For most families, the biggest question about life insurance is a simple one: Will my loved ones have to pay taxes on the money? The good news is that in most cases, the life insurance death benefit payout is received completely income tax-free.

This is a core feature of life insurance. It’s designed to provide peace of mind, ensuring your beneficiaries get the full amount you intended for them without the IRS taking a cut. But, as with anything involving taxes, there are a few situations where things can get more complicated.

Your Quick Guide to Life Insurance Taxation

Life insurance often feels like a straightforward promise, but how it interacts with the tax code isn’t always cut and dry. While the main payout to your family is typically shielded from income tax, other parts of a policy can create taxable events, especially while you're still living.

Think of it like this: the death benefit is a tax-free gift to your loved ones. Simple enough. However, if you start tapping into a permanent policy's cash value like a personal savings account, the IRS might start paying attention. Accessing that cash, selling the policy, or even just having a very large estate can introduce tax wrinkles you need to know about.

Common Life Insurance Tax Scenarios

To get a clear picture, let's break down the different ways you might interact with a life insurance policy and what the tax outcome usually looks like.

- Death Benefit Payout: As we covered, this is almost always received by beneficiaries 100% income tax-free. It's the most straightforward part.

- Cash Value Growth: The cash value inside a permanent policy grows on a tax-deferred basis. That means you aren’t paying taxes on the gains year after year as they build up.

- Policy Loans: You can generally borrow against your cash value up to the amount you've paid in premiums (your "cost basis") without it being a taxable event.

- Policy Surrender: If you decide to cancel or "surrender" your policy for its cash value, any money you receive that's more than your cost basis is considered a gain. This is taxable as ordinary income.

- Estate Taxes: This is a big one. If you personally own the policy when you pass away and your total estate is large enough, the death benefit can be included in your estate's value. This could potentially trigger federal or state estate taxes. This is why even a well-planned policy for someone who needs life insurance without a will could face tax issues if the ownership isn't structured correctly.

This guide will dive into each of these scenarios, but the table below gives you a quick reference for the key events.

Quick Guide to Life Insurance Taxation

To make it easier, here's a simple breakdown of the most common life insurance events and their tax implications.

| Life Insurance Event | General Tax Treatment | What You Need to Know |

|---|---|---|

| Death Benefit Received | Tax-Free | Beneficiaries generally do not pay income tax on the payout. |

| Cash Value Growth | Tax-Deferred | Gains are not taxed annually as they accumulate. |

| Policy Surrender | Potentially Taxable | Gains above your premium payments (cost basis) are taxed. |

| Policy Loans | Generally Tax-Free | Loans are not taxed as long as the policy remains in force. |

| Estate Inclusion | Potentially Taxable | The death benefit may be subject to estate tax if you own the policy. |

Understanding these basics is the first step in using your life insurance not just for protection, but as a smart financial tool.

Why the Death Benefit Is Usually Tax-Free

Here’s the single most powerful feature of life insurance: it delivers a financial lifeline to your loved ones without creating a new tax headache for them. When your beneficiary gets that life insurance payout, the money is almost always 100% income tax-free. This isn’t some clever loophole; it’s a core principle baked right into the U.S. tax code.

The IRS generally doesn’t treat a life insurance death benefit as "income." It’s more like a transfer of an asset you already paid for. Think of it like a safety deposit box you’ve been filling for years. When your heir finally opens it, they’re receiving the contents, not a paycheck.

This idea is officially captured in Internal Revenue Code (IRC) Section 101(a). It clearly states that amounts paid out "by reason of the death of the insured" don't count as gross income. Simple as that.

The Logic Behind the Tax-Free Rule

The government didn't make this rule by accident. It sees life insurance as a tool for social good—a way to keep families on their feet after losing someone they depend on. It’s a financial backstop that helps cover mortgages, bills, and everyday needs.

Taxing that support system would completely defeat the purpose.

Imagine a family gets a $500,000 death benefit to pay off the house and fund college. If that money were taxed like a salary, they could easily lose a massive chunk, putting their financial future at risk right when they’re most vulnerable. The tax-free rule ensures every dollar you intended for them gets where it needs to go.

This protection holds up no matter who the beneficiary is:

- A spouse who needs to cover living expenses and pay off debts.

- An adult child receiving an inheritance to build their own future.

- A business partner using the funds to keep the company running.

The tax-free death benefit isn’t just a nice perk—it's the core promise of life insurance. It guarantees your financial safety net works exactly as planned, delivering the full amount without the IRS taking a slice.

Putting It Into Practice

Let’s make this real. A self-employed contractor has a $750,000 term life policy and names his wife as the only beneficiary. After he passes away unexpectedly, she files a claim.

The insurance company sends her a check for the full $750,000. She doesn’t have to report a dime of it as income on her tax return. It’s her money, free and clear, to use for the mortgage, the kids' education, and to replace the income her husband provided. The life insurance tax rules were designed for this exact situation.

This simple, tax-free transfer is what gives so many people peace of mind. It lets you know, with certainty, the exact amount of support you’re leaving behind—a reliable and powerful legacy for your family.

How Cash Value Grows Without an Annual Tax Bill

Permanent life insurance is much more than just a safety net for your loved ones; it comes with a powerful savings feature called cash value. And one of its biggest perks is how that cash value grows: tax-deferred. This single benefit can supercharge your long-term financial strategy.

Think of it like a 401(k) or an IRA. As your money grows inside the policy year after year, you don’t get a 1099 from the IRS for the gains. This lets your investment compound without the annual drag of taxes, allowing it to build momentum over time. It’s this quiet, uninterrupted growth that makes life insurance such a smart financial tool.

Because of its tax-deferred status, permanent life insurance is a go-to for people looking to build another retirement asset, fund a business, or just create a flexible emergency fund. The money just works for you in the background, growing into a substantial resource.

The Power of Tax-Deferred Compounding

The idea behind tax-deferred growth is simple but incredibly effective. Since you aren't paying taxes on interest, dividends, or market gains each year, every penny stays in your policy to earn even more. It’s like a snowball rolling downhill—it gathers more snow and gets bigger, faster, because nothing is slowing it down.

Let's break it down:

- Scenario A (A Taxable Account): You put money in a regular brokerage account. Every year, you owe taxes on your gains, which shrinks the total amount you have left to reinvest for the next year.

- Scenario B (Life Insurance Cash Value): Your money grows inside the policy, and those gains aren't taxed annually. The full amount keeps compounding, which can lead to much bigger growth over the long haul.

This tax treatment is a key reason why life insurance companies can offer competitive returns alongside financial security. Insurers use this tax-deferred growth to strengthen their own portfolios, which in turn helps bolster returns for policyholders. For example, when Globe Life Inc. reported a $61.5 million income tax expense on $316.1 million in pretax income for Q1 2025, it gave a peek into how these tax dynamics work at a massive scale. Their performance was backed by a fixed maturity portfolio yielding a 5.25% taxable equivalent, showing how insurers manage assets to benefit their clients. You can read more about Globe Life's financial performance and its implications for policyholders.

Accessing Your Cash Value Without Taxes

Growth is only half the story; access is the other. The real magic of a permanent life insurance policy is that you can often tap into your cash value without triggering a tax bill. The main way to do this is through a policy loan.

The ability to borrow against your cash value, generally tax-free, transforms your life insurance policy from a simple death benefit into a flexible, living asset you can use throughout your life.

When you take a loan, you aren't actually withdrawing your money. Instead, the insurance company is lending you money and using your cash value as collateral. As long as your loan doesn't exceed what you've paid in premiums (your "cost basis"), the money you receive isn't considered taxable income.

This opens up a world of possibilities:

- Supplementing your retirement income, especially in down market years.

- Helping pay for a child's college tuition.

- Making a down payment on a new home.

- Covering an unexpected medical emergency or a business expense.

Now, it’s important to remember that policy loans do charge interest. If you don't pay them back, the outstanding balance will be subtracted from the final death benefit. But for those who manage them wisely, they offer a liquid source of cash with incredible life insurance tax advantages. To see a detailed breakdown, check out our guide on life insurance with a savings component. This combination of tax-advantaged growth and access is what makes permanent life insurance such a versatile tool for building and protecting your wealth.

When Your Life Insurance Creates a Tax Bill

Life insurance gets a lot of praise for its powerful tax advantages, but those benefits aren't set in stone. It’s critical to know the specific situations where a policy can flip from a tax-free asset to a source of taxable income.

These scenarios usually don't involve the death benefit itself. Instead, they pop up based on how you use the policy while you’re alive.

Getting these rules wrong can lead to surprise tax bills that chip away at the wealth you worked so hard to build. Let's walk through the most common events that can trigger a life insurance tax bill.

Surrendering Your Policy for Its Cash Value

One of the most common taxable events happens when you decide you no longer need your permanent life insurance and choose to surrender it. This means you’re canceling the policy and taking its accumulated cash value in return. If the cash you receive is more than the total premiums you've paid, that profit is a taxable gain.

It helps to think of it like selling a stock. The money you put in is your cost basis. Anything you get back over that amount is considered profit, and the IRS will tax it as ordinary income.

For example, say you paid $40,000 in premiums over 20 years, and your policy's cash value has grown to $55,000. If you surrender it, you'll get a check for $55,000, but that $15,000 difference is a taxable gain you’ll need to report on your tax return.

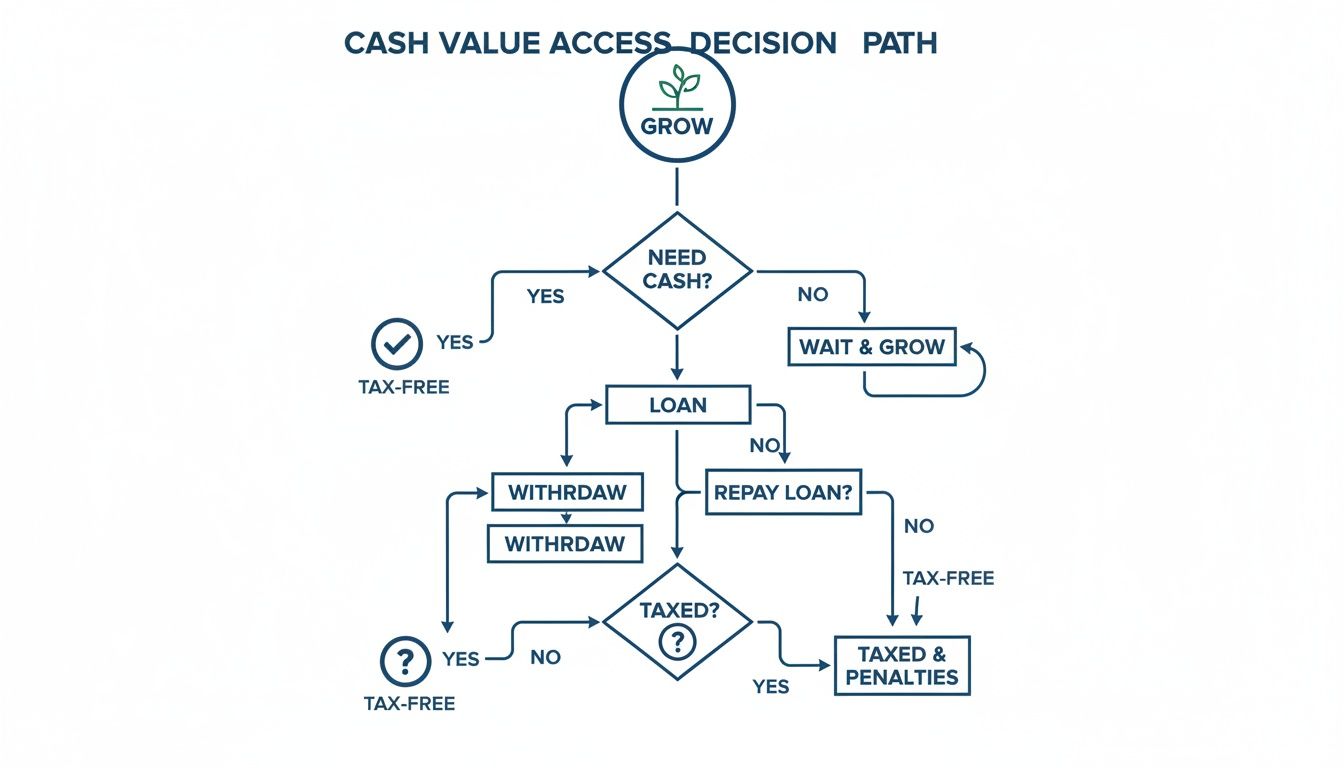

This decision path is where most people get tripped up. The flowchart below maps out the typical tax outcomes when you access your cash value.

As you can see, taking a policy loan is generally tax-free. But a full surrender can create a tax headache if you have gains.

The Transfer-for-Value Rule Explained

Another tricky area is the transfer-for-value rule. This IRS rule kicks in if a life insurance policy is sold or transferred to someone else for something of value. When that happens, the death benefit usually loses its income-tax-free status.

The IRS put this rule in place to stop people from trading policies like speculative investments. If a policy gets sold, the new owner can generally only exclude an amount equal to what they paid for the policy plus any future premiums they pay. The rest of the death benefit becomes taxable income.

Important Note: There are some key exceptions, like transfers to the insured person, a business partner, or a corporation where the insured is a shareholder. Still, it's a critical rule to know, especially for business succession planning.

When Interest on a Payout Is Taxable

While the death benefit itself is usually tax-free, any interest earned on that money is not. This often comes up when a beneficiary chooses not to take the payout as one lump sum.

Many insurance companies let beneficiaries receive the death benefit in installments over time. In that scenario, the insurer holds onto the principal and pays it out on a schedule. The money sitting with the company earns interest, and that interest portion of each payment is taxable as ordinary income.

- Lump-Sum Payout: You receive $500,000. This is tax-free.

- Installment Payout: You receive payments totaling $525,000 over five years. The original $500,000 is tax-free, but the extra $25,000 in interest is taxable.

This also applies if there’s a delay in paying the claim after the insured's death. The insurance company usually adds interest to the payout to make up for the delay, and that interest is taxable to the beneficiary.

How Global Tax Rules Affect Policies

The life insurance tax landscape is also being shaped by bigger economic forces. For example, a major shift happened with the 2024 implementation of global Pillar Two tax rules. These rules are designed to make sure huge multinational insurers—those with revenues over €750 million—pay a minimum tax of at least 15% in every country they operate in.

While this global initiative targets the insurance companies directly, it can have ripple effects on policy costs and features as carriers adjust to new profit margins. You can discover more insights about the 2025 insurance industry outlook on Deloitte.com to explore these dynamics. It's just another reminder of why careful financial planning is so important.

Keeping Life Insurance Out of Your Taxable Estate

When we talk about life insurance and taxes, the conversation often shifts for those with larger estates. It's no longer just about income tax—it's about estate tax. While your beneficiaries typically receive the death benefit income-tax-free, that payout can still get tangled up in your taxable estate if you own the policy when you pass away.

This is a detail that can cost your family dearly.

If the total value of your estate, including the life insurance proceeds, pushes you over the federal or state estate tax exemption, a huge chunk of that money could go to the government before your heirs ever see it. That's the last thing anyone wants, as it can defeat the whole purpose of leaving a financial legacy.

The good news? With a bit of smart planning, you can make sure your life insurance goes to your loved ones completely free from estate taxes.

Understanding Incidents of Ownership

The secret to keeping life insurance out of your estate comes down to avoiding what the IRS calls "incidents of ownership." It’s a legal term, but the idea is simple: if you have any significant control or rights over the policy, the IRS sees it as your asset.

And if it's your asset, it gets counted in your estate.

Common incidents of ownership include having the power to:

- Change who the beneficiaries are.

- Cash out or cancel the policy.

- Borrow against the cash value or use it as collateral for a loan.

- Assign the policy to someone else.

Basically, if you’re the one calling the shots on the policy, the IRS considers you the owner. To break that connection and shield the payout from estate taxes, you have to give up that control.

The Best Solution: The Irrevocable Life Insurance Trust

So, how do you give up control the right way? The most powerful strategy involves a special legal tool. Understanding what a life insurance trust is can be a game-changer for families looking to protect their assets. This vehicle is known as an Irrevocable Life Insurance Trust, or ILIT.

An ILIT is a trust designed for one primary job: to own and be the beneficiary of your life insurance policy. When you set one up, you're permanently transferring your "incidents of ownership" away. You'll appoint a trustee—a trusted person or financial institution—who will manage the policy based on the rules you lay out in the trust document.

By moving the policy into an ILIT, you create a legal firewall between you and the insurance. The policy is no longer part of your personal estate. When you pass away, the death benefit is paid directly to the trust, which then distributes the money to your heirs just as you instructed—all without getting caught in probate or hit with estate taxes.

This isn't just a clever trick; it's a cornerstone of high-level estate planning. For anyone serious about how to build a legacy, structuring assets like life insurance this way is often the first and most important step.

How an ILIT Works in Practice

Getting an ILIT set up involves a few critical steps. It has to be done right, or it won't provide the protection you're looking for.

- Create the Trust: First, you'll work with an attorney to draft the trust documents. This is where you'll name the trustee and spell out exactly how and when your beneficiaries will receive the funds.

- Fund the Trust: You can either transfer a policy you already own into the trust or—the better option—have the trust buy a brand-new policy. If the trust is buying the policy, you'll make cash gifts to the trust, and the trustee will use that money to pay the premiums.

- Respect the Three-Year Look-Back Rule: This is absolutely crucial. If you move an existing policy into an ILIT and then die within three years of that transfer, the IRS can "look back" and pull the death benefit right back into your taxable estate. To avoid this risk entirely, it's almost always smarter to have the ILIT buy a new policy from day one.

Using an ILIT creates a clear separation between your estate and your life insurance. It’s a proactive move that ensures your beneficiaries get every dollar you intended for them, preserving your wealth for the next generation.

Actionable Tax Strategies for Your Policy

Knowing the tax rules for life insurance is one thing. Actually using them to your advantage is where the real power lies.

Smart moves can turn your policy from a simple safety net into a seriously efficient financial tool for building and protecting your wealth. Whether you're a business owner, getting ready for retirement, or just making sure your family is secure, the right strategies can make a huge difference.

These aren't shady loopholes; they're established ways to get the most out of the tax-advantaged nature of life insurance. For a family, it might be as simple as structuring the policy ownership correctly to avoid estate taxes. For an entrepreneur, it could mean using the cash value as a flexible, tax-free line of credit. The key is to be proactive.

Using a 1035 Exchange to Upgrade Your Policy

One of the most powerful—and often overlooked—strategies is the 1035 exchange. It gets its name from Section 1035 of the Internal Revenue Code, which lets you swap an old life insurance policy for a new one without creating a tax bill. Think of it like trading in your old car for a new model without having to pay capital gains on its trade-in value.

This is a game-changer if:

- Your current policy is a poor performer or has sky-high internal fees.

- Your health has gotten better, meaning you could qualify for much better rates now.

- You want to move from a basic term policy to a permanent one that builds cash value.

Without a 1035 exchange, cashing out an old policy that has gains would mean an immediate tax bill. This provision lets you roll that value straight into a new, better contract, keeping your tax-deferred growth intact and your financial plan moving forward. For a deeper dive, you might be interested in our guide that explains what a rider on life insurance is, since you can often add new features during an exchange.

Strategies Tailored to Your Life Stage

The best life insurance tax strategy is the one that fits your goals and your life. A one-size-fits-all approach just doesn't cut it here.

For Business Owners and Self-Employed Professionals:

A permanent life insurance policy can act like a "business emergency fund." You can borrow against your cash value—usually tax-free—to cover unexpected costs, jump on an investment opportunity, or smooth out cash flow without the headache of qualifying for a bank loan.

For Working Families:

The main goal is often a clean, tax-free transfer of wealth. You just need to make sure the policy is owned correctly. Often, having it owned by a spouse or an Irrevocable Life Insurance Trust (ILIT) is enough to keep the death benefit out of your taxable estate, ensuring your beneficiaries get every penny you intended.

A well-structured life insurance plan does more than provide a payout; it delivers that payout with maximum tax efficiency, preserving the legacy you worked hard to build.

The demand for these kinds of efficient financial tools is on the rise worldwide. Recent data from the OECD shows a massive 11.9% jump in nominal life insurance premium growth across monitored markets in 2024—nearly double the rate of the year before. This spike is driven by aging populations and insurers adapting to inflation while keeping those core tax benefits. It just goes to show how critical tax efficiency has become for families and their advisors. You can check out the full report on global insurance market trends from the OECD.

A Few Common Questions We Hear All the Time

As we wrap up, let's tackle a few of the questions that come up most often. Getting straight answers can help lock in what you've learned and clear up any lingering confusion.

Do I Have to Report the Death Benefit to the IRS?

In almost every case, the answer is a simple no. When you receive a life insurance payout as a beneficiary, it isn't considered taxable income. That means you don’t need to report it on your federal tax return.

The only exception is if the payout sits with the insurer and earns interest before it's paid to you. In that scenario, only the interest is reportable.

What Is My "Cost Basis" in a Policy?

Think of your cost basis as everything you’ve paid into the policy. It’s the grand total of all the premiums you've paid over the years.

This number really only matters if you decide to surrender the policy for its cash value. You'll only owe taxes on the amount you receive that is greater than your cost basis.

One of the biggest misconceptions is that you can deduct your life insurance premiums. For individuals and families, you can't. The IRS sees it as a personal expense, just like your car insurance.

Can I Deduct My Life Insurance Premiums?

For the vast majority of us, the premiums for personal life insurance are not tax-deductible. The IRS is very clear that this is a personal expense.

While there are a few very specific exceptions for businesses, the rule for individual policyholders is firm.

If you happen to be a federal employee looking for more detailed information on your specific plan, a great resource is A Complete Guide to Federal Life Insurance (FEGLI).

At My Policy Quote, we help you find coverage that fits your life and your financial goals. Get your free, no-obligation quote today and secure your family's future.