So, what exactly is a High Deductible Health Plan, or HDHP? Think of it as a health insurance plan that flips the usual payment structure on its head. You get to pay a much lower monthly bill (your premium), but in exchange, you agree to cover a higher amount of your initial medical costs yourself before the insurance company really kicks in.

It’s a bit like having a higher deductible on your car insurance. You take on a little more of the initial risk, and in return, your regular payments are significantly smaller. This can be a brilliant financial move, especially if you’re generally healthy and don’t find yourself at the doctor’s office too often.

How a High Deductible Health Plan Really Works

At its core, an HDHP is a trade-off. You’re telling your insurance company, "I'll handle the smaller, more predictable costs if you lower my monthly premium." This simple shift encourages you to be more engaged with your healthcare spending because, for a while, it's your money paying the bills directly.

But not just any plan with a high deductible gets to be called an HDHP. For a plan to officially qualify, it has to meet some specific rules set by the government. In 2025, the IRS says an HDHP must have a minimum deductible of $1,650 for an individual or $3,300 for a family. You can find more details on these 2025 HDHP guidelines over at Fidelity.

The Key Terms You Need to Know

To really get how an HDHP works, you need to understand three core pieces of the puzzle. Each one defines a part of your financial responsibility.

- Premium: This is your fixed monthly fee to keep your insurance active. With an HDHP, the biggest perk is that this number is usually way lower than what you’d see with a traditional plan.

- Deductible: This is the amount of money you have to pay out-of-pocket for your medical care before your insurance starts sharing the cost. If you want to dive deeper, check out our guide on understanding the health insurance deductible.

- Out-of-Pocket Maximum: This is the absolute ceiling on what you’ll pay for covered medical services in a single year. Once you hit this limit through your deductible, copayments, and other costs, your plan steps in and pays 100% of your covered benefits.

To make it even clearer, here’s a quick table breaking down these moving parts.

Key Components of a High Deductible Health Plan at a Glance

| Component | Description | Key Figure (Example) |

|---|---|---|

| Premium | The fixed monthly fee you pay to the insurance company to maintain your coverage. | Lower than traditional plans. |

| Deductible | The amount you must pay for medical services before your insurance begins to share costs. | Minimum of $1,650 (individual) for 2025. |

| Out-of-Pocket Maximum | The total cap on your annual medical spending for covered, in-network services. | Capped at $8,300 (individual) for 2025. |

An HDHP is designed to protect you from major, catastrophic medical events while giving you lower fixed monthly costs. You take on the smaller, predictable expenses, and the insurance is there as a safety net for significant, unexpected health issues.

This structure puts you in the driver’s seat for your routine healthcare spending, all while giving you a solid backstop for those worst-case scenarios you hope never happen.

How an HDHP Works in Real Life

Theory is one thing, but what does an HDHP look like when life actually happens? Let’s walk through a year with a fictional character, Alex, to see how these plans really work, day in and day out. This story will turn all those confusing terms into something you can actually picture.

Alex is pretty healthy and picks an HDHP with a $3,000 deductible because the low monthly premium is a huge plus. Every month, the money saved on premiums goes straight into a Health Savings Account (HSA).

The First Few Months: Paying Out of Pocket

Early in the year, Alex heads in for a routine check-up. Since preventive care is usually covered at 100% before the deductible is even touched, this visit costs Alex nothing. It’s one of the best perks of an HDHP, designed to keep you on top of your health without worrying about the cost.

A month later, a nasty sinus infection hits. Alex goes to an urgent care clinic, gets a diagnosis, and picks up a prescription for antibiotics. The grand total? $200. Because the deductible hasn't been met, Alex pays this full amount directly—tapping into that tax-free HSA makes it sting a lot less.

So far, Alex has paid $200 toward the $3,000 deductible.

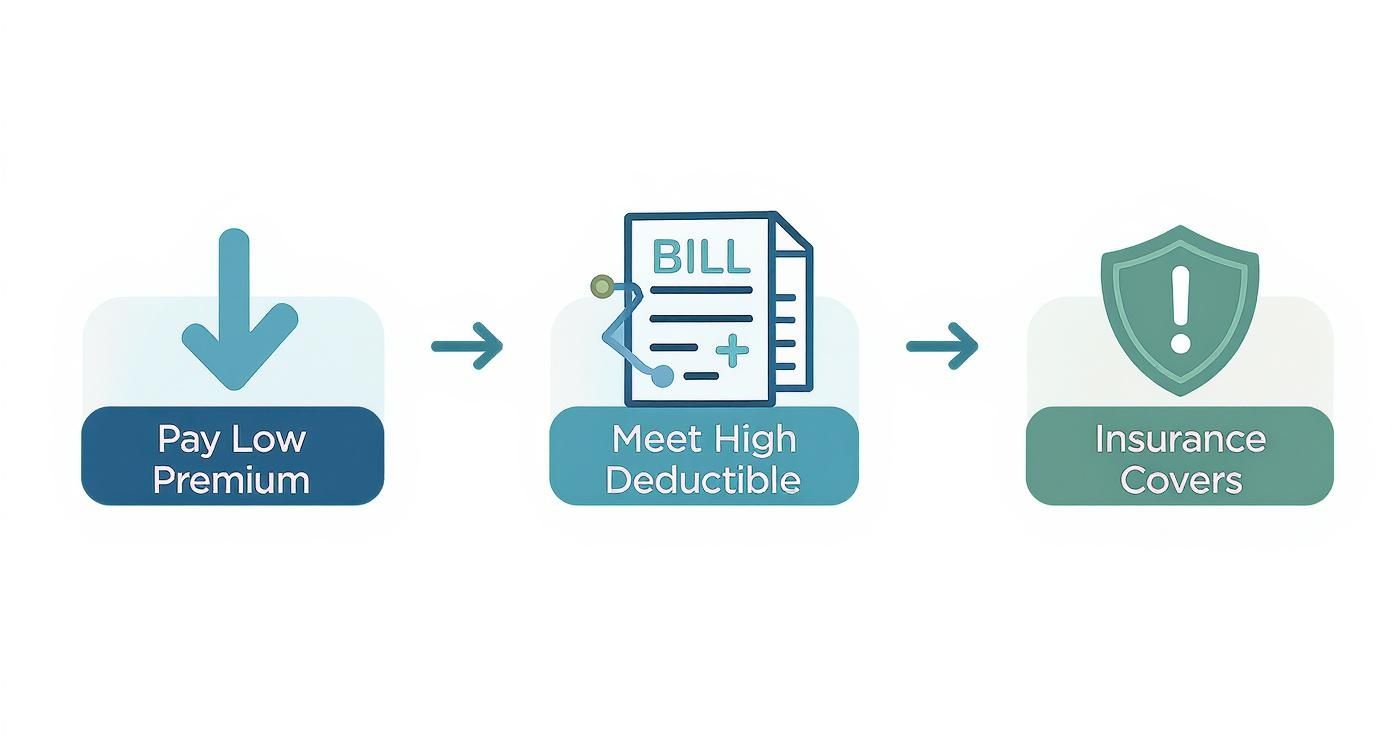

The infographic below shows how this works—you start with low monthly payments and handle the initial costs yourself until your insurance safety net kicks in.

It’s a trade-off: you take on more upfront responsibility in exchange for lower fixed costs and protection from truly catastrophic medical bills.

An Unexpected Event Changes Everything

Summer rolls around, and Alex goes for a weekend hike. A slip, a twisted ankle, and suddenly a trip to the emergency room is on the agenda. The visit includes an exam, X-rays, and a walking boot. The bill for this unexpected injury comes to $2,850.

This is where the structure of an HDHP really shows its value. Alex has already put $200 toward the deductible this year. This new bill eats up the remaining $2,800 of the deductible, bringing the total out-of-pocket spending for the year to exactly $3,000.

The Deductible Has Been Met. The second Alex pays that $2,800, a switch flips. For the rest of the year, Alex is no longer on the hook for the full price of medical care. The insurance company now steps in to share the burden.

That leaves just $50 from the ER bill, which falls into the next phase of the plan: coinsurance.

Life After Meeting the Deductible

Now that the $3,000 deductible is satisfied, Alex’s plan is officially in the coinsurance phase. Let's say the plan has an 80/20 coinsurance split. This is just a fancy way of saying the insurance company pays 80% of the bills, and Alex pays 20%.

- Insurance Company's Share: 80%

- Alex's Share (Coinsurance): 20%

For that leftover $50 from the ER visit, Alex is only responsible for 20%, which is just $10. The insurance company handles the other $40. Easy enough.

A few months later, Alex needs a follow-up visit with an orthopedic specialist to check on the ankle. The visit costs $250. Instead of paying the whole thing, Alex just owes the 20% coinsurance—a much more manageable $50. The insurance plan covers the remaining $200.

This cost-sharing continues for every covered medical service until the plan year resets on January 1st or Alex hits the out-of-pocket maximum. By planning for the deductible, Alex handled both routine care and a surprise injury without breaking the bank.

Pairing Your HDHP with a Health Savings Account

A High Deductible Health Plan is a solid tool on its own, but its true power gets unlocked when you pair it with a Health Savings Account (HSA). Think of your HDHP as the key that opens the door to one of the smartest financial accounts out there.

An HSA isn't just a rainy-day fund for medical bills. It’s a strategic savings vehicle that many experts call a "supercharged 401(k) for healthcare."

To even open and contribute to an HSA, you first have to be enrolled in a qualified HDHP. This powerful partnership is what turns a simple insurance plan into a long-term strategy for managing both your health and your wealth.

So, what makes an HSA so special? It’s famous for its triple tax advantage—a benefit that’s almost unheard of in the world of personal finance.

- Tax-Deductible Contributions: The money you put into your HSA is tax-deductible, which means it lowers your taxable income for the year. That’s an immediate win.

- Tax-Free Growth: Your HSA funds aren't just sitting there. They can be invested in mutual funds, stocks, and other assets, and all the earnings grow completely tax-free.

- Tax-Free Withdrawals: When you need to pay for qualified medical expenses, you can pull money out 100% tax-free.

This three-part benefit is a game-changer. Your money goes in tax-free, grows tax-free, and comes out tax-free for healthcare, making every single dollar you contribute work so much harder for you.

Maximizing Your HSA Contributions

Of course, there are limits. The IRS sets annual caps on how much you can contribute. For 2025, the contribution limits are $4,300 for individuals and $8,550 for families.

Plus, if you're age 55 or older, you get to add an extra $1,000 "catch-up" contribution each year.

These contributions can come from you, your employer, or even a family member. It’s common for employers to chip in as part of their benefits package, giving you a nice head start on building your savings.

Unlike a Flexible Spending Account (FSA), the money in your HSA is yours forever. The funds never expire. They just roll over year after year, letting you build a serious nest egg for your future health.

This "no use-it-or-lose-it" rule is what makes the HSA a powerful long-term investment account, not just a short-term savings tool. To dig deeper into how these accounts work, our guide to Health Savings Accounts in CA has all the details.

Using Your HSA for Qualified Expenses

So, what can you actually spend this tax-free money on? The list of qualified medical expenses is surprisingly long and covers a huge range of healthcare needs.

- Doctor’s office visits and copays

- Dental and vision care (including braces and glasses!)

- Prescription drugs and over-the-counter meds

- Chiropractic services and acupuncture

- Medical equipment like crutches or blood sugar monitors

One important update to keep in mind involves telehealth. As of 2025, a temporary pandemic-era rule allowing pre-deductible telehealth coverage has expired. Now, to keep your HSA eligibility, you'll need to pay for non-preventive telehealth visits yourself until you hit your deductible.

The real magic happens when you start treating your HSA like an investment. By paying for smaller medical costs out-of-pocket and letting your HSA funds grow, you can build a massive account balance over time.

For steady growth with less risk, consider investment strategies like dollar-cost averaging. It’s a simple way to turn your healthcare fund into a powerful supplemental retirement account. After you turn 65, you can even withdraw funds for any reason—not just medical—and only pay ordinary income tax, just like a traditional 401(k).

The Pros and Cons of Choosing an HDHP

A High Deductible Health Plan isn't a one-size-fits-all solution. Think of it more like a specialized financial tool. For some, it offers incredible benefits and savings. For others, it can introduce real financial challenges.

Choosing an HDHP is all about a trade-off: you get lower monthly costs, but you take on higher financial responsibility upfront. It's crucial to understand both sides of this coin to see if it truly lines up with your health, your lifestyle, and your bank account.

The Advantages of an HDHP

The first thing most people notice is the lower monthly premium. This isn't just a small discount; it can free up hundreds, or even thousands, of dollars over the year, giving your budget some much-needed breathing room.

This is the big draw, especially for people who are young, healthy, and don’t expect to see a doctor very often. That saved cash can be put toward other goals, like paying down debt or building your investments.

But the low premiums are only half the story. The other major upside is getting access to a Health Savings Account (HSA). As we’ve covered, an HSA is a powerhouse savings tool with a triple tax advantage that you just can't find anywhere else.

When you pair an HDHP with an HSA, you’re not just buying insurance—you’re adopting a long-term financial strategy. You lower your taxable income today, let your money grow tax-free, and create a tax-free fund for medical bills down the road.

Finally, an HDHP naturally makes you a smarter healthcare consumer. When you’re paying for care out-of-pocket before meeting your deductible, you’re more likely to shop around, compare prices, and ask if a test is truly necessary. This can lead to more efficient and mindful spending.

The Disadvantages of an HDHP

The biggest drawback is right there in the name: the high deductible. Until you hit that number, you're on the hook for 100% of your medical bills (outside of preventive care). That can be a pretty big financial hurdle to clear.

If an unexpected injury or illness pops up, you could be looking at a bill for thousands of dollars before your insurance plan starts chipping in. For anyone without a solid emergency fund or a funded HSA, that kind of surprise can be a major financial shock.

This high upfront cost can also make people hesitate to get the care they need. When every visit and prescription comes with a full-price tag, it’s tempting to delay treatment for "minor" issues, which can sometimes spiral into bigger problems.

For example, some studies have shown that people with chronic conditions might not get consistent care on an HDHP because the initial costs are a barrier, which could lead to worse health outcomes. You can learn more from this study on the JAMA Network Open.

It's helpful to think about how people handle big health expenses when insurance doesn't cover them. Some, for example, look for creative strategies for weight loss without insurance to manage their health goals without breaking the bank.

To give you a clearer picture of these trade-offs, let's compare an HDHP directly with a more traditional plan.

HDHP vs Traditional PPO Plan A Feature Comparison

| Feature | High Deductible Health Plan (HDHP) | Traditional PPO Plan |

|---|---|---|

| Monthly Premium | Typically much lower. | Usually higher. |

| Deductible | High (e.g., $3,000 for an individual). | Lower (e.g., $1,000 for an individual). |

| Out-of-Pocket Max | High; set by the IRS annually. | Can be lower or similar to an HDHP. |

| Doctor Visits | You pay the full, negotiated rate until your deductible is met. | You pay a fixed copay (e.g., $40) from day one. |

| Prescriptions | You pay the full, negotiated price until the deductible is met. | You pay a fixed copay (e.g., $15 for generic). |

| HSA Eligibility | Yes, you can contribute to a tax-advantaged HSA. | No, not eligible for an HSA. |

| Best For | Healthy individuals, savvy savers, and those who can cover the deductible. | Individuals or families who prefer predictable costs and frequent medical care. |

This table highlights the fundamental difference: an HDHP prioritizes low fixed costs and savings potential, while a PPO offers predictability and lower upfront expenses for care.

Weighing the Trade-Offs

So, how do you know if an HDHP is right for you? It really comes down to your personal situation. Let's look at a couple of quick scenarios.

Scenario 1: The Young, Healthy Professional

- Profile: A 28-year-old with no chronic health issues who sees a doctor maybe once a year for a check-up.

- Analysis: An HDHP is probably a fantastic fit. The low premium saves them money every single month, and they can pour funds into their HSA as a powerful investment vehicle. Since their risk of needing major medical care is low, the high deductible isn't a huge worry.

Scenario 2: The Family Managing Chronic Conditions

- Profile: A family of four, where a child has asthma that requires regular specialist visits and daily medication.

- Analysis: Here, an HDHP could be financially risky. They would likely hit their high family deductible, but paying all those costs upfront could strain their budget. A traditional plan with predictable copays for doctor visits and prescriptions would probably offer more stability and peace of mind.

For those in truly extreme medical situations, other plans might make more sense. If the out-of-pocket risk of an HDHP feels too daunting, you might want to read our guide on catastrophic health insurance, which is designed as a pure safety net for worst-case scenarios.

Ultimately, you have to be honest with yourself about your health, your tolerance for financial risk, and whether you could comfortably cover that deductible if life throws you a curveball.

Is an HDHP the Right Choice for You?

Choosing a health plan is one of those deeply personal decisions—there's no one-size-fits-all answer. A High Deductible Health Plan (HDHP) can be an incredible financial tool for one person and a huge source of stress for another.

The real key is to be brutally honest with yourself. Does the HDHP trade-off—rock-bottom premiums for higher upfront costs—actually work in your favor? To figure that out, you need to look at three things: your health, your finances, and your future goals.

Key Questions to Ask Yourself

Before you sign on the dotted line, take a minute and really think through these questions. Your answers will tell you almost everything you need to know.

- How often do I actually see a doctor? If you’re generally healthy and stick to annual check-ups, an HDHP looks pretty good. But if you have a chronic condition that means frequent visits, that high deductible could become a real financial burden, fast.

- Could I pay my entire deductible tomorrow if I had to? This is the million-dollar question. If a surprise $3,000 medical bill would send you into a panic, an HDHP is a risky bet unless you’ve already got a solid HSA ready to back you up.

- Am I disciplined enough to actually save? The magic of an HDHP is only unlocked when you consistently fund your Health Savings Account (HSA). If you commit to saving the money you’re not spending on premiums, the plan is a winner. If not, you’re just underinsured.

There's a reason these plans are everywhere. Today, HDHPs cover about 58% of people with private insurance, mostly because employers are trying to get a handle on rising costs. But with the median deductible hitting $2,750 in 2024, it's a major hurdle for many families. According to the U.S. Bureau of Labor Statistics, nearly half of U.S. households don't have enough liquid savings to cover an expense that large.

Exploring Different Life Scenarios

Let's get real and see how an HDHP plays out for different people. Forget the jargon—what does this choice actually look like in the real world?

Persona 1: The Healthy Young Professional

This person is in their 20s or early 30s, has no chronic conditions, and rarely needs a doctor outside of preventive care. For them, an HDHP is often a no-brainer. The super-low monthly premium frees up cash, and they can pour money into their HSA, treating it like a supercharged retirement account. The high deductible feels like a risk they can comfortably manage.

Persona 2: The Growing Family

Now, picture a family with two young kids. Children mean more doctor visits—for sniffles, check-ups, and the occasional playground mishap. The lower premium is tempting, but that family deductible is a much bigger number. If they have a solid emergency fund and are diligent about funding their HSA, it can still work. But a traditional plan with predictable copays might offer more stability and peace of mind.

An HDHP is best suited for those who can treat their deductible like a predictable, planned expense rather than an unexpected crisis. Your ability to absorb that initial cost is the ultimate determining factor.

Persona 3: The Individual with a Chronic Condition

Someone managing a condition like diabetes or asthma has a different reality. They have regular specialist visits, ongoing prescriptions, and constant monitoring. For this person, an HDHP can be a serious financial strain. They’ll likely hit their deductible every single year, but paying for all those initial services out-of-pocket can be tough. In this situation, a plan with lower, predictable costs from day one is almost always the safer, more practical choice.

In the end, it’s a mix of math and your own comfort with risk. To get it right, you have to know how to compare health insurance plans by weighing the monthly premium against what you might actually spend. That's how you find coverage that truly fits your health and your wallet.

Still Have Questions About High-Deductible Health Plans?

Even after digging into the details, a few specific questions almost always pop up when you're getting serious about an HDHP. I've put this section together to give you quick, direct answers to those last few uncertainties.

Think of it as clearing up the final bits of confusion so you can feel completely confident about your decision.

Is Preventive Care Really Covered Before I Hit My Deductible?

Yes, absolutely. This is one of the most powerful—and most misunderstood—perks of any qualified health plan, including an HDHP. Thanks to the Affordable Care Act (ACA), certain preventive services are covered at 100% before you’ve paid a single dollar toward your deductible.

That means you can (and should!) get your annual physical, routine vaccinations, and various health screenings without having to worry about an upfront bill.

These services are all about catching potential health issues early, and the goal is to remove any financial barrier that might stop you from getting essential care. Covered preventive services usually include things like:

- Annual wellness visits and check-ups

- Immunizations like the flu shot

- Screenings for blood pressure, cholesterol, and certain types of cancer

- Well-woman and well-child visits

Just make sure the service is officially classified as "preventive" by your plan and that you’re using an in-network provider to get the full benefit.

What Happens to My HSA if I Switch to a Different Plan?

This is a fantastic question and it gets right to the heart of what makes an HSA so valuable. The money in your HSA is 100% yours, always. It’s not tied to your job or your insurance plan.

It’s best to think of it like a personal bank account, but one that’s just for healthcare. If you leave your employer or switch from an HDHP to a more traditional plan (like a PPO), that HSA and every penny in it go with you.

Here's the most important rule to remember: You can always spend your existing HSA funds on qualified medical expenses, no matter what insurance you have. However, you can only contribute new money to an HSA during the months you are actively enrolled in a qualified HDHP.

So, if you move to a non-HDHP plan, your HSA simply becomes a healthcare checking account. You can no longer add new funds, but you can keep using the existing balance tax-free for medical needs until it’s gone.

Can I Use My HSA for More Than Just Doctor Visits?

You bet. The list of qualified medical expenses you can pay for with your HSA is incredibly broad and goes way beyond just covering your deductible or doctor's appointments. It includes tons of common health and wellness costs you’re probably already paying for out-of-pocket.

The IRS defines what counts, and the scope is surprisingly generous. You can use your tax-free HSA dollars for things like:

- Dental Care: Cleanings, fillings, crowns, and even braces.

- Vision Care: Eye exams, prescription glasses, contact lenses, and LASIK surgery.

- Prescriptions: Any medication prescribed by your doctor.

- Over-the-Counter Items: Things like pain relievers, allergy medicine, first-aid supplies, and menstrual care products.

- Therapeutic Services: This can cover chiropractic care, acupuncture, and physical therapy.

This flexibility turns the HSA into a powerful tool for managing your family's entire healthcare budget, not just the big-ticket items.

What’s the Deal with Telehealth Coverage Now?

This is a critical and timely question, because the rules have changed. During the COVID-19 pandemic, a special provision allowed HDHPs to cover telehealth visits before the deductible was met without messing up a person's HSA eligibility.

Unfortunately, that temporary rule expired at the end of 2024. As of January 1, 2025, we’re back to the old way of doing things.

This means for most non-preventive telehealth visits, you'll have to pay the full cost out-of-pocket until your deductible is met. It's a crucial detail to check during open enrollment—if an HDHP offers free or low-cost telehealth before the deductible, it could make you ineligible to contribute to an HSA.

Is an HDHP a Good Idea if I Know I Have a Big Medical Event Coming Up?

It might seem backward, but an HDHP can actually be a very smart choice, even if you know a big expense is on the horizon—like a planned surgery or the birth of a child. The reason why comes down to one key feature: the out-of-pocket maximum.

Yes, you'll almost certainly have to pay your full deductible. But once you hit that out-of-pocket max, your plan kicks in to cover 100% of in-network costs for the rest of the year. In a high-cost year, you put a firm, predictable cap on your total financial risk.

The strategy works best if you plan for it by aggressively funding your HSA ahead of time. By contributing the maximum allowed, you can pay for that entire out-of-pocket limit using tax-free dollars, which significantly lowers the true cost of your care.

Finding the right health insurance can feel like a puzzle, but it doesn't have to be. Whether you're self-employed, a family on a budget, or an early retiree, My Policy Quote is here to provide clear, straightforward options that fit your life. Explore your personalized quotes today at https://mypolicyquote.com and take the first step toward confident, affordable coverage.