Let's get right to it. For 2024, the two big numbers you need to know for Original Medicare are the Part A inpatient hospital deductible, which is $1,632 per benefit period, and the annual Part B medical deductible, set at $240.

These are your starting points—the initial out-of-pocket costs you’ll cover before Medicare starts paying its portion of the bills.

Your Medicare Deductibles Explained in 60 Seconds

Getting a handle on your Medicare deductibles is the first real step to managing your healthcare budget. Think of a deductible as the amount you pay out-of-pocket for your care before your insurance plan kicks in to help. It's a fundamental part of the cost-sharing agreement that defines what you'll be responsible for each year.

The Medicare deductible 2024 amounts aren't just random figures; they form the bedrock of your costs under Original Medicare. Before we can even talk about coinsurance, copayments, or supplemental plans, you have to get past this first hurdle.

Breaking Down the Key Numbers

Each part of Medicare is designed for different medical needs, which means each has its own way of handling costs. The two main deductibles you'll run into are for Part A (your hospital insurance) and Part B (your medical insurance).

- Part A Deductible: This one is for inpatient care, like a hospital stay. It’s tricky because it's not an annual deductible—it applies to each "benefit period."

- Part B Deductible: This is much simpler. It’s a straightforward, once-a-year amount that covers most of your outpatient services, like trips to the doctor or lab work.

Let’s put these essential costs into a simple table so you can see them clearly.

Medicare Part A and Part B Costs at a Glance

This table summarizes the standard deductible and premium amounts for Original Medicare in 2024.

| Medicare Part | Type of Cost | Standard Amount |

|---|---|---|

| Part A | Inpatient Hospital Deductible (per benefit period) | $1,632 |

| Part B | Annual Medical Deductible | $240 |

| Part B | Standard Monthly Premium | $174.70 |

Knowing these figures helps you plan for your upfront expenses and avoid surprises.

That $240 Part B deductible, for example, means you're on the hook for the first $240 of your doctor visits and other outpatient bills for the year. After you've paid that amount, Medicare starts sharing the cost.

Once you meet these initial deductibles, Medicare's coverage begins, but you'll still have other costs to think about, like coinsurance. This is exactly why so many people choose to get extra help from Medigap or Medicare Advantage plans to keep those out-of-pocket expenses from getting out of hand.

Throughout this guide, we'll break down exactly how these numbers play out in real-life situations.

How the Part A Hospital Deductible Really Works

The Medicare Part A deductible often catches people by surprise. It doesn't behave like the health insurance deductibles you're probably used to. Instead of a simple one-and-done payment for the year, think of it more like an "admission ticket" you pay each time you have a new hospital stay.

This is all tied to something called a benefit period. Because of this unique structure, it's entirely possible to pay the Part A deductible more than once in a single year. Understanding how this works is the key to getting a real handle on your potential out-of-pocket hospital costs.

What Is a Benefit Period?

So, what is this "benefit period" that controls everything? It’s simply how Medicare measures your use of inpatient hospital and skilled nursing facility (SNF) services.

Here’s the simple breakdown:

- It Starts: The clock on a benefit period starts ticking the day you're formally admitted to a hospital or SNF as an inpatient.

- It Ends: The period officially closes once you've been out of inpatient care for 60 consecutive days.

- It Can Reset: If you get admitted to the hospital again after that 60-day gap, a brand-new benefit period kicks off. And yes, that means you have to pay a new Part A deductible.

This is what makes the medicare deductible 2024 for Part A so different from the straightforward, pay-it-once-a-year Part B deductible.

For 2024, that Part A deductible is set at $1,632. If you have two separate hospital stays separated by more than 60 days, you’re on the hook for that $1,632 deductible each time.

How Costs Grow After the Deductible

Meeting your Part A deductible is just the first step. It unlocks your coverage for that benefit period, but it doesn't mean you're done paying—especially if you have a longer hospital stay.

Once you’ve paid the deductible, your costs are broken down by how long you're in the hospital:

- Days 1–60: Your cost is $0 per day. You're covered.

- Days 61–90: You’ll start paying a daily coinsurance of $408 per day.

- Days 91 and beyond: The cost jumps to $816 per day for each "lifetime reserve day" you use.

Medicare gives you a bank of 60 lifetime reserve days you can draw from over your entire life. Once those are gone, you're responsible for all costs.

The daily coinsurance adds up incredibly fast. Imagine a 75-day hospital stay. You’d owe the initial $1,632 deductible, plus 15 days of coinsurance at $408 a day. That's another $6,120 on your bill.

It's also important to know where Medicare coverage applies. For instance, Part A often covers short-term care in a skilled nursing facility after a qualifying hospital stay, but you should understand the difference between assisted living and nursing homes, as Medicare's rules are very specific.

This potential for huge, uncapped costs is exactly why so many people look for a way to fill these gaps. Our guide on what is a Medicare Supplement Plan explains how these policies can cover things like the Part A deductible and that scary daily coinsurance, giving you crucial financial protection and peace of mind.

Your Annual Part B Medical Deductible

After the head-spinning rules of Part A, the Medicare Part B deductible feels like a welcome relief. It’s refreshingly simple and works just like the annual deductibles you’re probably already used to.

For 2024, the Part B deductible is $240.

Think of it as the first tab you need to settle for your medical care each year. Once you’ve paid that $240 out-of-pocket for doctor visits or other outpatient services, Medicare starts sharing the cost with you for the rest of the year.

What Counts Toward the Part B Deductible?

The Part B deductible covers a huge range of outpatient medical services—basically, almost anything that isn't an overnight hospital stay. You’ll chip away at this deductible with the kind of healthcare you use most often.

Services that count toward your $240 Part B deductible include:

- Doctor Visits: From your annual check-up with your primary doctor to appointments with specialists.

- Outpatient Hospital Care: This includes things like emergency room visits, same-day surgeries, or being kept for observation.

- Medical Equipment: Items like walkers, oxygen tanks, or wheelchairs that your doctor orders for you.

- Lab Tests and X-rays: Any diagnostic tests needed to figure out what’s going on with your health.

- Ambulance Services: Medically necessary transportation to a hospital or other facility.

- Preventive Services: While many screenings are covered 100%, any follow-up diagnostic tests will usually apply to your deductible.

Every time you pay for one of these services, that amount gets tallied up. Once you hit that $240 mark, Medicare steps in.

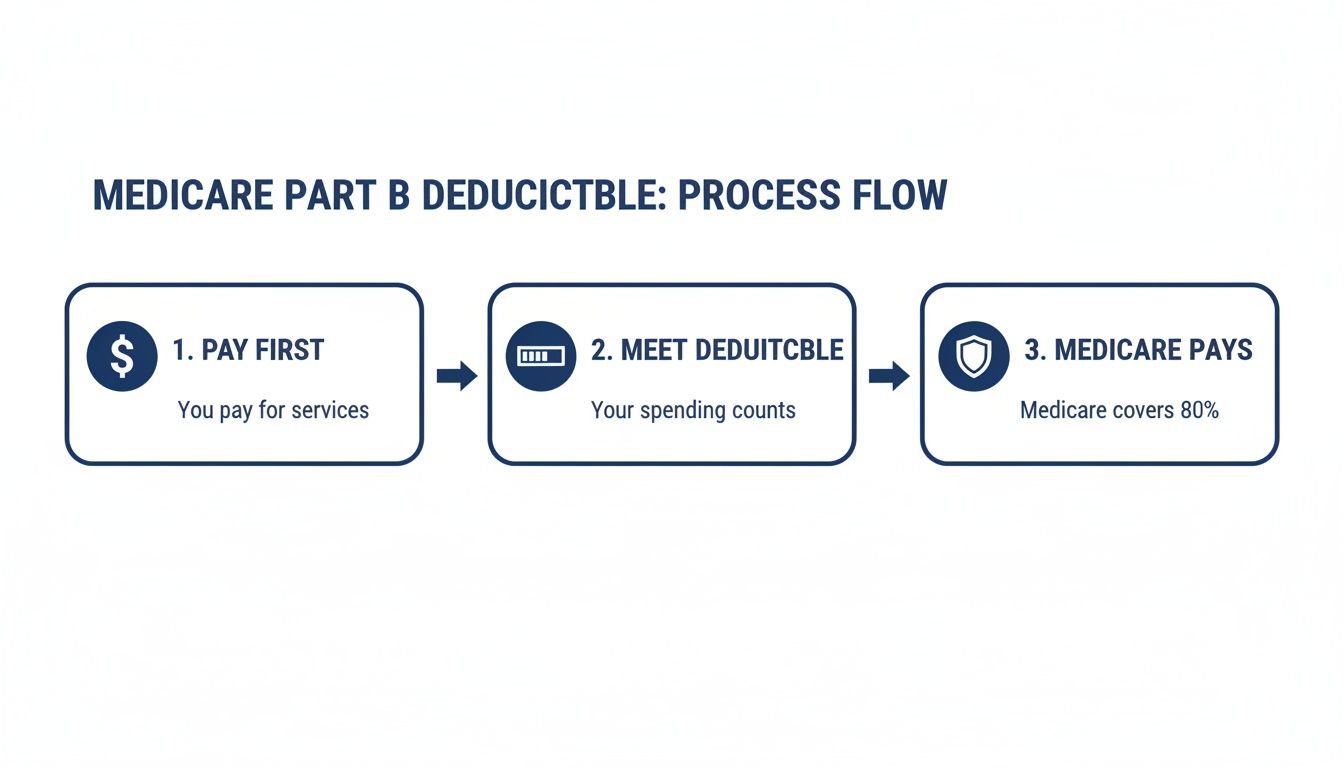

So, What Happens After I Meet the Deductible?

Hitting your deductible is a great milestone, but it doesn’t mean your medical bills vanish. This is where coinsurance enters the picture. For most services, you and Medicare will now split the cost in an 80/20 arrangement.

Here’s the breakdown:

- You pay the first $240: Your first medical bills of the year are all yours until you meet this amount.

- Medicare pays 80%: After the deductible is met, Medicare covers 80% of the approved cost for services.

- You pay 20%: The remaining 20% is your responsibility.

Here's the critical part: Original Medicare has no out-of-pocket maximum. That means there is absolutely no cap on your 20% share. A few serious health problems or one major outpatient surgery could leave you on the hook for a massive bill.

Imagine you need an outpatient procedure that costs $10,000 after your deductible is paid. Your 20% share would be $2,000. If you needed another one later that year, you’d owe another 20% of that cost, too.

How to Protect Yourself from Unlimited Costs

That uncapped 20% coinsurance is easily one of the biggest financial holes in Original Medicare. It’s also wise to be aware of other potential costs. For example, some doctors can legally bill you for more than Medicare's approved amount, which is why it's so important to understand the rules around Medicare Part B excess charges to sidestep any surprise bills.

This is exactly why most people on Original Medicare don't rely on it alone. They add a layer of protection. A Medigap plan, for example, is built specifically to fill the "gaps" Medicare leaves behind—including that 20% coinsurance. Depending on the plan you choose, it might even cover your Part B deductible.

It’s your safety net against the unpredictable and potentially devastating costs of healthcare.

Seeing Medicare Deductibles in Action

Numbers on a page can feel a bit abstract. It’s hard to really get a feel for how the Medicare deductible 2024 amounts work until you see them play out in a real-life situation. To make it all click, let’s walk through two common scenarios with two fictional people, John and Susan.

These stories will help turn confusing rules into clear, practical outcomes, showing you exactly how Medicare’s cost-sharing works when you actually need to use it.

John’s Hospital Stay: A Part A Case Study

Meet John. He's 72, and a serious infection has landed him in the hospital for an extended stay. He’s admitted on February 1st and isn't discharged until 75 days later. His experience is a perfect example of how the Part A deductible and daily coinsurance work together.

Let's break down his out-of-pocket costs, step-by-step:

-

The Upfront Deductible: The moment John is admitted, his "benefit period" starts. The first thing he’s responsible for is the $1,632 Part A deductible for 2024. Think of this as his entry ticket—it covers his first 60 days in the hospital.

-

Daily Coinsurance Begins: John’s recovery takes longer than 60 days. For every day after that initial period—from day 61 to day 75—he now has to pay a daily coinsurance.

-

Calculating the Extra Costs: For 2024, the daily coinsurance for days 61-90 of a hospital stay is $408. Since John was there for an extra 15 days, his bill starts to climb fast: 15 days x $408/day = $6,120.

When you add it all up, John's total responsibility for his 75-day hospital stay is a staggering $7,752. That's the $1,632 deductible plus the $6,120 in coinsurance. It’s a powerful illustration of how quickly costs can escalate for longer inpatient care.

John's story is a wake-up call. It shows that the Part A deductible is just the starting line. The daily coinsurance for extended stays is a major financial risk with Original Medicare, and it's precisely this kind of gap that Medigap plans are designed to fill.

And here’s the kicker: if John had to be hospitalized again later in the year (after being out for more than 60 days), a whole new benefit period would start. He’d be on the hook for another $1,632 deductible.

Susan’s Doctor Visits: A Part B Example

Now, let’s look at Susan. She's 68 and in good health, but she still has a few routine doctor visits and tests during the year, just like most of us. Her experience is a great way to see how the much simpler annual Part B deductible works.

Here’s a look at Susan's medical costs for the year:

- January: She goes for her annual wellness visit. Because this is a preventive service, Medicare covers it at 100%. Susan pays $0.

- February: She sees a dermatologist for a skin check. The Medicare-approved charge for the visit is $150. Since she hasn't paid anything toward her deductible yet, she pays the full $150. She's now made a good dent in her deductible.

- March: Her family doctor orders some bloodwork. The lab bill is $110. Susan pays the first $90 of that bill, which is exactly what she needs to meet her $240 annual deductible.

- After the Deductible is Met: What about the other $20 from the lab bill? Now that her deductible is satisfied, Medicare’s 80/20 cost-sharing kicks in. Medicare pays 80% ($16), and Susan is responsible for her 20% share, which is just $4.

For the rest of the year, Susan will only owe 20% of the Medicare-approved amount for any other Part B services she needs.

This visual breaks down the simple, three-step process Susan went through to meet her deductible and unlock her full coverage.

It’s a straightforward path: you cover the first costs of the year yourself until you hit the limit, and from then on, Medicare steps in to share the load.

Why These Scenarios Matter

John's and Susan's stories aren’t just examples—they reveal the core financial structure of Original Medicare. John's situation highlights the very real potential for high, uncapped costs during a major health crisis. Susan's story, on the other hand, shows the predictable, everyday expenses for routine care that you can expect year after year.

Seeing these outcomes makes it crystal clear why so many people choose to get extra coverage. Plans like Medicare Supplement (Medigap) are built specifically to cover these "gaps"—like the big Part A deductible and the endless 20% coinsurance—giving you a vital layer of financial protection and peace of mind.

Connecting the Dots on Your Total Medicare Costs

Getting a handle on the Part A and Part B deductibles is a great first step, but it’s really just one piece of a much bigger financial puzzle. To truly get control of your healthcare budget, you need to zoom out and see how everything fits together.

That’s especially true when it feels like costs are always creeping up.

And it’s not just a feeling—it’s the reality. Between 2018 and 2024, the Part B deductible alone jumped from $185 to $240. Over that same time, the Part A deductible climbed from $1,408 to $1,632. These aren't just numbers on a page; they're real-world increases that directly hit your wallet year after year.

Looking Beyond the Basics

The hard truth is that Original Medicare (Parts A and B) was never designed to cover everything. Two of the biggest things it leaves out are prescription drugs and all the "gaps" in coverage, like your deductibles and coinsurance.

This is where other plans come into the picture, and each has its own costs to consider.

- Medicare Part D: This is your prescription drug coverage. These plans are sold by private insurance companies, and they come with their own monthly premiums, annual deductibles, and copays at the pharmacy.

- Medicare Supplement (Medigap) Plans: Also sold by private insurers, these plans are built specifically to fill the gaps that Original Medicare leaves behind—including those big Part A and B deductibles.

Think of it this way: your true monthly healthcare cost isn't just the Part B premium. It's the Part B premium plus your Part D premium plus your Medigap premium, all working together.

How Medigap and Part D Complete the Picture

Let’s put the pieces together. Imagine Original Medicare is the foundation of your house. It's strong and essential, but it has some wide-open doors where big financial risks can walk right in.

A Part D plan adds a crucial room to your house—the pharmacy. Without it, you’re paying 100% for every prescription you need. Each Part D plan has its own list of covered drugs (a formulary), so it’s vital to find one that lines up with your medications. The maximum deductible for Part D in 2024 was $545, but this can vary from plan to plan.

Medigap plans are like the walls and roof of your house. They seal up the financial gaps left by Original Medicare, giving you predictable and stable healthcare costs.

Take Medigap Plan G, for example. It’s one of the most popular choices for a reason. Once you pay your annual Part B deductible ($240 in 2024), Plan G steps in to cover almost all of your remaining out-of-pocket costs.

- It pays that huge $1,632 Part A deductible for you.

- It covers your 20% Part B coinsurance, so you’re not stuck with uncapped medical bills.

- It even handles the daily coinsurance if you have a long hospital stay.

By pairing Original Medicare with a Part D plan and a Medigap policy, you create a powerful financial shield. This strategy turns unpredictable medical bills into manageable monthly premiums, giving you true peace of mind.

You can see how all these moving parts come together in our comprehensive Medicare planning guide, which walks you through making these choices for a secure retirement.

Your Top Questions About Medicare Deductibles, Answered

Even after we break down the nuts and bolts of Part A and Part B, a few key questions always pop up. Let's tackle the most common ones we hear, giving you clear, straightforward answers so you can manage your healthcare costs with confidence.

Think of this as your quick-reference guide for the real-world details.

How Do I Know if I’ve Met My Part B Deductible?

This is a great question, and thankfully, keeping track of your Part B deductible is easier than you might think. You're never left guessing when your 80/20 coverage will kick in.

Your best friend here is the Medicare Summary Notice (MSN). This isn't a bill; it's a statement Medicare mails you every three months detailing all the services billed in your name. On it, you'll find a section that shows exactly how much of your Part B deductible you've paid for the year.

Need a faster update? Just go online.

- Log into your MyMedicare.gov account. Your secure portal gives you real-time information.

- Look for the "Deductible Status" section. It's usually right on the dashboard and will either say "You have met your deductible" or show a progress bar of how much is left.

A quick check before a doctor's visit can save you from any surprises when the bill arrives.

If I Have a Medigap Plan, Do I Still Pay the Part A Deductible?

This gets right to the heart of why so many people find Medigap (or Medicare Supplement) plans so valuable. For most, a Medigap policy is the key to avoiding that big, upfront hospital bill.

So, the short answer is: it depends on your specific plan. But the good news is, most Medigap plans sold today cover the Part A deductible in some way.

Here's the key takeaway: some of the most popular plans, like Medigap Plan G, are built to cover the $1,632 Part A deductible completely. If you have Plan G and are admitted to the hospital, your plan pays that deductible for you. You don't see a bill for it.

Here’s a quick look at a few common plans:

- Medigap Plan G: Covers 100% of the Part A deductible.

- Medigap Plan N: Also covers 100% of the Part A deductible.

- High-Deductible Plans: With a High-Deductible Plan G, you have to pay a separate, larger plan deductible first. After you meet that, the plan will then cover the Part A deductible for you.

Choosing one of these plans means you can breathe easier, knowing you won't get hit with a $1,632 bill just for being admitted to the hospital.

What Happens if I Have Medicare and Other Insurance?

When you’re covered by Medicare and another policy (like from an employer), a process called "coordination of benefits" kicks in. It’s just a fancy term for the rules that decide which insurance pays first.

The plan that pays first is the "primary payer," and the second one is the "secondary payer."

This directly impacts your deductibles. If Medicare is your secondary payer, you often won't have to pay your Medicare deductibles out-of-pocket because your primary plan handles the initial costs.

For example:

- You're over 65 but still working at a large company (20+ employees): Your employer's plan is almost always primary. It pays first, and Medicare helps cover some of what's left.

- You're retired and have retiree insurance from a former job: In this case, Medicare is almost always primary. Your retiree plan then steps in to help with costs like deductibles and coinsurance.

Knowing who pays first is crucial for budgeting. If your other plan is primary, its rules determine your initial costs. If you have more questions about your specific setup, our collection of answers to the most common FAQ about Medicare can offer more clarity.

Do I Have to Pay My Deductible for Preventive Services?

Here's some great news. One of the best things about Medicare is its focus on keeping you healthy, and it backs that up by covering many preventive services at 100%.

That means you pay $0 for the service, and it doesn't even count toward your annual Part B deductible.

Medicare fully covers a whole range of screenings and check-ups to catch problems early. Some of the most common ones include:

- Annual "Wellness" Visit: A yearly check-in to create or update a personalized prevention plan.

- Flu Shots: One per flu season.

- Pneumonia Shots

- Cancer Screenings: Including mammograms, Pap tests, and colorectal cancer screenings.

- Cardiovascular Screenings: Blood tests to check cholesterol and other levels.

- Diabetes Screenings

One small catch to keep in mind: while the preventive screening itself is free, if your doctor finds something that needs a follow-up, those subsequent diagnostic tests would fall under your normal Part B deductible and coinsurance rules.

Trying to navigate the medicare deductible 2024 and find the right supplemental plan can feel like a maze, but you don’t have to figure it out alone. The experts at My Policy Quote are here to give you clear answers and help you find a plan that fits your life and your budget.