The big question: HSA vs HRA. What’s the real difference? It all boils down to one simple thing: ownership.

Think of it like this: a Health Savings Account (HSA) is your personal health savings account that you own and control. It’s your money. A Health Reimbursement Arrangement (HRA), on the other hand, is an account your employer owns and funds to help you with medical costs. It’s their money, set aside for you.

This single distinction changes everything.

Understanding the Core Differences Between HSA and HRA

When you’re weighing an HSA against an HRA, who owns the account is the first and most important piece of the puzzle. It determines where the money comes from, what happens if you switch jobs, and whether you can build long-term wealth.

An HSA is like a 401(k) for your healthcare. It’s an asset you own, and it grows with you over time. An HRA is more like a company expense account—a valuable perk, for sure, but it’s a benefit tied to your job, not a personal asset.

This is why the initial comparison matters so much. While both accounts help you pay for healthcare, they’re built for entirely different purposes.

HSA vs HRA Key Features at a Glance

To cut through the noise, this table lays out the fundamental differences side-by-side. It’s a quick-reference guide to how each account handles the things that matter most: ownership, contributions, and flexibility.

| Feature | Health Savings Account (HSA) | Health Reimbursement Arrangement (HRA) |

|---|---|---|

| Account Ownership | You (the employee) own the account. | Your employer owns the account. |

| Who Can Contribute | You, your employer, or anyone else. | Only your employer can contribute. |

| Portability | Yes, the account goes with you if you leave your job. | No, you typically forfeit the funds when you leave. |

| Fund Rollover | Yes, funds roll over year after year indefinitely. | Varies; the employer decides if funds roll over. |

| Investment Potential | Yes, funds can be invested for tax-free growth. | No, funds cannot be invested. |

| Eligibility | Must be enrolled in a High-Deductible Health Plan (HDHP). | Determined by the employer's plan design. |

This table makes the core trade-offs clear. You get more freedom and long-term potential with an HSA, but HRAs can offer great immediate benefits without requiring a specific type of health plan.

The simplest way to think about it is this: An HSA is a savings tool you control for life, while an HRA is a reimbursement benefit tied to your current job.

Getting these basics right is everything. An HSA gives you a powerful, portable savings vehicle that can even become a key part of your retirement strategy. An HRA is a helpful tool for right now, but it offers less freedom and no potential for long-term financial growth. It’s a benefit, not a nest egg.

How a Health Savings Account (HSA) Works

A Health Savings Account (HSA) isn't just a simple way to cover medical bills. Think of it as your own personal healthcare savings and investment tool—one that you completely own and control. It’s a powerful financial account loaded with tax benefits, designed to give you the reins when it comes to managing healthcare costs. This account belongs to you, not your employer.

The main requirement to open and fund an HSA is being enrolled in a qualified High-Deductible Health Plan (HDHP). An HDHP usually comes with lower monthly premiums, but you'll pay more out-of-pocket for medical costs before the insurance kicks in. This trade-off is precisely what makes pairing it with an HSA so effective when you compare HSA vs HRA options.

The Famous Triple Tax Advantage

The most celebrated feature of an HSA is something almost no other savings account can offer: a unique triple tax advantage. This three-part benefit makes every single dollar you contribute work that much harder for you.

Here’s the breakdown:

- Tax-Deductible Contributions: The money you put into your HSA is tax-deductible, which directly lowers your taxable income for the year. If your employer chips in, those funds are pre-tax, too.

- Tax-Free Growth: Your HSA funds can be invested in things like mutual funds or stocks. Any interest or earnings grow completely tax-free.

- Tax-Free Withdrawals: You can pull money out anytime to pay for qualified medical expenses without owing a dime in taxes.

This powerful combination creates a cycle of savings and growth, letting you build a serious healthcare nest egg over time. It’s really a strategic financial tool disguised as a health benefit.

Contribution Limits and Catch-Up Rules

The IRS sets annual limits on how much you can put into your HSA. These limits get adjusted for inflation and are different depending on whether you have individual or family coverage.

For 2024, the limits are $4,150 for self-only HDHP coverage and $8,300 for family HDHP coverage. That’s the total allowed from all sources, including contributions from you and your employer.

A huge plus for those getting closer to retirement is the catch-up contribution. If you're age 55 or older, you can put in an extra $1,000 a year on top of the standard limit.

This extra contribution is a golden opportunity to boost your savings right when you need it most, as healthcare costs often climb in retirement. It's a critical feature to weigh when looking at an HSA vs HRA for your long-term plans.

You Own It Forever

Maybe the most important thing to know about an HSA is its portability. Because the account is yours, it’s not tied to your job. If you switch employers, lose your job, or retire, the HSA and all the money in it stay with you.

This is a massive difference from an HRA, where the funds belong to the employer and are usually lost if you leave. With an HSA, your money rolls over year after year and is yours for life. This ownership transforms the account from a simple benefit into a lasting financial asset you can use for a huge range of health-related costs. If you want to dive deeper into qualified expenses, learn more about what you can use your HSA for in our detailed guide.

Even better, after age 65, you can withdraw funds for non-medical reasons and only pay regular income tax on them—just like a traditional 401(k).

Understanding Health Reimbursement Arrangements (HRA)

While an HSA feels like a personal savings account, a Health Reimbursement Arrangement (HRA) is more like a promise from your employer. Think of it as a formal account your company sets up and funds specifically to pay you back for qualified medical expenses. This is where the HSA vs HRA comparison gets really clear: the HRA is 100% funded and owned by your employer.

You, as the employee, cannot contribute your own money to an HRA. It’s purely an employer-funded benefit. This gives companies a straightforward way to help with healthcare costs without the hassle of a full-blown group health plan. To see how this works in practice, it helps to understand the basics of any expense reimbursement policy.

Different Types for Different Needs

Not all HRAs are the same. Employers have a lot of leeway in how they design them, meaning the rules, limits, and what you can spend the money on can vary quite a bit. This flexibility lets businesses create a benefit that fits their unique size and budget.

Here are the main types you’re likely to come across:

- Qualified Small Employer HRA (QSEHRA): Built for businesses with fewer than 50 full-time employees. It gives smaller companies a way to offer a monthly allowance for employees to purchase their own health insurance and cover other medical bills.

- Individual Coverage HRA (ICHRA): Open to employers of any size, an ICHRA reimburses employees for their individual health insurance premiums and other medical costs. It’s incredibly flexible, allowing employers to offer different amounts to different types of employees (like salaried vs. hourly).

- Group Coverage HRA (GCHRA): You’ll often hear this called an "integrated HRA" because it’s paired with a company’s traditional group health plan. Its job is to help employees cover the out-of-pocket costs the main plan doesn't, like deductibles and copays.

It’s so important to know which HRA your employer offers, because the rules for each are very different. If you want to dive deeper, our guide on what an HRA is breaks down how each one works.

The Critical Issue of Portability

Here’s one of the biggest downsides to an HRA: it’s not portable. Because your employer owns the account and all the money in it, you can't take it with you when you leave your job. In almost every situation, you lose whatever balance is left the day your employment ends.

This is a massive difference from an HSA, which is your personal asset for life, no matter where you work. The "use it or lose it" reality of an HRA (when you switch jobs) makes it a poor choice for long-term savings.

The core limitation of an HRA is its direct tie to your current employer. The funds are a benefit for your tenure, not a lasting financial asset you can build upon over your career.

Rollover Rules Are Up to the Employer

Just like portability, the rules for rolling over unused funds from one year to the next are completely up to your employer. They can decide to let you carry over some or all of your leftover HRA money, or they can enforce a policy where you forfeit everything at the end of the year.

This makes planning for the future tough. With an HSA, you have the guarantee that your entire balance rolls over, year after year, allowing it to grow. With an HRA, that security just isn't there, cementing its role as a temporary, job-specific perk rather than a permanent savings tool.

HSA vs. HRA: Who Really Controls Your Healthcare Dollars?

Once you get past the definitions, the real differences between an HSA and an HRA start to hit home. This isn't just about picking a health plan; it’s about choosing a financial strategy. The core of the debate boils down to control, flexibility, and your long-term financial freedom.

The biggest distinction always comes back to a simple question: who's in the driver's seat? With an HSA, you are. It's your asset. With an HRA, your employer holds the keys, offering you a benefit that’s tied directly to your job.

Ownership: The Ultimate Dealbreaker

This is where HSAs and HRAs go in completely opposite directions. An HSA is a personal bank account that you own, period. It doesn’t matter if you, your boss, or even your grandma puts money in it—those funds are 100% yours, always.

That means if you quit, get laid off, or start your own business, the HSA comes with you. It’s a permanent part of your financial life, a portable nest egg that follows you from one chapter to the next. For anyone facing career uncertainty or planning for the long haul, this is a massive advantage.

An HRA is built on a totally different foundation. Your employer owns the account and every dollar in it. Think of it as a reimbursement arrangement, not a savings account. When you leave your job, you almost always lose whatever is left in the account. That lack of portability makes it impossible to build any real long-term savings you can count on.

The core difference is simple but profound. An HSA is a lifelong financial asset you build for yourself. An HRA is a temporary workplace benefit your employer provides.

Who Puts Money In, and How Much?

The rules around contributions really shine a light on the strategic differences here. An HSA is incredibly flexible. You can fund it yourself with pre-tax payroll deductions, your employer can kick in money, and even family members can contribute on your behalf.

This gives you the power to really build up your savings. For 2024, the contribution limit is $4,150 for an individual and $8,300 for a family. In 2025, those numbers climb to $4,300 and $8,550—a serious opportunity to create a healthcare safety net.

HRAs are funded only by the employer. You can't contribute a single penny of your own money. The total amount available is decided by your company, which sets its own annual limit (though some types, like a QSEHRA, have specific rules). This setup gives your employer total control over the benefit, but it means you have zero ability to beef up the account on your own.

The Power of Portability: Your Money Follows You

Portability is probably the HSA's biggest superpower. Because you own it, the account is never chained to your job. This is a game-changer for freelancers, gig workers, and anyone who plans on making a career move. Your HSA balance just rolls over, year after year, growing without any "use-it-or-lose-it" pressure.

HRAs, on the other hand, are stuck. The funds are tied to your employer, and when you leave, the money stays behind. Rollover rules are also up to the company. Some might let you carry over unused funds, but many don't, which can create a scramble to spend it all before the plan year ends.

A quick but critical reminder: to open and contribute to an HSA, you must be enrolled in a High-Deductible Health Plan (HDHP). This is a key piece of the puzzle, as the lower premiums of an HDHP are designed to help you save more in your tax-free account. You can learn more about what constitutes an HDHP in our guide.

Investment Growth: The Real Game-Changer

Here’s where the HSA leaves the HRA in the dust. Once your HSA balance hits a certain minimum (usually around $1,000), you can invest it. We're talking mutual funds, stocks, and other assets, just like a 401(k). This turns your healthcare savings into a growth engine.

This investment feature transforms an HSA from a simple spending account into a powerful retirement tool. Over decades, those invested funds can compound tax-free, creating a massive nest egg to cover healthcare in retirement—which for many people is their single largest expense. An HRA has zero investment potential. The money just sits there as a cash balance.

This isn't just theory. When people have control over their healthcare funds, they tend to make smarter choices. Research shows that people with HSAs reduced their total medical spending by 5-7% and their pharmacy costs by 6-9% in the first year alone compared to those in traditional plans. The financial ownership an HSA provides encourages more thoughtful and effective healthcare decisions.

When you line them up on these key points, the choice becomes pretty clear. An HSA gives you ownership, flexibility, portability, and growth—making it a vital tool for long-term financial security. An HRA is a nice perk for immediate needs, but it's a limited, employer-controlled benefit that just can't compete.

Which Account Is Right for Your Situation

Choosing between an HSA and an HRA is more than just a numbers game. It's about finding the right tool for where you are in life. Your job, your family, your retirement goals—they all play a huge role in which account makes the most sense.

To really nail this decision, you have to look past the technical definitions. Let’s walk through a few common situations to see how these accounts work in the real world.

Scenario One: The Self-Employed Professional

Picture yourself as a freelance consultant or a 1099 contractor. You don't get a benefits package from an employer, and your income can swing from month to month. In your world, control and tax savings are everything.

Here, the Health Savings Account (HSA) is the hands-down winner. You pair it with a High-Deductible Health Plan (HDHP) you buy for yourself, and suddenly you have your own personal healthcare hub. You own it, you decide how much to contribute, and every single dollar you put in lowers your taxable income—a massive advantage when you're your own boss.

For anyone in the gig economy or running their own business, an HSA delivers something an HRA simply can't: total control. It's a portable, tax-advantaged account that travels with you, no matter what your career looks like.

An HRA isn't even on the table here, since it’s an employer-funded benefit. The HSA puts you in the driver's seat, letting you build a healthcare fund you can invest, grow, and take with you anywhere.

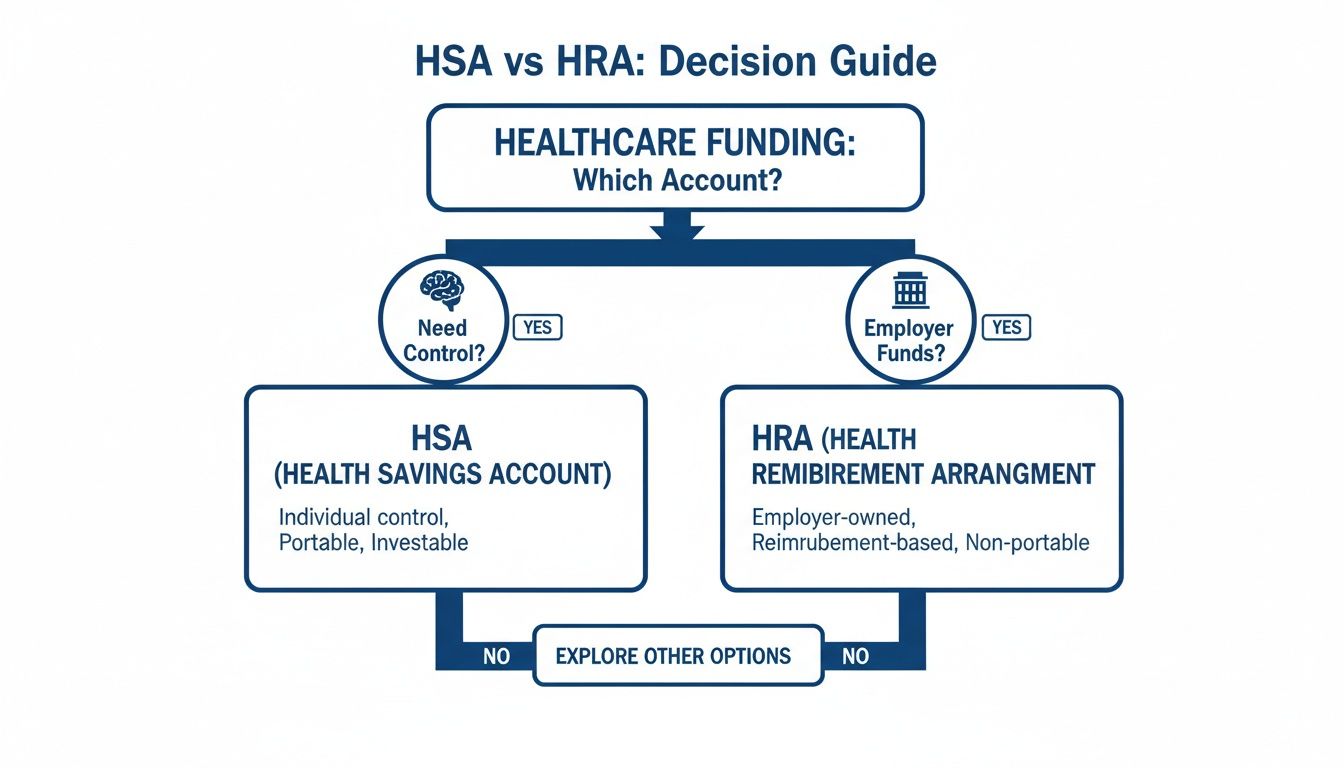

This decision tree breaks down the core choice: do you want personal control or to use employer funds?

As the flowchart shows, if personal ownership and long-term savings are your priority, the HSA is the way to go. If you’re looking to use a benefit funded entirely by your job, the HRA is the logical path.

Scenario Two: The Early Retiree or Pre-Medicare Adult

Now, think about someone who’s 62. They just retired and need to cover their healthcare costs for a few years until Medicare kicks in at 65. They’re healthy but want a solid financial cushion for whatever comes their way.

Again, the HSA proves to be the smarter strategic play. If they’ve been funding an HSA for years, it’s now a powerful retirement account. They can pull money out tax-free to cover medical bills, pay for COBRA, or even fund long-term care insurance premiums.

Even after they sign up for Medicare (which means they can no longer contribute), the money in their HSA is still theirs to use. It can pay for Medicare Part B and D premiums, deductibles, or anything else Medicare doesn't cover. An HRA, on the other hand, is tied to their old job and would be long gone, leaving them to pay for everything themselves.

There is a special type of HRA called an Individual Coverage HRA (ICHRA) that a former employer might offer to retirees, but it's not very common. You can learn more about what an ICHRA is and how it works if you think this might apply to you.

Scenario Three: The Working Family with Stable Employment

Let’s shift to a family of four. Both parents have jobs with good benefits. Their biggest challenge is managing the constant costs of raising kids—doctor visits, braces, and the inevitable trip to the ER.

For them, the choice gets a bit more interesting and really depends on what their employers are putting on the table.

If the company offers a generous HRA: This can be a fantastic, set-it-and-forget-it perk. The employer puts money in the account to help the family cover their deductible and other out-of-pocket costs. It’s a simple, direct way to lower their medical spending without any effort on their part.

If the company offers an HDHP with an HSA match: This is often the more powerful choice for the long run. The family can put their own pre-tax money into the HSA, get a company match, and build a serious medical savings fund. Anything they don't spend just rolls over and can be invested, turning it into a growing asset for the future.

So, what's the verdict? If the family needs immediate help with today's bills, an HRA is a great solution. But if they're looking to build long-term financial security, an HSA offers flexibility and growth potential that an HRA can't touch. It all comes down to their goals: short-term relief or long-term wealth.

HSA vs. HRA: Your Questions, Answered

Even after comparing the two, you probably still have a few questions. That’s normal. These accounts have specific rules that can feel confusing, especially when your life or job changes.

Let’s clear things up with straightforward answers to the questions we hear most often.

Can I Have Both an HSA and an HRA?

It’s a great question, but the answer is usually no. If your employer gives you a standard, general-purpose HRA that covers all your medical expenses, you’re out of luck for an HSA. The IRS sees that HRA as "other health coverage," which immediately disqualifies you from contributing to a Health Savings Account.

But there’s a little more to it. A couple of special HRA types are designed to work with an HSA:

- Limited-Purpose HRA: This kind only pays for specific things, like dental or vision. Since it doesn’t touch your general medical bills, it doesn’t mess with your HSA eligibility.

- Post-Deductible HRA: This one only kicks in after you’ve met your high-deductible health plan’s minimum deductible.

The bottom line? You absolutely have to read the fine print on your employer's HRA. Its specific design is the only thing that determines if you can pair it with an HSA.

What Happens to My HSA When I Get on Medicare?

This is where the HSA really shines as a retirement planning tool. The day you enroll in Medicare (usually at age 65), you can’t put any more money into your HSA. But the account doesn’t just disappear—it transforms.

All the money you’ve saved over the years is still yours. Better yet, you can pull it out completely tax-free to cover a whole host of qualified medical costs, including:

- Medicare Part B and Part D premiums

- Your Medicare deductibles and copays

- Premiums for qualified long-term care insurance

This makes an HSA a fantastic way to pay for healthcare in retirement, something an HRA just can’t do. Once you leave your job, that HRA money is gone for good.

The moment you sign up for Medicare, your HSA shifts from a savings vehicle to a spending tool. It becomes a dedicated, tax-free fund to cover the healthcare costs that Medicare doesn't.

Are All HRAs Basically the Same?

Not even close. This is one of the biggest points of confusion when comparing an HSA vs. HRA. While every HSA in the country follows the same federal rules for contributions, rollovers, and portability, HRAs are the Wild West.

Your employer designs the HRA and makes up the rules. That means the details can be wildly different from one company to the next.

- How much you get: The employer decides the annual contribution amount.

- If funds roll over: They decide if you can keep unused money for next year.

- What it covers: They can even restrict which expenses are eligible for reimbursement.

This is why you must read your company’s plan documents. The rules for your HRA are specific to your job, unlike the universal rules that govern every single HSA.

What if a Medical Bill Is Bigger Than My Account Balance?

Simple: you have to pay the difference out of your own pocket. If you have an HRA, your benefit is capped at whatever your employer put in. Once that money is spent, it’s gone.

But an HSA gives you a powerful strategic option here. Let’s say a big bill wipes out your HSA balance. You can pay for the rest with your own money and then—here’s the magic—reimburse yourself from your HSA years or even decades later.

This lets your invested HSA funds keep growing tax-free, effectively turning a medical expense into a long-term investment opportunity. It's a savvy move that’s completely impossible with an HRA.

Navigating the world of health insurance can be complicated, but you don't have to do it alone. At My Policy Quote, we specialize in finding the right coverage that fits your life and budget. Explore your options and get a personalized quote today at mypolicyquote.com.