An accelerated death benefit (ADB) is a feature tucked inside some life insurance policies that lets you access a chunk of your payout while you're still alive. It's triggered when you're diagnosed with a qualifying serious illness.

Think of it as an early advance on your own life insurance, giving you and your family critical funds exactly when you need them most.

What Is an Accelerated Death Benefit in Plain English?

We usually think of life insurance as something for our loved ones' future, long after we're gone. But a serious medical diagnosis can create immediate, overwhelming financial stress right now. An accelerated death benefit rider was created for this exact problem.

This feature transforms your policy from a future promise into a source of support during your lifetime.

It's not a loan you have to pay back. It’s a provision that gives you a significant, often tax-free, portion of the money your beneficiaries would have otherwise received. This gives you financial breathing room and flexibility during an incredibly difficult time.

How It Gives You Financial Breathing Room

The whole point of this benefit is to ease the financial strain that comes with a severe health crisis. Once you activate the rider, you can use the funds for anything you need—giving you back a sense of control and dignity.

People often use the money for things like:

- Covering Medical Expenses: Paying for treatments, prescriptions, and procedures that health insurance doesn't fully cover.

- Funding End-of-Life Care: Affording hospice services, in-home nursing, or a stay in a long-term care facility.

- Improving Quality of Life: Making your home more accessible, paying off stressful debts, or even taking one last family trip to create priceless memories.

An accelerated death benefit unlocks the value of your life insurance policy right when you need it, converting a future benefit into present-day relief.

To give you a quick overview, here’s how the core components typically break down.

Accelerated Death Benefit At a Glance

| Feature | Typical Provision |

|---|---|

| Eligibility Trigger | Diagnosis of a terminal illness (life expectancy of 6-24 months) |

| Benefit Amount | 25% to 100% of the policy's face value (often 50% to 80%) |

| Tax Status | Generally tax-free, but always consult a financial advisor |

| Impact on Beneficiaries | The remaining death benefit is paid out upon passing |

| Cost | Often included at no extra cost, or available for a small fee |

This table provides a snapshot, but always remember to review your specific policy documents for the exact details.

Understanding the Payout

So, how much can you actually get? The amount varies, but insurers generally allow you to access between 25% and 100% of your policy’s face value, though most fall in the 50% to 80% range. This benefit is usually triggered by a terminal illness diagnosis, which is often defined as having a life expectancy of 6 to 24 months. You can find more details about these provisions in university research on the topic.

Here’s a simple example: Let's say you have a $400,000 life insurance policy. Your insurer allows a 75% advance through the ADB rider.

This means you could receive $300,000 today to manage your expenses and care. The remaining $100,000 would then be paid to your beneficiaries upon your death.

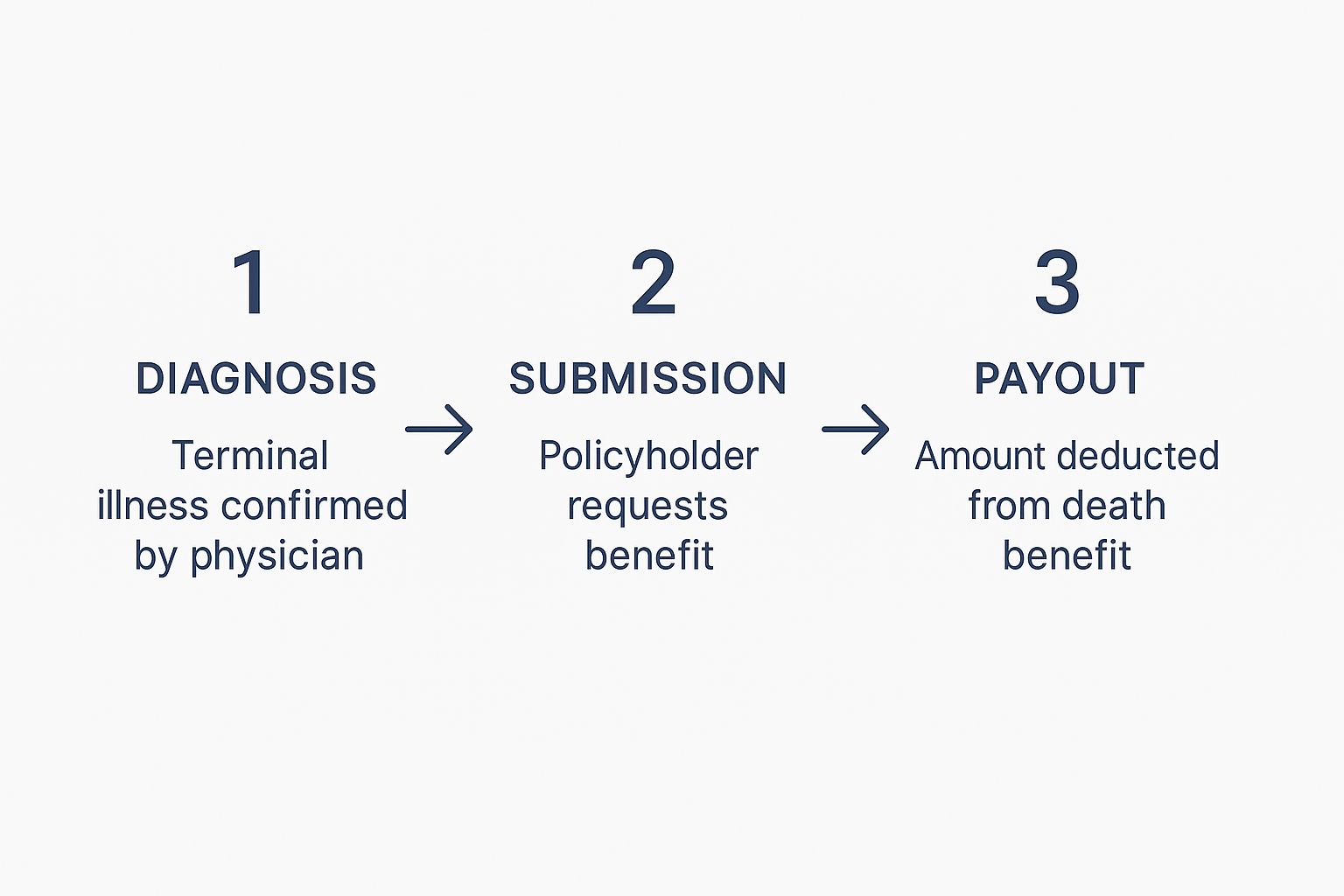

How Accessing Your Benefit Actually Works

When you get a serious diagnosis, figuring out how to tap into your accelerated death benefit is the next logical—and crucial—step. It’s not something that happens automatically. You have to be the one to kickstart the process.

It usually starts with a simple phone call to your life insurance company. Let them know what's happening and that you want to formally request to use the rider.

From there, your insurer will need to see official medical documents. This means getting a signed statement from your doctor that confirms your diagnosis and life expectancy, along with any other relevant medical records. They’ll review everything to make sure your situation lines up with the specific rules outlined in your policy.

The Payout Calculation and Process

Once your claim gets the green light, the insurance company will figure out your payout. It won't be the full face value of your policy, but it will be a big chunk of it—often somewhere between 50% and 80%. The final amount really comes down to the terms of your specific policy and how the insurer assesses your case.

This chart breaks down the simple steps from diagnosis to payout.

As you can see, the most important part is getting them the proof they need. That’s what triggers the benefit, which is then subtracted from the total amount your loved ones will receive later.

The money is usually paid out in a single lump sum, which gives you immediate control and flexibility. It's good to know that some insurers might charge a small, one-time administrative fee for processing the benefit, which they'll take out of your payment.

The core idea is simple: the money you get now is an advance on your death benefit. For every dollar you access today, that’s one less dollar available for your beneficiaries down the road.

This can be an incredibly powerful financial tool. Many families facing a serious illness are left wondering how to pay for hospice care and other overwhelming expenses. An accelerated death benefit provides immediate relief, so you can cover medical bills, end-of-life care, or whatever else you need without waiting.

Qualifying for an Accelerated Death Benefit

So, how do you actually get access to an accelerated death benefit? This is the most important question. While the fine print varies between insurance companies, eligibility almost always comes down to a serious medical diagnosis that has a major impact on your health and life expectancy.

The most common trigger is a terminal illness. Insurers usually define this as a condition where a doctor certifies your life expectancy is short—often just 12 to 24 months. That timeframe is a key piece of the puzzle.

But a terminal diagnosis isn't the only door that can open. Thankfully, many modern policies have broadened their rules to give policyholders more flexibility when they need it most.

Common Qualifying Conditions

Beyond a terminal prognosis, other life-altering health events can make you eligible for that early payout. They generally fall into a few key categories, though you'll need to check your own policy to see exactly what's covered.

Here are a few other common triggers:

- Chronic Illness: This often kicks in if a doctor certifies you can no longer perform two or more Activities of Daily Living (ADLs)—things like bathing, dressing, or feeding yourself—without help.

- Critical Illness: A diagnosis of a specific, life-threatening condition like a massive heart attack, a major stroke, or end-stage kidney failure can also qualify you.

- Long-Term Care Confinement: Needing to live permanently in a nursing home or another long-term care facility is another trigger included in some policies.

The key takeaway? Your specific policy is the ultimate guide. The definitions for "terminal," "chronic," and "critical" aren't universal; they change from one insurer to the next.

For a terminal illness, the prognosis is usually less than two years. While availability can depend on your state, most major life insurance companies in the U.S. now offer these riders, often with no extra upfront cost.

Because every person's situation is different, it's so important to read your policy documents or just call your insurance agent. This is especially true when you're looking into something like life insurance for parents, where understanding every single benefit is critical. A quick conversation can make sure you know exactly where you stand.

Weighing Your Options: The Pros and Cons of an Early Payout

Deciding to use your accelerated death benefit is a huge financial choice, and it's one that will affect you and your family for years to come. It’s an incredibly personal decision, with powerful upsides but also some very real trade-offs.

The biggest pro, of course, is getting immediate access to a large, often tax-free sum of money. During a crisis, that kind of financial relief can change everything.

The Powerful Advantages

The main benefit here is gaining the flexibility to handle an unbelievably tough time on your own terms. This isn't just about paying bills—it's about getting back a sense of control and dignity when you need it most.

Key advantages include:

- Covering Critical Expenses: You can pay for medical treatments that health insurance won't touch, afford top-tier hospice care, or even try experimental procedures.

- Reducing Financial Stress: That money can be used to wipe out a mortgage or clear credit card debt, lifting a massive weight off your family’s shoulders, both now and in the future.

- Improving Quality of Life: You get the freedom to use the funds for whatever matters most to you. Maybe that's making your home more accessible or creating one last, beautiful memory with the people you love.

The Significant Drawbacks

Tapping into these funds early isn't without its consequences, and they are permanent. The most significant drawback directly impacts the people you bought the policy for in the first place: your beneficiaries.

Every dollar you receive through an accelerated death benefit is a dollar that your loved ones will not get after you’re gone.

This reduction in the final payout is the heart of the trade-off. It’s a choice between your immediate needs and their future financial security.

It's also important to think about how this might affect other benefits. Getting a big lump sum of cash could suddenly make you ineligible for government assistance programs like Medicaid, which are often based on your income and assets.

The type of policy you have matters, too. Understanding the difference between term and permanent life insurance helps clarify how a rider like this fits into the bigger picture of your coverage over time.

Weighing Your Options: The Pros and Cons of ADB

Looking at the benefits and drawbacks side-by-side can make this difficult decision a little clearer. Here's a straightforward breakdown to help you weigh what's most important for your situation.

| Pros (Advantages) | Cons (Disadvantages) |

|---|---|

| Immediate cash for urgent needs. | Reduces the final payout for your beneficiaries. |

| Funds are typically tax-free. | Can affect your eligibility for government aid. |

| Eases financial stress during illness. | The decision to use it is irreversible. |

| Provides flexibility and control over care. | Some insurers charge a fee to access the benefit. |

Ultimately, there's no single right answer. It comes down to your health, your family's financial stability, and what will bring you the most peace of mind during a challenging chapter of life.

How This Benefit Helps in Real-Life Situations

To really get what an accelerated death benefit can do, we have to look past the definitions and see how it shows up in real life. It’s about more than money—it’s about providing practical and emotional relief during some of life’s toughest moments. It gives you back a sense of control when you need it most.

Let's walk through a story that might feel familiar. Imagine David, a family man with a $500,000 life insurance policy, gets a terminal cancer diagnosis. His doctors suggest an experimental treatment, but it’s not covered by his health insurance. Suddenly, his family is facing a massive, stressful financial roadblock.

This is where the accelerated death benefit comes in. David activates his rider and gets access to $300,000 of his policy now. That cash allows him to pay for the promising treatment without wiping out his family’s savings. The rest of the money? It lets him create priceless memories, like taking his family on one last trip without a single worry about the cost.

Ensuring Dignity in Long-Term Care

Now, let's think about another all-too-common situation. Sarah, a retired teacher, has a severe stroke that leaves her needing permanent, round-the-clock nursing care. The cost of a good facility is absolutely staggering, and her family is terrified they’ll have to sell their home to afford it.

Luckily, Sarah's policy includes an accelerated death benefit for chronic illness. She’s able to access 50% of her death benefit, which gives them a huge sum to cover several years of high-quality care. This single decision means she gets the professional support she needs while keeping the family’s home and her husband's financial future secure. For more on protecting a surviving partner, a spouse term rider is another powerful tool to consider. You can learn more about in our detailed guide.

An accelerated death benefit is more than just a financial transaction; it's a tool for dignity, allowing individuals to make crucial life and care decisions on their own terms.

When you’re navigating a serious diagnosis, the freedom an ADB provides is life-changing. It lets you focus on what really matters—your health and well-being. That support makes it possible to focus on vital resources for thriving with cancer and promoting wellness instead of stressing over bills.

Both David’s and Sarah’s stories show how this rider can turn a future promise into immediate, life-altering support.

Your Top Questions About ADBs, Answered

Even after getting the basics down, you probably still have a few questions floating around. That’s completely normal. Let's tackle the most common ones head-on to clear up any confusion.

Are ADB Payouts Taxable?

For the most part, no. Money you receive from an accelerated death benefit is not considered taxable income by the IRS, especially when it's for a terminal illness. The government views these funds much like a standard death benefit payout—as a non-taxable event.

But, things can get a little murkier with chronic or critical illness claims, and state tax laws can have their own quirks. It’s always a good idea to have a quick chat with a tax professional, just to be sure you understand how it all applies to you.

How Does It Impact My Beneficiaries?

This is the big one. When you use your ADB, it directly reduces the final payout your loved ones will receive. The amount you take out early, plus any small administrative fees the insurer might charge, is subtracted from the total.

For example, if you have a $400,000 life insurance policy and access $150,000 through the ADB, your beneficiaries would receive the remaining $250,000 when you pass away.

It’s the central trade-off of this feature: balancing your immediate, urgent financial needs against their future financial security.

Do All Life Insurance Policies Include This Rider?

Not always, but it’s becoming incredibly common. Most modern policies include an ADB rider right out of the box, often at no extra upfront cost. Older policies, however, are less likely to have it.

If you're a young family just starting to look at coverage, this is a feature you should absolutely ask about. Our guide on life insurance for young parents dives deeper into the key features that provide real-world value. The only way to know for sure is to pull out your policy documents or give your insurance company a call.

Can I Use the Money for Non-Medical Expenses?

Yes, one hundred percent. Once the funds are in your hands, they’re yours to use however you see fit. There are no restrictions, which is one of the biggest benefits.

You can cover medical bills, hire an in-home nurse, pay off your mortgage, or even use the money to take one last incredible family vacation. The choice is completely yours.

At My Policy Quote, we help you find life insurance that provides security for today and tomorrow. Explore your options and get a clear, no-hassle quote by visiting us at https://mypolicyquote.com.