Is health insurance required? It's a question that feels like it should have a simple yes or no answer, but the reality is a little more complicated.

While there's no longer a federal penalty for going uninsured, that's not the end of the story. A handful of states have stepped in to create their own rules, meaning the real answer depends entirely on your zip code.

Your Direct Answer on Health Insurance Requirements

Figuring out the rules around health coverage can feel like a puzzle. The confusion really started when the federal law changed. For years, the Affordable Care Act (ACA) had what was called an "individual mandate"—a rule requiring almost everyone to have health insurance or face a tax penalty.

It was a bit like the car insurance requirement in most states. Just as you need coverage to legally drive, you needed health coverage to avoid a penalty from the federal government. But in 2019, that all changed when the federal penalty was officially reduced to $0.

The Federal Rule vs State Rules

While the federal government took its foot off the gas, some states decided to take the wheel. In response to the federal change, they passed their own individual mandate laws, complete with state-level penalties for residents who don't have coverage.

This created a split system. Now, whether you're legally required to have health insurance comes down to the laws in your specific state. To get a better handle on the basics, our guide on what health insurance is and how it works is a great place to start.

The bottom line is this: The U.S. government no longer penalizes you for being uninsured, but your state government might. It's crucial to know your local laws to avoid an unexpected tax bill.

A Clear Comparison

To make this simple, let's lay it all out. The table below gives you a quick, at-a-glance look at how the federal and state rules stack up.

Health Insurance Requirements Federal vs State Level

This table quickly summarizes the current situation, so you can see exactly where the requirements come from.

| Requirement Level | Is Insurance Required? | Is There a Penalty for Being Uninsured? |

|---|---|---|

| Federal Level | No, it is not required by federal law. | No, the federal tax penalty is $0. |

| State Level (in certain states) | Yes, it is required by state law. | Yes, a state tax penalty applies. |

As you can see, the game has changed from a national one to a local one.

Even without a federal mandate, most people still choose to have coverage. It's estimated that around 331 million Americans will be insured in 2025, which means only about 27 million will be uninsured. This tells you a lot about the value and financial safety net that people feel insurance provides, even when it's not strictly required everywhere.

The Story Behind the Federal Mandate Shift

To untangle why “do I have to carry health insurance?” now feels like a puzzle, it helps to rewind to 2010. That’s when the Affordable Care Act rolled out the individual shared responsibility provision, better known as the individual mandate.

Think of buying health coverage like joining a community pool. You need:

- Healthy swimmers who chip in fees but rarely need lifeguards.

- Novice swimmers who require more support and safety gear.

Without both groups, the pool’s costs would skyrocket.

At its core, the mandate said: whether you’re fit as a fiddle or facing a chronic condition, get insured—or pay a penalty. This mix balanced out risk and kept premiums from swinging wildly.

From A Mandate To A Choice

For nearly a decade, skipping “minimum essential coverage” meant a hit on your tax return. That penalty wasn’t trivial—it was a real nudge to sign up.

Fast forward to the Tax Cuts and Jobs Act of 2017. Lawmakers left the individual mandate on the books but slashed the penalty to $0, effective January 1, 2019.

- 2017: Tax Cuts and Jobs Act sets the stage.

- 2019: Penalty for no coverage drops to $0.

The result? The federal rule became a recommendation, not a requirement. Understanding these policy shifts is critical, and you can explore more about navigating insurance industry regulatory compliance to see how the rules continue to shape the market.

This screenshot from the official Healthcare.gov website shows how individuals can still sign up for coverage through the marketplace.

Even with no federal penalty, the enrollment infrastructure remains robust for millions seeking protection.

The Ripple Effect On States

Zeroing out the federal fee left a gap. Insurers worried: if healthier people bow out, premiums could spike for everyone else. A few states decided they couldn’t wait.

The federal government stepped back, but some states stepped forward, crafting their own mandates to stabilize costs and keep pools balanced.

Now, whether you must carry coverage depends on your state. Skipping the national rule is no longer enough—you need to check local laws to know where you stand.

Which States Still Require Health Insurance

When the federal penalty for going uninsured disappeared in 2019, it left a gap—much like wiping out a national speed limit overnight. A few states decided to pick up the slack. They rolled out their own rules to keep insurers and consumers in balance.

If you live in one of these places, coverage isn’t optional. It’s a legal requirement. Miss it, and you’ll see a penalty on your state tax return.

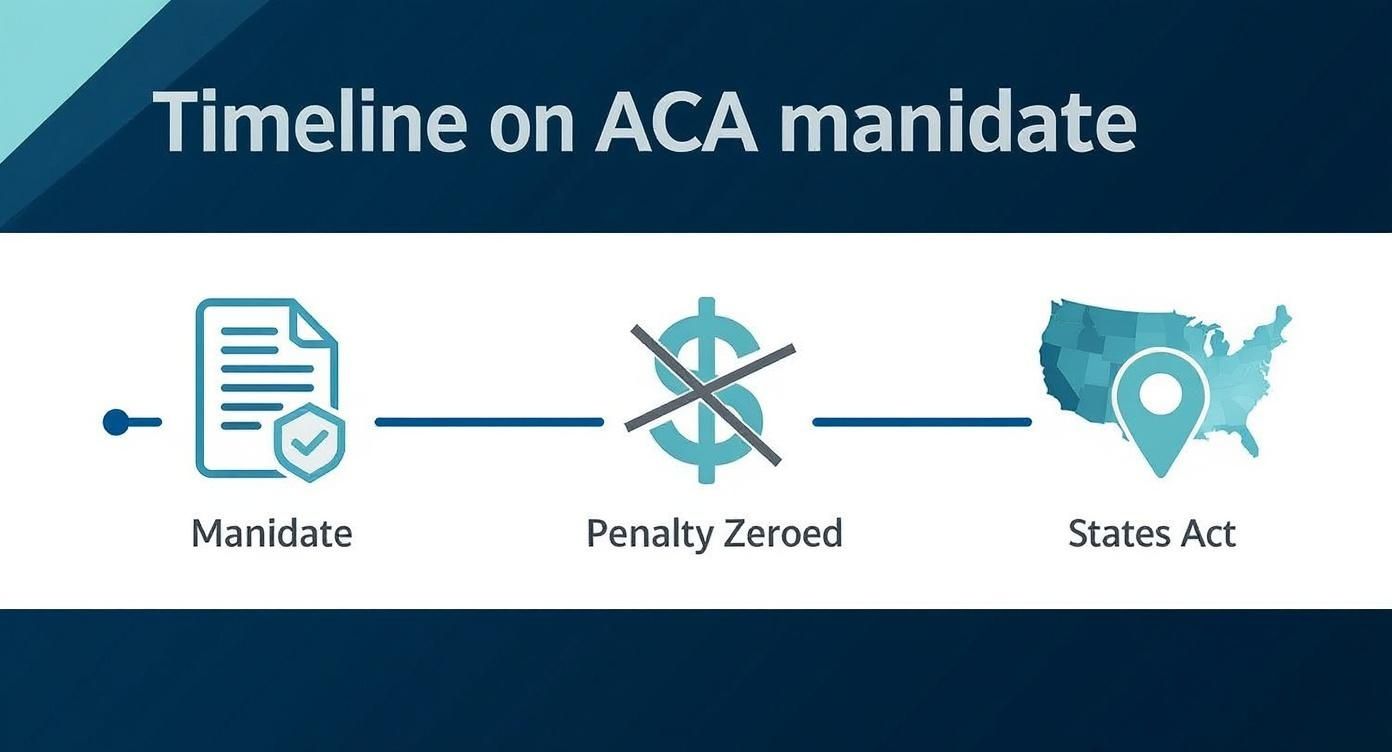

The following infographic shows how we went from one federal mandate to a patchwork of state rules.

This visual timeline highlights how the 2019 federal change spurred states to protect their insurance markets.

States With Individual Mandates

Right now, five states plus the District of Columbia require you to carry health insurance. Each has its own goal: avoid a risk pool dominated by higher-cost claims. But the way they enforce it—especially penalties—can vary quite a bit.

These jurisdictions are:

- California

- District of Columbia (D.C.)

- Massachusetts

- New Jersey

- Rhode Island

- Vermont (mandate in place, but no financial penalty at the moment)

In these areas, the answer to “Do I have to get insurance?” is a firm yes.

How State Penalties Are Calculated

Failing to carry coverage can cost you. Most states borrowed from the Affordable Care Act’s model and use one of two methods. You pay whichever penalty is higher.

-

Percentage of Income

Often 2.5% of your household income above the state’s filing threshold. -

Flat-Dollar Amount

A set fee per adult and half that for each child in your household.

These fees aren’t just about punishment. They’re an incentive for healthier people to sign up, which spreads risk and helps keep premiums more affordable.

State-By-State Health Insurance Mandate Details

Below is a detailed comparison of states that still require coverage. You’ll see how penalties stack up for individuals and families, and exactly how each state does the math.

| State | Annual Penalty for an Individual | Penalty for a Family | How the Penalty is Calculated |

|---|---|---|---|

| California | $900 or 2.5% of income | $450 per dependent child, family cap applies | Greater of the flat fee or the percentage of income |

| District of Columbia | $700 or 2.5% of income | $350 per dependent child | Greater of the flat fee or the percentage of income |

| Massachusetts | Based on income; up to 50% of the lowest-cost plan | Based on income and family size | Calculated as a percentage of the premium for an affordable plan |

| New Jersey | $695 or 2.5% of income | $347.50 per child, capped at $2,085 | Greater of the flat fee (with cap) or the percentage of income |

| Rhode Island | $750 or 2.5% of income | $375 per child, capped at $2,250 | Greater of the flat fee (with cap) or the percentage of income |

| Vermont | $0 | $0 | Coverage is required, but there is no monetary penalty at this time |

Understanding these state-specific rules is your first move toward staying compliant. Check your local regulations every year, so you’re never surprised by a tax-time bill.

The True Financial Risk of Being Uninsured

When people ask, "is health insurance required?" the conversation usually turns to tax penalties. But honestly, that’s missing the point. The real risk of going without insurance has nothing to do with the government and everything to do with protecting your financial future from one single, unexpected medical crisis.

It's a high-stakes gamble. You're betting that nothing will ever go wrong, but if it does, the cost of losing is catastrophic.

Think of it this way: health insurance is like a financial helmet. You might go for a long time without needing it, but when you fall, it's the only thing standing between you and life-altering damage. Choosing to be uninsured means you’re absorbing the full, brutal impact of every medical expense—from a simple check-up to a life-saving surgery.

And these costs are only getting steeper. Globally, medical expenses are projected to jump by 10.4% in 2025. That’s the third year in a row with such a massive increase. You can see the full breakdown of these rising global healthcare costs on njbia.org to understand how this trend affects everyone.

The Staggering Cost of Common Medical Events

That abstract idea of "financial risk" becomes painfully real when you start looking at the numbers. A sudden illness or a bad accident can create bills so massive they could take decades to pay off, changing your family's future forever.

Let’s get specific. Here’s what a few common medical emergencies could cost if you had to pay for it all out of pocket:

- Broken Leg: A straightforward fracture that needs surgery and a short hospital stay can easily run from $17,000 to $35,000.

- Emergency Room Visit: Let's say you have severe stomach pain. If it's appendicitis, an emergency appendectomy could cost more than $50,000.

- Heart Attack: The immediate treatment, hospital care, and follow-up therapies can quickly add up to bills over $100,000.

- Cancer Treatment: Depending on the type, a year of care with chemotherapy and radiation can range from $150,000 to over $400,000.

These aren't just figures on a page. They represent liens on homes, drained retirement accounts, and crushing debt that follows families for years. If you want to understand the consequences in more detail, our guide on what happens if you don't have insurance breaks it down even further.

The Hidden Costs of Skipping Coverage

Beyond the shocking price of an emergency, being uninsured comes with other, quieter financial penalties. Without a plan, you don't get the discounted rates that insurance companies negotiate with hospitals and doctors. Instead, you're hit with the "chargemaster" rate—which is often the highest possible price for any given service.

Health insurance does more than pay for emergencies. It gives you access to a network of doctors with pre-negotiated discounts, making routine and preventive care far more affordable.

This leads to one of the biggest hidden costs: missing out on preventive care. Things like the importance of regular health screenings can’t be overstated, as they catch small problems before they become big, expensive, and life-threatening ones.

At the end of the day, going uninsured is a bet against life’s uncertainty. A monthly premium is a predictable, manageable expense. The cost of a medical emergency is limitless. Health insurance is what transforms that terrifying, unpredictable risk into a simple line item in your budget—giving you not just medical coverage, but priceless peace of mind.

Your Action Plan For Getting Covered

Imagine mapping out a road trip. You decide where to start, chart your stops, and watch for toll booths. Getting health coverage works the same way—you need a clear route, checkpoints for paperwork, and a plan to avoid penalties.

Whether you’re enrolling through work or diving into a public exchange, building your path step by step makes all the difference. Our goal? To land on a plan that delivers minimum essential coverage without derailing your budget.

Primary Options To Explore

-

Employer-Based Coverage

Most workplaces offer group health plans. Shared premiums often make this the most affordable choice. -

ACA Marketplace Plans

Compare private policies side by side on the government exchange. You might qualify for subsidies if your income falls within certain brackets. -

Direct From Insurer

Some companies let you buy individual plans any time of year. The trade-off: you won’t get federal premium tax credits. -

Government Programs

Programs like Medicaid or Medicare cover you if you meet age or income thresholds.

Understanding Minimum Essential Coverage

Think of MEC as the basic safety features on a car—seat belts, airbags, the works. It’s the collection of benefits the law requires, from emergency room visits to prescription drugs. Without it, you could face state fines or limited access to care.

Choose The Right Enrollment Pathway

Start by checking which doors are open based on your job status and household earnings. Then gather your paperwork—pay stubs, tax returns, Social Security numbers. With everything in hand, follow these steps:

- Confirm Your Eligibility

- Collect Income Documentation

- Estimate Your Household Income

- Compare Plan Costs And Benefits

Once that’s done, see if you qualify for premium tax credits. Even a small subsidy can shave hundreds off your annual costs.

Learn About Open Enrollment

Most plans lock in each fall. Miss the window and you’re left hunting for short-term alternatives. Mark your calendar now to avoid surprises. You might also find our guide on open enrollment periods and deadlines helpful.

Secure Your Coverage

When enrollment kicks off, here’s your checklist:

- Create an account on your chosen platform

- Enter personal details with care

- Upload proof of income

- Select a plan and review all costs

- Submit your enrollment and save the confirmation

Locking in coverage early not only spares you a last-minute scramble, it also gives you uninterrupted access to preventive care.

Afterward, double-check your start date and payment schedule. Make sure you have minimum essential coverage so you dodge any state mandate penalties. And remember: what fits today might not fit tomorrow.

Maintain Your Coverage Year Round

Once you’re enrolled, stay alert. A move, a raise, or a new family member can change your eligibility—and your costs.

-

Report Changes Promptly

Updating income, household size, or address keeps your subsidies accurate. -

Watch Renewal Notices

You’ll get reminders before your plan renews. Read them closely. -

Explore Annual Rate Updates

Insurance premiums shift each fall. Take a fresh look at your options before renewing.

Pro tip from a benefits advisor: Don’t assume your current plan remains the best. Each year, shop and compare before you settle.

By treating coverage like an ongoing project, you’ll protect both your health and your wallet. This habit can save you hundreds—and ensure you always carry minimum essential coverage.

Take the wheel today: follow each step, hit every deadline, and confirm your enrollment. After all, having the right coverage isn’t just a legal must in some states—it’s peace of mind you can’t afford to skip.

Okay, let's get that rewritten for you. Here is the revised section, crafted to sound like it was written by a human expert, following the style and tone of your examples.

How to Qualify for a Mandate Exemption

Even in states where health insurance is required, life happens. Sometimes, things get in the way of maintaining coverage, and the system recognizes that. Fortunately, you may not have to pay a penalty if you meet certain criteria.

Let's walk through the most common exemptions to see if you might qualify.

Common Exemptions and When They Apply

The government doesn't want to penalize people who genuinely can't afford coverage. That’s why many exemptions are designed to protect you from unfair financial strain.

Here are some of the most frequent reasons you might be exempt:

- Your Income Is Below the Threshold: If your annual income is too low to be required to file a tax return, you can often claim an affordability exemption.

- You Belong to a Health Care Sharing Ministry: Membership in a recognized sharing ministry often qualifies as an exemption in states that allow it.

- You Had a Short Gap in Coverage: Life gets messy. A brief gap of less than three consecutive months usually won’t trigger a penalty.

- You’re Facing a Financial Hardship: Major life events—like an eviction, bankruptcy, or overwhelming medical debt—can grant you a hardship exemption.

For example, a freelancer whose income falls below the poverty line could likely skip coverage without facing a state fee. The key, however, is that you have to officially file for the exemption when you do your taxes.

Exemptions exist to prevent undue financial strain when coverage truly is unaffordable or impractical.

Remember, every state has its own specific forms, documentation requirements, and deadlines. Before you apply for anything, always check your local health department's website for the exact rules.

Steps to Apply for an Exemption

Navigating the process can feel a little intimidating, but it’s straightforward if you take it one step at a time.

- Check Your State's Guidelines: Start at the source—your state’s official health department website will have the most accurate info.

- Gather Your Documents: You'll need proof. Collect things like pay stubs, bank statements, or any letters related to a hardship.

- Complete the Exemption Form: Fill out the correct form carefully, following every instruction.

- Submit with Your State Tax Return: File the exemption along with your taxes and be sure to keep a copy of the confirmation for your records.

Once you’ve applied, the state agency will review your claim. You’ll typically get a notice in the mail within a few weeks letting you know if you’ve been approved or denied.

If your situation feels complicated, don't hesitate to consult a tax professional. That extra step can help you avoid mistakes and give you peace of mind that your exemption is valid.

Tips for a Smooth Exemption Process

- Start Early: Don’t wait until the last minute. Deadlines vary by state, and missing them can be a costly mistake.

- Keep Copies of Everything: Save all your forms and notices. It’s smart to have both digital and paper copies just in case.

Document everything and hit your deadlines. It’s the best way to secure your exemption without a hitch.

Thinking bigger for a moment, health insurance is really a protective safety net. The World Health Organization (WHO)) sees it as a critical component in achieving Universal Health Coverage (UHC), where everyone can get the health services they need without facing financial ruin.

Despite progress, the WHO found that in 2021, about 4.5 billion people still didn't have full coverage for essential health services. You can learn more about UHC findings on the WHO site).

Now you have a clear checklist for handling exemptions. With the right documents and timely filing, you can confidently figure out if you qualify and navigate the process with ease.

Frequently Asked Questions

It's one thing to understand the rules, but it's another to know how they apply to your life. Even when you get the big picture, a few specific questions can still pop up.

Here are some quick, straightforward answers to the most common things people ask us.

What If I Can't Afford Insurance in a Mandate State?

This is a huge concern for many, but don't panic. If you're in a state that requires health insurance but the cost just isn't in your budget, you have options. The system has built-in protections so you aren't penalized for a situation you can't control.

First, always check your state’s health insurance marketplace. You might be surprised to find you qualify for subsidies or tax credits that make your monthly premium much more manageable. These are based on your income and household size.

On top of that, most states offer an "affordability exemption." If the cheapest plan available still costs more than a certain percentage of your income, you can often claim this exemption when you file your taxes. It protects you from the penalty.

Does Short-Term Health Insurance Count?

Almost never. Short-term health insurance plans are not considered minimum essential coverage (MEC), and that’s the magic phrase here.

Why? Because they don't have to offer the same protections as ACA-compliant plans, like covering pre-existing conditions or basic preventive care.

A short-term plan is just that—a temporary patch to get you from one comprehensive policy to the next. It’s not a long-term solution and won't save you from a tax penalty in a mandate state.

If you live somewhere like California, New Jersey, or Massachusetts, relying only on a short-term plan will likely lead to a penalty. They're great for filling small gaps, like when you're between jobs, but that's about it.

Will I Get a Penalty for a Small Gap in Coverage?

Probably not. Life happens, and the rules account for that. Most states with a mandate allow for a “short gap” exemption.

This usually means you can be uninsured for less than three consecutive months in a year without getting hit with a penalty.

If you go uninsured longer than that, the penalty is typically prorated. In other words, you'll only owe a portion of the annual penalty based on how many months you were uninsured past that three-month grace period. It’s a fair system that recognizes that sometimes, things just fall through the cracks for a little while.

Feeling a bit overwhelmed? You don’t have to figure this out alone. The experts at My Policy Quote are here to help you find a plan that fits your budget and keeps you compliant. Visit us at https://mypolicyquote.com for a free, personalized quote today.