Choosing the right health insurance isn't about finding some secret formula. It really just comes down to a few key things: getting real about your personal health needs, understanding the true costs beyond that monthly bill, and figuring out which plan type—like an HMO or PPO—actually fits your life.

If you get these fundamentals right, you'll find a plan that gives you genuine security without any nasty financial surprises down the road.

Why Does Choosing Health Insurance Feel So Complicated?

If picking a health plan feels overwhelming, you’re not alone. The industry can feel like it was designed to be confusing, with its alphabet soup of acronyms and complicated cost structures. This guide is your roadmap to cut through all that jargon and help you make a decision you can feel good about.

The goal here isn't just to get "covered." It's to find a plan that actually works for you when you need it most. That means looking past the flashy ads and low sticker prices to see how your choice will play out in the real world.

Key Questions to Get You Started

Before you even start looking at specific plans, it helps to frame your search around a few core questions. Answering these now will give you a clear benchmark to measure every option against.

- How can you realistically map out your family’s health needs for the upcoming year?

- What are the hidden costs lurking behind an attractive, low monthly premium?

- Which type of insurance plan (HMO, PPO, etc.) genuinely fits your lifestyle and medical needs?

Navigating health insurance is less about finding a single "best" plan and more about finding the right plan for your specific circumstances. A perfect choice for a young, healthy individual might be a terrible fit for a growing family.

Before diving deep into comparing plans, it’s a good idea to get a high-level view of what you should be thinking about. This table breaks down the most important factors to keep in mind.

Key Factors for Choosing Your Health Plan

| Factor | What to Consider | Why It Matters for You |

|---|---|---|

| Your Health Needs | Think about regular prescriptions, chronic conditions, planned surgeries, or family planning. | A plan that doesn't cover your known needs will lead to high out-of-pocket costs. |

| Budget | Look beyond the monthly premium. Consider the deductible, copays, and out-of-pocket maximum. | The cheapest premium often comes with the highest costs when you actually need care. |

| Doctor & Hospital Network | Do you want to keep your current doctors? Need specialists? Are your local hospitals in-network? | Going out-of-network can be extremely expensive or not covered at all, depending on your plan. |

| Flexibility | How important is it to see specialists without a referral? Do you travel often and need coverage? | PPOs offer more flexibility but usually cost more. HMOs are more restrictive but can be more affordable. |

Thinking through these points first will make the process of sifting through different health insurance options much smoother and less stressful.

The health insurance market itself is also changing fast. The global industry is projected to grow from $2.32 trillion in 2025 to a staggering $4.45 trillion by 2032. This isn't just numbers on a page; it reflects rising healthcare costs and new trends like telemedicine and AI-personalized plans. You can learn more about these global health insurance market trends to see how the industry is shifting.

This introduction sets the stage for a straightforward journey, giving you the clarity needed to pick a plan that genuinely protects both your health and your finances.

Start by Assessing Your Real Healthcare Needs

Before you even glance at a single health insurance plan, the most important work happens right where you are. It’s about taking an honest look at your health, your family, and your finances.

Think of it this way: you wouldn't buy a car without knowing if you need an SUV for a growing family or a small commuter for city driving. Health insurance is the same. This initial self-check becomes the filter through which you’ll view every option, helping you cut through the noise.

Catalog Your Known Medical Expenses

Let's get specific. Move past the vague "what ifs" and start mapping out what your healthcare use actually looks like. This isn’t about predicting a crisis; it's about acknowledging your reality.

Grab a notepad and start listing your expected medical needs for the next year. Ask yourself a few practical questions:

- Prescriptions: Are there medications you or a family member take every month? Write them down. The difference in prescription coverage from one plan to another can be massive.

- Chronic Conditions: Is anyone managing something like diabetes, asthma, or a thyroid condition? These usually mean consistent specialist appointments and specific drug needs.

- Upcoming Life Events: Big changes on the horizon? If you're planning on starting a family or know a specific surgery is coming up, things like maternity coverage or surgical benefits become non-negotiable.

- Specialist Care: Does anyone see a therapist, dermatologist, or physical therapist regularly? You'll want to make sure these providers are not just covered, but easy to access.

Getting a clearer picture of your baseline health can also be a huge help. Using tools like at-home health testing for key insights can give you a better understanding of your body's needs, which in turn clarifies what kind of coverage makes the most sense.

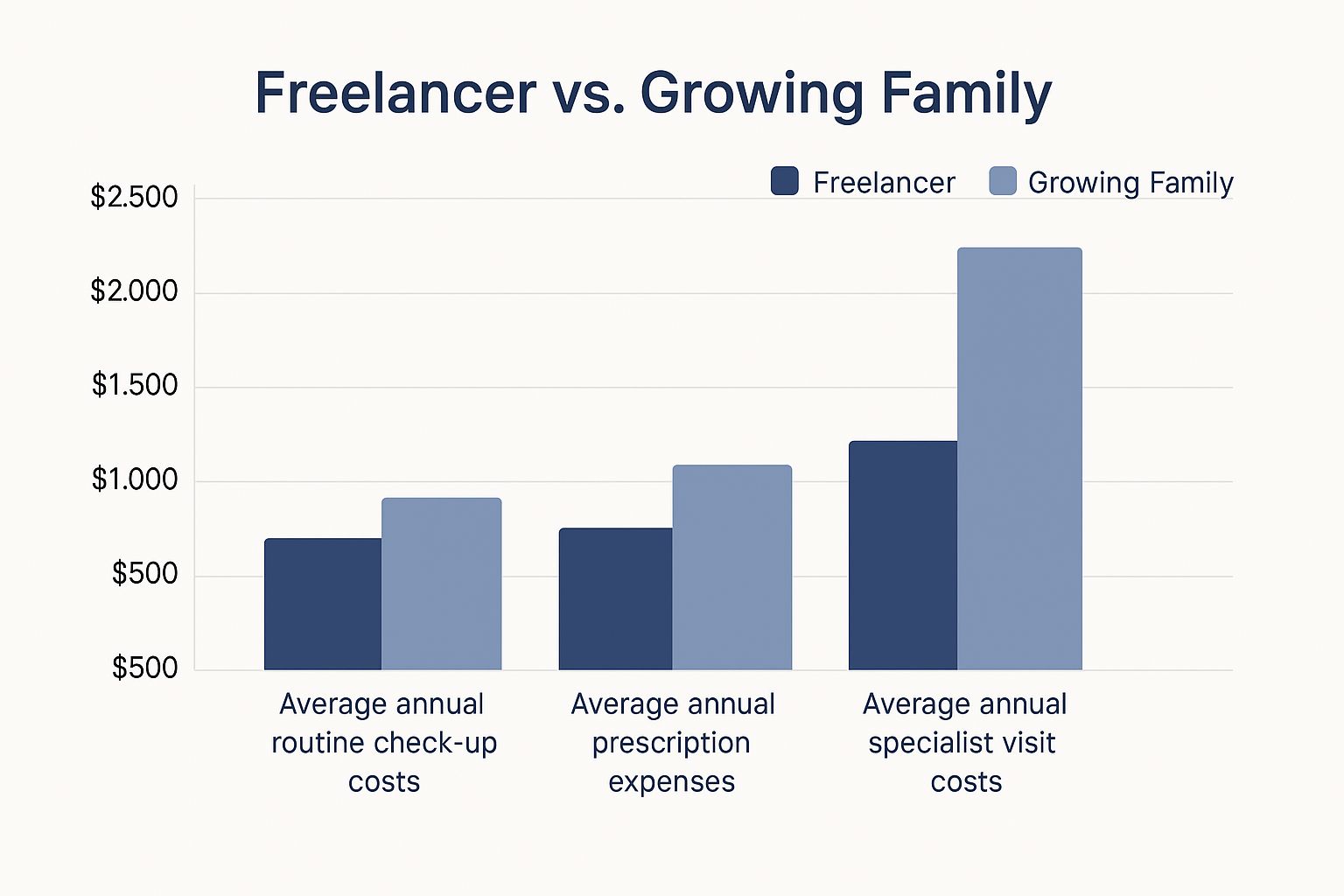

The infographic below shows just how different healthcare spending can be. A freelancer's needs often look nothing like those of a growing family.

As you can see, a family often deals with far more routine check-ups and specialist visits, making a plan with strong, comprehensive coverage absolutely essential.

Consider Your Financial Comfort Zone

Your health is one half of the story. The other is your wallet. It's time to be real about your tolerance for financial risk.

Are you the kind of person who sleeps better at night knowing your monthly costs are fixed, even if it means a higher premium? Or are you okay with a lower monthly payment in exchange for a higher deductible, banking on staying healthy? There's no wrong answer, only what's right for you.

An honest look at your savings and monthly cash flow is crucial. A plan with a $7,000 deductible is only a good deal if you can comfortably pay that amount before your insurance fully kicks in.

By creating this personalized checklist of health needs and financial boundaries, you’ve done the hardest part. You've turned a confusing, overwhelming search into a focused mission. Now you’re ready to find a plan that actually fits your life, not just one that looks good on paper.

Making Sense of Health Plan Types

Alright, you've got a good handle on your health needs. Now comes the part that trips a lot of people up: the alphabet soup of insurance plans. You'll see acronyms like HMO, PPO, EPO, and POS thrown around, and it's easy to get lost.

These aren't just random letters. They represent totally different ways of getting medical care, and picking the right one is crucial. It’s the difference between a plan that works with you and one that feels like a constant roadblock.

The Big Trade-Off: Cost vs. Flexibility

When you boil it all down, the choice between these plans comes down to one thing: cost versus flexibility. It’s a classic balancing act.

Generally, plans that give you the freedom to see any doctor you want, including specialists, will have higher monthly premiums. On the flip side, plans that are a bit more restrictive about who you can see usually cost less. There’s no single "best" choice—it all depends on what you value most.

A healthy 25-year-old might be perfectly happy with a restrictive HMO to keep their monthly bills low. But a family managing a chronic illness? For them, the freedom of a PPO to see specific specialists might be something they just can't compromise on. If you want to dive deeper into the two most common options, our guide on the main differences between HMO and PPO plans is a great place to start.

So, let's decode what each of these plan types actually means for you.

Decoding the Health Plan Alphabet

-

HMO (Health Maintenance Organization): These plans usually come with lower premiums, but there’s a catch. You have to use doctors, hospitals, and specialists within their network. You’ll also choose a Primary Care Physician (PCP) who acts as your gatekeeper, giving you referrals for any specialist you need to see.

-

PPO (Preferred Provider Organization): PPOs are all about flexibility. You can see doctors both in and out of their network, and you typically don’t need a referral to visit a specialist. That freedom comes at a price, though—expect higher premiums and out-of-pocket costs.

-

EPO (Exclusive Provider Organization): Think of an EPO as a middle ground. Like an HMO, it requires you to stay in-network (except for true emergencies). But like a PPO, you often don't need a referral to see a specialist, as long as they're in the network.

-

POS (Point of Service): A POS plan also mixes features. You'll pick a PCP and need referrals, similar to an HMO. But, you have the option to go out-of-network for care, though you’ll pay more for it.

The most important question you can ask yourself is this: "How important is it for me to keep my current doctors or have the freedom to choose any specialist I want?" Your answer will immediately help you narrow down the field.

To make it even clearer, here’s a quick table to help you see the differences side-by-side.

HMO vs PPO vs EPO vs POS: A Practical Comparison

This table breaks down the key distinctions between the four major plan types, focusing on the rules and freedoms that will impact you the most.

| Plan Type | Requires Primary Care Physician (PCP)? | Needs Referrals for Specialists? | Covers Out-of-Network Care? | Who It's Best For |

|---|---|---|---|---|

| HMO | Yes | Yes | No (except emergencies) | Individuals who want lower premiums and don't mind a structured system. |

| PPO | No | No | Yes (at a higher cost) | People who want maximum flexibility and are willing to pay more for it. |

| EPO | No | No | No (except emergencies) | Those who want the freedom to see specialists without referrals but are okay staying in-network. |

| POS | Yes | Yes | Yes (at a higher cost) | People who like the structure of an HMO but still want the option to go out-of-network. |

Once you understand these basic structures, you can see past the marketing slogans. You'll be able to confidently match a plan’s rules to your real-life needs, making sure you end up with a framework that actually supports your health instead of causing more stress.

Looking Beyond the Monthly Premium

It’s the first number everyone looks at: the monthly premium. And it's incredibly tempting to let that single dollar amount make the final call. But I’ve seen it time and time again—the plan that looks cheapest on paper can quickly become a financial nightmare the moment you actually need to use it.

The real cost of your health insurance isn't just what you pay each month. It's a mix of that monthly fee and what you have to fork over when you visit a doctor, fill a prescription, or have a procedure. To get the full picture, you need to understand the language of cost-sharing. Think of these as the financial rules of the game.

Decoding Your Out-of-Pocket Costs

Your monthly premium is just the price of admission. The real action starts when you and your insurance company begin sharing the medical bills. Here are the terms you absolutely have to know:

-

Deductible: This is the big one. It's the amount you must pay for your medical care before your insurance plan chips in a single dollar. If your plan has a $3,000 deductible, you are on the hook for the first $3,000 of your covered costs.

-

Copayment (Copay): This is a simple, flat fee you pay for a specific service after hitting your deductible. For example, you might have a $30 copay for a regular doctor’s visit or a $50 copay to see a specialist.

-

Coinsurance: This is where you split the bill with your insurer. It's a percentage of the cost you pay after your deductible is met. If your plan has 20% coinsurance, you cover 20% of the bill, and the insurance company handles the remaining 80%. Our guide on coinsurance vs. copay breaks this down even further.

-

Out-of-Pocket Maximum: This is your financial safety net. It’s the absolute most you will pay for covered services in a single year. Once your spending on deductibles, copays, and coinsurance reaches this limit, your plan pays 100% of the costs for the rest of the year.

It's a simple trade-off: plans with low monthly premiums almost always come with high deductibles and out-of-pocket maximums. This approach keeps your monthly budget predictable but leaves you exposed to a massive bill if a real medical issue pops up.

A Tale of Two Plans

Let's make this real. Imagine you need a minor outpatient surgery that costs $8,000. You’re trying to decide between two different health plans.

-

Plan A (The "Cheap" One):

- $350/month premium

- $6,000 deductible

- 20% coinsurance

- $8,000 out-of-pocket max

-

Plan B (The "Expensive" One):

- $550/month premium

- $1,500 deductible

- 20% coinsurance

- $5,000 out-of-pocket max

With Plan A, you would first pay your entire $6,000 deductible out of pocket. For the remaining $2,000 of the bill, you’d pay 20% coinsurance, which is $400. Your total cost for the surgery? $6,400.

Now let's look at Plan B. You'd pay your $1,500 deductible first. Then, you'd owe 20% coinsurance on the remaining $6,500, which comes out to $1,300. Your total for the surgery is $2,800—less than half of what you would have paid with the so-called "cheaper" plan.

If you're self-employed or run a small business, understanding these numbers is even more critical. Your health insurance premiums can often be a business expense, so don't forget to explore tax-saving strategies for freelancers and small business owners to see how everything fits together. This kind of analysis is the only way to truly learn how to choose the right health insurance for your life.

How Technology Is Shaping Your Insurance Choices

It’s no secret that the way we shop for and use health insurance is changing fast, and technology is in the driver's seat. These shifts are more than just small conveniences; they’re completely reshaping how we choose our plans, giving us access to smarter, more responsive coverage than ever before.

Gone are the days of one-size-fits-all insurance. Insurers are now using technology to create plans that truly reflect your personal health and lifestyle. This means they’re moving beyond basic demographic data to offer options that are a genuine fit for you.

You can dive deeper into this trend in our guide on embracing technology and personalization in health insurance.

The Rise of AI and Automation

Artificial intelligence (AI) is at the heart of this evolution. It’s what allows insurance companies to analyze massive amounts of data more effectively, leading to fairer pricing and plans that feel like they were made just for you.

AI uses predictive analytics to get a much more precise read on risk, which can result in premiums that more accurately match your personal health profile. You can learn more about the growing role of AI in the health insurance market and how it's influencing the industry.

This tech also brings some very real benefits to you as a policyholder:

- Faster Claims Processing: Instead of waiting weeks, automated systems can review and approve straightforward claims in minutes. That means you get reimbursed much faster.

- Smarter Customer Service: AI-powered chatbots can give you instant answers to common questions, 24/7. This frees up human agents to tackle the more complex issues that really need their attention.

Choosing a plan from a tech-forward insurer often means a smoother, more efficient experience from day one. It’s a sign that the company is invested in improving how you manage your healthcare.

Virtual Care Is Here to Stay

Maybe the most obvious change we’ve all seen is the explosion of telemedicine. What used to be a niche offering is now a standard feature in most modern health plans.

Virtual visits with doctors, therapists, and specialists offer incredible convenience and can be a lot more affordable than heading into an office. When you’re comparing plans, make sure to look for robust virtual care options—it’s a key benefit you don’t want to miss.

You've done the hard work, sorting through the options and narrowing it down to a couple of top contenders. Now comes the most important part: the final gut check. This is where you move from theory to reality, making sure the plan you choose actually works for your life.

Let's get this done.

The Make-or-Break Details

Before you sign on the dotted line, you have to nail down two critical details that can make or break your experience with a health plan.

First, confirm your doctors are in-network. Don't just skim the list or assume they're covered. Go to the insurance company's official website and use their provider directory. Search for your primary care doctor, your kids' pediatrician, any specialists you see, and even the hospital closest to your home. A cheap plan is useless if it forces you to leave a doctor you trust.

Next, dig into the prescription drug formulary. This is just a fancy term for the list of medications the plan covers. If you or a family member take medication regularly, you need to search for it by name. Pay close attention to its "tier," because that determines your copay. A plan with a low monthly premium can become a budget nightmare if your essential medication is on a high-cost tier.

Comparing Your Finalists Side-by-Side

With those details locked in, it's time for a simple, head-to-head comparison. Don't just look at the monthly premium—that's only one piece of the puzzle.

You need to understand your total potential annual cost. This gives you a clear picture of your worst-case financial risk for the year. Just add up the plan's annual premiums and its out-of-pocket maximum.

For example, a plan with a $400 monthly premium ($4,800 per year) and a $5,000 out-of-pocket max puts your total annual risk at $9,800. Run this simple calculation for each of your final choices. The numbers often tell a surprising story.

Getting Ready to Enroll

Once you’ve made your decision, the last step is to get enrolled smoothly. Timing is everything here. Most people can only sign up during the annual Open Enrollment Period, and if you miss that window, you could be without coverage for a whole year.

If you're not sure about the deadlines, take a moment to read our guide on what Open Enrollment means. It breaks down exactly what you need to know.

To make the process painless, gather all your documents beforehand. You'll need Social Security numbers and birthdates for everyone you're covering. Having this information ready turns a potentially stressful task into a straightforward one, letting you lock in your choice with confidence.

Lingering Questions About Choosing Health Insurance

Even after all the research, a few last-minute "what ifs" can creep in. It's totally normal. Let's tackle some of the most common questions head-on so you can move forward with total confidence.

What if I Pick the Wrong Plan? Can I Switch?

This is a big one, and the fear of getting "stuck" is real. For the most part, you can only change your health insurance plan during the yearly Open Enrollment Period. Think of this as your annual window to make adjustments for the upcoming year.

But life happens, right? Major events—like getting married, having a baby, or moving—can trigger what’s called a Special Enrollment Period (SEP). This gives you a brief window (usually 60 days) to hop into a new plan outside of that main enrollment timeframe.

My Doctor Just Left My Plan Mid-Year. Now What?

Ugh, this is one of the most frustrating things that can happen. Your insurance company is required to let you know if one of your doctors leaves their network. They'll usually give you a grace period to continue seeing that doctor, especially if you're in the middle of treatment.

After that transitional time, though, you’ll probably need to find a new doctor in your network to keep your costs down. It’s a perfect example of why checking the size and stability of an insurer's network from the very beginning is so important.

Are Pre-Existing Conditions Still a Thing?

Thankfully, no. Under the Affordable Care Act (ACA), insurance companies can't deny you coverage or jack up your rates just because you have a pre-existing condition. This applies to any ACA-compliant plan, whether you get it from the marketplace or an insurer directly.

This is a huge protection. It means conditions like asthma, diabetes, or even cancer can't be used against you. It’s a critical safeguard ensuring you can get care regardless of your medical history.

Figuring out health insurance doesn't have to be something you do alone. At My Policy Quote, our experts are here to help you weigh your options and find a policy that fits both your life and your budget.

Ready to see what's out there? Explore your personalized health insurance options by visiting us at https://mypolicyquote.com.