When you're trying to pick a health plan, the alphabet soup of HMOs and PPOs can feel overwhelming. But it really boils down to one simple question: What do you value more, lower costs or greater flexibility?

HMOs (Health Maintenance Organizations) are built to keep your monthly premiums down, but they do that by having you stick to a specific network of doctors and getting referrals for specialists. On the flip side, PPOs (Preferred Provider Organizations) give you the freedom to see almost any provider you want, in or out of network, without a referral—but that freedom comes with a higher price tag.

HMO vs PPO The Fundamental Differences

Choosing a health plan isn't just about the numbers; it’s about how you want to manage your healthcare. The structure of your plan decides everything—how you get treatment, what you’ll pay out-of-pocket, and which doctors you can trust with your well-being.

Primary Care Physician and Referrals

One of the biggest divides between these two plans is the role of your Primary Care Physician (PCP). Think of a PCP in an HMO as your healthcare quarterback. They’re your first call for everything, and they coordinate all your care, writing you a referral if you need to see a specialist.

PPOs don't have this "gatekeeper" system. If you wake up with a sore back and want to see a chiropractor, you can just go. This gives you more direct control over your healthcare journey. You can dive deeper into how this works when looking at individual health insurance plans.

Network Flexibility

This is another huge point of difference. HMOs have a tightly controlled, local network of doctors and hospitals. If you go outside that network for anything other than a true emergency, you’re likely paying for 100% of the bill yourself.

PPOs, however, give you options. They have a "preferred" network where your costs will be lowest, but they’ll still help pay for out-of-network care. It won't be as much, and you’ll pay more, but the choice is yours. For more on how networks are evolving, you can check out some health insurance market trends on sphericalinsights.com.

To make it even clearer, let's break it down side-by-side.

Key Differences Between HMO and PPO Plans

This table gives you a quick, at-a-glance look at what sets these two popular plans apart.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) |

|---|---|---|

| PCP Required | Yes, you must choose a PCP to coordinate your care. | No, a PCP isn't required to manage your care. |

| Referrals | Yes, you need a referral from your PCP to see most specialists. | No, you can see specialists directly without a referral. |

| Network Coverage | You must stay in-network (except for emergencies). | You can see both in-network and out-of-network providers. |

| Typical Cost | Lower monthly premiums and often lower out-of-pocket costs. | Higher monthly premiums and deductibles. |

Ultimately, the right plan depends entirely on your personal needs, your budget, and how you prefer to interact with the healthcare system.

Comparing Provider Networks and Your Freedom of Choice

When you get down to it, the biggest, most crucial difference between an HMO and a PPO is your freedom to choose. It’s a simple concept, but it directly impacts everything from your costs to your access to care, making it the most important factor in your decision.

The HMO Network: A Gated Community

Think of an HMO as a closed-network model. You must use the doctors, specialists, and hospitals that are part of that specific plan. Step outside that network, and—unless it’s a true medical emergency—you're likely paying for 100% of the cost yourself.

For many people, the strict network of an HMO is a perfectly fair trade-off for lower monthly premiums. But if you have a doctor you love or need highly specialized care, that network can feel less like a community and more like a barrier.

Let’s put it in real-world terms. Imagine you need a complex surgery, and the top surgeon for that procedure works out of state. If that doctor isn't in your HMO's network, the plan simply won't cover their services. This rigidity is at the heart of the difference between HMO and PPO plans.

The PPO Network: Flexibility Comes at a Price

A PPO, on the other hand, offers a more flexible, tiered approach. You have a "preferred" network of providers where your costs are lowest. But you also have the freedom to see doctors and specialists who are out-of-network.

This freedom, however, isn’t free. When you go out-of-network with a PPO:

- You'll face a higher deductible, often a separate one from your in-network deductible.

- Your coinsurance rate will be higher, meaning you pay a larger percentage of the bill.

- You might get "balance-billed", which is when the provider charges you the difference between their full fee and what your insurer paid.

Finding yourself in this situation can be stressful. Knowing what to do if your doctor doesn’t accept your health insurance is a critical piece of the puzzle. It's also worth thinking about how your main health plan works with other specialized coverage, like specific vision care networks like VSP.

Analyzing Your Potential Healthcare Costs

It’s easy to assume HMOs are always the cheaper option, but the real story is in the details. When you dig into the numbers, the true difference between an HMO and a PPO comes down to four key financial pieces: monthly premiums, deductibles, copayments, and coinsurance.

An HMO is built from the ground up for cost control. By keeping you within a specific network and requiring a Primary Care Physician (PCP) to coordinate your care, the plan can negotiate better rates. Those savings get passed on to you as lower monthly premiums. Many HMOs even offer minimal or $0 deductibles, which means your insurance starts chipping in much sooner.

Comparing Financial Trade-Offs

A PPO, on the other hand, charges higher premiums for one big reason: freedom. You’re paying for the privilege of seeing specialists without a referral and the flexibility to get care from providers outside the network. That freedom comes with higher deductibles and a more complex cost-sharing structure.

The core financial decision is straightforward: An HMO prioritizes predictable, lower monthly costs with structured care, while a PPO offers greater choice in exchange for higher premiums and potentially less predictable out-of-pocket expenses, especially if you go out-of-network.

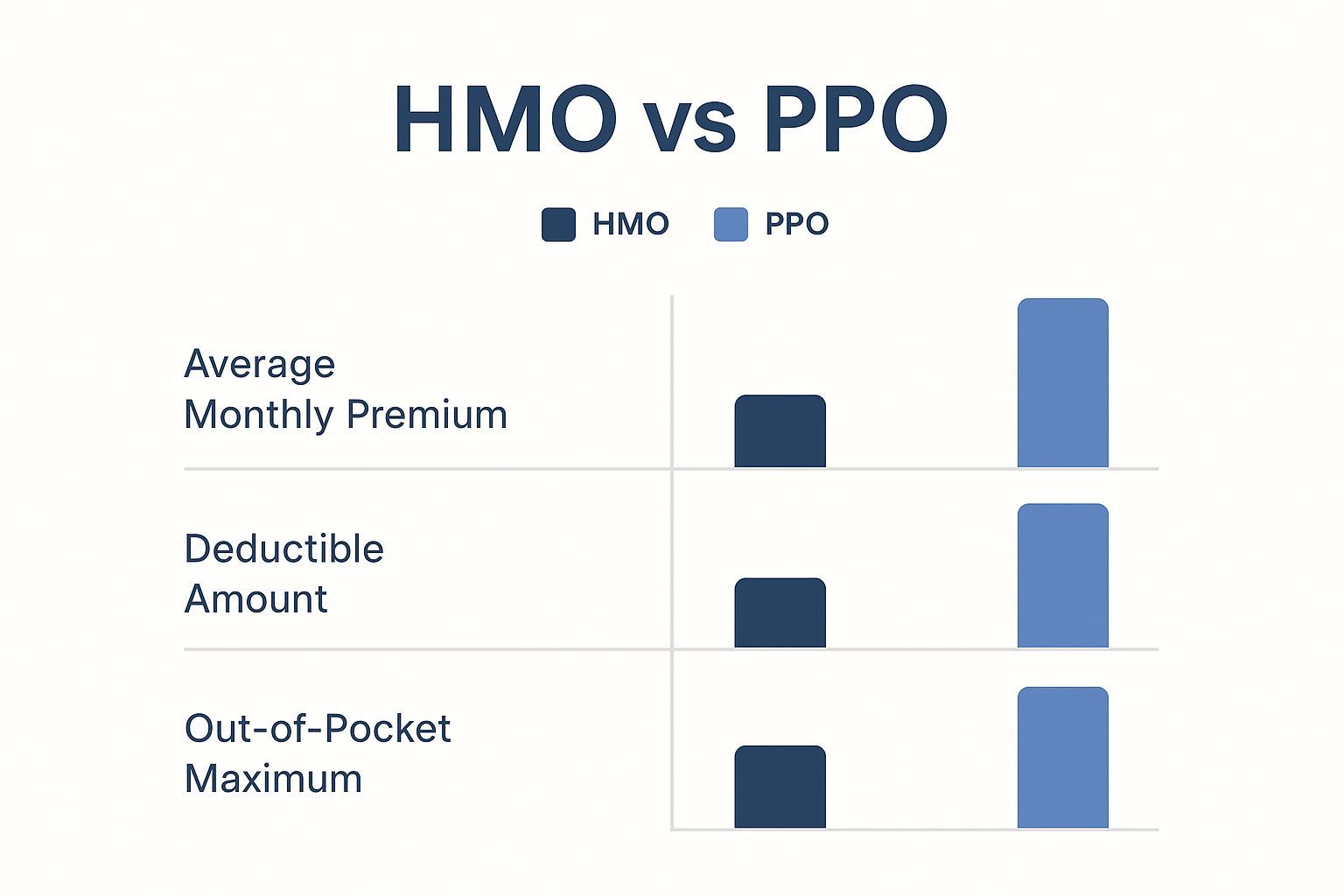

This chart gives you a quick visual on how the costs typically stack up.

As you can see, HMOs generally keep your upfront costs lower. PPOs ask for more each month but give you that wider access in return. Getting a handle on these financial moving parts is everything, and you can dive deeper into the specifics of coinsurance vs copay in our detailed guide.

Thinking long-term, these costs are a huge part of your overall financial picture, especially when it comes to retirement planning and healthcare expenses. To make this more concrete, here's a look at how costs might play out for common medical services.

Example Cost Scenarios HMO vs PPO

Let's look at a hypothetical breakdown. This isn't exact science, but it gives you a feel for how your out-of-pocket costs could differ in the real world.

| Service | Typical HMO Cost | Typical PPO In-Network Cost | Typical PPO Out-of-Network Cost |

|---|---|---|---|

| Routine Doctor Visit | $25 copay | $40 copay | 40% of bill after deductible is met |

| Specialist Visit | $50 copay (with referral) | $75 copay (no referral needed) | 40% of bill after deductible is met |

| Emergency Room Visit | $250 copay | $350 copay | $350 copay + 40% of bill after deductible |

| Generic Prescription | $10 copay | $15 copay | Not covered or covered at a very high cost |

The table really highlights the trade-offs. With an HMO, your costs are fixed and predictable as long as you stay in-network. With a PPO, you gain flexibility, but stepping outside that network can get expensive fast, exposing you to much higher, less predictable costs.

Referrals and Your Primary Care Physician: Who’s in Charge?

One of the biggest splits between an HMO and a PPO comes down to one question: How much control do you want over your healthcare journey? The answer lies in the role of your Primary Care Physician (PCP) and whether you need a referral to see a specialist.

In an HMO, your PCP is your trusted guide for everything. Think of them as the quarterback of your healthcare team. If you need to see a cardiologist for a heart concern or an orthopedist for joint pain, you start with your PCP. They evaluate your situation and then give you a referral to an in-network specialist.

This system is designed to keep your care coordinated and prevent unnecessary costs. Your PCP knows your entire health history, making sure every move is a smart one. The trade-off? That referral process can feel like an extra hoop to jump through, especially when you feel you know exactly what kind of specialist you need to see.

The HMO "Gatekeeper" Model

The HMO approach is all about structure. It’s built on the idea that your main doctor should have the final say on your care path.

- Here’s how it works: Let's say you've developed persistent knee pain. With an HMO, your first call is to your PCP. They’ll examine your knee and, if they agree it's necessary, refer you to an orthopedic specialist within the HMO network. You can't just call up the specialist and book it yourself.

This ensures there’s a clear, documented reason for every specialist visit. While it provides great oversight, it can feel a bit restrictive if you prefer to call the shots yourself.

For anyone who values having a single, trusted doctor coordinating their entire health journey, the HMO model is perfect. But if you're managing a chronic condition and already know which specialists you need, that extra step can feel like unnecessary red tape.

The PPO "Direct Access" Model

A PPO, on the other hand, puts you firmly in the driver's seat. It offers direct access to specialists, meaning there’s no gatekeeper and no referral needed.

If your knee hurts, you can research in-network orthopedists and book an appointment right away. That freedom is the biggest reason people choose PPO plans. It gives you complete autonomy over your healthcare decisions.

This flexibility is a game-changer for people who are proactive about their health or see multiple specialists. Someone managing diabetes, for example, might regularly see an endocrinologist, a podiatrist, and an eye doctor. A PPO lets them schedule those appointments on their own terms, without needing to go back to their PCP for a referral each time. That convenience is a huge factor when you're deciding between an HMO and a PPO.

Choosing the Right Plan for Your Life Situation

Knowing the difference between an HMO and a PPO is one thing. Figuring out which one actually fits your life is something else entirely. Your health insurance isn't just a card in your wallet—it should match your personal needs, your budget, and what you value most.

Let's walk through a few common scenarios to see how this plays out in the real world.

For the Healthy Young Professional

If you're young, healthy, and mostly just want coverage for check-ups and the occasional "just in case," an HMO is often the smartest financial move. Your biggest concern is probably keeping monthly costs down, and that's where HMOs shine.

With lower premiums and predictable copays for routine stuff, an HMO gives you a solid safety net without making you pay for flexibility you'll rarely use. The whole "see your primary doctor first" rule isn't a big deal when you aren't seeing specialists all the time anyway. It’s a small trade-off for big monthly savings.

For the Growing Family

This is where things get a little tricky. With kids, you're constantly dealing with pediatrician visits, sudden fevers, and maybe even a trip to a specialist for allergies or ear infections.

- HMO: An HMO can be a lifesaver for your budget. You’ll have fixed copays for all those well-child visits and sick appointments, which makes financial planning so much easier. Plus, having one primary doctor coordinating everything means no details get lost in the shuffle.

- PPO: On the other hand, if you value speed and choice—like seeing that amazing pediatric allergist everyone recommends without waiting for a referral—a PPO might be worth the higher cost. For busy parents, cutting out that extra step can be a huge relief.

Ultimately, it comes down to what your family needs more: the cost control and coordinated care of an HMO, or the convenience and freedom of a PPO.

For Managing a Chronic Condition

When you're dealing with a long-term illness like diabetes, heart disease, or an autoimmune disorder, a PPO is usually the clear winner. You need a team of specialists—cardiologists, endocrinologists, rheumatologists—and getting a referral for every single visit is just not practical.

A PPO gives you direct access, simplifying your life when you're already managing so much. It also opens the door to seeing a top expert who might not be in a local HMO network. That out-of-network coverage becomes absolutely essential. Yes, it costs more, but you can't put a price on getting the best care possible. To learn more about weighing these factors, check out our guide on how to compare health insurance plans.

For the Frequent Traveler or Remote Worker

If you live out of a suitcase, work from anywhere, or enjoy the RV lifestyle, a PPO isn't just a good choice—it's practically a necessity. HMO networks are built to be local. Step outside that specific geographic area, and your coverage can disappear.

A PPO, with its nationwide network and out-of-network benefits, travels with you. It gives you the peace of mind to know you can get care whether you're three states away for a business trip or exploring a national park. That kind of freedom is priceless.

Common Questions About HMO and PPO Plans

Even after you've weighed the costs and network sizes, the real-world questions start popping up. Knowing how your plan works day-to-day is the difference between smooth sailing and major headaches. Let’s clear up some of the most common points of confusion you might face after enrolling.

Can I Switch Between an HMO and a PPO Anytime?

Not exactly. For the most part, you can only switch health plans during the annual Open Enrollment Period. This is your once-a-year window to make any changes you want, for any reason.

But life happens. Certain major events—like getting married, having a baby, or moving to a new state—are considered a Qualifying Life Event (QLE). A QLE opens up a Special Enrollment Period just for you, allowing you to change your plan outside the normal window. Without one, you’ll have to wait.

What if I Have an Emergency While Traveling with an HMO?

This is a big one, but the answer is reassuring. By law, every qualified health plan, including HMOs, has to cover you in a true medical emergency, no matter where you are or if the hospital is in-network. A true emergency is anything a reasonable person would believe puts their health in serious danger.

Here’s the catch: The emergency care is covered, but the follow-up isn't. Once you're stabilized, your HMO will expect you to return to an in-network doctor for any ongoing treatment to be covered.

Is Prescription Drug Coverage Different?

Yes and no. The list of covered drugs (the "formulary") isn't really an HMO vs. PPO thing; it's specific to each individual plan. Both types use a tiered system, where generic drugs are cheap and brand-name medications cost more.

The real difference is often the pharmacy network. An HMO usually has a stricter list of in-network pharmacies you have to use. A PPO, staying true to its flexible nature, might give you a wider choice and even cover prescriptions from out-of-network pharmacies—though you'll definitely pay more for that convenience. Always, always check a plan's specific formulary before you sign up.

Navigating all these rules can feel like a lot, but you don't have to figure it out on your own. At My Policy Quote, we help people and families find the perfect plan to fit their life and their budget, every single day.

Get a clear, no-hassle quote today and make your decision with confidence. Find your ideal policy at https://mypolicyquote.com.