Losing your job is stressful enough. The last thing you need is a healthcare crisis on top of everything else. That period between your old health insurance ending and your new one starting can feel like walking a tightrope without a safety net.

One unexpected illness or accident could have devastating financial consequences. This guide is built to be your safety net, clearing up the confusion around gap health insurance between jobs.

The Critical Risk of a Coverage Gap

When you're between jobs, you have a lot on your plate—updating your resume, managing your finances, and networking. It's easy for health insurance to slide to the bottom of the to-do list.

But ignoring it creates a massive vulnerability. A coverage gap, even one that lasts just a few weeks, leaves you and your family exposed to the full, unsubsidized cost of medical care.

This isn’t some rare problem; it happens all the time. In the United States, around 18 million people lose their employer-sponsored health insurance every year after a job loss. What's more, nearly 37% of them stay uninsured for some time, often because of high costs or long waiting periods for a new plan to start.

Why Every Day of Coverage Matters

It's tempting to just "risk it" for a short while, especially when money is tight. But the financial stakes are incredibly high. An accident doesn’t check your calendar to see if your new benefits have kicked in.

Here’s why locking down temporary coverage is so important:

- Financial Protection: It’s your shield against catastrophic medical bills that could completely derail your financial future.

- Continuity of Care: It lets you keep up with necessary treatments, manage chronic conditions, and get your prescriptions filled without any breaks.

- Peace of Mind: Honestly, this one is huge. Knowing you're covered lets you focus 100% on your job search without the gnawing anxiety of a potential health crisis.

A gap in health insurance is more than an inconvenience; it's a gamble with your financial and physical well-being. Proactive planning turns this period of uncertainty into one of confident preparation.

While securing gap coverage is vital, don't forget to use helpful resources for job seekers to land your next role faster. The sooner you find a new job, the shorter you'll need that temporary bridge. Understanding your options is the first step toward building that bridge between your old job and your new beginning.

Why Going Uninsured Is a Financial Gamble

Going without health insurance, even for just a month or two between jobs, feels like a risk you can manage. You tell yourself, "I'm healthy. What could possibly go wrong?" But that thinking turns your financial well-being into a high-stakes gamble, and the odds are stacked against you.

Life is unpredictable. Accidents and sudden illnesses don't check your employment status before showing up. A simple misstep could mean a broken arm. A fever that won't break could turn into an emergency room visit. Without a policy to back you up, these everyday mishaps can bury you in thousands of dollars of medical debt overnight.

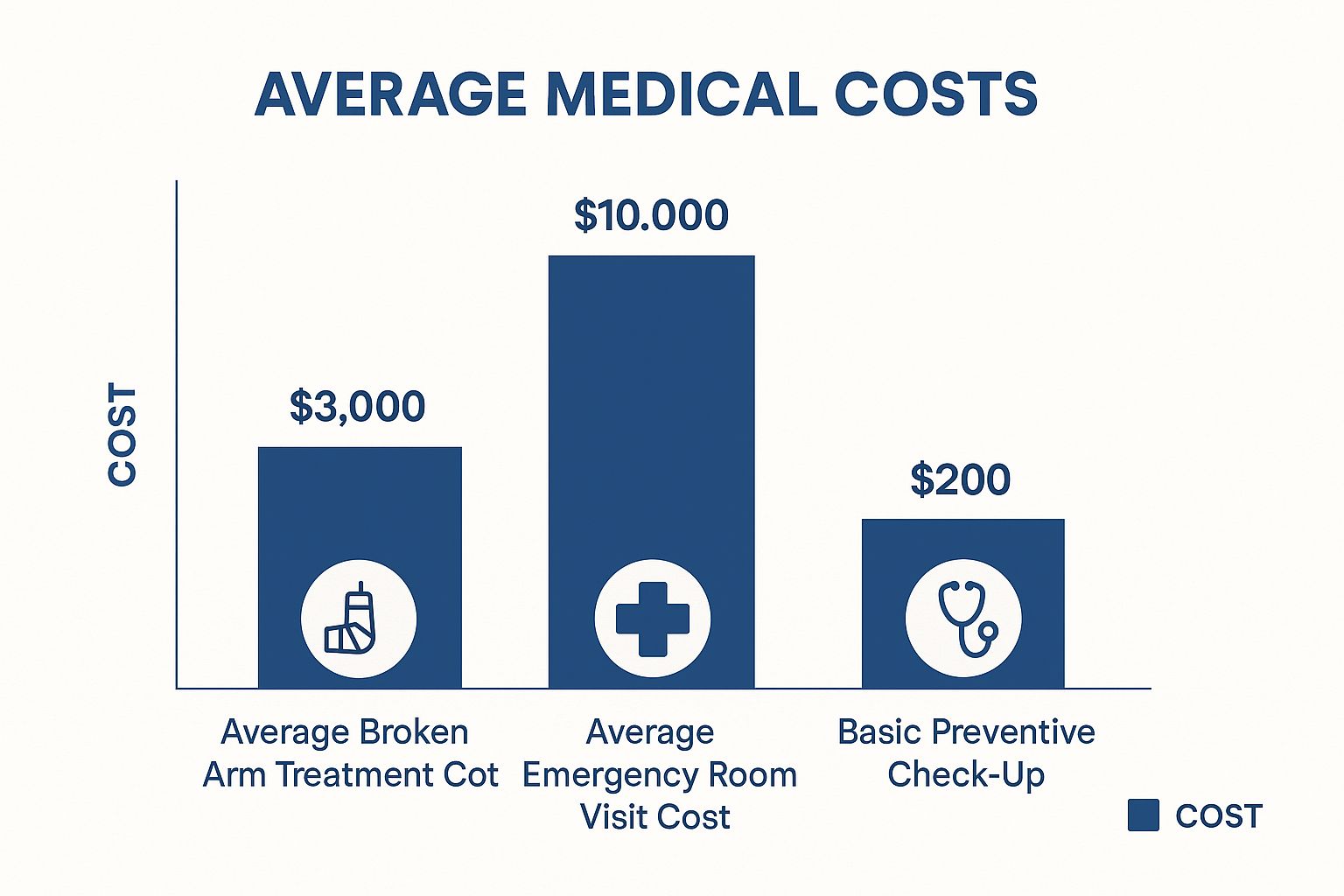

This is what those costs can look like in the real world.

As you can see, even one unexpected event can turn a temporary gap between jobs into a long-term financial nightmare.

The Hidden Costs of Delaying Care

The risk isn't just about big, dramatic accidents. When you're paying out-of-pocket, it’s tempting to put off routine care. You might skip a check-up, delay refilling a prescription, or ignore a nagging ache to avoid the bill.

This is a dangerous game. Postponing care for a chronic condition like asthma or diabetes can allow a small issue to spiral into a major health crisis. What starts as a way to save a few hundred dollars can backfire, leading to far worse health outcomes and even bigger bills down the road.

Viewing gap health insurance as an "extra" expense is a financial trap. It's not a luxury—it's a non-negotiable shield for your health and your savings during a vulnerable time.

The Ripple Effect of Medical Debt

The consequences of being uninsured spread far beyond the initial hospital bill. People without coverage often face worse health outcomes simply because they can't afford to get help. A 2023 analysis revealed that 45% of uninsured adults put off necessary medical care because of the cost.

The financial fallout is just as severe. Nearly 60% of all personal bankruptcies in the U.S. are tied to overwhelming medical bills. That number tells a powerful story: a short break in coverage can create financial damage that lasts a lifetime.

Securing gap health insurance between jobs is the single best way to protect yourself from this devastating domino effect. Our guide on how medical emergencies without insurance can ruin you financially dives deeper into this critical topic.

Your Primary Gap Insurance Options Explained

Losing your job doesn't mean you have to lose your health coverage. Think of the time between jobs as a bridge you need to cross, and your health insurance options are the different paths you can take to get to the other side safely. Each one is built a little differently, with its own costs and benefits.

Understanding these paths is the first step to making a smart, confident choice for you and your family.

Let's break down the main routes for gap health insurance between jobs.

COBRA: Keeping Your Old Plan

The first option is usually the most familiar: COBRA. The Consolidated Omnibus Budget Reconciliation Act lets you hang onto the exact same health plan you had with your old employer. It’s like nothing changed—you keep your doctors, your prescriptions, and any progress you've made on your deductible for the year.

But there’s a big catch: the cost. You’re now on the hook for 100% of the premium, plus a small administrative fee (usually around 2%). Since most employers pay a huge chunk of your premium, that new monthly bill can feel like a real shock to the system.

COBRA is all about continuity. It lets you keep the plan you know and trust, but that convenience comes at a steep price because you’re footing the entire bill yourself.

Short-Term Health Plans: The Temporary Safety Net

If COBRA’s price tag makes you wince, a short-term health plan might be a better fit. These are exactly what they sound like—temporary, low-cost plans designed to protect you from a worst-case scenario, like a major accident or a sudden, serious illness.

They’re much more affordable than COBRA, but that low cost comes with some serious trade-offs.

- Limited Coverage: They often skip coverage for pre-existing conditions, maternity care, mental health, and even prescription drugs.

- Not ACA-Compliant: These plans don't have to meet the "minimum essential coverage" standards set by the Affordable Care Act (ACA).

- Focus on Emergencies: Think of this as a safety net for a true catastrophe, not something you’d use for a routine check-up.

This makes them a decent choice for healthy people who are pretty sure their coverage gap will be very short.

ACA Marketplace Plans: Comprehensive and Subsidized Coverage

Your third major option is to get a plan through the Health Insurance Marketplace, which was created by the ACA. Losing your job-based coverage is what’s known as a “Qualifying Life Event.” This opens up a Special Enrollment Period, letting you sign up for a new plan even when it’s not the regular open enrollment season.

ACA plans are the real deal—they’re comprehensive, cover ten essential health benefits, and can’t turn you away for pre-existing conditions.

Even better, you might qualify for income-based subsidies that can dramatically lower your monthly premium, making it far more affordable than COBRA. For a lot of people, an ACA plan hits that sweet spot of solid coverage at a price they can actually manage. Taking the time to explore your options here is a critical step, and you can learn more about general health insurance gap coverage in our detailed guide. It's often the most complete and financially sound solution for a job transition.

Comparing Your Gap Health Insurance Choices

To make things a bit clearer, here’s a quick side-by-side look at how these three main options stack up. It can help you see at a glance which path might be the best fit for your situation.

| Feature | COBRA | Short-Term Health Plan | ACA Marketplace Plan |

|---|---|---|---|

| Cost | Highest (full premium + 2% fee) | Lowest | Varies (subsidies available) |

| Best For | Continuity of care, pre-existing conditions | Healthy individuals, very short gaps | Comprehensive coverage, affordability |

| Pre-existing Conditions | Covered | Generally NOT covered | Covered |

| ACA Compliant? | Yes | No | Yes |

| Doctor Network | Keep your current network | Limited network | Varies by plan |

| Coverage Level | Identical to your old employer's plan | Basic, emergency-focused | Comprehensive (10 essential benefits) |

Each option has its purpose. COBRA is for those who need to keep their exact plan, short-term is for a quick and cheap safety net, and the ACA Marketplace often provides the best all-around value.

When Does COBRA Make the Most Sense

When you're between jobs, the first name you'll probably hear for health insurance is COBRA. And honestly, for good reason. It offers something incredibly valuable when everything else feels uncertain: perfect continuity.

Think of it this way: COBRA isn't a new plan. It's you choosing to keep the exact same health insurance you just had. Your doctors don’t change. Your prescriptions are still covered. Best of all, any money you’ve already paid toward your annual deductible stays put. You don't have to start over from zero.

But here comes the sticker shock. While you were employed, your company paid a big chunk of your monthly premium. With COBRA, that safety net is gone. You’re suddenly on the hook for the entire premium, plus a small administrative fee of up to 2%. It’s a huge jump, and it catches a lot of people by surprise.

When the High Cost Is Justified

So, why would anyone pay that much? Because sometimes, it's the smartest move you can make for your health and your finances.

You should seriously think about COBRA if you:

- Are in the middle of medical treatment. If you or a loved one is undergoing something serious like chemotherapy, surgery recovery, or ongoing therapy, switching plans is a massive risk. COBRA keeps your care seamless with the doctors you already trust.

- Have already met your deductible for the year. If you've already spent thousands out-of-pocket, starting a new plan means that deductible resets to $0. Sticking with COBRA ensures your insurance starts paying its share right away for the rest of the year.

- Rely on specific, expensive medications or specialists. If your old plan is the only one that covers a critical prescription or gives you access to a specialist you can't replace, COBRA’s high premium might actually be cheaper than paying for that care on your own.

Choosing COBRA is less about finding the cheapest monthly premium and more about protecting yourself from potentially much higher costs associated with disrupting your healthcare.

Making the Right Decision

The good news is you don’t have to decide overnight. You get a 60-day window to enroll in COBRA, and the coverage is retroactive to the day you lost your old plan. This gives you time to breathe and look at your options.

If the price is just too steep, it's time to explore COBRA insurance alternatives. You might find an affordable and comprehensive plan on the ACA Marketplace or even a short-term plan that works for you. It all comes down to weighing the cost of the premium against the potential cost of changing your medical care.

Exploring More Affordable Alternatives

If the sticker shock from a COBRA premium has you seeing stars, take a deep breath. You have other excellent—and often much more affordable—ways to secure gap health insurance between jobs. These options can give you a solid financial safety net without that painfully high monthly cost.

Let's walk through two powerful choices that can protect your health and your budget while you're transitioning between jobs.

The Bare-Bones Safety Net: Short-Term Health Insurance

Think of short-term health insurance as a temporary, emergency-only plan. It’s not meant for everyday stuff. Instead, it’s a low-cost shield against a true catastrophe, like an unexpected hospitalization or a serious accident, during that brief gap in coverage.

These plans are fast and easy to get, but they keep prices low by trimming a lot of fat. You need to know their limitations before signing on the dotted line:

- No Coverage for Pre-Existing Conditions: This is the big one. These plans can and will deny you coverage based on your past medical history.

- Limited Benefits: They almost never cover routine check-ups, mental health services, maternity care, or prescription drugs.

- Not ACA-Compliant: They don’t have to offer the ten essential health benefits that more comprehensive plans do.

Still, a short-term plan can be a perfect fit if you're healthy, have no pre-existing conditions, and just need to cover a very short gap—like a 30-day waiting period before your new job’s insurance kicks in. For a deeper look, check out our guide explaining short-term health insurance in more detail.

A Comprehensive Solution: The ACA Marketplace

Your other major alternative is a plan from the Affordable Care Act (ACA) Marketplace. Losing your job-based health insurance is what’s known as a “Qualifying Life Event.” This is great news for you, because it opens up a Special Enrollment Period.

This special window lets you shop for and enroll in a comprehensive plan outside of the standard open enrollment season. You usually have 60 days from the day your old coverage ended to sign up.

ACA plans are real, robust insurance. By law, they have to cover pre-existing conditions and provide ten essential health benefits, including preventive care, emergency services, and prescriptions. That makes them a far more complete solution than any short-term plan.

The biggest game-changer with the ACA Marketplace is the potential for income-based subsidies. These tax credits can slash your monthly premium, often making a top-notch plan way cheaper than COBRA.

For example, a family might find that an ACA plan with subsidies costs them just a few hundred dollars a month for excellent coverage. That same plan through COBRA could easily be over a thousand dollars. This potential for massive savings makes exploring the Marketplace a non-negotiable step when you find yourself between jobs. It often delivers the best mix of thorough coverage and manageable cost.

Choosing the Right Coverage for Your Situation

Picking the right health plan between jobs feels like a huge decision, because it is. But it doesn't have to be overwhelming. The "best" plan isn't a one-size-fits-all solution; it's the one that fits your specific health needs, your budget, and how long you expect to be out of work.

To figure this out, you just need to ask yourself a few honest questions. Your answers will point you in the right direction.

-

How long will the gap actually be? If you already have a new job lined up and you're just waiting 30 days for benefits to kick in, a short-term plan is a great fit. If you're looking for a while, COBRA or an ACA plan will give you more stability.

-

Do I have any pre-existing conditions? This is the most important question. If the answer is yes, you need to look at COBRA or an ACA Marketplace plan. Short-term plans almost always exclude coverage for these conditions, which could leave you dangerously exposed.

-

Can I afford to switch doctors right now? If you’re in the middle of a specific treatment or you rely on a specialist you trust, sticking with them is crucial. The higher price of COBRA might be well worth it just for that continuity of care.

-

What’s my real-world budget? Look at your finances honestly. COBRA offers the exact same coverage you had, but that premium can be a shock to the system. If money is tight, a subsidized ACA plan is often a much smarter financial move.

Matching a Plan to Your Life

Let's put this into practice with a couple of real-world examples. You’ll see how different situations lead to very different choices.

Think about a healthy 28-year-old who is starting a new job in 45 days. They're a perfect candidate for a short-term health plan. It’s low-cost, covers major emergencies, and bridges that specific gap without costing a fortune. They simply don't need the bells and whistles—or the high price tag—of a more comprehensive plan.

Now, consider a 50-year-old with a chronic condition like diabetes. Their needs are completely different. The top priority is making sure they have uninterrupted access to their medication and specialists. For them, COBRA or a comprehensive ACA Marketplace plan is the only safe option. A cheap short-term plan is off the table because it wouldn't cover the care they rely on every single day.

The goal isn't just to have any insurance. It's about finding the right level of protection that matches your personal risk, your timeline, and what you can realistically afford.

Got Questions About Gap Coverage? Let's Clear Things Up.

Switching jobs is stressful enough without having to untangle the complexities of health insurance. Let's walk through some of the most common questions people have when they're in that in-between phase. Getting these answers straight can save you from a world of financial headaches down the road.

Can I Get a Short-Term Plan If I Have a Pre-Existing Condition?

This is a big one. And the honest answer is: probably not.

Short-term health plans aren't bound by the same ACA rules as Marketplace or employer plans. This means they can—and almost always do—deny coverage for pre-existing conditions. When you apply, they'll look at your medical history. If you have something like asthma, diabetes, or even a recent injury, you'll likely be denied or they'll exclude that condition from your policy.

If you have an existing health issue, COBRA or an ACA Marketplace plan are your safest bets. Period.

How Much Time Do I Have to Decide on COBRA?

You've got a bit of breathing room here, which is nice.

You have a 60-day election period to enroll in COBRA coverage. This countdown starts from the day you receive your COBRA notice or the day your old plan ended—whichever is later. This gives you a solid two months to weigh your options.

The best part? If you do choose COBRA, your coverage is retroactive, meaning it goes back to the day you lost your old plan. You won't have any gaps.

My New Job Has a Waiting Period. Now What?

This is the classic reason gap coverage exists! It’s incredibly common for a new employer to have a 30, 60, or even 90-day waiting period before your new benefits kick in. During that time, you're on your own.

A short-term health plan is often the perfect, low-cost solution to bridge this specific, temporary gap. It keeps you protected without breaking the bank while you wait for your new coverage to start.

Finding the right plan when your life is in transition can feel like a maze, but you don't have to navigate it alone. My Policy Quote is here to help people just like you find clear, affordable health insurance options to stay protected, no matter what comes next.

Ready to see what's out there? Explore your personalized quotes today.