Losing your job is stressful enough without having to worry about losing your health coverage, too. The good news is, you don’t have to. You can get quality health insurance without a job through a few key pathways, like the ACA Marketplace, COBRA, or Medicaid.

Where you fit depends on your income, where you live, and what kind of coverage you need right now.

Your First Steps After Losing Job-Based Coverage

That moment you lose your employer’s health plan can feel like the ground has vanished beneath your feet. But take a deep breath. There are safety nets built for this exact situation, and the most important thing you can do is act quickly.

In the U.S., finding health insurance without a job usually means turning to the Affordable Care Act (ACA) marketplaces, Medicaid, or COBRA. Since the ACA rolled out, far more people have been able to get coverage outside of a traditional job. For a deeper dive into the numbers, you can check out this global health insurance market analysis on Actupool.com.

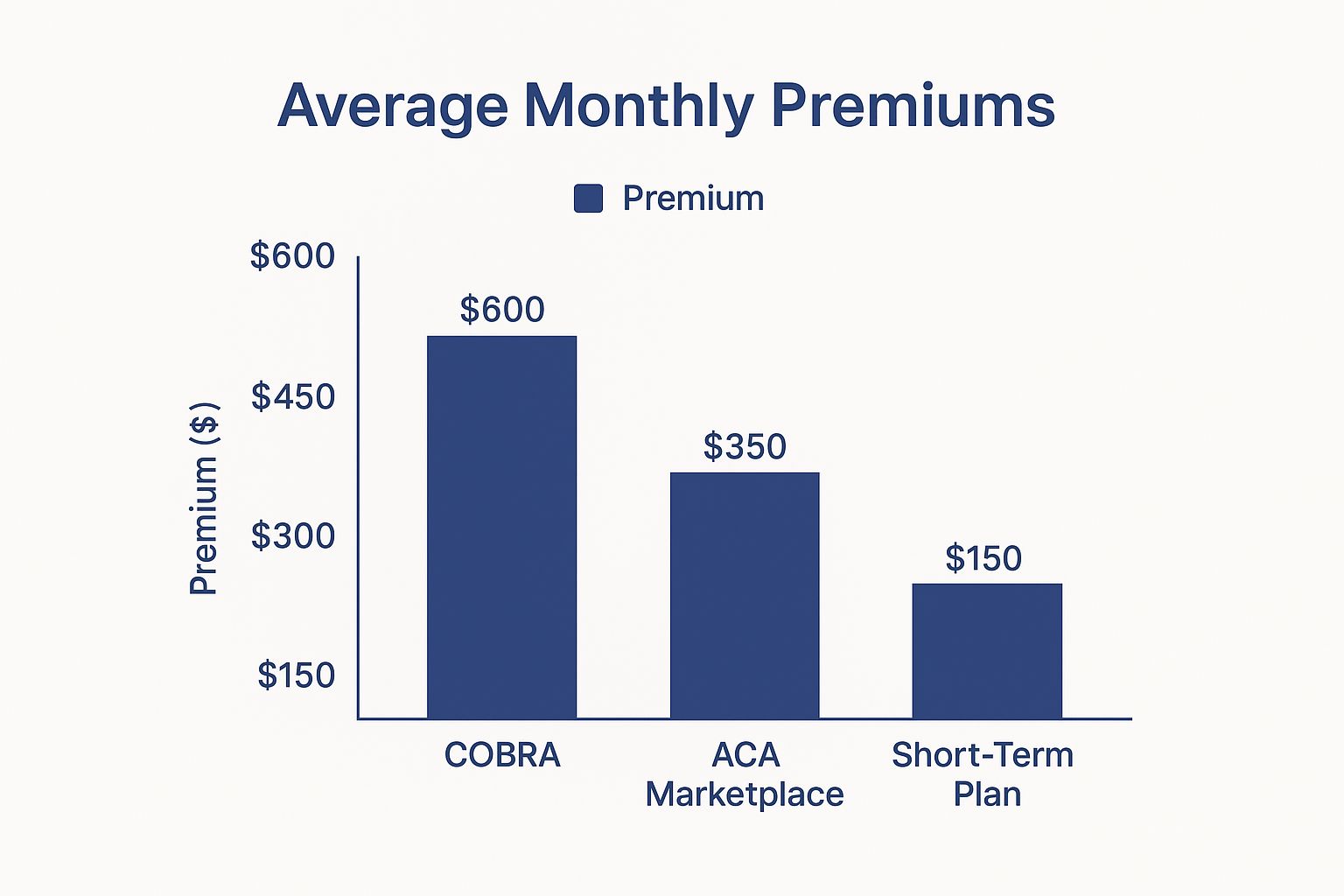

This image gives you a quick snapshot of what to expect financially from each option.

As you can see, the costs vary wildly. COBRA is by far the priciest, while other options can be incredibly affordable, showing the classic trade-off between cost, convenience, and how comprehensive the coverage is.

Understanding Your Main Pathways

Your immediate job is to figure out which path makes the most sense for your health and your wallet. You don’t need to become an overnight insurance guru, but knowing the basics will empower you to make a choice you feel good about.

Here’s a simple way to think about it:

- ACA Marketplace: Your best bet for finding affordable, long-term coverage. You might even qualify for subsidies that dramatically lower your monthly premium.

- COBRA: This lets you keep your exact same health plan from your old job. It’s a great option if you’re in the middle of treatment, but be prepared for a much higher price tag.

- Medicaid: If your income has dropped to zero or is very low, this program provides excellent coverage for free or at a very low cost.

The most important thing to remember is your 60-day Special Enrollment Period. It starts the day your old insurance ends. If you miss this window for the ACA Marketplace or COBRA, you could be locked out until the next open enrollment season. Don't wait.

Your Health Insurance Options at a Glance

To make this even clearer, let's lay it all out side-by-side. Think of this table as your starting point to quickly see which options are worth exploring more deeply.

Our full guide on getting health insurance without a job goes into even more detail, but this gives you the high-level view you need right now.

| Option | Best For | Typical Cost | Coverage Duration |

|---|---|---|---|

| ACA Marketplace | Individuals and families needing affordable, long-term, comprehensive coverage, especially those who qualify for subsidies. | Can be very low with subsidies; varies widely based on income and plan choice. | Annual, renewable. |

| COBRA | People who want to keep their exact same plan and doctors for a short time and can afford the full premium. | High; 102% of the full plan cost (both your share and your former employer's share). | Typically up to 18 months. |

| Medicaid/CHIP | Low-income individuals, families with children, pregnant women, and people with disabilities. | Free or very low-cost. | As long as you meet income and state eligibility requirements. |

Each path offers a different kind of support. The key is finding the one that provides the stability and peace of mind you need as you navigate your next steps.

Using the ACA Marketplace to Find a Plan

If you’ve recently lost your job, the Affordable Care Act (ACA) Marketplace is probably the first place you should look. Think of it as your dedicated starting point for finding quality health coverage when you're no longer covered by an employer. It was built for situations just like this.

Here's some good news: losing your job-based insurance is considered a Qualifying Life Event. This immediately opens up a Special Enrollment Period (SEP) for you. You get a 60-day window from the day your old coverage ends to pick a new plan on the Marketplace. Timing is everything here, so don't let that window close.

Navigating Your Special Enrollment Period

That 60-day period is your golden ticket to getting new coverage without a gap. To make sure everything goes smoothly, it’s a smart move to get your paperwork in order before you even start the application.

Trust me, having these items ready will save you a ton of time and frustration:

- Proof of Income: This could be recent pay stubs, an unemployment benefits letter, or last year’s tax return. You'll need to estimate your income for the rest of the year.

- Social Security Numbers: Make sure you have them for everyone in your household who needs coverage.

- Proof of Lost Coverage: You'll need a letter from your old job confirming when your insurance ended. This is the key that proves you qualify for the SEP.

Once you’ve got everything together, head over to HealthCare.gov, create an account, and start the application. The site will walk you through everything, asking about your household, your income projection, and what changed to confirm you’re eligible.

Unlocking Subsidies to Lower Your Costs

This is where the ACA Marketplace becomes a real game-changer, especially when your income has dropped. Based on what you expect to earn for the year, you could qualify for serious financial help.

The most common assistance is the Premium Tax Credit, which is applied directly to your monthly payment, bringing the cost way down.

Here’s a real-world example: Maria just lost her job. She figures her total income for the year, including unemployment and some side gigs, will be about $25,000. With that income, she could get a huge Premium Tax Credit. A solid Silver plan that might normally cost over $400 a month could now be less than $100 for her.

This is the whole point of the ACA—to make sure people can stay insured even when life throws them a curveball. It’s a very different system from what you see in many European countries or Canada, where public funding largely disconnects healthcare from employment. You can read more about these global health insurance models on Actupool.com.

Choosing the Right Metal Tier for You

When you start shopping on the Marketplace, you’ll see plans grouped into four "metal" tiers: Bronze, Silver, Gold, and Platinum. Don't get confused—this has nothing to do with the quality of doctors or hospitals. It's all about how you and the insurance company split the costs.

Picking the right tier is about matching a plan to your health needs and your wallet.

ACA Metal Tiers Explained

| Tier | Monthly Premium | Out-of-Pocket Costs | Best For |

|---|---|---|---|

| Bronze | Lowest | Highest (high deductible) | Healthy people who just want a safety net for major emergencies and don't visit the doctor often. |

| Silver | Moderate | Moderate (lower deductible) | A great middle ground. Crucially, this is the only tier where you can get extra "cost-sharing reductions" if you qualify. |

| Gold | High | Low (low deductible) | Anyone who knows they'll need regular medical care, like frequent appointments or prescriptions. |

| Platinum | Highest | Lowest (very low deductible) | People with significant, ongoing health conditions who want the most coverage and lowest out-of-pocket costs. |

For most people in between jobs, a Silver plan is often the sweet spot. Why? Because if your income is low enough, you can qualify for Cost-Sharing Reductions (CSRs) on top of your premium tax credits. These are extra subsidies that lower your deductible, copayments, and coinsurance—but they are only available on Silver plans. This can give you the out-of-pocket protection of a Gold or Platinum plan but with a much more affordable monthly premium.

Qualifying for Medicaid or CHIP Coverage

Losing your job and the health insurance that came with it can feel like the floor has dropped out from under you. But before you panic, it’s important to know about two of the strongest safety nets available: Medicaid and the Children's Health Insurance Program (CHIP).

These government programs offer comprehensive, high-quality health insurance without a job for very little—or even zero—cost to you. They are designed specifically for moments like this.

The best part? You can apply for Medicaid and CHIP at any time of year. There’s no waiting around for a special enrollment period. If you qualify, your coverage can start right away, giving you immediate peace of mind.

Who Is Eligible for Medicaid

Medicaid eligibility really comes down to your current household income. Thanks to the Affordable Care Act (ACA), many states expanded their programs to cover all adults earning up to 138% of the Federal Poverty Level (FPL).

Whether you qualify heavily depends on where you live.

- In states that expanded Medicaid: A single adult with a very low monthly income is likely to be eligible.

- In states that did not expand: The rules are much tougher. You often have to belong to a specific group, like being a pregnant woman, a parent with an extremely low income, or an individual with a disability.

This difference creates what’s known as the "coverage gap" in non-expansion states. It's a tough spot where you might earn too much for traditional Medicaid but not enough to get financial help on the ACA Marketplace.

Here’s a real-world example: Take a family of three. In a state with expanded Medicaid, they could qualify with an annual income up to roughly $34,307 (based on 2024 poverty levels). In a state without expansion, that same family might not be eligible at all.

Understanding CHIP for Children

Even if the adults in your household don't qualify for Medicaid, your kids still might have an option. The Children’s Health Insurance Program (CHIP) offers low-cost health coverage for children whose families earn too much for Medicaid but can’t afford private insurance.

Some states even extend CHIP coverage to pregnant women. While every state runs its program a little differently, the goal is always the same: making sure kids have access to check-ups, immunizations, and doctor visits. The income limits for CHIP are typically higher, creating a wider safety net for children.

How to Apply for Coverage

Applying has become much simpler than it used to be. The easiest place to start for most people is the official ACA Marketplace at HealthCare.gov.

When you complete a single application on the Marketplace, the system is smart enough to do two things at once:

- It checks if you can get a subsidized ACA plan.

- It also screens you for Medicaid and CHIP eligibility based on your income.

If it looks like you qualify for Medicaid or CHIP, the Marketplace automatically forwards your information to your state’s agency. From there, they’ll contact you to finish the enrollment. It takes the guesswork out of the process. For a more detailed look at the latest Medicaid rules, this Medicaid Intelligence Report is a great resource.

It’s a common misconception, but the vast majority of adults on Medicaid are already working in low-wage jobs, caring for family members, or going to school. The program is a critical support system for working families and people between jobs, ensuring a job loss doesn't become a health crisis.

Deciding if COBRA Is Worth the Cost

Keeping your old health plan through COBRA often sounds like the easiest choice after losing a job. It’s familiar. You know your doctors are in-network, and you don’t have to start from scratch.

But then the first bill arrives, and the sticker shock is real. Suddenly, you see why it's a path that requires some serious thought.

So, why the massive price jump? It’s simple: when you were employed, your company paid a big chunk of your premium. Under COBRA, you’re on the hook for 100% of that cost, plus a small administrative fee (usually around 2%). You’re paying the full, unsubsidized price.

This is exactly why most people looking for health insurance without a job head straight to the ACA Marketplace, where subsidies can make coverage much more affordable.

However, there are a few critical situations where the high cost of COBRA isn't just worth it—it's necessary.

When Paying the High Premium Makes Sense

Imagine you're in the middle of serious medical treatment, like chemotherapy. You have a trusted oncologist, a specific hospital you rely on, and you’ve already paid off your annual deductible.

Switching to a new plan right now, even a great one from the Marketplace, could be a disaster.

A new plan would mean:

- Starting over with a new deductible, potentially costing you thousands of dollars out-of-pocket all over again.

- Finding a new network of doctors, which could interrupt your care at the worst possible time.

- Getting new pre-authorizations for treatments that were already approved under your old plan.

In this scenario, COBRA acts as an essential bridge. It lets you keep your exact same coverage without any disruptions. The high monthly premium, while painful, might be a lot less than the financial and emotional toll of starting over with a new insurer mid-treatment.

Understanding COBRA Deadlines and Duration

Timing is everything with COBRA. You don’t have forever to make up your mind. Once your former employer sends you the official COBRA election notice, you have a 60-day window to decide whether to enroll.

Don't treat this like a casual deadline. If you miss that 60-day window, your option to elect COBRA is gone for good. You can even wait until day 59 to decide, and if you enroll, your coverage will kick in retroactively to the day you lost your job-based plan.

This gives you a little breathing room. You can use that time to explore other options, like a Marketplace plan, and compare costs side-by-side.

COBRA is designed to be a temporary fix. It typically lets you keep your old health plan for up to 18 months, but you have to cover the entire premium yourself. The cost can be steep—some COBRA premiums easily top $700 per month for an individual—making it a tough expense to maintain long-term.

Viewing COBRA as a Strategic Bridge

Ultimately, it helps to think of COBRA as a short-term strategic tool, not a permanent solution. It's the expensive but reliable option you use to get from Point A to Point B without risking your health.

Maybe you only need it for a couple of months until a new job starts or until your medical treatments are done. For a detailed breakdown of what to do when the price is just too high, you might want to read our guide on COBRA insurance alternatives. It can help you find a more sustainable plan for the long haul.

Exploring Alternative Coverage Options

So, what happens if the ACA Marketplace, COBRA, or Medicaid just aren't the right fit for you? Don't worry, you still have other paths to explore.

Think of these as alternative routes. They aren't for everyone and each has its own set of pros and cons, but knowing they exist gives you more power over your healthcare decisions, especially when you're in between jobs.

These options range from quick, temporary fixes to more stable, family-based solutions. The key is to really understand what you’re getting—and what you’re giving up. Globally, the demand for non-employer coverage is huge, with the health insurance market projected to jump from about USD 2.32 trillion in 2025 to USD 4.45 trillion by 2032. You can learn more about what’s driving this shift in this 2025 global health care executive outlook from Deloitte.com.

Short-Term Health Insurance: A Critical Look

At first glance, short-term health plans seem like a great deal. The monthly premiums are often just a fraction of what you’d pay for a standard ACA plan, which makes them look like the perfect temporary solution.

But that low price tag comes at a cost. These plans are not regulated by the Affordable Care Act, and that’s a huge deal. They don't have to play by the same rules.

Here’s what that really means for you:

- No Pre-existing Condition Coverage: They can—and often do—refuse to cover any health issue you had before the policy started.

- Limited Benefits: They aren’t required to cover the ten essential health benefits. This means you might find yourself without coverage for prescriptions, mental health care, or maternity services.

- Coverage Denials: Insurers can simply deny your application based on your medical history.

A short-term plan should only be considered a last resort for a very brief time—maybe a month or two. It’s a potential safety net if you’re in perfect health and just need protection from a catastrophic accident, but it is not a real substitute for comprehensive health insurance.

Catastrophic Health Plans: An Option For The Young

If you're under 30 or you qualify for a hardship exemption, you have another option on the ACA Marketplace: a catastrophic health plan. The name says it all—this plan is designed to protect you from a true worst-case scenario, not your regular check-ups.

These plans have super low monthly premiums but come with an extremely high deductible. For 2024, that deductible is $9,450.

This means you’ll pay for all your medical costs out-of-pocket until you hit that massive number. Once you do, the plan kicks in and covers 100% of essential health benefits for the rest of the year.

Think of it as a financial shield against a major car accident or a sudden, serious illness. It won’t help with a sinus infection, but it will keep you from financial ruin after a major hospitalization. For a closer look at how these plans stack up, check out our guide on affordable health insurance options.

Joining A Family Member’s Plan

For many people, the simplest and most affordable way to get insured without a job is by joining a family member's policy. If this is an option for you, it’s often the best one.

There are two main ways this works:

-

Joining a Spouse's Plan: If your spouse gets health insurance through work, losing your job counts as a Qualifying Life Event. This opens up a Special Enrollment Period, which allows them to add you to their plan right away, even if it's not open enrollment season. You usually have 30 to 60 days to make this change.

-

Joining a Parent's Plan: Thanks to the ACA, young adults can stay on a parent's health insurance plan until they turn 26. It doesn't matter if you're married, financially independent, or live on your own. This is a fantastic option that provides high-quality coverage during a time when you’re just getting your career started.

These family options give you access to solid, ACA-compliant coverage without the headache of navigating the Marketplace or paying for expensive COBRA plans. If you're eligible, they are almost always the first thing you should look into.

Your Top Questions About Health Insurance After a Job Loss

Losing your job is stressful enough without having to figure out health insurance on your own. It's a world filled with deadlines, jargon, and a lot of confusing "what-ifs." You're not just looking for a plan; you're looking for clear, direct answers so you can make a confident choice during an uncertain time.

Let's cut through the noise and tackle the questions I hear most often from people in your exact situation.

How Long Do I Have to Get a New Plan?

This is the most critical question, and the answer is all about timing. The clock starts ticking the second your old coverage ends.

You generally have a 60-day Special Enrollment Period (SEP) to sign up for a new plan through the ACA Marketplace. Think of it as a firm deadline. If you miss that window, you’ll most likely be stuck waiting for the annual Open Enrollment Period in the fall, which could mean months without coverage.

COBRA gives you a similar timeline. You have 60 days to decide and elect coverage after you get the official notice from your former employer. Acting quickly is the single best thing you can do to avoid a dangerous gap in your health security.

What If I Have Zero Income?

You can absolutely still get health insurance, even with no income. This is exactly what Medicaid was created for.

If you live in a state that expanded its Medicaid program, you will almost certainly qualify if your income is at or below 138% of the federal poverty level. The best part? You can apply for Medicaid any time of year—no need to worry about special enrollment windows.

A quick heads-up: In states that chose not to expand Medicaid, the eligibility rules are much tougher. It's possible to fall into a "coverage gap," but you should still apply. Your state's agency can often connect you with other local assistance programs you might not even know exist.

Do I Have to Work to Get Medicaid?

This is a really common point of confusion. The truth is, the vast majority of adults on Medicaid who can work, already do. Research from KFF shows that 63% of adult Medicaid recipients are in working families, often in low-wage jobs without health benefits.

Over the years, proposals to add work requirements have mostly been struck down in court. At its core, Medicaid is about giving people access to healthcare, not policing their employment status. For now, in most places, your ability to work isn't a factor in whether you qualify.

Is a Short-Term Health Plan a Good Substitute?

Short-term plans can look like a great deal with their low price tags, but they come with some serious risks. These plans are not regulated by the ACA, which means they don’t play by the same rules as Marketplace plans.

Here’s what that really means for you:

- They can flat-out deny you coverage for pre-existing conditions.

- They don't have to cover the basics, like prescriptions, maternity care, or mental health services.

- They can set annual or even lifetime caps on how much they'll pay for your medical bills.

A short-term plan might feel like a decent safety net for a month if you’re perfectly healthy, but it's a huge gamble. It is not a real substitute for comprehensive insurance and could leave you with financially devastating bills if something unexpected happens. If you're facing a temporary lapse, our guide on navigating a health insurance gap between jobs can point you toward more stable options.

Navigating this on your own can feel like a lot, but you have solid pathways to get quality coverage. The key is to know your deadlines, be honest about your financial situation, and choose a plan that gives you true security.

Finding the right health insurance on your own shouldn't be a struggle. At My Policy Quote, we specialize in helping individuals and families find affordable, high-quality plans that fit their unique needs. Explore your options today at https://mypolicyquote.com and get the peace of mind you deserve.