If you're looking for affordable health insurance, the single best place to start is the Health Insurance Marketplace. Why? Because it’s the only place you can get income-based subsidies, which can slash your monthly premiums and make great coverage truly affordable.

Your Game Plan for Affordable Health Insurance

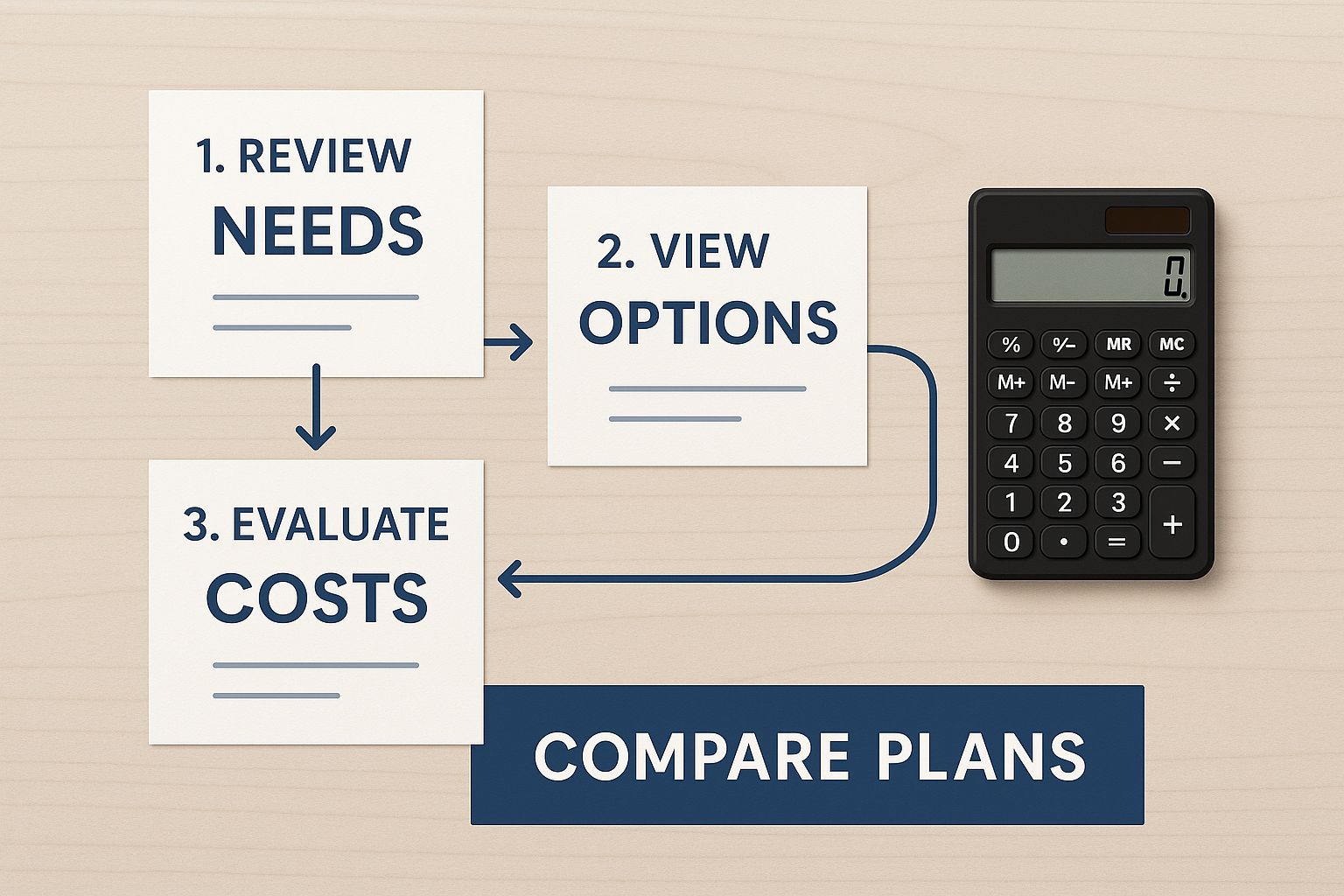

Finding a health insurance plan that fits your budget isn't just about finding the lowest monthly payment. It's about getting real value and the right kind of protection for you and your family. The process can feel like a maze, but it really comes down to three main paths. Knowing your options from the get-go makes all the difference.

Most people find their coverage in one of these ways:

- Employer-Sponsored Plans: This is usually the easiest route if you have a full-time job. Employers often cover a big chunk of the cost.

- The Health Insurance Marketplace: Your best friend if you're a freelancer, self-employed, or your job doesn't offer insurance.

- Direct from an Insurer: You can always buy a plan directly from an insurance company, but you'll miss out on any potential government subsidies.

Starting Your Search on the Marketplace

The Health Insurance Marketplace, which you can access at Healthcare.gov, was built to make shopping for a plan simple. More importantly, it’s the only place to get the Premium Tax Credit—a subsidy that lowers your monthly bill based on your income.

Here's what the homepage looks like. This is your starting point for seeing what plans and financial help you qualify for.

As you dive in, you'll see terms like deductibles and copayments. These are crucial because they determine how much you'll actually pay for care when you use your insurance.

The real challenge isn't just finding a low premium, but balancing that cost with a deductible you can actually afford. A cheap plan with a $9,000 deductible might not be useful for your family's needs.

To help you get a better handle on the different kinds of plans you'll see, here's a quick breakdown of the most common types.

Key Health Insurance Plan Types at a Glance

Navigating the alphabet soup of health insurance plans—HMO, PPO, EPO—can be confusing. Each one works a little differently when it comes to networks, referrals, and costs. This table gives you a simple, at-a-glance comparison to help you figure out which one might be the best fit for your life.

| Plan Type | Key Feature | Best For |

|---|---|---|

| HMO (Health Maintenance Organization) | Requires using in-network doctors and getting referrals from a Primary Care Physician (PCP). | Individuals and families who want lower premiums and are comfortable with a primary doctor coordinating their care. |

| PPO (Preferred Provider Organization) | Offers more flexibility to see both in-network and out-of-network doctors without a referral. | People who want more choice in their doctors and don't mind paying higher premiums for that freedom. |

| EPO (Exclusive Provider Organization) | A hybrid plan that doesn't require referrals but limits coverage almost exclusively to in-network doctors. | Those who want the freedom to see specialists without a referral but are okay staying within a set network to keep costs down. |

| POS (Point of Service) | Blends features of HMOs and PPOs. You choose a PCP and need referrals, but you can go out-of-network for a higher cost. | Someone who likes the coordinated care of an HMO but still wants the option to go out-of-network occasionally. |

Understanding these basic differences is a huge step toward picking a plan that won't just save you money, but will actually work for you when you need it.

The health insurance market is always changing, and that means new challenges and opportunities pop up all the time. Staying on top of trends can help you spot a good deal. For more actionable advice, take a look at our top tips for finding budget-friendly health coverage.

Mastering The Marketplace To Maximize Subsidies

If you don't get health coverage through an employer—maybe you're a freelancer, run a small business, or retired early—the Health Insurance Marketplace is your single most powerful tool. This is where you can find cheap health insurance by unlocking serious savings that simply aren't available anywhere else.

The secret? Knowing how to maximize your eligibility for government subsidies.

There are two major cost-savers you can only get through the Marketplace:

- Premium Tax Credits (PTCs): These are the real deal. They directly slash your monthly insurance payment, and your eligibility is based on your estimated household income for the year ahead.

- Cost-Sharing Reductions (CSRs): If you qualify for these, your out-of-pocket costs like deductibles and copayments get a major discount. But here's the catch: you must enroll in a Silver plan to get these extra savings.

I see this all the time—people underestimate just how important a Silver plan can be. A Bronze plan might look cheaper with its low monthly premium, but for a qualifying family, a Silver plan with CSRs can literally save them thousands of dollars in actual medical costs over the year.

This whole process is about sorting through your options to find what truly works for your wallet.

As you can see, it’s about more than just the monthly premium. You have to compare the plan details and calculate the true cost to really understand what you're paying.

Putting Subsidies Into Practice

Projecting your income accurately is everything. If you're a freelancer and land a big project, that income spike could reduce your subsidy. On the flip side, a slow quarter could mean you're eligible for more help.

It’s so important to report these changes to the Marketplace as they happen. This adjusts your subsidies in real-time and helps you avoid a nasty surprise of owing money back at tax time.

Life changes also open up a Special Enrollment Period, which gives you a 60-day window to pick a new plan. Things like getting married, having a baby, or losing other health coverage are all qualifying events that can completely change your subsidy eligibility.

After a big life event, it’s the perfect time to explore all your affordable health insurance options—you might unlock a much better plan for less money. Don’t just assume you have to wait for the next open enrollment to make a change.

Looking Beyond Premiums to Lower Your Total Costs

That rock-bottom monthly premium can feel like a major win, but it’s often a Trojan horse for crippling out-of-pocket expenses. Finding truly cheap health insurance means looking at the total picture, not just the initial price tag.

A plan with a low premium might look great on paper, but it could be hiding a sky-high deductible that you have to pay before your insurance covers a single dollar.

Think about it this way: would you rather have a plan with a $150 monthly premium and an $8,000 deductible, or one with a $250 premium and a $1,500 deductible? If you have an unexpected medical event, that first "cheaper" plan could end up costing you thousands more over the year.

Uncovering the Real Price Tag

The key is to understand how a plan's core components work together. You need to look beyond the premium and get a handle on these three critical numbers:

- Deductible: This is the amount you pay for covered health care services before your insurance plan even starts to pitch in. If this concept is new to you, we break it down in our guide on what a deductible is in insurance.

- Coinsurance: After your deductible is met, you and your insurance company start sharing the cost of care. Your share is the coinsurance, usually a percentage.

- Out-of-Pocket Maximum: This is the absolute most you will have to pay for covered services in a single plan year. Once you hit this cap, your insurance covers 100% of the costs.

This isn't just a local issue; it's a global struggle. In 2021, an estimated 2 billion people faced financial hardship because of medical expenses worldwide. This shows just how universal the challenge of out-of-pocket costs really is. You can learn more about global health coverage challenges) from the World Health Organization.

Sometimes, a high-deductible health plan (HDHP) can be a smart strategy, especially when you pair it with a Health Savings Account (HSA). An HSA lets you set aside pre-tax money to pay for qualified medical expenses, which can lower both your healthcare costs and your taxable income. It’s a powerful tool if you know how to use it.

Making Smart Choices with Employer Health Plans

If you get health insurance through your job, you've already won a big part of the affordability battle. Employer plans are often the best deal out there, but that doesn't mean you can just close your eyes and pick one during open enrollment. Making a savvy choice here is one of the smartest ways to find cheap health insurance that actually works for you when you need it.

Even with your company footing a large chunk of the bill, the details can make or break your budget. You’ll need to really look at the different plan types on the table, like an HMO versus a PPO.

Think about how your family actually uses medical care. Do you see specialists often? If so, a PPO’s flexibility might be worth the higher monthly premium.

Calculating Your True Annual Cost

That monthly premium coming out of your paycheck? It’s just the tip of the iceberg. To get the real picture, you have to factor in the deductible, coinsurance, and that all-important out-of-pocket maximum. A plan with a low premium but a sky-high deductible could end up costing you a fortune if an unexpected medical issue pops up.

The numbers don't lie. In 2024, the average annual premium for employer-sponsored family coverage hit a staggering $25,572, with employees kicking in about $6,296 of that. On top of that, 87% of employees have to meet an average deductible of $1,787 before their plan’s main benefits even start.

I see this all the time: people grab the lowest-premium plan to save a few bucks, only to find out their trusted family doctor isn't in-network. Any savings from that lower premium are instantly wiped out by massive out-of-pocket costs. Always, always check the provider directory before you enroll.

Don't forget to look beyond the standard insurance options. Many employers offer awesome benefits like corporate wellness programs that can help you stay healthy and cut down on long-term medical bills.

Some companies are also offering newer, more flexible options like an Individual Coverage Health Reimbursement Arrangement (ICHRA). This is where they give you tax-free money to go buy your own plan on the marketplace. It can be a fantastic way to get coverage that’s perfectly suited to your needs. Our guide on individual vs. group health insurance can help you figure out if that’s the right move for you.

When to Consider Alternative Insurance Options

Sometimes, a standard ACA-compliant plan just isn't the right fit for your immediate needs. In those moments, alternative insurance options can look pretty tempting. While they don't have the sturdy consumer protections of Marketplace plans, they can definitely fill a specific gap—as long as you know exactly what you're getting into.

Exploring these is a valid part of searching for cheap health insurance, but you have to be careful.

Short-Term Plans for Temporary Gaps

Let's say you’re between jobs and just need to bridge a coverage gap for a few months. A short-term health plan might catch your eye. They come with very low premiums, which is great, but there’s a massive trade-off.

Here’s the catch: these plans almost never cover pre-existing conditions. They also aren't required to cover the essential health benefits you get with an ACA plan, like maternity care or prescription drugs.

Think of a short-term plan as a band-aid, not a long-term cure. It's a safety net for a sudden, unexpected accident or illness, not a solution for comprehensive healthcare.

Catastrophic Plans and Health Sharing

Another route you might see is the catastrophic health plan. These are generally available only to adults under 30 or people who qualify for a hardship exemption. They have low monthly premiums, but their deductibles are sky-high. A catastrophic plan is designed to protect you from a true worst-case scenario, like a major surgery that costs tens of thousands of dollars. For routine care, you’ll be paying completely out of your own pocket.

You’ve probably also heard of health sharing ministries. These are faith-based groups where members chip in a monthly amount to help share each other's medical bills.

It's absolutely critical to understand that these are not insurance. They aren't regulated, they have no legal duty to pay your claims, and they often have very strict rules about what is—and isn't—covered. They can be a low-cost option for some, but they carry huge risks and don’t offer the guarantees that come with ACA-compliant coverage.

To make sense of it all, it helps to see these options side-by-side. The differences are pretty stark.

Comparing Traditional vs. Alternative Coverage

| Feature | ACA-Compliant Plan | Short-Term Plan | Health Sharing Ministry |

|---|---|---|---|

| Regulation | Heavily regulated by federal law | State-regulated; fewer protections | Unregulated; not insurance |

| Pre-existing Conditions | Must cover them | Almost never covered | Typically excluded |

| Essential Benefits | Required to cover all 10 | Not required to cover them | Varies widely; many exclusions |

| Subsidy Eligibility | Yes, if you qualify | No | No |

| Best For | Comprehensive, long-term coverage | Temporary gaps (1-12 months) | Healthy individuals who share the ministry's faith |

| Biggest Risk | Higher monthly premiums | Denial of claims for pre-existing conditions | No guarantee of payment for medical bills |

Ultimately, while alternatives can feel like a quick fix, they often leave you exposed when you need protection the most. Always weigh the low cost against the potential for high out-of-pocket expenses and claim denials.

Answering Your Top Health Insurance Questions

Trying to find the right health insurance plan can feel like you're navigating a maze blindfolded. A few straightforward answers can make all the difference. Let's tackle some of the most common questions that pop up, so you can move forward with total confidence.

When Is the Best Time to Look for a New Health Insurance Plan?

The main window to sign up for a new plan is during the annual Open Enrollment Period, which typically happens every fall. But let’s be real—life doesn’t always stick to a schedule.

If you go through a major life event, you could qualify for a Special Enrollment Period (SEP). This opens up a 60-day window for you to get a new plan outside of the usual time frame. Qualifying events include things like:

- Losing the health coverage you had through a job

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code or county

Think of these moments as built-in opportunities to hit pause, reassess what you need, and find a plan that actually fits your new life.

Can I Get Coverage with a Pre-existing Condition?

Yes, absolutely. Thanks to the Affordable Care Act (ACA), it is illegal for any official Marketplace plan to deny you coverage or charge you more just because you have a pre-existing condition, like asthma or diabetes. This is a core protection for all plans sold on state exchanges and Healthcare.gov.

This is a huge deal. Before the ACA, an estimated 133 million Americans had a pre-existing condition that could have gotten their application denied. Now, you can shop for a plan without that fear hanging over your head.

Just be careful—this protection doesn't apply to alternative plans like short-term insurance. Those types of plans often can and do deny claims based on pre-existing conditions, leaving you with unexpected bills.

What Is the Difference Between an HMO and a PPO Plan?

Choosing between an HMO and a PPO really comes down to a classic trade-off: cost versus flexibility.

An HMO (Health Maintenance Organization) usually comes with lower monthly premiums, which is great for your budget. The catch? You have to use doctors, specialists, and hospitals within its network. You’ll also need a referral from your primary care physician to see any specialist.

A PPO (Preferred Provider Organization) gives you a lot more freedom. You can see both in-network and out-of-network doctors without needing a referral. Of course, that freedom comes at a price—your costs will be higher, especially when you decide to go out-of-network.

Ultimately, your decision is about what you value more: the lower costs of an HMO or the greater choice and flexibility of a PPO.

Ready to find a plan that fits your budget and your life? At My Policy Quote, we make it easy to compare options and see what savings you qualify for. Start comparing plans now.