When you think about life insurance, you might picture complex policies designed to replace decades of income. But what about the immediate, practical costs that come up at the end of life? That's where final expense insurance steps in.

Think of it as a helping hand for your loved ones. It’s a straightforward, smaller-scale life insurance policy created specifically to cover final expenses like a funeral, lingering medical bills, or credit card debt. The whole point is to prevent your family from facing a financial strain during an already emotional time.

Understanding Final Expense Insurance

Final expense insurance offers a simple way to plan for the inevitable. Unlike those big, complicated policies, this one has a very clear job: providing a cash payout to your beneficiaries to handle the costs that pop up right after you pass away.

The coverage amounts are much smaller, usually between $5,000 to $25,000, which makes the monthly premiums far more affordable. This is a huge reason it’s such a popular choice for seniors, especially those on a fixed income who want to make sure their final wishes are honored without breaking their budget.

Let's take a quick look at the core features of these policies.

Final Expense Insurance At a Glance

| Feature | Description |

|---|---|

| Policy Type | A small whole life insurance policy. |

| Coverage Amount | Typically $5,000 to $25,000. |

| Main Purpose | To cover end-of-life costs (funerals, medical bills, etc.). |

| Payout Method | A tax-free cash benefit paid directly to your beneficiary. |

| Premiums | Generally low and fixed for life. |

| Eligibility | Often available to older adults, with simplified underwriting. |

This table gives you a bird's-eye view, but one of these features—the payout—is where the real power lies.

The Power of a Flexible Payout

Here’s what really sets final expense insurance apart: its flexibility. The policy pays a tax-free cash benefit straight to the person you choose as your beneficiary, not to a specific funeral home. This is a game-changer.

Your beneficiary gets total control over the money. They can use it for whatever is most pressing—the funeral service, a final utility bill, or even paying off a small loan. This freedom means they aren't locked into a specific company or plan.

This flexibility ensures that every loose end can be tied up neatly. It’s a practical tool that gives your loved ones the ability to manage your final affairs with dignity and without added financial stress.

Why This Coverage Is More Popular Than Ever

People are catching on. The demand for this kind of practical financial safety net is growing fast, and the numbers tell the story. Recent industry data shows a major uptick in people choosing this coverage.

New annualized premium payments for final expense insurance shot up by 16% year-over-year, reaching a staggering $1.05 billion. In that same period, over 1 million policies were sold—a 10% increase from the year before. This growth makes it clear that more and more people, especially seniors, are turning to this solution for peace of mind. You can dig into the specifics in the latest final expense insurance market report.

At the end of the day, final expense insurance isn't about leaving behind a fortune. It’s about preserving dignity and protecting your family. It’s a final act of love that ensures your legacy is one of care, not unexpected bills.

What Costs Does This Insurance Actually Cover?

The phrase "final expenses" might sound a little vague, but the bills it covers are very real—and they can pile up fast. When a loved one passes, families are often caught off guard by just how many costs emerge, adding financial strain right when they’re grieving most.

This is exactly where final expense insurance steps in. Think of it as a financial shield, giving your family a lump-sum of cash to handle those immediate bills without worry. The policy’s death benefit becomes a dedicated fund that your beneficiary can use wherever it’s needed most.

It’s all about preventing your family from having to drain their own savings, sell off assets, or go into debt just to give you a proper farewell. And unlike a prepaid funeral plan, which locks you into one provider for specific services, this insurance payout is pure cash. That flexibility is everything.

Breaking Down The Common Expenses

So, what kind of bills are we really talking about? While every situation is unique, most end-of-life costs fall into a few key categories. The death benefit from a final expense policy is designed to tackle these head-on.

Here’s a look at what it typically covers:

- Funeral and Burial Services: This is usually the biggest ticket item. It includes everything from the funeral director’s professional fees and embalming to the casket and the use of the funeral home for a viewing. The national median cost for a funeral with a viewing and burial is around $8,300.

- Cremation Costs: While it’s often a more affordable option, cremation isn't free. There are still costs for the process, an urn, and often a memorial service. The median cost for a cremation with a viewing and funeral is about $7,100.

- Cemetery and Burial Plot Fees: Beyond the funeral home, you have to account for the burial plot itself, the fee to open and close the grave, and a headstone or marker. These can easily run into thousands of dollars.

- Outstanding Medical Bills: End-of-life care can leave behind a trail of medical debt. Think hospital co-pays, prescription drug costs, and ambulance fees that health insurance didn’t fully cover.

- Lingering Personal Debts: Small debts don't just disappear. Credit card balances, car payments, or final utility bills all need to be settled from your estate.

The power of a cash benefit can't be overstated. Your beneficiary gets the money and decides how to use it—whether that's paying the funeral director, clearing a final medical bill, or even covering travel costs for family to attend the service.

Beyond The Funeral Itself

While taking care of funeral costs is the main goal, a final expense policy offers a buffer for so much more. It gives your family the financial breathing room they need to navigate the difficult transition period after you're gone.

This could mean covering a mortgage payment for a month or two, paying legal fees to settle the estate, or simply giving them a cushion so they don't have to make rushed decisions under pressure. It's about letting them grieve without the added weight of money worries.

This kind of peace of mind is how you build a legacy of care and thoughtfulness.

Is Final Expense Insurance the Right Choice for You?

Figuring out if a financial product is right for you is a deeply personal journey. There are so many options out there, so it’s important to know who really benefits from a final expense insurance policy. It’s not for everyone, but for a specific group of people, it offers a sense of security that nothing else can.

This type of insurance is usually a perfect match for seniors, typically between the ages of 50 and 85. Many people in this stage of life are on a fixed income and want an affordable way to make sure their end-of-life costs are taken care of. Their main goal? To stop their kids or loved ones from getting hit with a sudden, heavy financial burden.

It all comes down to responsible planning. If you don’t have a large savings account earmarked for these specific costs, a final expense policy works like a dedicated fund to shield your family. This is especially true if your biggest assets, like your home, shouldn't have to be sold just to cover a funeral.

An Accessible Option for Those with Health Concerns

One of the best things about final expense insurance is how easy it is to get, especially for people who might have trouble qualifying for traditional life insurance. Past health issues can make it tough to get approved for bigger policies that demand a full medical exam.

This is where final expense insurance really shines. The application is way simpler, and the bar for approval is much lower. Most people with common, age-related conditions like high blood pressure or diabetes can still get immediate coverage.

There are two main ways this works:

- Simplified Issue: You'll answer a few basic health questions, but you do not have to take a medical exam.

- Guaranteed Issue: For those with more serious health conditions, this type of policy asks no health questions at all. Approval is guaranteed. There's usually a two-year waiting period, but it ensures that everyone can get some form of coverage.

This structure means that even if you've been turned down for life insurance before, a final expense policy is probably still an option for you.

Who Should Consider This Policy?

Let's get straight to it. Is this policy the right move for your situation? If you find yourself nodding along to the points below, it’s a very strong contender.

This insurance is for anyone who believes their final act of love should be providing peace, not bills. It's for the planner who wants to ensure their legacy is about the memories they leave behind, not the debts.

This is for you if:

- You are between the ages of 50 and 85.

- You want to cover your own funeral, burial, or cremation costs.

- You have minimal savings and don’t want to burden your family.

- You have health issues that might prevent you from getting other insurance.

- You want an affordable monthly premium that will never go up.

It's a straightforward solution for a very specific need. While some might prefer to build a separate fund, it's worth exploring policies that offer both protection and growth. You can learn more in our guide on life insurance policies that include savings components.

Ultimately, final expense insurance delivers on a simple promise: a guaranteed cash payment to your loved ones right when they need it most, ensuring your final wishes are honored without creating a financial crisis.

Final Expense vs Other Types of Life Insurance

The world of life insurance can feel like a maze. With so many different terms and policies, it's easy to get lost trying to figure out what you actually need. To cut through the confusion, let’s compare final expense insurance directly with its two most common cousins: term life and traditional whole life.

Think of it like choosing the right tool for a job. You wouldn't use a sledgehammer to hang a picture frame, right? Life insurance works the same way. Each type is built for a very specific purpose.

The Key Difference Is Purpose

At its heart, the biggest distinction is what each policy is designed to do. They each solve a completely different financial problem for your family.

- Final Expense Insurance: This policy has one clear, permanent job. It provides a small, fast cash payout (usually between $5,000 to $25,000) to cover specific end-of-life costs like a funeral, cremation, or final medical bills. It’s all about preventing a predictable, immediate financial burden on your loved ones.

- Term Life Insurance: This is temporary coverage designed to handle huge financial responsibilities. Think of it as an income-replacement safety net. It offers a very large death benefit—often $500,000 or more—but only for a specific period, or "term," like 20 or 30 years. It’s perfect for protecting your family during your peak earning years when you have a mortgage to pay and kids to raise.

- Traditional Whole Life Insurance: This is also permanent coverage, but it’s a more complex financial planning tool. It comes with a larger death benefit and a cash value growth component, making it feel almost like an investment. People use it for things like estate planning or passing on wealth to the next generation.

Because their jobs are so different, their costs and the rules to qualify vary quite a bit. To get a feel for all the options out there, you can explore various life insurance policies at MyPolicyQuote.com.

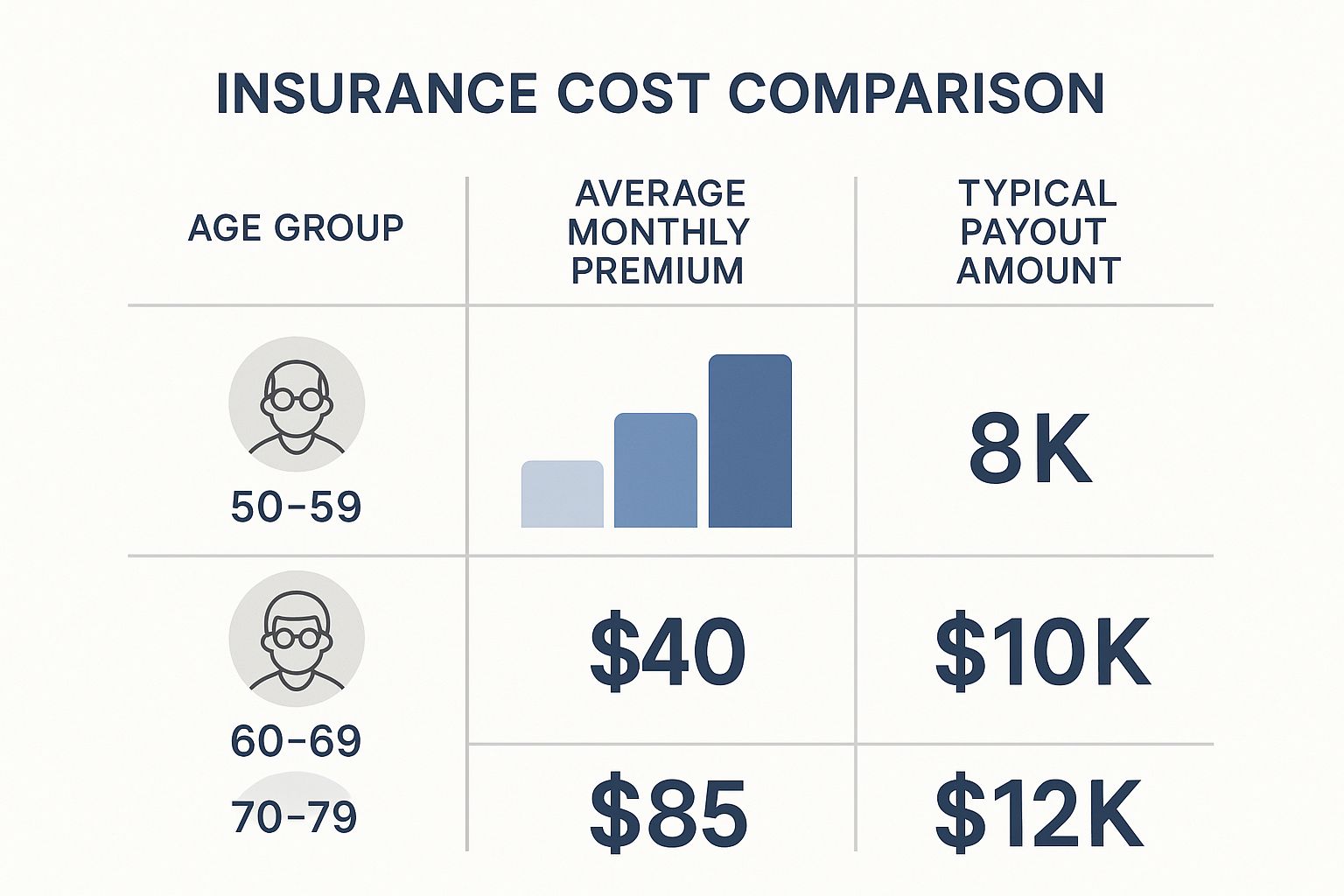

This infographic shows how factors like age directly impact what you might pay for a final expense policy and what it covers.

As you can see, the premiums are designed to be affordable and stay locked in, giving you peace of mind that those final costs will be handled.

A Head-to-Head Comparison

Sometimes, the best way to understand the difference is to see everything side-by-side. The table below breaks it down, showing how final expense insurance prioritizes affordability and easy access for one specific need, while other policies are built for broader—and often temporary—financial goals.

Final Expense vs Term Life vs Whole Life Insurance

| Feature | Final Expense Insurance | Term Life Insurance | Traditional Whole Life Insurance |

|---|---|---|---|

| Main Goal | Covers specific end-of-life costs (funeral, debts). | Replaces income during a specific period. | Provides a legacy and serves as a financial tool. |

| Policy Length | Permanent (lasts your entire life). | Temporary (10, 20, or 30 years). | Permanent (lasts your entire life). |

| Coverage Amount | Small ($5,000 – $25,000). | Large ($250,000+). | Medium to Large ($50,000+). |

| Premium Cost | Low and fixed for life. | Lowest cost initially, but increases dramatically after the term. | Highest cost, but includes a cash value component. |

| Health Requirements | Very lenient; simplified or guaranteed issue options available. | Strict; usually requires a full medical exam. | Moderate to strict; may require a medical exam. |

This table really highlights the trade-offs. You get what you pay for, and each policy is built for a different stage of life and a different financial strategy. It's not about finding the "best" policy, but the one that solves your problem.

For example, a 65-year-old on a fixed income doesn’t need a $1 million term policy. Their mortgage is paid off, their kids are independent, and their main worry is not leaving their family with a bill for their burial. A reliable $15,000 final expense policy is the perfect fit.

The easier qualification, especially for those with health issues, makes it a critical tool. It fills a gap that other types of insurance just aren't designed to cover.

How to Choose a Reliable Final Expense Policy

Choosing a final expense policy is a big decision, and it’s one that truly matters. This is your opportunity to put a solid plan in place that shields your family from unexpected costs and stress when they’re already grieving.

The great news? Finding a dependable policy isn’t nearly as complicated as it sounds. You just need to know what to look for.

Think of it like building a small but sturdy safety net for your loved ones. You need to make sure it’s the right size, woven from strong materials, and positioned perfectly to catch the exact costs your family will face.

Start by Estimating Your Final Costs

Before you can pick the right policy, you need a clear-eyed view of what your end-of-life expenses will actually be. It’s easy to underestimate these numbers, so spending a few minutes adding them up is the most important first step you can take.

Grab a piece of paper and jot down some rough estimates for these common expenses:

- Funeral and Burial or Cremation: Do a quick search for local funeral homes to see their general price lists. The national median cost for a funeral with a viewing and burial is around $8,300, but this number can swing dramatically based on where you live and what you want.

- Outstanding Medical Bills: Think about any leftover co-pays, deductibles, or other out-of-pocket medical costs that might need to be settled.

- Lingering Debts: Do you have a credit card balance, a small car loan, or any other personal debts? Make sure to add those to the list.

- Other Costs: Don't forget to include a little extra for things like legal fees to settle the estate or travel costs for family members who need to attend the service.

Once you have a total, you’ll have a target coverage amount. This simple exercise helps you avoid overpaying for too much insurance or, even worse, leaving your family short.

Always Compare Quotes from Multiple Insurers

You wouldn't buy the first car you test drive without seeing what else is out there, right? Insurance is no different. The price for the very same coverage amount can vary wildly from one company to the next.

Getting quotes from at least three different, reputable insurers isn't just a good idea—it's essential.

This is where an independent insurance agent can be a huge help. They aren’t tied to one company, so they can shop the entire market for you, finding the absolute best rate for your age and health. It saves you time and often leads to better deals than you could find on your own.

Key Insight: The goal isn’t just finding the rock-bottom cheapest premium. It’s about finding the best value—an affordable policy from a company with a proven history of paying its claims and treating families with respect.

Check the Insurer’s Financial Strength

This is a step people often overlook, but it’s critical. A final expense policy is a promise—a promise from an insurance company that it will be there for your family, possibly decades from now. You need to be confident that the company is financially sound.

Look for financial strength ratings from independent agencies like A.M. Best. They grade insurance companies on their financial health. A rating of "A-" or higher is a strong signal that the company has the money and stability to pay its claims. A cheap policy from a shaky company just isn’t a risk worth taking.

Read the Fine Print and Understand Waiting Periods

Finally, before you sign anything, take the time to read the policy details. Pay very close attention to any mention of a waiting period.

While many policies offer full protection from day one, guaranteed issue policies (the ones with no health questions) almost always come with a two-year graded death benefit.

This simply means that if death occurs from natural causes within the first two years, your beneficiary will get back all the premiums you paid, usually plus interest, instead of the full policy amount. Death by accident is typically covered in full from the very first day. Knowing this difference is vital and prevents any heartbreaking surprises for your family down the road.

The need for this kind of straightforward planning is growing worldwide. In response, insurers are creating products with locked-in premiums and guaranteed benefits, making it easier than ever for older adults to get covered. You can learn more about how technology is reshaping the final expense insurance landscape on 360iResearch.com. By following these steps, you can feel confident your policy will be a reliable source of support when it’s needed most.

Common Myths About Final Expense Insurance

Bad information can easily derail smart financial planning, especially when it comes to final expense insurance. A lot of people believe things that just aren't true, and that can stop them from getting the protection their family genuinely needs.

Let's clear the air and tackle some of the most common myths head-on. By separating fact from fiction, you can make a decision based on reality, not on rumors.

Myth 1: I'm Too Old or Sick to Qualify

This is probably the biggest—and most damaging—myth out there. So many people in their 70s or 80s, or those with pre-existing health conditions, just assume they’re automatically out of the running for coverage. That’s simply not the case.

Final expense insurance was built for this exact scenario. Most policies are "simplified issue," which means you only answer a few health questions. No medical exam required. Even better, there are "guaranteed issue" policies.

With a guaranteed issue policy, you can’t be turned down. Your acceptance is a sure thing, no matter your health history. There are no health questions at all, which creates a vital safety net for anyone with serious medical issues.

While these guaranteed plans usually have a two-year waiting period for non-accidental death, they make sure almost everyone can get some level of coverage. No one has to be left with nothing.

Myth 2: My Savings Will Cover Everything

Relying on your savings account for final expenses is a gamble. There are two big reasons why: inflation and accessibility. The $10,000 you’ve tucked away today won’t have the same purchasing power in 10 or 20 years. Funeral costs, like everything else, keep climbing.

Even more importantly, your savings might not be immediately available when your family needs them most. Bank accounts can be frozen during probate, forcing your loved ones to pay for a funeral out-of-pocket while they wait for the estate to settle. A final expense policy pays a tax-free cash benefit directly to your beneficiary, often within just a few days, completely bypassing probate.

Myth 3: It's the Same as a Pre-Paid Funeral Plan

This is a huge misunderstanding, and it's crucial to know the difference. While both are used for end-of-life planning, they are two very different tools.

- Pre-Paid Funeral Plan: You pay a specific funeral home for a set list of services. The big problem? The plan isn’t portable. If you move or the funeral home closes, your money could be gone.

- Final Expense Insurance: This is a life insurance policy that pays out a cash benefit. Your beneficiary gets the money and can use it however they see fit—at any funeral home, for any leftover medical bills, or to pay off credit card debt. That flexibility is its greatest strength.

The cash benefit gives your family control and ensures the money goes where it’s needed most. This is just one part of planning that's especially important when considering how to provide for your loved ones. For more ideas on securing your family's financial future, our guide on life insurance for parents offers valuable insights. Busting these myths reveals that final expense insurance is a flexible, reliable, and powerful tool for protecting your family.

Frequently Asked Questions

It's completely normal to have a few questions pop up as you think about how this all works in the real world. Let's walk through some of the most common ones we hear, so you can move forward with total confidence.

Does a Final Expense Policy Expire?

Nope, it doesn't. A final expense policy is a form of whole life insurance, which means it’s built to last your entire life. As long as you keep up with your premium payments, the coverage is guaranteed to be there for your loved ones, no matter when that day comes.

Better yet, your rate is locked in from day one. It will never increase, giving you a predictable, reliable safety net you can count on for the long haul.

Is the Death Benefit Taxable?

In almost every situation, the money paid out from a life insurance policy is 100% income tax-free for your beneficiaries. This is a huge advantage.

It means your family gets the full amount shown on the policy, without having to set aside a chunk for the IRS. A $15,000 policy pays out $15,000—every single dollar goes toward helping them cover costs during an already difficult time.

What if I Can No Longer Afford My Premiums?

Life happens, and sometimes finances get tight. If you ever find yourself struggling to pay your premiums, you're not necessarily out of luck. Most final expense policies build up a small cash value over the years, which creates a few lifelines.

Here’s what that could look like:

- Automatic Premium Loan: Your policy might be able to "borrow" from its own cash value to cover your premiums for a while, keeping your coverage active without you having to do a thing.

- Reduced Paid-Up Insurance: You could choose to stop paying premiums entirely and convert your policy into a smaller, fully paid-up one. The death benefit would be lower, but you’d still have permanent coverage with no more bills to pay.

- Policy Surrender: If all else fails, you can surrender the policy. This cancels the death benefit, but you’ll receive whatever cash value has accumulated.

The most important thing to remember? Talk to your insurance provider before you miss a payment. They can explain the specific options your policy offers so you can make a clear-headed decision that's right for you.

At My Policy Quote, we believe in making these choices simple and clear. We can help you compare policies from top-rated insurers to find the one that fits your budget and gives you true peace of mind. Find your policy at MyPolicyQuote.com and take the first step toward protecting your family's future today.