"Between jobs insurance" isn't a formal product you can buy off a shelf. Think of it more as a personal strategy—a way to combine different insurance options to keep you financially afloat while you navigate a career change.

It's about building a financial safety net so you can handle medical needs and other bills without having to drain your life savings. The right mix of coverage really depends on your personal situation, how much you can afford, and how long you think you'll be out of work.

Your Financial Bridge Between Career Moves

Losing a job can make you feel like the ground has disappeared from under your feet. The stress of not knowing where your next paycheck is coming from is bad enough. Now, imagine adding a sudden, massive medical bill to the mix.

This is exactly where a smart insurance strategy comes in. It becomes your financial bridge, connecting your last job to your next one and making sure you can get across that gap safely. It's a temporary support system you build for yourself using the tools available to protect both your health and your wallet.

Having a plan in place is what gives you peace of mind. It allows you to focus your energy on finding a new job, not on worrying about a potential financial disaster. Getting ahead of the problem is your best defense against the unexpected. You can find more details in our complete guide on what to do about insurance if you lose your job.

Key Components of Your Safety Net

Getting through this transition means understanding a few key options, each designed for a different purpose. Your main goal is to piece together a plan that covers your immediate health needs while also addressing the temporary loss of your income.

This financial buffer is incredibly important. In 2024, an estimated 23 million U.S. workers received unemployment benefits at some point during the year. Since those benefits typically only replace about 40-50% of your old paycheck, it’s clear why having a more complete plan is a must.

For some, bridging that gap might even mean looking into other temporary financial solutions, like no income verification personal loans, to cover essential expenses until that first new paycheck comes in.

Quick Guide to Your Insurance Safety Nets

To help you get your bearings, here's a quick look at the main types of insurance you'll want to consider. This table breaks down what each one does and who it's generally best for, giving you a simple, at-a-glance comparison.

| Insurance Type | Primary Purpose | Best For |

|---|---|---|

| COBRA | Continues your former employer's exact health plan. | Those who need to keep their specific doctors and have complex medical needs. |

| ACA Marketplace Plan | Provides new, comprehensive health coverage, often with subsidies. | Individuals and families who need affordable, quality health insurance. |

| Short-Term Health Insurance | Offers temporary, catastrophic coverage for a limited period. | Healthy individuals who need a low-cost, stopgap solution for a few months. |

| Income Protection | Replaces a portion of your lost salary. | Anyone who needs to cover living expenses like rent, mortgage, or utilities. |

Remember, the goal is to mix and match these options to create a custom safety net that fits your life right now. Taking a little time to understand them can make a world of difference during a challenging time.

Exploring Your Core Insurance Options

Losing a job is tough, and the last thing you want to worry about is your health insurance. But navigating your options doesn't have to be overwhelming. Think of it less like a single, huge decision and more like choosing the right path forward from a few clear options.

Let's walk through the main choices for between jobs insurance. We'll break down COBRA, ACA Marketplace plans, and other safety nets so you can find the route that truly fits your needs and protects your health and wallet.

COBRA: Keeping Your Old Health Plan

Your first major option is usually COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act. Put simply, COBRA lets you keep the exact same health plan you had with your old employer, usually for up to 18 months. It’s like temporarily "renting" your old coverage directly.

This is a great choice for continuity. You keep your doctors, your network, and all your existing benefits. If you're in the middle of a treatment plan or managing a chronic condition, this can be a lifesaver. This option is available if your old company had 20 or more employees.

But here's the catch: the cost. Your employer was likely paying a big chunk of your monthly premium. With COBRA, you’re on the hook for 100% of that cost, plus a small administrative fee (up to 2%). That price jump can be a serious shock, making it a comprehensive but often expensive solution.

ACA Marketplace Plans: A Fresh Start

Losing your job-based health insurance is what’s known as a "Qualifying Life Event." This is a big deal because it opens up a Special Enrollment Period on the Health Insurance Marketplace (often called the ACA or Obamacare marketplace). You get a 60-day window from the day your old coverage ends to sign up for a new plan.

Think of the ACA Marketplace as a shopping center for health insurance. You can compare plans from different private insurers, and they all have to cover essential health benefits.

The biggest win here? Affordability. Because your income for the year will likely be lower, you might qualify for subsidies, like the Premium Tax Credit. These credits can slash your monthly premium, making great coverage surprisingly affordable. For many people, an ACA plan is the most sensible and cost-effective type of between jobs insurance.

Short-Term Health Insurance: The Temporary Fix

If you’re pretty sure you’ll only be between jobs for a couple of months, a short-term health insurance plan might catch your eye. These plans are designed to be a cheap, temporary safety net for catastrophic events. They’re usually much less expensive than COBRA or a full-priced ACA plan.

However, they come with some serious strings attached. Short-term plans don't have to follow ACA rules, which means they can:

- Deny you coverage for pre-existing conditions.

- Refuse to cover things like maternity care, prescriptions, or mental health.

- Put dollar limits on how much they’ll pay out in a year or over your lifetime.

These plans are really only for healthy people who need a basic stopgap and are okay with the risks. They are a temporary patch, not a reliable, long-term solution.

Key Takeaway: Short-term plans look cheap upfront, but their limited coverage can leave you with massive bills if something serious happens. Always read the fine print so you know exactly what you’re getting—and what you’re not.

Protecting Your Paycheck: Income Protection

Health insurance is for medical bills, but it won't pay your mortgage or put food on the table. That’s where income protection strategies come in. Think of this as another critical form of between jobs insurance.

Your first stop should be your state’s Unemployment Benefits. If you were laid off for reasons that weren't your fault, you can likely get a portion of your old wages each week. The rules and amounts vary by state, so apply right away through your state's workforce agency.

Another piece of the puzzle is Income Protection Insurance, though this is something you usually have to buy while you're still employed. It’s a long-term plan that gives you a steady income if you can't work because of an illness or injury. Looking beyond just this transition, it’s always smart to explore the various personal insurance options available to build a complete financial safety net for yourself.

Choosing the Right Coverage for Your Needs

Picking the right between jobs insurance isn’t about finding a one-size-fits-all solution—because there isn’t one. It’s a personal decision, kind of like choosing the right tool for a very specific job. The best plan is the one that fits your life, your health, and your budget right now.

To get it right, you have to look at the big picture. Think of it like a personal checklist. How much can you truly afford each month? What kind of medical care do you or your family actually need? Answering these questions honestly will point you in the right direction.

For instance, someone managing a chronic condition like diabetes will probably find that COBRA’s comprehensive coverage is worth the high price tag. Keeping their trusted doctors is invaluable. On the flip side, if you're young, healthy, and just expecting a short gap between jobs, a basic, low-cost short-term plan might be all you need.

A Personal Needs Assessment

Before you start comparing plans, take a minute to ask yourself a few key questions. Your answers will be your guide.

- Your Budget: What’s the absolute most you can spend on a premium each month? Don't forget to think about deductibles and other out-of-pocket costs.

- Your Health Status: Do you or a family member have pre-existing conditions? Are you expecting to need regular prescriptions or specialist visits?

- Your Dependents: Are you covering a spouse or kids? Their health needs are just as important as yours.

- Your Timeline: How long do you realistically think you'll be between jobs? A few weeks is one thing, but a longer search might call for a more solid ACA plan.

Taking a moment for this reality check keeps you from just grabbing the cheapest or easiest option. It helps you make a strategic choice that protects you from financial shocks during an already stressful time. And that need for a safety net is growing. The global insurance market grew by 8.6% in 2024, with North America seeing an impressive 14.4% jump. You can read more about this in the Allianz Global Insurance Report 2025.

Comparing Your Top Health Insurance Options

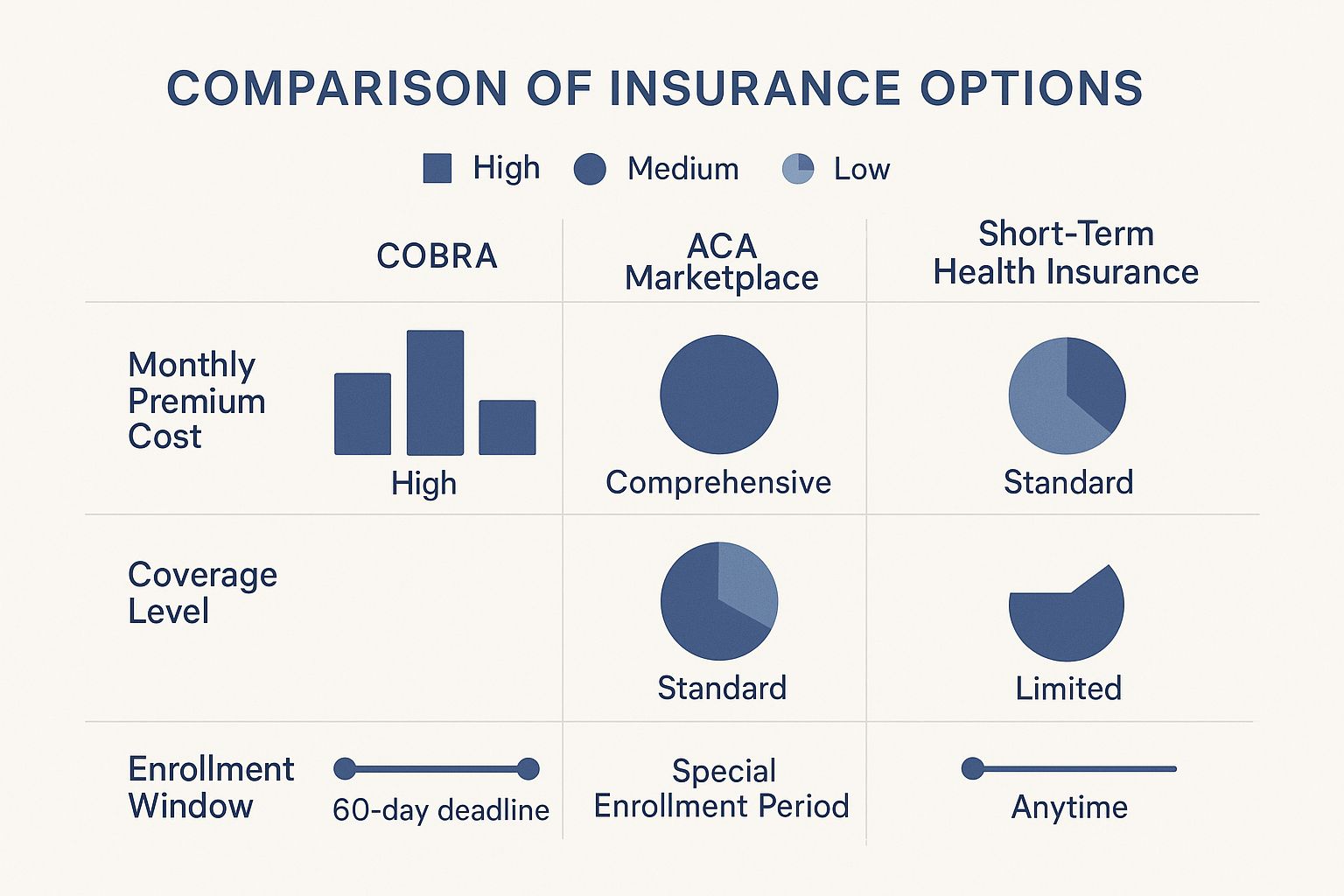

Once you know what you need, you can start comparing your options side-by-side. Each choice—COBRA, an ACA Marketplace plan, or Short-Term Health Insurance—strikes a different balance between cost, coverage, and flexibility.

The infographic below breaks down the main differences to help you see things clearly.

As you can see, COBRA gives you the best coverage but costs the most. Short-term plans are cheap, but they don't cover much.

To make it even simpler, here’s a table that lays it all out.

Comparing Your Health Insurance Options

This side-by-side look at COBRA, ACA Marketplace, and Short-Term Health Insurance will help you figure out which one is the best fit for your situation.

| Feature | COBRA | ACA Marketplace Plan | Short-Term Health Insurance |

|---|---|---|---|

| Best For | Keeping your exact plan & doctors | Comprehensive coverage, often with subsidies | Healthy individuals needing a temporary fix |

| Cost | Highest (you pay 102% of the premium) | Varies; subsidies can make it affordable | Lowest (very budget-friendly) |

| Coverage | Excellent; identical to your old plan | Comprehensive; covers essential health benefits | Limited; often excludes pre-existing conditions |

| Flexibility | Low; you can only keep your old plan | High; you can choose from various plans | Moderate; policies are for a limited time |

| Pre-existing Conditions | Covered | Covered | Usually not covered |

Each option has its trade-offs. The key is to pick the one that aligns with your personal assessment.

Key Insight: Your decision really boils down to a trade-off. Are you willing to pay more for the peace of mind that comes with complete coverage (COBRA)? Or would you rather save money with a basic plan that carries more risk (Short-Term)? ACA plans usually offer a great middle ground, especially if you qualify for subsidies.

At the end of the day, getting the right between jobs insurance is about creating stability. By figuring out what you need and understanding your options, you build a financial bridge to get you to your next job. It’s a proactive step that lets you focus on your job search with confidence, knowing you’re protected.

How to Manage Insurance Costs Without an Income

Seeing the price tag for health insurance without your old company’s help can be a serious shock. One minute, it’s a simple payroll deduction. The next, it's a huge bill staring you down, right when your income has dropped to zero.

It feels overwhelming, but don't panic. There are powerful, built-in strategies to make between jobs insurance genuinely affordable. You just have to know where to look.

Why COBRA Is So Expensive

The first question everyone asks is, "Why is my COBRA bill so high?" The answer is pretty simple: for the first time, you're seeing the plan's true, unsubsidized cost.

Back when you were employed, your company was likely paying a huge chunk of your monthly premium—often 70% or more. Under COBRA, you’re on the hook for 100% of that cost, plus an administrative fee of up to 2%. You aren’t just paying your old share; you’re paying your employer’s share, too.

Knowing this full price, however, gives you a valuable baseline. It helps you see just how much money you can save with the alternatives available to you now.

Unlocking Affordability with ACA Subsidies

This is the game-changer. Losing your job is a Qualifying Life Event, which kicks off a 60-day Special Enrollment Period to buy a plan on the ACA Health Insurance Marketplace. More importantly, it gives you access to serious financial aid based on your new, lower projected income.

This help comes in two main flavors:

- Premium Tax Credits: These are your secret weapon for lowering your monthly payment. When you apply, you’ll estimate your income for the rest of the year. The lower that number, the bigger your tax credit—slashing your premium in the process.

- Cost-Sharing Reductions: If your income falls below a certain level (around 250% of the federal poverty level), you might also get a plan with lower deductibles, copays, and out-of-pocket maximums. This saves you real money every time you actually use your insurance.

For most people, an ACA plan with subsidies is a far better deal than COBRA. You often get comparable coverage for a tiny fraction of the cost. Finding these savings is crucial, and you can learn even more in our guide on how to reduce insurance premiums.

Your income isn't what it was; it's what you project it will be. This distinction is critical for maximizing your subsidies and making coverage affordable while you're unemployed.

Using Your Health Savings Account Strategically

Did you have a high-deductible health plan (HDHP) with a Health Savings Account (HSA) at your old job? That account is now a powerful financial lifeline. The money in your HSA is yours to keep, and you can use it completely tax-free for qualified medical expenses.

This is a huge advantage when you’re between jobs. You can pull from your HSA funds to pay for:

- COBRA premiums (one of the few times you can pay premiums with an HSA)

- Deductibles and copayments on a new ACA plan

- Prescriptions, dental visits, and new glasses

Your HSA becomes your personal, tax-free healthcare fund. It’s a buffer that lets you handle medical costs without touching your emergency savings, which is more important than ever. In fact, employer-sponsored health plan costs are projected to jump by 10.4% in 2025, showing just how critical cost-effective solutions are becoming. You can see what this trend means for workers by reading the full analysis on commonwealthfund.org.

A Step-By-Step Guide to Applying for Coverage

The last thing you want to deal with during a job change is confusing paperwork and tight deadlines. Let's cut through the noise. This is your simple, straightforward roadmap to getting between jobs insurance.

We’ll walk through the exact steps for your main options, so you can apply with confidence and avoid those costly slip-ups. Think of it as a checklist to protect yourself. Following these steps means you won’t miss a critical window that could leave you uncovered right when you need it most.

Applying for COBRA Coverage

Continuing your old health plan through COBRA is an option, but it’s a race against the clock. Miss one deadline, and you lose your right to this coverage for good. Attention to detail here is everything.

Here’s the process, broken down into three non-negotiable steps:

-

Wait for Your Election Notice: Your old employer has up to 44 days after your last day to send you a COBRA election notice. This is the official document that explains your right to continue coverage, what it costs, and all the terms.

-

Make Your Decision Within 60 Days: Once that notice is sent, a strict 60-day window opens for you to decide. This is your one and only shot to enroll, so circle that date on your calendar immediately.

-

Submit Paperwork and Your First Payment: To lock it in, you have to send back the completed election form. After that, you have another 45 days to make your first premium payment, which usually covers you retroactively back to the day your old plan ended.

Enrolling in an ACA Marketplace Plan

Losing your job-based insurance kicks off a Special Enrollment Period (SEP). This gives you a 60-day window to get a new plan on the Health Insurance Marketplace. This is often the most affordable path, but you’ll need to have your documents in order.

Crucial Tip: Don't wait until your old coverage ends to start looking. You can start shopping and comparing plans on HealthCare.gov the moment you know your job is ending. This is the key to making sure you have zero gaps in your coverage.

To apply, you'll need to verify your identity, income, and why you lost your old coverage. This is how the system figures out what subsidies you qualify for.

Documents You May Need:

- Proof of job loss: A termination letter from your employer or a notice that your health benefits are ending will work.

- Income information: Grab your recent pay stubs, W-2 forms, or anything else that helps you estimate your income for the rest of the year.

- Household information: Social Security numbers and birth dates for everyone in your home who needs coverage.

Having these ready makes the whole process go much smoother. For a complete list, take a look at our guide on what documents you need to get insurance to make sure you’re fully prepared.

Filing for State Unemployment Benefits

This isn't health insurance, but unemployment benefits are a vital part of your financial safety net. You should apply for these the minute your job ends, as there’s often a waiting period before the first payment arrives.

To get started, head to your state's unemployment or workforce agency website. The rules change from state to state, but you’ll generally need to provide:

- Your Social Security number

- Your driver's license or state ID number

- Your employment history for the last 18 months (employer names, addresses, and dates)

- The reason you're no longer employed

The application is almost always online. Be honest and thorough with your answers to prevent any delays in getting the support you need.

Common Insurance Mistakes You Must Avoid

Losing a job is stressful enough. The last thing you need is a costly insurance mistake turning a temporary gap into a financial nightmare.

It’s easy to make a wrong move when you’re worried about money and your next career step. But knowing the most common pitfalls is the best way to protect both your health and your savings. Let's walk through them.

Going Bare and Hoping for the Best

The biggest temptation? Just skipping coverage altogether. You might think, "I'll land a new job in a month, what could possibly happen?"

But life doesn’t always stick to our plans. Imagine a simple slip on a patch of ice during a morning walk. That one trip to the ER for a broken ankle can easily rack up thousands of dollars in medical bills, wiping out your emergency fund in a single afternoon. That’s the gamble you take without between jobs insurance.

Ignoring Critical Deadlines

When it comes to signing up for health insurance, the clock is ticking. Loudly. Both COBRA and the ACA Marketplace have strict, non-negotiable deadlines. Miss them, and you’re out of luck.

- COBRA: You get a 60-day window from the day your election notice arrives. Once it's gone, it's gone for good.

- ACA Marketplace: Losing your job opens a 60-day Special Enrollment Period. If that window closes, you’ll likely have to wait until the next annual open enrollment.

Set calendar reminders. Put a sticky note on your mirror. Do whatever it takes to treat these dates like they’re set in stone—because they are.

Choosing a Plan on Price Alone

When money is tight, the cheapest plan looks like the smartest choice. But a low monthly premium can be a Trojan horse, hiding massive out-of-pocket costs.

A plan with a $100 monthly premium looks great on paper. But what if it comes with a $9,000 deductible? That means you're on the hook for almost every medical bill until you've paid that massive amount yourself.

Always look past the premium. Your out-of-pocket maximum is the real number you need to know. It’s the absolute most you’ll pay for covered care in a year, and it’s the key to understanding your true financial risk.

Before you choose, dig into the plan’s summary of benefits. Check the deductible, copayments, and that all-important out-of-pocket maximum to see the full picture.

Forgetting to Cancel Your Temporary Plan

You did it! You landed the new job, and your new health benefits are about to kick in. In all the excitement, it's easy to forget one final, crucial step: canceling your temporary coverage.

Whether you're on a COBRA plan or a short-term policy, it won't just stop on its own. You have to reach out and formally end it. If you don't, you could end up paying for two health insurance plans at once—a pointless waste of money right when you're getting back on your feet.

Got Questions About Insurance Between Gigs? We’ve Got Answers.

When you're navigating a job change, it's natural to have a million little questions pop up about your insurance. The details can feel overwhelming, but getting straight answers is the first step toward making a smart choice. Let's tackle some of the most common things people ask.

Can I Still Get Covered If I Quit My Job?

Yes, absolutely. When it comes to getting health insurance, why you left your job usually doesn't matter.

Whether you were laid off or decided to leave, losing your employer's health plan is the trigger. That loss of coverage makes you eligible to either continue with COBRA or buy a new plan from the ACA Marketplace.

Just remember, this is different from state unemployment benefits. To get unemployment checks, you typically need to have lost your job through no fault of your own. Quitting voluntarily usually disqualifies you unless you can prove you had a very good reason, like unsafe working conditions.

How Long Can I Keep a Short-Term Health Plan?

This is a tricky one because it completely depends on where you live.

Federal rules say you can have a short-term plan for up to 364 days and potentially renew it for up to 36 months. But—and this is a big but—many states have their own, much tougher rules.

Some states cap these plans at just a few months and won't let you renew them at all. It's critical to check your state's specific laws before you sign up. The last thing you want is to assume you're covered for a year, only to find out your plan expires after three months.

Don't Get Caught Off Guard: Always, always check your state's rules for short-term health insurance. What works in one state might not be an option in another.

What Happens to My Health Savings Account (HSA)?

Here’s some great news: the money in your HSA is 100% yours to keep, no matter what. Think of it as your personal health savings fund that your old employer has no claim on.

You can keep using those funds, tax-free, for all sorts of qualified medical expenses. This is a huge help when you're in between jobs. You can use it for:

- Paying COBRA Premiums: This is one of the rare situations where you can use HSA funds to pay for insurance premiums.

- Deductibles & Copays: Cover your out-of-pocket costs on a new Marketplace plan.

- Other Medical Bills: Use it for prescriptions, dental appointments, or new glasses.

The only catch? You can’t add new money to your HSA until you’re signed up for another HSA-qualified health plan. For most people, losing a job is a perfect example of a life change that lets you enroll in a new plan, and you can learn more about what is a qualifying event for health insurance in our complete guide.

Figuring out your insurance options can feel like a puzzle, but you don't have to solve it alone. The team at My Policy Quote is here to help you find the right coverage to protect you and your wallet during this transition. You can check out your affordable insurance options today by visiting https://mypolicyquote.com.