When you boil it down, the debate between term and whole life insurance really comes down to one core question: do you need protection for a specific time, or do you want coverage that lasts a lifetime and also helps you build wealth?

It's a foundational financial choice, and getting it right starts with understanding what each policy is truly designed for.

Understanding The Core Difference

Think of term life insurance as pure, straightforward protection. You buy it for a set period—maybe 10, 20, or 30 years—and if you pass away during that time, your family gets a payout. If the term ends and you're still here, the policy simply expires. It’s perfect for covering temporary, but major, financial responsibilities.

It’s the safety net for things like:

- Replacing your income until your kids are grown and on their own.

- Making sure the mortgage gets paid off, no matter what.

- Covering business loans so your partners aren’t left in a lurch.

Whole life insurance, on the other hand, is a different animal. It’s designed to be with you for your entire life, as long as you keep paying the premiums. But it does more than just offer a death benefit. A piece of every premium you pay goes into a savings vehicle called cash value, which grows over time with a guaranteed, tax-deferred interest rate. This makes it a powerful tool that blends protection with a long-term savings strategy.

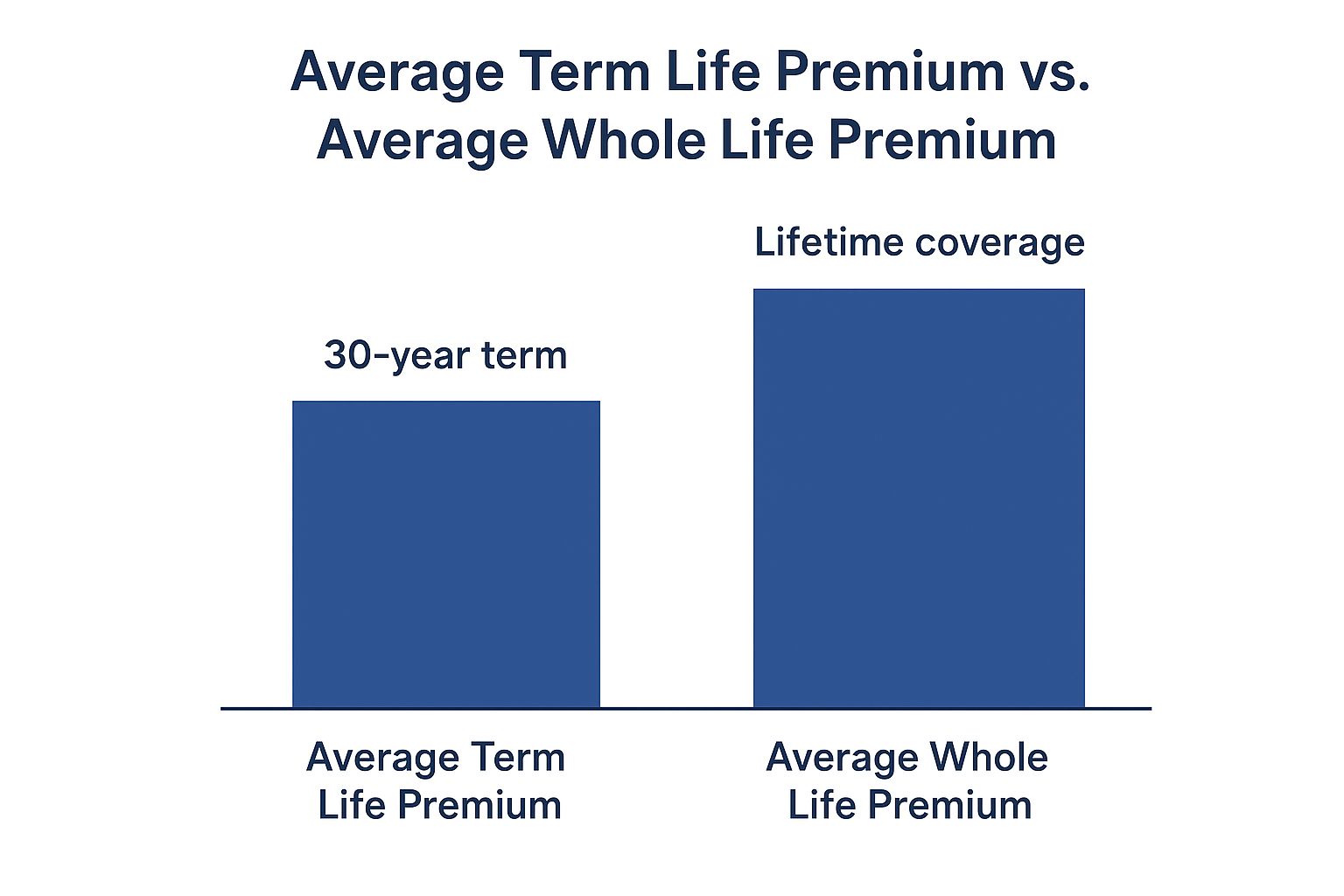

This next image really drives home the biggest trade-off between the two: the cost.

As you can see, that lifelong coverage and cash value component mean whole life comes with a significantly higher price tag. If you want to dive deeper into the nuts and bolts, you can learn more about the difference between term and permanent life insurance in our other guide.

To give you a quick, at-a-glance view, here’s a simple table breaking down the key features.

Quick Comparison Term Life vs Whole Life

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | For a specific period (e.g., 10, 20, 30 years) | Lifelong, as long as premiums are paid |

| Premiums | Lower and typically fixed for the term | Significantly higher, but usually fixed for life |

| Cash Value | No | Yes, builds a tax-deferred savings component |

| Primary Goal | Affordable income replacement and debt coverage | Lifelong protection and wealth accumulation |

Ultimately, both policies are cornerstones of the insurance world because they solve different problems for different people. In fact, term and whole life policies account for over 85% of all individual life insurance sold. Their popularity shows that there's no single "best" answer—only the one that fits your life, your goals, and your budget right now.

A Detailed Cost Analysis Of Term And Whole Life

When you start comparing term versus whole life insurance, one thing jumps out almost immediately: the price. It's no secret that term life is the more affordable option, but the actual difference in cost can be genuinely shocking. For many people, that number alone is the deciding factor.

Let's put some real numbers to it. Imagine a healthy 40-year-old man wants a $500,000 death benefit. For a straightforward 20-year term policy, he might pay around $335 a year. That’s less than a dollar a day.

Now, for a whole life policy with that same $500,000 death benefit, his annual premium could easily top $7,000. That's a massive jump—nearly 20 times more. This huge gap really gets to the heart of the choice you're making: are you buying temporary protection or a permanent financial tool? You can see a more detailed breakdown of this cost difference in this guide from Aflac.com.

The reason for this price gap is simple. Your premium dollars are doing two completely different jobs.

Where Your Premium Goes

With a term life policy, your premium pays for one thing and one thing only: the death benefit. It's pure, unadulterated insurance designed to cover you for a specific amount of time when your family needs financial protection the most. There are no bells, no whistles, and no extra components, which is what keeps it so incredibly cheap.

A whole life policy, on the other hand, splits your premium into two buckets:

- The Cost of Insurance: This part covers the death benefit, just like a term policy.

- The Cash Value Account: A big chunk of your premium gets funneled into a savings account that grows over time with a guaranteed, tax-deferred interest rate.

This is why you'll often hear whole life described as a kind of "forced savings" plan. You aren't just buying lifetime protection; you're also building a financial asset you can tap into later on through loans or withdrawals.

The cost of whole life isn't just about covering a death benefit. It's about funding a lifelong promise from the insurer that includes a guaranteed savings component. The much higher premium reflects the fact that the company knows it will pay out someday, and it’s simultaneously growing your money for you.

Key Factors Influencing Your Premium

No matter which path you take, your personal situation will shape the final price. Insurers are all about managing risk, and they look at a few key things to figure out what yours is:

- Age: This is the big one. The younger and healthier you are when you lock in a policy, the cheaper it will be for life.

- Health: Your medical records, current health, and lifestyle habits (especially smoking) play a huge role in what you'll pay.

- Gender: Statistically, women tend to live longer than men, which often translates to slightly lower premiums for the same amount of coverage.

- Coverage Amount: It's simple math—a $1 million policy is going to cost more than a $250,000 one.

In the end, choosing between term and whole life insurance comes down to a personal calculation. It’s about finding the right balance between what your budget can handle today and what your financial goals look like for the future.

Understanding The Cash Value In Whole Life Insurance

While term life insurance is purely about protection, whole life introduces a game-changing feature: its built-in cash value. This is what turns the policy from a simple safety net into a financial asset you can use during your lifetime. But it's vital to know how it works and what to realistically expect.

Think of the cash value as a savings account that's tucked inside your insurance policy. A piece of every premium you pay goes into this account, where it grows at a modest, guaranteed rate. On top of that, the growth is tax-deferred, so you won’t owe taxes on the gains as they pile up.

How Cash Value Grows And How You Access It

The growth is a marathon, not a sprint. It’s slow and steady, especially in the early years when more of your premium is covering the actual insurance costs. But over decades, that fund can grow into something substantial. And it’s not just locked away—it’s a liquid asset you can tap into when you need it.

You have two main ways to get to this money:

- Policy Loans: You can borrow against your cash value, usually at a pretty competitive interest rate, and you don’t need a credit check. The loan itself isn't considered taxable income, but remember, any amount you still owe when you pass away will be subtracted from the death benefit your family receives.

- Withdrawals or Surrender: You can also just withdraw a portion of the cash or surrender the policy completely to get the full accumulated amount. Just be aware that this can come with big consequences, like reducing your death benefit or ending your coverage for good.

The cash value in a whole life policy offers a unique combination of guaranteed growth and tax-advantaged accessibility. It acts as a disciplined savings tool, but its primary function is to support the permanent nature of the death benefit, not to compete with high-growth market investments.

It’s important to keep expectations in check. The guaranteed growth rate on a whole life policy is conservative by design. It's built for stability, not to beat the returns you might see from a strong stock portfolio. This is the core difference in the "insurance life term versus whole" debate—whole life gives you this conservative, built-in financial tool. To see how this feature is structured in top-tier plans, explore our guide on the best whole life insurance policies.

This unique mix of protection and savings is precisely what makes whole life a strategic choice for specific long-term goals, like planning your estate or creating another stream of income for retirement.

Comparing Flexibility And Coverage Duration

One of the biggest questions in the insurance life term versus whole debate comes down to time. How does each policy fit into the timeline of your life? The answer defines not just how long your protection lasts, but how much room you have to pivot as your life and needs inevitably change.

Term life insurance is built for specific seasons of life. Its defining feature is that it ends, usually in 10, 20, or 30-year increments. You pick a term that aligns with a major financial responsibility, like seeing a 30-year mortgage through to the end or making sure your kids are covered until they're financially independent.

This structure is what makes it so affordable. You get a huge amount of protection when your financial risks are at their peak. A young family might grab a 20-year policy to cover the years until their youngest is out of college. Once that term is up, the coverage—and the payments—simply stop.

The Power Of Convertibility In Term Life

Here’s a feature that’s easy to miss but incredibly valuable: convertibility. Many good term policies include an option to convert some or all of your coverage into a permanent policy, like whole life, without a new medical exam.

This is a game-changer. It acts as a safety net. If you develop a health issue during your term that would make getting new insurance impossible or outrageously expensive, convertibility gives you a guaranteed path to lifelong coverage. It’s a bridge from temporary needs to future certainty.

Whole life insurance gives you permanence from day one, but a convertible term policy gives you options. It lets you lock in low-cost coverage now while keeping the door open to permanent protection later, no matter what happens to your health.

On the other side of the aisle, whole life insurance is all about permanence. As long as you keep paying the premiums, your policy is there for your entire life. You can't outlive it, and you'll never have to re-qualify for coverage again.

This makes it the go-to solution for financial needs that don't have an expiration date. Think about scenarios where "for life" isn't just a nice-to-have, but an absolute must:

- Estate Planning: For families with significant assets, a whole life policy can provide the immediate cash needed to cover estate taxes, keeping those assets intact for the next generation.

- Lifelong Dependents: A parent of a child with special needs can use a whole life policy to fund a special needs trust, ensuring their child has financial support long after they're gone.

- Business Succession: For business partners, a permanent buy-sell agreement funded by whole life ensures the money is there to buy out a deceased partner's share, no matter when it happens.

At the end of the day, term life offers incredible flexibility for a chapter of your life. Whole life delivers a steadfast solution for a lifetime.

When To Choose Term Life Insurance

Deciding between life insurance options often boils down to one simple question: What specific financial risk are you trying to protect your family from?

Term life insurance really shines when your biggest financial responsibilities have a clear finish line. Its affordability and set timeline make it the most efficient way to get massive protection during your most vulnerable years.

Think of it as a dedicated financial bodyguard hired for a specific mission. For many of us, this mission is tied directly to major life milestones that eventually end.

Scenarios Built for Term Life Insurance

Term life is the perfect tool for covering temporary but significant financial obligations. It lets you match your coverage directly to the time your family would need it most, without overpaying for benefits you may not need later on.

Consider these common situations:

- Covering a Mortgage: If you have a 30-year mortgage, a 30-year term policy ensures your family can stay in their home, no matter what happens to your income.

- Raising a Family: A 20-year term policy can replace your income until your youngest child is financially independent, covering everything from daily expenses to future college tuition.

- Securing Business Loans: Entrepreneurs can use term life to cover the duration of a business loan, protecting their partners and personal assets from being liquidated to pay off the debt.

The real power of term life is its targeted efficiency. It delivers the maximum death benefit for the lowest cost precisely when your financial obligations are at their peak. It offers true peace of mind without wrecking your budget.

The Impact of Age and Budget

For younger individuals and families, term life's low cost is a total game-changer. It allows them to afford the large coverage amounts they truly need to replace decades of future income.

The pricing is directly tied to risk, and it climbs steeply as you get older. For example, a healthy 30-year-old man might pay around $275 annually for a $500,000, 20-year term policy. That same policy for a 60-year-old could cost nearly $2,646 per year. You can see more examples of these life insurance rate trends on NerdWallet.com.

This is why locking in a policy when you're young is so powerful. If you're exploring how to best protect your loved ones during their formative years, check out our guide on term life insurance for family protection strategies.

Ultimately, term life empowers you to prioritize affordable, high-value coverage when it matters most.

When Whole Life Insurance Makes Sense

Most of the time, term life insurance gets the job done. It covers you when you need it most and then it’s over. But the insurance life term versus whole conversation isn't just about picking the cheaper option—it’s about understanding what you’re trying to solve.

Sometimes, a "temporary" fix just won't cut it. Whole life insurance steps in when your financial needs are permanent, because it's built to last a lifetime.

Use Cases for Lifelong Protection

Whole life shines in specific situations where its dual promise—a guaranteed death benefit and a growing cash value—offers a solution that nothing else can.

Think of it as a specialized tool for complex, long-term goals:

- Estate Planning: For high-net-worth families, a whole life policy delivers immediate, tax-free cash to their heirs. This money can cover estate taxes or other major expenses without forcing the family to sell off assets like a business or beloved property.

- Funding a Special Needs Trust: Parents of a child with special needs worry about providing support that lasts a lifetime. A whole life policy can be used to fund a special needs trust, ensuring a professional trustee will always have the resources to care for their child, long after they're gone.

- Business Succession Plans: For partners in a business, a whole life policy is the perfect way to fund a buy-sell agreement. It guarantees that when one partner dies—whether it’s in five years or fifty—the surviving partners get the exact cash needed to buy out the deceased’s share, keeping the business stable and running smoothly.

The real power of whole life is its certainty. When you know a financial need is coming but you don’t know when, a permanent policy is the only thing that can offer a guaranteed solution.

A Tool for Financial Discipline

Beyond these specific jobs, whole life insurance also acts as a kind of forced savings account. Your required premium payments steadily build a tax-deferred cash value, creating a pool of money for people who value that kind of financial discipline.

This growing fund can eventually be used to supplement your retirement income, giving you another layer of security. For parents weighing these kinds of long-term financial strategies, our guide on life insurance for parents offers some deeper insights.

When your goals are permanent and you need a mix of protection and guaranteed savings, whole life insurance isn’t just an option—it’s the answer.

Your Top Life Insurance Questions, Answered

Once you’ve looked at term vs. whole life insurance side-by-side, it's completely normal to still have a few questions rolling around in your head. Let's tackle some of the most common ones with straightforward answers to help you feel confident in your choice.

So, Which Policy Is Really Better?

This is the big one, isn't it? Everyone wants to know which policy is the flat-out winner. But the honest answer is, neither one is better than the other in every situation. The "best" choice is the one that fits your life, your budget, and your goals.

For most families, term life insurance is more than enough. Its job is simple: replace your income during your most critical earning years. It’s there to make sure big debts, like your mortgage, are covered and your kids’ education is funded if you’re no longer around. It delivers the most protection for the lowest possible cost.

Whole life insurance, on the other hand, is a specialized tool for permanent needs. Think of it for more complex situations, like setting up an estate plan, funding a special needs trust for a lifelong dependent, or building a guaranteed cash reserve for your retirement. It’s built for the long haul.

What Happens When My Term Policy Runs Out?

If you outlive your term policy, the coverage simply ends. Your beneficiaries won’t receive a payout, and you don’t get your premiums back. It’s a lot like your car insurance—you pay for protection for a set period, and if nothing happens, the policy has done its job.

But what if you still need coverage when the term is up? You have a couple of options:

- Get a New Policy: You can always apply for a new life insurance policy. Just know that the premiums will be based on your current age and health, which means it will likely be much more expensive than your first one.

- Convert Your Policy: Many term policies come with a "convertibility" option. This lets you switch your term plan into a whole life policy without needing another medical exam, locking in your coverage for good.

The most important thing to remember about term life insurance is that it’s designed to be temporary. The goal is to reach a point where you no longer need it—because your kids are grown, your house is paid off, and your biggest financial responsibilities are behind you.

Making the right life insurance decision is one of the most important steps you can take to protect your family’s future. The experts at My Policy Quote are here to help you compare personalized options and find the perfect fit for your needs and budget. Get your free, no-obligation quote today at https://mypolicyquote.com.