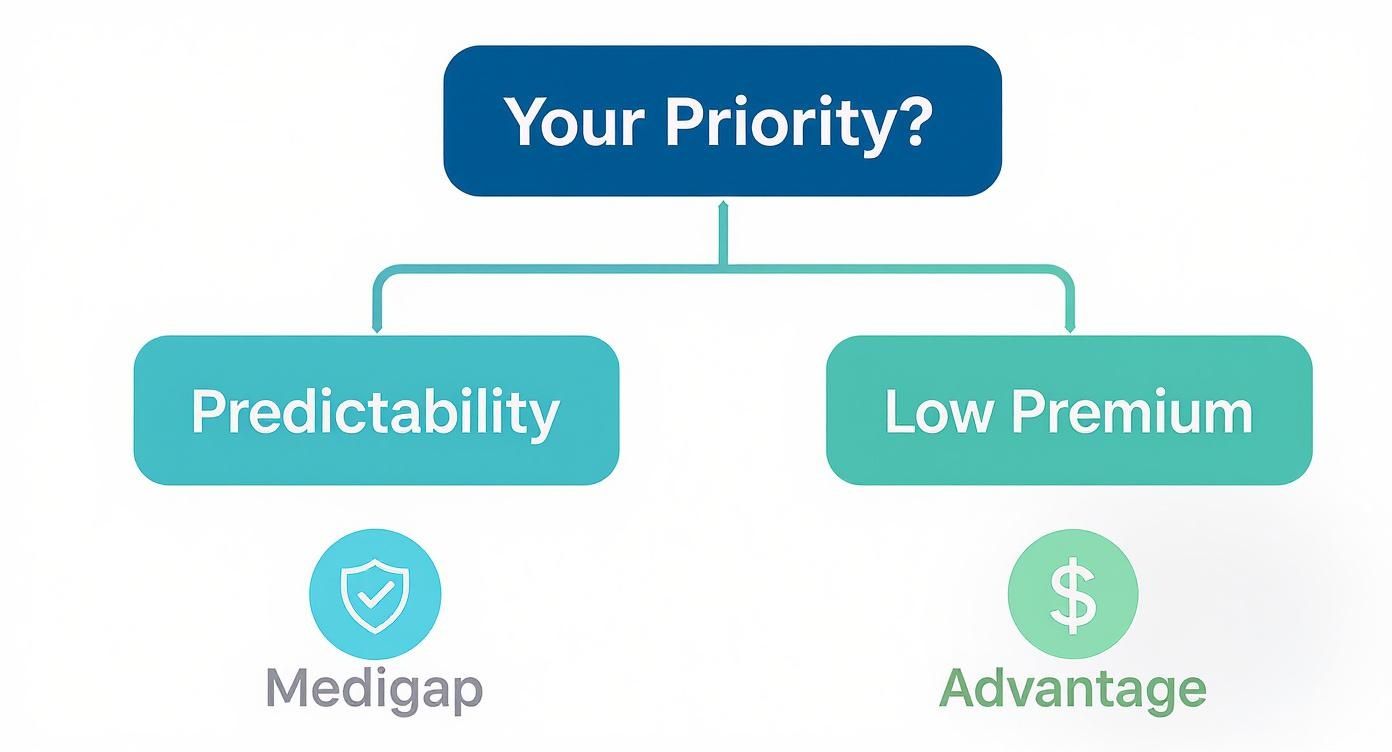

When it comes to Medicare, the biggest fork in the road is often the choice between Advantage and Medigap. It really boils down to one question: do you prefer an all-in-one plan with lower monthly costs but potential out-of-pocket expenses, or would you rather pay a higher premium upfront for more predictable, comprehensive coverage?

Medicare Advantage plans essentially replace Original Medicare, while Medigap plans work with it. Your decision hinges on what you value more—low premiums today or minimal costs when you actually need care.

Comparing Your Two Medicare Paths

Picking your Medicare coverage is a huge decision. It sets the stage for your healthcare access and your budget for the entire year. The goal isn’t to find the single “best” plan out there, but to find the one that fits your life—your health, your finances, and your comfort level with risk.

Let’s get straight to the point on what these plans actually do. A Medicare Advantage (Part C) plan is a private insurance alternative to Original Medicare. It bundles everything—Part A (hospital), Part B (medical), and usually Part D (prescriptions)—into one convenient package. Many even throw in extras like dental or vision.

A Medicare Supplement (Medigap) policy, on the other hand, isn’t a standalone plan at all. Think of it as a sidekick to Original Medicare. It’s designed specifically to fill in the financial "gaps" that Original Medicare leaves behind, like your deductibles and coinsurance.

Quick Look Medicare Advantage vs Medigap

To make things a little clearer, here’s a simple side-by-side comparison. It’s a great way to see the fundamental differences at a glance.

| Feature | Medicare Advantage (Part C) | Medicare Supplement (Medigap) |

|---|---|---|

| Primary Function | Replaces Original Medicare | Supplements Original Medicare |

| Cost Structure | Low or $0 monthly premiums, but you pay copays for services. | Higher monthly premiums, but you pay little to nothing for services. |

| Doctor Choice | You’re usually limited to a local network of doctors (HMO/PPO). | You can see any doctor in the U.S. that accepts Medicare. No referrals needed. |

| Extra Benefits | Often includes dental, vision, hearing, and gym memberships. | No extra benefits. You’ll need separate policies for those. |

This table gives you the high-level view, but the right choice often comes down to your personal priorities and how you see your healthcare needs evolving.

As you can see, if predictable spending is your top priority, a Medigap plan is often the way to go. It offers stability, even if it costs a bit more each month. For a deeper look at building a long-term strategy, our complete Medicare planning guide can help you put all the pieces together.

Understanding How Each Plan Works With Medicare

To really get to the heart of Medicare Advantage vs. Medicare Supplement, you have to understand how they interact with Original Medicare. They’re built on completely different foundations. Think of it like this: one is a totally new road, and the other is a co-pilot for the road you’re already on.

One path replaces Original Medicare, while the other is designed to work with it. Grasping this single concept is crucial, because it shapes everything from your out-of-pocket costs to which doctors you can see.

Medicare Advantage: An All-In-One Alternative

A Medicare Advantage plan, also called Part C, is a different way to get your Medicare benefits. When you sign up for one, you’re choosing to let a private, Medicare-approved insurance company manage your Part A (hospital) and Part B (medical) coverage.

These plans bundle all your benefits into a single, convenient package. Most even include prescription drug coverage (Part D) and may offer extra perks that Original Medicare doesn’t, like routine dental, vision, and hearing services. It's an all-in-one approach that has exploded in popularity.

In fact, Medicare Advantage plans now cover more than half (54%) of everyone eligible for Medicare, with enrollment topping 32.8 million people. A huge reason for this growth is the built-in financial safety net—an annual out-of-pocket maximum that’s capped at $8,850. Original Medicare just doesn't have that protection on its own. You can discover more insights about these Medicare Advantage trends and see why so many are making the switch.

Key Takeaway: With Medicare Advantage, a private insurer is in the driver's seat. You'll use their insurance card, play by their rules (like network restrictions), and pay their copays and coinsurance when you get care.

Medicare Supplement: A Supportive Partner

Medicare Supplement plans, better known as Medigap, work in a completely different way. They don’t replace Original Medicare—they work with it. A Medigap plan’s only job is to fill in the financial "gaps" that Parts A and B leave behind.

This means a Medigap policy steps in to help pay for your share of the bills, like:

- The Part A deductible for a hospital stay

- The Part B deductible for doctor visits and tests

- Your 20% coinsurance for most outpatient care

- Excess charges if a doctor bills more than the Medicare-approved amount

You’re still in Original Medicare, and you’ll still show that red, white, and blue card every time you see a doctor. After Medicare pays its share, the leftover bill is automatically sent to your Medigap plan, which pays some or all of the rest, depending on which policy you have.

This two-part system gives you predictable costs and the freedom to see any doctor in the country who accepts Medicare. If you want to dive deeper, our guide on what a Medicare Supplement plan is is a great next step. It's a powerful combo of government coverage and private insurance protection.

A Nuanced Look at Your Total Healthcare Costs

When you’re comparing Medicare Advantage and Medigap, the monthly premium is just the tip of the iceberg. It’s what you don’t see at first glance—the copays, the deductibles, the total out-of-pocket spending—that really tells the story of what a plan will cost you.

It boils down to a fundamental choice: would you rather pay more upfront each month for predictable, stable costs? Or would you prefer to pay as you go, with lower monthly premiums but variable costs when you actually need care?

The Medicare Advantage "Pay-As-You-Go" Model

Advantage plans often catch people’s attention with their $0 monthly premiums. It sounds like a fantastic deal, and for some, it is. But there’s a trade-off. Your costs show up when you go to the doctor or hospital.

Think of it like a pay-as-you-go phone plan. You don't pay much upfront, but you pay for every service you use. This comes in the form of:

- Copayments: A set fee for a service, like $20 for a check-up or $50 to see a specialist.

- Coinsurance: A percentage of the bill, such as 20% for a wheelchair or outpatient procedure.

- Deductibles: Some plans require you to pay a certain amount for your care or drugs before they start pitching in.

- Out-of-Pocket Maximum: This is your safety net. It’s the absolute most you could spend in a year, and it can be as high as $8,850 for in-network care.

This model can feel great when you’re healthy and don't need much medical attention. But a sudden illness or an unexpected injury can cause those copays and coinsurance bills to stack up fast, pushing you closer and closer to that maximum.

The Medigap Approach: Predictable and Stable

A Medigap plan is built on the opposite idea: budget for your healthcare upfront and eliminate surprises. You pay a higher, fixed premium every month, and in return, the plan handles most—or all—of the costs that Original Medicare leaves behind.

With a popular option like Plan G, once you’ve paid your annual Part B deductible, your Medicare-approved costs are typically 100% covered.

That means no surprise coinsurance bills after a hospital stay and no copays for doctor visits. It takes the financial guesswork out of healthcare, which is a huge relief for anyone managing a chronic condition or who simply wants to know exactly what they’ll spend each month.

The Core Financial Question: Are you more comfortable paying a fixed, higher monthly premium for near-zero costs when you need care, or do you prefer a lower (or $0) premium with the understanding that you'll pay for services as you use them?

Comparing Annual Costs with Real-World Scenarios

Let's put some real numbers to this to see how it plays out for people with different health needs. The examples below show potential total costs for the year, not including the standard Part B premium that everyone pays.

Annual Cost Scenarios: Advantage vs. Medigap

| Healthcare Usage Level | Example Medicare Advantage Plan Costs | Example Medigap Plan G Costs |

|---|---|---|

| Low Usage (Healthy year, few visits) | Total Annual Cost: $300 ($0 premium + $300 in copays) |

Total Annual Cost: $2,037 ($150/mo premium + $237 Part B deductible) |

| Medium Usage (Several specialist visits, one ER trip) | Total Annual Cost: $2,500 ($0 premium + $2,500 in copays/coinsurance) |

Total Annual Cost: $2,037 ($150/mo premium + $237 Part B deductible) |

| High Usage (Hospital stay, frequent specialist care) | Total Annual Cost: $6,500 ($0 premium + $6,500 in copays/coinsurance) |

Total Annual Cost: $2,037 ($150/mo premium + $237 Part B deductible) |

As you can see, the Medigap plan's total cost stays the same, no matter what health challenges the year brings. That consistency provides powerful financial protection. The Advantage plan is definitely cheaper in a healthy year, but its costs can climb quickly when you need more care.

And remember, prescription drug costs can also vary. Understanding the different stages of Part D coverage is key. You can learn more about how your medication expenses might change in our guide to the insurance donut hole. Ultimately, your choice comes down to your personal health outlook and how much financial risk you’re comfortable with.

Comparing Your Freedom to Choose Doctors and Hospitals

Beyond the numbers, one of the biggest forks in the road when comparing Advantage plans vs supplemental plans is your freedom to see the doctors you want, where you want. This isn’t just a small detail; it fundamentally shapes how you’ll experience healthcare.

Are you comfortable with a local network, or do you need the flexibility to see any doctor, anywhere in the country? It’s a classic trade-off: the managed care structure of an Advantage plan versus the go-anywhere freedom of Original Medicare with a Medigap policy. Your answer here will define your healthcare journey for years to come.

The Medicare Advantage Network Model

Most Medicare Advantage plans work like a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). At their core, these plans rely on a specific network of doctors, specialists, and hospitals that have agreed to set prices. This is the secret sauce that allows insurers to offer plans with very low—or even $0—monthly premiums.

But this cost-saving setup comes with some important rules:

- You Must Stay In-Network: With an HMO, you generally have to use doctors and facilities inside the plan’s network for your care to be covered, unless it's a true emergency.

- Referrals Are Often Required: Many HMOs ask you to get a referral from your primary care doctor before you can see a specialist. It’s an extra step that can slow things down.

- Going Out-of-Network Costs You: PPOs are more flexible and let you see providers outside the network, but you’ll almost always face much higher copays and coinsurance for doing so.

It’s crucial to understand these rules. For a deeper dive, our guide on the difference between a PPO and an HMO breaks down exactly how these networks operate in the real world.

Real-World Scenario: Picture this: you live in Florida but love spending summers up in North Carolina. If you have an HMO Advantage plan, your routine doctor visits in North Carolina probably won't be covered. You'd have to travel back to Florida for any non-emergency care.

The Medigap Freedom and Flexibility Model

When you stick with Original Medicare and add a Medigap plan, the whole concept of a network disappears. Your coverage isn’t tied to a specific city or a pre-approved list of doctors.

The rule is refreshingly simple: you can see any doctor or visit any hospital in the United States, as long as they accept Medicare. And since nearly 9 out of 10 non-pediatric primary care doctors accept it, your options are wide open.

This approach gives you some powerful advantages:

- Nationwide Coverage: Your health insurance travels with you. It doesn’t matter if you’re visiting family in another state or you’re a “snowbird” splitting your time between climates.

- No Referrals Needed: Want to see a cardiologist or a dermatologist? Just make the appointment. You don’t need to get permission from a primary care doctor first.

- Access to Top Specialists: If you’re ever diagnosed with a rare or complex condition, you have the freedom to seek out the nation’s leading experts and medical centers, wherever they are.

The Medigap route is all about prioritizing total, unrestricted access to care. You’ll pay a higher monthly premium for that predictability and control, but it ensures your choice of doctor is driven by your health—not a network directory. It’s the right choice for anyone who values choice, travels often, or simply wants the peace of mind that comes from knowing the best care is always within reach.

Evaluating the True Value of Extra Benefits

Let’s be honest—the extra perks in Medicare Advantage plans are tempting. They advertise dental, vision, hearing, and even gym memberships, and those commercials are effective because they tap into real needs that Original Medicare just ignores. These bundled benefits can be a huge plus, but it’s so important to look past the marketing and figure out what they’re actually worth to you.

This is where the two paths really diverge. Medigap plans don't do extras. Period. Their one and only job is to shield you from high medical costs. If you go with Medigap and want dental or vision coverage, you’ll have to buy separate, standalone policies. This brings us to the core of the advantage plans vs supplemental plans debate: is it better to get everything bundled in one package or to build your own safety net piece by piece?

Analyzing the Depth of Advantage Plan Benefits

Here’s the thing: not all "extra benefits" are created equal. The dental coverage in one Advantage plan might be fantastic, while another’s is barely there. One plan might just cover a routine cleaning and an X-ray, leaving you on the hook for the full cost of a crown or root canal. Another might offer more, but with a low annual cap, like $1,000. Once you hit that, you’re paying out-of-pocket.

You have to get personal and evaluate what you really need.

- Dental Coverage: Are you just looking for routine check-ups, or do you have a history of needing more complex work? Dig into the plan details to see what’s actually covered.

- Vision Benefits: Does the plan just cover a basic eye exam, or does it give you a real allowance for new glasses or contacts?

- Hearing Aids: This is a big one. Hearing aids can be incredibly expensive. Is the plan offering a small discount or a substantial allowance that makes a true difference?

And people care about these perks. A lot. Research shows that over 83% of Medicare members see these supplemental benefits as a key part of their coverage. You can discover more about how beneficiaries use these benefits and understand why they’ve become such a focal point.

The Standalone Policy Alternative

Choosing a Medigap plan means you’re in the driver’s seat. You’ll build your own benefits package by buying policies separately. Yes, it means a bit more upfront work and a few different premium payments, but it gives you one powerful thing: control. You can hand-pick a dental or vision plan that gives you exactly the level of coverage you need, without being stuck with the limitations of a bundled plan.

Key Consideration: If you know you have significant or specific dental or vision needs, a standalone policy paired with a Medigap plan will almost always offer more comprehensive coverage than what’s bundled into an Advantage plan.

In the end, it’s a cost-benefit analysis. Add up what you’d pay for separate policies and weigh that against the convenience and coverage of an Advantage plan. If your needs are minimal, those bundled perks can be a fantastic, money-saving bonus. But if you anticipate needing more extensive care, the freedom to choose your own robust policy often provides better value—and better health outcomes—in the long run.

Matching a Plan to Your Personal Situation

So, which is better: an Advantage plan or a Supplemental plan? Honestly, there’s no single right answer. It’s not about which plan is "best" overall, but which one is best for you.

A generic pro-con list just can't capture what matters in your real life—your health, your travel plans, or how you feel about your budget. The clearest way to see the difference is to walk through a few common situations. Let's see how these plans really stack up for people in different stages of retirement.

For the Healthy Traveler Who Craves Freedom

Meet Sarah. She’s newly retired, in great health, and ready to spend a few months each year visiting her grandkids across the country. She rarely sees a doctor, but when she does, she doesn’t want any hassles. Her biggest priority? Freedom.

For Sarah, a Medicare Supplement (Medigap) plan is the obvious choice. Sure, a Medicare Advantage plan might look tempting with a lower premium, but the network rules would drive her crazy. Imagine trying to find an in-network doctor for a sinus infection while you're three states away from home—it's a headache she doesn't need.

With Medigap and Original Medicare, she has a nationwide network. She can see any doctor who takes Medicare, anywhere in the U.S., no referrals needed. That higher monthly premium is a small price to pay for total peace of mind and the freedom to live her retirement on her own terms.

A Medigap plan’s real value isn’t just in the bills it covers. It’s in the absolute freedom it gives you. If you travel or have a second home, that kind of unrestricted access is everything.

For the Retiree Managing a Chronic Illness

Now, let's think about David. He’s managing diabetes and a heart condition, which means he has regular appointments with a few different specialists. What he wants most is predictability. The idea of getting a huge, unexpected hospital bill is what keeps him up at night.

David’s peace of mind comes from the rock-solid stability of a Medigap plan. With a plan like Plan G, once he pays his small annual Part B deductible, all of his Medicare-approved costs are covered at 100%. That’s it.

- No Copays: He doesn't have to pull out his wallet for every single specialist visit.

- No Coinsurance: A major surgery won't end with a surprise bill for 20% of the cost.

- Simple Budgeting: His healthcare costs are basically fixed to his monthly premium. It’s simple, predictable, and lets him breathe easier.

An Advantage plan just wouldn't work for him. The pay-as-you-go copays and coinsurance would create constant financial stress and uncertainty, which is the last thing he needs.

For the Budget-Conscious Senior Who Needs Great Value

Finally, there’s Maria. She’s healthy, living on a fixed income, and needs to keep her monthly bills as low as possible. She stays local and is perfectly happy using doctors in a specific network if it means saving money.

For Maria, a $0-premium Medicare Advantage plan is a perfect fit. It gives her medical and drug coverage all in one plan, without adding another monthly bill to her budget. The built-in dental and vision benefits are a huge plus, saving her hundreds of dollars a year.

She knows she'll have copays when she needs care, but she's comfortable with that trade-off. Plus, the plan’s out-of-pocket maximum acts as a crucial safety net, protecting her from ever facing a truly catastrophic medical bill.

Common Questions About Your Medicare Choices

Digging into the details of Medicare can bring up some really important questions. When you're weighing Medicare Advantage against Medigap, getting clear on the rules is the key to making a smart decision and avoiding surprises later on.

Let's walk through some of the most common questions people ask.

Can I Have a Medicare Advantage Plan and a Medigap Plan at the Same Time?

Nope, you can't. It's actually illegal for an insurance company to sell you a Medigap policy if they know you're already in a Medicare Advantage plan. The two serve completely different, mutually exclusive purposes.

Think of it this way: a Medigap plan works with Original Medicare to fill in the gaps. On the other hand, a Medicare Advantage plan is a private insurance option that replaces Original Medicare. You have to pick one path or the other—you can't mix and match.

If I Choose Medigap, Do I Still Need a Separate Part D Plan?

Yes, you almost certainly will. Medigap plans sold today are not allowed to include prescription drug coverage. Their one and only job is to help cover the costs left over by Parts A and B, not your medications.

This is a major difference from Medicare Advantage plans, which usually bundle everything—including drug coverage (Part D)—into one package. If you go the Medigap route, you'll need to shop for and enroll in a standalone Medicare Part D plan from a private insurer to get help with your prescriptions.

The Bottom Line: Choosing Medigap means you're building your own three-part coverage: Original Medicare (Parts A & B) + your Medigap plan + a separate Part D drug plan.

Are All Medigap Plans the Same, Even From Different Companies?

This is a "yes and no" answer. The core medical benefits for each Medigap plan letter—like a Plan G or a Plan N—are standardized by the federal government. That means a Plan G from one company has to offer the exact same coverage as a Plan G from any other company.

This standardization is a huge help because it makes it much easier to compare your options. The only real differences between companies are the monthly premium they charge you, their reputation for customer service, and maybe some subtle differences in how they set their rates. But the actual coverage you get for a specific plan letter will always be identical.

Navigating the world of Medicare is so much simpler when you have an expert in your corner. At My Policy Quote, we bring the clarity you need to find the right plan for your life. Find your personalized quote today.