Trying to pick a health insurance plan can feel like a nightmare.It’s confusing, the options are overwhelming, and you’re constantly worried you’ll make a mistake that costs you a fortune down the road. But it doesn’t have to be this complicated.

You just need to know what actually matters. Forget trying to memorize every confusing term. Let's cut through the noise and focus on how to find a plan that works for your life and your bank account.

Your Guide to Choosing the Right Health Plan

The single biggest mistake I see people make? They pick a plan just because it has the lowest monthly premium. This is a huge trap. It often leads to shocking out-of-pocket costs the moment you actually need to use your insurance.

To avoid that, you have to look deeper. A good evaluation always comes down to four key areas. Think of them as the legs of a table—if one is weak, the whole thing is wobbly and unreliable.

The four pillars are:

- Total Costs: This is everything you might pay, not just the monthly bill. It includes your deductible, copays, and the all-important out-of-pocket maximum.

- Provider Network: Can you actually see your doctors? What about the best local hospital? Going out-of-network can be financially devastating.

- Coverage & Benefits: Does the plan cover the things you know you’ll need, like physical therapy, mental health visits, or maternity care? The devil is in the details.

- Prescription Drugs: If you take medications regularly, you have to check if they're covered. A drug that’s not on the plan's list (the "formulary") could cost you hundreds or even thousands.

The healthcare marketplace is notoriously complex, and it’s not always by accident. Recent government analysis shows that in most states, just a few big insurance companies dominate the market. Less competition often means higher prices and fewer real choices for you. That makes it even more critical to have a clear strategy.

The global health insurance market is booming, expected to grow from USD 2.32 trillion in 2025 to a staggering USD 4.45 trillion by 2032. As costs rise, understanding your own coverage becomes non-negotiable. You can read the full global health insurance market outlook to get a bigger picture of these trends.

Before we dive into comparing plans, let's get a handle on the core concepts. These aren't just vocabulary words; they're the rules that determine how much money leaves your wallet when you need care. For a more detailed walkthrough, our simple guide on how to choose health insurance provides additional context.

Here's a quick cheat sheet to get you started.

Quick Guide to Health Insurance Core Concepts

| Term | What It Means for Your Wallet | Key Consideration |

|---|---|---|

| Premium | The fixed monthly fee you pay to keep your plan active. | This is a predictable, recurring cost. It's important, but it's not the whole story. |

| Deductible | The amount you must pay out-of-pocket before your insurance starts paying its share. | A high deductible usually means a lower premium, but you're on the hook for more upfront costs. |

| Copay | A flat fee you pay for a specific service, like $25 for a doctor's visit. | These are predictable for routine care, but they add up. |

| Coinsurance | The percentage of costs you pay after your deductible is met. (e.g., you pay 20%, insurer pays 80%). | This is where costs can become unpredictable, especially for major medical events. |

| Out-of-Pocket Maximum | The absolute most you will have to pay for covered services in a plan year. | This is your financial safety net. A lower maximum offers better protection against catastrophic costs. |

Getting comfortable with these five terms is the first step toward making a confident decision. They are the foundation of any health plan, and understanding them puts you back in control.

Calculating the True Cost of Your Health Plan

When you’re comparing health insurance plans, that monthly premium is the first thing you see. It’s the sticker price, and it’s tempting to let that one number guide your entire decision. But that’s a mistake.

Focusing only on the premium is like buying a car based on the monthly payment alone—it completely ignores the real costs, like gas, repairs, and insurance. The true price tag of your health plan is so much more than that single monthly fee.

To really know what a plan will cost you, you have to see how four different pieces fit together: the premium, deductible, copayments, and coinsurance. They all work together to determine what you’ll actually spend on healthcare over the year.

Let's walk through a real-world scenario to see what I mean.

A Real-World Cost Breakdown

Imagine you twist your knee playing basketball over the weekend. Your doctor says you need an MRI to see what’s going on, and the total bill for that scan comes to $1,500. Let’s see how two different plans would handle this exact situation.

Plan A: High Premium, Low Deductible

- Monthly Premium: $500

- Annual Deductible: $1,000

- Coinsurance: 20%

With this plan, you’d first pay $1,000 of the MRI cost out of your own pocket to meet your deductible. After that, your insurance starts helping. For the remaining $500, your 20% coinsurance kicks in, meaning you owe another $100 ($500 x 0.20).

Your total out-of-pocket cost for just that one MRI? $1,100.

Plan B: Low Premium, High Deductible

- Monthly Premium: $300

- Annual Deductible: $5,000

- Coinsurance: 20%

Under this plan, your $5,000 deductible is way higher than the cost of the MRI. That means you are responsible for paying the entire $1,500 bill yourself. While you save money every month on the premium, this one unexpected event costs you more out-of-pocket.

This simple example shows just how critical it is to look past the premium. The right plan for you really depends on your health needs and what you can comfortably afford if something unexpected happens.

Key Takeaway: Your "true cost" isn't just the monthly premium. It’s the premium plus what you might realistically pay in deductibles, copays, and coinsurance over a year. A lower premium often means you're taking on more financial risk.

Deciphering High-Deductible Plans and HSAs

High-Deductible Health Plans (HDHPs) have become really popular, especially for people who are younger and generally healthy. They are built on the trade-off we just saw: you accept a higher deductible in exchange for paying a lower monthly premium. If you don't expect to need a lot of medical care, this can be a smart financial move.

But the real magic of an HDHP happens when you pair it with a Health Savings Account (HSA). An HSA is a special savings account that’s only available to people with a qualified HDHP, and it comes with a triple-tax advantage that’s hard to beat.

- Tax-Deductible Contributions: The money you put into your HSA lowers your taxable income for the year.

- Tax-Free Growth: Your funds can be invested and grow over time, completely tax-free.

- Tax-Free Withdrawals: You can pull money out for qualified medical expenses—like paying that deductible—without paying a dime in taxes.

This powerful duo lets you save for healthcare in an incredibly efficient way. The money is yours to keep and rolls over every single year, unlike a Flexible Spending Account (FSA). You can learn more about how these accounts can benefit your bottom line by exploring health insurance tax benefits and other savings strategies.

So, how do you know if an HDHP with an HSA is the right call for you?

Which Cost Structure Fits You Best?

Ultimately, choosing between a traditional plan and an HDHP comes down to a personal gut check on your risk tolerance and financial habits.

Consider a traditional, higher-premium plan if:

- You or someone in your family has a chronic condition that requires regular doctor visits or medications.

- You know you'll need significant medical care in the next year, like a planned surgery or having a baby.

- You value predictability and prefer fixed costs (like copays) for routine care to avoid a sudden, large bill.

An HDHP with an HSA might be a better fit if:

- You’re generally healthy and don’t see the doctor much outside of your annual physical.

- You want to keep your monthly premium low to have more cash on hand.

- You’re disciplined enough to consistently put money into an HSA to build a safety net for future medical costs.

To compare health insurance plans effectively, you have to look at your total potential financial exposure. When you look at all the cost components together, you can finally move beyond the sticker price and find a plan that gives you both the coverage you need and the financial peace of mind you deserve.

After you’ve crunched the numbers on deductibles and premiums, it's time to ask the one question that can make or break your decision: “Can I keep my doctor?”

For many of us, this is the dealbreaker. The trust you've built with your primary care physician or a specialist is something you just can't put a price on. This is exactly why digging into a plan's provider network is so incredibly important.

A plan's "network" is simply the group of doctors, hospitals, and clinics that have a contract with your insurer. If you see a provider outside that group, you could be on the hook for the entire bill. Ouch. The type of plan you pick—like an HMO, PPO, or EPO—is what determines how much freedom you have to choose who you see.

Let's unpack what these confusing acronyms actually mean for you.

Understanding Your Network Options

Every type of health plan has a different approach to how you get care. The big three you'll see everywhere are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

While HMOs are often popular for their lower monthly premiums, PPOs continue to be a go-to for people who value flexibility, even if it costs a bit more. To see how these trends are shaping the industry, you can explore detailed health insurance market research.

Here’s a look at how they really stack up in the real world.

HMO vs PPO vs EPO A Practical Comparison

Choosing between an HMO, PPO, or EPO can feel like alphabet soup. This table breaks down the key differences to help you see which one truly fits your life and healthcare needs.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|---|

| Primary Care Physician (PCP) | Usually required. Your PCP is your main point of contact for all your care. | Not required. You can go straight to a specialist without a referral. | Not required. You have direct access to specialists inside the network. |

| Referrals to Specialists | Required. You'll need a referral from your PCP before you can see a specialist. | Not required. You have the freedom to book appointments with specialists on your own. | Not required. You can see any in-network specialist without a referral. |

| Out-of-Network Coverage | None, except in a true life-or-death emergency. You pay 100% of the cost otherwise. | Yes, but it will cost you. You'll have a higher deductible and pay more out of pocket. | None, except for true emergencies. Going out of network means you foot the entire bill. |

| Best For | People who want lower premiums and are happy to have their care coordinated through a single trusted doctor. | Anyone who wants the most flexibility to see any doctor and is willing to pay more for that freedom. | A good middle-ground option for those who want to see specialists directly but don't need out-of-network care. |

As you can see, the trade-off is pretty clear: HMOs give you lower costs but more rules, while PPOs offer freedom at a higher price. EPOs sit somewhere in the middle.

How to Verify Your Doctor Is In-Network

Never, ever just assume your doctor is covered. Networks change every single year, and sometimes, doctors in the very same clinic can accept different insurance plans. You have to do the legwork yourself before you sign up.

Here’s a simple, no-fail process to get it right:

- Check the Insurer's Website: Every insurance company has an online "Find a Doctor" tool. Get specific. Search for the exact plan name (e.g., "BlueCross PPO Gold 3500"), then look up your doctor's name.

- Call the Doctor's Office: This is the most crucial step. Don't just ask if they "take" the insurance company; call the billing department and ask, "Do you participate in the [Exact Plan Name] network for 2025?" This is the only way to be 100% certain.

- Don't Forget Other Facilities: Your doctor isn't the only piece of the puzzle. Make sure your preferred hospital, imaging center, and even the lab you use (like Quest or Labcorp) are also in-network.

Heads Up: Here's a common "surprise bill" trap. The anesthesiologist, radiologist, or pathologist at an in-network hospital might be out-of-network. Always ask the hospital about this before any planned procedure.

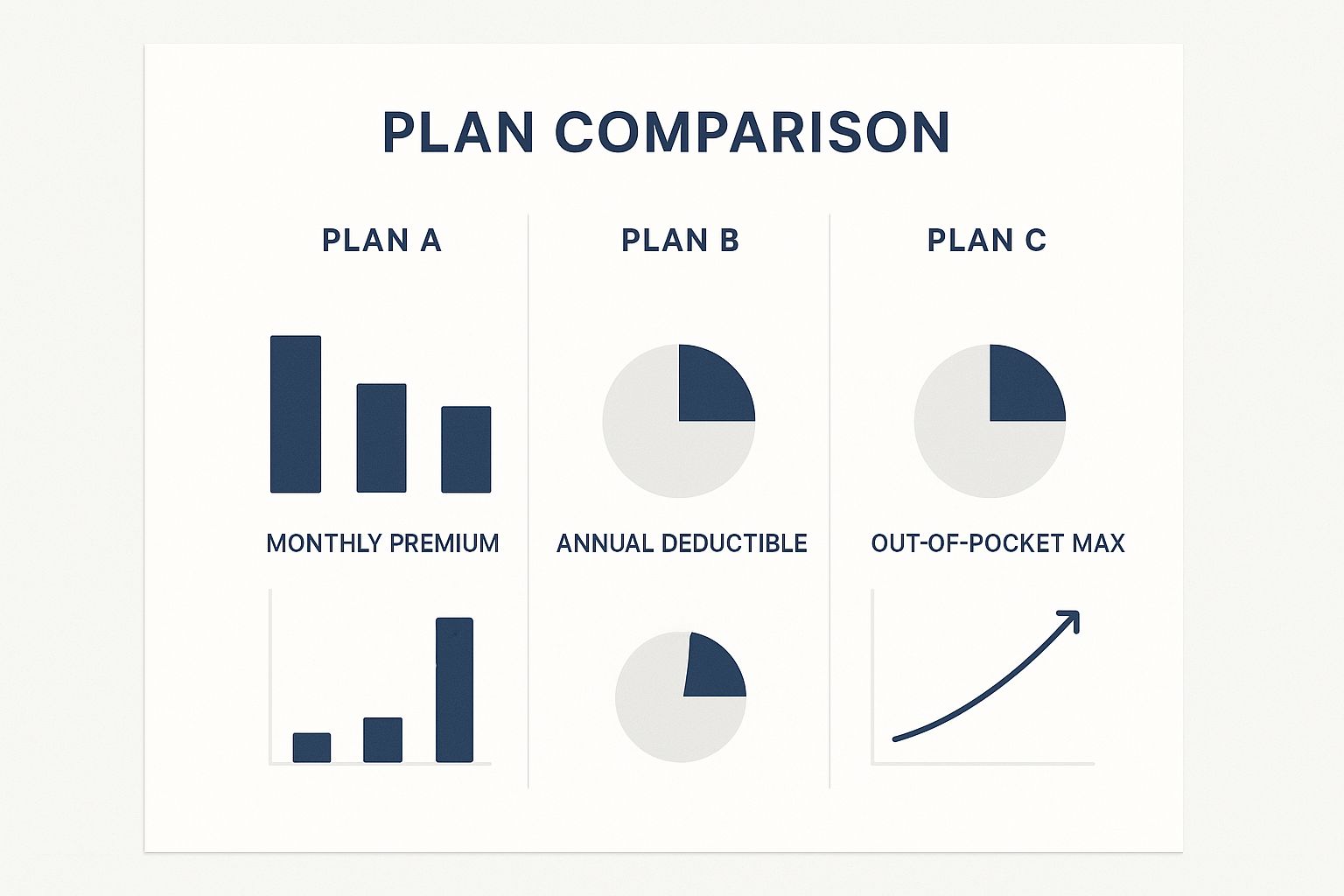

This graphic is a great reminder of how total costs can stack up. A plan with a tempting low premium might have a sky-high out-of-pocket maximum, which means you're taking on a lot more financial risk.

Don't Overlook Your Prescriptions

Just as important as your doctor is the plan's prescription drug list, or "formulary." You could find the perfect plan, only to discover your daily medication isn't covered or is stuck in a super expensive tier.

When comparing plans, find the "Prescription Drug List" document. It’s usually a PDF on the insurer's website. Search for your specific medications and see which "tier" they're in.

- Tier 1: The cheapest generic drugs. You'll have the lowest copay.

- Tier 2: "Preferred" brand-name drugs with a medium copay.

- Tier 3: "Non-preferred" brand-name drugs. These have a high copay.

- Specialty Tiers: Extremely expensive drugs, often with a high coinsurance percentage instead of a flat copay.

If a medication you rely on isn't covered at all, you could be paying its full retail price out-of-pocket—we're talking hundreds or even thousands of dollars a year. Taking a few minutes to check the formulary is one of the smartest things you can do to protect both your health and your wallet when you compare health insurance plans.

Finding Benefits That Fit Your Lifestyle

Once you’ve wrestled with networks and crunched the numbers on costs, it’s time to look at what you’re really buying: the benefits. A great health plan is more than just a ticket to an annual checkup. It’s a safety net that supports your whole life—from mental well-being to physical therapy and everything in between.

The key to all of this is a surprisingly simple document: the Summary of Benefits and Coverage (SBC). Every single plan is required by law to provide one, and it’s designed to let you compare apples to apples. Think of it as the official nutrition label for your health insurance.

The SBC breaks down what the plan covers and what you'll actually pay, all in plain English. It's your best friend for digging into the details that truly matter.

Looking Beyond the Basics

This is where the real comparison happens. Two plans might have the exact same premium and deductible but offer wildly different coverage for the services you need most. Your personal health needs have to be front and center here.

Don't just give the SBC a quick glance. Actively hunt for the benefits that are important to you right now—or could be just around the corner.

Let's imagine Sarah, a 30-year-old graphic designer. She’s looking at two PPO plans, and on the surface, they seem identical. Both have a $400 monthly premium and a $3,000 deductible.

- Plan X offers unlimited physical therapy sessions after a simple $40 copay. Mental health visits are also just a $40 copay.

- Plan Y, however, caps physical therapy at only 20 visits for the whole year. And for mental health, she’d have to pay 50% of the cost after her deductible is met.

Sarah runs marathons and sees a therapist for stress management. For her, Plan X is the undeniable winner, even though the sticker price was the same. This is exactly why you have to look past the big numbers and see how a plan fits your life.

Pro Tip: Your eyes should go straight to the "Limitations & Exceptions" section of the SBC. This is where the fine print lives. You'll find crucial details like visit limits, services that need pre-approval, or things that aren't covered at all.

Key Benefits to Scrutinize

Your life stage and lifestyle should guide what you look for. As you review each plan's SBC, make a mental checklist of your non-negotiables and see how they stack up.

Here are a few benefits that can make or break a plan:

- Mental Health Services: What does therapy really cost? Is it a straightforward copay, or do you have to deal with confusing coinsurance percentages? Check coverage for both inpatient and outpatient care.

- Physical and Occupational Therapy: Pay close attention to visit limits. If you're an active person or managing a chronic condition, a low cap on visits could be a massive problem.

- Maternity and Newborn Care: If you're thinking about starting or growing your family, this is a huge one. Compare the costs for prenatal care, the delivery itself, and postnatal checkups.

- Telehealth Options: In today's world, easy access to virtual care is a must for convenience. Make sure the plan covers virtual visits with your primary doctor, specialists, and therapists, and check the copay.

- Emergency Room vs. Urgent Care: Knowing the cost difference here can save you a fortune. An ER visit might have a $500 copay, while urgent care could be just $75. Understanding when to use each is key.

A plan that looks cheap on paper can become incredibly expensive if it doesn't cover the services you actually depend on.

The Power of Preventive Care

Here’s one of the best parts of any modern health plan: coverage for preventive services. Thanks to the Affordable Care Act (ACA), all marketplace plans are required to cover a long list of preventive care at no cost to you.

That means no copay, no coinsurance, and you don’t even have to meet your deductible first. It’s your health insurance actively helping you stay healthy.

Taking full advantage of these free services is one of the smartest things you can do for your well-being.

Common no-cost preventive services include:

- Annual wellness visits and checkups

- Screenings for blood pressure, cholesterol, and diabetes

- Important cancer screenings like mammograms and colonoscopies

- Standard immunizations, like your annual flu shot

When you compare health insurance plans, you can take comfort in knowing these core preventive benefits are built-in. It’s a huge value that helps you stay on top of your health and catch problems early—saving you stress and money down the road.

Don't Guess—Let Modern Tools Do the Heavy Lifting

Remember wrestling with a clunky spreadsheet, trying to make sense of endless health insurance options? Those days are gone. Today, the right technology can do all the hard work, turning a confusing process into a clear-cut choice.

It's not just a trend; it's a huge shift in how insurance works. Insurers are using smarter tech to offer personalized plans and simplify everything for you. In fact, the global market for this kind of simplified, embedded insurance is expected to hit over $722 billion in premiums by 2030. You can read more about how technology is changing the future of health insurance and what it means for consumers.

This means you finally have tools that go way beyond just comparing monthly premiums.

Let a Recommendation Engine Be Your Guide

Think of a plan recommendation engine as your personal insurance shopper. Instead of you drowning in policy documents, these tools ask smart, simple questions about your life and health.

They'll typically want to know things like:

- Your doctors' and preferred hospitals' names

- A list of your current prescriptions

- How often you expect to need medical care (low, medium, or high)

- Your household income (to see if you qualify for subsidies)

The engine then crunches the numbers on every available plan. It doesn't just show you the premium; it gives you an estimated total annual cost for each one. This helps you see the true cost and avoid getting lured in by a deceptively low monthly price.

The Big Takeaway: These tools are brilliant at comparing the financial side of things. They instantly show you which plan will likely be cheapest based on your specific needs, saving you hours of guesswork and complicated math.

Don't Forget the Digital Perks

A modern health plan is so much more than an ID card in your wallet. It’s a full suite of digital tools designed to make your life easier. When you’re comparing plans, don’t overlook these valuable features.

A great plan should feel convenient and connected.

What to Look for in a Plan's Tech Features:

- A Solid Mobile App: Can you find a doctor, pull up your ID card, and check on a claim right from your phone? A good app is your command center.

- Built-in Telehealth: Access to virtual doctor, specialist, and therapy appointments isn't just a nice-to-have anymore—it’s essential. Make sure it's seamlessly part of the plan.

- Wellness Programs & Apps: Many insurers now offer free access to apps for fitness, meditation, and nutrition. These are real perks that help you stay healthy.

These tech features are especially important if you're planning for your long-term health. For those nearing retirement, understanding these digital tools is a key piece of the puzzle. You might also want to read our guide on navigating retirement health insurance for a more complete picture.

By choosing a plan with strong digital tools, you’re not just buying insurance—you’re investing in convenience and a proactive way to manage your health for years to come.

Common Questions About Choosing a Health Plan

Even when you feel like you have a handle on comparing health insurance, some questions just keep popping up. That's totally normal. Getting clear, simple answers to these last few sticking points is what gets you over the finish line, feeling confident in your choice.

Let's break down some of the most common ones we hear.

What Is the Difference Between a Deductible and an Out-of-Pocket Maximum?

This is a big one. Think of your deductible as the first financial hill you have to climb each year. It's the specific amount of money you have to pay for your own covered healthcare before your insurance plan even starts to chip in.

So, if your plan has a $2,000 deductible, you're on the hook for that first $2,000 in medical costs.

Once you’ve met that deductible, your insurance starts helping out, but you'll still have costs like copayments or coinsurance. That brings us to the next term.

The out-of-pocket maximum is your ultimate financial safety net for the year. It’s the absolute most you will have to pay for covered medical services, period. This total includes your deductible, all your copays, and any coinsurance payments.

Once you hit this number, your plan pays 100% of your covered care for the rest of the year. It’s the single most important feature that protects you from truly catastrophic medical bills.

Key Takeaway: Your monthly premiums don't count toward your deductible or your out-of-pocket maximum. Think of premiums as the membership fee to keep your plan active.

Should I Choose a Plan with a Lower Premium or a Lower Deductible?

This is the classic trade-off, and honestly, there's no single "right" answer. It all comes down to your personal health, your family's needs, and your budget.

A lower premium plan—like a High-Deductible Health Plan (HDHP)—is great for saving money on your fixed monthly bills. If you're generally healthy, don't expect many doctor visits, and want to keep more cash in your pocket each month, this can be a smart move. The catch? You're taking on more financial risk if a surprise health issue comes up.

On the other hand, a lower deductible plan means you'll pay a higher monthly premium, but your costs will be much more predictable when you actually need care. Since your insurance kicks in much sooner, it's often a better fit if you have a chronic condition, take regular medications, or just want the peace of mind that comes with knowing a big medical bill won't catch you off guard.

Can I Keep My Doctor if I Switch Health Insurance Plans?

Maybe, but you absolutely have to check for yourself. Never, ever assume your doctor is in-network with a new plan, even if it's from the same insurance company you've used before. Provider networks can change every year and are incredibly specific to each individual plan.

Before you sign up for anything, take these two steps:

- Go to the insurance company’s official website and use their provider directory. Make sure you select the exact plan name you're considering.

- Call your doctor's billing office directly. This is the most reliable method. Ask them, "Do you participate in the [Exact Plan Name] network for the upcoming year?"

If keeping your doctor is a top priority, then you have to pick a plan that includes them. This is also crucial if you're planning for future healthcare needs, like retirement. For more on that, our Medicare planning guide is a great resource to help you prepare for those big transitions.

What Is a Health Savings Account (HSA) and Should I Get One?

A Health Savings Account (HSA) is a seriously powerful, tax-advantaged savings account you can use for medical expenses. The only way you can open and contribute to an HSA is if you're enrolled in a qualified high-deductible health plan (HDHP).

If you're eligible, getting one is almost always a fantastic idea. Why? Because HSAs offer a rare triple tax advantage:

- Contributions are tax-deductible: The money you put in lowers your taxable income for the year.

- The money grows tax-free: You can invest your HSA funds, and any growth is completely tax-free.

- Withdrawals are tax-free: You can take money out for qualified medical expenses anytime, without paying a dime in taxes.

The best part? The money in your HSA rolls over every year. It’s your money, and it’s yours to keep forever, even if you change jobs or switch insurance plans. It's an incredible tool for both covering your deductible and building a healthcare nest egg for the future.

Navigating all of this can feel complicated, but you don't have to figure it out on your own. My Policy Quote specializes in helping individuals, families, and early retirees find coverage that truly fits. We cut through the noise to match you with a plan that works for your life and your budget. Get your free, personalized quote today and take the first step toward coverage you can feel good about.