Ever wonder how an insurance company decides whether to cover you—and exactly how much you’ll pay for it? That whole behind-the-scenes decision process is called underwriting.

It's the critical step where the insurer sizes up the risk before shaking hands on a policy. Think of it as the gatekeeper for the entire insurance world.

The Gatekeeper of Your Insurance Policy

The person making that crucial call is the underwriter. They’re like a risk detective, digging into the details to protect the insurance company from taking on too much of a gamble.

Their main job is to figure out the odds of you filing a claim. That single evaluation is the core of what is underwriting in insurance. By carefully choosing who to cover, underwriters make sure the company stays financially healthy enough to pay out claims when they inevitably happen.

This process keeps the entire system balanced for everyone involved. It’s the reason you and your neighbor might apply for the same exact home insurance but get two totally different quotes. To get a feel for the bigger picture, you can check out our guide that explains in detail how insurance works and the concepts that drive it.

And this job is only getting more complex. Personal insurance premiums jumped by 9.5% between 2022 and 2023 alone, a sign that assessing risk is becoming a more intricate science.

At the end of the day, the underwriter’s decision is what determines if you can get coverage for your car, home, health, or life. This gatekeeper role really boils down to three key functions:

- Risk Selection: Deciding who is an acceptable risk and who is not.

- Risk Classification: Sorting approved applicants into different groups (like preferred, standard, or substandard) based on their risk profile.

- Pricing: Setting a fair premium that matches the level of risk you bring to the table.

Once you understand the "why" behind it all, navigating the application process becomes much clearer. You start to see how your unique details and history directly shape the offer an insurer puts in front of you.

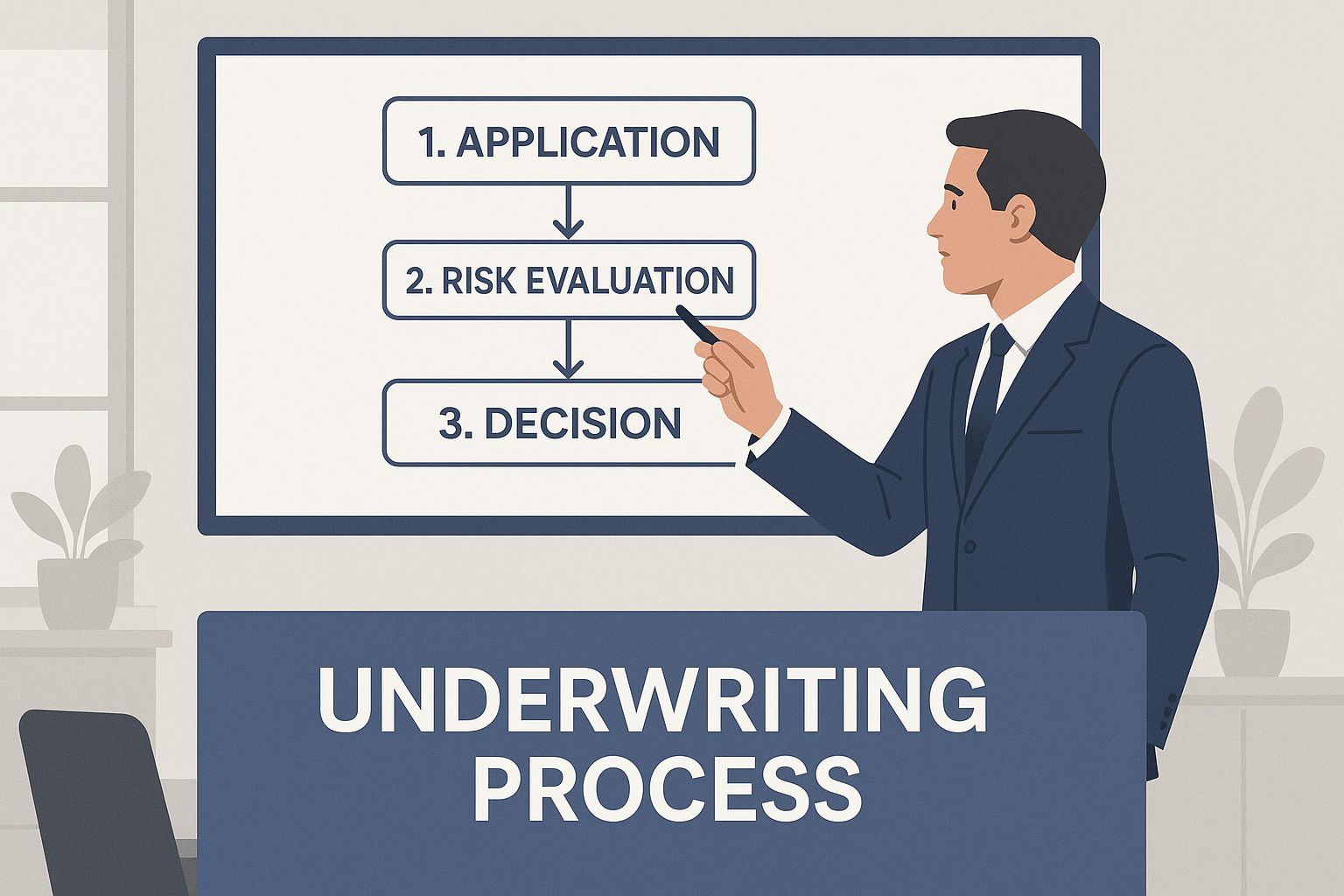

How the Underwriting Journey Unfolds

So, what happens after you hit "submit" on that insurance application? It might feel like your information disappears into a black box, but there’s a clear, methodical process going on behind the scenes.

Think of an underwriter as a detective. Their job is to build a complete and accurate file to understand the story of the risk they’re being asked to cover. Every piece of information helps them paint a clearer picture.

This journey, from your initial application to the final decision, follows a few key stages.

As you can see, it’s all about gathering the facts, analyzing the details, and then classifying the risk before a final premium can be set.

Step 1: Gathering Your Information

First things first, the underwriter collects all the necessary data. This goes way beyond just what you wrote on your application form. They need to verify the details and often dig a little deeper to get the full story.

What they look for depends entirely on the type of insurance you want.

- For Life Insurance: This is personal. They’ll likely review your doctor’s medical records, ask for a paramedical exam, and look at your prescription history and driving record.

- For Home Insurance: It’s all about the property. Underwriters will examine inspection reports, your past claims history (often through a CLUE report), and public records that detail the home’s age, what it’s made of, and if it’s in a high-risk area for floods or fires.

- For Auto Insurance: Your driving habits are key. They'll pull your motor vehicle report, check your credit-based insurance score (where permitted), and look up your car’s make, model, and safety features.

Step 2: Analyzing the Risk

Once all the files are on their desk, the real analysis begins. This isn't just guesswork. Underwriters lean on actuarial data—huge datasets that predict how likely certain events are—along with specialized software to build your risk profile.

They’re looking for patterns or red flags that point to a higher chance of a future claim. For example, a history of at-fault accidents is a clear signal for auto insurance, just like an old, leaky roof would be for a homeowner's policy.

The bottom line is this: An underwriter’s goal isn’t to find a reason to say no. It’s to accurately price the risk you represent so the insurance company can confidently pay out all its future claims and stay in business.

Step 3: Classifying and Pricing the Policy

After the deep dive, the underwriter assigns you to a risk class. This is the moment of truth, as this classification directly impacts whether you’re approved and what your premium will be.

Most people fall into one of these common categories:

- Preferred/Elite: You’re the gold standard. With excellent health, a spotless driving record, or a perfectly maintained home, you present the lowest risk and get the best rates.

- Standard: This is where most people land. You meet the insurer's guidelines for an average level of risk, so you’ll pay standard premiums.

- Substandard: You’re seen as a higher-than-average risk, maybe due to a pre-existing health condition or a few marks on your driving record. You can still get coverage, but it will cost more.

- Denied: In some cases, the risk is just too high for the insurer's guidelines, and the application is declined.

This system is all about fairness—matching the price you pay to the level of risk you bring.

Keep in mind, timing can also play a role, especially with health insurance. To get a better handle on how these timelines work, you can learn what open enrollment is and why it matters in our other guide.

Key Factors That Shape Underwriting Decisions

When an underwriter looks at your application, they see much more than just a name and a few numbers. They’re piecing together a puzzle—a detailed picture of your unique risk profile.

The factors they use to build this picture change dramatically depending on what you’re trying to insure.

Knowing what they look for is a game-changer. It pulls back the curtain, showing you exactly how your personal details or business operations translate into your final premium. It’s the reason why your quote can be so different from your neighbor's.

Let's break down what underwriters are really looking for across the most common types of insurance.

Life Insurance Considerations

When it comes to life insurance, the underwriting process gets deeply personal. The entire goal is to estimate your life expectancy, and they do that by looking at your health and lifestyle.

Here's what’s on their checklist:

- Age and Gender: Statistically, these are two of the biggest predictors of how long a person might live.

- Health History: This is a deep dive into your medical records, any pre-existing conditions like diabetes or heart disease, and even your family's health history.

- Lifestyle Choices: Underwriters need to know about things like tobacco use, alcohol consumption, and any high-risk hobbies. Think skydiving, not stamp collecting.

- Occupation: A desk job is seen as much lower risk than being a logger or a commercial fisherman, and your premium will absolutely reflect that.

It's simple, really. A young, healthy non-smoker with a safe job will almost always get the best rates. On the other hand, someone with chronic health issues in a hazardous line of work will be seen as a higher risk.

Auto Insurance Risk Factors

For auto insurance, the focus shifts entirely from your personal health to your driving habits and your car. The underwriter’s job here is to predict how likely you are to get into an accident and file a claim.

They zero in on a few key data points:

- Driving Record: Your history is the most direct clue to your future. Accidents, traffic violations, and speeding tickets all tell a story.

- Vehicle Type: The car you drive matters. Its make, model, age, and safety features are all part of the equation. A high-performance sports car simply costs more to insure than a family minivan because claims tend to be more expensive.

- Location: Where you live and park your car has a huge impact. Underwriters analyze local theft, vandalism, and accident rates right down to your zip code.

- Credit-Based Insurance Score: In most states, insurers use a score based on your credit history as a way to help predict future insurance losses.

A driver with a clean record in a safe, reliable car will pay significantly less than someone with multiple speeding tickets driving an expensive vehicle in a high-crime area.

Business Insurance Underwriting

Underwriting for a business is a whole different beast. It's far more complex because it involves sizing up operational, financial, and liability risks all at once. The goal is to get a clear picture of the specific hazards tied to a company’s industry and day-to-day work.

Key criteria include:

- Industry Type: A quiet accounting firm and a massive construction company face completely different worlds of risk.

- Claims History: Past losses are one of the strongest predictors of future ones. Underwriters will carefully review any previous claims.

- Financial Stability: A company’s revenue and overall financial health can show how well it’s able to manage risk on its own.

- Safety Protocols: Underwriters love to see proof of strong safety programs, regular employee training, and solid risk management procedures.

To give you a clearer idea of how these factors differ, take a look at this comparison:

Underwriting Factors Across Major Insurance Types

| Insurance Type | Primary Underwriting Factors | Example of High-Risk Factor |

|---|---|---|

| Life Insurance | Age, health history, lifestyle (smoking, hobbies), occupation | A 55-year-old smoker with a history of heart disease |

| Auto Insurance | Driving record, vehicle type, location, credit-based score | A young driver with multiple speeding tickets in a sports car |

| Home Insurance | Property location (weather/crime risk), age of home, claims history | An older home with outdated wiring in a flood-prone area |

| Business Insurance | Industry risk, claims history, financial stability, safety protocols | A roofing company with a history of frequent employee injury claims |

As you can see, the "risk puzzle" an underwriter solves is different every time. The pieces they use depend entirely on what—or who—is being insured.

Understanding these factors gives you power. It helps you see your own risk profile through an underwriter’s eyes, which is the first step to improving it. Once you know what they’re looking for, you can take action and stop overpaying for insurance by focusing on the things that matter most.

The Evolution of Underwriting Methods

Underwriting has come a long way from the days of dusty paper files and manual calculators. The core question has always been the same: "Is this a good risk?" But how underwriters find that answer has changed completely, thanks to technology and the need for smarter, faster decisions.

Back in the day, everything was done through manual underwriting. This is the traditional approach, where an experienced human underwriter personally sifts through every application, medical record, and property report. They use their hard-earned expertise and company guidelines to make a judgment call. It’s thorough, and it allows for a lot of nuance, but it's also slow and can lead to inconsistencies.

The Rise of Automated Decisions

To speed things up, the industry embraced automated underwriting. Think of it as a super-smart checklist. The system uses algorithms to make decisions on simpler, lower-risk policies almost instantly. If an applicant's information checks all the pre-programmed boxes, the policy can get approved in minutes—no human intervention needed.

This is a game-changer for standard policies like car or home insurance. It frees up human underwriters to spend their time and brainpower on the complex, unusual cases that truly need a deep-dive analysis.

The New Era of Enhanced Underwriting

Today, we're in a new phase, often called enhanced underwriting. This isn't just about automation; it's about augmentation. It combines the raw analytical power of technology with the critical thinking and intuition of a seasoned professional.

Enhanced underwriting uses powerful tools to comb through massive amounts of data, spotting subtle patterns and connections that a person might easily miss. This gives a much clearer, more precise picture of risk, moving way beyond simple checklists.

To keep up with today’s challenges, insurers are using advanced tech like artificial intelligence (AI) and complex algorithmic models. These "enhanced underwriters" are not only more efficient but also better at innovating. This directly impacts their combined operating ratios (COR)—the key measure of underwriting profitability. Better underwriting means better financial health for the insurer.

It's such a big deal that Lloyd’s of London has called algorithmic underwriting a cornerstone of its future strategy. You can dive deeper into how the industry is changing and discover some of the key trends underwriters should know about.

This evolution is fundamentally changing what is underwriting in insurance. It's no longer just a reactive process looking at past events. It's becoming a proactive one, using predictive analytics to forecast future risks with incredible accuracy. For you, that means fairer pricing, faster approvals, and a more stable insurance market for everyone.

What Happens After the Underwriter Decides

So, you've submitted your application, the underwriter has sifted through all the details, and now you’re waiting for the final word. This is where your application shifts from a "maybe" into a solid answer.

It can really only go one of three ways. Let's walk through what each outcome means for you.

The best-case scenario is a clean and simple outright approval. This means you checked all the boxes for the insurer, and your policy is good to go, exactly as quoted. All that’s left is to make your first premium payment, and your coverage kicks in.

But not every "yes" is quite that straightforward.

Understanding Modified Approvals and Exclusions

Sometimes, an underwriter will come back with a "yes, but…" This is what’s known as a modified approval or a rated policy. It means the insurance company is still willing to cover you, but they need to tweak the terms to account for something they found during their review.

This usually looks like one of these:

- Higher Premiums: This is the most common one. If the underwriter sees something that makes you a higher risk—maybe a pre-existing health issue or a few dings on your driving record—they’ll approve you, just at a higher price than you were first quoted.

- Policy Exclusions: In some situations, an insurer might offer you a policy but carve out a specific risk. For home insurance, this could mean they’ll cover your house but exclude damage from a specific type of flood if the property has a history of it.

- Reduced Coverage Amounts: The underwriter might also approve you for a smaller policy than you asked for. This limits their potential payout if you file a claim.

A modified approval isn't a rejection; think of it as a counter-offer. The insurer is telling you exactly what it will take for them to get comfortable with the risk. Your job is to read those changes carefully and decide if the policy still works for you.

Navigating a Denial and Your Next Steps

Then there's the outcome no one wants: a denial. This happens when the underwriter decides your risk is just too far outside what they’re willing to cover. It’s frustrating, for sure. But it is not the end of the road.

First things first, you have the right to know why. The insurer has to give you a clear reason for turning you down. If you think they got it wrong or had incomplete information, you can appeal the decision. This is your chance to provide new documents or explain the situation better.

If the appeal doesn't work, it’s time to shop around. Underwriting rules are not the same everywhere. What one company considers an "unacceptable risk" might be perfectly fine for another. This is where an independent insurance agent can be a lifesaver—they know which carriers are more likely to say "yes" to your specific situation.

Don't let one "no" stop you from getting the protection you need.

How Market Trends Influence Underwriting Strategy

Underwriting never happens in a bubble. The decisions an underwriter makes are a direct response to what’s happening in the world—from economic swings and legal battles to something as unpredictable as the weather.

You’ll often hear industry insiders talk about market cycles, which boil down to two main types: soft markets and hard markets. In a soft market, insurance companies are competing fiercely for your business, which means you’ll see lower premiums and more generous coverage. But in a hard market, insurers get cautious. They tighten their belts, raise rates, and might offer less coverage to protect their own financial health.

The Impact of Economic and Legal Shifts

Think about it: when the cost of car parts, building materials, or medical procedures goes up, the cost to pay out claims also rises. To stay in business, insurers have to adjust their pricing. This is especially true after a large-scale disaster, like a major hurricane, which can flip an entire region into a hard market for property insurance almost overnight.

An underwriter's job is to look into the future. They have to price today's policies to cover tomorrow's losses, which are shaped by everything from inflation to major court rulings.

The legal landscape has a huge say, too. For instance, in the second quarter of 2025, even as global insurance rates dropped by 4%, casualty insurance premiums were being pushed higher. Why? A major factor was the rise of massive “nuclear” jury awards in U.S. courtrooms, which made underwriters far more conservative. You can read more about these global insurance market trends on marsh.com.

Ultimately, these big-picture forces have a direct impact on the policies and prices you see. When healthcare costs climb, it affects everything from what you’ll pay for your premium to your experience filing a health insurance claim. It’s a constant dance, with underwriting strategies always evolving to keep up with a world full of changing risks.

Still Have Questions About Underwriting?

Even after getting the basics down, a few questions about insurance underwriting tend to pop up. Let’s clear up some of the most common ones to give you a complete picture.

How Long Does the Underwriting Process Take?

Honestly, it depends. The timeline for underwriting can vary wildly.

Simple auto or home insurance policies often fly through automated systems and can get approved in just a few minutes. You might even have a decision before you hang up the phone with an agent.

But more complex policies need a human touch. A life or disability insurance application, for example, often requires medical exams and pulling records from your doctors. This detailed, hands-on review can easily take several weeks—or even more than a month—to wrap up.

Can You Improve Your Underwriting Outcome?

Absolutely. You have more control here than you might think.

The single most important thing is to be honest and thorough on your application. Hiding information almost always backfires and causes much bigger problems down the road.

Beyond that, you can take practical steps to show an underwriter you’re a lower risk:

- For Life or Health Insurance: Improving key health numbers—like quitting smoking or lowering your cholesterol—can make a huge difference in your premiums.

- For Home Insurance: Taking proactive steps to reduce risk speaks volumes. Installing a security system, updating an old roof, or clearing brush in a fire-prone area shows underwriters you're a responsible homeowner.

- For Auto Insurance: A clean driving record is the clearest and most powerful way to secure better rates.

Think of it this way: your application is telling a story about you. When you take steps to improve your risk profile, you give the underwriter a better story to read. And a better story usually leads to a happier ending with a better premium.

What Is the Difference Between an Agent and an Underwriter?

This is a great question, and the roles are completely different.

An insurance agent is your guide and advocate. They’re the person you talk to—the one who helps you shop for policies, answers your questions, and works to find coverage that fits your life.

An underwriter, on the other hand, works for the insurance company behind the scenes. They are the risk analyst who you’ll likely never speak to. Their job is to evaluate the application your agent submits and decide if the insurer should take on the risk, and if so, at what price.

Put simply: the agent sells the policy, but the underwriter is the one who approves it.

Navigating the world of insurance can feel complicated, but you don't have to do it alone. At My Policy Quote, we connect you with experts who can help you find the right coverage at a fair price. Explore your options today.