When we daydream about retirement, our minds usually drift to sun-soaked beaches or finally getting around to that passion project. But the biggest financial question mark isn't about your travel budget—it's about your health. Putting a solid retirement health insurance plan in place is truly the foundation of a worry-free future, making sure a sudden health issue doesn't sink your life's savings. It’s arguably the most critical financial puzzle you'll have to solve.

Why Healthcare Is Your Biggest Retirement Hurdle

For most of your working life, health insurance was probably something you didn't think about too much. It was a line item on your pay stub, a benefit your employer mostly handled behind the scenes. You had a predictable safety net.

But the day you retire, that entire system disappears. Poof. Gone. You're left with a significant—and often intimidating—gap to fill. This isn't like switching to a new job with a different benefits package. It's more like being handed the keys to an airplane and being told, "Alright, you're the pilot now."

That's the best way to think about retirement health insurance. You're moving from a group plan where someone else was in the cockpit to a new reality where you are in complete control. Suddenly, it’s on you to navigate a sky full of confusing terms, competing plans, and new costs. It’s a massive shift that catches a lot of folks off guard, turning what should be a celebration into a period of serious stress.

The Staggering Cost of Being Unprepared

This isn’t just a paperwork headache; the financial shock can be profound. The fear of being able to afford medical care in retirement is so real that it’s fundamentally changing when and how people leave the workforce.

The truth is, healthcare costs have become a primary driver of major life decisions. The sheer financial weight of post-employment medical care is forcing many to completely rethink their golden years.

The numbers back this up. A jaw-dropping 33% of Americans now say they plan to retire later than they wanted to, while another 30% expect to only "partially" retire. The number one reason? The daunting cost of paying for health insurance without an employer subsidizing it. You can dig into these findings in the 2025 Global Retirement Reality Report.

Building Your New Foundation for Security

When you lose your employer-sponsored plan, you're essentially starting from square one. Your new strategy will likely be a patchwork quilt, pieced together from federal programs like Medicare and private insurance plans designed to fill in the gaps. The challenge is that these pieces don't always fit together perfectly, and they all come with their own price tags.

Your new financial reality will almost certainly include:

- Monthly Premiums: The regular payments you make to keep your policy active.

- Deductibles: What you have to pay out-of-pocket before your insurance kicks in.

- Copayments and Coinsurance: Your share of the cost for doctor’s visits, prescriptions, and other services.

Without a solid game plan, these costs can add up faster than you can imagine, potentially draining the very nest egg you worked so hard to build. That’s why figuring out your retirement health insurance isn't just a good idea—it's the single most important thing you can do to protect your financial security. This guide will be your roadmap to making sense of it all, sidestepping common mistakes, and making choices that protect both your health and your wealth.

Understanding Your Core Coverage Options

Once you punch the clock for the last time, you’re often leaving more than just your job behind—you’re also saying goodbye to your employer-sponsored health plan. That transition can feel a lot like being dropped into a foreign country without a map. Suddenly, you're navigating a brand-new system with unfamiliar rules and a dizzying number of choices. But don't worry, once you get your bearings, the path forward becomes much clearer.

Your journey starts with understanding the three main pillars of retirement health insurance: Medicare, coverage from a former employer, and plans from the private marketplace. Think of these as the main highways you can take—each with its own scenery, tolls, and destinations.

Medicare: The Cornerstone of Your Plan

For most Americans, Medicare is the starting point. It's the federal health insurance program designed for folks 65 or older, as well as some younger people with certain disabilities. The first thing to grasp is that Medicare isn't a single, monolithic plan. It’s actually a system made up of different "parts," each covering something specific.

Let's imagine you're building a house to protect your health and finances.

- Medicare Part A (Hospital Insurance) is your home's foundation. It’s what covers you for inpatient hospital stays, care in a skilled nursing facility, hospice, and some home health care. The good news? Most people don't pay a monthly premium for Part A, as long as they or their spouse paid Medicare taxes for at least 10 years.

- Medicare Part B (Medical Insurance) is like the walls and roof of your house. This part covers the things you need to stay healthy outside of a hospital, like doctor's visits, outpatient care, preventive screenings, and durable medical equipment. You will pay a monthly premium for Part B.

Together, Part A and Part B are what we call Original Medicare. This is the basic structure of your healthcare house, but it’s not move-in ready just yet. It has some significant gaps—like deductibles and coinsurance—and it almost never covers prescription drugs, dental, or vision care.

Expanding on the Foundation: Part C and Part D

To make your healthcare house a truly comfortable and complete home, you'll need to add a few key features. This is where the other parts of Medicare come in, letting you either bundle your coverage or add specific protections.

Medicare Part C (Medicare Advantage) is like buying an "all-in-one" home package from a builder. These plans are offered by private insurance companies approved by Medicare. By law, they have to cover everything Original Medicare (Parts A and B) does, but they usually sweeten the deal by including prescription drug coverage (Part D), dental, vision, and even hearing benefits—all bundled into a single plan.

On the other hand, Medicare Part D (Prescription Drug Coverage) is like getting a separate key just for the pharmacy. It's standalone coverage you can add to Original Medicare. If you decide against an all-in-one Medicare Advantage plan, you’ll almost certainly need to buy a separate Part D plan to keep your medication costs from getting out of hand.

Key Insight: The choice between Original Medicare (plus a Part D plan) and a bundled Medicare Advantage plan is one of the biggest decisions you'll make in retirement. It directly impacts your monthly costs, which doctors you can see, and the extra benefits you'll get.

Other Paths: Retiree Plans and Private Insurance

While Medicare is by far the most traveled road, it isn't the only one. A smaller group of retirees might have access to other options.

Employer-Sponsored Retiree Health Plans: Some companies and public employers still offer health benefits to their retirees. Honestly, this is becoming a real rarity in the private sector, but it's a fantastic perk if you can get it. These plans almost always work in coordination with Medicare. For instance, some government entities, like the state of Michigan for its school employees, have commendably pre-funded these benefits to ensure they're available for the long haul. You absolutely must check with your HR department well before retiring to see if this is on the table and what it will cost you.

Private Marketplace Insurance: What if you retire early, before you turn 65 and become eligible for Medicare? You'll need a bridge to get you there. The Health Insurance Marketplace created by the Affordable Care Act (ACA) is your go-to source. Here, you can shop for individual or family plans to cover that gap. Depending on your post-retirement income, you might even qualify for subsidies to help lower your monthly premiums. This is a critical safety net to keep you covered during those pre-Medicare years.

Choosing Between Medicare Advantage and Medigap

Once you’re enrolled in Original Medicare, you hit your first big fork in the road. You’ve got the basic foundation, but it's full of gaps—think deductibles, coinsurance, and other out-of-pocket costs. Your next move is deciding how to fill those gaps, and it really boils down to two completely different paths for your retirement health insurance: Medicare Advantage (Part C) or Medigap.

Let me put it this way. Original Medicare is like getting the sturdy frame of a car. A Medicare Advantage plan is like leasing a fully loaded vehicle from a specific dealership. It comes with everything bundled in—engine, GPS, fancy sound system—but you're required to use their approved service centers for maintenance.

On the other hand, Medigap is like buying premium, à la carte parts to build out your car's frame. You get to customize it exactly how you want, giving you the freedom to take it to just about any mechanic in the country.

This decision will shape your healthcare journey for years, impacting your monthly budget, your out-of-pocket spending, and which doctors you can see. There’s no single right answer here. The best choice is deeply personal and depends on your health, finances, and what you value most in a plan.

The All-in-One Simplicity of Medicare Advantage

Medicare Advantage plans, which you’ll often hear called Part C, are an alternative route for getting your Medicare benefits. These plans come from private insurance companies that have a contract with Medicare. The law requires them to cover everything Original Medicare (Parts A and B) does, but they don't just stop there.

The biggest draw for Medicare Advantage is that everything is bundled together. Most plans throw in extra benefits you simply won't get from Original Medicare alone.

- Prescription Drug Coverage (Part D): This is often built right into the plan, so you don't have to worry about buying a separate drug policy.

- Dental, Vision, and Hearing: Many plans include routine coverage for these essential, everyday health needs.

- Wellness Programs: You might find some nice perks like gym memberships or fitness programs included.

In exchange for these bundled goodies and what is often a $0 monthly premium (you still have to pay your standard Part B premium), Advantage plans usually work within a provider network, like an HMO or PPO. This just means you'll need to use the doctors, specialists, and hospitals that are in the plan’s network to keep your costs low. For many retirees, that trade-off is a no-brainer for the simplicity and predictable costs.

The Comprehensive Freedom of Medigap

Medigap, also known as Medicare Supplement Insurance, is a completely different animal. Instead of replacing Original Medicare, these plans work alongside it. They are designed to do one thing and do it very well: pay for the "gaps" that Original Medicare leaves you responsible for, like your deductibles, copayments, and coinsurance.

The main benefit of Medigap is freedom—both in your choice of doctors and in the predictability of your healthcare budget. With a Medigap plan, your biggest advantage is choice. You can see any doctor or go to any hospital in the U.S. that accepts Medicare. No networks. No referrals needed to see a specialist.

Medigap provides incredible peace of mind by dramatically reducing—or even completely eliminating—your out-of-pocket costs for services Medicare covers. You’ll pay a higher monthly premium for this robust protection, but in return, you get a powerful shield against surprise medical bills.

There are several standardized Medigap plans, each identified by a letter (like Plan G or Plan N), and each offers a different level of coverage. While they don't include extras like dental or vision, their entire purpose is to be your financial safety net. To see how the different plans stack up, you can find a helpful breakdown of the best Medicare Supplement plans and what they cover. This can help you zero in on the right level of coverage for your needs and budget.

Medicare Advantage vs. Medigap at a Glance

Making this choice can feel overwhelming, so let's break it down side-by-side. This table gives you a direct comparison of the key features to help you decide which path—Medicare Advantage or Medigap—is a better fit for your retirement health insurance needs.

| Feature | Medicare Advantage (Part C) | Medigap (Medicare Supplement) |

|---|---|---|

| How It Works | Replaces Original Medicare; an all-in-one plan from a private insurer. | Works with Original Medicare; fills in the cost gaps. |

| Premiums | Often $0/month (besides your Part B premium), but can have higher out-of-pocket costs. | You pay a separate monthly premium in addition to your Part B premium. |

| Doctor Choice | Usually restricted to a network (HMO or PPO). | See any doctor or hospital nationwide that accepts Medicare. No networks. |

| Out-of-Pocket Costs | You pay copays and coinsurance until you hit an annual maximum. | Significantly reduces or eliminates most copays and coinsurance for Medicare-covered services. |

| Extra Benefits | Most plans include drug, dental, vision, and hearing coverage. | Does not include extra benefits. You'll need separate policies for drugs, dental, etc. |

| Referrals | Often required to see a specialist. | Never required to see a specialist. |

| Best For You If… | You prefer lower premiums, bundled benefits, and don't mind using a network. | You want freedom of choice, predictable costs, and protection from high medical bills. |

Ultimately, both are great options, but they serve different needs. Your decision hinges on what matters more to you: lower upfront costs and bundled convenience, or maximum freedom and financial protection.

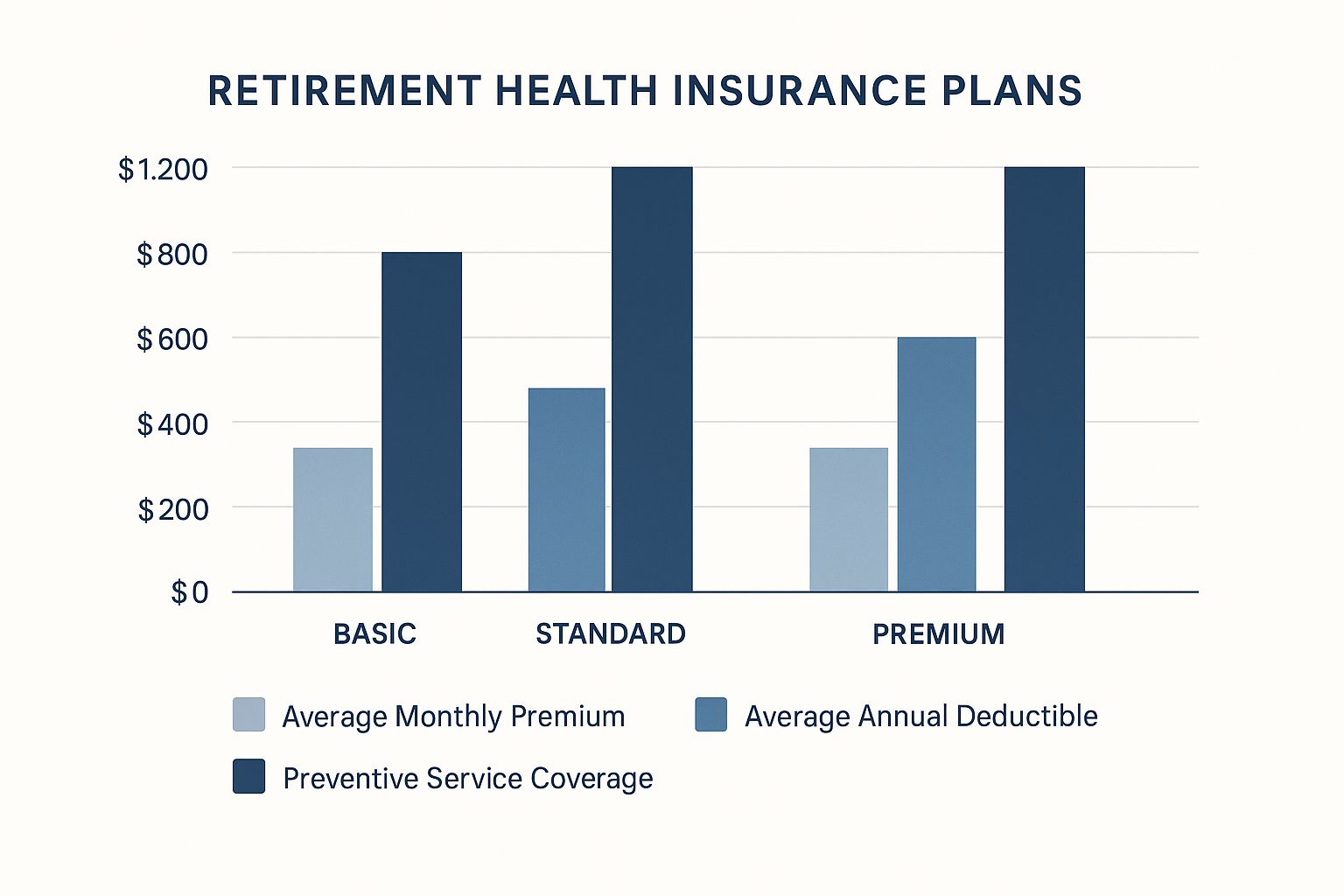

As this chart shows, there’s often an inverse relationship between your monthly premium and your potential out-of-pocket costs. Lower premium plans might look attractive, but they could come with a higher annual deductible—a critical trade-off to weigh in your decision.

At the end of the day, choosing between Medicare Advantage and Medigap is a personal calculation. It's about finding the right balance between lower monthly payments with some network rules versus higher premiums for more freedom and a stronger financial safety net.

How to Avoid Costly Enrollment Mistakes

When it comes to your retirement health insurance, timing isn’t just important—it’s everything. Miss a deadline, and you could be looking at lifelong financial penalties and scary gaps in your coverage. It’s one of those things you absolutely have to get right the first time.

Navigating these enrollment windows can feel like trying to catch a series of moving trains. Each one has a specific destination and a strict schedule. Understanding them is your ticket to a smooth, penalty-free ride into your healthcare future.

Your First and Most Important Deadline: The Initial Enrollment Period

The most critical window is your Initial Enrollment Period (IEP). This is your personal, one-time-only, seven-month window to sign up for Medicare.

Your IEP starts three months before the month you turn 65, includes your birthday month, and runs for three months after. So, if your birthday is in July, your enrollment window opens on April 1st and closes on October 31st.

Missing this window is the most common—and most expensive—mistake people make. If you don't sign up for Medicare Part B during your IEP (and you don't have other qualified health coverage), you could be hit with a permanent late enrollment penalty. This isn't just a slap on the wrist; it's an extra cost tacked onto your Part B premium for the rest of your life.

Think of your IEP as your one-time pass to get on the Medicare train without any extra fees. If you miss it, you'll have to pay a higher fare for the entire journey.

When Life Changes Your Plans: Special Enrollment Periods

Of course, life doesn't always follow a neat timeline. What if you’re still working at 65 and perfectly happy with your employer's health plan? That’s exactly what a Special Enrollment Period (SEP) is for.

An SEP lets you sign up for Medicare outside your initial window without penalty, usually after a specific life event. The most common trigger by far is losing your health coverage from your job.

When you (or your spouse) stop working and that coverage ends, an eight-month SEP kicks in, giving you plenty of time to enroll in Medicare Part B. This flexibility ensures you can move from your work plan to Medicare without a gap. Other qualifying events, like moving out of your current plan’s service area, can also trigger an SEP.

Your Annual Chance to Make Changes

Once you're enrolled, you aren't stuck with your choices forever. The Annual Enrollment Period, which you’ll often hear called Open Enrollment, is your yearly opportunity to review and adjust your coverage. This period runs from October 15th to December 7th every year.

During this time, you can:

- Switch from Original Medicare to a Medicare Advantage plan

- Move from a Medicare Advantage plan back to Original Medicare

- Change from one Medicare Advantage plan to another

- Enroll in, drop, or switch a Medicare Part D prescription drug plan

This annual check-in is your chance to make sure your plan still fits your health needs and your budget. For a closer look, you can read our guide that explains what Open Enrollment is and why it matters. Getting these dates right is the key to building a secure retirement without the stress of penalties.

Creating a Realistic Healthcare Budget

So you’ve picked your core health plan. Now comes the big question: what is this all actually going to cost? This is where the rubber meets the road. Moving from theory to practice means creating a realistic budget that turns vague fears about medical bills into a solid, manageable financial plan.

Think of it like planning a cross-country road trip. You wouldn't just budget for gas, right? You’d factor in tolls, oil changes, meals, and the occasional motel stay. Your retirement healthcare budget works the same way. It's about a lot more than just that monthly premium—it’s the full picture of every cost you might encounter on your journey.

Cataloging Your Total Healthcare Expenses

To get a true handle on your spending, you need to look past the sticker price. Your total out-of-pocket costs are a mix of several different expenses, and each one plays a key role in your financial stability. For a truly secure retirement, you have to anticipate all of them.

Here are the primary costs to build into your budget:

- Monthly Premiums: This is your fixed, non-negotiable payment to the insurance company that keeps your coverage active. It’s the cost of admission, whether it’s for Medicare Part B, an Advantage plan, a Medigap policy, or a Part D drug plan.

- Annual Deductibles: This is the amount you have to pay yourself for covered services before your insurance company starts chipping in. Think of it as your initial share of the risk you take on each year.

- Copayments & Coinsurance: These are the costs you pay after hitting your deductible. A copay is a flat fee (like $25 for a doctor's visit), while coinsurance is a percentage of the total bill (for example, you pay 20%, and your plan pays 80%).

These predictable expenses form the foundation of your budget. But a truly bulletproof financial plan also prepares for the things your main insurance policy might not cover at all.

Factoring in the Financial Unknowns

Even the most comprehensive health plans have gaps. Some of the most common—and potentially most expensive—healthcare needs are often left out of Original Medicare and many private plans. Overlooking them can be a catastrophic financial mistake.

The most effective healthcare budgets are proactive, not reactive. They build a buffer for expenses that fall outside the lines of traditional insurance, protecting your life savings from the shock of a major health event.

These crucial gaps often include:

- Long-Term Care: This isn't medical care, but help with daily activities like bathing, dressing, or eating. Original Medicare doesn't cover it, and the costs can wipe out a nest egg in a shockingly short amount of time.

- Dental & Vision: Routine check-ups, fillings, eyeglasses, and contacts are usually not covered by Original Medicare.

- Hearing Aids: These vital devices can be incredibly expensive and are another common exclusion.

What makes budgeting even tougher is that healthcare costs don't stand still. They rise every year due to inflation and other economic pressures. This is tracked by medical trend rates, which measure the annual increase in healthcare costs. For 2025, the global medical trend rate is expected to stay in the double digits for the second year in a row, according to research from Aon. This is a flashing red light for retirees on fixed incomes, as it directly leads to higher premiums and out-of-pocket expenses.

This reality makes some people wonder if they should just self-fund their healthcare from savings. While it might seem appealing, it's an incredibly risky gamble. To see why, you can read our breakdown of health insurance vs. personal savings and which is better. A smart budget, paired with the right insurance, is almost always the more secure path forward.

Planning for Gaps in Your Coverage

Finding a solid medical plan is a fantastic first step, but it’s just one piece of the retirement healthcare puzzle. A lot of retirees get a nasty surprise when they discover that Original Medicare leaves some pretty big—and potentially expensive—holes in its coverage.

Ignoring these gaps is like building a sturdy boat but forgetting to patch the leaks. To create a truly watertight financial plan for your health, you have to address the "Big Three" that are often left out: long-term care, dental, and vision services. These aren't just nice-to-haves; they are absolutely fundamental to your long-term health and financial stability.

The Critical Need for Long-Term Care Insurance

Long-term care (LTC) is hands-down one of the biggest financial curveballs retirement can throw at you. We're not talking about medical treatment here. This is about getting help with daily living activities—things like eating, bathing, or getting dressed—because of a chronic condition or disability.

Here's the kicker: Original Medicare does not cover these ongoing custodial care services. The costs for a home health aide or a stay in a nursing facility can evaporate a lifetime of savings with shocking speed. This is precisely what LTC insurance is designed for—it shields your nest egg from being wiped out by these extended care needs.

This reality is a big reason the global insurance industry is growing. In fact, health and life insurance premiums are expected to drive EUR 3,798 billion in growth over the next decade, largely because of aging populations needing more complete coverage. You can dive deeper into these trends in Deloitte's 2024 Insurance Industry Outlook.

Don't Overlook Dental and Vision Plans

While maybe not as financially catastrophic as a long-term care event, everyday dental and vision expenses can really add up. Original Medicare won't foot the bill for routine cleanings, fillings, crowns, eyeglasses, or contact lenses.

To keep from paying for all of this out-of-pocket, you'll want to look into a separate dental and vision plan. They are usually quite affordable and can easily save you thousands of dollars over the course of your retirement.

Your HSA: A Powerful Retirement Tool

Finally, let's talk about one of the best tools in your retirement toolkit: the Health Savings Account (HSA). If you were able to contribute to one during your working years, you've got an incredible financial asset waiting for you.

Even after you're on Medicare, you can use the funds in your HSA tax-free to pay for a whole host of medical expenses.

Think of a pre-65 funded HSA as your personal, tax-advantaged healthcare fund for retirement. You can use it for Medicare premiums, deductibles, and all those costs Medicare doesn't touch, like dental and vision care.

This makes an HSA the perfect vehicle for filling those coverage gaps. Of course, for anyone retiring before they hit 65, navigating the path to Medicare is its own challenge. You can learn more in our guide to securing health insurance before Medicare.

Your Retirement Health Insurance Questions Answered

Trying to figure out the fine print of retirement health insurance can feel like a real headache. It’s totally normal to have questions about how it all applies to you. This FAQ tackles some of the most common puzzles retirees run into, giving you straight answers so you can make your next move with confidence.

Can I Keep My Employer Health Insurance When I Retire?

This is the big one, right? The short answer is: maybe, but don’t count on it. It’s becoming less and less common.

Some employers, particularly in government or public education, might offer retiree health benefits. For example, the state of Michigan made headlines by setting aside billions to fully fund health plans for its retired public school employees—but that’s definitely the exception, not the rule.

A more likely scenario is that you can stay on your company’s plan for a short time through COBRA. The big catch? You have to pay 100% of the premium yourself, plus a small administrative fee. This can get incredibly expensive, fast. Your best bet is to talk directly with your HR department to get the hard numbers and see what your options truly are.

Do I Need Medicare at 65 if I Am Still Working?

This all boils down to how big your company is. It's a critical detail.

- If you work for a company with 20 or more employees: You can usually delay signing up for Medicare Part B without getting hit with a late penalty, as long as your employer's plan is your primary coverage.

- If your company has fewer than 20 employees: You almost certainly need to enroll in Medicare Part A and Part B when you turn 65. In this situation, Medicare acts as your primary insurer. If you don't sign up on time, you could be stuck with lifelong penalties and major gaps in your coverage.

Crucial Takeaway: The "20 employee rule" is a make-or-break detail. Getting this wrong can lead to permanent, costly penalties. Always double-check with your benefits administrator to confirm your company’s size before you decide.

What Happens if I Move to Another State?

Whether your health plan can pack up and move with you depends entirely on what kind of coverage you have.

If you have Original Medicare paired with a Medigap plan, you're in great shape. Your coverage is nationwide. You can see any doctor or go to any hospital in the U.S. that accepts Medicare, no problem.

On the other hand, if you have a Medicare Advantage plan (like an HMO or PPO), your coverage is locked to a specific geographic service area. Moving out of that area counts as a qualifying life event, which gives you a Special Enrollment Period to pick a new plan available in your new state.

Planning for retirement has enough moving parts. Finding the right health coverage shouldn't add to the stress. At My Policy Quote, we specialize in making insurance clear and simple, helping you find affordable options that fit your life. Explore your personalized quotes today and get the peace of mind you deserve.

Article created using Outrank