Forget the old-school, high-pressure tactics. To truly succeed in selling life insurance today, you need to be more than a salesperson; you need to become a trusted guide. The best agents I know have all mastered a client-first approach. It’s about building genuine relationships, understanding what keeps people up at night, and then showing them how to find peace of mind.

This guide breaks down that exact process, giving you a clear roadmap to follow.

Your Roadmap: The 5 Pillars of Selling Life Insurance

The days of simply pushing a product are long gone. If you want to build a lasting career, you have to shift your entire mindset from just closing a deal to starting a lifelong advisory relationship.

This all starts with trust. You earn that trust by taking the time to genuinely understand a client's world—their family, their dreams, and their biggest financial fears. Only then can you present life insurance for what it really is: an essential tool for protecting the people they love.

A Renewed Focus on Financial Security

Let's be honest, recent years have been a wake-up call for many families. The pandemic, in particular, brought the need for financial protection into sharp focus, pushing sales to record highs in 2021—growth we haven't seen in decades.

While that initial spike has leveled off, the industry is still on solid ground. Forecasts for 2025 project steady premium growth between 2% and 6% for the U.S. individual life market. This isn't just a blip; it represents a fundamental, lasting shift in how people value the security life insurance provides. If you're interested in the numbers, you can explore more about these market dynamics and what’s on the horizon.

This means you’re walking into conversations with a more aware and often more receptive audience. Your job is to be the expert who can guide them through the details with empathy and clarity.

The bottom line: Modern agents succeed because they act as guides, not vendors. Your real value is in your ability to listen, educate, and build a plan that truly protects what matters most to your client.

The entire modern sales process can be distilled into five core pillars. Mastering each one will give you a repeatable, client-focused framework for success.

Here's a quick look at the essential stages that form a successful, client-centric sales cycle.

Core Pillars of Modern Life Insurance Sales

| Pillar | Objective | Key Action |

|---|---|---|

| Prospecting | Find and connect with the right people who genuinely need your help. | Identify ideal client profiles and build targeted outreach campaigns. |

| Presenting | Show how a policy directly solves the client's specific problems and goals. | Frame the conversation around their needs, not just product features. |

| Handling Objections | Address concerns with empathy and turn hesitation into understanding. | Listen carefully, validate their concerns, and provide clear answers. |

| Closing | Guide the client to a confident decision to protect their family. | Make the application process simple and reinforce the value. |

| Following Up | Nurture the relationship beyond the initial sale for long-term loyalty. | Schedule regular check-ins and policy reviews to ensure coverage stays relevant. |

Each pillar builds on the last, creating a seamless experience that puts the client's needs at the center of everything you do. Let's dive into how you can master the first, and arguably most important, pillar: prospecting.

Mastering Prospecting and Lead Generation

Your success in this business is decided long before you ever sit down to talk about a policy. It all starts with building a consistent, predictable way to find qualified people who are genuinely open to what you have to say. Let's be honest, the days of cold calling hundreds of names from a phone book are over. Modern prospecting is all about creating real value and drawing the right people in.

The bedrock of any solid prospecting strategy is knowing exactly who you're trying to help. Who are you uniquely positioned to serve? Vague ideas like "families" or "new homeowners" just don't cut it anymore. To make your message land, you have to get specific.

Think about it. Maybe your ideal client is a self-employed professional, somewhere between 35 and 50, who just welcomed their second child. Or perhaps it's a small business owner with a partner, who's starting to worry about what happens if one of them isn't around anymore. When you define your audience this clearly, you'll know where to find them and exactly what to say.

Cultivating a Powerful Referral Engine

The absolute best leads you'll ever get will come from referrals. But here's where many agents miss the mark—they just ask for them. The top producers I know earn them by delivering an incredible client experience and building strategic relationships.

Your aim should be to make giving you a referral feel like the most natural next step for a happy client. Once you've successfully put a policy in place and they're feeling secure and relieved, the timing is perfect.

Here’s how that might sound:

"John, I'm really glad we got this protection squared away for your family. You know, a lot of my clients have friends or colleagues in a similar spot who just haven't had the chance to look at their own plans. Who comes to mind that might appreciate a conversation like the one we had?"

This approach isn't pushy; it’s helpful. You're framing the referral as a way for them to help someone in their network, not just as a favor to you.

A crucial piece of advice: referrals aren't limited to your clients. You can create a steady stream of high-quality introductions by building relationships with other professionals—think accountants, estate planning attorneys, and mortgage brokers. These folks are already trusted advisors to the exact people you want to meet.

To make these professional partnerships thrive, it has to be a two-way street. Offer to co-host an educational webinar, write an article for their client newsletter, or simply be a reliable resource they can call on. When they see you as a competent expert who adds value, they’ll send people your way with confidence.

Blending Digital and Traditional Prospecting

A truly effective strategy combines modern digital outreach with proven, old-school methods. You need to be visible online, but you also need to be a real presence in your community.

-

Sharpen Your Digital Presence: Your LinkedIn profile is your new business card. Don't let it look like a boring resume. Turn it into a resource hub. Share articles about financial planning for young families or succession strategies for small businesses. Post your own insights on industry news. This establishes you as an authority and attracts connections.

-

Get Involved in Your Community: Never underestimate the power of looking someone in the eye and shaking their hand. Sponsoring a local kids' sports team, joining the Chamber of Commerce, or volunteering for a cause you believe in builds genuine trust. People do business with people they know, like, and trust.

Real-World Scenarios for Opening Conversations

How you kick off a conversation sets the tone for everything that follows. The goal isn't to ambush someone with a sales pitch; it's to build rapport and organically uncover a need.

Scenario 1: At a Networking Event

Instead of saying: "Hi, I sell life insurance. Do you have any?"

Try this instead: "So, what brought you to the event tonight? That’s fascinating. You know, a lot of the business owners I talk to are so focused on growing their company, they haven't had a moment to think about protecting everything they're building. Is that something that's ever crossed your mind?"

Scenario 2: Following Up on a Referral

Instead of opening with: "Hi, Sarah gave me your number and said you need life insurance."

Try this low-pressure approach: "Hi Mike, my name is [Your Name]. Our mutual friend, Sarah, and I were chatting the other day and your name came up. She mentioned you recently launched a new business—that's fantastic, congratulations! I specialize in helping entrepreneurs make sure their personal and business assets are protected while they grow. I'm not sure if that's a priority for you right now, but would you be open to a brief chat next week to see if I can help?"

See the difference? The second approach is respectful and puts you on their side from the very first sentence. By mastering these kinds of nuanced techniques, you'll stop chasing leads and start attracting clients, building a career that's not only successful but sustainable.

Building Unshakeable Trust with a Needs Analysis

The discovery meeting is where you earn the right to give advice. I can't stress this enough: this isn't a sales pitch. It’s a financial fact-finding mission where you shift from being a salesperson to becoming a trusted confidant. Your main job here is to listen far more than you talk.

This whole process is about uncovering the why behind their need for life insurance. You have to get a real sense of their financial world, their family dynamics, and what actually keeps them up at night. Forget about policy features for now. Instead, focus entirely on their life, their goals, and their worries.

Setting the Stage for Openness

You have to make the client feel comfortable and in control right from the start. A good way to do this is to reassure them that the conversation is purely exploratory. You're just there to learn about them and see if there are any gaps you might be able to help fill.

I often kick things off by saying something like, "Thanks for making time for this. My only goal today is to understand what's most important to you and your family. We won't be making any decisions; this is just about you sharing your story so I can see the big picture."

This simple framing takes the pressure off immediately and encourages a much more open, honest dialogue.

Uncovering Goals with Powerful Questions

In a needs analysis, your most valuable tool is the open-ended question. These can't be answered with a simple "yes" or "no" and are specifically designed to get your client talking, thinking, and feeling.

The trick is to ask questions that go deeper than surface-level finances. You’re trying to connect their money to their emotions and their family.

Here are a few that have always worked well for me:

- "If you look ahead 10 or 20 years, what does an ideal future for your family look like?" This helps you understand their long-term dreams.

- "What are the biggest financial goals you're working toward right now?" This could be anything from wiping out the mortgage to funding a college education.

- "What worries you most when you think about your family's financial future?" This question gets right to the core fears that life insurance is built to solve.

- "If something were to happen to you tomorrow, what would you want to make sure is taken care of for your loved ones, no matter what?" This makes the need for protection feel tangible and immediate.

Remember to practice active listening. This isn't just waiting for your turn to talk. Nod, reflect back what you hear ("So, it sounds like making sure the kids can stay in this house is a top priority for you"), and ask follow-up questions to dig deeper.

Making Complex Concepts Simple

Life insurance is loaded with jargon. Your job is to be the translator, turning complex ideas into simple, relatable concepts. I've found that analogies are incredibly powerful for this.

For instance, when explaining why they need coverage beyond what work provides, you could say: "Think of your work policy like a company car. It's great while you're there, but the day you leave your job, you have to hand over the keys. A personal policy is like a car you own—it's yours, and it goes with you no matter where your career takes you."

Debt is another critical topic. Many clients don't fully grasp how their mortgage or business loans could cripple their family financially. You might explain how a policy ensures these responsibilities don't become a burden. If they have specific concerns, understanding how life insurance covers debts like mortgages and loans can provide immense peace of mind.

This approach makes the value of life insurance crystal clear. You're not selling a product; you're providing a solution to the very real problems and fears you’ve just helped them put into words. This is how you build a foundation of trust that lasts a lifetime.

Presenting Solutions and Navigating Objections

You’ve done the hard work of building trust and really getting to the heart of what your client needs. Now it's time to connect those needs to a real solution. This isn't a product pitch; it's the moment you show them you've crafted a plan that solves the very problems they shared with you.

Your presentation should feel like the natural next step in your conversation. Don't lead with policy jargon. Instead, frame the life insurance plan as the specific tool that achieves their most critical goals—whether that's paying off the mortgage, funding the kids' college education, or making sure their partner can retire without financial worry.

Crafting a Solution-Focused Narrative

Before you even mention a policy, start by recapping what you learned from them. Use their own words to show you were listening intently.

Here’s what that sounds like in practice:

"When we last spoke, you said your absolute top priority was making sure Sarah and the kids could stay in this house and live comfortably, no matter what. You also mentioned wanting to ensure college was covered down the road. I took that to heart and put together a plan specifically designed to knock out both of those goals."

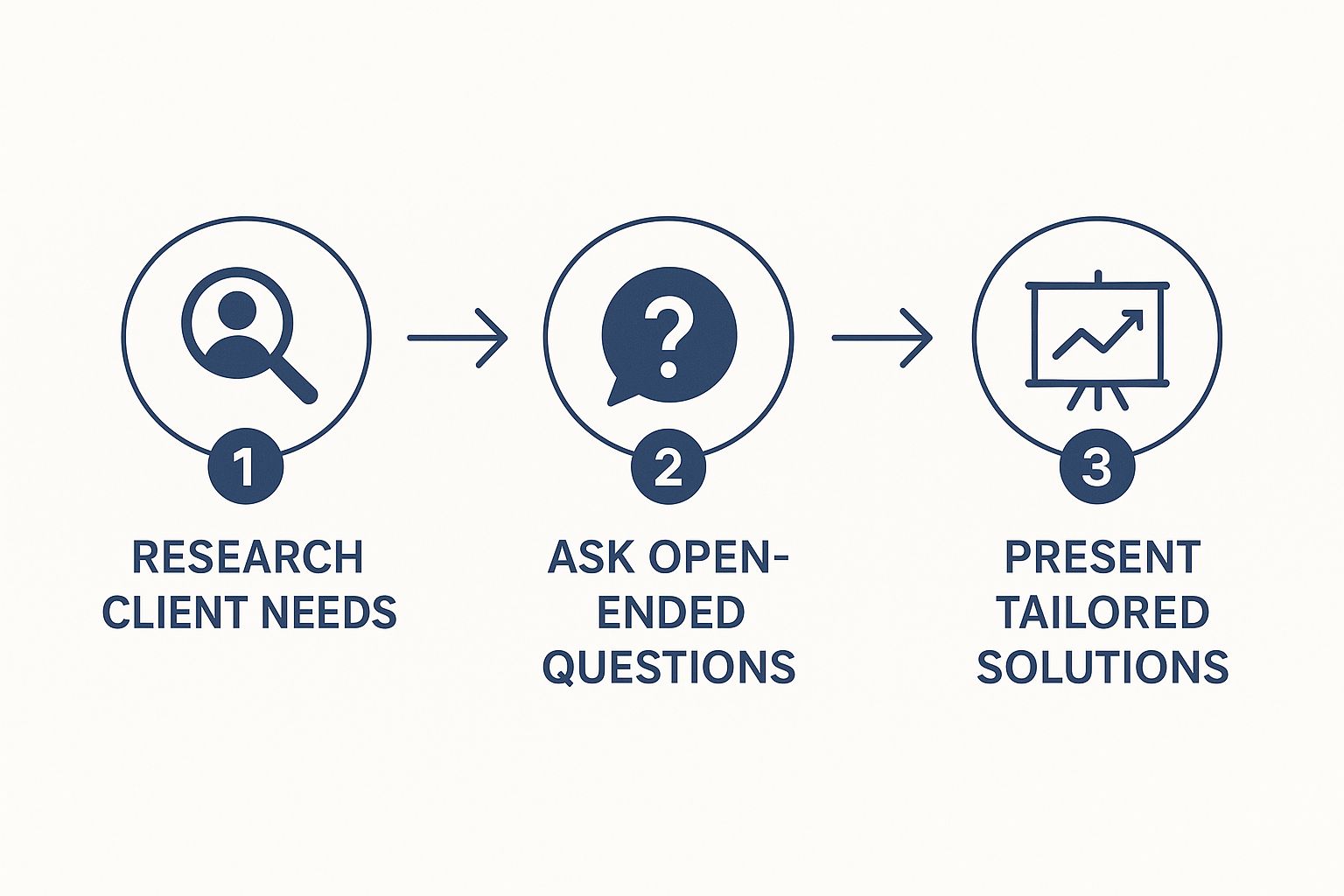

This approach instantly puts them at ease and frames the entire conversation around their life, not your product. You're not just a salesperson; you're a problem-solver who is delivering on a promise. This visual really brings home how a tailored solution is the logical end-point of all your initial discovery work.

As you can see, understanding the client’s world is the foundation. Your presentation is simply the final piece of the puzzle.

Handling Common Objections with Empathy

Let's be clear: objections are not rejections. They're usually just requests for more information or a bit of reassurance. The trick is to listen, validate their concern, and then gently guide the conversation back to the value and peace of mind you’re offering. Never get defensive.

Here are the big three objections you’ll hear and how to handle them like a pro.

-

"It's too expensive." This is the one you’ll hear most often. Your first move is to agree. "I totally get it, fitting another payment into the budget is always a real consideration." Then, you pivot to value by breaking it down into something relatable. "When you look at it, we’re talking about $3 a day. We're essentially redirecting the cost of a daily coffee to guarantee your family gets hundreds of thousands to cover the house and their future if something were to happen."

-

"I need to think it over." This is usually code for "I'm still not 100% sure about something." Open the door for them. "Of course. This is a big decision and you should feel completely comfortable. To help you think it through, what part of the plan is giving you the most pause? Is it the monthly cost, the coverage amount, or maybe something else entirely?" This gets you to the real root of their hesitation.

-

"I'm young and healthy, I don't need it yet." Acknowledge their good fortune. "That's fantastic, and honestly, that’s the absolute best time to lock this in." Then, introduce the urgency. "Because you're young and healthy, you can secure the lowest possible rates for the next 30 years. This plan will never be cheaper or easier to qualify for than it is right now."

An objection is your chance to shine and reinforce the value you bring. It proves the client is engaged and thinking seriously. Your calm, confident response is what builds unshakable trust.

Connecting Your Solution to the Bigger Picture

It can also help to zoom out and show them they aren’t alone in making this decision. The life insurance market is huge for a reason—the need is universal. The global insurance industry isn't small potatoes; in 2024, total premium income hit a staggering EUR 7.0 trillion. Life insurance was the biggest slice of that pie, making up EUR 2,902 billion in premiums. Millions of families see this as a foundational part of their financial plan. You can dig into the numbers yourself in the Allianz Global Insurance Report 2025.

By framing the policy correctly, you help the client understand this isn't just another monthly bill. It’s a direct investment in their family's future. To answer their more detailed questions, it’s crucial you know what exactly does life insurance cover. This knowledge empowers you to speak with authority on what is—and isn't—protected.

When you successfully navigate these conversations, the decision to move forward stops feeling like a sale and starts feeling like the most logical, responsible, and caring step a person can take.

From Closing the Sale to Building a Lifelong Client

The close isn't a high-pressure finale. Honestly, if you've done your job right, it should feel like the quiet, logical conclusion to a helpful conversation. When you've put in the work to build real trust and truly understand what your client needs, asking for the business is the most natural next step. The real skill is knowing when they're ready.

You have to learn to listen for the subtle buying signals. They rarely come as a grand announcement. Instead, look for small but significant shifts in language. A client might go from asking "what if" questions to "what's next" questions.

Listen for phrases like, "So, the monthly premium would be…" or "When would the coverage actually start?" Those are your green lights. It means they’ve mentally shifted from considering the policy to owning it.

When you hear those cues, it’s your moment to ask for the business with quiet confidence. Something simple and low-stress works best. Try: "It seems like this plan checks all the boxes we discussed. Are you ready to move forward with the application and get your family protected?" It’s direct, respectful, and keeps them in the driver's seat.

Setting Expectations for the Application and Underwriting

Once you get that "yes," your hat changes. You go from educator to project manager. To a client, the application and underwriting process can feel like a complete black box, and it's your job to shine a light on it and provide a clear roadmap. This is where so many agents drop the ball, creating needless anxiety and buyer's remorse.

Break it down for them in plain English:

- The Application: Let them know you’ll walk them through the paperwork together. Your goal is to make it as painless as possible.

- The Medical Exam: Explain that a paramedical professional will schedule a time that's convenient for them, often right in their own home. Reassure them this is a totally standard part of the process.

- The Underwriting Wait: Be straight with them. Underwriting can take several weeks. Setting a realistic timeline from the start prevents them from wondering what’s happening a few weeks down the line.

Proactively managing this phase is where you really earn your stripes. Send a quick email confirming the application has been submitted. Check in after their medical exam. These small touchpoints show you’re on top of things and reinforce their decision to trust you. A client who feels guided and informed is one who stays calm and confident.

The underwriting period is a true test of your professionalism. Your communication during this "quiet" time will define the client's experience and set the stage for a long-term relationship. Keep them in the loop, even if there’s no big news to share.

The Post-Sale Strategy That Creates Lifelong Clients

The most successful agents I know understand one thing perfectly: getting the policy approved is the start of the relationship, not the end. This is how you separate yourself from the transactional salespeople who just move on to the next deal. Turning a one-time sale into a lifelong advisory relationship requires a deliberate follow-up system.

When you deliver the policy, don't just stick it in the mail. Schedule a meeting—in person or over video—to go over it. This is your chance to reinforce the immense value of what they've just bought and tie up any loose ends. More importantly, it’s when you outline your commitment to them for the long haul.

Let them know you'll be in touch for annual policy reviews. Frame these not as sales calls, but as simple check-ins. Life changes—a new baby, a promotion, a new home—and you need to make sure their coverage still makes sense. This proactive service builds incredible loyalty and shows you care about their well-being, not just the commission.

This level of service is crucial. The global life insurance market is valued at roughly USD 8.25 trillion and is projected to hit nearly USD 18.03 trillion by 2034. With over 134 million individual policies active in the U.S. alone, standing out through exceptional service is everything. You can explore more data on the global life insurance market to see the full scope of the opportunity.

To ensure your client has a smooth and positive journey from the very beginning, a structured onboarding process is key.

Client Onboarding and Nurturing Checklist

This checklist outlines the critical steps for welcoming a new client and laying the foundation for a lasting professional relationship.

| Phase | Action Item | Goal |

|---|---|---|

| Immediate Post-Sale | Send a "Thank You & Confirmation" email. | Reassure the client and confirm the next steps in the application process. |

| Application Process | Assist with form completion and schedule the medical exam. | Make the process seamless and stress-free for the client. |

| Underwriting Period | Provide weekly check-in updates, even if there's no news. | Manage expectations and show proactive communication. |

| Policy Approval | Call the client with the good news immediately. | Share in their excitement and reinforce the value of their decision. |

| Policy Delivery | Schedule a meeting to review the policy document together. | Ensure they understand their coverage and answer all final questions. |

| Ongoing Nurturing | Schedule the first annual review and add them to your newsletter. | Establish a long-term service commitment beyond the initial sale. |

Following these steps transforms the transaction into a relationship, proving you're a resource they can count on for years.

By providing ongoing value, you become their go-to advisor. This approach not only builds unbreakable loyalty but also turns your clients into your best source of referrals. As a final touch, you can empower them by sharing our guide on the common mistakes people make when buying life insurance. It’s one more way to show you’re invested in their financial well-being.

Answering Your Top Insurance Sales Questions

Jumping into life insurance sales is an exciting move, but let's be honest—it comes with a mountain of questions. Once you get past the basics of prospecting and presenting, you start wondering what it really takes to build a career that lasts.

So, let's pull back the curtain and tackle some of the most common questions I hear from new agents. The truth is, this career is less about being a slick salesperson and more about becoming a trusted, empathetic guide for families.

What Skills Really Matter for a New Agent?

Success in this business boils down to a unique mix of people skills and product smarts. Of course, you need to know your policies inside and out, but it’s your human touch that will make all the difference. The agents who truly make it are the ones who can connect with people on a genuine, personal level.

If you want to build a solid foundation, focus on these three things:

- Radical Empathy: You have to be able to sit across from someone—whether it's at their kitchen table or on a video call—and truly understand their hopes, dreams, and biggest fears. It’s not just listening; it’s feeling what they feel.

- Clear Communication: Your superpower is taking complicated insurance jargon and making it simple. Use analogies, tell stories, and give straightforward explanations. When clients understand what they’re buying, they feel confident and empowered.

- Unwavering Resilience: You're going to get rejected. Deals you were sure about will fall apart. It happens. The agents who last are the ones who see every "no" as a learning experience and just keep going with a positive attitude.

The most critical skill isn't salesmanship; it's relationship-building. When clients see you as a trusted advisor first and a salesperson second, you've already won. Your job is to educate and empower, not just to sell.

A Realistic Timeline for Success

Let's be real: building a sustainable book of business doesn't happen in a few weeks. This is a marathon, not a sprint, and setting the right expectations from day one is the key to avoiding burnout. Your first year is often the toughest—it’s all about learning the ropes, prospecting like crazy, and laying the groundwork for the future.

Expect the first 6 to 12 months to be a whirlwind of activity where you're learning more than you're earning. This is your time to fine-tune your process, build a pipeline, and celebrate those first few wins. By year two, if you’ve been consistent, you'll start to see the momentum build as referrals begin to trickle in. True stability and a comfortable income often take 3 to 5 years of dedicated, consistent effort.

A good mentor can be a game-changer. Find a veteran agent or a supportive manager who can show you the way, offer advice when you’re stuck, and help you sidestep common pitfalls. This can shave years off your learning curve. Don't ever be afraid to ask for help.

The Biggest Mistakes New Agents Make (And How to Avoid Them)

So many promising agents flame out within their first couple of years because of a few common, completely avoidable mistakes. Knowing what these traps are ahead of time is your best defense. The biggest one? Thinking this is a typical 9-to-5 job. It's not—it requires an entrepreneurial spirit.

Here are the career-killers I see most often:

-

Inconsistent Prospecting: This is the absolute number one reason agents fail. You get busy with paperwork, client meetings, and underwriting follow-up, and you let your prospecting slide. You must block out time for lead generation every single week, no exceptions. It’s the engine of your business.

-

Lousy Follow-Up: A lead is worthless without a great follow-up system. Dropping the ball, letting applications sit without giving your client updates, or vanishing after the policy is delivered—these are surefire ways to destroy trust and lose out on future referrals. A CRM isn't a nice-to-have; it's essential.

-

Fear of Talking About Money: New agents often get squeamish when it's time to discuss the premium. You have to get comfortable with this conversation. Frame it confidently not as a monthly bill, but as a small, predictable investment for an incredible amount of protection and peace of mind.

-

Ignoring Younger Clients: It’s a huge mistake to assume young people don't care about life insurance. In reality, their youth is exactly why it’s the perfect time for them to get covered—it's cheaper and easier to qualify for. Your job is to educate them on that incredible value. You can get great ideas on how to approach this by learning if life insurance is worth it if you're young.

If you can steer clear of these mistakes and focus on consistent, empathetic action, you'll be well on your way to building a career that’s not just profitable, but deeply meaningful.

At My Policy Quote, we provide the tools and insights you need to build a successful career as a trusted insurance advisor. https://mypolicyquote.com