Let's get one thing straight about healthcare costs in retirement: they’re big, they’re unpredictable, and they’ll likely be one of your largest expenses after you stop working. For someone who is 65 and retiring in 2025, that bill is projected to hit a staggering $172,500 over their lifetime.

That number makes planning not just a good idea, but an absolute must.

The Reality of Retirement Healthcare Costs

When we dream about retirement, we picture traveling, spending more time with family, or finally picking up that hobby we never had time for. But the one expense that can quietly sideline those dreams is healthcare.

It’s like planning a long road trip. You know you'll need gas, but you have no idea what the price per gallon will be or how many miles you'll end up driving. That’s the kind of uncertainty we’re dealing with.

The costs aren't a single, neat bill. They’re a mix of different expenses that change over your retirement years, including:

- Routine Premiums: These are your monthly payments for Medicare and any supplemental insurance you choose.

- Out-of-Pocket Expenses: This bucket includes everything from co-pays and deductibles to dental, vision, and hearing care—costs that standard Medicare often doesn’t cover.

- Unexpected Health Events: A sudden illness or an accidental injury can lead to significant, unplanned medical bills.

- Long-Term Care Needs: This is often the biggest expense of all, covering assistance with daily living activities if you ever need it.

The Ever-Growing Price Tag

The financial challenge of healthcare in retirement isn’t a fixed target. It's constantly moving, and for decades, it has only moved in one direction: up.

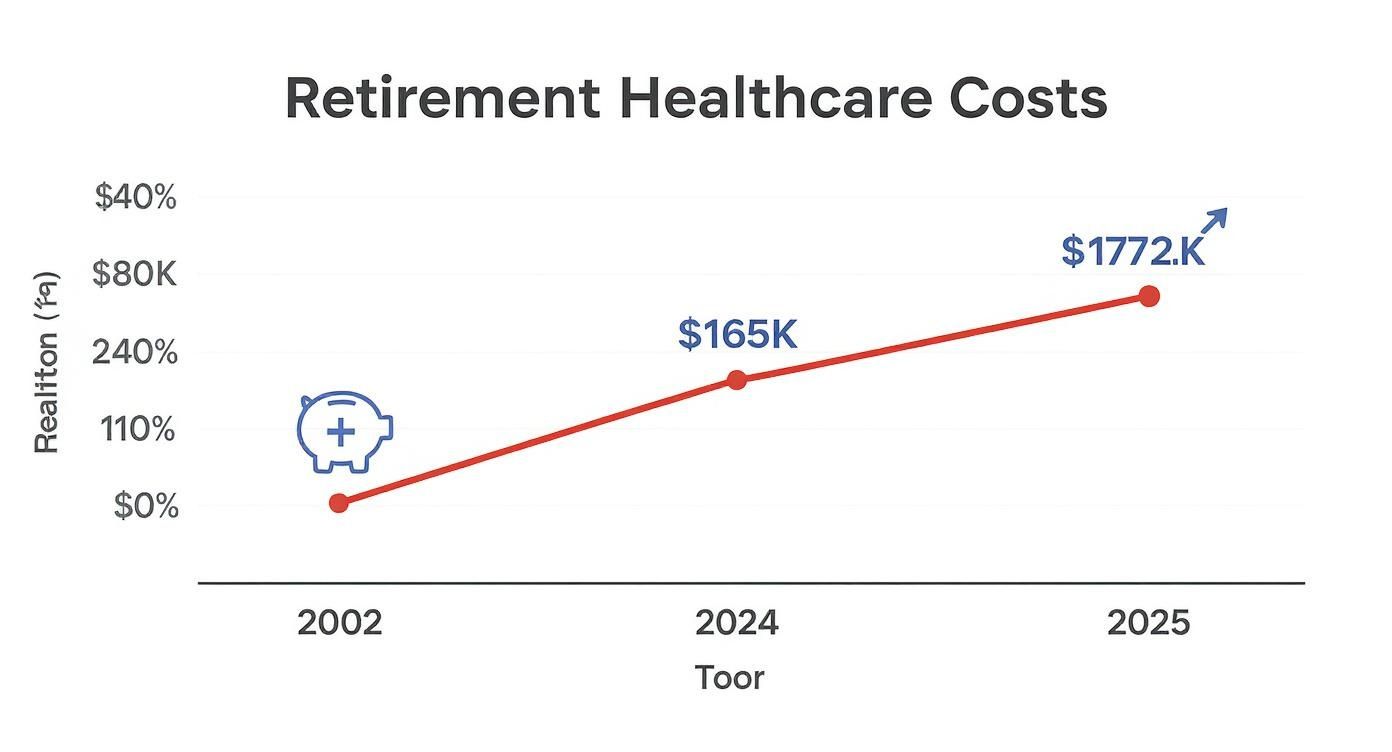

Recent data paints a clear picture. A 65-year-old retiring in the U.S. in 2025 can expect to spend, on average, $172,500 on healthcare throughout their retirement. That figure is up from $165,000 in 2024 and has more than doubled from the $80,000 estimate back in 2002.

This infographic really puts the sharp increase into perspective.

Here's a quick look at how those numbers have climbed, showing why yesterday's savings goals just won't cut it for today's retirees.

Estimated Lifetime Retirement Healthcare Costs At a Glance

| Retirement Year | Estimated Individual Cost |

|---|---|

| 2002 | $80,000 |

| 2024 | $165,000 |

| 2025 | $172,500 |

The trend is undeniable. What was considered enough for a retiree two decades ago is nowhere near what’s needed today, hammering home the urgent need for a solid savings plan.

Planning Beyond the Averages

While national averages are a good starting point, they don't tell your personal story. Real-life retirement healthcare costs often include major expenses tied to specific conditions, like those that can come with understanding cognitive decline.

The trap isn’t the costs themselves—they’re inevitable—but failing to plan for them. Healthcare needs to be baked into your income plan, so you know how these expenses will be paid today and twenty years from now.

Ultimately, the first step to tackling this challenge is framing it correctly. This guide is here to move you from a place of worry to one of empowerment. Once you understand what these expenses are made of and explore the right savings tools, you can build the financial buffer you need.

To get started, you might be interested in our guide on navigating your options for https://mypolicyquote.com/2025/06/28/retirement-health-insurance/.

Decoding Your Major Healthcare Expenses

Trying to figure out your future healthcare bill can feel like packing for a trip without knowing the destination. You know you’ll need resources, but what kind? And how much? The reality is, your costs won’t come from a single source. They fall into four main categories, and each one needs its own plan.

Let’s unpack these expenses one by one. By breaking down the puzzle, we can build a clear financial map that prepares you for the road ahead.

Medicare Premiums

Think of Medicare premiums as your monthly membership fee for health coverage. Good news first: most people get Medicare Part A (for hospital stays) without paying a premium, thanks to years of paying Medicare taxes. But Part B (for doctor visits) and Part D (for prescriptions) will have a monthly cost.

This isn't a fixed price. The standard Part B premium for 2025 is $185 per person each month, but yours might be higher. Why? Medicare looks at your income from two years ago to see if you need to pay an Income-Related Monthly Adjustment Amount (IRMAA)—basically, a surcharge for higher earners.

This means a one-time financial event, like selling your home, could unexpectedly raise your Medicare premiums two years down the line. It's a small detail that can have a big impact.

Deductibles and Cost-Sharing

On top of your monthly premiums, you’ll also pay for a portion of your care when you actually use it. This is where deductibles, co-pays, and coinsurance come in. It’s a lot like car insurance—you have a deductible to meet before coverage really kicks in, and then you share the rest of the cost.

Here's what those terms actually mean:

- Deductible: The amount you pay out-of-pocket before Medicare starts covering its share.

- Co-pay: A flat fee for a specific service, like a checkup or a prescription.

- Coinsurance: The percentage you pay after your deductible is met. For Part B, this is usually 20% of the approved cost.

These little payments might not seem like much on their own, but they can add up fast, especially if you’re managing a chronic condition.

Expenses Not Covered By Medicare

Here’s one of the biggest surprises for new retirees: Original Medicare doesn’t cover everything. In fact, it leaves some pretty big gaps, forcing you to pay for some very common and essential services completely on your own.

Relying on Medicare to cover all your health costs is one of the most common and costly mistakes people make. Many retirees are caught completely off guard by what isn't included.

The most common uncovered expenses are:

- Routine Dental Care: Regular cleanings, fillings, crowns, or dentures are almost never covered.

- Vision Services: Eye exams and glasses are your responsibility.

- Hearing Aids: These critical devices, which often cost thousands, are not covered.

Because dental issues can become a major expense, understanding dental insurance options ahead of time is a smart move.

The Long-Term Care Wild Card

Finally, we have the single biggest financial risk in retirement: long-term care (LTC). This isn’t about medical treatments; it’s about custodial care—help with daily activities like bathing, dressing, and eating. Medicare almost never covers this.

The numbers are genuinely startling. The median annual cost for an assisted living facility is over $70,000. For a nursing home, it can top $111,000. With nearly 70% of people over 65 expected to need some form of LTC, ignoring this is a gamble you can't afford to take. Planning for this possibility is an absolute must. To get a better handle on your options, you can dive into our guide on the cost of long-term care insurance.

Why Your Personal Healthcare Bill Will Vary

When you hear a figure like $170,000 for average retiree healthcare costs, it’s easy to feel a jolt of panic. But hold on. It’s crucial to remember what an "average" really is—a mathematical midpoint that mashes together millions of unique lives into one single, impersonal number.

The truth is, your actual healthcare costs in retirement will be as unique as you are.

Think of that national average like the sticker price on a new car. It gives you a ballpark idea, but the final amount you pay depends on the model you pick, the features you add, and where you buy it. Your personal health, lifestyle, and a few other key factors will shape your final healthcare bill in the exact same way.

Health and Lifestyle Choices

Let's get straight to the point: the biggest driver of your future medical expenses is your health right now. Someone actively managing a chronic condition like diabetes or heart disease will have a completely different cost journey than someone with no major health issues.

It's a simple but powerful reality. Your health today directly shapes your financial needs tomorrow.

Lifestyle choices play a huge part in this. Imagine two 65-year-old retirees:

-

Scenario A (Active Ann): Ann stays active, eats well, and avoids smoking. Her proactive approach to wellness lowers her risk for many expensive chronic diseases, which will likely mean lower healthcare spending over the long run.

-

Scenario B (Sedentary Sam): Sam leads a more relaxed life with less physical activity and a history of smoking. His choices may raise his risk for health problems down the road, potentially leading to higher insurance premiums, more doctor visits, and pricier prescriptions.

These everyday decisions are really the down payment on your future health. Small, consistent habits today can lead to massive savings over a 20- or 30-year retirement.

The Longevity Factor

Living a long, full life is the goal, right? But it also means your retirement savings need to last longer. This is often called "longevity risk"—the financial challenge of outliving your money. If you live to be 95, you're naturally going to rack up more healthcare bills than someone who lives to 75.

This is where we often see a difference between genders. On average, women live longer than men, which means they typically face more years of healthcare expenses. Their longer timeline often includes a greater need for long-term care, pushing their total lifetime costs higher.

Beyond the basic estimates, when you factor in gender and individual health, the numbers get even more real. One analysis projects a healthy 65-year-old retiring in 2025 might need $281,000 (for men) to $320,000 (for women) to cover their lifetime healthcare expenses.

These figures show exactly why a one-size-fits-all savings goal just doesn't work.

Your Retirement Location Matters

Where you decide to settle down for your retirement can have a surprisingly big impact on your wallet. From insurance premiums to the price of a doctor's visit, healthcare costs vary dramatically from one state—or even one city—to the next.

Living in a high-cost urban area will likely mean higher expenses than settling in a quiet, rural community. This is also true for your insurance options. The availability and cost of Medicare Advantage and Medigap plans can change based on your zip code.

As you map out your finances, you need to understand how these plans differ. You can learn more in our guide on the contrasts between Medicare vs. private insurance. Researching the cost of living and healthcare in your dream retirement spot is a critical step that too many people forget.

Alright, let's get into the nitty-gritty. Now that you know what makes up retirement healthcare costs, it's time to figure out what that means for you.

Trying to estimate these future expenses can feel like guessing the weather for a random Tuesday ten years from now. It’s a bit of a guessing game, but you don’t need a crystal ball. All you need is a practical way to turn that vague worry into a real, tangible savings goal.

Let’s walk through a few solid methods—from a quick back-of-the-napkin number to a more detailed roadmap—to calculate what your healthcare costs in retirement might actually look like.

Start with a Simple Benchmark

If you just want a quick, straightforward number to get started, a percentage-based approach is your friend. Financial experts often suggest setting aside a specific slice of your retirement budget just for healthcare.

A common rule of thumb is to dedicate 15% of your annual retirement expenses to medical costs. It's simple math. If you're planning to live on $70,000 a year after you stop working, you’d budget around $10,500 of that for healthcare. This gives you a solid baseline and is a fantastic starting point.

But remember, this is just a benchmark. To get a number that truly fits your life, you’ll want to dig a little deeper.

Create a Detailed Healthcare Budget

For anyone who prefers precision over a rough estimate, building a detailed budget is the way to go. This means listing out your expected costs one by one, based on your personal health, the insurance you choose, and your lifestyle. Think of it as creating a specific grocery list instead of just guessing how much you'll spend at the store.

To build your custom budget, start gathering a few key pieces of information:

- Estimate Your Premiums: Start with the basics. Look up the current standard Medicare Part B premium and the average Part D premium. If you’re thinking about a Medigap or Medicare Advantage plan, get quotes for someone your age in your area.

- Project Out-of-Pocket Costs: Take a look at what you spend now. How much do you typically shell out for co-pays, prescriptions, or visits to a specialist? Use that as a starting point, and don't forget to adjust it for any health conditions you're managing.

- Factor in Uncovered Services: This is where people get tripped up. Don't forget the gaps in coverage. Budget for things like routine dental cleanings, eye exams, new glasses, and maybe even hearing aids down the road. These can easily add up to $1,000-$3,000 or more each year.

- Consider Long-Term Care: This is the big one. While it's impossible to know for sure if you'll need it, you can't ignore the risk. Start researching the cost of long-term care insurance or decide on a dedicated savings strategy to cover these potential expenses.

A personalized budget is your financial roadmap. It moves you from relying on national averages to building a plan based on your own life, health, and choices, which is the key to confident retirement planning.

Use Online Retirement Healthcare Calculators

You don't have to do all the math yourself. There are some excellent online tools that can help you project your future healthcare needs. These calculators use a ton of data to give you an estimate based on your age, gender, health, and even where you live.

A quick word of advice, though: use a few different calculators to get a range of estimates. Each one uses slightly different assumptions, so comparing the results will give you a much more balanced perspective. They’re fantastic for fine-tuning your budget and stress-testing your savings goals.

By combining a simple benchmark, a detailed budget, and insights from online tools, you can build a realistic estimate you can actually work with. This number becomes your target, empowering you to create a focused savings plan that truly prepares you for the financial realities of healthcare in retirement.

Building Your Retirement Healthcare Savings

https://www.youtube.com/embed/VJcE7UcVVlg

Okay, you’ve done the hard part and figured out a rough savings target. Now what? The next question is simple: where do you actually put the money? Building a nest egg specifically for medical bills isn’t just about saving more—it’s about saving smarter.

Fortunately, there are a few powerful financial tools designed to help your funds grow efficiently, ready for the day you’ll need them. Think of these accounts like different tools in a workshop. While a hammer can do a lot, sometimes you need a specialized wrench. The key is picking the right tools for your financial situation and putting them to work consistently.

The Ultimate Tool: The Health Savings Account

When it comes to saving for future medical costs, the Health Savings Account (HSA) is in a class of its own. It's often called "triple-tax-advantaged," a rare feature that makes it an absolute powerhouse for long-term growth.

Here’s what that triple threat looks like in action:

- Tax-Deductible Contributions: The money you put in lowers your taxable income for the year, giving you an immediate break.

- Tax-Free Growth: Your investments inside the HSA grow without being hit by capital gains taxes, letting your money compound faster.

- Tax-Free Withdrawals: As long as you use the money for qualified medical expenses, you won’t pay a single penny in taxes when you take it out.

There is a catch: to be eligible for an HSA, you need to be enrolled in a high-deductible health plan (HDHP). And once you enroll in Medicare (usually at 65), you can no longer contribute. But here's the best part—all the money you've already saved is yours to use, tax-free, for the rest of your life. This makes the HSA an exceptional tool for covering healthcare costs in retirement.

Other Powerful Savings Vehicles

While the HSA is a superstar, it shouldn’t be the only player on your team. Other retirement accounts, like Roth IRAs and traditional 401(k)s, can also play a huge role in your healthcare savings strategy, each with its own unique benefits.

A Roth IRA is a fantastic partner to an HSA. You contribute with after-tax dollars, so there’s no upfront tax deduction. But in exchange, your investments grow tax-free, and all qualified withdrawals in retirement are 100% tax-free. This gives you incredible flexibility, since you can use the funds for anything—including medical bills—without a tax hit.

A Traditional 401(k) or IRA gives you a tax deduction on your contributions today, which is great for lowering your current tax bill. The money grows tax-deferred, but you will pay income tax on withdrawals in retirement. It may not be as tax-efficient for medical costs as an HSA or Roth, but it's still a cornerstone of retirement saving that can absolutely be tapped for health expenses.

The goal is to build a diversified financial toolkit. Combining the specific tax advantages of an HSA with the flexibility of a Roth IRA and the growth potential of a 401(k) creates a robust, multi-layered defense against future medical expenses.

A solid plan also means keeping your current expenses in check. To learn more about managing costs right now, check out our practical advice on how to reduce insurance premiums and free up more cash for your long-term goals.

Comparing Your Savings Options

Seeing these accounts side-by-side can make it much clearer which ones are the right fit for your financial plan. Each has its own rules, but they all offer unique advantages for covering healthcare expenses in your later years.

Here's a quick look at how the top savings vehicles stack up for retirement healthcare costs.

Comparing Top Savings Accounts for Retirement Healthcare

| Savings Vehicle | Tax on Contributions | Tax on Growth | Tax on Withdrawals for Healthcare | Best For |

|---|---|---|---|---|

| Health Savings Account (HSA) | Tax-Deductible | Tax-Free | Tax-Free | Dedicated, tax-free funds specifically for current and future medical costs. |

| Roth IRA | Not Deductible | Tax-Free | Tax-Free | Flexible, tax-free funds that can be used for healthcare or any other expense. |

| Traditional 401(k)/IRA | Tax-Deductible | Tax-Deferred | Taxed as Income | General retirement savings that can be used for healthcare but will be taxable. |

Ultimately, turning a big, scary savings goal into something you can actually achieve comes down to one thing: consistency.

By starting early and strategically using these powerful accounts, you can build a formidable financial reserve designed to protect both your health and your retirement dreams.

Common Questions About Retirement Healthcare Costs

As you start mapping out life after work, a few big questions about healthcare costs in retirement always seem to pop up. Getting straight answers is the only way to build a financial plan you can actually rely on.

Let’s tackle some of the most common points of confusion head-on to give you a clearer picture.

Does Medicare Cover Everything?

The short answer? A definite no. This is probably the single biggest misconception people have when they first retire. While Original Medicare (Part A and Part B) is an absolute cornerstone of healthcare for seniors, it was never designed to cover everything.

You’re still on the hook for monthly premiums, deductibles, and co-pays. But more importantly, there are entire categories of care that Medicare simply doesn’t touch, and these can get expensive fast.

These uncovered costs typically include:

- Most long-term care services (like nursing homes or in-home health aides)

- Routine dental work, from cleanings to crowns

- Eye exams and glasses

- Hearing aids and the appointments to get them fitted

This is exactly why so many retirees choose to either buy a Medicare Supplement (Medigap) policy or enroll in a Medicare Advantage (Part C) plan. These private insurance options are designed specifically to fill in those gaps and make your out-of-pocket costs far more predictable.

How Much Should I Save in My HSA?

There’s no magic number here, because the right Health Savings Account balance for you depends on your health, your lifestyle, and even where you decide to live in retirement. That said, the best strategy is simple: contribute the maximum you can, every single year you're eligible.

Many financial planners suggest aiming for a balance that could cover your health plan's out-of-pocket maximum for several years in a row.

For a 65-year-old couple, building up a six-figure balance in an HSA is a fantastic goal. It creates a dedicated, completely tax-free fund to handle premiums, co-pays, and other medical bills throughout retirement. That delivers both financial security and priceless peace of mind.

What Is the Biggest Healthcare Cost Mistake?

Hands down, the most financially devastating mistake is underestimating—or completely ignoring—the potential need for long-term care (LTC). Too many people wrongly assume that Medicare will pay for an extended stay in a nursing home or cover the cost of an aide to help them at home. It won’t.

The reality is that long-term care costs can wipe out a lifetime of savings in just a few short years. Failing to have a specific plan for this risk, whether it's through dedicated savings, LTC insurance, or a hybrid policy, is a critical oversight you may not be able to recover from. Planning for this possibility isn't optional; it's an essential part of any secure retirement plan.

Navigating the world of insurance can feel complicated, but you don't have to figure it all out alone. My Policy Quote is here to help you find the right coverage to protect your health and your nest egg. Explore your options and get a personalized quote today at https://mypolicyquote.com.