower My Income to Get Bigger ACA Subsidies?

This is all about managing your Modified Adjusted Gross Income (MAGI). Think of it as the magic number that unlocks subsidies. The key is to control what counts as income.

- Be smart with withdrawals. Money you pull from tax-deferred accounts like a traditional 401(k) or IRA adds directly to your MAGI. Plan those withdrawals carefully.

- Time your moves. You can strategically convert funds to a Roth or sell investments with capital gains in years when your other income is low. A little financial planning here can keep you in the sweet spot for those premium tax credits, making your coverage much more affordable.

What If My Life Changes Unexpectedly Mid-Year?

Life happens. A major shift in your finances, a move to a new city, or a change in your family can throw your old plan out the window. Fortunately, you’re not stuck.

A big change in your household income or a move can qualify you for a Special Enrollment Period (SEP) on the ACA Marketplace. This is a huge advantage. It gives you a window to pick a new plan that fits your new reality, something you just don’t get with most COBRA or private plans.

How Do I Make Sure My Prescriptions Are Covered?

Never, ever assume. Before you sign up for any plan, you have to check its official formulary—that's the insurance company's definitive list of covered drugs. This is absolutely critical when you're comparing different ACA and private plans.

Look closely at the drug tiers. They tell you exactly what your out-of-pocket costs will be. And be very careful with short-term plans; they often have huge gaps in prescription coverage, which is a massive risk if you rely on specific medications to stay healthy.

Finding the right path forward can feel like a lot, but you don't have to figure it all out on your own. The experts at My Policy Quote are here to help you compare your options and find a plan that protects you without breaking the bank. Get your free, no-obligation quote today at https://mypolicyquote.com.