Let's be honest, health benefits can feel complicated and a little rigid. That’s where a Health Reimbursement Arrangement (HRA) comes in—it’s a fresh approach to health coverage designed for flexibility.

At its core, an HRA is a tax-advantaged health benefit funded entirely by your employer. But don't think of it as a traditional insurance plan or a bank account. It’s much simpler. Think of it as a monthly allowance your company sets aside just for you, specifically to cover your medical expenses and insurance premiums.

Unpacking Your Health Reimbursement Arrangement

So, what does an HRA look like in the real world?

Imagine your employer gives you a dedicated, tax-free budget to spend on your health. While you usually don't get a physical debit card, the idea is the same. You get real control and can use those funds for what you actually need.

This completely changes the game. Instead of being locked into a one-size-fits-all group plan that might not suit your family, an HRA lets you choose your own individual insurance. Your employer contributes a predictable, fixed amount, and you direct those funds to the care that matters most.

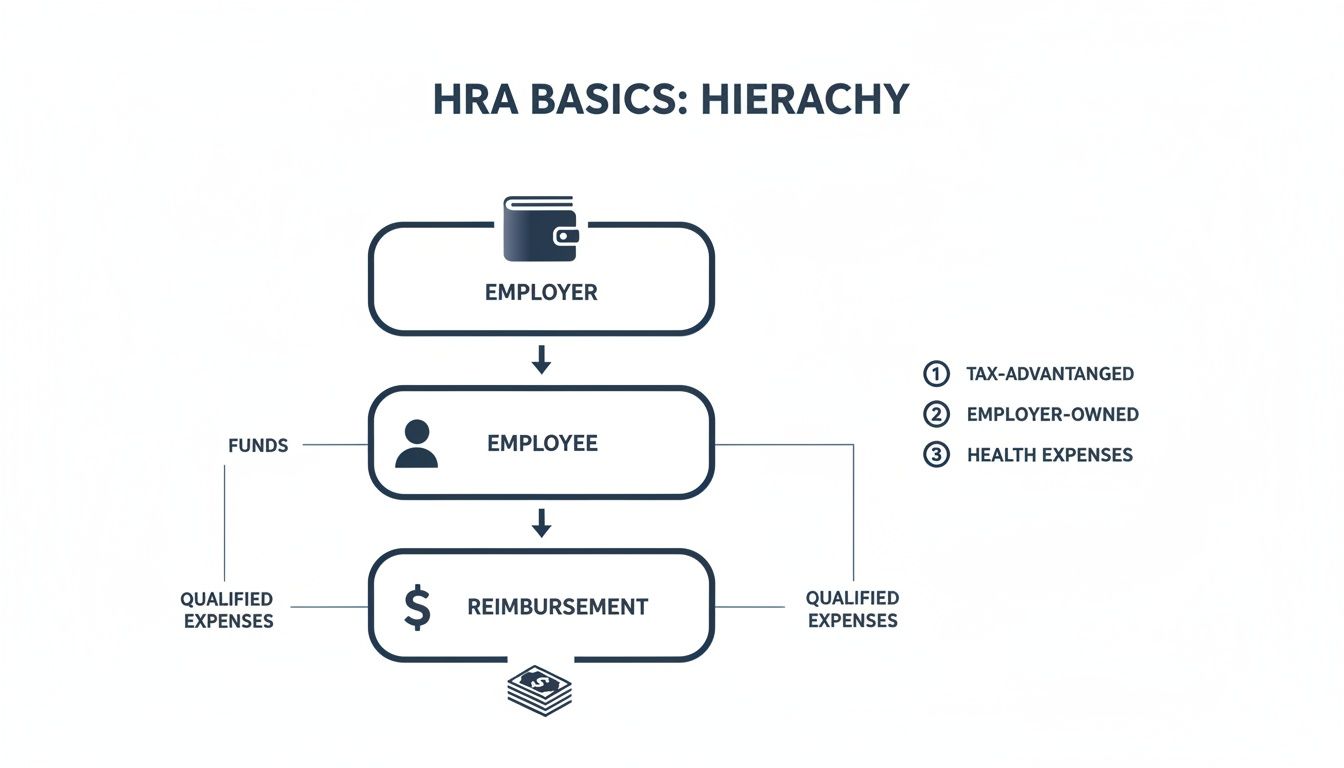

Before we dive deeper, here’s a quick overview of the essential HRA concepts.

HRA Core Concepts at a Glance

| Feature | Description |

|---|---|

| Funding Source | Funded 100% by the employer. You don't contribute a dime from your paycheck. |

| Account Type | It's an "arrangement," not an account. The money stays with the employer until you file a claim. |

| Tax Status | All reimbursements you receive are 100% tax-free for qualified medical expenses. |

| Flexibility | You choose your own health plan and decide how to spend the funds on eligible costs. |

| Ownership | The employer owns the HRA and sets the allowance amount. Unused funds typically stay with the company. |

This table shows just how different an HRA is from other health benefits, putting the power of choice back in your hands.

The Basic Reimbursement Cycle

The process is refreshingly simple. It’s a straightforward loop that keeps you in the driver’s seat. Understanding this cycle is the key to seeing how valuable an HRA can be.

Here's how it works:

- Step 1: Your Employer Sets the Allowance. Your company decides on a monthly contribution amount it will offer for your healthcare costs.

- Step 2: You Pay for an Expense. You cover a qualified medical expense out-of-pocket, like your monthly insurance premium, a doctor’s copay, or a prescription.

- Step 3: You Submit for Reimbursement. Just provide proof of your expense—like a receipt or an invoice—to your HRA administrator.

- Step 4: You Get Paid Back, Tax-Free. Your employer reimburses you for the approved expense. That money is completely free of both payroll and income taxes.

This reimbursement process is what makes an HRA tick. It empowers you to manage your own healthcare spending while giving your employer a cost-effective, predictable way to offer great health benefits.

To see the bigger picture of how money moves in healthcare, it helps to understand how providers operate. You can learn more from a guide to healthcare revenue cycle management.

And while HRAs are powerful, they aren't the only tax-advantaged health benefit out there. People often compare them to Health Savings Accounts (HSAs). To see how they stack up, check out our detailed guide comparing the features of an HSA and HRA. This groundwork will help as we explore the different types of HRAs available.

Exploring the Different Types of HRAs

Think of Health Reimbursement Arrangements (HRAs) less like a one-size-fits-all solution and more like different tools in a toolbox. Each one is designed for a specific job, and understanding which one to use is the key to unlocking their power for both employers and employees.

The main models you'll run into are the Individual Coverage HRA (ICHRA), the Qualified Small Employer HRA (QSEHRA), and the Integrated HRA. Each comes with its own set of rules, contribution limits, and ideal use cases. Let’s break them down to see how they actually work.

At its core, the HRA process is straightforward: the employer sets aside the funds, the employee has a qualified health expense, and the employer provides a tax-free reimbursement.

This simple flow is what makes every HRA model tick. It’s a direct, employer-to-employee reimbursement system that cuts through the complexity of traditional group insurance.

The Individual Coverage HRA (ICHRA)

First up is the Individual Coverage HRA (ICHRA), which is by far the most flexible and powerful HRA available today. It allows employers of any size—from a two-person startup to a global corporation—to offer tax-free funds that employees use to buy their own health insurance on the individual market.

What makes the ICHRA so unique? There are no contribution limits. This gives employers complete control over their budget, letting them offer as much or as little as they can afford. They can even set different allowance amounts for different employee classes, like salaried versus hourly workers.

The ICHRA has exploded in popularity because it’s a real alternative to rigid, one-size-fits-all group plans. Recent data shows that adoption among large employers shot up by 34% between 2024 and 2025 alone. You can dig into the numbers in the full report on ICHRA growth trends from the HRA Council.

Here’s how it works: A tech company with 150 employees decides its group plan is just too expensive. Instead, it gives each employee a $600 per month ICHRA allowance. Now, every employee can shop for a plan that truly fits their life—whether it's a low-premium plan for a young, single person or a more comprehensive plan for a growing family.

The Qualified Small Employer HRA (QSEHRA)

Next, we have the Qualified Small Employer HRA (QSEHRA), often just called the small business HRA. Just like its name suggests, this one is built exclusively for businesses with fewer than 50 full-time equivalent employees that don't offer a group health plan.

Unlike the ICHRA, the QSEHRA has annual contribution caps set by the IRS. For 2026, the limits are:

- $6,450 for an individual ($537.50 per month).

- $13,100 for an employee with a family ($1,091.66 per month).

These numbers are adjusted each year for inflation. The main rule with a QSEHRA is that the employer has to offer the same allowance to all full-time employees, though the amounts can be different for individuals versus families.

Here’s how it works: A local coffee shop with 10 employees wants to start offering health benefits. They set up a QSEHRA, offering $300 a month for single employees and $600 for those with families. This lets them provide a great benefit while keeping their budget predictable and under control.

The Integrated HRA

Finally, let's talk about the Integrated HRA, sometimes known as a Group Coverage HRA (GCHRA). This HRA works with a traditional employer-sponsored group health insurance plan. Its whole purpose is to help employees cover the out-of-pocket medical costs that their main insurance plan doesn't pay for.

An Integrated HRA can reimburse things like deductibles, copayments, and coinsurance. It’s like a financial cushion that makes the company’s primary health plan more affordable and easier for employees to actually use. These are often paired with high-deductible health plans, a strategy employers use to lower their overall premium costs. You can learn more about this in our guide that explains what is a high deductible health plan.

Here’s how it works: A construction company has a group plan with a $3,000 deductible. To soften that blow, it also offers an Integrated HRA with a $1,500 annual allowance. When an employee has a procedure and pays toward their deductible, they can submit the receipt to the HRA and get reimbursed for the first $1,500. Just like that, their deductible is effectively cut in half.

Comparing HRA Models: ICHRA vs. QSEHRA vs. Integrated HRA

Feeling a little dizzy from all the acronyms? Don't worry. This table breaks down the key differences between the three main HRA types so you can see them side-by-side.

| Feature | ICHRA | QSEHRA | Integrated HRA |

|---|---|---|---|

| Employer Size | Any size | Fewer than 50 employees | Any size |

| Contribution Limits | No IRS-set limits | Yes, IRS sets annual limits | No IRS-set limits |

| Who Can Participate | Employees not offered a group plan | Employees not offered a group plan | Employees enrolled in the group plan |

| Allowance Flexibility | Can vary by employee class | Must be same for all employees | Can vary by employee class |

| Best For | Replacing group plans with choice | Small businesses offering benefits for the first time | Enhancing an existing group health plan |

Ultimately, choosing the right HRA depends entirely on the employer's size, budget, and what they're trying to achieve—whether it’s offering benefits for the first time or making a great plan even better.

Understanding HRA Tax Rules and Eligibility

The real magic behind a Health Reimbursement Arrangement (HRA) isn't just about covering medical bills—it's about the powerful financial advantages that come with it. This is where an HRA stops being just another health benefit and becomes a savvy financial tool for both companies and their teams. Let's break down how the tax rules and eligibility make this possible.

The core idea is beautifully simple: HRA money is tax-free. For an employee, every single dollar they get back for a qualified medical expense is 100% free from both income and payroll taxes. That money goes straight to healthcare costs, with zero cut for Uncle Sam.

For employers, the contributions they make toward employee HRA allowances are treated as a regular business expense. This makes the funds 100% tax-deductible, giving them a predictable and cost-effective way to offer a top-tier health benefit.

Who Is Eligible to Participate?

Getting into an HRA is pretty straightforward, but there are a few key rules to follow. It’s not a free-for-all; the benefit is tied directly to your job and having the right kind of health coverage in place.

So, who can be covered under an employee’s HRA?

- The Employee: The main participant must be a W-2 employee of the company offering the HRA.

- The Employee's Spouse: A legal spouse is also eligible to be covered.

- Dependents: Kids and other qualifying dependents (usually up to age 26) can have their medical costs reimbursed, too.

This family-friendly approach makes an HRA an incredible tool for households, allowing one allowance to help cover the medical needs of several people. There is, however, one big catch everyone has to meet.

To receive tax-free reimbursements from an ICHRA or QSEHRA, every family member using the funds must be enrolled in a qualifying health insurance plan. This is called Minimum Essential Coverage (MEC), and it ensures the HRA is supplementing real insurance, not trying to replace it.

The Real-Dollar Impact of Tax-Free Reimbursements

The phrase "tax-free" can sound a bit abstract until you actually see what it means for your wallet. Let’s walk through a quick before-and-after to show you the real financial difference an HRA makes.

Imagine you have a $300 medical bill. You’re in the 22% federal income tax bracket and pay 7.65% in FICA taxes (for Social Security and Medicare).

Scenario 1: Paying With Your Paycheck (No HRA)

- To have $300 cash in hand to pay that bill, you first need to earn enough to cover the taxes on it.

- Your total tax hit is 29.65% (22% + 7.65%).

- To actually take home $300, you would need to earn roughly $426. The other $126 goes straight to taxes.

Scenario 2: Paying With Your HRA

- You pay the $300 medical bill yourself.

- You submit the receipt for reimbursement.

- You get the full $300 back, completely tax-free.

In this simple case, the HRA just saved you $126. Imagine that happening over and over again with deductibles, copays, and prescriptions throughout the year—the savings can easily climb into the thousands. It's a direct boost to your take-home pay.

For anyone wanting a deeper dive into financial strategies, exploring all available health insurance tax benefits can give you an even clearer picture. This powerful, simple tax treatment is what truly defines an HRA and makes it such a game-changing benefit.

How HRAs Work with ACA Plans and Medicare

Figuring out how a Health Reimbursement Arrangement (HRA) fits with big players like the ACA Marketplace and Medicare can feel a little complicated at first. But don't worry—they're actually designed to work together quite smoothly. Knowing the rules of the road is the key to getting the most out of your benefits and staying on the right side of the law.

Let's break it all down.

The most important thing to understand is that ICHRAs and QSEHRAs were built to partner with individual health insurance. This isn't some happy accident; it's the whole point. HRAs act as a bridge, connecting the money your employer provides with the health plan you choose for yourself.

Integrating an HRA with ACA Marketplace Plans

When your employer offers an Individual Coverage HRA (ICHRA) or a Qualified Small Employer HRA (QSEHRA), there’s one main rule: you have to enroll in a qualifying health plan to use the funds tax-free. For a lot of people, that means heading to the ACA Marketplace to find coverage.

This is where things get interesting. The amount of your HRA allowance directly affects whether you can get a Premium Tax Credit (PTC), which is the government subsidy that helps make Marketplace plans more affordable.

- The Affordability Test: The government looks at your HRA offer to see if it’s considered "affordable." If your allowance is big enough to buy the lowest-cost silver plan in your area for less than a set percentage of your household income, you generally won't qualify for a government subsidy.

- Opting In or Out: If the HRA is deemed affordable, you simply use those tax-free funds to buy your plan. If it’s unaffordable, you get a choice: you can either accept the HRA money anyway or opt out and take the government subsidy instead. The one thing you cannot do is have both at the same time.

This system makes sure you get one form of financial help—either from your employer or the government—but prevents anyone from "double-dipping." It’s all about giving you options.

An HRA works hand-in-hand with the ACA. It gives you a private, tax-free funding source that you can use to shop for your own compliant health insurance. It’s a partnership that gives you the freedom to pick a plan you actually like, while your employer handles the funding.

This whole setup hinges on having insurance that meets certain government standards. To use an HRA, your policy must be considered what is creditable coverage, which just means it provides a solid baseline of benefits.

Using an HRA with Medicare

For older adults, especially those in that pre-Medicare 60-64 age group or anyone transitioning onto Medicare, the ICHRA offers some incredible flexibility. Unlike a QSEHRA, an ICHRA can be used to pay for Medicare premiums. This is a total game-changer for employers looking to support their entire team, including valued employees nearing retirement.

An employee who is enrolled in Medicare can use their ICHRA allowance to cover a whole range of premiums, which is a massive financial relief.

What Medicare Premiums Can an ICHRA Reimburse?

- Medicare Part A (Hospital Insurance): For anyone who has to pay a premium for it.

- Medicare Part B (Medical Insurance): The standard monthly premium for doctor visits and outpatient care.

- Medicare Part C (Medicare Advantage): Premiums for those all-in-one private insurance plans.

- Medicare Part D (Prescription Drugs): Premiums for standalone drug plans.

- Medicare Supplement Plans (Medigap): Premiums for policies that fill in the gaps, covering costs like deductibles and coinsurance.

Think about what this means. A 65-year-old employee who’s still on the job can get their Medicare Part B and Medigap premiums reimbursed, completely tax-free. That’s a powerful benefit that smooths the transition from work-based benefits to retirement, taking a huge financial weight off their shoulders.

Weighing the Pros and Cons of an HRA

A Health Reimbursement Arrangement (HRA) is a modern, flexible take on health benefits. But is it the right fit for you or your business? Like any financial tool, an HRA has its own unique set of strengths and weaknesses.

Getting a handle on this balance is crucial, whether you're an employer designing a benefits package or an employee counting on it for your healthcare.

Let's look at this from both sides of the table to get a clear picture of how an HRA really works in the wild.

Advantages for Employers

For businesses, especially small to mid-sized companies, HRAs can solve some of the biggest headaches that come with traditional group health insurance. The upsides usually boil down to two things: budget control and simplicity.

- Predictable Costs: You set a fixed monthly allowance for your team, and that’s it. No more surprise rate hikes or unpredictable premium jumps year after year. This makes long-term financial planning so much easier.

- No Participation Worries: Traditional group plans often demand a minimum number of employees to sign up. HRAs completely do away with that rule, making them a perfect fit for even the smallest teams.

- Freedom from Plan Management: Companies are off the hook from the complicated, time-sucking task of choosing and managing a one-size-fits-all health plan. It’s a huge administrative relief.

When thinking about setting up an HRA, some organizations also look into the broader benefits of outsourcing HR and recruitment to handle things like benefits administration. It’s one more way to simplify and focus on what your business does best.

Advantages for Employees

For employees, the number one benefit of an HRA is choice. Pure and simple. Instead of being shoehorned into a single group plan, you get the freedom to pick an insurance policy that perfectly fits your personal health needs, your doctor preferences, and your budget.

The real power of an HRA is its portability and personalization. You choose your plan from the entire individual market, and if you switch jobs, your health plan comes with you. You just lose the HRA funding from your old employer.

This whole model is a massive part of the healthcare reimbursement market, which was valued at USD 28.69 billion in 2024. And it’s not slowing down—it's projected to hit USD 90.43 billion by 2033. This shows just how much momentum is behind these reimbursement-style benefits.

Potential Disadvantages to Consider

Of course, no system is perfect. HRAs have a few potential downsides that you need to know about before jumping in.

For employers, the biggest hurdle is the administrative side of things. While it's way easier than managing a group plan, an HRA still needs careful setup, solid documentation, and strict compliance with IRS rules to keep its tax-free status. Many businesses just hire a third-party administrator (TPA) to handle all that.

For employees, the challenges are a bit more personal:

- Navigating the Marketplace: You’re now in the driver's seat for researching and picking your own health insurance plan. This can feel pretty overwhelming if you’ve never done it before.

- Allowance Gaps: The monthly HRA allowance your employer gives you might not cover the full cost of the plan you want. If that happens, you’ll have to pay the difference out of your own pocket.

- No Fund Ownership: This is a big one. Unlike a Health Savings Account (HSA), the employer owns the HRA funds. If you leave your job, you can’t take any unused money with you.

At the end of the day, an HRA is a trade-off. It swaps the built-in simplicity of a single employer-picked plan for the incredible flexibility of individual choice and budget control. For many modern businesses and their employees, that’s a trade that makes perfect sense.

Your Top HRA Questions, Answered

As you get to know Health Reimbursement Arrangements (HRAs), the practical, real-world questions always start to bubble up. This is where theory meets reality. Getting a handle on the day-to-day mechanics is the key to feeling confident and making the most of your health benefits.

We’ve pulled together the most common points of confusion and turned them into straightforward answers. Think of this as your final checklist for mastering your HRA, from what happens when you switch jobs to whether you can finally get those new glasses covered.

What Happens to My HRA Funds If I Leave My Job?

This is probably one of the biggest differences between an HRA and other health accounts. Unlike a Health Savings Account (HSA), HRA funds are owned by your employer.

Because the company owns the account, the money isn’t portable. If you leave your job, any unused funds in your HRA typically stay behind with the company. It’s not your personal savings account to take with you.

However, some employers will give you a short window to submit claims for medical expenses you had before you left. And if you choose to continue your health coverage through COBRA, some HRA plans may even let you keep using the funds during that period. Always check your specific plan documents or chat with HR to know exactly what happens when your employment ends.

Can I Use My HRA for Dental and Vision Expenses?

Yes, in most cases, you absolutely can. HRAs are designed to cover a huge range of medical costs, and that almost always includes dental and vision care.

The IRS keeps a master list of "qualified medical expenses" in Publication 502, which is the official rulebook for what an HRA can cover. It's surprisingly broad and includes things like:

- Dental Treatments: Everything from routine cleanings and fillings to bigger jobs like root canals, crowns, and even orthodontia like braces.

- Vision Care: You can typically get reimbursed for eye exams, prescription eyeglasses, contact lenses, and even laser eye surgery like LASIK.

Just remember, while the IRS sets the ground rules, your employer has the final say on the plan’s design. They can choose to be more restrictive, so it's always smart to double-check your specific plan’s list of eligible expenses.

Is an HRA the Same as an HSA or FSA?

Nope, they’re not the same, but it’s an easy mistake to make. They are all tax-advantaged accounts built to help with healthcare costs, but the key differences are who puts money in, who owns it, and whether the funds roll over.

Here’s a simple way to think about it:

An HRA is like a company expense account just for your health—your employer funds it, and they manage it. An HSA, on the other hand, is like your own personal health savings account that you own and can take with you anywhere.

This chart breaks it down:

| Feature | HRA (Health Reimbursement Arrangement) | HSA (Health Savings Account) | FSA (Flexible Spending Account) |

|---|---|---|---|

| Funding | 100% employer-funded | Employee and/or employer | Employee and/or employer |

| Ownership | Employer owns the funds | Employee owns the funds | Employer owns the funds |

| Portability | Stays with the employer | Goes with you if you change jobs | Stays with the employer |

| Rollover | Varies by plan design | Funds roll over year after year | Typically "use-it-or-lose-it" |

Knowing these differences is crucial for smart financial planning, especially as healthcare costs keep climbing. For context, in 2025, employer-sponsored health insurance premiums averaged USD 9,325 for single coverage and USD 26,993 for family plans, with costs rising faster than both wages and inflation. You can find more insights on these healthcare reimbursement trends from Grand View Research.

How Do I Actually Get Reimbursed from My HRA?

Getting your money back from an HRA is designed to be pretty painless. The whole point is to make it easy for you to use the funds your employer has set aside.

It usually works like this:

- You Pay for an Expense: First, you cover the cost of a qualified medical expense or your insurance premium out of your own pocket.

- You Submit Proof: Next, you provide documentation to prove what you paid. This is usually a receipt, an itemized invoice, or an Explanation of Benefits (EOB) from your insurance company. You’ll send this to your employer or, more likely, the third-party administrator (TPA) that manages the HRA.

- The Expense Is Verified: The administrator checks your submission to make sure it’s an eligible expense under your plan.

- You Get Your Money Back: Once it’s approved, you get reimbursed completely tax-free. This usually happens via direct deposit into your bank account or a check in the mail.

To make things even easier, some HRA administrators offer a dedicated debit card. You can use it to pay for eligible expenses directly at the doctor’s office or pharmacy, which means no waiting for a reimbursement. It’s a convenient feature that makes managing your health spending a breeze.

Navigating the world of health insurance can be complex, but you don't have to do it alone. At My Policy Quote, we specialize in helping individuals and families find the perfect coverage to pair with their HRA. Whether you're self-employed, nearing retirement, or just looking for a better plan, our experts are here to guide you.

Explore your health insurance options with My Policy Quote today!