Think of health insurance enrollment like a members-only club. Most of the time, the doors are closed, and you can only sign up during one specific time of year: the Open Enrollment period. If you miss that window, you're usually out of luck until the next year.

But life doesn’t always follow a schedule. What happens when a major life change hits you out of the blue?

That’s where a Special Enrollment Period (SEP) comes in. It’s a second chance—a special key that unlocks the door to health coverage when you need it most, even if it's outside the standard sign-up dates.

Your Lifeline for Health Coverage

So, why isn't enrollment open all year? The system is designed to keep the insurance market stable. If people could just buy a plan the day they got sick, it would drive up costs for everyone. Think of it like this: you can't buy car insurance after you've already had an accident.

The SEP acts as a crucial safety net. It recognizes that big life changes often bring new healthcare needs, and you shouldn't have to wait months to get protected.

What Kicks Off a Special Enrollment Period?

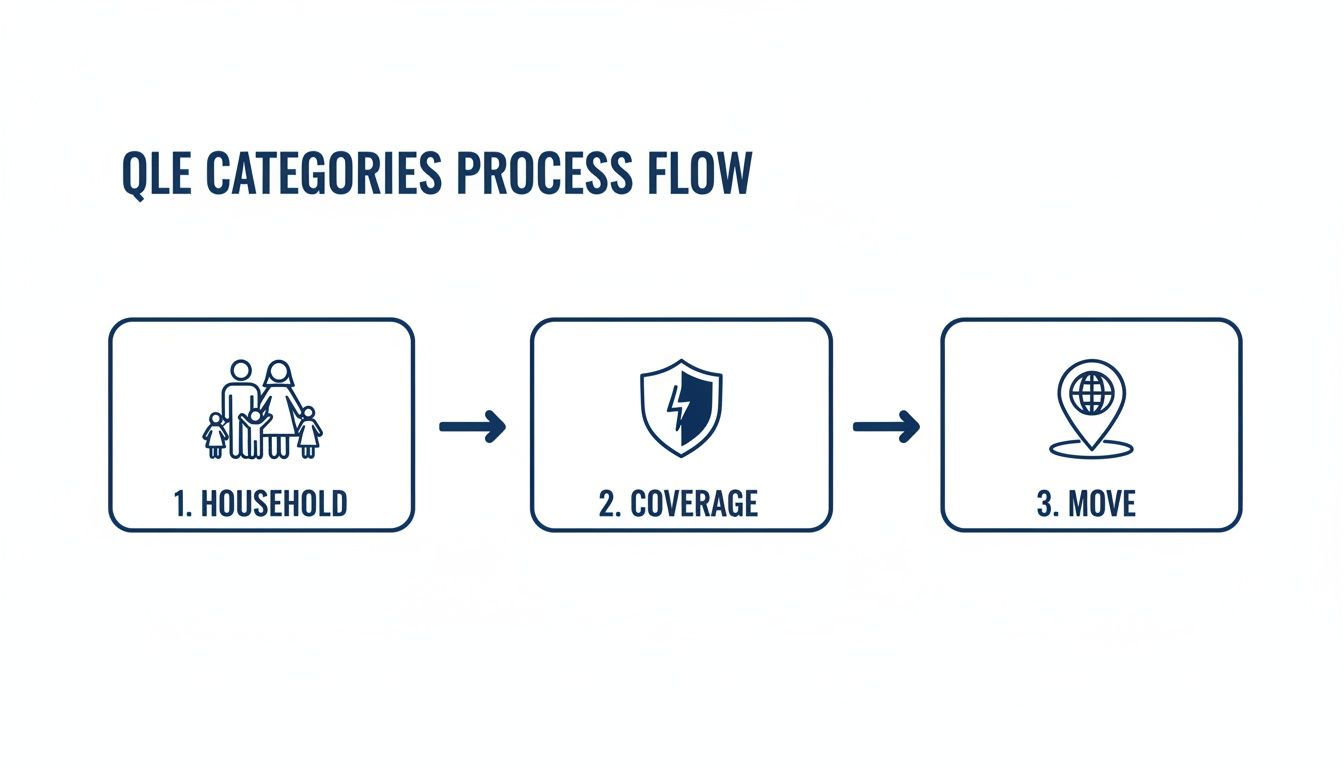

The event that unlocks an SEP is called a Qualifying Life Event (QLE). This isn't just any minor life update; it has to be a significant, recognized event that reshuffles your household, your home address, or your current health coverage.

Here are some of the most common triggers:

- Big changes at home: Getting married, having a baby, or going through a divorce all count.

- Losing your current coverage: This could happen if you leave a job, get laid off, or turn 26 and can no longer stay on a parent's plan.

- Moving to a new zip code: If your relocation puts you in an area where your old plan isn't offered, you’ll get an SEP.

Once a Qualifying Life Event happens, the clock starts ticking. You generally have just 60 days from the date of the event to pick and enroll in a new health plan. If you miss that deadline, you'll almost certainly have to wait for the next Open Enrollment.

Understanding if you've experienced a QLE is the first step. While most people know about the annual sign-up window, many don’t realize this alternative path exists. This guide will walk you through the specific events that grant you access to an SEP, so you know exactly when you can get covered.

Do You Qualify for a Special Enrollment Period?

So, you missed Open Enrollment. Does that mean you’re locked out of getting health insurance until next year? Not necessarily.

There’s a back door available for people going through major life changes. It’s called a Special Enrollment Period (SEP), and it gives you a window to sign up for a new health plan outside the standard enrollment dates.

The key to unlocking this window is having a Qualifying Life Event (QLE). Think of it as a specific, significant moment in your life that the system recognizes as a valid reason to need new insurance. Simply wanting a new plan isn't enough—you need to have experienced a specific, approved change.

Let’s break down what really counts.

Major Changes in Your Household

Life moves fast, and when your family structure changes, your insurance needs often change right along with it. These moments are some of the most common reasons people qualify for an SEP.

You can typically enroll in a new plan if you’re:

- Getting married. Tying the knot means you can get on a plan together.

- Welcoming a child. Having a baby, adopting, or fostering a child lets you add them to your coverage.

- Going through a divorce or legal separation. If you lose your health plan because of a split, you get a chance to find your own.

- Experiencing the death of the person who holds the policy. This tragic event allows you to enroll in a new plan so you're not left without coverage.

These are huge life milestones, and the system is designed to give you the flexibility you need. You can learn more in our detailed guide on what is a qualifying event for health insurance.

Losing Your Current Health Coverage

Losing your health insurance is stressful, and it’s probably the most urgent reason to need a new plan. This is a critical safety net, giving you a chance to find new coverage without a gap.

You’ll most likely qualify for an SEP if you lost your plan for one of these reasons:

- You lost your job-based insurance. This includes being laid off, quitting, or having your hours cut.

- You’re turning 26. Young adults "aging out" of a parent's plan get their own window to enroll.

- You’re no longer eligible for Medicaid or CHIP. If your income changes, you can switch to a Marketplace plan.

- Your COBRA coverage runs out. Once those benefits expire, you get an SEP to find something new.

Heads up: Losing coverage because you forgot to pay your premiums does not count. To qualify, the loss of coverage needs to be involuntary.

This provision is a lifeline for millions. In fact, CMS reported that more than 2.5 million Americans got health coverage through an SEP, which shows just how essential this safety net is.

Moving to a New Location

Believe it or not, a change of address can sometimes mean a change in health plan eligibility. If you move to a new ZIP code or county, you might find your old plan doesn’t work there anymore.

Here’s how a move can open an enrollment window for you:

- Moving to a different ZIP code or county where your current insurer doesn't offer plans.

- Moving to the U.S. from another country.

- A student moving to or from college.

- A seasonal worker moving for a job.

The catch is that your move has to be permanent and result in you having access to different health plan options. A quick vacation won't do it.

Other Qualifying Circumstances

Life is full of unique situations, and there are a few other circumstances that can also trigger an SEP.

These less common but equally important events include:

- A big change in your income that affects your eligibility for financial help.

- Becoming a U.S. citizen.

- Being released from incarceration.

- Your employer offering you an ICHRA (Individual Coverage Health Reimbursement Arrangement).

To help you see if your situation applies, we’ve put together a quick summary of the most common events.

Common Qualifying Life Events for a Special Enrollment Period

This table breaks down the typical life changes that might make you eligible for an SEP.

| Event Category | Specific Life Event Example | Who This Often Affects |

|---|---|---|

| Household Changes | Getting married or divorced | Newlyweds, separating couples |

| Having or adopting a baby | New and growing families | |

| Loss of Coverage | Losing a job with health benefits | Employees, contractors |

| Turning 26 and aging off a parent's plan | Young adults | |

| Losing Medicaid or CHIP eligibility | Individuals with income changes | |

| Moving | Relocating to a new state or ZIP code | People moving for work or school |

| Other Events | Gaining U.S. citizenship | New American citizens |

| Leaving incarceration | Formerly incarcerated individuals |

Seeing your own life change in this list is the first step. If you think you qualify, the next step is to act quickly before your special window closes.

How to Apply for a Special Enrollment Period

So, you’ve had a big life change and think you qualify for a Special Enrollment Period (SEP). That’s the first step. Now, it’s time to take action.

Applying for an SEP might sound complicated, but it’s really just a three-step dance: gather your proof, watch the clock, and send in your application. Getting this right means you’ll get the health coverage you need without any frustrating delays. The secret is to be prepared.

Step 1: Gather Your Verification Documents

Before you can officially enroll, you have to prove that your qualifying life event actually happened. Think of it this way: when you apply for a loan, you need paperwork to prove your income. It's the same idea here. The Health Insurance Marketplace needs official documents to confirm you're eligible for an SEP. Without them, your application will hit a wall.

Common Documents You Might Need:

- Getting Married? Have a copy of your marriage certificate ready.

- Welcoming a Baby? You'll need a birth certificate or adoption records.

- Losing Other Coverage? Get a letter from your old insurance company or employer on official letterhead stating the exact date your coverage ended.

- Moving to a New Town? You'll need proof of both your old and new addresses. Utility bills, a lease agreement, or bank statements work great.

Make sure these documents clearly show your name and the date of the event. Having them scanned and ready to upload will make everything go so much smoother. For more examples of the specific paperwork you might need, check out our guide on navigating life event health insurance.

Step 2: Understand Your 60-Day Deadline

This is the golden rule of SEPs, and you can’t afford to ignore it. The moment your qualifying life event happens, a 60-day countdown starts ticking. You have to pick a new health plan and finish your enrollment within that window. No exceptions.

If you get married on June 1st, your deadline is July 31st. Lose your job-based health plan on March 15th? You have until May 14th to enroll.

Crucial Takeaway: Missing this 60-day deadline is one of the most common—and costly—mistakes people make. If you let it slide, you’ll probably have to wait until the next Open Enrollment Period, which could leave you uninsured for months.

Put a reminder in your phone. Circle the date on your calendar. Treat this deadline like you would for filing your taxes. The consequences of missing it are just too high.

Step 3: Navigate the Application Process

With your documents in hand and your deadline in mind, you're ready to apply. The main hub for this is the official Health Insurance Marketplace.

The different life changes all lead to the same application path, whether it’s related to your household, your old coverage, or a recent move.

This process is pretty straightforward once you know where to go.

Where to Apply:

- HealthCare.gov: This is the federal marketplace that most states use. You'll create an account, fill out the application, and state your qualifying life event.

- State-Based Marketplaces: Some states, like California (Covered California) or New York (NY State of Health), run their own health insurance exchanges. If you live in one of them, you’ll apply directly on their site.

- Directly Through an Insurer or Broker: You can also work right with an insurance company or a licensed agent. This is a fantastic option if you want some expert guidance to help you find the right marketplace-compliant plan.

During the application, the system will ask you to upload your documents. Once you submit everything, the Marketplace will review your proof, which can take anywhere from a few days to a couple of weeks. After you get the green light, you can officially enroll in a plan. Your coverage will usually start on the first day of the month after you sign up. For example, if you enroll on May 20th, your new plan kicks in on June 1st.

Real-World SEP Scenarios You Can Relate To

Knowing the rules of a special enrollment period sep is one thing. Seeing how it actually works for real people? That's when it all clicks. Abstract terms like "qualifying life events" suddenly make sense when you connect them to life's biggest moments.

Let's walk through a few stories to show you how an SEP might apply to your own life. Each one highlights a different trigger, the proof you'll need, and the thought process behind choosing a new health plan.

From Wedding Bells to a New Health Plan

Meet Maria. She's a self-employed graphic designer who has always managed her own Marketplace health plan. Then, she married Alex, who has a great health plan through his job.

That happy day wasn't just a celebration—it was a qualifying life event. Getting married opened a 60-day window for them to figure out their health coverage together. Should Maria join Alex’s plan, or should they look for a new family plan on the Marketplace?

They had to move quickly to make a decision.

- Their Qualifying Event: Getting married.

- Document Needed: A clean copy of their official marriage certificate.

- Their Decision: After comparing the costs, adding Maria to Alex's work plan was the clear winner. They sent the marriage certificate to Alex's HR department and got her enrolled, simple as that.

When COBRA Runs Out for an Early Retiree

Now, let's talk about David. At 62, he took early retirement and used COBRA to keep his old employer's health insurance. But he knew COBRA was just a temporary bridge, and the sky-high premiums were eating into his retirement savings.

When his 18 months of COBRA coverage were about to end, David was facing a gap in coverage before he could get Medicare at 65. Luckily, the end of COBRA is a qualifying life event that triggers a special enrollment period.

This was his chance to find something much more affordable.

- His Qualifying Event: His COBRA coverage ending.

- Document Needed: A letter from his COBRA administrator confirming the exact date his benefits would stop.

- His Decision: David jumped on the Marketplace and found a Silver plan that worked perfectly. Thanks to tax credits based on his retirement income, his new premium was much lower. He got enrolled before his COBRA ran out, so he never had a single day without coverage.

Losing a job or retiring is complicated enough without worrying about insurance. If this sounds like your situation, check out our guide on finding insurance if you lose your job for more in-depth advice.

A Growing Family and a New Arrival

Here’s a story about Sarah and Ben, who just welcomed their first child, Lily. Along with all the joy of becoming parents came an urgent question: how do we get our daughter health insurance?

The birth of a child is a classic qualifying life event. It gave their family an SEP, meaning they had 60 days from Lily’s birthday to either add her to their current plan or switch to a new one entirely.

It was the perfect time to reassess what they needed as a new family.

- Their Qualifying Event: Having a baby.

- Document Needed: A copy of Lily’s birth certificate or a confirmation-of-birth letter from the hospital.

- Their Decision: Sarah and Ben quickly realized their old "couples" plan wasn't going to cut it for well-child visits and immunizations. They used their SEP to upgrade to a Gold-level family plan with great pediatric coverage, making sure Lily had the best care from day one.

Aging Off a Parent’s Plan

Finally, there's Leo. He just turned 26. While he was celebrating, he also knew it meant he could no longer stay on his parents' health insurance. This "aging off" moment is how most young adults start navigating the insurance world on their own.

Losing coverage at age 26 is a qualifying life event, which gave Leo his own 60-day special enrollment period to find and sign up for a plan.

This was his moment to take charge of his own healthcare.

- His Qualifying Event: Turning 26 and losing his parents' coverage.

- Document Needed: A letter from his parents’ insurance company showing when his coverage would end, plus his birth certificate to prove his age.

- His Decision: Leo is young, healthy, and just starting out. He found a Bronze plan on the Marketplace with a low monthly premium. It was the perfect fit for his budget while still protecting him from a major medical emergency.

The power of the special enrollment period sep became crystal clear during the COVID-19 pandemic, when a federal SEP helped over 2.1 million Americans get covered. For so many, this was a lifeline. You can find more details about these enrollment flexibilities and their impact on states.

Common SEP Mistakes and How to Avoid Them

Navigating a special enrollment period sep can feel like walking a tightrope. The rules are strict, and one small misstep could leave you without health coverage when you need it most. The good news? Every common mistake is completely avoidable with a little foresight.

Let's walk through the most frequent errors people make and, more importantly, how you can sidestep them to get your coverage locked in without a hitch.

Missing Your 60-Day Deadline

This is the number one mistake, and it's the most unforgiving. After your qualifying life event happens, a 60-day countdown kicks off. If you miss that window, the door to enrollment slams shut. You’ll almost certainly have to wait for the next Open Enrollment Period.

Think of it this way: if you lose your job-based coverage on May 10th, your absolute last day to enroll in a new plan is July 9th. It’s a firm deadline with very few exceptions.

What to do instead: The moment your qualifying event happens, mark that 60-day deadline on your calendar. Set a reminder on your phone. Don’t put it off—start looking at plans and gathering your documents right away to avoid a last-minute scramble.

Failing to Provide Proper Documentation

Just saying you had a life event isn't enough—you have to prove it. The Marketplace requires official documents to verify you’re eligible for a special enrollment period sep. Submitting the wrong paperwork, or none at all, will bring your application to a dead stop.

A blurry photo, a letter without an official letterhead, or a file that doesn't clearly show the date of your event will get your application denied. It's that simple.

What to do instead: Before you even start your application, figure out exactly which documents you need.

- Getting married? Have a clear, scanned copy of your marriage certificate.

- Losing other coverage? You'll need a formal letter from your old insurance company or employer showing the exact date your plan ended.

- Having a baby? A birth certificate or a confirmation-of-birth letter from the hospital will work.

Pro Tip: Make sure every document is crystal clear, easy to read, and includes your full name and the date of the event. Having high-quality digital copies ready to go will save you from frustrating delays.

Misunderstanding When Your New Coverage Starts

A lot of people get tripped up here. They assume their new plan kicks in the second they enroll, but that's rarely the case. When you enroll during an SEP, your coverage usually starts on the first day of the following month.

For example, if you pick your plan and pay your premium on April 20th, your coverage won’t actually begin until May 1st. That gap can catch you by surprise, leaving you uninsured for a few weeks if you aren't prepared.

What to do instead: Pay close attention to the "effective date" listed during the enrollment process. Double-check it before you finalize everything. If you have prescriptions to fill or appointments coming up, you need to plan for that gap.

Avoiding these simple but critical mistakes makes all the difference in successfully using your special enrollment period sep.

Got Questions About Your Special Enrollment Period? We’ve Got Answers.

Jumping into a special enrollment period sep can feel a bit confusing, even when you know the basics. Life throws curveballs, and you need clear answers. Here are the most common questions we hear, broken down so you can move forward without any lingering doubts.

What Happens If I Miss My 60-Day Window?

This one’s a big deal. If you miss that 60-day deadline after your qualifying life event, the window to enroll slams shut. You’ll almost certainly have to wait for the next annual Open Enrollment Period to get a new health plan.

Exceptions are incredibly rare. It's so important to act quickly because missing that deadline could mean going without health insurance for months. Treat it with urgency.

Can I Change My Plan During a Special Enrollment Period?

Yes, absolutely. An SEP isn't just for people who are uninsured. Let’s say you already have a Marketplace plan but a big life change happens—like you have a baby or your income changes significantly. You can use your SEP to switch to a different plan that’s a better fit for your new reality.

For example, a new parent might want to switch from a Bronze plan to a Gold plan to get stronger coverage for all those new baby checkups. It's a built-in flexibility to make sure your health plan keeps up with your life.

Here's the bottom line: A Special Enrollment Period lets you enroll in a new plan or change the one you already have through the Marketplace. It’s designed to ensure your coverage actually works for you, all year long.

How Long Until My New Coverage Kicks In?

Once you send in your application and any proof they need, the Marketplace usually takes a few days to a week to give it the green light. After you get approved, you can lock in your plan choice.

Your new health coverage typically starts on the first day of the month after you enroll. For instance:

- If you enroll on May 20, your coverage starts on June 1.

- If you enroll on July 5, your coverage starts on August 1.

There are a few special cases, like the birth or adoption of a child, where your coverage can be backdated to the day of the event. Just be sure to double-check your plan's official "effective date" when you sign up so you know exactly when you're protected.

What if I Lost My Old Plan Because I Didn't Pay the Premium?

This is a common mix-up. Losing your health insurance because you didn’t pay the monthly premium is not a qualifying life event. Unfortunately, this situation won’t trigger a special enrollment period sep.

If this happens, you’ll have to wait for the next Open Enrollment Period to sign up for new coverage. Most insurance companies offer a grace period for late payments, so if you think you might miss a payment, call them right away.

Still have questions or feeling a little lost? The rules can get tangled, but you don’t have to untangle them by yourself. The experts at My Policy Quote are here to offer clear, one-on-one help to find the right health plan for you. Get a free, no-pressure quote and some friendly advice today at https://mypolicyquote.com.