When you peel back the layers, term life insurance is refreshingly simple. It boils down to a core promise: you get affordable coverage for a set amount of time (think 10, 20, or 30 years) without any complicated investment features. This makes it an incredibly effective tool for protecting your biggest financial responsibilities—like a mortgage or raising kids—during the years your income matters most.

Understanding Term Life Insurance Essentials

At its heart, term life insurance is a straightforward agreement. You pay a fixed premium for a specific number of years, called the "term." If you pass away during that time, the insurance company pays a tax-free, lump-sum death benefit to the people you’ve chosen. It’s that direct.

This financial safety net is built to replace your income and handle critical expenses, making sure your family’s world isn't turned upside down financially. It's a key part of the basics of financial planning for a reason—it secures your family's future. If you outlive the term, the policy just ends. No bells, no whistles, no payout.

Key Types of Term Policies

Not all term policies are created equal. When you start comparing plans, you'll mainly run into two variations: level term and decreasing term. Knowing what makes them different is the first step to figuring out which one fits your life.

- Level Term Life Insurance: This is the one most people choose. Both your death benefit and your monthly premium stay exactly the same for the entire policy term. That predictability is perfect for covering long-term needs that don’t change, like replacing your income until retirement.

- Decreasing Term Life Insurance: Here, the death benefit gets smaller over time, usually year by year, while your premium stays the same. It’s built for one specific job: to cover a large debt that you're paying down, like a mortgage. As your loan balance shrinks, so does your coverage.

It’s also crucial to know how term life differs from permanent life insurance. While term is temporary, permanent policies are designed to cover you for your entire life and build a cash value you can borrow against. To see which philosophy matches your goals, it's worth exploring the difference between term and permanent life insurance.

For most families, term life insurance delivers the biggest bang for your buck. It directly tackles the number one reason people buy life insurance in the first place: replacing lost income when your loved ones need it most.

Comparing Level vs. Decreasing Term

So, which one is right for you? The answer comes down to what you're trying to protect. This table breaks down the main purpose of each policy type to help you see where you fit.

| Policy Type | Primary Use Case | Best For | Example Scenario |

|---|---|---|---|

| Level Term | Income Replacement & Future Expenses | Families with young kids, covering college tuition, or making sure a surviving spouse is financially secure. | A 35-year-old parent gets a 20-year, $1 million policy so their kids are covered all the way through college. |

| Decreasing Term | Specific Debt Repayment | Homeowners who want their mortgage paid off no matter what, or business owners covering a specific loan. | A couple takes out a 30-year decreasing term policy that mirrors the payoff schedule of their new home loan. |

Ultimately, term life insurance is about buying time and peace of mind. It’s a guarantee that even if the worst happens, your family will have the money they need to stay on their feet and build the future you always planned for them.

Establishing Your Core Comparison Criteria

Jumping into a life insurance comparison without a game plan is a recipe for confusion. It's tempting to just look at the monthly premium, but that number is only a tiny piece of a much larger puzzle. A cheap policy isn't a good deal if it leaves your family unprotected when it matters most.

To find the best value, you need to know exactly what you’re looking for before you start comparing quotes. It's about setting your own criteria. This helps you cut through the noise and focus on what truly matters for your family's future.

Pillar 1: Calculating Your Coverage Amount

First things first: how much coverage do you actually need? This figure, called the death benefit, is the tax-free lump sum your loved ones will receive. You might hear rules of thumb like getting 10 to 12 times your annual income, but a truly personalized approach is always better.

To get a real number, think about the financial gaps your family would face without you.

- Mortgage and Debt: What would it take to completely pay off your home, car loans, and credit card balances?

- Income Replacement: How much is needed to cover daily expenses until your youngest child is financially independent?

- Future Education: What are the projected costs for your kids' college or vocational training?

- Final Expenses: Funeral costs and end-of-life medical bills can add up fast, often totaling thousands of dollars.

Add these up, and you’ll have a clear, data-driven picture of the coverage your policy needs to provide. This takes the guesswork out of your term life insurance comparison. You can dive deeper into this with our guide on the right term life insurance for family.

Pillar 2: Selecting the Right Term Length

Once you know how much coverage you need, the next question is for how long. The "term" is simply the number of years your policy is active, usually available in 10, 15, 20, 25, or 30-year options.

The goal here is simple: match the term length to your longest financial responsibility.

For instance, if you just bought a home with a 30-year mortgage and have a newborn, a 30-year term makes perfect sense. It ensures your family is protected until the house is paid off and your child is grown. On the other hand, if your kids are in high school and you only have 15 years left on the mortgage, a 15-year term could be all you need.

Choosing a term that's too short is a huge risk, potentially leaving your family exposed during their most vulnerable years. But picking one that's too long means you're just paying for coverage you don't need anymore. It’s all about aligning the term with your financial timeline.

Pillar 3: Provider Reputation and Financial Strength

A life insurance policy is a promise that could be cashed in decades from now. You need absolute certainty that the company you choose will still be around to keep it. This is where independent financial strength ratings are non-negotiable.

Look for ratings from trusted agencies like A.M. Best, which grades insurers on their financial stability. A rating of "A-" (Excellent) or higher is a strong indicator that they can meet their obligations.

Customer service is the other half of the reputation equation. Check consumer satisfaction scores from organizations like J.D. Power and read real-world reviews. How does a company really treat its clients when they file a claim?

The global life insurance market is massive and projected to hit around USD 18.03 trillion by 2034, according to Precedence Research. With so many players, sticking with a provider that has a proven track record of stability and great customer care is your safest bet.

To help you organize your thoughts, here’s a quick rundown of the essential criteria to keep in mind as you compare different policies.

Key Comparison Factors for Term Life Insurance Policies

| Evaluation Criterion | What to Look For | Why It Matters for You |

|---|---|---|

| Coverage Amount | A death benefit that covers all debts, income replacement, and future goals (like college). | Ensures your family can maintain their standard of living and won't face financial hardship. |

| Term Length | A duration that matches your longest financial obligation, like a mortgage or raising children. | Avoids paying for coverage you no longer need or, worse, having your policy expire too soon. |

| Premium Cost | Competitive and affordable monthly or annual payments that fit comfortably within your budget. | The best policy is one you can consistently afford to keep active for the entire term. |

| Provider's Financial Strength | High ratings from agencies like A.M. Best ("A-" or better). | Gives you confidence that the insurer will be financially stable enough to pay out a claim decades from now. |

| Customer Service Reputation | Positive reviews and high satisfaction scores for claims processing and support. | A company that is easy to work with can make a stressful time much easier for your loved ones. |

| Available Riders | Optional add-ons like accelerated death benefit or waiver of premium for disability. | Allows you to customize your policy to fit unique needs and add extra layers of protection. |

| Conversion Options | The ability to convert your term policy into a permanent one without a new medical exam. | Provides long-term flexibility if your financial situation or needs change in the future. |

By using these pillars as your guide, your comparison becomes a strategic evaluation—not just a price hunt. You’ll be equipped to choose a policy with confidence, knowing it truly protects the people you care about most.

Comparing the Top Term Life Insurance Providers

Okay, you know what makes a good term life policy. Now it’s time to put that knowledge to work and actually compare some of the best providers out there.

Not all insurance companies are created equal. Some are built for speed and convenience, targeting healthy people with rock-bottom online rates. Others specialize in flexibility, working with applicants who might have a few health issues. The "best" company isn't a one-size-fits-all answer—it’s the one that aligns perfectly with your life and your family's needs.

Let's break down a few of the top names in the business. We'll look at their strengths, who they're really built for, and what makes them stand out. This is about moving beyond generic lists and finding the right fit for you.

Provider Spotlight: Haven Life

Haven Life really shook things up by creating a super-fast, digital-first application process. They’re backed by the financial powerhouse MassMutual, so you get a modern, streamlined experience without sacrificing an ounce of reliability.

Their biggest selling point is pure speed and simplicity. If you're healthy, under 60, and looking for up to $3 million in coverage, you can often get a decision in minutes—without ever needing a medical exam. This makes them a fantastic choice for busy professionals or anyone who just wants to get it done efficiently online.

Key Differentiator: Haven Life's "InstantTerm" process is a true game-changer. It gets rid of the single biggest hassle in buying life insurance: the medical exam. For qualified applicants, this makes getting protected easier than ever before.

But that speed comes with a trade-off. The process is run by algorithms, which can be rigid if you have a more complicated health history. If you have a pre-existing condition, a traditional company with a human underwriter might give you a more personalized (and better) rate.

- A.M. Best Rating: A++ (Superior) via MassMutual

- Available Term Lengths: 10, 15, 20, 25, and 30 years

- Ideal For: Healthy people under 60 who value a fast, simple, and completely online process for getting significant coverage.

Provider Spotlight: Banner Life

Banner Life, which is part of Legal & General America, is almost always in the conversation for one simple reason: incredibly competitive pricing, especially for longer terms. If you're looking for a 20, 30, or even a 40-year policy, they are often one of the most affordable options you'll find.

They also really shine when it comes to underwriting flexibility. Banner is well-known for offering good rates to people with common, well-managed health conditions like high cholesterol or blood pressure. Their height and weight charts are also a bit more lenient than many competitors.

The application process is more traditional and usually requires a medical exam, but the money you could save often makes it well worth it. This makes Banner a go-to choice for budget-conscious families who want to lock in the lowest possible premium for the most coverage.

- A.M. Best Rating: A+ (Superior)

- Available Term Lengths: 10, 15, 20, 25, 30, 35, and 40 years

- Ideal For: Price-sensitive buyers, anyone needing a term longer than 30 years, or people with minor, controlled health issues.

The term life insurance market is strong and always evolving. In the U.S., sales bounced back quickly in 2023, driven by competitive prices and the ease of digital platforms. With term and whole life making up over 85% of all policies sold, the industry keeps adapting, and LIMRA projects steady premium growth into 2025. You can learn more about what’s ahead for the U.S. individual life insurance market in 2025 and see the latest trends.

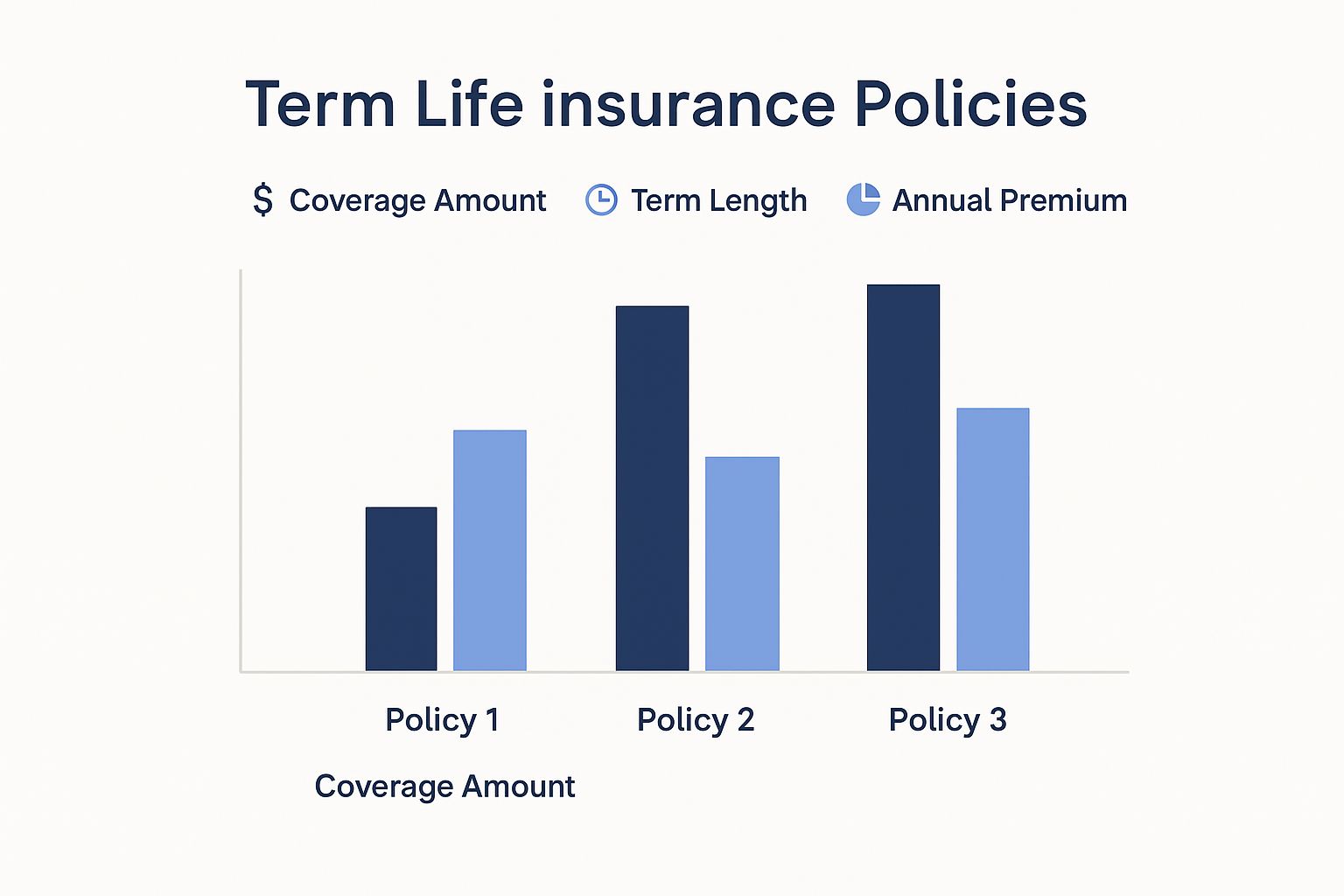

This visual below does a great job of showing how different policy choices can help you meet different financial goals by comparing coverage, term, and cost.

As you can see, there's a clear trade-off between how much coverage you get, how long the policy lasts, and the annual premium you'll end up paying.

Provider Spotlight: Protective Life

Protective Life has carved out its space by offering some of the absolute lowest premiums available, often going head-to-head with Banner Life on price. For applicants in excellent health, Protective can easily be the most affordable option on the market.

Their low prices are consistent across different age groups and term lengths, which means they should be on your comparison list no matter your situation. They offer a simple, straightforward product without a ton of frills, focusing on one thing: delivering core protection at an unbeatable value.

One interesting feature they offer is an "income provider" option. This lets your beneficiary receive the death benefit as a series of monthly payments instead of one large lump sum, which can be a huge help for someone who might feel overwhelmed managing a large amount of money all at once.

- A.M. Best Rating: A+ (Superior)

- Available Term Lengths: 10, 15, 20, 25, 30, 35, and 40 years

- Ideal For: Healthy individuals of any age whose main goal is to secure the most coverage for the lowest possible price.

Side-by-Side Provider Feature Comparison

Choosing a provider often comes down to what you value most. Is it speed, cost, or flexibility? This table puts the key features side-by-side to help make that decision a little clearer.

| Provider | A.M. Best Rating | Available Term Lengths | Key Policy Riders | Ideal For |

|---|---|---|---|---|

| Haven Life | A++ (Superior) | 10, 15, 20, 25, 30 | Accelerated Death Benefit (included) | Healthy individuals who want a fast, digital, no-exam process. |

| Banner Life | A+ (Superior) | 10, 15, 20, 25, 30, 35, 40 | Accelerated Death Benefit, Term Rider, Waiver of Premium | Budget-conscious buyers and those with minor health conditions. |

| Protective Life | A+ (Superior) | 10, 15, 20, 25, 30, 35, 40 | Accelerated Death Benefit, Child Rider, Waiver of Premium | Applicants in excellent health seeking the absolute lowest premiums. |

At the end of the day, the only way to do a true term life insurance comparison is to get quotes from a few different companies. Your specific health, age, and coverage needs will ultimately decide who can offer you the best deal. Think of this guide as a starting point to zero in on the providers that are most likely a great match for you.

How Policy Riders Customize Your Coverage

A standard term life policy is a great start. It builds a strong foundation of financial security for the people you love. But life isn't standard, is it? That’s where policy riders come in.

Think of these optional add-ons as specialized tools for your coverage. Your base policy is the house, but riders are the custom features—like a security system or an accessibility ramp—that make it a perfect fit for your family’s actual needs. Adding the right ones during your term life insurance comparison can add critical layers of protection.

These add-ons can offer financial help during tough times that don't involve death, like a serious illness or a disability that stops you from working. Knowing the most common riders is the key to building a policy that truly has your back.

The Accelerated Death Benefit Rider

One of the most valuable riders you’ll find is the Accelerated Death Benefit (ADB). It’s often included at no extra cost, and it’s a game-changer. This feature lets you access a portion of your own death benefit while you’re still living if you’re diagnosed with a qualifying terminal illness.

Let’s say you have a $500,000 policy and get diagnosed with a condition giving you 12 months or less to live. The ADB rider could let you access a large chunk of that money—say, $250,000—right away. That money is yours to use however you see fit, whether it's for experimental treatments, paying off debt, or taking one last trip with your family.

The Accelerated Death Benefit rider transforms a policy from something that only helps after you're gone to a resource that can provide crucial financial support and dignity during one of life's most challenging times.

It’s important to know that whatever you take out is subtracted from the final payout your beneficiaries receive. Still, since most modern policies include this powerful feature for free, it's something you should always look for.

The Waiver of Premium Rider

What happens if you become seriously disabled and can’t work anymore? How would you keep paying your premiums? The Waiver of Premium rider was designed for exactly this terrifying scenario.

If you become totally disabled for a set period (usually six months), the insurance company will waive your monthly payments, but your policy stays active. Your coverage continues, uninterrupted.

Imagine a construction worker who suffers a career-ending injury. With this rider, their life insurance remains in place even when they can't afford the premiums. Their family stays protected during a time of incredible financial and emotional stress.

This rider is especially important for:

- Primary breadwinners whose income is the family's lifeline.

- People working in physically demanding or high-risk jobs.

- Anyone who wants to ensure a long-term disability doesn't destroy their family's financial future.

This rider does add a small amount to your premium, but the peace of mind it buys is often worth every penny. It closes a huge potential gap in your financial safety net.

The Child Term Rider

For parents, the Child Term Rider is a simple and affordable way to get a modest amount of life insurance for all of your children under a single add-on.

Typically, one rider provides a small death benefit (from $10,000 to $25,000) for each eligible child until they reach adulthood, often age 25. The goal isn't income replacement; it's to cover unexpected final expenses and give parents the financial breathing room to grieve without worrying about bills.

A huge benefit here is convertibility. When your child becomes an adult, you can often convert their rider into a small permanent life insurance policy of their own, no matter what their health looks like at the time.

The demand for thoughtful financial protection is growing. In fact, North America saw a 14.4% jump in life insurance premium income in 2024. This trend, highlighted in the Allianz Global Insurance Report, shows that more people are realizing how crucial this coverage is. For a deeper look at policy types, you might find our guide on term versus whole life insurance helpful.

You've done the hard work, laid out the comparisons, and have all the information you need. Now it's time to connect the dots, pick a policy with confidence, and start the application. This is the moment your research becomes a real financial safety net for your loved ones.

Making that final choice isn’t just about grabbing the lowest quote. It's about finding the policy that fits your specific chapter in life. We all have different responsibilities at different times, and your coverage should reflect that reality.

A Framework for Your Decision

The best way to choose a provider is to look at your own life. Let's break down how different priorities can point you toward the right policy.

- Young Professionals with a New Mortgage: Your main worry is probably that 30-year loan. A 30-year term policy from a cost-effective carrier like Banner Life or Protective Life is often a perfect fit, making sure the house is paid off no matter what happens.

- New Parents with Young Children: For you, income replacement is everything. You need coverage that can support your family for the next 20-25 years. A 25- or 30-year term with a significant death benefit gives you peace of mind, knowing there’s money for daily bills and future college funds.

- Established Families Nearing Retirement: If the mortgage is almost gone and the kids are on their own, your needs have likely changed. A shorter 10- or 15-year term could be just right to bridge the gap to retirement, covering final expenses or any small debts left behind.

Choosing the right term life insurance policy is a key part of putting together a comprehensive end-of-life plan, ensuring your loved ones are financially protected when they need it most.

The best policy isn't some abstract idea; it's the one that mirrors your financial timeline and your obligations. Match your term length and coverage amount to your biggest responsibilities. That’s how you get protection that truly works.

Once you’ve lined up your needs with a specific policy, the application is the next step. Knowing what’s coming makes the whole process feel much less intimidating.

Navigating the Application and Underwriting Process

Think of the application as the insurance company’s way of getting to know you. They’ll focus on your health and lifestyle to figure out your final rate. Honesty isn’t just the best policy here—it's the only one that works.

Here’s what you can generally expect:

- Submit the Application: You’ll fill out forms with basic personal info, your health history, your family’s medical history, your job, and lifestyle details (like whether you smoke or have risky hobbies).

- Phone Interview: Don't be surprised if a representative from the insurer calls for a quick chat. They'll just confirm the info you provided and ask a few follow-up questions.

- The Medical Exam: Most traditional term policies require a free medical exam. A professional will come to your home or office to check your height, weight, and blood pressure, and take small blood and urine samples. It’s usually fast and simple.

- Underwriting Review: This is the waiting game. The insurer’s underwriting team looks over your application, exam results, and might request your medical records. This deep dive can take anywhere from a few weeks to a couple of months.

- Receive Your Offer: Once the review is done, you'll get a final offer. If everything checks out, you’ll get the rate you were quoted. If they found any surprises, the rate might be adjusted. From there, you can accept the policy, make your first payment, and your coverage will officially be in place.

Full transparency is so important. Hiding a medical condition or a risky hobby could cause your policy to be voided down the road, leaving your family with nothing. By being upfront and understanding the steps, you can move forward knowing you've secured powerful protection for the people you care about most.

Common Questions About Term Life Insurance

Even after you've compared all the details, a few questions always seem to surface. It's perfectly normal. Getting straight answers to these common concerns is often the last step before you feel truly confident in your decision.

We've heard them all, so let's tackle the biggest ones head-on. Answering these will not only clear up any lingering doubts but also help you sidestep some of the most common—and costly—mistakes people make. For a closer look at those pitfalls, our guide on life insurance mistakes to avoid is a great resource.

How Much Term Life Insurance Coverage Do I Really Need?

You've probably heard the old rule of thumb: get 10 to 12 times your annual income. While that’s a decent starting point, it's just that—a start. Your family’s real needs demand a more personal calculation.

To get to the right number, you need to think about every major financial obligation you'd leave behind. Start with the big ones: your mortgage, car loans, and any outstanding credit card or personal debt. Then, look to the future. What about college for the kids? How much income would your family need each year to live comfortably without you?

The right coverage amount isn't a guess. It's a carefully calculated number that ensures your family can wipe the slate clean of debt, cover day-to-day life, and still chase their dreams without financial worry.

Using a good needs calculator or sitting down with a financial advisor can help you dial in a figure that brings real peace of mind.

Should I Buy Directly From an Insurer or Use an Agent?

This one is a big deal. Going directly to an insurer can feel quick and easy, especially if you’ve already done your homework and know exactly which company you want.

But there’s a huge advantage to working with an independent agent or broker. They shop your profile across multiple insurance companies at once, which often turns up a much better rate than you'd find on your own. Their real value shines when it comes to navigating the different underwriting standards between carriers.

This is especially true if you have any pre-existing health conditions. One company might see your situation as high-risk, while another might be far more lenient. A good agent knows which insurers are best for specific health profiles, and that inside knowledge can save you a ton of money over the years.

What Happens If My Term Life Policy Expires?

This is probably one of the most important questions people have. When your term is up, your coverage simply ends. You stop paying premiums, and the policy is done. Since it's term insurance, there's no cash value, so there's no payout if you outlive it.

But you're not usually left without options. Most insurers will offer a few paths forward:

- Convert the Policy: Many term policies come with a conversion privilege. This lets you switch some or all of your coverage to a permanent policy, like whole life, without needing another medical exam.

- Renew Annually: Some policies can be renewed year after year once the initial term expires. Be careful here, though—the premium is almost always significantly higher and will increase every single year.

- Purchase a New Policy: You can always just apply for a brand new term policy. This will mean a new application and probably another medical exam, with rates based on your current age and health.

Is It Possible to Have Multiple Life Insurance Policies?

Yes, absolutely. It's not only legal but often a smart financial strategy. People do it all the time, using a technique called "laddering" to match different policies with specific, time-sensitive needs.

For instance, you might get a 30-year, $750,000 policy to make sure the mortgage is covered no matter what. At the same time, you could add a separate 20-year, $500,000 policy to see your kids through college. Once that 20-year need is gone, you can let that policy expire, lowering your total premiums while still keeping the long-term mortgage protection in place. It’s a cost-effective way to get the exact amount of protection you need, right when you need it.

Ready to find a policy that fits your family's needs and budget? At My Policy Quote, we make comparing top-rated insurance providers simple. Get your personalized, no-obligation quotes today and take the first step toward securing your family's financial future. https://mypolicyquote.com