Yes, COBRA insurance is almost always expensive. The sticker shock is real.

You suddenly go from paying a small fraction of your health insurance premium to covering 100% of the cost your employer was heavily subsidizing—plus a little extra.

Why COBRA Insurance Costs So Much

When you leave a job, that financial safety net your employer provided for health insurance vanishes. The key to understanding why COBRA feels so expensive is realizing that the small deduction from your paycheck was just the tip of the iceberg.

Your employer was likely paying the lion's share of the total premium behind the scenes. With COBRA, you inherit that entire bill.

The Hidden Costs You Now Pay

Think of it like a restaurant meal where your company always picked up 80% of the check. All you ever saw was your 20% portion. Suddenly, you're responsible for your original 20% plus their 80%.

On top of that, COBRA allows the plan administrator to tack on a 2% fee just for managing your account. It's this one-two punch that makes the monthly cost feel so overwhelming.

The core reason for the expense is simple: the employer subsidy is gone. You are now covering the full group rate premium, which was previously invisible to you as an employee.

COBRA can be a real financial strain, especially for self-employed professionals and 1099 contractors who are used to managing their own benefits. To put it in perspective, in 2023, employers covered an average of $7,034 annually for individual plans and a staggering $17,393 for family coverage.

Once you elect COBRA, you're on the hook for that full amount plus the 2% fee. This means monthly bills often fall between $400 to $700 for an individual and can easily soar past $1,997 for a family. You can discover more insights about COBRA premium averages to see how these costs break down.

To make this shift crystal clear, let's look at a side-by-side comparison.

Cost Shift at a Glance: Employer Plan vs. COBRA

This table illustrates the dramatic change in who pays for what when you move from your old job's health plan to COBRA coverage.

| Cost Component | Your Cost (Employer Plan) | Your Cost (COBRA Plan) |

|---|---|---|

| Employee's Share | Typically 20-30% of total premium | 100% of total premium |

| Employer's Share | Typically 70-80% of total premium | $0 (No contribution) |

| Administrative Fee | $0 | Up to 2% of the total premium |

As you can see, the financial responsibility flips entirely onto you. That generous employer contribution disappears, leaving you to shoulder the entire premium and an administrative fee.

Why You Pay So Much More for COBRA Insurance

Ever gotten your first COBRA bill and felt a wave of sticker shock? You’re not alone. To understand why the price is so much higher than what you’re used to, you have to peek behind the curtain of how your old health plan was funded.

Think of it like splitting a really expensive dinner bill with a generous friend. While you were working, you paid your small share (your premium deduction), and your employer picked up the rest of the tab—often the biggest part. With COBRA, your friend has left the table, and the entire check is now yours.

The Three Parts of Your New Premium

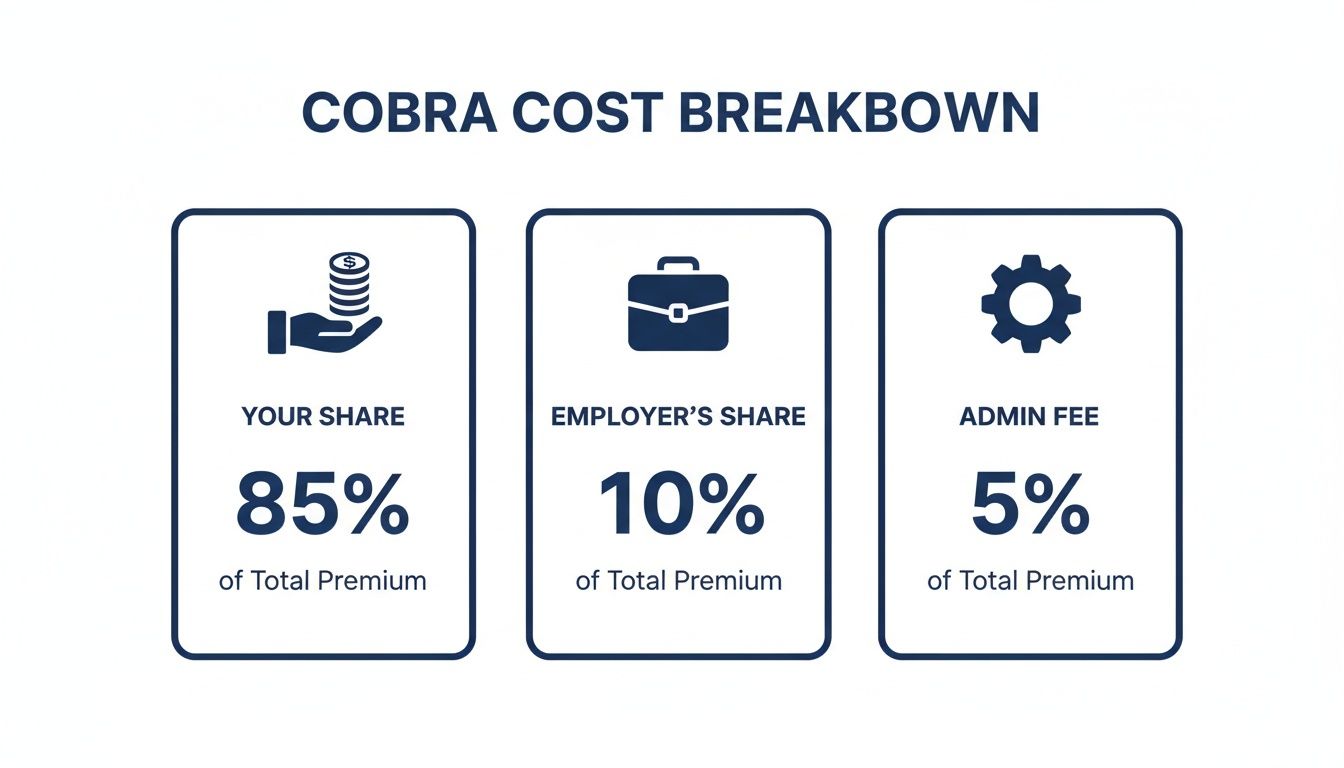

That new, higher COBRA premium isn't just one big number; it’s actually made of three separate pieces. Understanding them shows you exactly where the money is going.

- Your Original Share: This is the part you already know—the amount that used to come out of your paycheck.

- The Employer's Share: This is the game-changer. It’s the large chunk your employer was quietly contributing on your behalf, which now falls to you.

- A 2% Administrative Fee: The law lets the plan administrator add a small 2% fee to cover the cost of managing your COBRA account.

Suddenly, you’re seeing the true, unsubsidized cost of that group health plan. Our article on what is employer-sponsored health insurance dives deeper into how these employer contributions work.

Seeing the Subsidy Disappear

This financial shift hits hard, especially when a job loss creates uncertainty. The full weight of a COBRA premium reveals just how much support an employer’s plan provides. For example, back in 2019, the total annual cost for coverage averaged $7,012 for a single person and a whopping $20,599 for a family.

Before, you only paid a small piece of that. With COBRA, you’re on the hook for up to 102% of the entire cost.

The core reason COBRA feels so expensive is sticker shock. You're transitioning from paying a small, subsidized portion of your health insurance to shouldering the entire premium that your employer once heavily supported.

In practice, this means your monthly payments can skyrocket. For 2026, estimates show costs jumping to $400-$700 for an individual and $2,000-$3,000 for a family. It’s the exact same plan, with the same doctors and benefits you had before. The only thing that’s changed is you’re now covering the bill alone, without the silent financial partner you once had.

How COBRA Costs Compare to Other Health Insurance Options

Getting that first COBRA notice can feel like a shock. The price tag is high, but the idea of losing your doctor and your current health plan is even more unsettling. It’s a classic dilemma.

The good news? COBRA isn't your only path forward. The most common alternative is a plan from the Affordable Care Act (ACA) Marketplace. Understanding how they stack up is the key to protecting both your health and your wallet.

At its core, the choice often comes down to cost versus continuity. COBRA is all about continuity—you keep your exact same plan, doctors, and any progress you've made toward your deductible. The ACA Marketplace, on the other hand, is usually the more affordable route, thanks to financial help based on your income.

COBRA vs. ACA Monthly Premiums

The first thing you'll notice is the sticker shock from the monthly premium. With COBRA, you're on the hook for the full, unsubsidized group rate your old company paid, plus a 2% admin fee. It’s a big, fixed number.

ACA Marketplace plans have a powerful tool that COBRA lacks: premium tax credits, also known as subsidies. These credits are tied to your estimated income for the year. If you've just lost your job, your income is likely way down, which means you could qualify for serious financial aid that slashes your monthly payments.

The infographic below breaks down exactly why your COBRA premium is so much higher than what you're used to paying.

As you can see, you’re now covering your share, the much larger chunk your employer used to pay, and that extra administrative fee on top.

Comparing Network Access and Plan Benefits

This is where COBRA really has an edge. Because you’re keeping the exact same plan, nothing about your coverage changes. You stick with your doctors, specialists, and hospital network. If you’re in the middle of a treatment plan or managing a chronic condition, that stability can be absolutely priceless.

ACA plans mean a fresh start. You’ll be choosing a new plan with a new network. This might mean you have to find a new primary care doctor or check if your specialists are covered. While there are many fantastic ACA plans with great networks, it does take a little homework to make sure your doctors are included. If you need a hand with that, check out our guide on how to compare health insurance plans.

The difference in who uses these plans also tells a story. People with serious health needs often pick COBRA to keep their doctors, which drives up the average cost of care. Back in 2018, the average COBRA enrollee spent $11,695 a year on healthcare. In comparison, workers with employer coverage spent just $6,724.

While an unsubsidized Marketplace plan might look similar in price to COBRA, the subsidies and cost-sharing reductions available for lower-income folks can make ACA plans a much, much more affordable option overall.

COBRA vs ACA Marketplace a Head-to-Head Comparison

To make it even clearer, let's put these two options side-by-side. This table breaks down the most important differences to help you see which one might be a better fit for you right now.

| Feature | COBRA Insurance | ACA Marketplace Plan |

|---|---|---|

| Monthly Cost | Very high; you pay 102% of the total premium. | Can be very low, thanks to income-based subsidies. |

| Keep Your Doctors? | Yes. You keep your exact same network. | Maybe. You must choose a new plan and check its network. |

| Keep Your Plan? | Yes. It’s the same plan you had with your employer. | No. You select a brand new plan from the Marketplace. |

| Financial Help? | No. There are no subsidies available. | Yes. Premium tax credits can significantly lower costs. |

| Deductible | You keep any progress you've made toward your deductible. | Your deductible resets to $0 with a new plan. |

| Best For… | People who need to keep their doctors and can afford the premium. | People who need an affordable monthly premium. |

Ultimately, choosing between COBRA and the ACA Marketplace is a personal decision based on your priorities.

Key Takeaway: The decision really boils down to a simple trade-off. If keeping your doctor and plan is your top priority and you can handle the high cost, COBRA is your answer. If you need to lower your monthly expenses, an ACA Marketplace plan is almost always the smarter financial choice.

Strategies to Manage or Avoid High COBRA Costs

Seeing that first COBRA premium can feel like a punch to the gut. It's easy to feel defeated, but it’s so important to know you have options. Instead of just accepting a cost that breaks your budget, you can make some strategic moves to find coverage that works for you without leaving you unprotected.

The most powerful tool you have is the Special Enrollment Period on the ACA Marketplace. Losing your job-based health insurance is what’s called a “qualifying life event,” and it opens a 60-day window for you to sign up for a brand-new plan, even if it’s outside the normal open enrollment season.

This is a complete game-changer. Why? Because ACA plans come with income-based subsidies. If your income has dropped after leaving your job, you could easily qualify for premium tax credits that make your coverage way more affordable than COBRA. It’s worth exploring different COBRA insurance alternatives to see what fits your new financial reality.

Using the Wait and See Approach

Did you know you don't have to sign up for COBRA right away? The law gives you 60 days just to decide if you want it, and then another 45 days after that to make your first payment. This creates a smart, totally legal strategy you can use.

Here’s how it works: you can hold off on enrolling and paying for up to 105 days. If you stay healthy during that time and don’t need a doctor, you can let the COBRA option expire and save yourself thousands in premiums. Simple as that.

But what if something does happen, like a trip to the ER? No problem. You can retroactively sign up and pay for COBRA. Your coverage will be backdated to the day you lost your old plan, making sure those big bills are covered. It’s a safety net while you figure things out. Preparing for unexpected expenses like these is key, and learning to build a dedicated savings pot through methods like Mastering Formulas for Sinking Funds can make a huge difference in your financial peace of mind.

Finding Other Coverage Options

The ACA Marketplace is fantastic, but it's not the only other path. Other solutions can help bridge the gap.

A common misconception is that COBRA is your only choice for keeping quality coverage. In reality, the 60-day election period is your opportunity to shop around for a plan that aligns with your new financial reality.

Think about these possibilities:

- Short-Term Health Plans: If you just need to cover a brief gap between jobs, these plans can be a low-cost, temporary fix. Just be aware they aren't ACA-compliant, which means they often don't cover pre-existing conditions or essential benefits like maternity care.

- Health Savings Account (HSA): Do you have an HSA from your old job? You can use those tax-free funds to pay your COBRA premiums. This doesn't actually lower the premium, but it gives you a major tax advantage that takes a lot of the financial sting out of the high cost.

When Is Paying for COBRA Worth the High Price?

When you first see the sticker price for COBRA, your gut reaction might be to slam the door on it. It’s expensive—no doubt about it. But in some situations, paying that premium isn’t just a good idea; it’s the smartest strategic move you can make for your health and your finances.

The secret to COBRA’s power is its continuity. It’s not just another health plan. It’s the exact same one you just had. That stability can be priceless when life feels anything but stable.

Think of it like this: if your car is in the middle of a complex engine repair with a mechanic you trust, you wouldn’t tow it to a brand-new shop just because they’re a few bucks cheaper. You’d stick with the expert who already knows what’s going on. The same logic applies to your healthcare.

Critical Moments When COBRA Makes Sense

So, when does it actually make sense to pay for COBRA? It usually boils down to a few key scenarios where changing your insurance could cause more harm—and cost more money—than the high monthly premium.

You're in the Middle of Treatment: This is the big one. If you’re undergoing care for a serious illness like cancer, are pregnant, or managing a chronic condition, keeping your doctors, specialists, and hospital network is non-negotiable. Switching plans mid-treatment could mean starting from scratch with a new medical team.

You've Already Met Your Deductible: Have you already paid hundreds or even thousands toward your annual deductible or out-of-pocket maximum? Sticking with COBRA means you keep all that progress. A new ACA plan would reset your deductible to $0, and you’d have to start paying all over again before your new insurance kicks in.

You Just Need a Short-Term Bridge: COBRA is the perfect gap coverage if you have a new job lined up but there’s a waiting period before your new benefits start. It’s also an excellent, high-quality bridge for anyone just a few months away from becoming eligible for Medicare. If that’s you, our guide on COBRA for retirees could be a huge help.

The decision often comes down to one question: Is the cost of keeping your doctors and your progress worth more than the financial and medical risks of starting over with a new plan?

While the answer to "is COBRA insurance expensive" is almost always a resounding yes, its true value isn't just measured in dollars. It's measured in uninterrupted care, peace of mind, and financial predictability right when you need it most.

A Few More Questions About COBRA Costs

Diving into the world of COBRA can feel like a lot, especially when you're in the middle of a job change. Even after you get the big picture, a few specific questions always seem to pop up. Let's clear up some of the most common ones right now.

My goal here is to get rid of any lingering confusion so you can feel totally confident in your healthcare decisions. I'll give you straight, practical answers to help you move forward.

Can I Get a Refund if I Cancel COBRA?

This is a big one. The short answer is no, COBRA premium payments are generally not refundable. Once you’ve paid for a month of coverage, that payment is considered final, even if you find new insurance and cancel before the month is over.

It’s best to think of it like a monthly subscription service. You pay for access for the full period, regardless of how much—or how little—you end up using it. That’s why it’s so critical to be sure before you send in that first payment.

What Happens if I Miss a COBRA Payment?

Missing a payment can have some pretty serious consequences, so you’ll want to be careful here. You typically get a grace period, which is often 30 days from your payment's due date.

But if you miss that grace period window, your COBRA coverage will be terminated for good. You can’t just sign back up, and losing your coverage this way usually doesn't qualify you for a Special Enrollment Period on the ACA Marketplace.

Am I Locked In for the Entire 18 Months?

Absolutely not. This is a common misconception. You can cancel your COBRA coverage at any point—you're never obligated to keep it for the full 18 months (or longer, depending on your situation).

For instance, maybe you just need to cover a two-month gap before your new job’s benefits kick in. You can simply elect COBRA, pay the two monthly premiums, and then let the plan administrator know you’re terminating your coverage. That flexibility is one of its most useful features.

At My Policy Quote, we know these decisions aren't easy. We're here to help you lay out all your options side-by-side, from sticking with COBRA to finding a new plan on the ACA Marketplace. We want you to find coverage that truly protects your health and your wallet.

Ready to see what's out there? Explore your personalized insurance options at https://mypolicyquote.com.