So, you’ve lost your job, and the first thing on your mind is health insurance. You’ve heard about COBRA, a safety net that lets you keep your old health plan. But then comes the big question: how much is this going to cost?

The short answer is you’ll pay 100% of your plan's total premium, plus a small 2% administrative fee. It’s a number that often catches people off guard because it’s a huge jump from the small amount you saw deducted from your paycheck.

Your Quick Answer to COBRA Insurance Costs

Think of it this way: when you were employed, your company likely paid a big chunk of your health insurance premium. You only had to cover your small share. It was like splitting a very expensive dinner bill with a generous friend every month.

With COBRA, that generous friend is gone. Suddenly, you’re responsible for the entire bill—your old share, your employer's much larger share, and that little 2% fee on top. That’s why COBRA feels so expensive. It’s not a new, inflated price; it's the first time you’re seeing the true, unsubsidized cost of your health plan.

Seeing the Real Price Tag

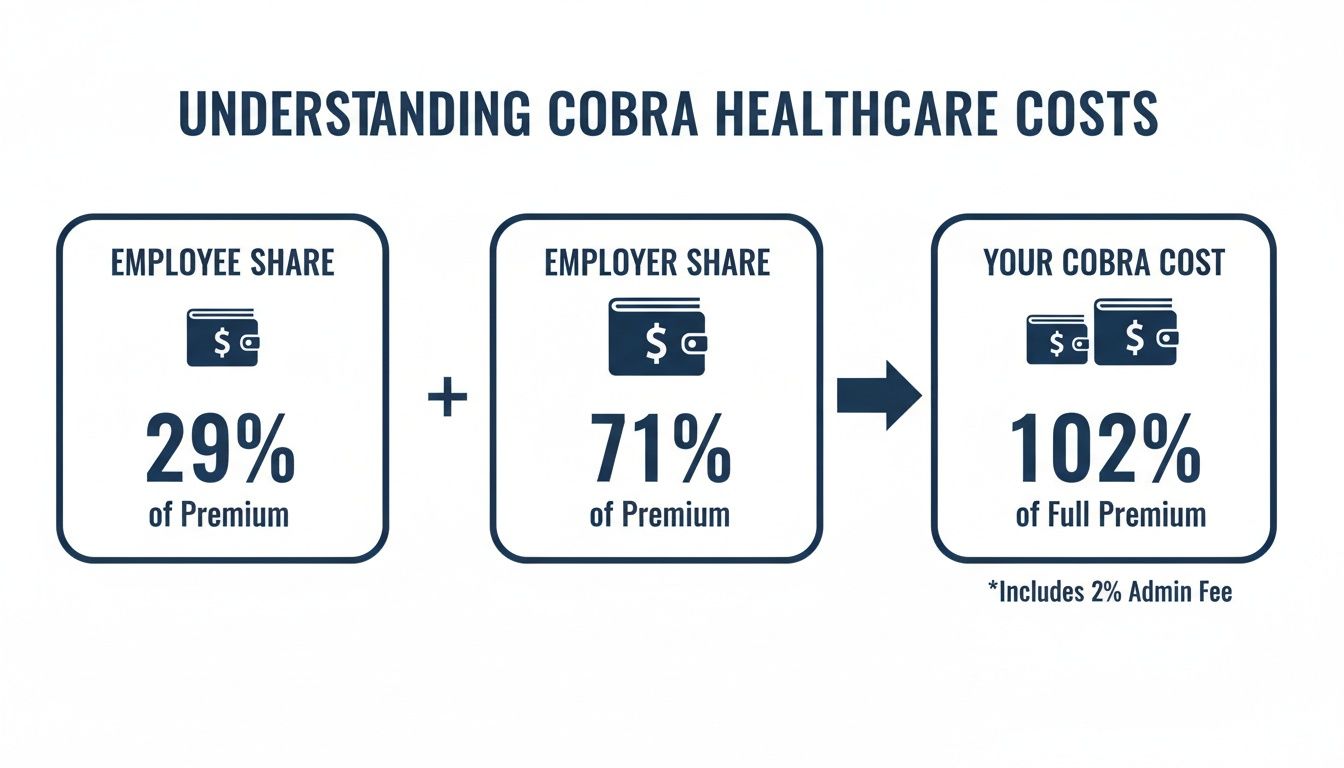

It helps to see it laid out visually. This infographic breaks down exactly where the money goes and why your new payment is so much higher.

As you can see, the COBRA cost is simply the combination of what you used to pay and what your employer was quietly covering for you all along.

National Averages and Your Wallet

The difference can be dramatic. According to recent KFF data, the average annual premium for family coverage through an employer hit $26,993. Out of that, workers paid just $6,850 on average. The rest? That was covered by the employer.

When you switch to COBRA, that entire cost becomes yours. On average, this means you could be looking at $650 to $750 a month for an individual or a staggering $1,800 to $2,200 a month for a family. If you want to dive deeper into how these numbers are built, you can learn more from My Policy Quote's guide to monthly premiums.

To put this jump into perspective, here’s a table comparing what an employee typically pays versus the full amount they'd be responsible for under COBRA.

Estimated Monthly Cost Employee vs Full COBRA Premium

| Coverage Type | Average Employee Monthly Contribution | Average Full Monthly Premium (COBRA Cost) |

|---|---|---|

| Individual | ~$117 | ~$745 |

| Family | ~$571 | ~$2,250 |

This side-by-side comparison really shows the sticker shock. It’s a significant financial shift that requires careful budgeting if you decide COBRA is the right path for you.

So, How Is Your COBRA Premium Actually Calculated?

That first COBRA bill can definitely cause some sticker shock. But once you see the math, it starts to make sense. It’s not some inflated new price—it’s simply the full, unsubsidized cost of the exact same health plan you had when you were employed.

The formula itself is pretty straightforward.

Your Total Monthly COBRA Premium = 100% of the Group Health Plan's Premium + a 2% Administrative Fee

Let’s break that down. The “100% premium” part is the big one. It’s the total monthly cost of your plan, which includes both the portion you used to see deducted from your paycheck and the much larger chunk your employer was paying for you behind the scenes.

Then there's that small fee on top, which federal law allows your old company to add to cover the hassle of managing your coverage.

What Goes Into That “100% Premium”?

That big premium number isn't just pulled out of thin air. The price your employer originally negotiated with the insurance carrier is based on the risk and cost for everyone in the entire group plan.

Understanding this helps explain why your COBRA cost is what it is. It has nothing to do with your personal health and everything to do with the collective profile of your former coworkers.

Three main things shape that group premium:

- The Plan's Benefits: A "Cadillac" plan with a tiny deductible, a massive network, and amazing benefits is always going to cost more than a basic, high-deductible plan.

- Employee Demographics: Insurers look at the big picture. What’s the average age of the employees? Where are they located? How many kids and spouses are on the plan? A younger, healthier group generally costs less to insure.

- The Group's Claims History: The insurance company also looks back at how much medical care the entire employee group actually used in previous years. If there were a lot of expensive claims, premiums for everyone will likely go up the next year.

Basically, you’re now on the hook for the full cost that reflects all those group factors.

What's With the Extra 2% Fee?

That little 2% fee can feel like adding insult to injury, but it has a specific job. It’s not extra profit for your old boss.

This fee is legally allowed to help your former employer cover the administrative costs of keeping you on their plan. Think about it: someone has to process your paperwork, handle your monthly payments, and talk to the insurance company for you. It’s a fixed, predictable part of your bill.

Let’s run the numbers with a quick example.

Example: Calculating an Individual Plan

Let's say the total monthly cost for your individual health plan was $700.

- What you paid from your check: $150

- What your employer paid: $550

- Total Group Premium: $700

Now, here’s how to calculate your COBRA premium:

- Start with the full premium: $700 (That’s the 100%)

- Calculate the 2% admin fee: $700 x 0.02 = $14

- Add them up: $700 + $14 = $714

Your new monthly COBRA payment would be $714. Seeing it laid out like this can really help with budgeting. To get an even deeper look at how insurers come up with these numbers in the first place, check out our guide on what is an insurance premium. It gives you the full picture of your new financial responsibility.

Putting COBRA Costs into a Real-World Context

The COBRA formula is simple on paper, but what does it actually feel like when the bill arrives? Abstract numbers and percentages don't hit home until you see them in dollars and cents.

To really understand what COBRA costs, let's move past the theory and look at a few stories—scenarios that happen every day. These examples show just how much your monthly costs can jump depending on your old plan and how many people you need to cover.

Scenario 1: The Single Tech Professional

Let's start with Alex, a 32-year-old software developer who just got laid off. While he was working, his top-tier PPO plan felt incredibly cheap. It was perfect for managing a chronic condition, and he barely noticed the small deduction from his paycheck.

Now, he's seeing the real price for the first time, and it's a shock.

- What Alex Paid: He used to contribute just $150 per month.

- What His Employer Paid: The company was quietly covering another $600 per month.

- The Full Monthly Premium: That brings the total cost to $750 per month.

To figure out his COBRA payment, we take that full premium and tack on the 2% admin fee. The math is easy, but the result is a gut punch.

Alex's COBRA Calculation:

($750 Full Premium) + ($750 x 2% Admin Fee) = $765 per month

For Alex, the cost explodes from $150 to $765 a month. That's more than a five-fold increase, and it’s a powerful reminder of how much value an employer subsidy really holds.

Scenario 2: The Family Navigating a Career Change

Now, meet the Garcia family. Maria, a marketing manager, is bravely leaving her corporate job to launch her own consulting firm. She needs to keep herself, her spouse, and their two kids insured during the transition.

Their family plan was great—it covered everything from annual check-ups to ER visits. The amount they paid felt totally reasonable as part of their household budget.

Here's how their new costs stack up.

Sample COBRA Cost Breakdown for a Family of Four

This table breaks down how the Garcias' monthly COBRA premium is calculated, showing the full cost they're now responsible for.

| Cost Component | Monthly Amount | Description |

|---|---|---|

| Full Group Premium | $2,100 | The total unsubsidized cost for the family's health plan. |

| 2% Admin Fee | $42 | Calculated as 2% of the $2,100 premium. |

| Total Monthly COBRA Cost | $2,142 | The final amount the Garcia family must pay each month. |

Before this, the Garcias were paying around $600 a month. Their new $2,142 bill is a huge new line item in their budget, right as Maria is getting her business off the ground. This is exactly why it's so critical to explore all your options for insurance while between jobs.

Scenario 3: The Early Retiree Bridging to Medicare

Finally, there's David, who just retired at 62. He has three years to go until he’s eligible for Medicare, and he absolutely needs solid health coverage until then. His wife is already on Medicare, so he just has to worry about himself.

His old employer had a fantastic health plan, and David wants to keep his network of doctors. He sees the high cost of COBRA as a necessary investment for peace of mind during this important life stage.

- David's Old Payment: He used to pay $200 per month.

- The Company's Hidden Help: His employer was kicking in another $750 per month.

- The Full Price Tag: This means the plan's total cost is $950 a month.

- His New COBRA Cost: $950 + (2% of $950) = $969 per month.

David's monthly payment is jumping from $200 to $969. It's a steep price, but he’s already baked it into his retirement budget. He knows it’s a temporary bridge to ensure he has zero gaps in his care.

These stories all show the same thing: while the COBRA math is always the same, the final number is deeply personal.

How Long Your COBRA Coverage Can Last

Figuring out the cost of COBRA is one thing, but knowing how long that coverage will last is just as important. Think of it as a temporary bridge, not a permanent highway. How long that bridge is depends entirely on why you became eligible in the first place.

For most people, the situation is straightforward. If you lost your job or your hours were cut, you fall into the most common category.

The Standard 18-Month Rule

Losing your job (for any reason other than gross misconduct) or having your hours reduced qualifies you for up to 18 months of COBRA coverage. This is the baseline, the standard safety net designed to give you plenty of time to find a new job with benefits or explore other insurance options.

While 18 months might seem like a long time, certain life events can actually extend your coverage, giving you an even longer runway when you need it most.

How Your Coverage Can Be Extended

Think of these extensions as special circumstances that add more time to your COBRA clock. They aren't automatic, though.

To get an extension, you have to be proactive. You must notify your plan administrator—usually within 60 days of the event—to prove you qualify.

These extensions can push your total coverage out to 29 or even 36 months. Here’s how it works:

-

Disability Extension (up to 29 months): If you or a family member on the plan is determined to be disabled by the Social Security Administration (SSA) within the first 60 days of COBRA, your whole family's coverage can be extended by 11 months. This brings your total to 29 months, providing critical stability during a challenging time.

-

Second Qualifying Event (up to 36 months): Sometimes, life throws another curveball while you're already on COBRA. If the covered employee passes away, gets divorced, or becomes eligible for Medicare during the initial 18-month period, their spouse and children can get an additional 18 months of coverage. This brings their total to a full 36 months. The same 36-month total applies to a child who "ages out" of their parents' plan while on COBRA.

What to Do When COBRA Is Ending

No matter how long your COBRA lasts, it will eventually end. The biggest mistake you can make is waiting until the last few weeks to figure out your next move.

The good news? The end of your COBRA coverage triggers a Special Enrollment Period (SEP), which gives you a 60-day window to sign up for a new plan on the ACA Marketplace.

Start looking at your options on HealthCare.gov at least two or three months before your COBRA runs out. This gives you time to compare plans, see if you qualify for subsidies that could save you a ton of money, and make a smooth transition without any gaps in your health coverage.

When State Rules and Medicare Come into Play

The federal COBRA law was designed for companies with 20 or more employees, which is great—unless you worked for a smaller business. If your last job was at a local startup or a family-owned shop, you might think you're completely out of luck.

But hold on. This is where state laws often step in to fill the gap.

Your State Might Have a “Mini-COBRA” Law

Many states have their own continuation coverage laws, often called “mini-COBRA.” These rules act as a safety net, mirroring the federal law but applying it specifically to employees of smaller businesses. So, losing your job at a 15-person company doesn't have to mean losing your health plan.

The catch? The rules are different everywhere you go. While the goal is the same—letting you hang onto your health plan for a while—the details can vary quite a bit.

You'll want to watch for differences in:

- Company Size: Some state laws cover businesses with as few as two employees, while others might set the bar at ten.

- Coverage Duration: The timeline might be shorter than the federal 18-month standard. It’s not uncommon to see mini-COBRA last for only 9 or 12 months.

- Eligibility Rules: The qualifying events that let you enroll could be slightly different from the federal ones.

Since there's no single standard, you have to check your state’s specific rules. The best place to start is your state's Department of Insurance website. A quick search will give you the exact regulations for your situation.

The Critical Overlap: COBRA and Medicare

If you're getting close to retirement age, the decision to take COBRA gets a lot more complicated. This is especially true if you're eligible for Medicare. Making the wrong move here can lead to some serious financial pain, like lifelong penalties and big gaps in your coverage.

The rules can feel tangled, but here’s the most important thing to remember: once you’re eligible, Medicare almost always becomes your primary insurer. COBRA then slides into the secondary payer spot, meaning it only pays for costs after Medicare has paid its share.

Crucial Takeaway: If you are eligible for Medicare but stick with COBRA instead of enrolling in Medicare Part B, you could be paying a massive premium for a plan that covers next to nothing.

Why? Because your COBRA plan operates on the assumption that Medicare is paying first. If you never signed up for Medicare, there is no primary payer, and you could get stuck with the entire bill yourself.

How to Avoid Costly Medicare Penalties

Timing is everything. If you put off enrolling in Medicare Part B just because you have COBRA, you can trigger a late enrollment penalty. This isn’t a small, one-time fee—it’s a permanent price hike added to your Medicare Part B premium for the rest of your life.

Here’s the right way to handle it:

- Sign up for Medicare during your Initial Enrollment Period. This is the seven-month window that opens up around your 65th birthday. Don't miss it.

- Use COBRA as a supplement, not a replacement. You can use COBRA to cover things Medicare doesn't, like certain deductibles. But it's almost always more expensive than a dedicated Medigap plan.

- Losing your job triggers a Special Enrollment Period. When your employment ends, you get an eight-month window to sign up for Medicare without any penalty. Critically, COBRA does not count as active employer coverage, and it won't give you another Special Enrollment Period down the road.

Understanding how COBRA fits into your complete financial picture is key, especially when it bumps up against big life events and programs like Medicare. For a deeper dive into managing these moving parts, you might want to explore resources on broader financial planning for retirement. A smart decision today can save you from a world of expensive headaches tomorrow.

Finding Affordable Alternatives to COBRA

If the sticker shock from your COBRA offer has you reeling, take a deep breath. You’re not stuck. While keeping your old plan is one path, it’s definitely not the only one. For most people, there are far more affordable—and just as good—health coverage options out there, all thanks to your recent job change.

Losing your employer-sponsored health insurance kicks open a special door: the Special Enrollment Period (SEP). This isn't just insurance jargon; it's your official ticket to shop for a new health plan outside of the usual year-end enrollment window. You typically have 60 days from the day your old coverage ends to make a move, so now is the time to explore.

The ACA Marketplace: Your Best First Stop

For almost everyone leaving a job, the Health Insurance Marketplace (found at HealthCare.gov) should be the very first place you look. Think of it as a central hub where you can compare plans from different insurance companies, all in one place.

The single biggest reason to start here is the potential for financial help. Unlike COBRA, where you’re on the hook for 102% of the full, unsubsidized premium, Marketplace plans come with income-based subsidies that can slash your monthly costs.

Key Insight: Many people are shocked to find out they qualify for a subsidy. Based on your new estimated income for the year, you could get an Advance Premium Tax Credit (APTC) that directly lowers your monthly bill. For some, this makes a top-notch plan massively cheaper than COBRA.

When you fill out a Marketplace application, it automatically checks if you’re eligible for these cost-saving credits. This is why, nine times out of ten, a Marketplace plan is the smartest financial move you can make. For a deeper dive into the numbers, our guide on COBRA insurance alternatives can help you weigh everything side-by-side.

Medicaid and CHIP: A Safety Net for Lower Incomes

While you’re on the Marketplace site, the system does something else for you—it checks if you qualify for Medicaid or the Children’s Health Insurance Program (CHIP). These are government-funded programs that provide free or extremely low-cost health coverage to millions of Americans with limited incomes.

- Medicaid Eligibility: It’s based on your current monthly household income. If your income has dropped off a cliff after losing your job, you might qualify now even if you never did before.

- Coverage: Medicaid is comprehensive. It covers doctor visits, hospital stays, prescriptions, and more, often with little to no out-of-pocket costs.

If you’re eligible, Medicaid is almost always your most affordable option. It’s a critical safety net when money is tight.

Short-Term Health Plans: A Temporary Bridge

Another route you might see is a short-term health plan. These are built to be a temporary patch—a way to get catastrophic coverage for a few months up to a year. Their monthly premiums are often much lower than both COBRA and unsubsidized Marketplace plans.

But you have to go in with your eyes wide open. These plans come with major trade-offs.

Short-term plans are not regulated by the Affordable Care Act (ACA), which means they don't play by the same rules.

- They Can Deny You: Insurers can look at your health history and flat-out reject your application.

- No Coverage for Pre-Existing Conditions: If you have an ongoing health issue, a short-term plan will not pay for any related care. Period.

- Bare-Bones Benefits: They often skip essential benefits like prescription drugs, maternity care, or mental health services.

A short-term plan can be a cheap stopgap if you’re young, perfectly healthy, and just need a bridge until your next job’s insurance kicks in. But for anyone with existing health needs or who wants real, comprehensive protection, it’s a risky gamble. Always read the fine print to see what’s covered—and more importantly, what isn’t.

Frequently Asked Questions About COBRA

Even after you’ve crunched the numbers on what COBRA costs, a few practical questions always pop up. It’s one thing to understand the price tag, but another to know how it all works in the real world.

Let’s tackle some of the most common things people wonder about once they’re facing this decision.

Can I Switch From COBRA to a Marketplace Plan Later?

Yes, but the timing is everything. You can absolutely drop COBRA and sign up for an ACA Marketplace plan during the annual Open Enrollment Period. You might also get a Special Enrollment Period if your COBRA coverage officially ends or if an employer-paid subsidy runs out.

Here’s the catch: simply deciding you don’t want to pay for COBRA anymore does not give you a special window to buy a Marketplace plan. This is why it’s so important to compare all your options right after you lose your job—that’s your golden opportunity to choose between COBRA and the ACA Marketplace.

Do I Have to Insure My Whole Family on COBRA?

Nope, you don't. This is a common misunderstanding. Every single person on your old health plan—you, your spouse, your kids—is considered a “qualified beneficiary.” Think of it like this: each person gets their own individual ticket to elect COBRA.

This gives you a ton of flexibility. You could, for example, enroll just your child in COBRA to keep their pediatrician, while you and your spouse hop on a more affordable Marketplace plan. It’s a powerful strategy that can save you a lot of money if other options work for some family members but not all.

This mix-and-match approach is one of COBRA’s most overlooked benefits. You can create a custom coverage solution for your family by combining COBRA for one person with a Marketplace plan for another, getting the best of both worlds.

What Happens If I Miss a COBRA Payment?

This is where you need to be really careful. You get a grace period, which is usually 30 days from the premium's due date. If you miss that 30-day window, your coverage is gone for good. It will be permanently terminated, and there's no way to get it back.

The termination is retroactive, meaning it goes back to the last day of the month you actually paid for. You’ll be left with a sudden gap in your health coverage. Because the stakes are so high, it's a smart idea to set up automatic payments or put reminders in your calendar. Missing a payment means losing your safety net without a second chance.

Trying to figure out health insurance during a major life change is tough, but you don't have to go it alone. At My Policy Quote, our specialty is helping people like you find the right coverage at the right price, whether that's COBRA or a smarter alternative. Let us help you explore your options at https://mypolicyquote.com so you can get the clarity you need to move forward with confidence.