A waiver of premium is an add-on to your life insurance policy that pays your premiums if you become totally disabled and can’t work. Think of it as insurance for your insurance. It’s a safety net that keeps your coverage active during a major life crisis, without you having to worry about the cost.

The Ultimate Safety Net for Your Policy

Life is completely unpredictable. You buy life insurance to protect your family after you’re gone, but what if a serious illness or injury stops you from working and paying for that policy? Without a backup plan, your coverage could lapse, leaving your loved ones with nothing.

This is exactly where the waiver of premium rider comes in. It’s a powerful feature that acts as a financial backstop. If you meet the policy's definition of "total disability," the insurance company steps in and covers your premium payments for as long as your disability lasts. Your policy stays in full force.

How It Provides Peace of Mind

This rider essentially guarantees your life insurance protection continues, no matter what health challenges life throws your way. It’s a cornerstone of a solid financial plan, offering security when you're most vulnerable. The benefits are simple but powerful:

- Policy Protection: Your life insurance coverage stays active, even if you have zero income.

- Financial Relief: It lifts the burden of making premium payments during an already difficult time.

- Family Security: Your beneficiaries' financial future remains secure, without any interruption.

Grasping how different types of life insurance work, like Variable Universal Life Insurance policies, can give you a better feel for where these riders fit into the bigger picture.

Defining the Terms of Protection

While the concept is straightforward, the details really matter. The waiver of premium has been around for decades, but the specific terms can vary a lot from one insurer to another.

A 2022 study by the Society of Actuaries found most policies have a waiting period—typically six months—before the benefit kicks in. To qualify, you have to be considered "totally disabled," which usually means you're unable to perform the duties of your job for an extended time. This kind of foundational knowledge is key before you dive deeper into how these riders work, which we cover in our guide on understanding life insurance policies.

How The Waiver of Premium Process Unfolds

So, you have a waiver of premium rider. What happens if you actually need to use it?

Kicking this benefit into gear isn’t instant. There’s a clear, structured process designed to verify your disability claim. Knowing the steps ahead of time can take a lot of the stress and uncertainty out of the equation when you’re already dealing with a life-changing event.

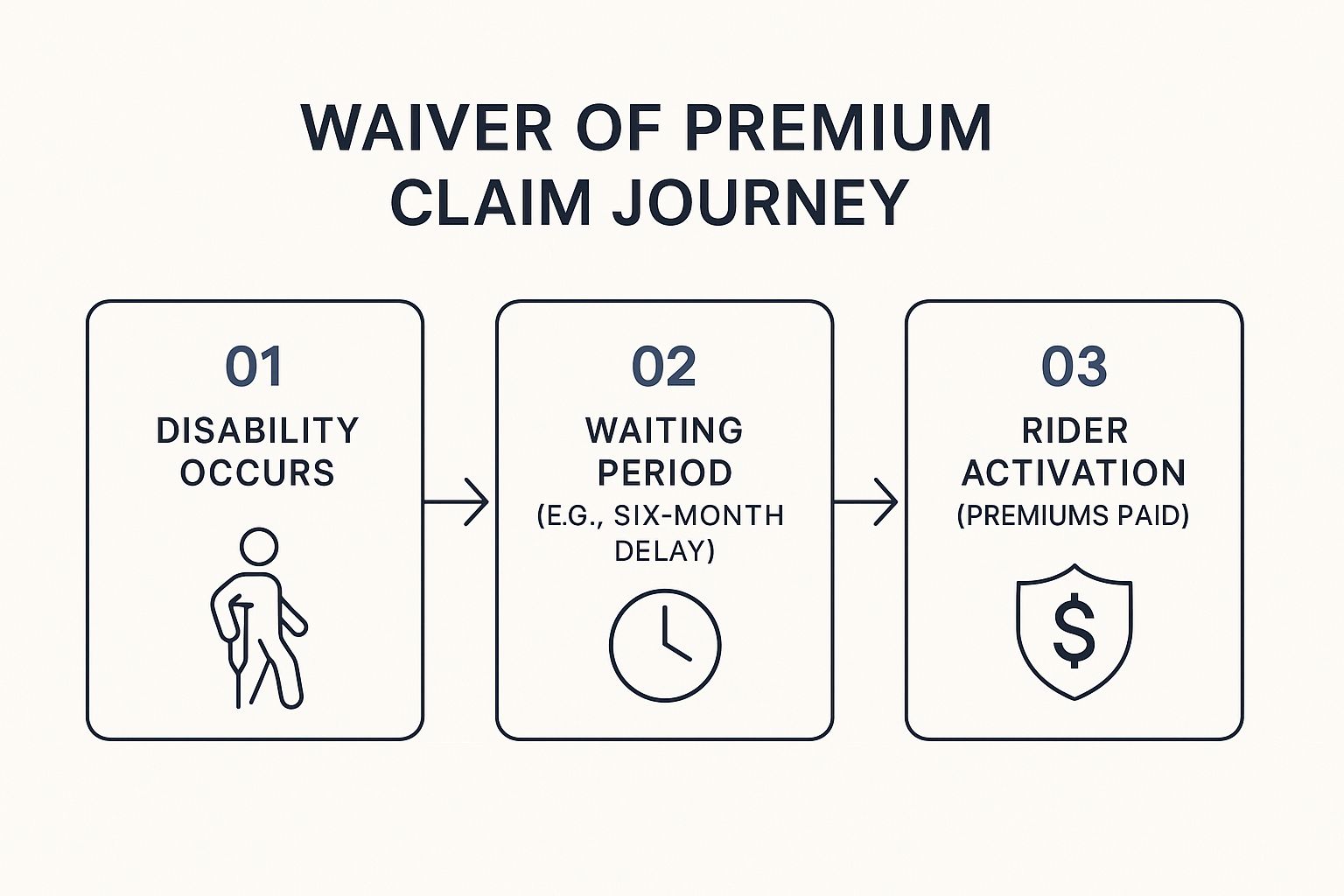

It all starts the moment a qualifying disability stops you from being able to work. Your first move is to notify your insurance company to get the claim started. This is a critical step, because it officially starts the clock on the most important phase: the waiting period.

Navigating the Waiting Period

Just about every waiver of premium rider comes with a waiting period, sometimes called an elimination period. Think of it as a set amount of time you have to remain disabled before your benefits can actually kick in.

A pretty standard waiting period is six months, though this can definitely vary from one policy to another. During these months, you’re still on the hook for paying your life insurance premiums. If you miss them, you could risk your policy lapsing—which is the last thing you want. This is exactly why having a solid emergency fund is so important.

You can learn more about those risks in our guide on what happens if you stop paying for life insurance. Only after you’ve made it through this period and your claim is approved will the insurance company start waiving your payments.

Key Takeaway: The waiting period is a mandatory delay. You have to keep paying your premiums during this time to keep your policy active and make sure you’re eligible for the waiver.

This infographic breaks down the simple, three-step journey from the moment you’re disabled to when the rider is activated.

As you can see, the process flows from the initial event, through that necessary delay, and finally to the point where your financial burden is lifted.

Proving Your Disability Claim

Once you’ve cleared the waiting period, getting your claim approved all comes down to providing solid proof of your total disability. What counts as "total disability" isn't a vague idea—it's spelled out very clearly in your policy, and that definition is the yardstick your claim will be measured against.

To build a strong claim, you'll need to gather some comprehensive paperwork. Insurers will almost always ask for:

- A Claimant's Statement: This is your side of the story—a detailed account of your disability and exactly how it stops you from working.

- An Attending Physician's Statement (APS): A formal report from your doctor that confirms your diagnosis, treatments, and what they expect for your recovery.

- Complete Medical Records: Think test results, hospital records, and notes from any specialists. This is the evidence that backs up your doctor's statement.

- Proof of Lost Income: You may need to show pay stubs or tax documents to prove you’re no longer earning an income from your job.

The insurer's claims department will go through all of this information with a fine-toothed comb to make sure your situation lines up with their definition of total disability. If everything checks out and they approve your claim, they will officially activate your waiver of premium rider. From that point on, they take over your payments, and your policy is secure.

Understanding the Real Cost of This Protection

While the peace of mind a waiver of premium rider offers is invaluable, it doesn't come for free. Adding this extra layer of security to your life insurance policy will nudge your monthly payment up, and it’s smart to understand exactly how that cost is calculated.

Think of it like adding collision coverage to your car insurance. You pay a little extra each month for serious protection against a major, unexpected event. The cost isn't a random number but is carefully figured out based on the insurer's assessment of your individual risk.

Several key factors come into play when an insurance company prices this rider. They are essentially underwriting the risk of you becoming disabled, so they look at a similar set of criteria they used for your main life insurance policy.

Key Factors That Influence the Cost

Your personal profile plays the biggest role in what you'll pay for this protection. The insurer’s goal is to predict the likelihood that they will one day need to step in and cover your payments.

- Your Age: Younger applicants almost always pay less. The older you get, the higher the statistical probability of experiencing a disability, which naturally drives the cost up.

- Your Health: Your current health and medical history are critical. Any pre-existing conditions that increase your risk of disability will lead to a higher premium for the rider.

- Your Occupation: Let's be honest, some jobs are just riskier than others. A construction worker or a pilot will likely pay more for a waiver of premium rider than an office administrator because their on-the-job risk of injury is higher.

The Bottom Line: The cost of a waiver of premium rider is a direct reflection of your personal risk profile. Healthier, younger individuals in safer occupations will almost always pay the lowest rates for this valuable coverage.

So, what does this actually look like in dollars and cents? Industry research shows that these riders typically add an extra $3 to $50 per month to your base premium. That can be anywhere from 3% to 20% of the total.

For a clearer picture, check out our guide on what an insurance premium is to understand how these payments work.

The table below breaks down a few examples to show how this might play out.

Estimated Monthly Cost of a Waiver of Premium Rider

| Policyholder Profile | Base Monthly Premium | Estimated WOP Rider Cost (Monthly) | Total Monthly Premium with WOP |

|---|---|---|---|

| Healthy 30-Year-Old, Office Job | $50 | $3 – $5 | $53 – $55 |

| 45-Year-Old with Minor Health Issues | $120 | $12 – $18 | $132 – $138 |

| 55-Year-Old in a Physical Job | $250 | $35 – $50 | $285 – $300 |

As you can see, the cost is all about context. The wide range reflects the different underwriting standards and benefit structures across various insurance companies. It’s always best to get a personalized quote to know for sure.

Is a Waiver of Premium Rider Worth It for You?

So, should you add a waiver of premium rider to your life insurance policy? This isn't a one-size-fits-all answer. It really comes down to a personal calculation: paying a little extra now for a whole lot of protection later on.

Think of it as a trade-off. Your decision will likely hinge on your job, your savings, and frankly, how much risk you're willing to live with.

The biggest pull for most people is the sheer peace of mind. There’s something incredibly powerful about knowing your family’s financial safety net will stay strong, even if a total disability takes away your income. It turns your life insurance policy from just another bill into a self-funding promise during a crisis.

Weighing the Pros and Cons

The choice gets a lot clearer when you lay out the good against the bad. For some, that slightly higher premium is a tiny price to pay for such a huge security blanket. For others, maybe those in low-risk careers with a hefty emergency fund, the extra cost might not seem worth it.

Take a good look at your own life. Are you the main income earner for your family? Does your job involve physical labor or carry a higher-than-average risk of injury? Crucially, if you couldn't work, do you have enough savings to cover all your bills—including insurance premiums—for at least six months? Answering these questions honestly will tell you just how valuable this rider could be for you.

A policy with a permanent waiver of premium is the gold standard. It means once it kicks in, you’re off the hook for payments for good, no matter what happens with your health. That makes your policy a much more secure and predictable asset for your family.

To help you decide, let's break down the key arguments for and against adding this rider to your policy. Seeing the trade-offs side-by-side can make all the difference.

Waiver of Premium Rider Pros vs Cons

This table offers a straightforward look at the advantages and disadvantages, helping you weigh if this rider is the right move for your financial plan.

| Advantages (Pros) | Disadvantages (Cons) |

|---|---|

| Complete Policy Protection: Guarantees your life insurance coverage stays active if you become totally disabled, preventing a lapse when you need it most. | Increased Monthly Cost: This rider isn't free. It will add a bit more to your regular premium, increasing your overall monthly expenses. |

| Financial Burden Lifted: Frees you from the stress of making premium payments when you have no income, letting you focus completely on your recovery. | Strict Qualification Rules: The definition of "total disability" can be very specific, and not all serious health issues will actually qualify for the benefit. |

| Uninterrupted Family Security: Ensures your beneficiaries' financial future is protected without any gaps, preserving the core reason you got the policy in the first place. | The Waiting Period: You have to keep paying premiums during a mandatory waiting period (often six months) before the waiver even starts. |

| Peace of Mind: Provides invaluable emotional comfort knowing your financial plan has a powerful backup system in place for a worst-case scenario. | Potential for Never Using It: Like any insurance, you might pay for this rider for decades and never become disabled, meaning it was a pure cost with no payout. |

At the end of the day, a waiver of premium rider is a strategic move to protect your future. It's designed for people who want to make absolutely sure that a disability doesn't just disrupt their health, but also unravel the financial safety net they've worked so hard to build for their loved ones.

Why Rider Costs and Terms Vary So Much

If you've ever shopped for a waiver of premium rider, you’ve probably noticed something strange. The prices and terms are all over the map. One insurer might offer it for just a few bucks a month, while another charges way more for what looks like the same protection.

This isn’t random. It’s a sign of a deeper challenge inside the insurance industry itself.

The root of the problem is a lack of modern, standardized data. Insurers use actuarial science—the math of risk—to figure out how much to charge. But when it comes to this specific rider, the data on disability rates, how long claims last, and recovery trends is surprisingly inconsistent. A lot of it is just plain old.

An Industry of Educated Guesses

This data gap means every company has to make its own "educated guess" to set a price. Without one single, reliable industry benchmark, their approaches can vary wildly.

One insurer might lean on conservative assumptions, which translates to a higher cost for you. Another might use more optimistic data, offering a lower price but possibly slapping on stricter terms to balance their risk. It’s a well-known issue among insurance pros.

A 2018 Society of Actuaries survey really pulled back the curtain on this. The report found that most insurers hadn't updated their pricing models for this rider in over a decade, even with huge shifts in public health and mortality. This just confirms it: the way companies calculate risk for the waiver of premium is all over the place. You can dive into the details yourself in the 2018 survey on waiver of premium practices.

Consumer Takeaway: This lack of a standard actually gives you the upper hand. Shopping around isn’t just about finding the cheapest option—it’s about finding the best mix of cost, terms, and an insurer you can count on.

All this variability highlights why the underwriting process is so critical. To get a better feel for how insurers size up risk, check out our guide on what underwriting in insurance is.

Ultimately, knowing this empowers you. Since prices and even the definition of "total disability" can differ so much, it’s a huge reminder to compare quotes, read the fine print, and find a rider that truly fits your life and your budget.

Common Questions About Waiver of Premium Riders

Even after you get the basics down, a few "what if" questions always seem to pop up about the waiver of premium rider. That's completely normal.

Let's walk through the most common ones to clear up any confusion and show you how this benefit actually works in the real world.

Does the Rider Cover Partial Disability?

This is a big one, and the answer is almost always no. A waiver of premium rider is built for total disability. It’s designed to kick in when you are completely unable to perform the essential duties of your job.

Partial disability, where you might be able to work a few hours a week or in a different role, typically won't trigger the benefit. The insurance company requires solid medical proof that you cannot work at all, so the bar is set pretty high.

What Happens If I Recover and Can Work Again?

If your health improves and you’re able to go back to work, the waiver of premium benefit comes to an end. The insurance company will let you know it’s time to start paying your premiums again.

The takeaway: Think of this rider as a bridge. It carries your policy over the period you can't earn an income. Once you're back on your feet, you take over again.

Are There Age Limits for This Benefit?

Yes, absolutely. Most waiver of premium riders don't last forever. They usually have a cutoff age, typically around 60 or 65. If a disability happens after you’ve passed that age, the rider won’t activate.

Insurance companies include this limit because the odds of becoming disabled go up significantly as we get older. Always check the fine print in your policy so you know the exact age your rider expires.

How Is This Different From Disability Income Insurance?

It’s easy to mix these two up, but they do completely different jobs.

- A Waiver of Premium rider is laser-focused. It only pays your life insurance premium, making sure your policy doesn’t lapse while you're disabled. It doesn't give you any cash.

- Disability Income Insurance is a separate policy that protects your paycheck. It replaces a chunk of your monthly income so you can keep paying your mortgage, buying groceries, and covering other bills.

Here’s a simple way to remember it: a waiver of premium protects your life insurance policy. Disability insurance protects your lifestyle. They work great together, but one can't replace the other.

At My Policy Quote, we help you navigate these details to find the right coverage for your unique needs. Get a personalized life insurance quote today.