At its core, the main difference between Medicare and private insurance is who they’re for and how they’re run. Medicare is a federal program designed mostly for adults 65 and over, plus younger people with certain disabilities. On the other hand, private insurance is open to just about everyone, usually offered through a job or bought directly from an insurer.

Which one is right for you? It really boils down to your age, where you work, and what your health looks like.

Choosing Your Health Insurance Path

Trying to decide between Medicare and private health insurance can feel like a maze. But it gets a lot simpler once you understand what each one was built to do. They’re designed for different people at different stages of life, and each comes with its own set of rules and benefits.

Key Distinctions at a Glance

For most working adults and their families, private insurance is the go-to option. You’ll see a bunch of different plan types, like HMOs and PPOs, which determine which doctors and hospitals are in your network. These are commercial plans sold by companies looking to make a profit.

Medicare, however, is a social insurance program run by the government. It was created to act as a safety net for retirees and people with qualifying long-term disabilities. Its benefits are standardized into different "Parts" (like A, B, C, and D), so there's generally less variation in the core coverage compared to the private market. For anyone approaching that magic number 65, figuring out your health insurance before Medicare is a huge part of planning for the future.

Understanding the Core Trade-Offs

This decision isn’t just about turning 65. It's about weighing your options when it comes to costs, the freedom to choose your doctors, and what’s actually covered. For instance, Original Medicare lets you see any doctor in the country who accepts it—that’s a level of freedom you won’t find with most private plans. The catch? It doesn't have a cap on your annual out-of-pocket spending, which is a standard feature in private insurance.

Here’s a crucial difference: Private insurance is often tied to your job. If you change jobs, your insurance probably changes, too. Medicare isn't connected to employment; it's based on age or disability, giving you stable, long-term coverage once you qualify.

This table breaks down the foundational differences in the "Medicare vs. private insurance" debate:

| Feature | Medicare | Private Insurance |

|---|---|---|

| Primary Eligibility | Age 65+ or specific disabilities | Open to all ages; often employer-based |

| Provider Network | Nationwide (Original Medicare) or local (Advantage) | Varies by plan (HMO, PPO, etc.) |

| Funding Source | Federal government (taxes, premiums) | Private companies (premiums) |

| Cost Structure | Standardized parts with set deductibles/coinsurance | Premiums, deductibles, copays vary widely |

How Medicare Works: A Detailed Breakdown

Before we can really compare Medicare vs private insurance, we need to get one thing straight: Medicare isn't just one plan. Think of it more like a system of building blocks you can use to put together the right coverage for you.

The whole system is built on a foundation called Original Medicare. It’s the government-run program, and it’s split into two main parts that work hand-in-hand.

The Core Components of Original Medicare

Medicare Part A (Hospital Insurance) is the first piece of the puzzle. Most people get this part premium-free as long as they (or a spouse) paid Medicare taxes for at least 10 years. It’s designed to help with the big stuff—inpatient care.

That means it helps cover things like:

- Semi-private rooms if you're admitted to a hospital

- Care in a skilled nursing facility (but only after a qualifying hospital stay)

- Hospice care

- Certain home health care services

Medicare Part B (Medical Insurance) is the second piece. This covers a huge range of outpatient services and supplies—basically, anything you need to diagnose or treat a medical condition outside of a hospital stay. Unlike Part A, this one has a monthly premium that’s usually taken right out of your Social Security check.

Part B is for your day-to-day medical needs:

- Doctor's visits and services

- Preventive care, like flu shots and cancer screenings

- Ambulance rides

- Durable medical equipment, such as walkers or wheelchairs

Together, Parts A and B make up Original Medicare. One of its best features is freedom; you can see any doctor or go to any hospital in the U.S. that accepts Medicare. But there’s a big gap: it doesn't cover most prescription drugs. And that brings us to the next building block.

Adding Prescription Drug Coverage

To fill that medication gap, you can sign up for a Medicare Part D (Prescription Drug Plan). These are separate plans sold by private insurance companies that are approved by Medicare. Each Part D plan has its own list of covered drugs (called a formulary) and its own costs.

Here's a critical point to remember: Original Medicare (Parts A & B) has no annual out-of-pocket maximum. This means there's no ceiling on what you could potentially spend on your share of the costs in a given year. That’s a major difference when you’re weighing Medicare vs private insurance.

An Alternative Path: Medicare Advantage

Instead of building your coverage piece by piece with Parts A, B, and D, there's another route that’s become incredibly popular: Medicare Part C, better known as Medicare Advantage. These are all-in-one plans offered by private insurance companies that contract directly with Medicare.

By law, these plans have to cover everything Original Medicare does. But they often roll in Part D prescription drug coverage and even add extra perks that Original Medicare won’t touch, like routine dental, vision, and hearing care.

The catch? These plans usually operate more like the private insurance you’re used to, with networks like HMOs or PPOs. This can limit your choice of doctors and hospitals, unlike the go-anywhere freedom of Original Medicare. Making this choice is a huge part of your long-term healthcare strategy, which is why a solid Medicare planning guide can be a lifesaver.

The shift toward these plans is undeniable. By 2025, it's projected that over half (54%) of all eligible people will be enrolled in a Medicare Advantage plan. While this shows a strong preference for these bundled options, it’s worth noting that Medicare actually pays these private plans about 20% more per person than it spends on those in traditional Medicare. You can read more about this trend on KFF.org.

Navigating Private Health Insurance Options

While Medicare is a straightforward federal program, private health insurance is a completely different world. It’s a vast, sometimes confusing landscape, but it’s how most Americans under 65 get their healthcare coverage. The options stretch from employer-sponsored plans to individual policies you buy on your own.

To really understand the medicare vs private insurance debate, you have to get comfortable with the private side's lingo and structures. Unlike Medicare's standardized "Parts," private insurance is a buffet of choices. Each one comes with its own set of rules about which doctors you can see and how much you'll pay out of pocket.

Where Private Insurance Comes From

For most people, private coverage comes directly from their job. These group health plans are a staple employee benefit, and because the employer usually pays a good chunk of the monthly premium, it's often the most affordable route.

But what if you're self-employed, a freelancer, or your company doesn't offer benefits? You can buy a plan yourself, either straight from an insurance company or through the Health Insurance Marketplace created by the Affordable Care Act (ACA). The Marketplace is also where you can find out if you qualify for subsidies to help lower your costs.

Here's a critical point: private insurance plans, whether from your boss or the Marketplace, have to cover essential health benefits and cap your annual out-of-pocket spending. That's a huge difference from Original Medicare, which has no out-of-pocket maximum at all.

Demystifying the Alphabet Soup of Plan Types

As you start looking at plans, you’ll run into a series of acronyms. Each one—HMO, PPO, EPO, POS—describes how the plan works, striking a different balance between what you pay and how much freedom you have to choose your doctors.

- HMO (Health Maintenance Organization): These plans keep costs down by requiring you to use doctors and hospitals within their network. You'll also need to pick a Primary Care Physician (PCP) who will give you a referral to see any specialists.

- PPO (Preferred Provider Organization): PPOs give you much more flexibility. You can see providers both in and out of the network without a referral, but you’ll save a lot of money by staying in-network.

- EPO (Exclusive Provider Organization): Think of an EPO as a hybrid. Like an HMO, it usually won't cover out-of-network care unless it's an emergency. The big plus? You typically don't need a referral to see a specialist.

- POS (Point of Service): This plan mixes features from HMOs and PPOs. You might need a referral from your PCP, but you still have the option to go out-of-network for a higher cost.

Getting a handle on these options is key. It's worth spending time understanding different types of private health insurance policies before making a decision.

Understanding Your Financial Responsibility

Your monthly premium is just the beginning. To truly know what you'll spend, you have to look at the whole picture—deductibles, copays, and coinsurance. Our guide on how to compare health insurance plans can walk you through weighing these factors.

The rise of private insurance has massively impacted national health spending. In fact, data shows it accounted for 30.1% of all U.S. health spending in 2023, a huge jump from just 20.4% in 1970. What’s more, spending per person by private insurers grew by 80.4% through 2023, far outpacing Medicare's 50.3% growth over the same period. You can dig into more of these U.S. health care spending trends on HealthSystemTracker.org.

Comparing Critical Insurance Features Side-By-Side

https://www.youtube.com/embed/5_tn_ad56Jk

To really understand the medicare vs private insurance debate, you have to look past the high-level stuff and get into the details that hit your wallet and your health. How you see a doctor, what’s actually covered, and what you’ll pay can be worlds apart.

Private insurance is all about market competition, which means a huge variety of plans, networks, and prices. Medicare, on the other hand, is a standardized federal benefit—though the rise of private Medicare Advantage plans has blurred the lines by bringing in some of that private insurance flavor.

Let’s break down the features that matter most.

Eligibility and Enrollment Rules

The first and most obvious difference is who can sign up and when. Private insurance is generally open to anyone, usually through a job or by buying a plan directly. Enrollment happens during specific windows, like when you start a new job or during the annual Open Enrollment Period.

Medicare is much more specific. It’s designed for people 65 and over or those with certain disabilities like End-Stage Renal Disease (ESRD) or ALS. Your first chance to sign up is your Initial Enrollment Period, a seven-month window around your 65th birthday. If you miss it and don't have other coverage, you could face late enrollment penalties for the rest of your life.

Provider Networks and Access to Care

One of the biggest decisions you'll make involves the trade-off between network freedom and cost. This is where Original Medicare and most private plans are fundamentally different.

With Original Medicare (Parts A & B), you’re not tied to a local network. You can see any doctor or visit any hospital in the U.S. that accepts Medicare. For people who travel or want to see top specialists anywhere in the country, that freedom is a huge deal.

Private insurance and Medicare Advantage plans work differently. They use managed care networks to keep costs down. You’ll usually run into two main types:

- HMOs (Health Maintenance Organizations): These plans require you to stick with in-network doctors and usually need a referral from your primary care physician to see a specialist.

- PPOs (Preferred Provider Organizations): PPOs give you more flexibility. You can see out-of-network doctors, but you’ll pay a lot more for it.

Figuring out what is the difference between HMO and PPO is critical, as it directly controls who you can see and how much you’ll spend.

Coverage for Essential Health Services

Both systems cover the big things, like hospital stays and doctor visits. But when you dig into the specifics—like dental, vision, or even coverage for home doctor visits—the differences become clear.

Original Medicare is famous for what it doesn't cover. There’s no routine dental, vision, or hearing care. It also doesn't include prescription drug coverage, which is why most people buy a separate Part D plan. In contrast, private plans on the ACA Marketplace must cover ten essential health benefits, which nearly always include prescription drugs and pediatric dental and vision.

This gap is exactly why Medicare Advantage plans have become so popular. They bundle these extra benefits together, creating an all-in-one package that feels more like a private plan.

Crucial Takeaway: The single biggest financial risk with Original Medicare is its lack of an out-of-pocket maximum. Private plans and Medicare Advantage plans legally have a cap on what you can spend in a year. With Original Medicare, your 20% coinsurance costs are technically unlimited, which makes supplemental coverage (like a Medigap plan) almost a necessity.

Medicare vs Private Insurance Feature Comparison

To make these differences easier to see, let's put them side-by-side. This table breaks down how each type of insurance handles the features that will impact you the most, from monthly costs to network access.

| Feature | Original Medicare (Parts A & B) | Medicare Advantage (Part C) | Private Insurance (e.g., Employer Plan) |

|---|---|---|---|

| Provider Network | Nationwide; see any doctor accepting Medicare | Local or regional HMO/PPO networks | Typically local or regional HMO/PPO networks |

| Referrals to Specialists | Not required | Often required for HMOs | Often required for HMOs, not for PPOs |

| Prescription Drug Coverage | Not included (requires separate Part D) | Usually included (MAPD plans) | Almost always included |

| Dental, Vision, & Hearing | Not covered | Often included as extra benefits | Coverage varies; often requires a separate policy or rider |

| Out-of-Pocket Maximum | None. No limit on your spending. | Yes. All plans have a legal annual limit. | Yes. All ACA-compliant plans have a legal annual limit. |

| Monthly Premium | Part A often free; Part B & D have premiums. | Often has low or $0 premiums (plus your Part B premium). | Varies widely based on employer contribution or subsidies. |

| Deductibles | Separate deductibles for Parts A and B. | Often a single deductible; some plans have $0 deductibles. | Can range from low to over $9,000 depending on the plan. |

This quick-glance comparison highlights the core trade-offs. Original Medicare offers unmatched freedom, but with significant coverage gaps and financial exposure. Medicare Advantage and private plans provide more comprehensive, all-in-one coverage with cost protections, but at the expense of network flexibility.

Choosing The Right Insurance For Your Life Stage

Knowing the difference between Medicare and private insurance is one thing, but figuring out how it applies to your life? That’s something else entirely. The best choice in the Medicare vs private insurance debate isn’t a one-size-fits-all answer. It comes down to where you are in life—your age, your job, your health, and your budget.

Let’s move past the technical details and look at a few real-world situations. Seeing how these choices play out for others can make your own path much clearer.

Scenario 1: The 64-Year-Old Preparing For Retirement

Meet Sarah. She’s 64 and getting ready to retire from her corporate job next year. For decades, she's relied on her company's PPO plan, which has a great network and costs she can predict. Now, she's staring down the transition to Medicare.

Her big decision is whether to go with Original Medicare (plus a Medigap and Part D plan) or to bundle it all into a Medicare Advantage (Part C) plan.

- The Original Medicare Path: This option is all about freedom. Sarah could keep seeing her trusted specialists anywhere in the U.S. that accepts Medicare, and she wouldn't need a single referral. The catch? She’d have to manage three different plans (A, B, and D) plus a Medigap policy to fill in the coverage gaps. Her total premiums might be higher, but her out-of-pocket costs for care would be incredibly predictable.

- The Medicare Advantage Path: An all-in-one Medicare Advantage plan could mean a much lower monthly premium—maybe even $0 on top of her Part B premium. It would probably wrap in dental and vision benefits, just like her old employer plan did. The trade-off is the network. She’d have to make absolutely sure all her doctors are in the plan’s local network and be prepared for referrals.

For Sarah, it really boils down to her priorities. If keeping her current team of doctors and having nationwide flexibility is non-negotiable, Original Medicare with a Medigap plan is the clear winner. But if she'd rather have a simpler, lower-premium option and her doctors are in-network, an MA plan is a very compelling choice.

Scenario 2: The Self-Employed Professional Under 65

Now, let's think about Mark, a 45-year-old self-employed graphic designer. He doesn't get health insurance through an employer, so he's on his own. Since he's under 65, Medicare isn't on the table for him.

Mark’s only route is a private insurance plan, which he'll most likely buy through the Health Insurance Marketplace. His main challenge is finding the right balance between the monthly premium he can afford and the out-of-pocket costs he might face, like deductibles and copays.

For anyone who's self-employed, income is a huge factor. Marketplace plans offer premium tax credits that can dramatically lower your monthly payments if you qualify, making great private insurance much more affordable than you might think.

He needs to take a hard look at his health. If he's healthy and rarely goes to the doctor, a high-deductible health plan (HDHP) could save him money. But if he has a family or expects to need regular care, a plan with a lower deductible like a Gold or Platinum PPO might be a smarter investment, even with the higher monthly premium.

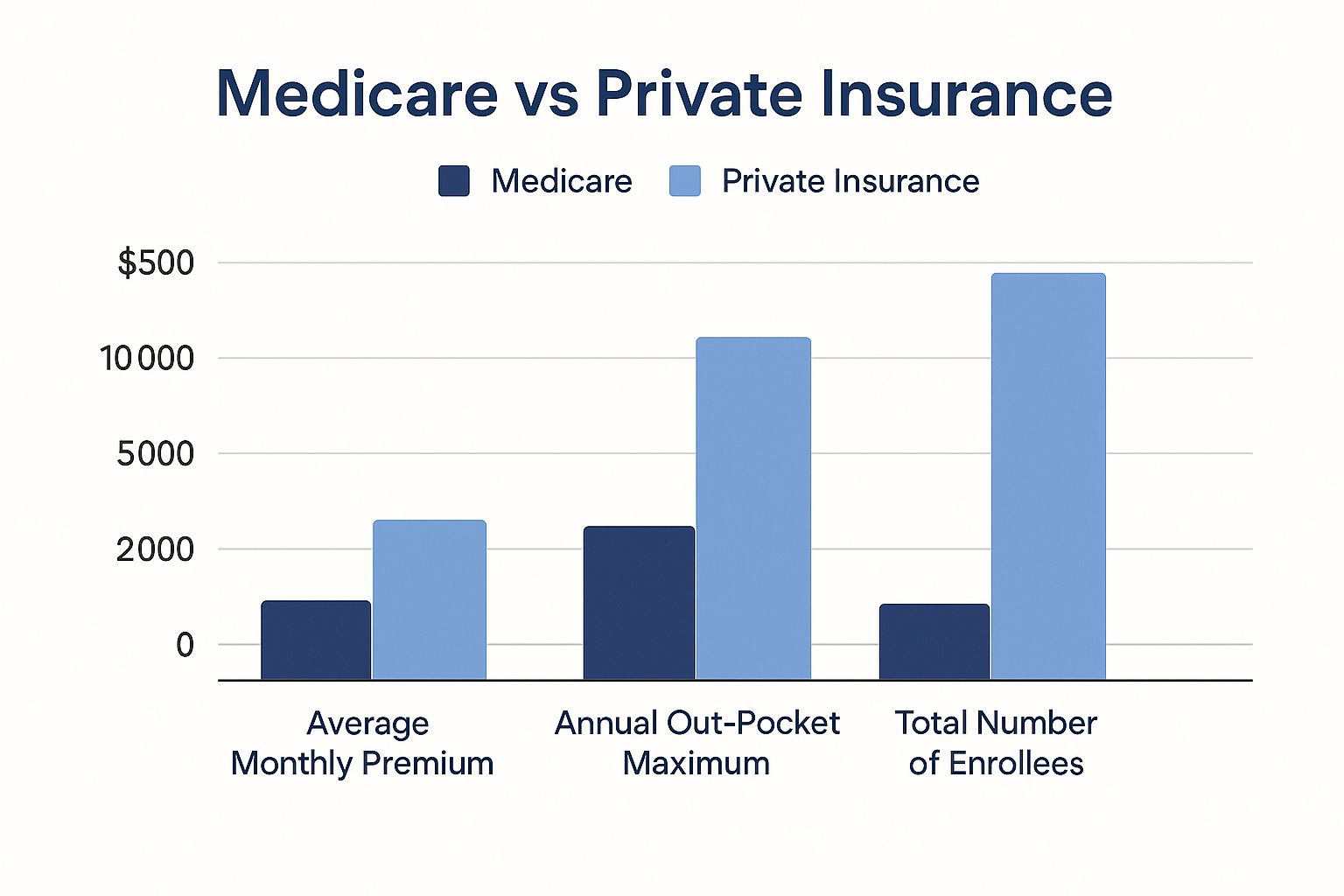

The infographic below paints a clear picture of how these key cost and enrollment numbers stack up between Medicare and the private market.

This really brings it home: while private plans offer a safety net with out-of-pocket maximums, Medicare is a massive system with its own unique way of handling costs for millions of people.

Scenario 3: The Individual With a Chronic Condition

Finally, there’s Maria. She’s 68 and lives with a chronic condition that requires frequent specialist visits and very specific, expensive medications. She's already on Medicare but is using the Open Enrollment Period to make sure she has the absolute best coverage for her situation.

For Maria, the devil is in the details. Her choice between Original Medicare and Medicare Advantage has to be razor-sharp.

- If she sticks with Original Medicare and Medigap: This combo is a powerhouse for someone with high medical needs. It gives her incredible financial protection and the freedom to see any specialist she wants. Since Medigap plans pay the 20% coinsurance, her costs for all those doctor visits would be almost completely covered. She could also pick a standalone Part D plan chosen specifically because it covers her expensive prescriptions best.

- If she goes with a Medicare Advantage plan: She would need to find a Special Needs Plan (SNP) if one is available for her condition. These plans are literally designed for people like her, offering tailored benefits and care coordination. But she would have to be incredibly careful, checking and double-checking that every one of her specialists and her preferred hospital are in the network. She'd also need to confirm her medications are on the plan's list of covered drugs at a price she can manage.

For someone managing a serious health issue, the peace of mind that comes with the freedom and predictable costs of Original Medicare plus a good Medigap plan is often worth the higher premium. The risk of a key specialist suddenly leaving a Medicare Advantage network could be just too stressful and disruptive to her care.

How to Make Your Final Health Insurance Decision

Okay, let's get real. The Medicare vs. private insurance debate isn't just about numbers on a page—it's about your life, your health, and your money. To make the right call, you need to look past the fancy plan names and get down to what truly matters for you.

Think of it as a personal health audit. It’s the only way to make sure your decision is based on reality, not just slick marketing brochures.

A Practical Checklist for Your Decision

First things first: forget the monthly premium for a second. What you really need to figure out is the total potential annual cost. Add up the premiums, deductibles, copays, and—most importantly—the plan’s out-of-pocket maximum. That cheap plan might look great now, but it could end up costing you a fortune if you actually need to use it.

Next up is the provider network. This one’s a deal-breaker. Make a list of every single doctor, specialist, and hospital you count on. Now, check if every last one is in-network for the plans you're considering. Losing a doctor you trust is a huge disruption, not to mention a costly one.

Here's something to remember: This decision isn't set in stone. Your health, your budget, and the plans themselves can all change. The smartest thing you can do is commit to reviewing your coverage every year during Open Enrollment. That's how you stay in control.

Finally, run through these questions. Your honest answers will point you in the right direction:

- Your Prescriptions: Are all your medications covered? Dig into the plan's formulary and find out exactly what your copay will be for each one.

- The "Extras": How important are dental, vision, or hearing benefits to you? Be honest—will you actually use them enough to make a higher premium worth it?

- Travel Plans: Do you spend a lot of time on the road? Original Medicare is your ticket to nationwide coverage. Most private or Medicare Advantage plans will keep you tied to a local network.

- The Worst-Case Scenario: Does the plan have an out-of-pocket maximum? This is your financial safety net. Don't even consider a plan without one. It protects you from financial ruin if something catastrophic happens.

Going through these steps gives you clarity. It moves the decision from a confusing mess of options to a clear choice based on your life.

Frequently Asked Questions

When it comes to Medicare versus private insurance, a lot of questions pop up. It's easy to get tangled in the details, but getting clear answers is the key to avoiding costly mistakes and choosing with confidence.

Let's walk through some of the most common situations people find themselves in.

Can I Have Both Medicare And Private Insurance?

Yes, you can, but the rules on how they work together are very specific. If you have Medicare and you're still covered by a plan from your current job (at a company with 20 or more employees), your work plan is your primary insurance. It pays first. Medicare then acts as a secondary payer, picking up some of the costs your employer plan doesn't cover.

It’s a different story for smaller companies or if you have a retiree health plan. In those cases, Medicare usually pays first. This system of "coordination of benefits" is designed to make sure claims are handled correctly without anyone paying twice.

One thing to remember: It is illegal for an insurance agent to knowingly sell you an ACA Marketplace plan if you already have Medicare. They're designed as separate, primary coverage systems, not partners.

What If I Am Still Working At Age 65?

If you’re turning 65 but still working and have good health coverage through a larger employer, you’ve got options. You might be able to delay signing up for Medicare Part B and avoid the late enrollment penalty that usually comes with waiting.

This is a big decision, though. You'll want to sit down and compare what you're paying for your employer plan against the costs of Medicare Part B plus any supplemental coverage you might want. A lot of people in this situation sign up for the premium-free Part A and just wait on Part B until they officially retire.

How Do I Decide Between Medigap And Medicare Advantage?

This is the classic fork in the road for anyone new to Medicare. Think of it this way: Original Medicare paired with a Medigap (or Medicare Supplement) plan is all about freedom and predictability. You can see any doctor in the country who accepts Medicare, and your out-of-pocket costs are incredibly stable.

On the other hand, a Medicare Advantage (Part C) plan is an all-in-one package. These plans often come with lower monthly premiums and bundle in extra perks like dental, vision, and hearing coverage. The trade-off? You have to stick to a local network of doctors and hospitals. The right choice really comes down to what you value more: provider freedom (Medigap) or lower premiums and extra benefits (Advantage).

At My Policy Quote, we get how personal these decisions are. We're here to help you sort through the noise and find the health insurance solution that fits your life perfectly. Let's find your plan.