Navigating Medicare can sometimes feel like learning a new language. One of the terms that trips people up the most is "Part B excess charges." It sounds complicated, but it's a simple concept once you break it down.

These are extra fees—up to 15% above the standard Medicare-approved price—that certain doctors are legally allowed to bill you. It’s a rare occurrence, but knowing it exists is the first step to avoiding surprise medical bills.

Understanding Medicare Part B Excess Charges

Think of it like this: Medicare has a price list for services, and most doctors agree to it. They "accept assignment," which means they accept Medicare's approved amount as full payment. Done and done.

But a small handful of doctors don't fully agree to that price list. They still accept Medicare patients, but they reserve the right to charge a little extra. That "little extra" is the Part B excess charge.

This is probably one of the most misunderstood parts of Medicare billing, and that confusion can lead to real financial stress. The good news? These charges aren't a free-for-all. They are strictly regulated, only apply to a specific type of provider, and have a firm cap.

To help you get a quick handle on this, here's a simple breakdown of the most important things to know.

Excess Charges at a Glance

This table sums up the essentials in a nutshell.

| Key Question | The Short Answer |

|---|---|

| What are they? | An extra fee, up to 15% over the Medicare-approved amount, that some doctors can charge. |

| Who can charge them? | Doctors who are "non-participating" with Medicare but have not opted out completely. |

| Is this common? | No, it’s quite rare. Most doctors in the U.S. accept Medicare assignment. |

| How do I avoid them? | Always ask your doctor's office, "Do you accept Medicare assignment?" A "yes" means no excess charges. |

Thinking about these details is a key part of smart healthcare planning for your retirement.

An excess charge is essentially a provider's fee for not being a full participant in the Medicare payment system. It's the difference between what they want to charge and what Medicare is willing to pay.

Understanding these finer points empowers you to take control. When you know how all the moving parts work together, you can make informed decisions and keep unexpected costs at bay. For a broader look at how to build a solid strategy, a comprehensive Medicare planning guide can give you the context you need to feel confident.

Why Accepting Assignment Is Critical for Your Wallet

To really get a handle on Medicare Part B excess charges, you first need to wrap your head around a key idea: Medicare assignment.

Think of it like a handshake deal between your doctor and Medicare. When a doctor “accepts assignment,” they’re agreeing to take the Medicare-approved amount as their full payment. Simple as that.

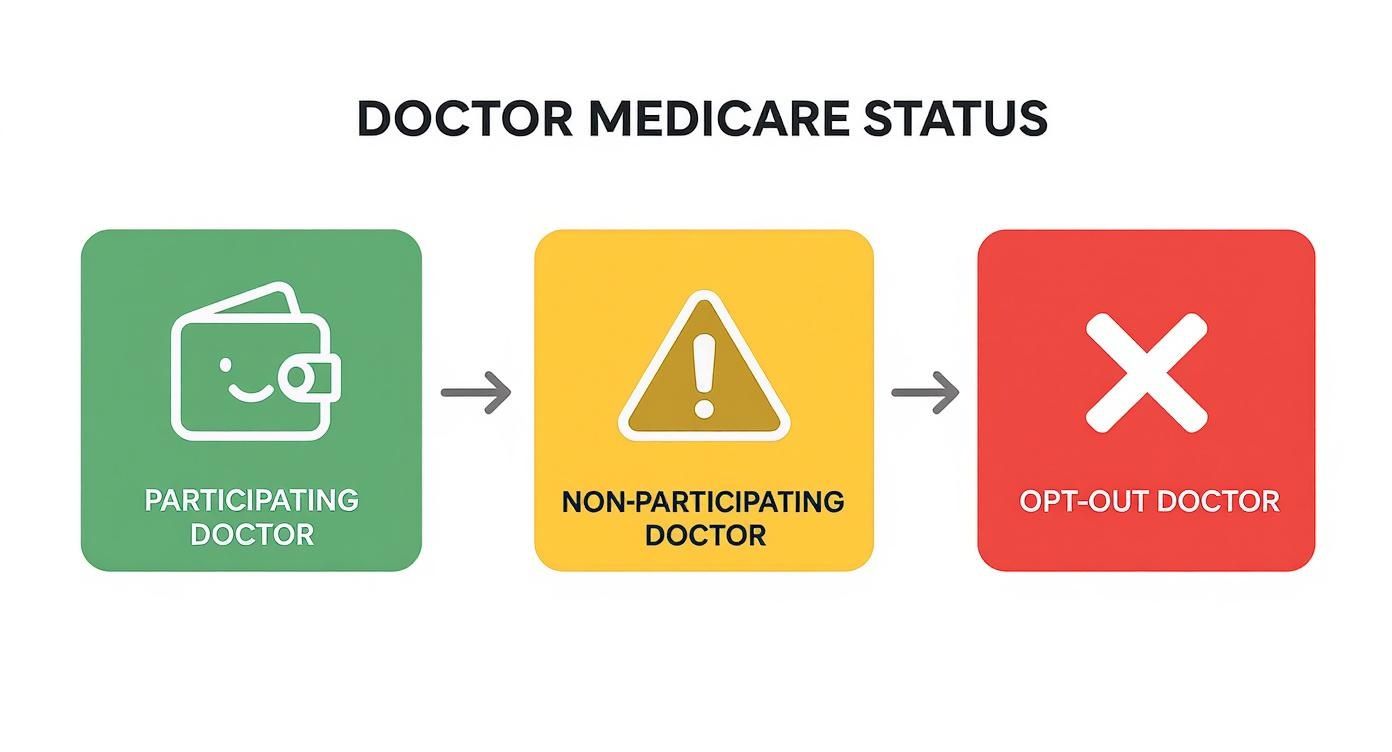

This single agreement is the most important factor in whether you can get hit with an excess charge. It’s not just some billing detail; it's a promise that directly impacts your wallet. Every doctor falls into one of three categories based on this decision, and knowing which is which will save you from surprise bills down the road.

Participating (PAR) Providers

Good news—most doctors are in this group. A Participating (PAR) Provider has signed an official agreement to always accept Medicare assignment for every single Medicare patient and service.

So, what does that mean for you?

- They bill Medicare for you, so you don’t have to.

- They legally cannot charge you a penny more than your standard Medicare deductibles and coinsurance.

This is the easiest, most predictable setup. If you see a PAR provider, you can relax knowing a Medicare Part B excess charge is completely off the table.

Non-Participating (non-PAR) Providers

This is where things get tricky. A Non-Participating (non-PAR) Provider is the only type of doctor who can legally send you a bill for an excess charge.

These providers still see Medicare patients, but they haven't signed that all-in agreement. Instead, they get to decide whether to accept assignment on a claim-by-claim basis. If they decide not to accept assignment for your visit, they can charge you up to 15% more than what Medicare would normally approve. That extra 15%? That’s the excess charge.

A doctor’s choice to be non-participating gives them more billing freedom, but it shifts a potential financial risk directly onto you. This is exactly why it’s so important to ask about their status before you make an appointment.

Opt-Out Providers

This last category is much more straightforward. Opt-Out Providers have completely cut ties with the Medicare program. No contracts, no billing, no connection whatsoever.

If you choose to see an opt-out provider, you’re on the hook for 100% of the bill. Medicare won't pay a dime. It’s a totally private arrangement between you and your doctor, existing completely outside of the Medicare system.

It's also worth noting that this is a different situation from a doctor who simply doesn't accept your specific insurance plan. If you ever run into that issue, you can learn more about what to do if your doctor doesn’t accept your health insurance to figure out your next steps.

The Financial Impact: A Real-World Example

Let's break down how this looks with an actual medical bill. Imagine you have a specialist appointment, and the Medicare-approved amount for the visit is $200.

Scenario 1: You visit a PAR Provider (Accepts Assignment)

- Medicare Pays (80%): $160

- Your Coinsurance (20%): $40

- Excess Charge: $0

- Your Total Cost: $40

Scenario 2: You visit a non-PAR Provider (Does NOT Accept Assignment)

- Medicare-Approved Amount (Slightly Reduced): $190 (non-PAR doctors get 95% of the standard rate)

- Medicare Pays (80% of $190): $152

- Your Coinsurance (20% of $190): $38

- Maximum Excess Charge (15% of $190): $28.50

- Your Total Cost: $66.50 ($38 coinsurance + $28.50 excess charge)

See the difference? In this example, seeing a non-PAR provider who doesn’t accept assignment costs you over 66% more out of your own pocket. A simple question—"Do you accept Medicare assignment?"—is all it takes to avoid that extra cost and stay in control of your healthcare spending.

How Excess Charges Are Calculated Step by Step

Trying to figure out the math behind Medicare Part B excess charges can feel a little daunting. But once you break it down, the formula is actually pretty simple. The most important thing to remember is this: the 15% charge is based on the Medicare-approved amount for a service, not the doctor's original, higher bill. That one detail makes all the difference.

Let's walk through a real-world example to see exactly how this works.

Imagine you need to see a dermatologist. The one you choose is a "non-participating" provider, meaning they don't accept Medicare assignment. After your visit, they hand you a bill for $500.

The Initial Medicare Adjustment

First things first, Medicare has its own rulebook. Because this doctor doesn't fully participate, Medicare's approved payment for them is automatically a little lower—95% of what they'd pay a doctor who does participate.

So, let's say the standard Medicare-approved rate for this procedure is normally $400. For your non-participating doctor, the calculation looks like this:

- $400 (Standard Rate) x 0.95 = $380 (Non-Participating Approved Rate)

This $380 becomes the new baseline. Everything else—what Medicare pays, what you owe, and the excess charge—is calculated from this adjusted number.

Calculating the Excess Charge and Your Total Cost

Now we can put all the pieces of the puzzle together. Using that $380 approved amount, here’s how the final bill stacks up:

- Medicare's Payment: Medicare covers its usual 80% of the approved amount. That comes out to $304 ($380 x 0.80).

- Your Coinsurance: You’re on the hook for the remaining 20%. In this case, that’s $76 ($380 x 0.20).

- The Excess Charge: Finally, the doctor can add up to 15% of the approved amount. This tacks on an extra $57 ($380 x 0.15).

Your total out-of-pocket cost is your standard coinsurance plus that new excess charge.

Your Total Bill = Coinsurance + Excess Charge

$76 + $57 = $133

Just like that, an extra charge gets stacked right on top of what you’d normally owe, making a routine visit more expensive than you planned for.

This whole process is laid out in the graphic below, which clearly shows how a doctor's Medicare status can directly impact your wallet.

The visual flows from a green, "wallet-friendly" participating provider to a yellow "warning" for non-participating doctors, highlighting the financial risk you take on.

In most states, doctors, surgeons, and specialists are legally allowed to bill up to 15% more than Medicare’s approved amount. The tough part? These charges are added on top of your standard coinsurance and deductibles, and they don’t count toward your annual deductible. It’s an easy way for unexpected financial burdens to pile up.

You can read the full analysis on Medicare Part B financial burdens to get a deeper understanding. Knowing how this works empowers you to ask the right questions and choose providers who fit your budget.

How Your State's Rules Affect Your Risk

While Medicare is a federal program, where you live can make a huge difference in whether you’ll ever see a Part B excess charge. It’s a surprising twist, but a handful of states have passed their own laws to protect residents from these extra fees.

This means for some, the whole conversation about excess charges is just a "what if." But for most others, it's a real financial risk that you need to know about. Figuring out which group you fall into starts with understanding your state’s rules.

States That Prohibit Excess Charges

Good news if you live in certain states: local laws step in to shield you from excess charges. In these protected areas, even doctors who don't fully participate in Medicare can't legally bill you more than the standard Medicare-approved amount.

It’s a powerful layer of financial protection. The eight states that offer this safeguard are:

- Connecticut

- Massachusetts

- Minnesota

- New York

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

If your home is in one of these eight states, you generally won’t get hit with a Medicare Part B excess charge from a local doctor. It just makes navigating healthcare a little simpler and removes one more potential surprise from your medical bills.

Some people find it helpful to use a little memory trick to recall these states: TOM’s CROP. (T for Vermont, O for Ohio, M for Massachusetts and Minnesota, C for Connecticut, R for Rhode Island, and P for Pennsylvania). It's a quick way to remember where you're protected.

The Financial Difference State Rules Make

Living in a protected state versus one that isn't creates a stark contrast in your potential out-of-pocket costs. The very same doctor’s appointment could cost you more or less depending entirely on your zip code.

Let’s break down exactly what that looks like.

State Regulations on Medicare Excess Charges

The table below shows the clear divide between states with and without these consumer protections.

| State Status | Governing Rule | Impact on Beneficiaries |

|---|---|---|

| Protected State (e.g., New York) | State law prohibits excess charges. | You’re only responsible for your standard 20% coinsurance, even if your doctor doesn't accept assignment. |

| Unprotected State (e.g., Florida) | Federal law permits excess charges. | You could owe your 20% coinsurance plus an extra charge of up to 15% of the Medicare-approved amount. |

The difference is clear as day. In an unprotected state, the responsibility falls on you to check a doctor's status or get a Medigap plan to cover the gap. In a protected state, the law handles that for you.

For the majority of Americans living outside those eight states, the risk of an excess charge is very real. This just goes to show how vital it is to always ask providers if they accept Medicare assignment or to have a backup plan in place to cover these specific costs. Your state’s rules really do shape your entire strategy for keeping your healthcare costs predictable.

Using Insurance to Cover Excess Charges

https://www.youtube.com/embed/eOP76hMPiDs

Knowing how to spot and avoid Medicare Part B excess charges is a great start, but having a real financial safety net is even better.

Original Medicare, on its own, won’t touch these extra fees. That leaves you holding the bag for the entire amount. This is exactly where supplemental insurance becomes one of the most important parts of your healthcare strategy.

Think of the right insurance plan as your shield. It’s there to absorb the financial shock of these unexpected costs, giving you the freedom to choose your doctors and the peace of mind to protect your budget.

Medigap: The Ultimate Protection Against Excess Charges

Medicare Supplement insurance, better known as Medigap, was created for one reason: to fill the financial gaps Original Medicare leaves behind. These plans are your first and best line of defense against Part B excess charges.

Two Medigap plans, in particular, offer complete, worry-free protection:

- Medigap Plan G: This is now the most comprehensive plan you can get if you're new to Medicare. It covers 100% of Part B excess charges. If you have this plan, you will never pay a dime for these fees. Simple as that.

- Medigap Plan F: If you were eligible for Medicare before January 1, 2020, Plan F also covers 100% of excess charges. While it’s no longer available to new enrollees, it’s still a gold-standard plan for those who have it.

With either Plan G or F, you get the freedom to see any doctor who accepts Medicare—even those who don't take assignment—without the fear of getting a surprise bill. Your Medigap plan just pays the extra charge for you. This level of rock-solid coverage is why so many people feel these are the best Medicare Supplement plan options available.

How Medicare Advantage Plans Handle This Issue

Medicare Advantage, or Part C, plays by a completely different set of rules. These plans are run by private insurance companies. They’re required to cover everything Original Medicare does, but they do it through managed care networks.

Here’s how that affects excess charges:

- In-Network Providers: When you see a doctor inside your Medicare Advantage plan’s network (like an HMO or PPO), you will never face a Part B excess charge. The doctors have a contract with your insurer that stops them from billing you above the plan's negotiated rates.

- Out-of-Network Providers: If you go outside the network for care, things get more expensive. You won't get a bill labeled "excess charge," but you will face much higher copays and coinsurance. In some cases, the service might not be covered at all.

This makes Medicare Advantage a trade-off. You’re protected from excess charges, but you give up the freedom to see any doctor you want. Your healthcare choices are guided by your plan's list of approved providers.

Choosing Your Financial Strategy

So, what’s the right move for you? It really comes down to what you value most. Both Medigap and Medicare Advantage protect you from the sting of excess charges, but they get you there in very different ways.

| Coverage Type | How It Handles Excess Charges | Key Consideration |

|---|---|---|

| Medigap Plan G or F | Covers 100% of Part B excess charges. | Gives you total freedom to see any doctor who accepts Medicare, no strings attached. |

| Medicare Advantage | Prevents excess charges through provider networks. | Limits your choice of doctors to those inside the plan’s network to keep costs down. |

On top of private insurance, veterans may qualify for government programs that offer significant financial help. These benefits can be especially useful for things Medicare doesn't cover well, like long-term care. Looking into programs like VA Aid and Attendance benefits can be a smart move when planning for your total healthcare expenses.

Your Action Plan to Avoid Excess Charges

Knowledge is only powerful when you act on it. Now that you know how Medicare Part B excess charges work, it’s time to put that knowledge to use. Dodging these surprise fees isn’t about complex strategies—it’s about building a few simple, repeatable habits.

Think of this as your personal playbook for every doctor's visit. A few quick steps can help you protect your wallet and keep your healthcare costs predictable, appointment after appointment. This is how you take back control.

Before Your Appointment

The easiest way to deal with excess charges is to stop them before they even happen. A little prep work before seeing a new provider can save you a ton of money and stress down the road.

Your pre-visit checklist just has three simple steps:

-

Ask the Magic Question: When you call a new doctor’s office, ask the billing department one direct question: "Do you accept Medicare assignment?" A clear "yes" is your guarantee that you won’t face an excess charge. If they pause or just say "we accept Medicare," ask them to clarify. That phrase doesn't always mean they accept assignment.

-

Verify with Medicare’s Tool: Don’t just take their word for it—double-check for yourself. Medicare has an official online tool called the Physician Compare tool. You can look up any provider and confirm their participation status in minutes, giving you total peace of mind.

-

Know Your Insurance Inside and Out: If you have a Medigap plan, know exactly how it covers these charges. If you have Plan G or Plan F, you’re 100% covered, so there’s nothing to worry about. For everyone else with different supplement plans or just Original Medicare, sticking to participating providers is a must for your budget.

After Your Appointment

Even when you plan ahead, it’s smart to stay on top of your paperwork after you’ve received care. Reviewing your statements is the final, critical step to make sure you were billed correctly and to catch errors before they become a headache.

Here’s what you need to look for:

-

Review Your Medicare Summary Notice (MSN): This document is mailed to you every three months and details everything billed to Medicare. Look closely at the "Notes" column. If a provider billed an excess charge, it will often be noted here, showing you exactly what you owe beyond your normal coinsurance.

-

Scrutinize the Provider’s Bill: Compare the bill you get from the doctor’s office with your MSN. The numbers should match up. If you see a charge that seems off or is labeled with something you don’t recognize, it’s time to pick up the phone.

An unexpected charge isn't a final bill; it's an invitation to ask questions. Always challenge bills that don’t make sense—billing errors are more common than you’d think.

If you spot a charge you believe is wrong, your first call should be to the provider’s billing office. If that doesn't fix it, you can file an appeal with Medicare. Your Medigap company can also be a huge help in these situations. And if you’re thinking about getting better protection, learning how to change from Medicare Advantage to Medigap can be a game-changing move.

Common Questions About Excess Charges

Let's be honest, Medicare billing can feel like a maze. Just when you think you've got it figured out, a new term pops up. To help clear the air, we're tackling some of the most common questions people have about Medicare Part B excess charges.

Think of this as your cheat sheet. We'll give you direct, simple answers so you can feel confident and in control of your healthcare costs.

Can a Hospital Bill Me for Part B Excess Charges?

This one trips a lot of people up, but the answer is pretty straightforward: Hospitals generally cannot send you a bill for Part B excess charges.

These charges are a very specific thing, tied only to services you get under Part B—think doctor visits, lab work, or medical equipment.

When you're admitted to a hospital as an inpatient, that's covered by Part A, where excess charges don't even exist. And for outpatient services you get at a hospital? There's often an "all-or-nothing" rule in play. If the hospital takes Medicare assignment, every doctor working there usually has to as well, which stops these extra fees in their tracks.

Do Excess Charges Count Toward My Part B Deductible?

No, they don't. This is a super important detail for anyone trying to budget their healthcare spending. Any money you pay for Part B excess charges will not help you meet your annual Part B deductible.

Your deductible is the amount you have to pay first before Medicare starts chipping in. Excess charges are completely separate from that. They're an extra fee billed directly by the provider, sitting outside of the standard Medicare cost-sharing system.

It's crucial to remember this: an excess charge is always an extra out-of-pocket cost. It comes on top of your deductible and your normal 20% coinsurance, without giving you any other financial benefit.

Can My Doctor Bill Me for More Than the 15% Limit?

Absolutely not. That 15% limit is a hard-and-fast rule set by federal law, and doctors are legally required to follow it. A non-participating provider can't just decide to charge you 16%, 20%, or any other amount they want above that Medicare-approved rate. It’s non-negotiable.

If you ever get a bill with an excess charge that looks higher than 15% of what Medicare approved, it's almost certainly a billing mistake.

Here’s what you should do:

- Step 1: Call the doctor’s billing office right away and ask them to explain the charge.

- Step 2: Pull out your Medicare Summary Notice (MSN). It will show you exactly what Medicare approved and what your share should be.

- Step 3: If the office won't fix the mistake, you have every right to file an appeal directly with Medicare.

Knowing the rules is your best defense. That 15% cap protects you from being overbilled, so don't ever be afraid to question a bill that just doesn't look right.

Figuring out insurance can be tough, but you don't have to do it by yourself. The experts at My Policy Quote are here to help you find the perfect Medigap or Medicare Advantage plan that can protect you from surprise costs like excess charges. Visit us at https://mypolicyquote.com for a free, no-pressure quote and get the peace of mind you deserve.