Medigap Plan G is, hands down, the most popular Medicare Supplement policy for folks just turning 65 or new to Medicare. Why? It covers nearly every single out-of-pocket cost that Original Medicare leaves on your plate.

The only thing it doesn’t cover is the annual Medicare Part B deductible. Once you meet that, Plan G kicks in, giving you incredible financial predictability and, more importantly, peace of mind.

Understanding Your Medigap Plan G Protection

Think of Original Medicare as a good, solid umbrella. It keeps most of the rain off, but on a windy day, you're still going to get wet. Those stray drops are your deductibles, coinsurance, and copayments.

Medigap Plan G is like adding a high-quality raincoat and waterproof boots to your outfit. It covers everything else, protecting you from getting soaked by unexpected medical bills. It’s built specifically to fill the gaps in Medicare Part A and Part B.

This plan has become the top choice for new Medicare beneficiaries who value knowing exactly what their healthcare will cost each month. If you’re someone who would rather pay a predictable premium to avoid surprise bills down the road, you’re in the right place. To get a bird's-eye view, our guide on https://mypolicyquote.com/2025/11/29/what-is-a-medicare-supplement-plan/ is a great place to start.

Why Is Plan G So Popular

Medigap Plan G didn’t just become a favorite by accident—it rose to the top after some big changes in 2020. Enrollment has soared to over 5.7 million members, a huge jump from 5.3 million the year before.

This happened because, as of January 1, 2020, the government stopped allowing newly eligible Medicare enrollees to buy Plan F. With Plan F off the table for new folks, Plan G stepped up as the most comprehensive option available.

This policy makes your healthcare budget incredibly simple. You pay your annual Part B deductible, and from that point on, Plan G handles its share of all Medicare-approved costs. It's a straightforward approach that brings a lot of clarity and security.

With Medigap Plan G, your only major out-of-pocket medical expense for the year is the Part B deductible. That’s it. This makes budgeting for your health simple and predictable, removing the fear of a serious illness or accident leading to massive medical debt.

To put it in perspective, here’s a quick snapshot of how Plan G steps in to cover the costs that Original Medicare leaves behind.

Medigap Plan G at a Glance

| Original Medicare Cost | How Medigap Plan G Covers It |

|---|---|

| Part A Deductible & Coinsurance | 100% Covered |

| Part B Coinsurance or Copayment | 100% Covered |

| First 3 Pints of Blood | 100% Covered |

| Part A Hospice Care Coinsurance | 100% Covered |

| Skilled Nursing Facility Coinsurance | 100% Covered |

| Part B Excess Charges | 100% Covered |

| Foreign Travel Emergency Care | 80% Covered (up to plan limits) |

| Part B Deductible | You Pay This Annually |

Once you've paid that one deductible for the year, you can see how the plan takes over, offering nearly seamless coverage for Medicare-approved services.

Who Benefits Most from Plan G

This plan is a fantastic match for anyone who wants near-total coverage and the freedom to see any doctor or visit any hospital in the U.S. that accepts Medicare. Forget about networks—there are no restrictions to worry about.

Plan G might be perfect for you if you:

- Value Predictability: You prefer a stable monthly premium in exchange for knowing your out-of-pocket costs will be minimal or zero.

- Want Comprehensive Coverage: You want the confidence that comes from knowing everything from a long hospital stay to a routine doctor's visit is covered.

- Prioritize Freedom of Choice: You want to pick your own healthcare providers without needing a referral or checking a network list.

For federal retirees, figuring out how different plans work together can be tricky. Exploring the interaction between FEHB and Medicare can shed light on how Plan G fits into the picture. Its structure often appeals to those who are already used to having broad access to providers and predictable costs.

A Deep Dive into Your Plan G Coverage

Let's go beyond the basic charts and talk about what Medigap Plan G coverage feels like in the real world. Think of it as a financial shield, protecting you from the kind of unexpected medical bills that can throw your entire budget off track.

When you see a term like "Part A Coinsurance" on a benefits list, it’s not just industry jargon. It’s your safety net. It means if you ever have a long hospital stay, you won't be on the hook for the massive daily charges that kick in after day 60. Original Medicare stops paying its full share then, but Plan G steps right in to cover it. That one benefit alone could save you thousands.

Breaking Down Hospital and Inpatient Benefits

The first major piece of protection Plan G offers is paying your Medicare Part A deductible. This is the large, upfront cost you’d otherwise have to pay out-of-pocket for an inpatient hospital stay. In 2024, that single deductible was over $1,600. With Plan G, you don't even have to think about it.

It also covers your coinsurance for skilled nursing facility care. If you need short-term rehab after a qualifying hospital stay, Medicare covers the first 20 days. But from day 21 to 100, a steep daily copay starts. Plan G pays this for you, so your recovery isn't overshadowed by daily bills piling up.

On top of that, the plan covers the first three pints of blood you might need for a transfusion each year, whether you’re in a hospital or an outpatient clinic.

The real value of Medigap Plan G is how it turns unpredictable, potentially devastating medical costs into one simple, manageable monthly premium. It gives you the freedom to focus on getting better, not on the bills.

How Plan G Covers Your Doctor Visits and Outpatient Care

When you visit a doctor, get lab work done, or use medical equipment, Medicare Part B covers 80% of the cost—but only after you’ve met your yearly deductible. You're left responsible for the other 20%, and there’s no annual cap on how high that amount can climb. This is where Plan G becomes so powerful, because it picks up that 20% coinsurance for you.

This is a huge deal. Whether it's a routine check-up, a pricey MRI, or durable medical equipment like a walker, your 20% share is paid in full.

Another critical—and often overlooked—benefit is coverage for Part B excess charges. In most states, doctors who don't fully accept Medicare's approved payment rates can legally bill you up to 15% more. Plan G is one of only two Medigap plans that covers these extra charges. This gives you the freedom to see any doctor who accepts Medicare patients without worrying about surprise bills. You can learn more about how this works in our guide on understanding Medicare Part B excess charges.

Additional Protections Included with Plan G

Your coverage doesn't stop at the doctor's office. Plan G also includes a foreign travel emergency benefit, which is a must-have for anyone who plans to travel outside the U.S.

- How it Works: The plan pays for 80% of your emergency medical care costs during the first 60 days of your trip.

- Deductible: You pay a small deductible first.

- Lifetime Limit: The benefit has a lifetime maximum, giving you a solid safety net for health emergencies abroad.

This benefit adds another layer of security, so you can travel with real confidence.

The One Thing You Pay: The Part B Deductible

As comprehensive as Plan G is, there's one cost it doesn’t cover: the annual Medicare Part B deductible. This is a relatively small, once-a-year amount you pay for your outpatient services.

Once you’ve paid this deductible out of your own pocket, Plan G’s powerful coverage kicks in and pays its share for the rest of the year. Understanding this single, predictable cost is the key to seeing the true value of Plan G. It simplifies your healthcare budgeting and removes nearly all other financial guesswork.

Understanding the Costs of Medigap Plan G

Medigap Plan G offers wonderfully predictable coverage, but the monthly premium you pay can be a bit of a moving target. Getting a handle on what goes into that price tag is the key to becoming a smart shopper and landing a policy that gives you real value for years to come.

The monthly premium isn't a one-size-fits-all number. It’s set by the insurance company you choose, and every carrier has its own way of crunching the numbers. Think of it like getting a mortgage—different lenders will offer you different interest rates based on their own secret sauce.

How Insurance Companies Price Your Premium

Carriers typically use one of three methods to set your Medigap Plan G premium. Knowing which one a company uses is a big deal because it directly impacts how your rate might change down the road.

-

Community-Rated: This is like everyone in a community pool paying the same entry fee, no matter their age. Every policyholder in a certain area pays the same monthly premium. Your rate won't climb just because you have a birthday, but it can still go up due to inflation and other factors that affect everyone.

-

Issue-Age-Rated: This is like locking in a fixed rate. Your premium is based on how old you are when you first buy the policy. It won't increase just because you get older, but it can still rise for other reasons, like the overall cost of healthcare going up.

-

Attained-Age-Rated: This is the most common model you'll see. Your premium starts lower, based on your current age, but it's designed to increase as you get older. Think of it like an adjustable-rate mortgage—your payments start low but are scheduled to rise over time. It might look like the cheapest option at first but could become more expensive in the long run.

Understanding these pricing models is crucial. An attained-age policy might look like a bargain at 65, but an issue-age policy could save you more money over the next 20 years. Always ask your agent how a plan is rated.

Key Factors That Influence Your Premium

Beyond the pricing model, a few personal details play a huge role in shaping your final monthly cost. Insurance companies are all about assessing risk, and these factors help them figure out a premium that fits your specific profile.

Your location is a major driver. Healthcare just costs more in some states—and even in different zip codes within the same state. A Plan G policy in a big city will almost always cost more than the exact same policy in a rural town.

Other common factors include:

- Your Age: The younger you are when you enroll, the lower your premium will usually be.

- Tobacco Use: Smokers are seen as higher risk and almost always pay significantly more than non-smokers.

- Gender: In some states, your gender can be a rating factor, leading to different rates for men and women.

- Household Discounts: Many companies will offer a nice discount if you and your spouse both sign up for a plan with them.

Facing the Reality of Rate Increases

Let's be honest: your Medigap Plan G premium will probably go up over time. These aren't random hikes; they're driven by real-world economics. As medical care gets more expensive due to inflation and new technologies, insurance companies have to adjust their rates to cover those higher bills.

Recent trends tell the story. The average monthly premium for Medigap Plan G is now around $155.33, which adds up to $1,864 a year. This follows rising loss ratios for insurers, which have climbed from 77% to nearly 85% in recent years. Premiums also swing wildly from state to state. For example, data shows an average Plan G premium of $159 a month in New Mexico compared to $236 in New York. You can get more insights into these cost variations and trends on MedicareSupplement.com.

This is why choosing a plan isn't just about finding the lowest price today. A company with a history of stable, moderate rate increases might be a much smarter financial move over the long term than one that lures you in with a low introductory rate only to hit you with steep hikes later. Your goal is to find a plan that stays affordable for the rest of your life.

How to Enroll in Plan G and Avoid Costly Mistakes

When it comes to your healthcare, timing is everything. Enrolling in Medigap Plan G at the right moment is one of the biggest financial decisions you'll make, and getting it right can save you a world of headaches and money down the road.

The secret? It all comes down to your one-time Medigap Open Enrollment Period.

Think of it as your six-month golden window. It kicks off on the first day of the month you’re both 65 or older and officially enrolled in Medicare Part B. During these six months, you hold all the cards because you have something called guaranteed issue rights.

This is your VIP pass. It forces insurance companies to sell you any Medigap plan they offer, including Plan G. They can't ask about your health history, they can't deny you for pre-existing conditions, and they can't charge you a penny more because of them. It's a one-shot deal that puts you in complete control.

Your Golden Window: The Medigap Open Enrollment Period

Once that six-month window slams shut, it’s gone for good. If you wait and decide to apply for a Plan G policy later, the game changes completely. You’ll almost certainly face medical underwriting.

Medical underwriting is exactly what it sounds like. The insurance company puts your health under a microscope. They’ll dig into your past and present medical conditions and your prescription history to decide if they even want to offer you a policy—and at what price.

If you’ve developed any health issues, an insurer could legally deny your application flat out. Or, they could approve you but with a much higher premium. This is precisely why jumping on your Open Enrollment Period is so critical. It lets you skip the line and bypass the gatekeeper entirely.

The single biggest mistake new Medicare beneficiaries make is missing their Medigap Open Enrollment Period. Enrolling during this six-month window guarantees your acceptance into Medigap Plan G, regardless of your health.

What Happens If You Miss Your Initial Window?

Letting your Open Enrollment Period slip by can have some serious long-term financial consequences. Imagine you keep your employer's health plan until you're 68 and then decide it's time for Medigap. Since your golden window closed years ago, you'll have to go through medical underwriting.

That minor health issue that popped up when you were 66? It could now be the very thing that prevents you from getting the Plan G coverage you need.

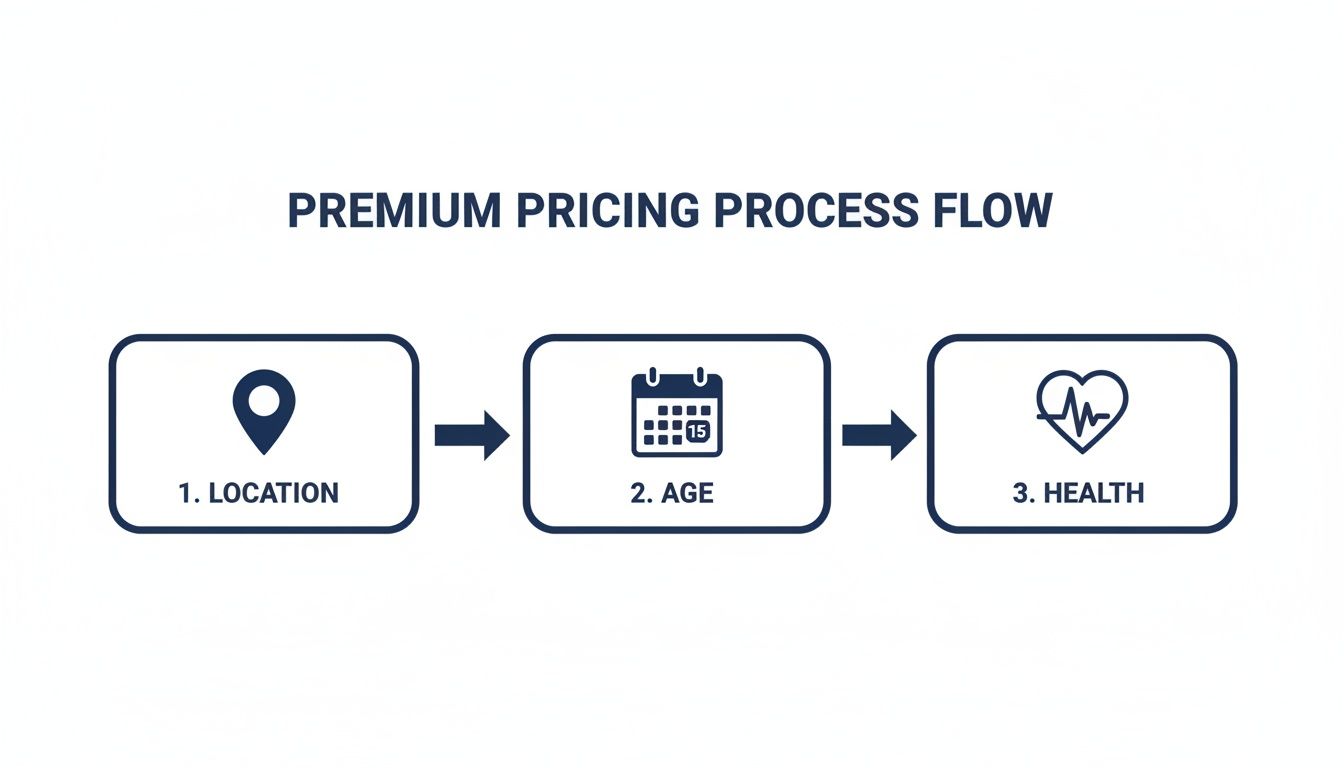

This flowchart breaks down how insurers look at your personal details—especially when you’re outside a guaranteed issue period.

As you can see, your location sets a baseline price, but it’s your age and, most importantly, your health profile that can really move the needle on your monthly premium.

But life happens. The good news is that certain situations can grant you another shot at guaranteed issue rights. These are called Special Enrollment Periods.

These special circumstances are usually tied to losing other health coverage. For example:

- You lose your group health coverage from an employer.

- You move and your Medicare Advantage plan is no longer available.

- Your current insurance provider goes out of business.

These events open a new, but limited, window to enroll in a Medigap plan without going through underwriting. If you're in a similar boat, learning how to change from Medicare Advantage to Medigap can give you a clear path forward.

Ultimately, your best strategy is to be proactive. Aim to sign up during your initial Medigap Open Enrollment Period to lock in the best access and pricing for your Plan G policy. It's a simple step that builds a foundation for predictable, stable healthcare costs for all the years to come.

Comparing Plan G to Other Popular Medigap Options

Choosing the right Medigap plan isn't about finding the "best" one on paper—it's about finding the one that fits your life, your budget, and how you want to handle your healthcare. While Plan G is an incredible all-around choice, seeing how it stacks up against its closest siblings, Plan F and Plan N, really clarifies things.

Think of it like this: Plan G is the modern, reliable workhorse that has nearly every feature you could ask for. Plan F is the classic, fully-loaded luxury model, but it's only available to a select few. And Plan N? That's the smart, economical choice that delivers great performance but asks you to chip in for a couple of minor things yourself.

The First-Class Option: Plan F

For years, Medigap Plan F was the undisputed king. It was the "first-class ticket" of Medicare Supplements, covering every single gap Original Medicare left behind, including the annual Part B deductible. With Plan F, you had virtually zero out-of-pocket costs for any Medicare-approved service. It was simple and comprehensive.

But, a federal law changed the rules. As of January 1, 2020, Medigap plans can no longer cover the Part B deductible for new Medicare members.

This means Plan F is only available if you were eligible for Medicare before January 1, 2020. If you became eligible after that date, you simply can't buy a Plan F policy. This is exactly why Plan G has stepped up to become the new gold standard for anyone new to Medicare seeking top-tier coverage.

The À La Carte Choice: Plan N

On the other side of Plan G is Medigap Plan N, an option that's quickly gaining fans. Plan N is built for people who are comfortable with a little cost-sharing in exchange for a lower monthly premium. It’s the "à la carte" choice.

Like Plan G, it covers the big, potentially scary gaps in Medicare. But it asks you to handle a few small, predictable costs on your own.

With Plan N, you might have:

- A copayment of up to $20 for some doctor's office visits.

- A $50 copayment for an ER visit (but only if you aren't admitted to the hospital).

- Unlike Plan G, Plan N does not cover Part B excess charges (which are rare, but possible).

These copays are the trade-off. In return, the monthly premium for Plan N is often quite a bit lower than Plan G. For someone who only sees a doctor a few times a year, the savings on premiums can easily add up to more than any copays they might have.

The decision between Plan G and Plan N really boils down to this: Do you prefer paying a little more each month for total predictability, or would you rather save on premiums and handle small, occasional copays as they come up?

Medigap Plan G vs. Plan F vs. Plan N: A Side-by-Side Look

Sometimes, seeing everything laid out in a simple chart makes the differences click. This table gives you a clear, at-a-glance comparison of the three most popular Medigap plans.

| Coverage Benefit | Medigap Plan G | Medigap Plan F | Medigap Plan N |

|---|---|---|---|

| Part A Deductible & Coinsurance | Covered | Covered | Covered |

| Part B Coinsurance | Covered | Covered | Covered (with copays) |

| Part B Deductible | Not Covered | Covered | Not Covered |

| Part B Excess Charges | Covered | Covered | Not Covered |

| Skilled Nursing Facility Coinsurance | Covered | Covered | Covered |

| Foreign Travel Emergency | Covered | Covered | Covered |

This comparison makes it easy to see why Plan G has become the go-to for so many. It delivers the same powerful, first-class protection as the old Plan F, with the single exception of that small Part B deductible. For a deeper dive, our guide to choosing the best Medicare Supplement plan breaks it down even further.

Medigap vs. Medicare Advantage: A Quick Contrast

Finally, it's crucial to know how the entire Medigap philosophy differs from Medicare Advantage (Part C) plans. It's like comparing buying a house to renting an apartment—they're just two fundamentally different ways to approach your healthcare coverage.

Medigap plans work with Original Medicare. They are standardized policies that give you the freedom to see any doctor or visit any hospital in the U.S. that accepts Medicare. Your costs are predictable, and your access to care is wide open.

Medicare Advantage plans are an alternative to Original Medicare. Offered by private insurers, they usually operate with provider networks (like an HMO or PPO). They often bundle in extras like prescription drugs, dental, or vision coverage. While their monthly premiums can be very low—sometimes even $0—you may face higher out-of-pocket costs when you actually need care, and you have to stay within the plan's network to get the lowest prices.

Your choice between Medigap Plan G, Plan N, or a Medicare Advantage plan really comes down to what you value most—the freedom and predictability of Medigap or the lower premiums and bundled benefits of an Advantage plan.

Got Questions About Medigap Plan G? We’ve Got Answers.

Jumping into the details of any insurance plan can feel a little overwhelming. It’s only natural to have a few last-minute questions. Think of this section as a straightforward chat where we tackle the most common things people ask about Medigap Plan G.

No jargon, no runaround—just clear answers so you can feel confident about your next steps.

Let's dive right in.

Will My Medigap Plan G Premium Go Up Over Time?

Yes, it's pretty much a guarantee that your premium will increase over the years. Insurance companies regularly adjust their rates to keep pace with inflation and the rising costs of healthcare. It's just the reality of the industry.

The way your premium is structured also plays a big role. Whether it’s an attained-age, issue-age, or community-rated plan will affect how—and how often—your rates change. Remember, a super-low premium today doesn't automatically mean it's the cheapest plan for you down the road.

Does Plan G Cover My Prescriptions?

This is a big one: No, Medigap Plan G does not cover prescription drugs. It’s crucial to understand this distinction.

Medigap plans are built to fill the gaps in Original Medicare (Parts A and B), which don't cover most of the medications you'd pick up from a pharmacy. To get that coverage, you'll need to sign up for a separate Medicare Part D Prescription Drug Plan.

Think of it like this: Plan G is your partner for hospital and doctor bills, while Part D is your partner for prescription medications. They work together, but they are two different plans.

Is the High-Deductible Plan G a Smart Move?

For the right person, the High-Deductible Plan G can be a fantastic option. The deal is simple: you pay a much lower monthly premium, but you agree to cover your medical costs yourself until you hit a set deductible for the year.

This trade-off often makes sense for:

- People who are in good health and don't anticipate needing a lot of medical care.

- Anyone with enough savings to comfortably pay the deductible if something unexpected happens.

- Those who want to keep their fixed monthly insurance costs as low as possible.

Can I Be Turned Down for Plan G?

Yes, you can absolutely be denied coverage for Plan G if you apply at the wrong time. This is why your Medigap Open Enrollment Period is so important. It's your golden ticket.

This six-month window kicks off the month you turn 65 and enroll in Medicare Part B. During this period, you have "guaranteed issue rights." That means insurance companies can't say no or charge you more because of your health history. If you let this window close, you'll likely face medical underwriting, and a pre-existing condition could be grounds for denial.

Ready to see what a Medigap Plan G policy might look like for you? The team at My Policy Quote can pull instant, personalized quotes from top-rated carriers in your area. Find the perfect balance of coverage and cost by visiting https://mypolicyquote.com today.