Think of health insurance enrollment like a train schedule. For most of the year, there's only one time you can get on board: the annual Open Enrollment Period. But what happens if your life takes an unexpected turn and you desperately need to change your ticket?

That's where a qualifying life event comes in. It’s like a special, unscheduled stop that lets you get on or switch trains when you otherwise couldn't. It’s a major life change that gives you a limited-time opportunity to enroll in or adjust your health coverage outside of that standard once-a-year window.

Your Health Insurance Guide to Life’s Big Changes

Let's be honest, navigating health insurance can feel like trying to solve a puzzle. But the rules around qualifying events are actually there to help you, not trip you up. They ensure that a big life change—like losing a job or welcoming a new baby—doesn't leave you stranded without medical coverage.

This special window to make changes is officially called a Special Enrollment Period (SEP). It’s your chance to get a new health plan that actually fits your new situation.

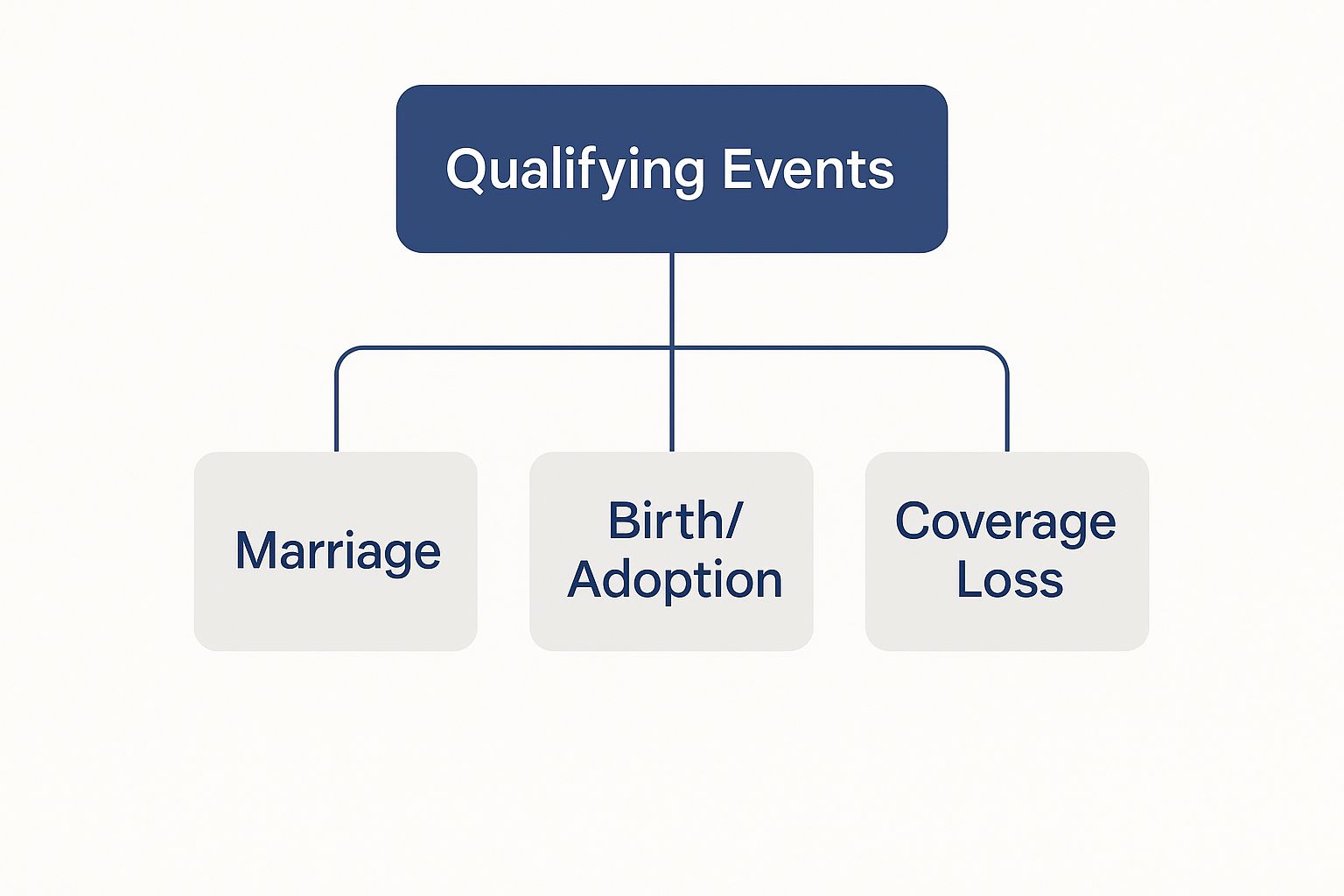

Main Categories of Qualifying Events

So, what exactly counts as a qualifying event? Under U.S. healthcare regulations shaped by the Affordable Care Act (ACA), these events are neatly sorted into four main buckets: loss of other health coverage, changes in your household, a change in residence, and a few other unique situations. For a more technical breakdown, you can see how HR experts at BambooHR.com define these events.

This simple diagram helps break down the most common triggers.

As you can see, life's biggest milestones are often what open the door to a Special Enrollment Period.

To make it even clearer, here’s a quick rundown of the most common qualifying life events you're likely to encounter.

Quick Guide to Common Qualifying Events

| Event Category | Common Examples |

|---|---|

| Loss of Health Coverage | Losing your job-based insurance, losing eligibility for Medicaid or CHIP, turning 26 and aging off a parent's plan. |

| Changes in Household | Getting married, having a baby, adopting a child, getting divorced or legally separated and losing coverage. |

| Changes in Residence | Moving to a new ZIP code or county, moving to the U.S. from another country, moving to or from a shelter. |

| Other Qualifying Events | Gaining U.S. citizenship, leaving incarceration, changes in income that affect your eligibility for subsidies. |

These are just the highlights, of course, but they cover the situations most people run into. The key takeaway is that you don't have to wait for Open Enrollment if one of these major events happens to you.

Making the Most of Your Special Enrollment Period

When a qualifying life event happens, the government doesn't just leave you stranded. Instead, you're granted a Special Enrollment Period (SEP). Think of it as a personal, limited-time window that opens up just for you, allowing you to sign up for a new health plan or switch your current one outside of the usual open enrollment season.

But this window doesn't stay open for long. In nearly all situations, you have 60 days from the date of the event to make your move. If you miss that deadline, the window slams shut, and you'll likely have to wait until the next annual Open Enrollment Period. That could mean going months without coverage.

Why Acting Fast Is So Important

Jumping on this opportunity is crucial. If you drag your feet, you risk creating a serious gap in your health coverage, leaving you and your family exposed to massive medical bills if something unexpected happens.

The moment your qualifying event takes place, a 60-day clock starts ticking. The best thing you can do is start getting your documents together right away. The insurance marketplace will need to verify your life event, and having your proof ready makes everything go much smoother.

Key Takeaway: Your Special Enrollment Period is a use-it-or-lose-it deal. The 60-day timeline is firm, so being prepared with the right paperwork is absolutely essential to avoid losing your chance at coverage.

What Documents Will You Need?

The proof required really depends on what just happened in your life. Having these documents ready to go will save you a ton of headaches during the application process.

- Losing Other Coverage: You'll need an official letter from your old insurance company or your former employer. It should clearly state when your coverage ended.

- Getting Married: A copy of your marriage certificate is the standard proof.

- New Child: For a newborn or adopted child, you’ll need a birth certificate or the final adoption paperwork.

- Moving to a New Area: You'll need to prove you've actually moved. Things like utility bills, a new lease, or bank statements showing both your old and new addresses work perfectly.

Getting a handle on the paperwork for a specific life event and its impact on health insurance can make all the difference. With the right documents in hand, you can secure your new health plan quickly and without any frustrating hold-ups.

When Losing Your Health Insurance Opens a New Door

Losing your health insurance can feel like the rug has been pulled out from under you. It’s often stressful and unexpected, but it's also the single most common reason you get a second chance to enroll in a new plan outside of the usual open enrollment window.

Think of it less as a setback and more as a trigger. This specific life change immediately unlocks a Special Enrollment Period, giving you a crucial window to find coverage that fits your new situation. Millions of people go through this every year, and knowing how it works is the key to protecting your health and finances without any gaps.

Common Ways You Might Lose Coverage

Losing a health plan can happen for a bunch of different reasons, and most of them will qualify you for that special enrollment window. Once the clock starts, you generally have 60 days to shop for and enroll in a new plan through the Health Insurance Marketplace.

Here are a few of the most common scenarios people run into:

-

Leaving a Job: It doesn't matter if you quit, were laid off, or let go. The moment you lose that employer-sponsored health plan, you've got a qualifying event. This is a critical safety net when you're between jobs.

-

Turning 26: The day you turn 26, you officially "age out" of your parent's health insurance plan. This birthday is a built-in qualifying life event, specifically designed to give you a chance to get your own policy.

-

Losing Medicaid or CHIP Eligibility: If your income goes up and you no longer qualify for programs like Medicaid or the Children's Health Insurance Program (CHIP), that loss of coverage is your ticket to a Special Enrollment Period.

Here’s a crucial distinction: To qualify, the loss of coverage needs to be involuntary. If you simply decide to cancel your plan or you get dropped for not paying your premiums, that won't count.

When you leave a job, you'll probably hear about COBRA. It lets you keep your old health plan, but you have to pay the full premium yourself, which is often incredibly expensive. Before you sign up for COBRA, it’s always a good idea to explore COBRA insurance alternatives on the Marketplace—you might find a much more affordable plan, especially with subsidies.

How Household Changes Affect Your Health Plan

Some of life's most significant moments—from joyful beginnings to difficult goodbyes—happen right within our own homes. These events don't just shift your family's dynamic; they can fundamentally change your health insurance needs. This is why understanding what a qualifying event is for health insurance is so important.

When your household size changes, the health plan that worked for you yesterday might not be the right fit today. Thankfully, the system is designed to help. These major life changes trigger a Special Enrollment Period (SEP), opening up a 60-day window for you to adjust your coverage or find a new plan that better suits your new reality.

Welcoming a New Family Member

Bringing a new person into your home is probably the most common (and happiest!) reason people need to change their health insurance. These events are designed to make sure your growing family is protected from day one.

- Getting Married: Saying "I do" means you can combine your health plans. You can add your new spouse to your plan, jump onto theirs, or even shop for a new plan together.

- Having a Baby: A newborn needs immediate health coverage. The birth of a child is a classic qualifying event that lets you add your baby to your policy right away.

- Adopting a Child: Finalizing an adoption or bringing a foster child into your home also counts, ensuring your new child gets the seamless coverage they need.

Navigating Separation and Loss

On the flip side, some household changes are incredibly difficult. Events that reduce your household size are also considered qualifying events, largely because they can throw your coverage and finances into chaos.

A divorce or legal separation, for example, almost always means one person will lose coverage under their former spouse's plan. This event creates a critical opportunity to enroll in a new individual plan without having to wait for the annual Open Enrollment period. The death of a family member who was on your plan is also a qualifying event.

These rules provide a safety net, allowing you to secure new coverage during what are often emotionally and financially stressful times. You can also explore our guide on the dependent health insurance age limit to learn more about keeping family members covered as they get older.

When a New Address Means New Health Insurance

Most people think of moving as a stressful whirlwind of boxes and logistics. What often gets overlooked is that a big move can also be a golden opportunity to reassess your health insurance. A permanent change of address is a key qualifying event for health insurance, but it's a detail that easily slips through the cracks, causing people to miss out on finding a better plan.

Of course, not every move opens this door. Shifting to a new apartment across the street probably won’t do it. To trigger a Special Enrollment Period, your move generally needs to land you in a new ZIP code, county, or state where the available health plan options are different from what you had before.

The reason for this is simple: health insurance is incredibly local. The plans and doctor networks available in one town can be completely different from those just one county over. A significant move means you're entering a whole new healthcare market, and you need a chance to get covered there.

What Kind of Moves Qualify

So, how do you know if your relocation counts? The main question to ask is: does this move fundamentally change the health plans I can access? If you're planning a residential move, a general guide to residential moving can help you sort out the logistics while you figure out your insurance situation.

Here are a few common scenarios that almost always qualify:

- Moving to a different state for a new job or to be closer to family.

- A student moving to or from the city where they attend school.

- A seasonal worker moving between their home base and their place of work.

- Moving into or out of a shelter or another form of transitional housing.

The rule of thumb is this: if your old health plan simply isn't offered at your new address, you've almost certainly got a qualifying event on your hands.

This kicks off a crucial 60-day window for you to enroll in a new plan that actually serves your new area. For a closer look at how moving can affect your coverage, check out our guide on moving cities or countries.

Answering Your Questions About Qualifying Events

Even when you know the rules, it's natural to wonder how they apply to your life. Let's dig into some of the most common questions people have about qualifying events so you can move forward with confidence.

Does Pregnancy Count as a Qualifying Event?

This is a really common point of confusion. While pregnancy itself doesn't count as a qualifying life event to get a new health plan, the birth of your child absolutely does.

The moment your baby arrives, a 60-day Special Enrollment Period kicks off. That window is your opportunity to add your newborn to your existing plan or even switch the whole family to a new one. It's also worth remembering that every Marketplace plan is required to cover pregnancy and childbirth—they're considered essential health benefits.

What if I Miss My Special Enrollment Window?

The 60-day timeline for a Special Enrollment Period (SEP) is a hard deadline. If you let it pass, you’ll almost certainly have to wait until the next annual Open Enrollment Period to get health coverage.

That’s why moving quickly is so critical. Exceptions are incredibly rare, so it's best to start gathering your documents and begin the application as soon as your qualifying event happens. You don't want to risk a gap in coverage.

A Critical Reminder: Missing your SEP deadline can leave you uninsured for months. Think of that 60-day window as a firm, non-negotiable deadline to protect yourself and your family.

Does Voluntarily Quitting My Job Qualify?

Yes, it does. Many people don't realize this, but leaving a job for any reason—whether you quit, were laid off, or retired—and losing your health insurance along with it is a qualifying life event. It’s a crucial safety net.

When you lose that employer-sponsored plan, it triggers a Special Enrollment Period, giving you a chance to enroll in a Marketplace plan. Your old employer might offer you COBRA to continue your plan, but it's always smart to compare costs. A new plan from the Marketplace could be much more affordable.

The numbers show just how important these events are. It's estimated that about 1 in 3 health insurance enrollments outside of the standard Open Enrollment Period happens because of a qualifying life event. Loss of health insurance is the single biggest driver, accounting for nearly 40% of all special enrollments. You can find more details in these qualifying life event statistics on PeopleKeep.com.

Can I Change My Plan During an SEP?

You bet. A Special Enrollment Period isn't just for the uninsured. It also gives you the flexibility to change your current Marketplace plan.

For example, let's say you get married. You and your new spouse might realize that a different plan would better suit your combined needs and budget. Your SEP is the perfect time to make that switch and ensure your coverage truly fits your new life.

Navigating these rules can feel complicated, but you don't have to figure it all out on your own. The experts at My Policy Quote are here to help you find the right plan for your unique situation. Explore your health insurance options with us today!