Losing your job is a huge blow. But it absolutely does not mean you have to lose your health coverage, too.

When you're suddenly unemployed, your main paths to getting insured are buying an ACA Marketplace plan, continuing your old plan with COBRA, seeing if you qualify for Medicaid, or using a short-term plan as a temporary bridge. The good news? Losing your employer's coverage is considered a "Qualifying Life Event," which opens a special 60-day window for you to enroll in a new plan without having to wait for the annual open enrollment period.

Your First Steps After Losing Employer Health Coverage

Let's be real—facing a job loss is stressful enough. The last thing you need is the added anxiety of a medical emergency without a safety net. The one-two punch of losing your income and your health benefits can leave you feeling completely vulnerable.

Fortunately, the system has built-in protections designed for this exact situation. Think of your job loss not just as an ending, but as a trigger that unlocks new pathways to get insured.

The most important thing is to act fast. You typically have just 60 days from the day your old plan ends to make a choice and sign up for new coverage. This is your moment to take a breath, look at your new budget and your family's health needs, and figure out the best path forward.

Quick Comparison of Your Health Insurance Options

To help you get a clear picture right away, here’s a simple breakdown of the four main routes you can take. Each one is built for a different situation and budget.

| Insurance Option | Best For | Cost Level | Key Feature |

|---|---|---|---|

| ACA Marketplace | Individuals and families with reduced income needing financial aid. | Low to Moderate | Subsidies (tax credits) can drastically lower your monthly premium. |

| COBRA | People who want to keep their exact same doctor and plan, and can afford it. | High | You keep your existing coverage, but pay 100% of the premium (plus an admin fee). |

| Medicaid | Individuals and families with very low or no income. | Free or Very Low | Provides comprehensive coverage at little to no cost if you qualify. |

| Short-Term Plans | Healthy individuals needing a temporary, low-cost bridge between jobs. | Low | Cheaper premiums, but with very limited coverage and no protections for pre-existing conditions. |

Understanding these basic differences is the best first move you can make. It helps you zero in on the option that makes the most sense for you right now, giving you one less thing to worry about.

Finding Your Way Forward

The official HealthCare.gov website is the central hub for exploring ACA Marketplace plans. It's where you can see if you're eligible for subsidies that could make your insurance much more affordable.

This portal is your starting point for comparing what's out there and applying for financial help based on your new, lower income.

The challenge of finding health insurance if unemployed is something millions of people face. In 2024, about 8.6 million Americans were uninsured, with job loss being one of the biggest reasons. While you're sorting out your insurance, learning some strategies for addressing employment gaps on your resume can also be a proactive step toward your next role and getting those employer benefits back.

The reality is that long-term unemployment, which affects 25.7% of all unemployed people, often means going a long time without company-sponsored coverage. That's what makes these other insurance pathways so incredibly essential.

Finding Your Footing on the ACA Marketplace After Job Loss

When the health insurance you had through your job comes to an end, it can feel like the rug’s been pulled out from under you. But there’s a powerful safety net ready to catch you: the Affordable Care Act (ACA) Marketplace. Think of it as your go-to hub for finding new health coverage when you’re unemployed and need options.

Here's the good news: you don't have to wait for the once-a-year sign-up window. Losing your job-based plan is what’s known as a Qualifying Life Event (QLE). This event cracks open a Special Enrollment Period (SEP), a crucial 60-day window for you to get a new plan without any gaps in your coverage.

Your 60-Day Lifeline to Get Covered

That Special Enrollment Period is your golden ticket. It’s a chance to get insured when most people can't. This 60-day clock starts ticking the day you lose your employer’s health benefits, so it’s important to act fast.

Miss this window, and you could be stuck waiting months for the next annual Open Enrollment Period—leaving you uninsured and vulnerable. To get started, head over to HealthCare.gov, the main portal for most states.

Key Takeaway: Losing your job-based health insurance opens a 60-day Special Enrollment Period. This is your chance to enroll in a new ACA Marketplace plan without delay.

You’ll need to create an account and fill out an application. This isn’t just for getting a plan; it’s what determines if you qualify for financial help to make that plan affordable. If you're curious about the difference between these sign-up periods, our guide on what Open Enrollment means can clear things up.

Unlocking Financial Help with Subsidies

For anyone who is unemployed, the single biggest advantage of the ACA Marketplace is the financial help available through subsidies. These are designed to directly lower what you pay for health insurance.

The main form of assistance is the Premium Tax Credit (PTC). Think of it as a discount coupon from the government that gets applied right to your monthly bill, slashing the amount you owe. For many people, these credits bring the cost down to a surprisingly manageable level.

Your eligibility for subsidies is all about your estimated household income for the entire year. This is a critical point. You'll need to project what you think you'll earn, which includes:

- Any income you’ve already made this year.

- Unemployment benefits you expect to get.

- Any money from freelance gigs, part-time work, or other sources.

The lower your projected income, the bigger your potential subsidy. To give you an idea of how much this helps, in early 2024, the average person on the Marketplace paid just $105 per month for their plan after subsidies kicked in.

Comparing the "Metal Tiers"

Once you know what kind of financial help you can get, it’s time to shop for a plan. On the Marketplace, plans are grouped into four "metal tiers" to make comparing them easier. Each tier strikes a different balance between what you pay each month (your premium) and what you pay when you actually get care (your out-of-pocket costs).

- Bronze: These plans have the lowest monthly payments but the highest costs when you need care. They’re great for protecting you against a worst-case scenario.

- Silver: A middle-of-the-road option with moderate monthly premiums and moderate costs for care. Crucially, if you qualify for extra savings called cost-sharing reductions, you must pick a Silver plan to get them.

- Gold: You’ll pay a higher monthly premium, but your costs for doctor visits and treatments will be low. This is a solid choice if you know you’ll need regular medical care.

- Platinum: These have the highest monthly premiums but the absolute lowest out-of-pocket costs. They’re best for people who expect to need significant and frequent medical attention.

The right tier for you comes down to your personal situation. Look at your budget, your health, and how often you think you’ll see a doctor. This is about finding the right health insurance if unemployed that balances what you can afford with the coverage you truly need.

Deciding If You Should Keep Your Old Plan With COBRA

When you lose a job, a thick envelope about COBRA is often one of the first things to land in your mailbox. It can feel like a lifeline—a way to hold onto the exact same health insurance plan you had with your employer. That familiarity is incredibly comforting when everything else feels uncertain.

Think of COBRA as hitting the pause button on one big change. You keep your doctors, your prescription coverage stays the same, and any money you've already paid toward your deductible still counts. But all that convenience comes at a steep price, and it’s crucial to understand what you’re signing up for.

Understanding the True Cost of COBRA

The sticker shock is real. While you were working, your company was likely paying a huge chunk of your monthly health insurance premium—often most of it. With COBRA, that safety net vanishes.

You’re suddenly on the hook for 100% of the premium, which includes the part you always paid and the much larger share your employer used to cover. On top of that, there's a small administrative fee, usually around 2%.

Here’s a real-world example: Let's say your plan’s total monthly premium was $600. Your employer paid $450, and $150 came out of your paycheck. Under COBRA, your new cost would be the full $600 plus a 2% fee, making your monthly bill $612.

That massive jump is why COBRA feels so expensive. Before you commit, you have to sit down with the numbers and see if that fits into your new, tighter budget.

Who Is Eligible and How Do You Sign Up

COBRA eligibility is pretty straightforward. It’s generally available to people who worked at companies with 20 or more employees. When you leave your job, your employer is legally required to let you know you have the option to continue your coverage.

You get a 60-day window to decide if you want to enroll in COBRA. This is a hard deadline. If you let it pass, the opportunity is gone for good.

The process usually looks like this:

- Notification: Your old employer sends you a COBRA election notice in the mail.

- Decision Period: You have 60 days from when you get the notice (or when your coverage ended, whichever is later) to sign up.

- Payment: Once you enroll, you get another 45 days to make that first premium payment.

The coverage is retroactive, which means as long as you sign up in time, you won’t have any gap in coverage from the day your job ended. In most situations, you can keep your COBRA plan for up to 18 months.

When COBRA Makes the Most Sense

Even with the high cost, there are times when COBRA is absolutely the right move. It all comes down to weighing the price against your need for specific, uninterrupted medical care.

COBRA might be your best bet if:

- You're in the middle of medical treatment: If you or a family member is being treated for a serious condition, keeping your doctors is non-negotiable. A new plan could mean finding new specialists and disrupting vital care.

- You've already met your deductible: If you've paid a lot toward your annual deductible or out-of-pocket maximum, starting over with a new plan would be a huge financial setback. Sticking with COBRA preserves that progress.

- You need a specific, expensive medication: If your current plan is the only one that covers a critical prescription, COBRA’s high premium might still be cheaper than paying for that drug yourself.

But for most people, that monthly bill is just too much to handle. It's always smart to check out COBRA insurance alternatives to see if you can get a more affordable plan on the ACA Marketplace. You have to weigh the comfort of COBRA against the real-world impact on your wallet.

Diving into Medicaid and CHIP: Support When You Need It Most

If losing your job tanked your income, there are two programs you absolutely need to know about: Medicaid and the Children's Health Insurance Program (CHIP). These aren't obscure, complicated systems. They are the bedrock safety nets built to give millions of Americans free or very low-cost health coverage when their income is limited.

Think of Medicaid as a public utility for your health. Just like there are programs to help with the heating bill when money gets tight, Medicaid makes sure you can still see a doctor and pick up prescriptions when your income drops. It’s a powerful lifeline when you're looking for health insurance if unemployed.

One of the best things about these programs is how flexible they are. You don't have to wait for a special enrollment window like you do with Marketplace plans. You can apply for Medicaid or CHIP at any time of year. If you qualify, your coverage can start right away, so you don't have to face any scary gaps in care.

How Do You Qualify for Medicaid?

The big thing to understand about Medicaid is that it looks at your current monthly income, not what you made six months ago. This is a game-changer for someone who just lost their job, because it focuses on your present situation, not your past earnings.

The main factor that determines who gets in is whether your state decided to expand Medicaid under the Affordable Care Act.

-

In States with Expanded Medicaid: It's much easier to qualify. Generally, adults can get coverage if their household income is up to 138% of the Federal Poverty Level (FPL). This opens the door for a lot of low-income adults, not just specific groups like pregnant women or people with disabilities.

-

In States without Expanded Medicaid: The rules are a lot tougher and can vary quite a bit. Eligibility is often restricted to very specific groups, and many adults without kids might not qualify, no matter how low their income is.

Here's the bottom line: Your eligibility for Medicaid really comes down to where you live. Always check your state’s specific income rules, because that’s the most important piece of the puzzle.

Since the rules can feel a little complex, it never hurts to apply even if you aren't sure. The application itself will figure out what you're eligible for, and there's no penalty for trying.

CHIP: Your Child’s Healthcare Safety Net

Working hand-in-hand with Medicaid, the Children's Health Insurance Program (CHIP) provides vital coverage for kids and, in some states, pregnant women. CHIP was designed for families who make a bit too much to get Medicaid but still can't afford a private insurance plan.

The income limits for CHIP are usually higher than Medicaid, which means it helps cover more working families. Together, these programs make sure millions of children can get their check-ups, doctor visits, and immunizations, no matter what their parents' job situation is. It’s an essential resource for families seeking stable health insurance for low-income workers, making sure their kids stay healthy during tough times.

How to Get Started

Applying for Medicaid and CHIP is pretty simple, and you can usually do it right through the same website you'd use for a Marketplace plan.

- Start at HealthCare.gov: This is your one-stop-shop. The system is designed so there's "no wrong door."

- Fill Out the Application: You'll answer questions about who is in your household and what your current monthly income looks like.

- Automatic Check: Based on your answers, the Marketplace will automatically see if you're a good fit for Medicaid or CHIP in your state.

- Get Your Results: If it looks like you qualify, your info is sent straight to your state's Medicaid agency to finish the process.

This system takes all the guesswork out of it. You fill out one application, and it points you toward the best, most affordable coverage you can get—whether that’s a subsidized plan or free coverage through Medicaid.

When to Consider a Short-Term Health Plan

If you're looking for health insurance if unemployed, you’ve probably seen ads for short-term health plans. The low monthly payments can seem like a lifesaver, especially when money is tight. But it's so important to know what you’re really buying. These plans are not a replacement for real, comprehensive health insurance.

Think of it like this: a short-term plan is the spare tire in your trunk. It’s a cheap, temporary fix designed to get you a short distance in an emergency, but you wouldn’t drive across the country on it. It’s there for a sudden accident or a completely unexpected, critical illness—and that's about it.

These plans don't have to follow the rules of the Affordable Care Act (ACA). That's a huge deal. It means they can sidestep the consumer protections that Marketplace plans are required to offer, which can leave you exposed.

What Short-Term Plans Don't Cover

Because they aren't ACA-compliant, short-term insurance companies get to be very picky about who they cover and what they’ll pay for. That low price tag comes with some serious strings attached.

Before you even think about signing up, you need to understand what’s almost always left out:

- Pre-existing Conditions: Insurers can—and usually will—deny you coverage for any health issue you had before the plan started. This isn't just for major things; it could be anything from asthma and diabetes to an old knee injury.

- Essential Health Benefits: They are not required to cover the ten essential health benefits. That means you’ll likely have zero coverage for maternity care, mental health services, or prescription drugs.

- Preventive Care: Forget about annual check-ups, immunizations, or routine cancer screenings. You’ll be paying for all of that yourself, completely out-of-pocket.

Globally, we're seeing how critical it is to have solid health coverage, especially when you're not employed. The World Health Organization highlights a growing shortage of health workers, which strains the very public systems many unemployed people depend on. It’s a reminder that tying health security to a job can be a fragile setup.

The Risks Beyond the Low Premium

The potential problems with short-term plans go way beyond what they don't cover. Signing up for one can leave you in a financial hole you never saw coming.

A short-term plan is basically a bet on your own good health. It can work for a very brief, predictable gap in coverage, but one surprise diagnosis or accident can lead to devastating medical bills that the plan won't touch.

These plans often have sky-high deductibles and out-of-pocket maximums. Even for something that is covered, you could be on the hook for thousands of dollars before the insurance company pays a dime.

On top of that, these policies aren't considered "minimum essential coverage." If you live in a state that requires you to have qualifying health insurance, you could even face a tax penalty for having one. For a much deeper look into their limits, check out our guide on what to know about short-term health insurance.

So, when does a short-term plan make sense? Only in a very specific, very narrow situation: if you're a healthy person bridging a confirmed coverage gap of just a month or two—like when you're waiting for a new job's benefits to kick in. For anything longer or more uncertain, an ACA Marketplace plan gives you far more protection and true peace of mind.

How to Choose the Right Plan for Your Situation

Okay, you've seen the main roads to getting health insurance if unemployed. Now comes the tricky part: picking the one that's actually right for you. It’s not just about grabbing the first plan you see; it's about matching the coverage to your life right now.

Think of it like packing for a trip where you don’t know the exact destination. You have to consider your budget, what you might need along the way, who you want to see, and how long you'll be gone. Choosing a health plan works the same way. It all comes down to your personal finances, your health, your doctors, and your timeline.

The Four Pillars of Your Decision

To make the best call, you need to get really honest with yourself about where you stand. Let's break it down into four simple but powerful questions.

- What's Your Monthly Budget? With no paycheck coming in, every single dollar matters. What is the absolute most you can spend on a monthly premium without adding more stress to your plate? Be realistic.

- What Are Your Health Needs? Are you someone who rarely sees a doctor, or do you have a chronic condition that requires regular visits and prescriptions? This is a huge factor. It will tell you whether you need a comprehensive plan or if something more basic will get you by.

- Can You Keep Your Doctors? If you’re in the middle of a treatment plan or just really trust your current doctor, keeping them might be your number one priority. Some plans are much more flexible with their networks than others.

- How Long Will You Be Unemployed? Do you have another job lined up in a month? Or are you settling in for a longer search? Your expected timeline is critical for deciding between a temporary band-aid and a more stable, long-term solution.

A Framework for Choosing Your Plan

Once you have those answers, a path forward starts to become clear. You'll see that each option offers a different balance of cost, coverage, and convenience. There's a trade-off with every choice.

Key Insight: There’s no single "best" plan. The right plan is the one that wraps the most appropriate protection around your specific health and financial situation while you navigate this transition.

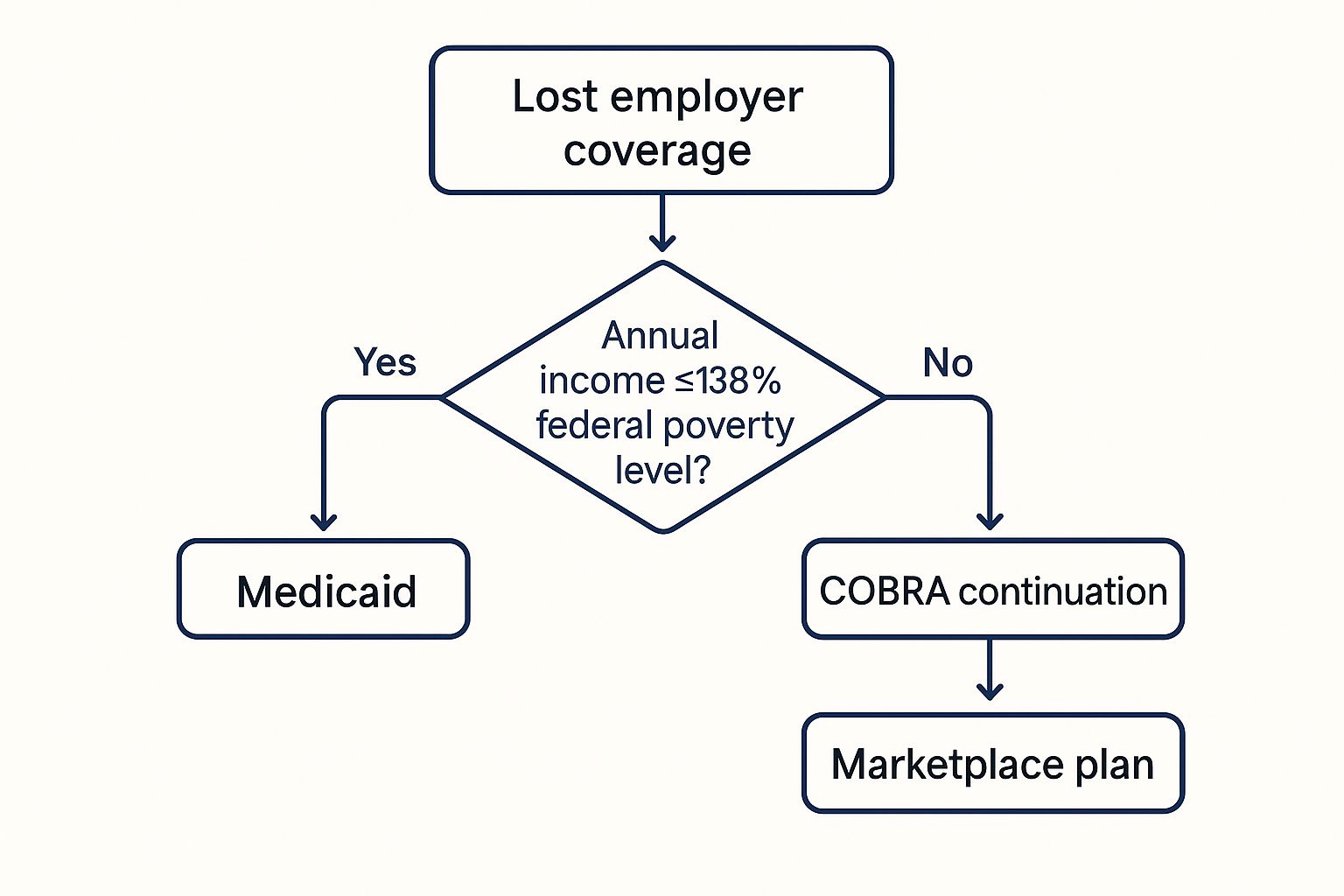

This visual guide can help you see the forks in the road more clearly, especially when it comes to how your income influences your options.

As you can see, your current income is the first major decision point. It can immediately point you toward Medicaid or steer you toward options like the ACA Marketplace or COBRA.

Decision Matrix for Your Health Insurance Options

To make this even easier, let's put everything side-by-side. This table breaks down how each plan stacks up against the most important factors, helping you see the pros and cons at a glance.

| Factor | ACA Marketplace Plan | COBRA | Medicaid | Short-Term Plan |

|---|---|---|---|---|

| Best For | Most people needing a balance of cost and comprehensive coverage. | Those who must keep their exact doctor/plan and can afford the high cost. | Individuals and families with very low income. | Healthy people needing a temporary bridge for a very short, known gap. |

| Cost | Can be very low-cost or even $0 with subsidies. | Very expensive; you pay 102% of the full premium. | Free or extremely low-cost. | Low premiums, but high out-of-pocket costs and deductibles. |

| Coverage | Comprehensive; covers essential health benefits and pre-existing conditions. | Identical to your old employer's plan. | Comprehensive; covers all essential health benefits. | Very limited; often excludes pre-existing conditions, prescriptions, maternity. |

| Doctor Choice | Flexible; you can choose from various PPO and HMO networks. | You keep your exact same network of doctors. | Limited to doctors and hospitals that accept Medicaid. | Very restrictive network, or no network at all. |

Looking at this comparison, you can start to see which column best aligns with your answers to the four pillar questions. It's all about finding the best fit for your unique circumstances.

Comparing Your Options in a Nutshell

Here's the final breakdown to bring it all home.

-

ACA Marketplace Plan: This is usually the go-to choice. With subsidies, it can be incredibly affordable. The plans are solid, cover what you need, and give you enough options to find one that includes your doctors. It's a reliable solution for an uncertain period.

-

COBRA: Only go this route if keeping your current plan and doctor is a non-negotiable and you have the cash to cover the hefty premium. It’s best for very short gaps, especially if you've already hit your deductible for the year.

-

Medicaid: If your income has dropped significantly, this is your lifeline. It offers complete coverage for little to no cost, acting as the ultimate healthcare safety net when you need it most.

-

Short-Term Plan: Think of this as a last resort. It's for healthy people who just need to bridge a confirmed gap of a month or two. The low price tag is tempting, but the coverage gaps and potential risks are massive.

This challenge isn't just a U.S. issue. In the European Union, the link between unemployment and health insurance is a constant focus, particularly after the COVID-19 pandemic led to a 76% spike in unemployment benefit costs between 2019 and 2021. It shows a global need for strong systems that keep people covered during tough economic times. You can learn more about these European social protection trends if you're curious.

By carefully thinking through these factors, you can move forward with a plan that protects both your health and your wallet. You've got this.

You've Got Questions? We've Got Answers.

Losing your job brings up a million questions, and navigating health insurance on your own can feel like trying to solve a puzzle in the dark. Let's shed some light on the most common concerns people have when they're in this exact spot.

"What If I Honestly Can't Afford a Monthly Premium?"

This is the number one worry, and there's a straightforward answer. If even the cheapest plans feel out of reach, your first move is to see if you qualify for Medicaid. It's the health safety net designed for people with very low incomes, and for many, it comes with a $0 monthly premium.

The good news? When you apply through HealthCare.gov, the system is built to automatically check your Medicaid eligibility based on your state and income. If you qualify, you can get solid, comprehensive coverage without the stress of another monthly bill.

"Can I Get Covered if I Have a Pre-Existing Condition?"

Yes. A huge, unequivocal yes. Because of the Affordable Care Act (ACA), it is 100% illegal for any Marketplace health plan to turn you away or charge you more because of a health issue you already have.

This is a game-changer. It means your diabetes, asthma, or a past cancer diagnosis won’t stand in the way of you getting insured. This protection is one of the most powerful reasons to stick with an ACA plan over other options, ensuring that a job loss doesn't also mean losing the medical care you depend on.

Your Built-In Protection: Every single ACA Marketplace plan must cover pre-existing conditions. You can't be denied or up-charged for any health issue you had before your new coverage kicks in.

"How Do My Unemployment Checks Affect My Application?"

It’s a good question. Your unemployment benefits do count as income. When you're filling out your Marketplace application, you'll need to report those benefits along with any other money you expect to earn this year.

The system crunches these numbers to figure out if you qualify for a Premium Tax Credit (the subsidy that lowers your monthly cost). While unemployment benefits raise your "official" income, a huge number of people still qualify for major financial help, making their premiums far more manageable.

"What Happens if I Pick Up a Part-Time Gig or Some Freelance Work?"

Life changes, and so can your income. If you start a new part-time job or start freelancing, it's super important to log back into your HealthCare.gov account and update your income information. Think of it as keeping your profile in sync with your real life.

Why does it matter so much? If your income goes up and you don't report it, you could end up having to pay back some (or all) of your subsidy when you file your taxes. On the flip side, if your income drops even lower, reporting it could unlock even more financial aid. It pays to keep it current.

Finding the right path forward can feel overwhelming, but you don't have to figure it all out alone. The friendly experts at My Policy Quote are here to help you weigh your options and find the most affordable coverage for where you are right now. Visit us at https://mypolicyquote.com to get started.